Market Overview

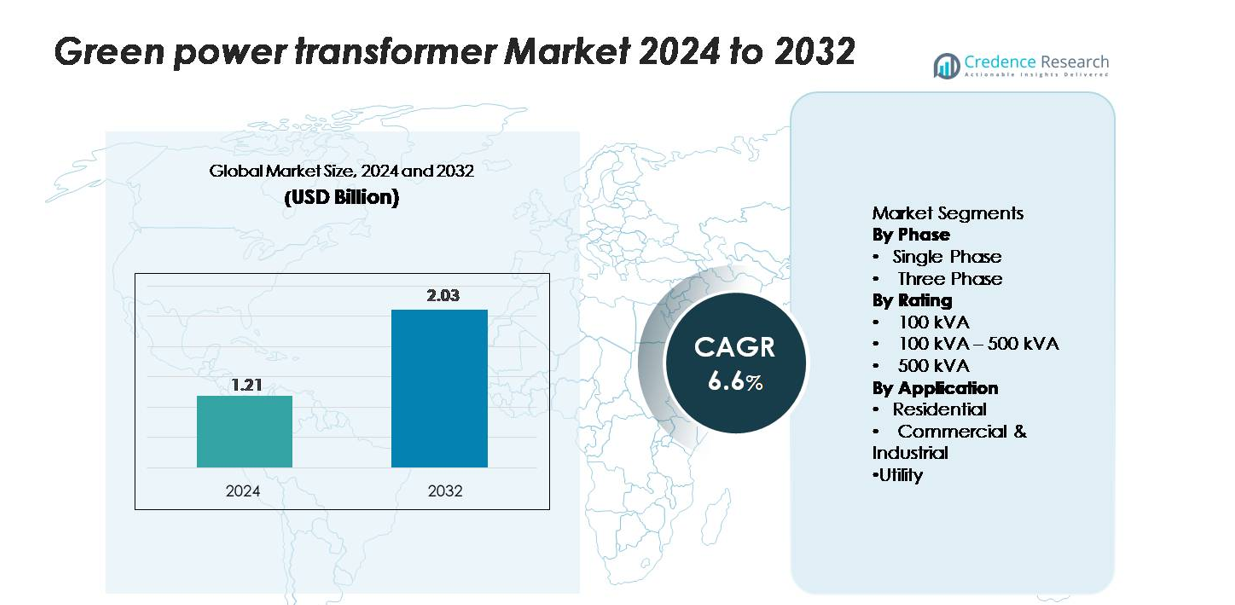

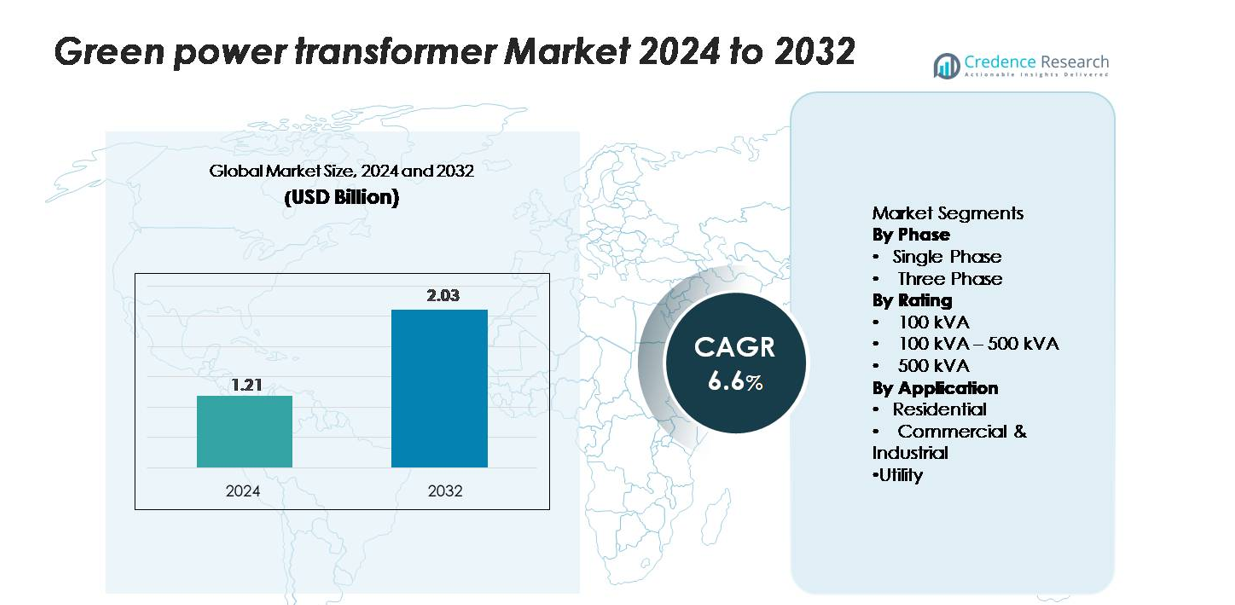

The global green power transformer market was valued at USD 1.21 billion in 2024 and is projected to reach USD 2.03 billion by 2032, expanding at a CAGR of 6.6% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Green Power Transformer Market Size 2024 |

USD 1.21 billion |

| Green Power Transformer Market, CAGR |

6.6% |

| Green Power Transformer Market Size 2032 |

USD 2.03 billion |

The green power transformer market is led by major global players including ABB, Alstom Grid, CG Power and Industrial Solutions, Eaton, GE Grid Solutions, Hitachi Energy, Hyosung Heavy Industries, Ormazabal, Schneider Electric, and Siemens Energy, each competing through advancements in low-loss cores, eco-efficient insulation materials, and smart-monitoring capabilities. These companies maintain strong partnerships with utilities and renewable developers, enabling widespread deployment across transmission and distribution networks. North America holds the largest regional share at approximately 35%, supported by aggressive grid-modernization programs and high adoption of sustainable transformer technologies. Europe and Asia-Pacific follow closely, driven by renewable integration mandates and expanding electrification initiatives.

Market Insights

- The global green power transformer market was valued at USD 1.21 billion in 2024 and is projected to reach USD 2.03 billion by 2032, registering a CAGR of 6.6% during the forecast period.

- Market growth is driven by increasing renewable energy integration, stricter eco-efficiency regulations, and rising utility investments in low-loss, environmentally friendly transformer technologies across transmission and distribution networks.

- Key trends include rapid adoption of natural-ester insulation, digital monitoring features, amorphous metal cores, and transformer solutions optimized for decentralized energy systems and smart grid modernization.

- The market is moderately competitive, with players such as ABB, Hitachi Energy, Siemens Energy, GE Grid Solutions, and Schneider Electric strengthening portfolios through innovation in sustainable materials, sensor-enabled designs, and high-efficiency transformer configurations; high upfront costs remain a restraint.

