| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Bacon Slicers Market Size 2024 |

USD 593.50 million |

| Bacon Slicers Market, CAGR |

5.62% |

| Bacon Slicers Market Size 2032 |

USD 948.56 million |

Market Overview:

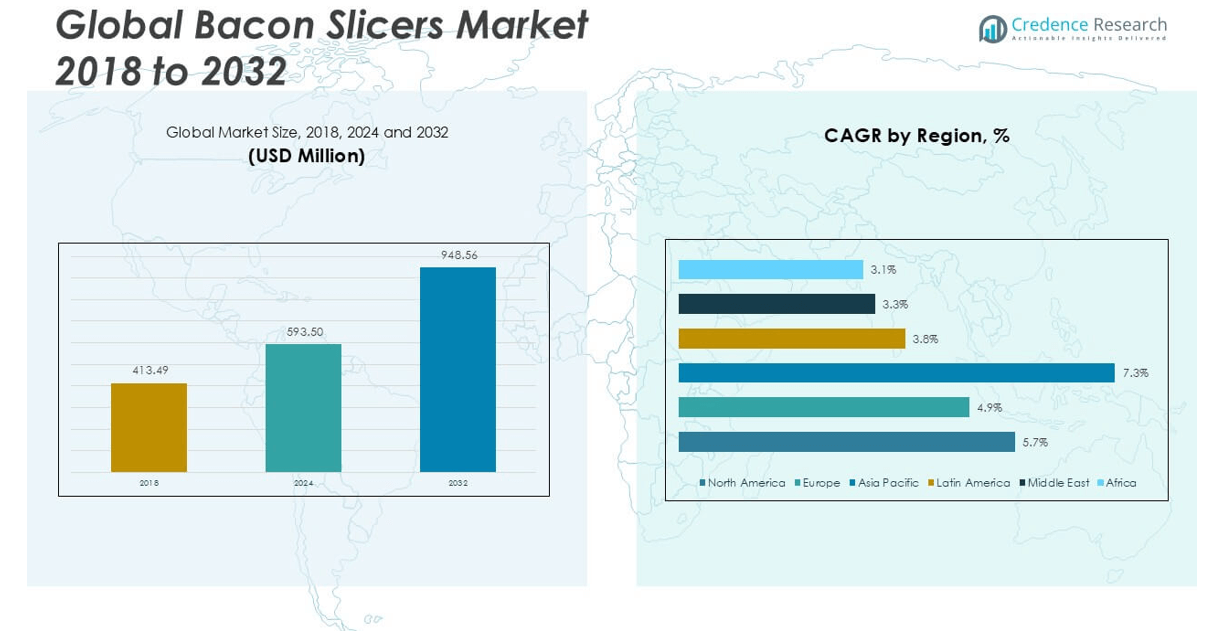

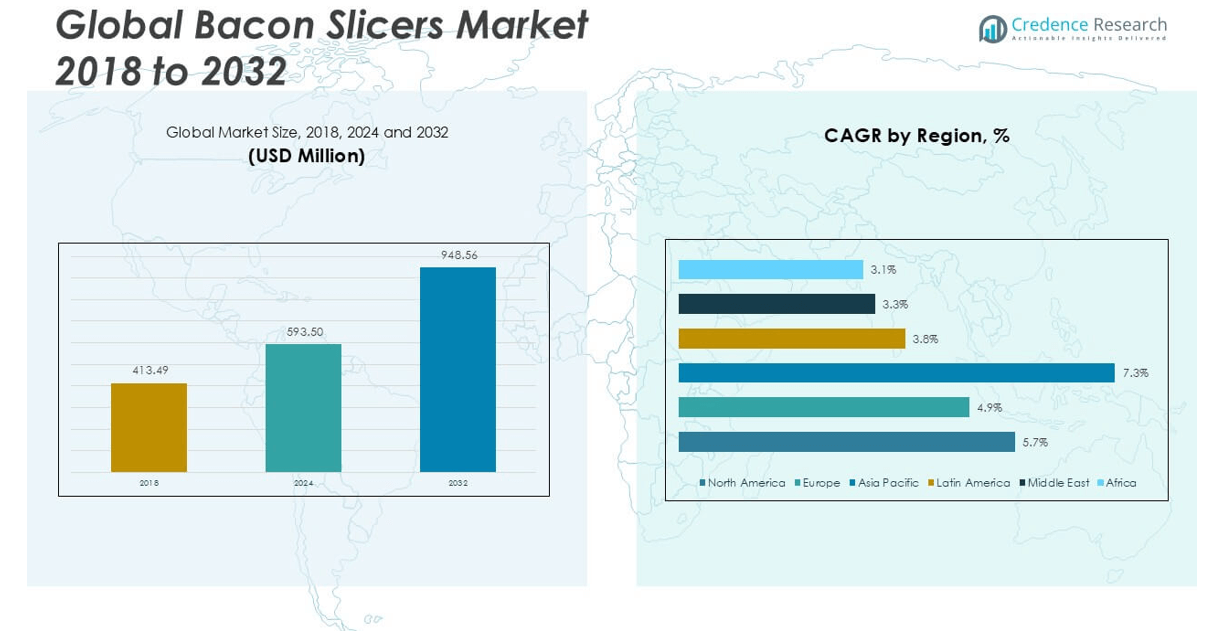

The Bacon Slicers market size was valued at USD 413.49 million in 2018, increased to USD 593.50 million in 2024, and is anticipated to reach USD 948.56 million by 2032, at a CAGR of 5.62% during the forecast period.

The Bacon Slicers market is highly competitive, with key players including Grote Company, Thurne, Weschenfelder, Provisur Technologies, Sirman, Weber Maschinenbau, HOBART Corporation, Bizerba, Berkel, and Globe Food Equipment Co. These companies focus on innovation, automation, and product reliability to meet the growing demand for precision slicing in the food processing industry. Grote Company and Weber Maschinenbau hold prominent positions due to their extensive product portfolios and global distribution networks. North America leads the market with a 41.9% share in 2024, driven by high consumption of processed meat and widespread adoption of automated food processing systems. Europe follows with a 29.6% share, supported by strong regulatory frameworks and advanced manufacturing capabilities.

Market Insights

- The Bacon Slicers market was valued at USD 593.50 million in 2024 and is projected to reach USD 948.56 million by 2032, growing at a CAGR of 5.62% during the forecast period.

- Rising demand for processed meat and packaged bacon in foodservice and retail sectors is driving the adoption of efficient slicing equipment globally.

- Automation and smart slicing technologies are gaining traction, with automatic slicers accounting for 64% of the technology segment due to enhanced precision and reduced labor dependency.

