Market Overview:

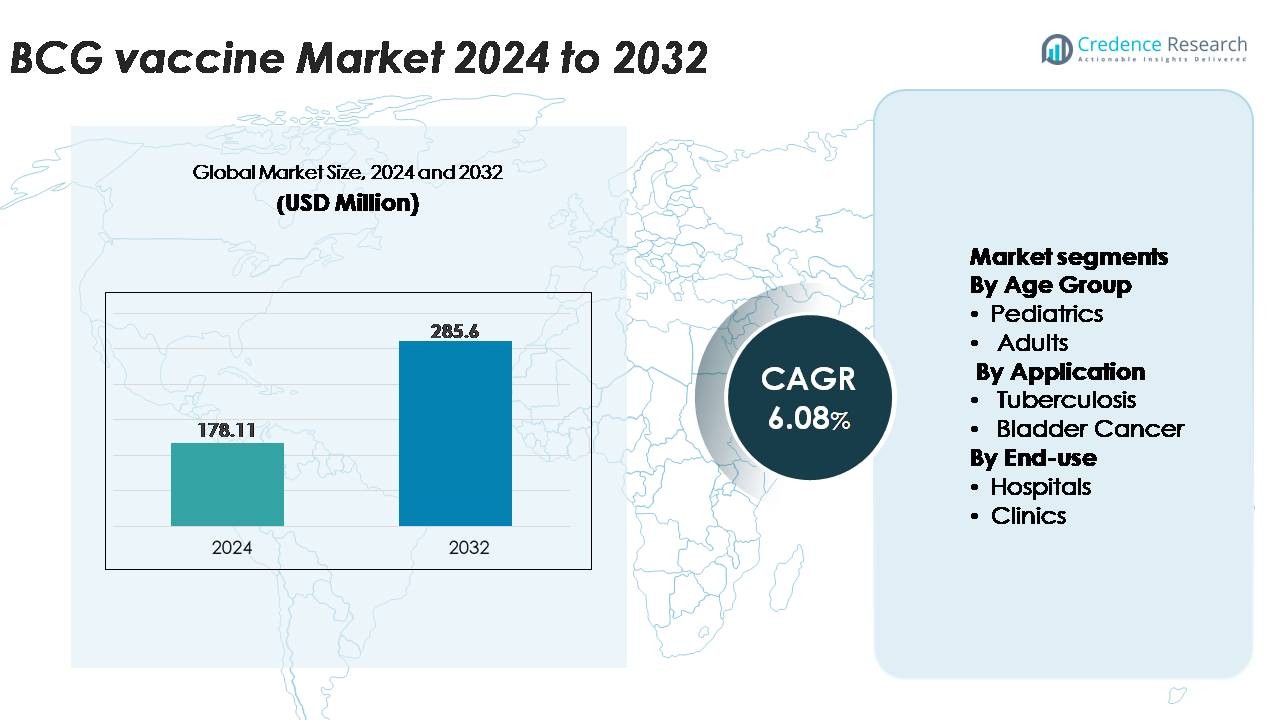

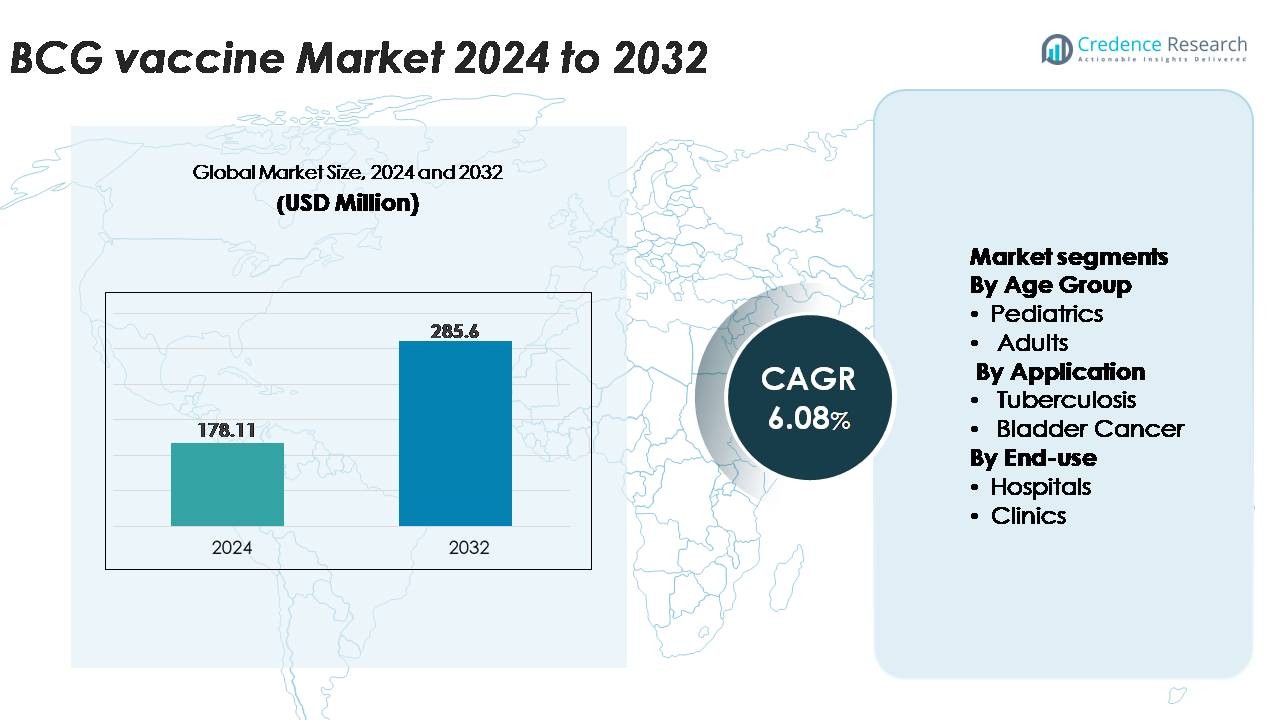

The BCG vaccine market was valued at USD 178.11 million in 2024 and is projected to reach USD 285.60 million by 2032, expanding at a CAGR of 6.08% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| BCG Vaccine Market Size 2024 |

USD 178.11 Million |

| BCG Vaccine Market, CAGR |

6.08% |

| BCG Vaccine Market Size 2032 |

USD 285.60 Million |

The BCG vaccine market is shaped by a mix of global and regional manufacturers, with major contributors including the Serum Institute of India, Japan BCG Laboratory, Biomed Lublin S.A., Microgen, Zydus Group, Taj Pharmaceuticals, GSBPL, AJ Biologics Sdn Bhd, BCG Vaccine Laboratory, and Merck & Co., Inc. These companies collectively support both large-scale pediatric immunization programs and oncology-focused BCG formulations for bladder cancer therapy. Asia-Pacific leads the global market with approximately 42% share, driven by high TB prevalence, mandatory neonatal vaccination policies, and strong domestic production capacity across India, China, and Southeast Asia. Europe and North America follow with significant demand linked to bladder cancer treatment utilization and stable clinical infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The BCG vaccine market was valued at USD 178.11 million in 2024 and is projected to reach USD 285.60 million by 2032, expanding at a CAGR of 6.08%, supported by rising global immunization needs and expanding oncology applications.

- Market growth is driven by mandatory neonatal TB vaccination programs, strong public-health funding in high-burden countries, and expanding adoption of intravesical BCG therapy for non-muscle-invasive bladder cancer, which continues to strengthen clinical demand.

- Key trends include increasing investment in next-generation BCG strains, recombinant vaccine research, and supply-chain modernization, along with rising interest in adult and booster vaccination strategies to support high-risk groups.

- Competitive dynamics are shaped by major producers such as Serum Institute of India, Japan BCG Laboratory, Microgen, Biomed Lublin, Zydus, GSBPL, and others, with market restraint primarily stemming from recurrent global supply shortages and complex manufacturing timelines.