- Regionally, North America leads with ~35% share, followed by Europe at ~30% and Asia-Pacific at ~28%; by segment, single-phase units and the 100–500 kVA rating hold the dominant shares due to widespread deployment in residential, commercial, and utility applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Phase:

Single-phase green power transformers account for the dominant share of the market, driven by their widespread deployment in residential zones, small commercial establishments, and rural electrification programs. Their lower installation cost, compact footprint, and suitability for distributed renewable systems—such as rooftop solar and small wind installations—strengthen adoption. Three-phase transformers continue to expand in industrial and utility settings; however, single-phase models maintain leadership due to high-volume installations in low- to medium-voltage networks. Ongoing grid modernization and rural grid upgrades further reinforce demand for efficient single-phase configurations.

- For instance, ABB’s single-phase pole-mounted distribution transformer series includes models engineered with amorphous-metal cores that reduce core losses by up to 70 watts per unit, while supporting ratings up to 500 kVA for rural and semi-urban feeder upgrades.

By Rating:

The 100 kVA–500 kVA segment holds the largest share of the green power transformer market, reflecting its suitability for diverse applications across commercial buildings, community-scale renewable projects, and suburban distribution networks. This rating range offers an optimal balance between power capacity, operational efficiency, and cost, making it the preferred choice for grid-connected solar plants and medium-load centers. Although units below 100 kVA remain relevant in residential micro-grids and small enterprises, the 100 kVA–500 kVA category leads due to its broader deployment in expanding commercial and semi-urban distribution infrastructures.

For instance, Schneider Electric’s dry-type Green Premium distribution transformer series (such as the Trihal line) includes a 400 kVA, 11/0.415 kV model engineered with cast-resin insulation and certified to operate within the limits of Class F insulation (meaning a temperature rise of 100 K), which allows for a maximum winding temperature of 155 °C.

