Market Overview

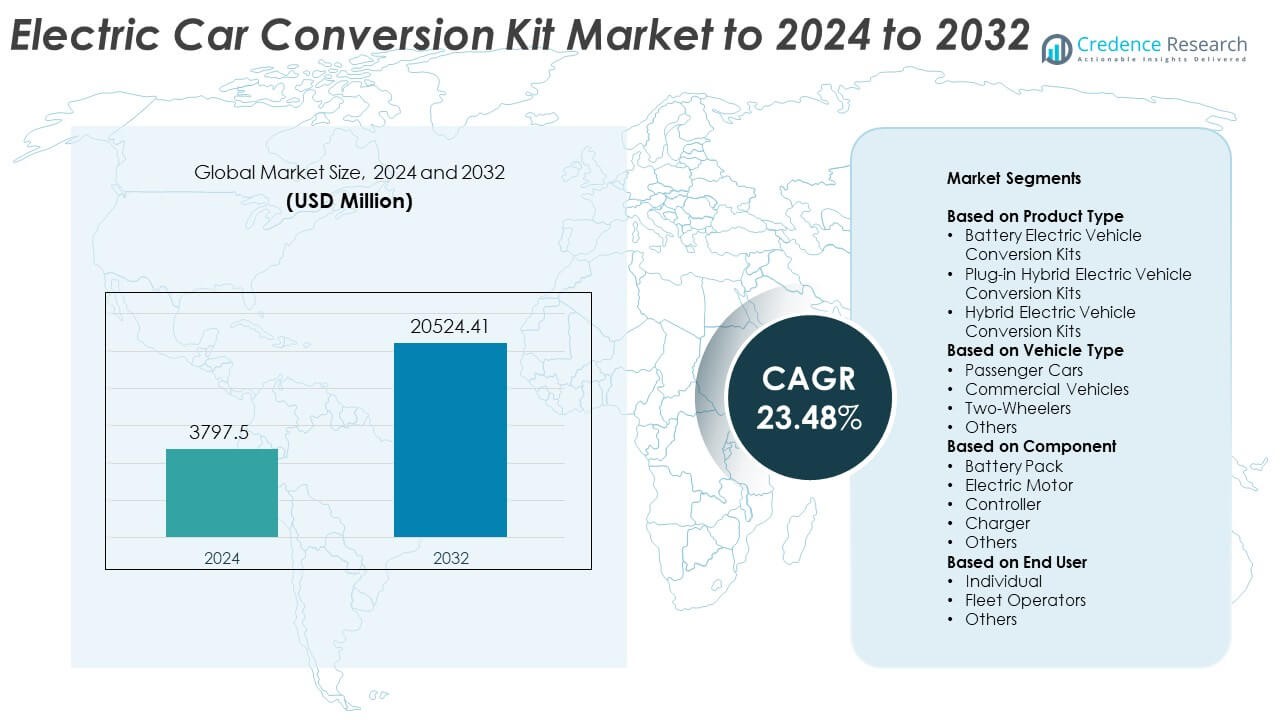

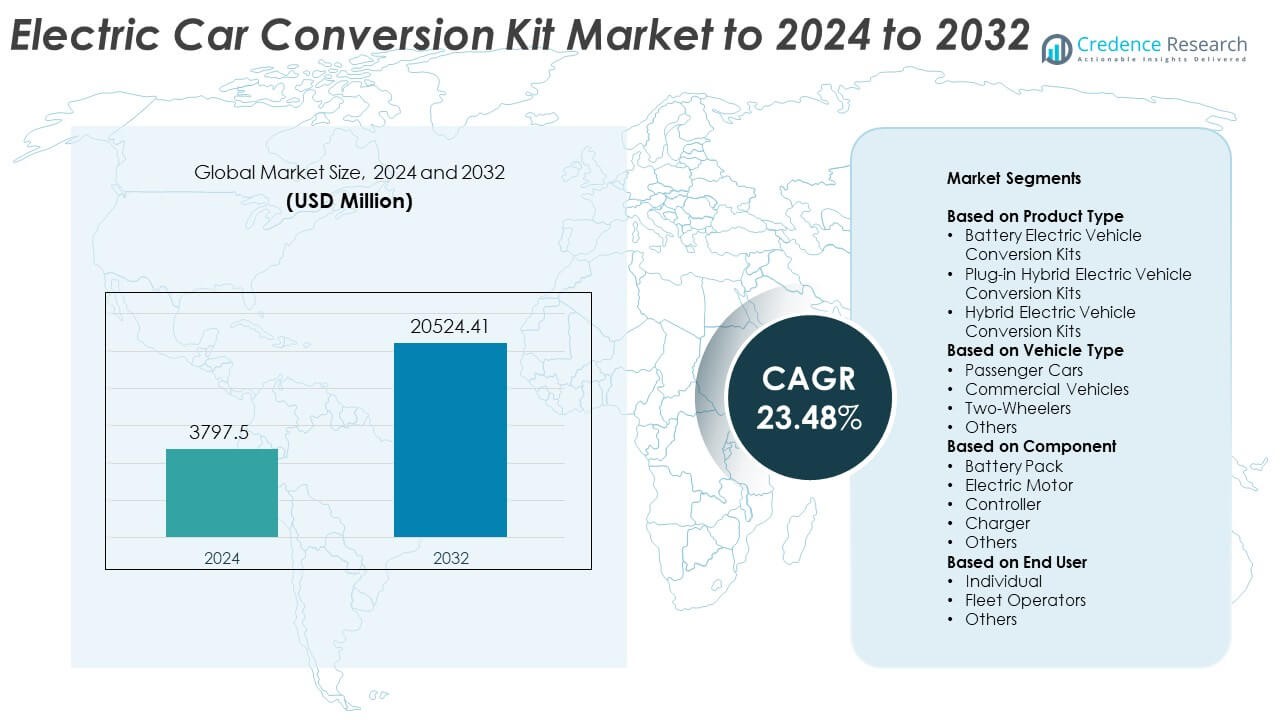

Electric Car Conversion Kit Market size was valued at USD 3797.5 million in 2024 and is anticipated to reach USD 20524.41 million by 2032, at a CAGR of 23.48% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Car Conversion Kit Market Size 2024 |

USD 3797.5 Million |

| Electric Car Conversion Kit Market, CAGR |

23.48% |

| Electric Car Conversion Kit Market Size 2032 |

USD 20524.41 Million |

The Electric Car Conversion Kit Market is shaped by companies such as Electric Classic Cars, EV-propulsion, EV4U Custom Conversions, Electric GT, Revolt Systems, Canadian Electric Vehicles, EV West, EV Conversion Kits, EVolve Electrics, and E Ink Holdings. These players compete through improved battery systems, compact motors, safer controllers, and modular kit designs that reduce installation time. North America leads the market with about 34% share due to strong retrofit adoption and a large aftermarket ecosystem. Europe follows with nearly 29% share, supported by strict emission rules, while Asia Pacific holds around 27% driven by cost-efficient electrification trends.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Electric Car Conversion Kit Market reached USD 3797.5 million in 2024 and will reach USD 20524.41 million by 2032, growing at a 23.48% CAGR.

• Rising adoption of cost-effective electrification drives demand, with battery electric conversion kits holding about 58% share due to higher efficiency and zero-emission performance.

• Key trends include modular kit designs, advanced battery packs, and expanding certified workshop networks that improve installation speed and safety compliance.

• Competition strengthens as players enhance motor efficiency, controller safety, and diagnostic software while expanding service networks to reach hobbyists and fleet users.

• North America leads with 34% share, followed by Europe at 29% and Asia Pacific at 27%, with passenger cars dominating by vehicle type at nearly 62% share.

Market Segmentation Analysis:

By Product Type

