Market Overview:

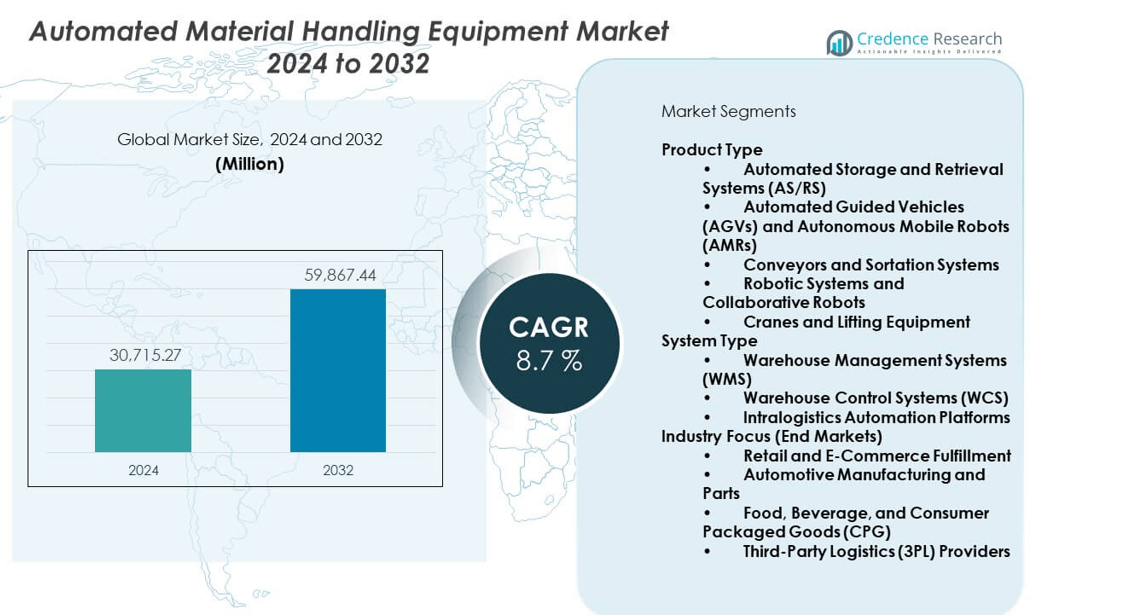

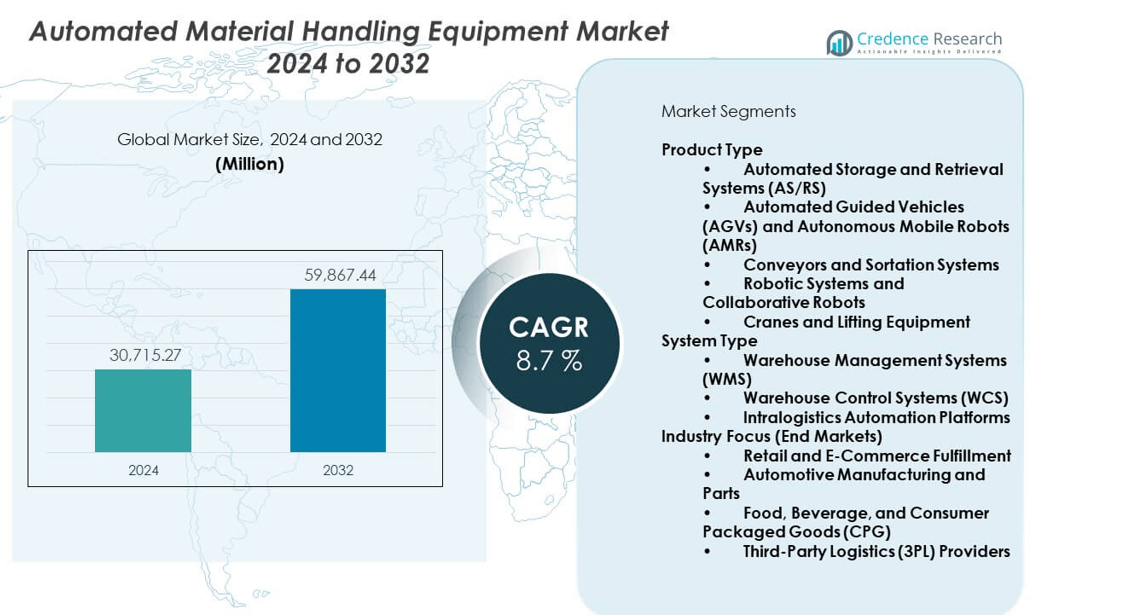

The Automated material handling equipment market is projected to grow from USD 30,715.27 million in 2024 to an estimated USD 59,867.44 million by 2032, with a compound annual growth rate (CAGR) of 8.7% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automated Material Handling Equipment Market Size 2024 |