By Application:

The utility segment dominates the market due to extensive procurement of green power transformers for grid reinforcement, renewable power integration, and substation upgrades. Utilities increasingly invest in environmentally friendly transformers to reduce losses, improve power quality, and comply with efficiency regulations and eco-design standards. While commercial and industrial users adopt these systems to support energy-efficient operations and onsite renewable generation, residential installations remain smaller in scale. The utility sector’s large-scale installations, long-term infrastructure planning, and high-capacity project pipelines ensure its continued leadership in overall market contribution.

Key Growth Drivers

Rising Integration of Renewable Energy into Power Grids

The rapid global shift toward renewable energy continues to accelerate demand for green power transformers, which play a critical role in integrating solar, wind, and hybrid energy systems into transmission and distribution networks. As governments implement policies to decarbonize electricity supply, utilities increasingly deploy eco-efficient transformers that minimize energy losses and support grid stability under variable renewable inputs. Large-scale solar parks and wind farms depend on high-efficiency step-up and step-down transformers to ensure consistent voltage output and fault tolerance. Furthermore, the rise of community-level renewable projects and distributed energy resources amplifies the need for transformers capable of handling bidirectional power flow. Green transformers—characterized by superior insulation materials, reduced emissions, and high recyclability—align closely with national and corporate sustainability goals, making them indispensable for renewable expansion programs across both developed and emerging markets.

- For instance, Hitachi Energy’s EconiQ™ series includes a 132/33 kV eco-efficient power transformer that uses natural ester insulation with a flash point above 300 °C and delivers a short-circuit withstand capability of 25 kA for 2 seconds, enabling reliable operation in utility-scale solar and wind integration nodes.

Government Regulations Favoring Energy Efficiency and Eco-Design

Regulations targeting carbon reduction, energy efficiency, and sustainable grid modernization drive significant adoption of green power transformers. Many countries have introduced strict standards restricting the use of mineral-oil-based insulation, promoting biodegradable fluids, and mandating low-loss transformer designs. These regulations encourage utilities and industries to replace aging infrastructure with advanced, eco-friendly transformers that meet efficiency thresholds and reduce lifecycle emissions. Financial incentives, subsidies for green equipment, and mandatory compliance programs further accelerate procurement. In regions like Europe and East Asia, eco-design directives and carbon footprint reporting requirements compel manufacturers to innovate insulation materials, magnetic cores, and transformer configurations. As grids evolve to support electric vehicles, distributed generation, and digitalized monitoring systems, compliance becomes a critical driver for upgrading traditional transformer fleets. Consequently, regulatory frameworks act as both an enabler and accelerator for long-term market growth.

- For instance, Siemens Energy’s GEAFOL Neo dry-type transformer introduced a redesigned core using grain-oriented silicon steel that limits no-load losses to 280 watts for a 1,000 kVA, 11/0.4 kV configuration, while utilizing a halogen-free Class F insulation system certified according to EN 50588-1 eco-design regulations.

Expansion of Smart Grids and Digital Power Infrastructure

The global movement toward smart grid modernization significantly boosts the demand for green power transformers equipped with advanced diagnostic and monitoring capabilities. As utilities upgrade conventional networks to intelligent, automated systems, they increasingly adopt transformers that incorporate sensors, IoT modules, and condition-monitoring platforms to optimize performance and reduce downtime. These digital-ready green transformers support predictive maintenance, remote monitoring, and improved load management—features essential for managing fluctuating renewable inputs and enhancing grid resilience. Growth in electric vehicle charging networks and urban energy management systems also amplifies the need for efficient, eco-friendly transformers capable of handling dynamic loads. Smart grids rely heavily on transformers with minimal transmission losses and superior thermal stability, further strengthening demand. The integration of artificial intelligence and real-time analytics in power distribution creates long-term opportunities for manufacturers offering technologically advanced, sustainable transformer solutions.

Key Trends & Opportunities

Growing Adoption of Bio-Based and Eco-Efficient Insulation Materials

A major trend reshaping the market is the increasing use of biodegradable and high-performance insulating fluids such as natural esters. These fluids offer improved fire safety, superior biodegradability, and enhanced thermal performance compared to traditional mineral oils. As industries and utilities prioritize environmental compliance and safety, the adoption of such materials presents significant opportunities for transformer manufacturers. Bio-based insulation supports longer equipment life, higher overload capacity, and lower environmental risk in case of leaks, making it attractive for densely populated urban installations, renewable power stations, and critical infrastructure. Manufacturers that can innovate in insulation chemistry and eco-efficient cooling systems stand to benefit from expanding regulatory pressures and customer preferences for sustainable grid components.