- North America leads the regional market with a 41.9% share in 2024, followed by Europe at 29.6%, while Asia Pacific emerges as the fastest-growing region with a CAGR of 7.3%.

- High initial investment and stringent hygiene regulations pose challenges for small and mid-sized processors, limiting widespread adoption in developing economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The Bacon Slicers market, by product type, is segmented into vertical slicers and horizontal slicers. Among these, horizontal slicers held the dominant market share in 2024, accounting for over 58% of the segment revenue. This dominance is attributed to their ability to deliver uniform thickness and high-speed slicing, which enhances operational efficiency in commercial food processing units. Their adaptability to automated lines and minimal maintenance requirements further support their strong market presence. Vertical slicers, while effective for smaller-scale operations, are primarily used in specialty retail or artisanal meat shops due to their compact design.

- For instance, the Weber S6 slicer achieves a blade speed of 2,000 rpm, supports a throat width of 520 mm, and handles products up to 1,700 mm in length.

By Technology

In the technology segment, automatic bacon slicers emerged as the leading sub-segment, capturing around 64% of the total market share in 2024. This growth is driven by increased demand for automation in food processing industries to improve slicing precision, reduce labor costs, and enhance throughput. Semi-automatic bacon slicers also hold a significant position in the market, particularly in medium-scale and specialty meat processing applications. While they account for a smaller share compared to fully automatic models, their affordability and ease of operation make them a preferred choice for businesses with moderate production volumes. Semi-automatic slicers offer a balanced combination of manual control and mechanical assistance, which is ideal for custom slicing requirements.