- Regionally, Asia-Pacific leads with ~42% share, followed by Europe (~22%), North America (~18%), Latin America (~10%), and Middle East & Africa (~8%), while the pediatrics segment accounts for the dominant share due to mandatory newborn immunization.

Market Segmentation Analysis:

By Age Group (Pediatrics, Adults)

The pediatrics segment dominates the BCG vaccine market, holding the largest share due to the long-standing global mandate for newborn and infant immunization against tuberculosis. High-burden regions in Asia and Africa continue to record strong vaccination volumes as part of national immunization schedules, supported by expanded birth cohorts and government-funded procurement programs. Increased focus on pediatric TB prevention, WHO-driven vaccine coverage targets, and improved cold-chain infrastructure further reinforce the segment’s lead. In contrast, the adult segment remains smaller, primarily driven by booster trials, special-risk group vaccination, and oncology-related applications, but its share grows at a moderate pace.

- For instance, the Japan BCG Laboratory (JBL) has supplied more than 2.25 billion doses of its BCG vaccine globally over its operational history.

By Application (Tuberculosis, Bladder Cancer)

Tuberculosis remains the dominant application, accounting for the majority of BCG vaccine usage because of its established role in preventing severe pediatric TB forms such as miliary TB and TB meningitis. National immunization programs, particularly in high-incidence countries, ensure consistent demand supported by donor-funded distribution frameworks. Meanwhile, the bladder cancer segment grows steadily as BCG immunotherapy maintains its position as a gold-standard intravesical treatment for non-muscle-invasive bladder cancer. Increased incidence of NMIBC in aging populations and expanded adoption of maintenance therapy regimens contribute to rising utilization, though overall market share remains lower than TB-driven demand.

· For instance, Biomed Lublin S.A. is one of several manufacturers of the BCG vaccine, which it sells to various countries for use in tuberculosis immunization programs and oncology treatments.

By End-use (Hospitals, Clinics)

The hospital segment leads the market due to its central role in newborn vaccination, large-scale immunization workflows, and intravesical BCG therapy delivery for bladder cancer patients. Hospitals benefit from integrated supply chains, specialized nursing staff, and well-established reporting mechanisms that support consistent administration volumes. Clinics represent a growing secondary channel, driven by decentralized immunization programs, higher accessibility in semi-urban and rural areas, and increased private-practice participation in pediatric vaccinations. However, their share remains comparatively smaller, as complex oncology procedures and high-risk newborn interventions are predominantly performed in hospital settings.

Key Growth Drivers

Expansion of Global TB Immunization Programs and High Disease Burden

The continued expansion of national tuberculosis immunization programs represents a major growth driver for the BCG vaccine market. High-burden regions such as South Asia and Sub-Saharan Africa maintain significant demand, supported by government-backed mandates requiring BCG vaccination at birth. WHO’s End TB Strategy further encourages countries to strengthen vaccine coverage, integrate TB screening with immunization visits, and improve cold-chain reliability in rural health systems. As TB continues to affect millions annually, priority efforts to reduce childhood morbidity and mortality accelerate procurement cycles. Countries undergoing demographic expansion with large newborn populations generate sustained vaccine demand, while donor agencies support supply stabilization through bulk purchasing frameworks. Together, these structural factors reinforce BCG’s position as an essential vaccine in global public health infrastructures.

- For instance, the Serum Institute of India one of the world’s leading BCG producers and the world’s largest vaccine manufacturer by volume operates a vaccine manufacturing platform with an installed total capacity exceeding 4 billion doses annually.