- For instance, Cargill’s FR3™ natural-ester fluid is certified with a flash point above 300 °C and enables transformers to operate at hotspot temperatures up to 20 °C higher than mineral-oil units, allowing manufacturers like Hitachi Energy to design sealed distribution transformers rated up to 72.5 kV with extended thermal aging performance.

Increasing Demand for Transformers Supporting Decentralized Energy Systems

The rise of microgrids, distributed solar installations, and decentralized power systems opens new growth avenues for compact and efficient green power transformers. These systems require transformers optimized for variable loads, bidirectional power flow, and high-frequency switching conditions. As residential and commercial consumers adopt rooftop solar, battery storage, and hybrid energy systems, demand for smaller yet high-efficiency transformers continues to grow. Remote communities, industrial parks, and smart campuses increasingly deploy decentralized grids, creating opportunities for custom-designed green transformers with enhanced energy efficiency and low environmental impact. Manufacturers with flexible design capabilities and modular product portfolios are well-positioned to capture this emerging segment.

- For instance, Hitachi Energy’s RESIBLOC® dry-type transformers—used widely in microgrids and distributed renewable nodes—feature a cast-resin winding system capable of operating at hotspot temperatures up to 155 °C, with short-circuit withstand strength verified at up to 35 kA for 1 second.

Technology Advancements in High-Efficiency Core and Coil Design

Advancements in magnetic core materials—such as amorphous metal cores—are enabling substantial reductions in no-load and load losses, strengthening the adoption of high-efficiency green transformers. Improved coil winding techniques, advanced cooling mechanisms, and optimized thermal management further enhance overall performance. These innovations unlock opportunities for manufacturers to differentiate their product portfolios with ultra-low-loss models suitable for renewable projects, smart substations, and urban distribution networks. As energy costs rise globally, the economic advantages of high-efficiency designs become more compelling, driving greater customer interest in premium sustainable transformer solutions.

Key Challenges

High Initial Investment and Cost of Eco-Friendly Materials

Despite long-term operational savings, green power transformers often involve higher upfront costs due to advanced materials, sustainable insulation fluids, and enhanced manufacturing processes. Utilities operating with budget constraints or in cost-sensitive regions may postpone upgrades, choosing to extend the life of traditional transformers instead. The adoption of natural ester oils, amorphous metal cores, and enhanced monitoring systems further raises initial procurement expenses. In emerging markets, limited financial incentives for eco-friendly equipment intensify this challenge. For many buyers, the cost-benefit realization occurs over long operating cycles, making short-term budget planning a barrier to market expansion.

Technical Limitations and Compatibility Issues in Existing Grid Infrastructure

Integrating new green power transformers into aging or incompatible grid systems poses operational and technical challenges. Differences in load profiles, voltage requirements, thermal performance expectations, and protection schemes can create barriers during installation and commissioning. Utilities may face constraints in retrofitting older substations, especially where space limitations, outdated switchgear, or insufficient monitoring systems restrict the use of advanced transformer technologies. Additionally, transformer standards vary across regions, complicating cross-border adoption. These compatibility issues require significant planning, engineering adjustments, and investments in supporting infrastructure—factors that slow overall market penetration.

Regional Analysis

North America

North America holds the largest share of the green power transformer market, accounting for an estimated 32–35%, supported by strong investments in grid modernization, renewable energy integration, and aging transformer replacement programs. The United States drives most of the demand through large-scale solar and wind installations, strict eco-efficiency regulations, and widespread adoption of natural-ester-insulated transformers. Canada contributes through clean energy expansion and reliability-focused grid upgrades. The region’s advanced utility infrastructure, high environmental compliance standards, and rapid deployment of smart grid technologies further reinforce North America’s leadership in the market.

Europe

Europe captures approximately 28–30% of the global market, driven by aggressive decarbonization targets, eco-design regulations, and rapid renewable energy penetration across Germany, the U.K., France, and the Nordic countries. The region is a frontrunner in adopting bio-based insulation fluids, low-loss transformer cores, and grid-supportive technologies compatible with distributed renewable systems. Extensive electrification of transport systems, expansion of offshore wind capacity, and refurbishment of aging substations significantly boost transformer demand. Strong regulatory emphasis on lifecycle sustainability and carbon reduction ensures Europe remains a critical growth hub for green transformer manufacturers.