USD 30,715.27 million |

| Automated Material Handling Equipment Market, CAGR |

8.7% |

| Automated Material Handling Equipment Market Size 2032 |

USD 59,867.44 million |

Rising automation in warehousing and industrial plants fuels market expansion due to higher output needs. Firms adopt robotics and AS/RS systems to manage peak loads and limit manual handling. Manufacturers rely on automated tools to shorten cycle times and maintain quality in fast-moving operations. E-commerce players scale automated sorting and retrieval to meet tighter delivery expectations. Industries push digital monitoring, which helps streamline equipment performance and reduces downtime. Growing pressure for lean operations strengthens interest in flexible and modular handling systems across production lines.

North America leads due to strong investment in robotics, advanced logistics networks, and mature distribution systems. Europe shows solid growth supported by high technology adoption in automotive, food, and machinery sectors. Asia Pacific emerges fastest as China, Japan, South Korea, and India expand industrial capacity and upgrade factory automation. Rising e-commerce penetration across Southeast Asia further accelerates regional demand. The Middle East increases adoption through logistics modernization, while Latin America improves uptake due to expanding manufacturing clusters and growing warehouse automation needs.

Market Insights:

- The Automated material handling equipment market is projected to grow from USD 30,715.27 million in 2024 to USD 59,867.44 million by 2032, supported by a CAGR of 8.7%, driven by warehouse automation, robotics adoption, and digital control systems.

- North America leads the market, supported by advanced logistics infrastructure, strong automation maturity, and widespread deployment of robotics across manufacturing and fulfillment networks.

- Europe holds the second-largest share, driven by strong adoption in automotive, food processing, and high-precision industrial sectors that require consistent, high-speed automated handling.

- Asia-Pacific ranks third due to rapid industrial expansion, strong e-commerce penetration, large-scale manufacturing bases, and growing investment in warehouse digitalization. It is also the fastest-growing region, supported by rising automation programs across China, Japan, South Korea, and India.

- Segment distribution is led by AS/RS, which dominates due to high adoption in dense storage and fulfillment environments, while AGVs and AMRs follow as the fastest-expanding segment supported by flexible routing, scalability, and growing use in dynamic warehouse layouts.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Shift Toward High-Precision and High-Speed Industrial Automation

Growing demand for accurate handling drives rapid adoption of advanced systems. Firms deploy robotics to raise throughput in high-volume zones. Manufacturers upgrade lines to reduce human error in repetitive tasks. E-commerce operators use automation to control peak flows. Logistics hubs improve accuracy with integrated scanning and routing tools. Warehouses adopt AS/RS units to lift storage density. Automotive plants rely on robots to manage heavy parts with steady precision. The automated material handling equipment market gains strong support from rising performance needs. It helps industries maintain consistency in demanding production cycles.

- For instance, the FANUC M-20iD robot series, such as the M-20iD/25 model, delivers a high repeatability of ±0.02 mm. This high rigidity and precision enhance accuracy in fast industrial lines, such as material handling or machine tending applications.

Growing Need To Reduce Labor Dependence and Improve Workplace Safety

Industries push automation to manage shrinking labor pools. Companies use automated lifts and conveyors to limit injury risks. High-risk zones gain safer workflows through robotic movement. Warehouses cut manual lifting in high-volume areas. Distribution centers deploy automated pallet handlers to improve ergonomics. Firms standardize safety workflows through digital control nodes. Robotics platforms help maintain safe spacing in crowded layouts. The automated material handling equipment market expands due to rising safety priorities. It encourages consistent protection across critical operations.

- For instance, the ABB SafeMove2 system enables certified speed and position monitoring, which replaces physical barriers with virtual safety zones to reduce operator exposure during robotic movement.

