Market Overview

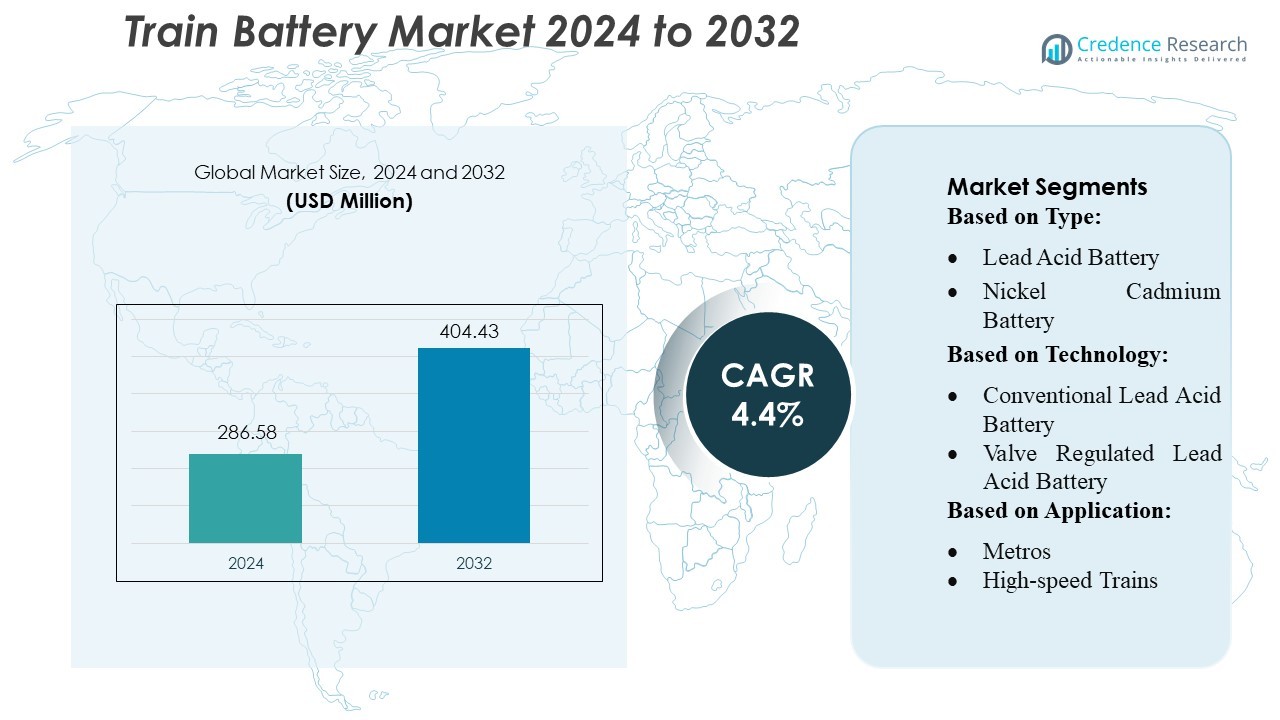

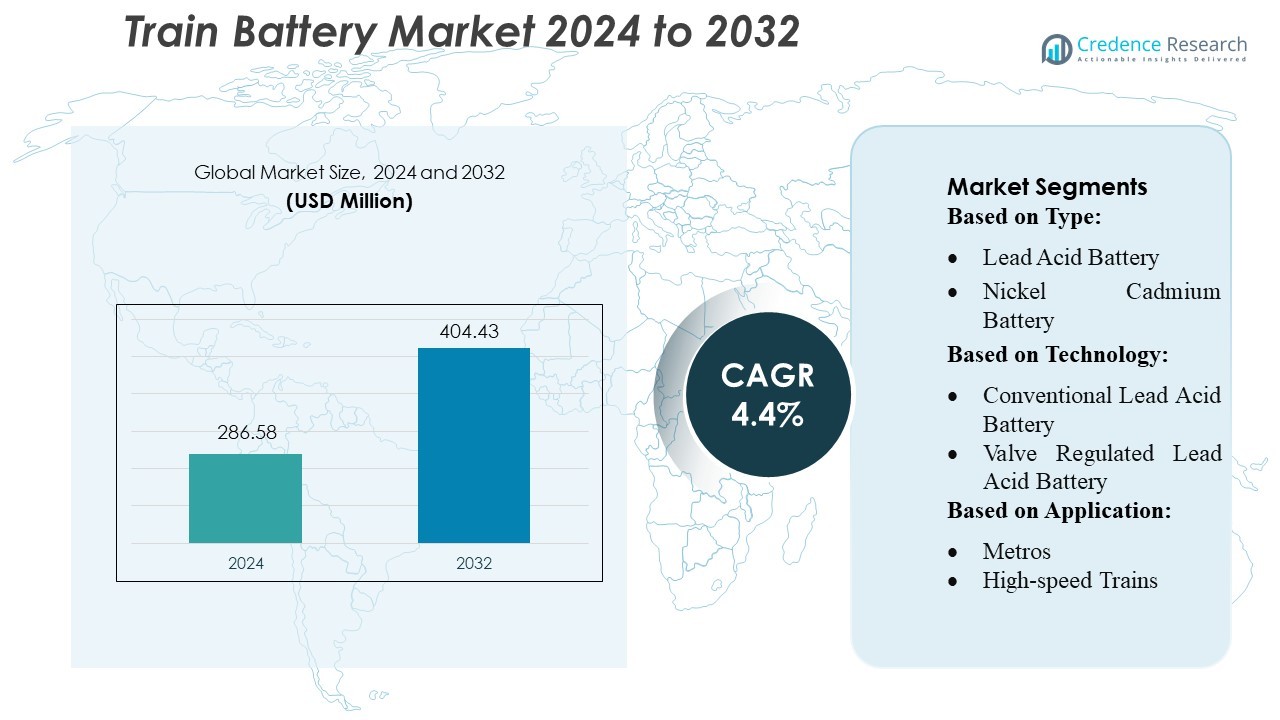

Train Battery Market size was valued USD 286.58 million in 2024 and is anticipated to reach USD 404.43 million by 2032, at a CAGR of 4.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Train Battery Market Size 2024 |

USD 286.58 Million |

| Train Battery Market, CAGR |

4.4% |

| Train Battery Market Size 2032 |

USD 404.43 Million |

The Train Battery Market—including FIRST NATIONAL BATTERY, Hitachi Rail, ENERSYS, HOPPECKE, EXIDE INDUSTRIES, East Penn Manufacturing, AEG Power Solutions, GS Yuasa, Amara Raja Group, and FURUKAWA ELECTRIC—drive innovation through high-performance chemistries, scalable manufacturing, and strong partnerships with rail OEMs. Among global regions, North America leads the market, holding approximately 39.6 % of the global market share, underpinned by large-scale investments in hybrid and battery-electric commuter trains and a robust rail infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Train Battery Market reached USD 286.58 million in 2024 and is projected to hit USD 404.43 million by 2032 at a 4% CAGR, driven by rising demand for energy-efficient and hybrid rail systems.

- Growing preference for advanced chemistries such as lithium-ion and improved lead-acid batteries strengthens market demand, supported by OEM adoption of high-density and long-cycle solutions.

- Competitive intensity increases as major players focus on innovation, scalable production, and strategic collaborations to enhance reliability, safety, and integration with modern rolling stock.

- High initial investment, stringent certification requirements, and concerns over battery durability in extreme operating environments continue to restrain wider adoption across certain rail networks.