Asia-Pacific

Asia-Pacific represents around 26–28% of market share and is the fastest-growing region, led by substantial power infrastructure expansion in China, India, Japan, and Southeast Asia. Rapid urbanization, rising electricity demand, and large-scale renewable energy programs fuel adoption of green transformers across transmission and distribution networks. China dominates regional installations through massive solar-wind integration and grid upgrade initiatives, while India accelerates demand through rural electrification and smart city projects. Government-backed efficiency mandates, the shift toward sustainable grid components, and strong manufacturing capabilities make Asia-Pacific a pivotal market for long-term growth.

Middle East & Africa

The Middle East & Africa region holds roughly 6–8% of the market, with demand primarily driven by renewable energy diversification, utility modernization, and grid reliability initiatives. Gulf countries including the UAE, Saudi Arabia, and Oman invest heavily in green transformers to support large solar farms, hydrogen projects, and sustainable city developments. In Africa, electrification programs and expansion of decentralized energy systems generate steady demand, particularly in South Africa and Kenya. While adoption is gradual due to budget constraints, increasing regulatory focus on efficiency and sustainability strengthens long-term market potential.

Latin America

Latin America accounts for an estimated 5–7% of global share, supported by growing renewable energy deployment and grid reinforcement efforts across Brazil, Chile, Mexico, and Argentina. Expanding solar and wind sectors, combined with programs to reduce transmission losses, drive steady adoption of environmentally friendly transformer technologies. Brazil leads the market through large utility-scale renewable projects and transmission upgrades. Although investment cycles can be uneven due to economic fluctuations, the region’s long-term commitment to clean energy and grid modernization continues to create opportunities for green power transformer deployment.

Market Segmentations:

By Phase

By Rating

- 100 kVA

- 100 kVA – 500 kVA

- 500 kVA

By Application

- Residential

- Commercial & Industrial

- Utility

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the green power transformer market is characterized by a mix of global manufacturers and regional suppliers competing on technology innovation, energy-efficient designs, and compliance with eco-friendly standards. Leading companies focus on developing transformers with low-loss cores, biodegradable insulation fluids, and advanced monitoring capabilities to align with regulatory demands and sustainability goals. Strategic priorities include expanding manufacturing capacity, strengthening utility partnerships, and enhancing product portfolios for smart grids and renewable energy integration. Mergers, acquisitions, and joint ventures are common as firms aim to widen geographic reach and improve supply chain resilience. Regional players remain competitive by offering cost-efficient, customized solutions for local grid requirements. With rising demand for eco-efficient power infrastructure, the market continues to shift toward digitally enabled, high-performance green transformers, intensifying competition across both developed and emerging economies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ABB

- Alstom Grid

- CG Power and Industrial Solutions

- Eaton

- GE Grid Solutions

- Hitachi Energy

- Hyosung Heavy Industries

- Ormazabal

- Schneider Electric

- Siemens Energy

Recent Developments

- In September 2025, ABB Announced an investment of US$110 million in the U.S. to expand R&D and manufacturing of advanced electrification solutions to serve grid and data-centre demand.

- In April 2025, ABB stated it will expand local U.S. production (including grid equipment) and committed about US$120 million to expand production of low-voltage electrical equipment in Tennessee & Mississippi.

- In January 2025, CG Power and Industrial Solutions (India) Board approved establishing a greenfield transformer manufacturing facility of ~45,000 MVA capacity in Western India at an estimated cost of ₹712 crore (~US$ ≈ 90 million) to meet long-term transformer demand.

Report Coverage

The research report offers an in-depth analysis based on Phase, Rating, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for green power transformers will accelerate as nations expand renewable energy capacity and modernize grid infrastructure.

- Utilities will increasingly replace aging transformer fleets with eco-efficient, low-loss models to meet sustainability and regulatory requirements.

- Natural-ester and other biodegradable insulating fluids will see stronger adoption due to safety, environmental benefits, and improved thermal performance.

- Smart grid expansion will drive demand for transformers equipped with sensors, condition monitoring, and digital diagnostics.

- Adoption of amorphous metal cores and advanced coil designs will continue reducing energy losses and improving transformer efficiency.

- Decentralized energy systems and microgrids will create new opportunities for compact, high-efficiency green transformers.

- Large-scale solar, wind, and hybrid renewable projects will boost demand for high-capacity, grid-supportive transformer installations.

- Manufacturers will expand local production and supply chains to address rising global demand and reduce delivery lead times.

- Growing electrification of transport and industry will increase load requirements, prompting utilities to invest in advanced transformers.

- Emerging markets will adopt green transformers more rapidly as government policies prioritize energy efficiency and low-carbon infrastructure.