Expansion of Omni-Channel Fulfillment and High-Speed Distribution Networks

Retailers scale automated tools to handle rapid order cycles. E-commerce firms rely on high-speed sorting to support tight delivery targets. Distribution hubs adopt smart conveyors for fast SKU movement. Robotics fleets enable smoother picking during peak traffic. AS/RS systems support accurate multi-level storage. Integrated software helps teams track flows in real time. Automation improves package routing and lowers handling errors. The automated material handling equipment market strengthens its role in digital retail ecosystems. It supports reliable movement across dense fulfillment grids.

Increasing Adoption of Digital Monitoring, Predictive Control, and Smart Fleet Coordination

Industries deploy digital platforms to track operational health. Predictive tools reduce downtime across automated lines. IoT sensors help detect wear in early stages. Software directs mobile robots with greater accuracy. Real-time dashboards improve team response in busy hubs. Cloud links support wide-area equipment control. Data analytics refine routing within complex layouts. The automated material handling equipment market benefits from steady digital integration. It drives higher uptime and smoother flow patterns.

Market Trends:

Rising Deployment of Autonomous Mobile Robots for Scalable and Flexible Operations

Companies shift toward AMRs to handle dynamic load changes. Factories use mobile robots to replace fixed-path vehicles. Warehouses adopt fleets that adjust routes without manual resets. E-commerce hubs rely on AMRs for zone-to-zone transfers. Software enables coordinated fleet movement in shared paths. Firms expand AMR use in low-light or off-hour cycles. AMRs reduce layout constraints in growing facilities. The automated material handling equipment market sees faster adoption of flexible robotic fleets. It improves operational freedom across shifting production zones.

- For instance, Amazon publicly confirms operating more than 1 million mobile robots across its fulfillment network, with newer autonomous models like Proteus enabling dynamic routing without fixed tracks. The entire fleet is coordinated using a generative AI model called DeepFleet, which optimizes travel efficiency and helps speed up the fulfillment process.

Strong Expansion of Energy-Efficient Handling Systems With Low-Carbon Designs

Industries invest in energy-saving drives to reduce power use. Warehouses deploy high-efficiency conveyors for long shifts. Motors with regenerative features help cut electricity loads. Robotics platforms gain lighter frames for reduced consumption. Power-control software optimizes runtime cycles. Facilities adopt cooling-efficient hardware to extend equipment life. Firms prioritize greener handling systems to support sustainability goals. The automated material handling equipment market aligns with the push toward clean operations. It supports low-emission strategies in expanding industrial zones.

- For instance, Siemens’ SINAMICS regenerative drive technology returns excess braking energy to the power grid and, in specific verified deployments like engine test stands, can reach energy savings of up to 80%. More generally, these regenerative variable frequency drives enable energy recovery of up to 50% during typical braking operations, cutting overall drive-level consumption by minimizing heat losses and reducing operating costs.

Growing Use of AI-Driven Vision Tools for Inspection, Sorting, and Material Routing

AI-powered cameras improve quality checks at high speed. Vision tools help identify damaged goods in early stages. Sorting units use AI to track shape, size, and orientation. Robotics arms align boxes with better precision through real-time imaging. Plants tighten inspection cycles to maintain consistent quality. Vision systems support error-free routing in crowded lines. Firms use AI signals to reduce misplacement events. The automated material handling equipment market benefits from advanced visual intelligence. It enhances accuracy across dense work environments.

Integration of Modular and Rapidly Deployable Handling Platforms Across Industries

Manufacturers adopt modular systems to manage fast capacity shifts. Warehouses expand zones through plug-and-play conveyor modules. Firms deploy stackable storage units to scale quickly. Robotics platforms gain modular add-ons for new tasks. Plants reduce setup time through pre-configured frameworks. Fast swaps support short production cycles across sectors. Modular tools reduce downtime during expansion phases. The automated material handling equipment market moves toward highly configurable designs. It enables quick adaptation to shifting demand levels.

Market Challenges Analysis:

High Upfront Costs, Complex Integration Needs, and Limited Workforce Skill Depth

Automation projects require large capital spending for hardware and software. Firms struggle to integrate new tools with older equipment. Legacy layouts limit effective deployment of advanced systems. Companies face skill gaps while training teams for modern platforms. Small enterprises delay adoption due to cost pressure. Integration delays impact operational timelines across plants. Software upgrades often demand extra support teams. The automated material handling equipment market faces resistance from budget constraints and skill shortages. It slows transformation in cost-sensitive sectors.