- Regionally, North America dominates with 39.6% share, while Asia-Pacific continues to expand rapidly; by segment, lithium-ion batteries gain the fastest growth, supported by electrification initiatives in passenger and freight rail fleets.

Market Segmentation Analysis:

By Type:

In the Train Battery Market, lithium-ion batteries dominate due to their high energy density, long cycle life, and reduced maintenance requirements, accounting for the largest share of the segment. Their adoption accelerates as rail operators modernize rolling stock and prioritize lightweight, high-performance storage solutions to support auxiliary loads and regenerative braking systems. Lead-acid batteries maintain steady demand in cost-sensitive and legacy systems, while nickel-cadmium batteries serve niche applications requiring high reliability under extreme temperatures. The overall shift toward electrification and efficiency continues to strengthen lithium-ion’s leadership across global rail fleets.

- For instance, FIRST NATIONAL BATTERY supplies rail-grade lead-acid cells with capacities reaching 1,550 Ah in its heavy-duty locomotive series, enabling enhanced backup duration and operational resilience for freight and passenger rail operators.

By Technology:

The Lithium Iron Phosphate (LFP) technology segment holds the leading market share, driven by its strong thermal stability, long service life, and superior safety profile for high-power rail applications. Operators favor LFP systems for metros and high-speed trains due to their ability to support frequent charge–discharge cycles and lower total cost of ownership. Among nickel-cadmium types, pocket plate and fiber/PNE variants remain relevant for heavy-duty operations, while valve-regulated and gel tubular lead-acid batteries meet the needs of conventional rolling stock. Growing demand for high-efficiency and low-maintenance power solutions continues to accelerate the migration toward advanced lithium technologies.