- For instance, the Grote 613 Multi‑Slicer operates at up to 90 strokes per minute per lane, with slice thickness ranging from 1 mm to 12.7 mm across a 152 × 330 mm slicing zone.

Market Overview

Rising Demand for Processed Meat Products

The increasing global consumption of processed meat, particularly in ready-to-eat and convenience food categories, is driving the demand for bacon slicers. Urbanization, changing dietary habits, and busy lifestyles have boosted the consumption of packaged bacon, especially in North America and Europe. Food processing companies are scaling up production to meet rising demand, prompting investment in high-capacity, efficient slicing equipment. Bacon slicers enable precise, uniform cuts essential for product consistency, making them indispensable in maintaining quality and reducing food waste in large-scale operations.

- For instance, Provisur’s Formax SX330 automatic model features a throat area of 160 × 330 mm, supports log lengths up to 1,000 mm, and runs blade speeds of 1,500 rpm, allowing rapid SKU changeovers and high-volume efficiency.

Advancement in Slicing Technologies

Technological innovations such as programmable control systems, advanced blade designs, and integration with automated production lines have significantly improved slicing accuracy and efficiency. These advancements reduce manual labor, improve hygiene standards, and increase throughput, making automatic slicers highly attractive for food processing firms. The emergence of smart slicing solutions with real-time monitoring and maintenance alerts further enhances operational reliability. As manufacturers focus on automation and digitalization, the adoption of advanced bacon slicers is expected to rise across industrial meat processing facilities.

- For instance, Bizerba’s A660 slicer integrates weighing functionality that reduces overweight and waste by up to 15%, while slicing at rates between 40 and 300 slices per minute, offering precise portion control with integrated weighing and hygienic design.

Expansion of Foodservice and Retail Sectors

The global expansion of foodservice chains, quick-service restaurants (QSRs), and modern retail formats is fueling the demand for consistent and efficient meat slicing solutions. These establishments prioritize speed, hygiene, and portion control, which bacon slicers deliver effectively. Retailers offering freshly sliced bacon also rely on high-performance slicers to maintain product appeal and shelf-life. Additionally, the rising number of delis, supermarkets, and specialty meat outlets in emerging markets is contributing to higher sales of both automatic and semi-automatic bacon slicer.

Key Trends & Opportunities

Shift Toward Automation and Smart Slicing

A growing trend in the bacon slicers market is the shift toward fully automated, intelligent slicing machines equipped with sensors, AI-based controls, and data analytics capabilities. These systems enable predictive maintenance, energy efficiency, and production optimization. As food manufacturers face rising labor costs and seek to minimize human error, the demand for such smart technologies is growing. This trend presents significant opportunities for manufacturers to innovate and offer value-added solutions that enhance operational efficiency and reduce downtime in high-volume processing environments.

- For instance, Weber’s weSLICE 7500 can achieve blade speeds of 1,850 rpm, enabling multi-track slicing with interleaving, supporting high throughput performance in automated lines.

Increased Adoption in Emerging Markets

Emerging economies in Asia-Pacific, Latin America, and the Middle East are witnessing rising disposable incomes and dietary westernization, contributing to increased consumption of processed meats including bacon. This shift is encouraging local meat processing firms to invest in modern slicing technologies to meet rising consumer demand. As infrastructure in food manufacturing and cold chain logistics improves in these regions, the market presents lucrative opportunities for bacon slicer manufacturers to expand their customer base and establish regional production or distribution hubs.

- For instance, Sirman’s MIRRA 300 Y09 electric meat slicer, imported into Vietnam in 2024, has a capacity rating of 120 kg per hour demonstrating its suitability for commercial-scale production and the type of equipment increasingly adopted in emerging markets.