Rising Adoption of BCG Immunotherapy for Non-Muscle-Invasive Bladder Cancer (NMIBC)

Increasing clinical reliance on intravesical BCG immunotherapy for non-muscle-invasive bladder cancer acts as a strong market catalyst. BCG remains the standard of care for intermediate- and high-risk NMIBC, with global guidelines recommending multi-week induction plus long-term maintenance therapy. As bladder cancer incidence grows in aging populations across Europe, North America, and East Asia, demand for pharmaceutical-grade BCG formulations continues to rise. Healthcare providers increasingly favor BCG over alternative intravesical agents due to its superior recurrence prevention and well-established safety profile. Ongoing shortages have also encouraged governments and manufacturers to expand production capacities and invest in strain optimization. These dynamics position bladder cancer applications as a fast-growing driver complementing the vaccine’s traditional role in infectious disease prevention.

· For instance, ImmunityBio’s collaboration with the Serum Institute of India in May 2024 includes large-scale manufacturing of both standard BCG (sBCG) and the next-generation recombinant BCG (iBCG) to address global supply shortages. The iBCG is currently undergoing Phase 2 trials in Europe, where it has demonstrated an enhanced safety profile and potent immunogenicity compared to standard BCG.

Strengthening Vaccine Manufacturing Capacity and Supply Chain Modernization

Investments in BCG vaccine production modernization significantly propel market growth. Manufacturers are upgrading fermentation systems, integrating automated fill–finish equipment, and enhancing lyophilization capabilities to ensure batch consistency and reduce contamination risks. Several countries have funded domestic production facilities to achieve supply independence and mitigate historical shortages. Enhanced quality assurance frameworks, GMP-compliant cleanrooms, and digital batch traceability platforms improve efficiency and regulatory adherence. Cold-chain improvements including last-mile monitoring and temperature-stable packaging support distribution in remote settings. Together, these infrastructure expansions not only ensure uninterrupted access but also build resilience against global supply disruptions, thereby strengthening the market’s long-term stability.

Key Trends and Opportunities:

Pipeline Advancements in Next-Generation and Recombinant BCG Platforms

A strong trend shaping the market is the development of next-generation BCG constructs and recombinant formulations aimed at improving immunogenicity and safety. Research groups are engineering genetically modified strains with enhanced antigen expression, reduced reactogenicity, and improved protection against pulmonary TB. Parallel efforts explore BCG-based vectors for non-TB indications, including oncology and autoimmune disorders, expanding the vaccine’s therapeutic footprint. Increased investment in mucosal immunity research and controlled human infection models accelerates clinical progress. These innovations signal a shift toward more potent and targeted BCG derivatives, creating opportunities for premium product portfolios and future commercialization pathways.

- For instance, MTBVAC developed by Biofabri (Zendal Group) and the University of Zaragoza entered Phase 3 clinical evaluation in 2024, supported by a manufacturing scale-up to 20 million annual doses at Biofabri’s Porriño facility.

Growing Focus on Adult, Booster, and High-Risk Population Vaccination Strategies

Emerging vaccination strategies represent a major market opportunity as global health authorities reconsider adult and booster BCG administration for high-risk groups. Healthcare workers, immunocompromised populations, and individuals with occupational exposure are being evaluated for potential revaccination benefits. Ongoing trials assessing BCG’s non-specific immune-boosting effects including possible protection against respiratory infections further stimulate research-driven interest. As TB control programs expand beyond childhood immunization, adult-targeted vaccines create new revenue channels and diversify demand. Countries aiming to curb latent TB infection rates increasingly explore booster strategies, potentially reshaping the age-distribution profile of BCG utilization.

· For instance, the recombinant BCG candidate VPM1002, originally developed by Vakzine Projekt Management (VPM) in Germany and licensed to the Serum Institute of India (SII), was evaluated in multiple Phase 3 trials involving thousands of adult participants across India. A large-scale trial in healthy household contacts of TB patients enrolled 12,000 individuals to assess protective efficacy and safety.

Digitalization of Immunization Systems and Data-driven Coverage Optimization

Digital transformation across healthcare systems creates an important opportunity to enhance BCG coverage and supply planning. National programs are deploying electronic immunization registries, mobile health applications, and real-time stock dashboards to track newborn vaccinations and manage inventory more efficiently. Digital cold-chain sensors improve temperature monitoring, reducing wastage and ensuring dose integrity. Predictive analytics allow health authorities to forecast regional demand, optimize outreach campaigns, and identify coverage gaps. The integration of digital tools not only elevates operational reliability but also strengthens evidence-based policymaking, contributing to long-term market stability.