- For instance, Hitachi Rail’s Masaccio (Blues) hybrid train incorporates Toshiba’s SCiB battery modules based on LTO chemistry, delivering over 20,000 charge–discharge cycles and enabling up to 15 minutes of zero-emission operation in non-electrified zones, according to official Hitachi Rail specifications.

By Application:

Metros represent the dominant application segment, capturing the highest share of demand as urban transit networks expand and adopt energy-efficient onboard power systems. Their frequent start-stop cycles and continuous auxiliary power needs drive adoption of advanced lithium-ion and LFP solutions, enabling long service intervals and improved reliability. High-speed trains and passenger coaches also contribute significantly as railway modernization projects increase worldwide. Light rail, trams, and monorails show steady growth supported by urban infrastructure development. Metro fleet expansions, alongside increasing electrification and safety requirements, remain the primary drivers of battery demand across the application landscape.

Key Growth Drivers

- Expansion of Electrified and Urban Rail Networks

The rapid expansion of electrified rail infrastructure and urban transit systems drives strong demand in the train battery market. Governments are increasing investments in metros, commuter rails, and high-speed networks to reduce congestion and carbon emissions. This growth requires reliable onboard power systems that support lighting, HVAC, braking, and safety functions. As countries upgrade ageing fleets and deploy new electric rolling stock, operators prioritize high-efficiency and low-maintenance battery technologies, positioning lithium-ion and advanced lead-acid solutions as critical components of modern rail ecosystems.

- For instance, MedGenome Labs has processed over 60,000 NIPT samples since 2017, validating its proprietary Claria NIPT (based on Illumina’s VeriSeq) with 100% concordance in sex-chromosome aneuploidy detection across 51 high-risk cases.

- Shift Toward Lightweight and High-Efficiency Battery Technologies

Rail operators increasingly adopt lightweight and high-efficiency batteries to enhance operational performance and reduce energy consumption. Lithium-ion batteries gain traction due to their high energy density, long lifecycle, and ability to support regenerative braking systems. These advantages enable rail fleets to reduce maintenance downtime and improve overall energy utilization. The industry’s focus on maximizing auxiliary power reliability and optimizing train weight encourages continuous upgrades from traditional lead-acid systems to advanced lithium-based chemistries, fueling sustained market growth.

- For instance, HOPPECKE technical data, FNC® cells can be operated reliably within a wide temperature range, typically from –40°C to +60°C. With special electrolytes, temperatures as extreme as –50°C to +70°C are possible.

- Rising Emphasis on Safety, Reliability, and Backup Power Systems

Growing regulatory focus on passenger safety and uninterrupted rail operations boosts demand for robust battery systems. Modern trains rely heavily on batteries to power emergency lighting, control systems, door mechanisms, and communication equipment during grid failures. Operators seek durable, vibration-resistant, and thermally stable solutions to comply with global rail safety standards. Innovations in thermal management, battery monitoring systems, and fire-resistant chemistries further accelerate the adoption of high-performance batteries capable of delivering consistent backup power under demanding conditions.

Key Trends & Opportunities

- Accelerating Adoption of Lithium-Iron-Phosphate (LFP) and LTO Technologies

A key market trend is the growing adoption of LFP and lithium titanate oxide (LTO) batteries, driven by their superior safety profile, long cycle life, and high thermal stability. LFP’s cost-effectiveness and reduced degradation rate make it well-suited for metros and commuter trains with frequent cycling. Meanwhile, LTO offers ultra-fast charging and exceptional low-temperature performance, creating opportunities for next-generation rail applications. These advanced chemistries support sustainability goals and provide long-term economic benefits, positioning them as cornerstone technologies for future rail electrification.

- For instance, Exide Industries is building a lithium-ion gigafactory in Bengaluru with a first-phase capacity of 6 GWh, split equally between LFP and NMC chemistries, according to its investor presentation.

- Digitalization and Smart Battery Management Systems (BMS)

The integration of advanced battery management systems creates opportunities for improved diagnostics, predictive maintenance, and prolonged battery lifespan. Smart BMS solutions enable real-time monitoring of temperature, voltage, and state-of-charge, ensuring safe and optimized operation across varying load conditions. As operators increasingly adopt IoT and data analytics for fleet management, demand grows for batteries equipped with intelligent health-monitoring capabilities. This trend supports cost reduction, enhances operational reliability, and aligns with broader digital transformation initiatives within the railway sector.