Battery Electric Vehicle Conversion Kits lead this segment with about 58% share in 2024. Demand rises as owners shift to full-electric systems for zero tailpipe emissions and lower operating costs. Workshops prefer BEV kits because these systems offer simpler architecture, fewer moving parts, and improved reliability. Plug-in hybrid kits grow in urban regions where mixed-mode driving supports range flexibility, while hybrid electric vehicle kits gain traction among cost-sensitive users seeking partial electrification. Growth accelerates as governments expand incentives for vehicle electrification and older cars move toward emission-compliant upgrades.

- For instance, Electrogenic offers drop-in EV conversion kits for models like the Land Rover Defender. The standard 52 kWh battery kit offers a range of approximately 100+ miles (160+ km) on-road.

By Vehicle Type

Passenger Cars dominate this segment with nearly 62% share in 2024. Adoption expands as car owners convert aging petrol and diesel vehicles to meet emission norms and reduce running expenses. Conversion workshops focus on passenger cars due to higher volumes and standardised chassis layouts, which simplify installation. Commercial vehicles see steady adoption for urban delivery fleets aiming to cut fuel costs, while two-wheelers rise in markets with dense city traffic. Growth continues as electrification policies target light-duty vehicles and encourage retrofit solutions.

- For instance, Transition-One develops EV conversion kits for small city cars like the Renault Twingo and Fiat 500. The company claims a driving range of about 60 miles (approximately 100 km) on a single charge due to the small battery size.

By Component

Battery Pack holds the largest share in this segment with around 48% in 2024. The battery pack dominates because it forms the core cost component and determines vehicle range, safety, and performance. Manufacturers invest in lithium-ion upgrades that enhance energy density and speed up the conversion process. Electric motors and controllers gain traction as kit suppliers shift to compact, higher-efficiency designs, while chargers expand with growing home-charging adoption. Market demand strengthens as declining battery prices make conversions more affordable.