Key Challenges:

Supply Shortages and Manufacturing Constraints

Historical and recurring shortages of BCG vaccines continue to pose a significant challenge for global distribution. Production is concentrated among a limited number of manufacturers, which increases vulnerability to facility shutdowns, batch failures, or regulatory non-compliance issues. The complex manufacturing process characterized by long culture timelines, biosafety requirements, and sensitivity to contamination limits scalability and rapid output expansion. Supply interruptions particularly affect low-income regions, leading to delayed newborn vaccinations and the risk of increased TB transmission. Overreliance on a few global suppliers heightens the urgency for diversified manufacturing ecosystems and redundancy planning.

Safety Concerns and Contraindication Management in High-risk Groups

Safety-related challenges influence market growth, particularly for populations with immunocompromised conditions, HIV infections, or severe malnutrition. BCG can cause adverse reactions such as disseminated BCG disease in high-risk individuals, leading health authorities to adopt strict contraindication protocols. These safety considerations require careful screening and can delay vaccination timelines in regions with weak diagnostic infrastructures. In bladder cancer therapy, BCG shortages or variations in strain potency may complicate treatment schedules and affect patient outcomes. Addressing these risks demands improved training, stronger clinical guidelines, and enhanced post-vaccination surveillance systems.

Regional Analysis:

North America

North America accounts for around 18% of the BCG vaccine market, driven primarily by its strong utilization in bladder cancer immunotherapy rather than routine pediatric TB vaccination. The United States leads regional demand due to high incidence of non-muscle-invasive bladder cancer and continued preference for intravesical BCG as the standard of care. Canada maintains smaller but stable procurement volumes through specialized medical centers. Supply stabilization measures, expanded oncology treatment capacity, and multiple clinical trials evaluating recombinant BCG candidates further support market growth, although dependence on imported vaccine batches remains a limiting factor.

Europe

Europe represents approximately 22% of global BCG vaccine demand, supported by a mix of tuberculosis prevention in high-risk communities and extensive use in bladder cancer treatment protocols. Countries such as Germany, France, and the U.K. maintain significant purchasing volumes due to aging populations and corresponding increases in NMIBC incidence. Eastern Europe continues routine infant immunization, bolstering consistent baseline demand. The region benefits from advanced manufacturing quality standards and strong pharmacovigilance systems but remains vulnerable to occasional supply constraints, prompting investment in procurement diversification and cross-border stock management strategies.

Asia-Pacific

Asia-Pacific is the dominant region with nearly 42% market share, driven by large birth cohorts, high tuberculosis prevalence, and government-mandated neonatal BCG vaccination programs. India, China, Indonesia, and the Philippines account for a major share of global pediatric immunization volumes. Strong public-health expenditure, expanded cold-chain infrastructure, and growing domestic production capabilities strengthen regional supply reliability. Additionally, increased screening programs, donor-funded immunization support, and ongoing upgrades to vaccine manufacturing facilities enhance long-term stability. The region’s large patient population for both TB prevention and bladder cancer therapy solidifies its position as the fastest-growing BCG vaccine market.

Latin America

Latin America holds around 10% of the BCG vaccine market, supported by universal neonatal vaccination policies across major countries such as Brazil, Mexico, Argentina, and Colombia. High TB incidence in urban and underserved regions drives steady procurement under public immunization frameworks. Regional governments continue improving vaccine distribution networks, especially in remote areas. Bladder cancer treatment applications add a small but rising contribution, particularly in Brazil’s expanding oncology care infrastructure. Despite strong demand, periodic supply fluctuations and import dependency challenge consistent coverage, prompting increased interest in regional manufacturing partnerships and multi-supplier procurement agreements.