- For instance, GS Yuasa’s LIM30H-8A lithium-ion module — used in battery-powered trains — supports a maximum current of 600 A and includes a Battery Management Unit (BMU) that monitors each cell’s voltage and temperature, enabling external data output for system-level diagnostics.

- Growing Focus on Sustainability and Circular Battery Value Chains

Sustainability initiatives create opportunities for recycling and second-life applications of rail batteries. With environmental regulations tightening, operators and manufacturers explore eco-friendly materials, low-carbon manufacturing processes, and standardized recycling methods. The rise of circular value chains supports efficient recovery of lithium, nickel, and other valuable materials, reducing reliance on mining. Additionally, repurposing used train batteries for stationary energy storage offers cost advantages and promotes resource efficiency, positioning sustainability as a major opportunity for long-term market development.

Key Challenges

- High Initial Costs of Advanced Battery Technologies

One of the major challenges is the high upfront cost associated with lithium-ion, LFP, and LTO batteries compared to traditional lead-acid systems. Although these technologies offer long-term benefits, the significant initial investment can limit adoption, particularly in cost-sensitive regions and for older rolling stock. Budget constraints within public rail agencies further slow down fleet electrification and modernization efforts. Overcoming this challenge requires lower battery prices, supportive financing models, and government incentives to accelerate large-scale deployment.

- Technical Limitations and Safety Concerns in Harsh Rail Environments

Train batteries operate under demanding conditions, including vibrations, temperature fluctuations, and heavy cycling, which can impact performance and lifespan. Ensuring thermal stability, preventing overcharging, and avoiding thermal runaway remain critical concerns, especially for lithium-based chemistries. Meeting stringent railway safety certifications and reliability standards adds complexity to system design and integration. These technical barriers can delay adoption and require ongoing advancements in battery engineering, robust housing designs, and enhanced safety monitoring systems to ensure long-term operational resilience.

Regional Analysis

North America

North America holds an estimated 25–28% share of the global train battery market, driven by continued investments in fleet modernization and the transition toward hybrid locomotives. The United States leads regional demand due to large-scale refurbishment programs across freight rail operators and the adoption of advanced lithium-ion systems for improved energy density and lifecycle durability. Canada contributes momentum with expanding urban transit electrification initiatives supporting regenerative braking solutions. The region benefits from strong supplier presence, improved charging technologies, and government initiatives promoting low-emission rail transport, collectively strengthening its position in high-performance train battery adoption.

Europe

Europe commands approximately 32–35% of the global market, making it the dominant region due to its aggressive rail electrification targets and early integration of next-generation battery chemistries. Germany, France, and the U.K. drive adoption through hybrid and battery-electric trains designed to replace diesel units on non-electrified routes. EU-backed decarbonization policies accelerate procurement of lithium-titanate and solid-state battery systems known for fast-charging capability and extended cycle life. Growing cross-border rail connectivity projects and high-density commuter networks create sustained demand for advanced onboard energy storage solutions, reinforcing Europe’s leadership in technological innovation and market share.

Asia-Pacific

Asia-Pacific holds an estimated 30–33% share, emerging as the fastest-growing region due to large-scale urban transit expansion and strong government support for rail modernization. China and India lead volume demand through substantial investments in metro, regional, and high-speed rail networks requiring reliable auxiliary and traction battery systems. Japan and South Korea contribute through adoption of lithium-ion and nickel-metal hydride technologies in advanced rolling stock. Increasing electrification of freight corridors, rising production of domestic rolling stock, and rapid technological upgrades position APAC as a core growth engine in the global train battery landscape.

Latin America

Latin America accounts for roughly 5–7% of the global market, with growth driven by incremental upgrades in passenger and freight rail systems. Brazil and Mexico lead adoption as modernization programs prioritize improving reliability and operational efficiency of existing rolling stock. The region increasingly integrates lithium-ion and lead-acid batteries for auxiliary power applications across urban transit networks. Although investment levels remain modest compared to major markets, ongoing rail expansion projects, public-private partnerships, and rising interest in hybrid locomotives are gradually strengthening market penetration and creating opportunities for technology suppliers over the forecast period.