Key Growth Drivers

Rising Adoption of Vehicle Electrification

Governments push stricter emission norms, which drives vehicle owners to shift toward cleaner mobility. Many buyers choose conversion kits to avoid the higher cost of new electric cars. Workshops promote full-electric retrofits because these upgrades improve energy efficiency and trim long-term fuel expenses. Rising fuel prices also encourage adoption, especially in urban regions. As charging networks expand and battery technology improves, owners find conversion kits more practical. This factor stands as a key growth driver for the Electric Car Conversion Kit Market.

- For instance, BYD reported selling 3.02 million new energy vehicles in 2023, up from 1.86 million in 2022, demonstrating rapid electrification momentum that supports demand for retrofit and conversion solutions.

Cost-Effective Option Compared to New EV Purchases

Conversion kits offer a cheaper way to switch to electric mobility without buying a new EV. The lower upfront price appeals to budget-sensitive drivers and owners of older vehicles. Many users extend vehicle life while reducing operating costs. Falling battery prices make retrofits even more attractive. Fleet operators also embrace conversions to cut fuel consumption and align with sustainability goals. Growing awareness about lifecycle cost benefits strengthens market growth, making this factor a key growth driver.

- For instance, GoGoA1 offers RTO-approved electric conversion kits for popular models like the Honda Activa. The kit, including a 72V 21Ah Li-Ion battery and motor.

Supportive Government Policies and Incentives

Many regions provide tax rebates and supportive regulations that encourage retrofitting of ICE vehicles. Approval frameworks for conversion workshops and emission compliance boost installation confidence. Incentive programs help reduce the cost gap between traditional vehicles and electric conversions. Municipalities promote retrofits for taxis, delivery vans, and shared vehicles. Policy alignment with climate targets increases market visibility. These supportive actions boost demand and position this factor as a key growth driver for the Electric Car Conversion Kit Market.

Key Trends and Opportunities

Advancement in Battery and Motor Technologies

Manufacturers design lightweight, energy-dense battery packs that enhance range and safety. New motor designs improve torque, efficiency, and installation flexibility. Compact components reduce space needs, making older vehicles easier to convert. Fast-charging compatibility expands user convenience and strengthens long-term adoption. Technology upgrades open opportunities for premium kits targeting performance enthusiasts. This is a major key trend and opportunity in the Electric Car Conversion Kit Market.

- For instance, Tesla has disclosed that its Model 3/Y permanent-magnet drive units can exceed 90 % efficiency over a wide operating range, illustrating how modern motor and inverter designs enhance energy use and range for both factory EVs and conversion-grade components

Growing Adoption of Conversion Kits in Commercial Fleets

Delivery companies and mobility operators retrofit vehicles to reduce fuel use and meet low-emission zone rules. Fleet managers prefer conversions because the process avoids buying new EVs and shortens downtime. Lower operating costs improve fleet profitability, making retrofit programs attractive. Urban logistics growth increases demand for clean vans, taxis, and small trucks. This segment offers strong business potential for kit manufacturers and installers. It stands as a key trend and opportunity shaping market expansion.

- For instance, DHL Group had more than 35,200 electric vehicles in its global pickup-and-delivery fleet by the end of 2023, along with over 25,000 e-bikes, e-trikes, and cargo bikes.

Key Challenges

High Initial Conversion Costs and Limited Standardization

Despite lower costs compared to new EVs, many vehicle owners still face high upfront expenses. Custom fitting for different vehicle models increases service complexity. Lack of universal standards for kit design and installation slows workshop adoption. Safety certification adds extra cost and time. These barriers reduce conversion uptake in cost-sensitive markets. This stands as a key challenge for the Electric Car Conversion Kit Market.

Limited Availability of Skilled Technicians and Infrastructure

Conversion work demands trained technicians familiar with electrical systems, battery integration, and safety rules. Many regions lack certified workshops, slowing installation rates. Weak charging infrastructure limits adoption in rural areas. Delays in regulatory approvals add to operational hurdles. Skill shortages also increase service costs. This factor remains a key challenge, restricting broader market penetration.

Regional Analysis

North America

North America holds about 34% share in 2024, driven by strong EV adoption and rising interest in retrofitting older gasoline vehicles. Many states support conversion programs through incentives and inspection frameworks that ease compliance. Consumer preference for sustainable mobility and lower fuel costs boosts kit installation rates. Workshop networks expand quickly, especially in the U.S., where hobbyist communities and aftermarket suppliers play a key role. Canada sees steady growth as fleets explore conversions for urban routes. Overall demand strengthens as charging access improves and battery prices decline.