Rising Cybersecurity Risks, Reliability Concerns, and Infrastructure Limitations in Expanding Facilities

Connected systems increase exposure to digital threats. Firms secure networks to protect automated workflows. Unplanned downtime impacts high-speed zones with heavy reliance on robotics. Facilities face power and connectivity gaps during expansion. Reliability drops when sensors fail in high-stress environments. Plants struggle with space limitations in older buildings. Infrastructure upgrades take long to execute. The automated material handling equipment market encounters hurdles tied to reliability and network security. It drives the need for stronger safety layers and resilient site planning.

Market Opportunities:

Rapid Adoption of Robotics in Emerging Industries and Untapped Manufacturing Clusters

New manufacturing zones seek automation to improve output quality. Robotics expansion supports precision work in electronics, food, and automotive suppliers. Emerging economies invest in new warehouses that favor automated lifts. Firms deploy smart shuttles for faster internal movement. Robotics platforms reduce dependency on scarce labor pools. Growth zones seek digital tools for long-term stability. Automation aligns with government-led manufacturing reforms. The automated material handling equipment market gains momentum through this expansion. It opens broad opportunities across developing regions.

Growing Demand for AI-Enabled Handling Tools, Smart Warehousing, and Real-Time Optimization

AI tools guide routing, picking, and movement patterns across busy hubs. Predictive insights shorten repair windows in automated lines. Warehouses shift toward fully supervised digital monitoring. Firms deploy cloud control nodes for wide-area coordination. Robotics fleets gain stronger autonomy for complex navigation. Real-time data supports faster operational decisions. Digital twins help refine future workflows before execution. The automated material handling equipment market captures new opportunities through deep digital integration. It accelerates smarter and more reliable handling ecosystems.

Market Segmentation Analysis:

Product Type

The Automated material handling equipment market spans a broad range of solutions that support high-volume and high-precision workflows. AS/RS platforms lead adoption in dense storage environments due to strong accuracy and space efficiency. AGVs and AMRs gain traction in flexible warehouse layouts that require autonomous movement. Conveyors and sortation systems remain essential for high-speed routing tasks in distribution hubs. Robotic systems and collaborative robots support repetitive and heavy-duty operations across industrial plants. Cranes and lifting equipment maintain relevance in facilities that handle bulky loads and palletized goods.

System Type

WMS platforms guide inventory decisions and maintain visibility across complex supply chains. WCS solutions synchronize equipment movement and improve flow consistency in dynamic layouts. Intralogistics automation platforms combine software and hardware functions to control routing, task execution, and performance optimization. These systems strengthen operational integration across warehouses and manufacturing sites.

- For instance, Google Cloud noted that Manhattan’s cloud-native platform was rebuilt using microservices to deliver innovation and release features quarterly versus annually, thereby helping “ensure customer environments were running effectively across the stack”.

Industry Focus (End Markets)

Retail and e-commerce fulfillment centers adopt automation to achieve faster order cycles. Automotive plants deploy robotics and lifting tools to support precision assembly. Food, beverage, and CPG facilities rely on automated lines for high-throughput operations. 3PL providers scale systems to manage variable client demand and multi-site logistics needs.

Application Areas

Automation supports palletized and item-level handling across production and storage environments. Batch picking and order fulfillment require robotics and mobile fleets for accuracy. Cross-docking and sortation depend on conveyors and real-time routing tools. Replenishment and inbound/outbound logistics use integrated control systems to maintain flow continuity.

Segmentation:

Product Type

- Automated Storage and Retrieval Systems (AS/RS)

- Automated Guided Vehicles (AGVs) and Autonomous Mobile Robots (AMRs)

- Conveyors and Sortation Systems

- Robotic Systems and Collaborative Robots

- Cranes and Lifting Equipment

System Type

- Warehouse Management Systems (WMS)

- Warehouse Control Systems (WCS)

- Intralogistics Automation Platforms

Industry Focus (End Markets)

- Retail and E-Commerce Fulfillment

- Automotive Manufacturing and Parts

- Food, Beverage, and Consumer Packaged Goods (CPG)

- Third-Party Logistics (3PL) Providers

Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Application Areas

- Palletized and Item-Level Handling

- Batch Picking and Order Fulfillment

- Cross-Docking and Sortation

- Replenishment and Inbound/Outbound Logistics

Regional Analysis:

North America

North America holds the largest share of the automated material handling equipment market, supported by strong automation maturity and advanced logistics networks. Manufacturers deploy robotics and AS/RS solutions to improve speed across production sites. E-commerce operators invest in high-density fulfillment centers that rely on automated tools. Warehouses upgrade software platforms to improve tracking and coordination. High labor costs push firms toward scalable robotics integration. The region maintains its lead due to heavy investment in next-generation supply chain automation. It continues to set global benchmarks in reliability and throughput performance.