Middle East & Africa

The Middle East & Africa represents about 4–6% of the global market, supported by emerging rail infrastructure projects and a shift toward modern, energy-efficient rolling stock. Saudi Arabia and the UAE drive demand through high-speed and urban rail developments requiring advanced onboard power storage systems. South Africa contributes through fleet modernization in freight transport and commuter rail applications. Despite limited electrified rail lines, increasing investment in long-distance connectivity, safety upgrades, and auxiliary power enhancements is steadily expanding the region’s adoption of both lead-acid and lithium-ion train battery technologies.

Market Segmentations:

By Type:

- Lead Acid Battery

- Nickel Cadmium Battery

By Technology:

- Conventional Lead Acid Battery

- Valve Regulated Lead Acid Battery

By Application:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Train Battery Market features a diverse set of global and regional manufacturers, including FIRST NATIONAL BATTERY, Hitachi Rail Limited, ENERSYS., HOPPECKE Carl Zoellner & Sohn GmbH, EXIDE INDUSTRIES LTD., East Penn Manufacturing Company, AEG Power Solutions, GS Yuasa International Ltd., Amara Raja Group, and FURUKAWA ELECTRIC CO., LTD. The Train Battery Market is characterized by intensifying innovation, strategic collaborations, and a strong focus on long-term performance optimization. Manufacturers increasingly prioritize advanced chemistries that deliver higher energy density, extended lifecycle, and improved safety under demanding rail operating conditions. Companies are expanding their R&D capabilities to develop batteries that support faster charging, enhanced thermal stability, and reduced maintenance requirements, aligning with the global shift toward more sustainable and electrified rail networks. In addition, partnerships with rolling stock OEMs, rail operators, and infrastructure developers are becoming essential to address evolving technical standards and integration needs. Competition also centers on expanding regional footprints, strengthening aftermarket service networks, and offering cost-efficient, rail-certified battery solutions. This dynamic environment continues to push the industry toward next-generation technologies capable of supporting modern electric, hybrid, and autonomous train systems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- FIRST NATIONAL BATTERY

- Hitachi Rail Limited

- HOPPECKE Carl Zoellner & Sohn GmbH

- EXIDE INDUSTRIES LTD.

- East Penn Manufacturing Company

- AEG Power Solutions

- GS Yuasa International Ltd.

- Amara Raja Group

- FURUKAWA ELECTRIC CO., LTD.

Recent Developments

- In May 2025, NHOA Energy, a global provider of large-scale energy storage systems, started the construction of a 400 megawatt-hour battery energy storage system (BESS) in Kallo, Beveren, Belgium, in partnership with ENGIE.

- In May 2025, Vivo launched the V50 Elite edition with a snapdragon processor, a 6000 mAh battery, and bundled earbuds in India. The brand provides 3 years of OS updates and 4 years of security support. The 42-hour battery life and fast charging will leverage the brand and the battery market.

- In July 2024, Alstom announced plans to begin manufacturing large batteries for railway components in India by 2025, which can be used in hybrid trains like Vande Bharat and metro systems. The company will reconfigure its Maneja facility in Gujarat to locally produce these batteries after initially importing them.

- In April 2024, Green Li-ion, a Singapore-based company, launched North America’s first commercial-scale installation to produce recycled, battery-grade materials from spent lithium-ion batteries. The facility is located in Atoka, Oklahoma, and uses the company’s patented Green-hydrorejuvenation technology to convert black mass into materials like precursor cathode active material (pCAM).

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will increasingly shift toward high-energy-density chemistries to support longer train runtimes and improved operational efficiency.

- Adoption of lithium-ion and solid-state technologies will accelerate as rail operators emphasize safety, weight reduction, and lifecycle performance.

- Manufacturers will expand investments in smart battery management systems to enhance monitoring accuracy and predictive maintenance capabilities.

- Demand for batteries designed for hybrid and fully electric trains will grow as countries advance rail electrification programs.

- Regulatory pressures will drive the development of eco-friendly, recyclable battery materials and reduced environmental footprints.

- Rail OEMs and battery suppliers will form more strategic partnerships to integrate advanced storage solutions into next-generation rolling stock.

- The aftermarket segment will strengthen due to rising requirements for battery servicing, refurbishment, and lifecycle extension.

- Grid-connected and renewable-powered charging infrastructure will gain importance, supporting more efficient battery usage in rail fleets.

- Emerging markets will adopt modern train batteries rapidly as they expand rail networks and modernize aging fleets.

- Technological convergence will support the evolution of autonomous and smart rail systems that rely heavily on reliable onboard energy storage.