Key Challenges

High Initial Investment and Maintenance Costs

The high capital investment required for advanced bacon slicing equipment poses a challenge for small and medium-sized enterprises (SMEs). Automatic slicers with advanced features involve substantial upfront costs and ongoing expenses related to blade replacement, calibration, and maintenance. These costs can be prohibitive for companies with limited budgets or variable production volumes, hindering wider adoption. Moreover, the need for skilled personnel to operate and maintain complex machinery adds to the operational burden, especially in developing markets.

Stringent Hygiene and Safety Regulations

The bacon slicers market must navigate stringent food safety and hygiene regulations imposed by agencies such as the FDA and EFSA. Slicing equipment must meet specific standards regarding material use, design, cleaning processes, and contamination control. Non-compliance can result in fines, product recalls, or reputational damage. Ensuring equipment design allows for easy disassembly and thorough sanitation without compromising performance presents a technical and regulatory challenge for manufacturers seeking market entry or expansion in highly regulated regions.

Volatility in Raw Material Supply Chain

Supply chain disruptions, including fluctuations in raw material availability and price volatility for components like stainless steel and motors, impact production schedules and cost structures for bacon slicer manufacturers. Global events such as geopolitical tensions, pandemics, or trade restrictions can delay delivery timelines and increase procurement costs. These uncertainties pose a risk to production planning and margin stability, particularly for smaller manufacturers with limited inventory buffers or reliance on single-source suppliers.

Regional Analysis

North America

North America held the largest share in the bacon slicers market in 2024, accounting for 41.9% of the global revenue. The market grew from USD 175.00 million in 2018 to USD 248.49 million in 2024 and is projected to reach USD 398.30 million by 2032, registering a CAGR of 5.7%. This growth is primarily driven by high consumption of processed meat products, presence of leading food processing companies, and increasing automation in meat processing facilities across the U.S. and Canada. Investments in advanced slicing technology and strict quality control standards further reinforce North America’s dominant position.

Europe

Europe represented the second-largest regional market in 2024, contributing 29.6% of the global bacon slicers market share. The market expanded from USD 126.67 million in 2018 to USD 175.74 million in 2024 and is anticipated to reach USD 265.70 million by 2032, growing at a CAGR of 4.9%. Strong demand for premium-quality bacon, widespread adoption of automated meat processing systems, and compliance with stringent food safety regulations are key growth drivers. The region’s mature meat processing sector and growing emphasis on operational efficiency and hygiene are boosting the demand for advanced slicing equipment.

Asia Pacific

Asia Pacific is the fastest-growing region in the bacon slicers market, with a CAGR of 7.3%, and accounted for 19.8% of the global market share in 2024. The market grew significantly from USD 75.38 million in 2018 to USD 117.77 million in 2024, and is projected to reach USD 214.45 million by 2032. Rising disposable incomes, increasing consumption of Western-style processed foods, and expanding food manufacturing infrastructure are key factors driving demand. China, Japan, and India are emerging as major consumers due to urbanization and shifts in dietary patterns favoring convenience and packaged meat products.

Latin America

Latin America contributed 4.2% to the global bacon slicers market in 2024, with market size increasing from USD 17.51 million in 2018 to USD 24.78 million in 2024, and expected to reach USD 34.52 million by 2032, at a CAGR of 3.8%. The market is driven by gradual growth in the processed meat sector and rising adoption of automation in meat production facilities in countries like Brazil and Mexico. While adoption remains moderate, improving food safety regulations and increasing export of processed pork products are supporting investment in efficient slicing technologies across the region.

Middle East

The Middle East bacon slicers market held a 2.5% share in 2024, growing from USD 11.30 million in 2018 to USD 14.80 million in 2024, and is forecasted to reach USD 19.86 million by 2032, at a CAGR of 3.3%. The region is witnessing steady demand due to the expansion of high-end retail and foodservice sectors in countries like the UAE and Saudi Arabia. Despite cultural and dietary limitations on pork consumption, demand for beef and poultry alternatives prepared using bacon slicers is supporting market growth. Growth opportunities lie in diversifying product applications and food processing investments.