Europe

Europe accounts for the second-largest share of the automated material handling equipment market, driven by strong adoption in automotive, food, and industrial manufacturing hubs. Firms upgrade factory lines to align with strict quality and safety regulations. Robotics suppliers gain steady demand from high-precision production environments. Warehouses adopt energy-efficient conveyors and sorting units to meet sustainability goals. Retail networks expand automated fulfillment nodes to support tighter delivery cycles. The region strengthens its position through strong engineering expertise and broad industrial digitalization. It supports long-term adoption across mature industrial clusters.

Asia-Pacific

Asia-Pacific represents the fastest-growing share of the automated material handling equipment market due to rapid industrial expansion. China, Japan, South Korea, and India invest in new plants that depend on automation for high-volume output. E-commerce growth creates strong demand for robotic picking and advanced sorting tools. Manufacturers deploy intralogistics systems to manage rising production complexity. Governments support automation upgrades through policy-driven industrial reforms. The region attracts global vendors seeking large-scale installation opportunities. It continues to expand its share through strong momentum in manufacturing and logistics modernization.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Daifuku Co., Ltd. (Japan)

- KION Group AG (Germany) – including Dematic

- SSI Schaefer Group (Germany)

- Toyota Industries Corporation (Japan) – including Vanderlande Industries (Netherlands)

- Honeywell Intelligrated (US)

- Murata Machinery Ltd. (Japan)

- BEUMER Group (Germany)

- Swisslog Holding AG (Switzerland) – part of KUKA Group

- JBT Corporation (US)

- Bosch Rexroth (Germany) – and allied automation suppliers

- TGW Logistics Group (Austria)

Competitive Analysis:

The Automated material handling equipment market features strong competition among global automation vendors that invest in robotics, AS/RS platforms, and advanced software systems. Leading players focus on scalable intralogistics solutions that support high-volume fulfillment and time-critical industrial operations. Firms strengthen portfolios through robotics fleets, energy-efficient conveyors, and AI-enabled control systems to improve reliability. Vendors compete on performance, integration depth, and service networks that support long-term operational uptime. Partnerships with logistics operators help expand system deployments across new facilities. Companies invest in modular platforms to meet rapid layout changes in dynamic industries. It maintains highly competitive intensity due to rapid technology upgrades and strong end-user demand for automation.

Recent Developments:

- In May 2025, Honeywell partnered with Teradyne Robotics to deliver intelligent automation for logistics and warehouse operators, integrating autonomous mobile robots (AMRs) and cobots with Honeywell’s software and implementation capabilities. Earlier, in June 2025, Honeywell and Flowserve formed a partnership to develop cloud-enabled predictive asset management solutions for industrial infrastructure.

- In April 2025, Daifuku launched its new Intralogistics plant in Hyderabad, India, expanding its production of automated storage/retrieval systems and conveyor solutions to meet the growing demand across industries. This facility enhances Daifuku’s supply chain capacity and supports regional growth in material handling automation.

Report Coverage:

The research report offers an in-depth analysis based on by Product Type, System Type, Industry Focus, Geography, and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for integrated robotics will rise in fast-moving warehouse environments.

- AS/RS platforms will gain wider use across high-density storage applications.

- AI-driven predictive tools will support smoother operations and lower downtime.

- Mobile robots will expand across mixed-industrial layouts with flexible routing.

- Software-centric automation will grow faster than hardware-only deployments.

- Sustainability goals will increase adoption of energy-efficient handling systems.

- E-commerce expansion will push higher investment in fast-cycle fulfillment hubs.

- Modular automation will help firms scale sites with shorter installation time.

- Partnerships between vendors and logistics firms will accelerate technology rollout.

- Global supply chain shifts will boost automation upgrades in emerging economies.