Europe

Europe accounts for nearly 29% share in 2024, supported by strict emission regulations and rapid growth in low-emission zones. Drivers convert older petrol and diesel cars to avoid emission penalties and extend vehicle usability. Countries like Germany, France, and the U.K. promote certified retrofit pathways that enhance safety and market credibility. High environmental awareness fuels adoption among private users and small fleets. Workshops benefit from clear regulatory guidance and strong demand for sustainable transport. Growth continues as cities push toward climate-neutral mobility goals across the region.

Asia Pacific

Asia Pacific holds about 27% share in 2024, led by strong interest in cost-effective electrification across India, China, and Southeast Asia. High fuel prices and rising urban pollution levels encourage adoption of conversion kits. Local suppliers design low-cost solutions that fit older compact vehicles common in the region. Growing two-wheeler electrification also contributes to segment expansion. Government targets for cleaner transportation push conversion markets alongside new EV sales. Fleet operators in dense cities drive steady installations, while battery supply chains in China support competitive pricing.

Latin America

Latin America captures around 6% share in 2024, with growth led by Brazil, Mexico, and Chile. Rising fuel expenses and increasing environmental regulations push drivers to consider affordable conversion options. Market expansion remains gradual due to limited certified workshops and varied regulatory approval processes. However, urban taxi fleets and delivery services show growing interest in retrofits to lower operating costs. Local innovators start offering modular kits suited to older regional vehicle models. Awareness campaigns and pilot programs help build confidence among consumers and small fleet owners.

Middle East and Africa

Middle East and Africa hold nearly 4% share in 2024, reflecting early-stage adoption but rising interest in sustainable vehicle upgrades. Wealthier Gulf nations explore conversions for niche applications and vintage vehicles, while African markets focus on cost savings and reduced fuel use. Limited charging access slows adoption, but government clean-mobility initiatives gradually improve conditions. Retrofit demand grows in commercial fleets, especially in urban logistics. Local workshops begin offering basic conversion services, and falling battery costs support long-term potential across both regions.

Market Segmentations:

By Product Type

- Battery Electric Vehicle Conversion Kits

- Plug-in Hybrid Electric Vehicle Conversion Kits

- Hybrid Electric Vehicle Conversion Kits

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Two-Wheelers

- Others

By Component

- Battery Pack

- Electric Motor

- Controller

- Charger

- Others

By End User

- Individual

- Fleet Operators

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Electric Car Conversion Kit Market features leading companies such as Electric Classic Cars, EV-propulsion, EV4U Custom Conversions, Electric GT, Revolt Systems, Canadian Electric Vehicles, EV West, EV Conversion Kits, EVolve Electrics, and E Ink Holdings. Market players focus on engineering modular kits that support faster installation, higher efficiency, and improved safety compliance. Many suppliers expand product lines to cover multiple vehicle categories, including passenger cars, commercial fleets, and vintage models. Companies invest in advanced battery systems, compact motors, and smarter controllers to enhance performance and range. Partnerships with certified workshops strengthen service networks and build customer trust. Firms also improve software integration for real-time diagnostics and tuning support. Growing demand from individual users and fleet operators encourages manufacturers to refine cost-effective designs. Continuous innovation, regulatory alignment, and expanding retrofit infrastructure shape competition and support long-term market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Electric Classic Cars

- EV-propulsion

- EV4U Custom Conversions

- Electric GT

- Revolt Systems

- Canadian Electric Vehicles

- EV West

- EV Conversion Kits

- EVolve Electrics

- E Ink Holdings

Recent Developments

- In 2025, E Ink Holdings and AUO Display Plus formed a joint venture to enhance the production and availability of large-format ePaper modules, a technology that aligns with the sustainable mobility goals of the broader EV industry.

- In 2025, Edison Motors announced they were developing a retrofit kit specifically for pickup trucks.

- In 2022, Electric GT showcased the eGT-413 V8 EV Crate Motor Swap System and the eGT-913 Porsche 911 specific EV conversion system at SEMA, which continue to be dominant offerings.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Vehicle Type, Component, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for conversion kits will rise as emission rules tighten worldwide.

- Battery technology will improve range and make retrofits more efficient.

- More certified workshops will appear to support safe and standardised installations.

- Fleet operators will adopt conversions to cut fuel costs and meet sustainability goals.

- Conversion kit designs will become compact, modular, and easier to install.

- Government incentives will continue to boost retrofit adoption across older vehicles.

- Charging infrastructure growth will increase confidence in long-term electric mobility.

- Local manufacturers will offer low-cost kits tailored to regional vehicle models.

- Digital tools will enhance diagnostics, tuning, and post-installation performance support.

- Partnerships between automakers and retrofit companies will expand market reach.