Africa

Africa accounted for 2.0% of the global bacon slicers market in 2024, with a market value of USD 11.91 million, up from USD 7.63 million in 2018. It is projected to reach USD 15.74 million by 2032, reflecting a CAGR of 3.1%. Growth remains modest due to limited industrial food processing infrastructure and lower consumption of processed meats. However, urbanization and improving cold chain logistics are gradually enhancing the potential for processed food production. South Africa and Nigeria lead the regional demand, and future growth will depend on investment in food manufacturing capacity and awareness of meat-processing technologies.

Market Segmentations:

By Product Type

- Vertical Slicers

- Horizontal Slicers

By Technology

- Automatic Bacon Slicer

- Semi-automatic Bacon Slicer

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Bacon Slicers market is marked by the presence of several well-established players and emerging manufacturers striving for technological advancement and market expansion. Key companies such as Grote Company, Weber Maschinenbau, Provisur Technologies, and Bizerba dominate the industry through comprehensive product portfolios, global distribution networks, and a strong focus on automation and hygiene compliance. These companies continuously invest in R&D to develop high-precision, efficient slicing solutions that cater to the evolving needs of large-scale food processors. Mid-sized players like Sirman, Thurne, and Globe Food Equipment Co. are gaining traction by offering customizable and cost-effective slicers to small and medium enterprises. Competitive strategies include product innovation, mergers and acquisitions, and expansion into emerging markets to gain a stronger foothold. As the demand for processed meat continues to grow, especially in Asia Pacific and Latin America, manufacturers are increasingly targeting these regions to strengthen their global market position and revenue base.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Grote Company

- Thurne

- Weschenfelder

- Provisur Technologies

- Sirman

- Weber Maschinenbau

- HOBART Corporation

- Bizerba

- Berkel

- Globe Food Equipment Co.

Recent Developments

- In October 2024, Marel introduced an advanced bacon slicing machine with automated thickness adjustment and minimal product waste, targeting high-volume food processors.

- In July 2024, FAM NV launched a compact bacon slicer model for small and medium-sized enterprises, offering affordable precision slicing solutions.

- In May 2024, Treif Maschinenbau GmbH unveiled a new slicing technology integrating AI-based cutting systems for improved efficiency and product quality.

- In May, 2022, Vodafone Idea has these days expanded inside the Tower Top Preamplifier Market thru its merger with Indus Towers. This merger is an instance of ways telecommunication groups are seeking to lessen expenses and boom performance within the tower installed amplifier market.

Market Concentration & Characteristics

The Bacon Slicers Market exhibits a moderately concentrated structure, with a few key players holding a significant share of global revenue. It is characterized by high product specialization, strong technological integration, and growing emphasis on automation. Leading companies such as Grote Company, Weber Maschinenbau, and Provisur Technologies dominate the landscape by offering advanced slicing systems that meet industrial standards for speed, precision, and hygiene. It features a mix of global manufacturers and regional players, where established brands compete on innovation, quality, and service capabilities. Product differentiation centers around slicing thickness control, hygiene compliance, and integration with automated lines. The market serves both industrial food processors and mid-sized commercial kitchens, with varying demand based on production scale. It continues to evolve with rising adoption of smart technologies and demand for energy-efficient machines. Barriers to entry remain moderate due to capital intensity and regulatory compliance requirements, particularly in North America and Europe, where standards are more stringent.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for bacon slicers will continue to rise due to increasing consumption of processed meat worldwide.

- Automation will play a critical role, with manufacturers investing in advanced, high-speed slicing equipment.

- Smart slicers with integrated sensors and real-time monitoring systems will gain wider adoption.

- Emerging markets in Asia Pacific and Latin America will present strong growth opportunities.

- Food safety regulations will push manufacturers to enhance hygiene standards and machine design.

- Compact and energy-efficient slicers will see higher demand among small and mid-sized processors.

- Strategic partnerships and acquisitions will remain key for expanding global market presence.

- Manufacturers will increasingly focus on customization to meet varied slicing needs.

- Digital transformation and Industry 4.0 integration will influence future product development.

- Rising operational costs may challenge smaller players, encouraging consolidation in the market.