Middle East & Africa

The Middle East & Africa region accounts for approximately 8% of global market share, driven largely by the high burden of pediatric tuberculosis and reliance on BCG vaccination at birth across most countries. Sub-Saharan Africa exhibits strong demand due to elevated TB transmission rates and widespread integration of BCG in national immunization schedules. Gulf countries contribute additional volume through bladder cancer treatment utilization. Improvements in donor-funded vaccine access programs and expanded cold-chain capabilities support rising coverage. However, supply shortages, logistics constraints, and healthcare access disparities continue to hinder uniform immunization performance across several low-income markets.

Market Segmentations:

By Age Group

By Application

- Tuberculosis

- Bladder Cancer

By End-use

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The BCG vaccine market is moderately consolidated, with a limited number of WHO-prequalified manufacturers shaping global supply dynamics. Key players such as Serum Institute of India, Japan BCG Laboratory, InterVax, Statens Serum Institut, and GreenSignal Bio Pharma dominate procurement channels through large-volume production capabilities and long-standing participation in national immunization programs. These companies invest heavily in GMP-compliant fermentation systems, lyophilization upgrades, and stringent quality-control processes to ensure consistent batch performance. In oncology applications, specialized pharmaceutical-grade BCG strains used for intravesical therapy strengthen competitive differentiation, with supply stability acting as a critical determinant of provider preference. Strategic collaborations with global health agencies, expansion of domestic manufacturing in emerging economies, and diversification of strain portfolios help companies mitigate historical shortages. Market competition also intensifies around recombinant and next-generation BCG development, where research partnerships and clinical trial progress increasingly influence long-term positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Microgen

- Taj Pharmaceuticals Limited

- Japan BCG Laboratory

- BCG Vaccine Laboratory

- Serum Institute of India Pvt. Ltd.

- GSBPL

- Biomed Lublin S.A.

- Zydus Group

- AJ Biologics Sdn Bhd

- Merck & Co., Inc.

Recent Developments:

- In 2024, General global BCG-market supply-capacity data global demand was estimated at 330 million doses, and there are reportedly 24 active BCG manufacturers worldwide.

- In May 2024, ImmunityBio, Inc. signed an exclusive global arrangement with the Serum Institute of India to supply ImmunityBio with Bacillus Calmette-Guerin (BCG). The agreement covers the manufacturing of standard BCG (sBCG) that is currently approved for use outside the U.S., as well as a next-generation recombinant BCG (iBCG) undergoing testing, intended for use in combination with ImmunityBio’s ANKTIVA (nogapendekin alfa inbakicept-pmln) for currently approved and potential future indications. This collaboration may help the company to acquire an enhanced customer base and capitalize on emerging opportunities.

Report Coverage:

The research report offers an in-depth analysis based on Age group, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Global demand will continue rising as countries strengthen newborn TB immunization programs and expand vaccination coverage in high-burden regions.

- Bladder cancer applications will drive steady growth as BCG remains the gold-standard therapy for non-muscle-invasive cases with widening adoption of maintenance regimens.

- Manufacturers will increase production capacity to reduce recurring shortages and enhance supply reliability across low- and middle-income countries.

- Development of recombinant and next-generation BCG strains will accelerate, improving immunogenicity, safety, and therapeutic versatility.

- Digital immunization platforms and real-time supply monitoring will improve forecasting, distribution efficiency, and vaccination coverage tracking.

- Regulatory agencies will tighten GMP and quality compliance requirements, pushing manufacturers to modernize facilities and adopt advanced process controls.

- Emerging adult and booster vaccination strategies for high-risk populations will create new demand channels beyond pediatric immunization.

- National health systems will increasingly prioritize localized manufacturing to reduce import dependency and secure stable vaccine access.

- Bladder cancer clinical research will expand, exploring optimized dosing schedules and combination therapies that reinforce BCG’s therapeutic relevance.

- International health partnerships and donor-backed procurement programs will strengthen equity and long-term access across underserved regions.