Market Overview

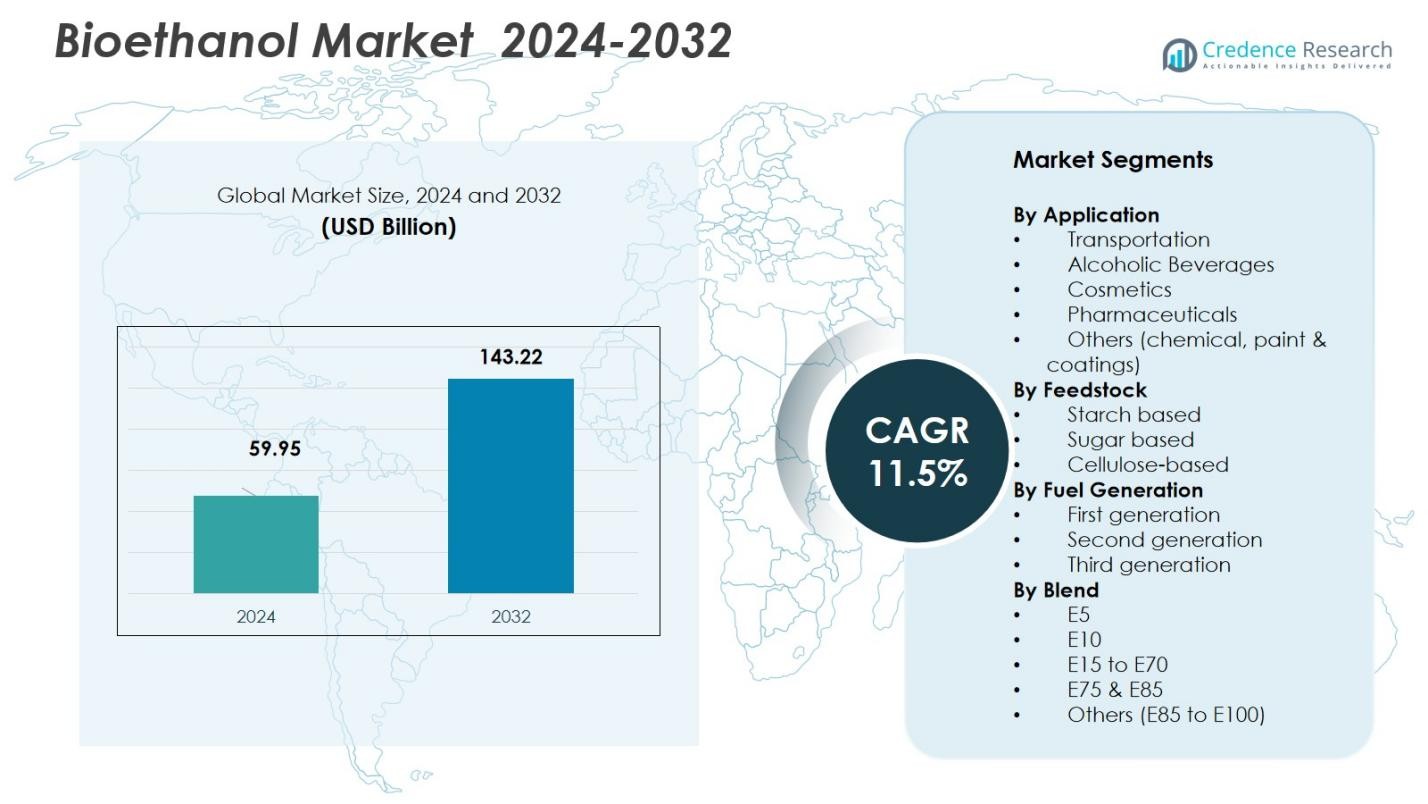

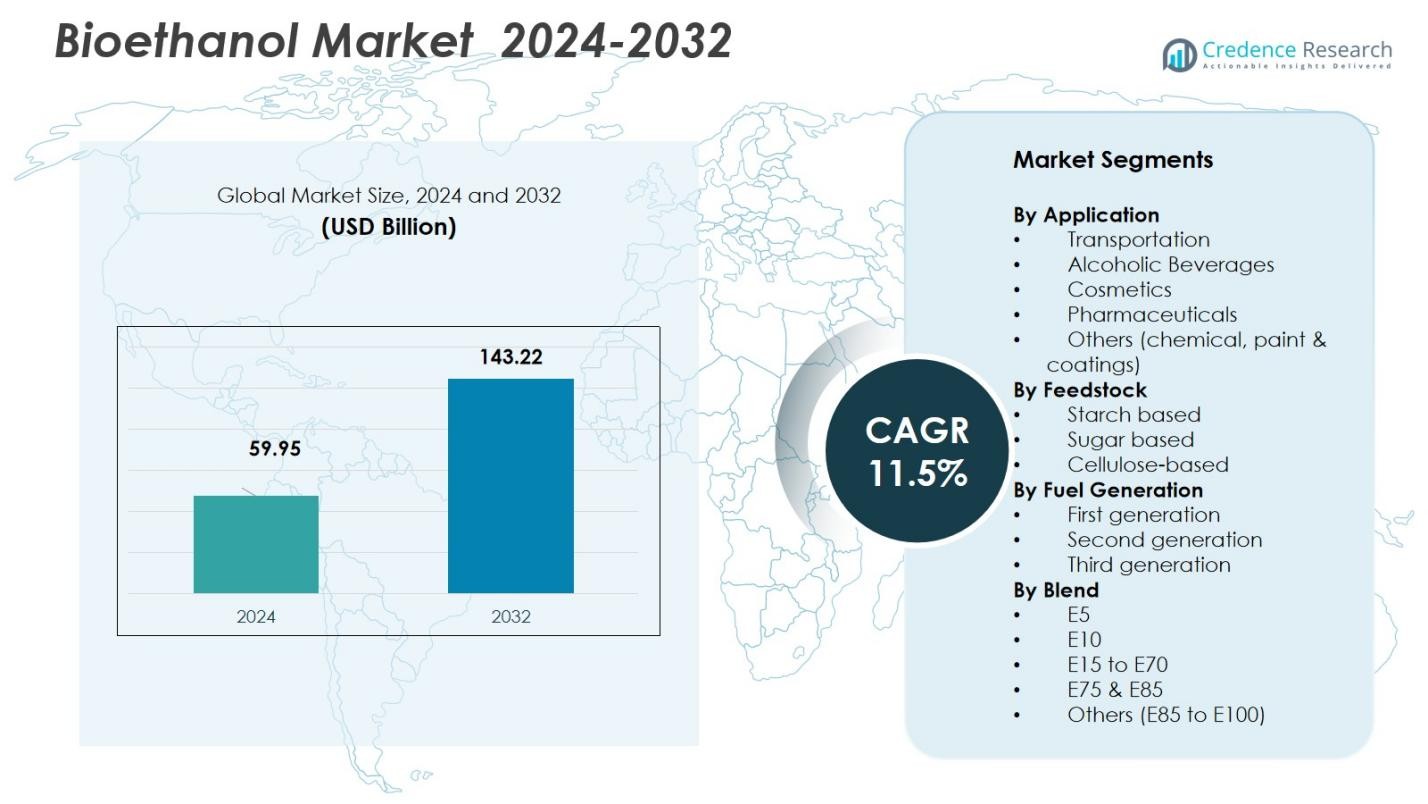

The Bioethanol Market size was valued at USD 59.95 Billion in 2024 and is anticipated to reach USD 143.22 Billion by 2032, at a CAGR of 11.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Bioethanol Market Size 2024 |

USD 59.95 Billion |

| Bioethanol Market, CAGR |

11.5% |

| Bioethanol Market Size 2032 |

USD 143.22 Billion |

The Bioethanol Market is dominated by key players such as Archer Daniels Midland Company (ADM), POET LLC, Green Plains Inc., Valero Energy Corporation, and BP plc. These companies are prominent for their large-scale production facilities, innovative technologies, and extensive distribution networks. North America leads the market with a 36.0% share in 2024, driven by its well-established agriculture sector and government policies promoting renewable energy. Asia-Pacific follows with 28.7% of the market share, reflecting the growing adoption of bioethanol in countries like China and India. Latin America holds 17.2% of the market, with Brazil’s sugarcane-based ethanol production playing a crucial role. Europe and the Middle East & Africa account for 12.8% and 5.3%, respectively, with Europe focusing on sustainability and regulatory mandates driving demand. These regions, alongside the leading companies, are poised to influence the continued expansion and innovation in the global bioethanol market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Bioethanol Market size was valued at USD 59.95 Billion in 2024 and is projected to reach USD 143.22 Billion by 2032, growing at a CAGR of 11.5% during the forecast period.

- The key growth drivers include stringent government regulations promoting renewable energy, rising environmental concerns, and technological advancements in bioethanol production, particularly second- and third-generation bioethanol.

- Increasing adoption of higher ethanol blends in transportation fuels, along with the rising demand for biofuels in emerging economies, presents significant growth opportunities for the market.

- Key market restraints include feedstock availability and cost, alongside the ongoing food vs. fuel debate, which may limit the expansion of bioethanol production.

- North America holds the largest market share of 36.0% in 2024, followed by Asia-Pacific with 28.7%, and Latin America at 17.2%. Europe and the Middle East & Africa account for 12.8% and 5.3%, respectively.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Application:

The Bioethanol market is prominently driven by its application in the Transportation sector, holding a dominant share of 58.3% in 2024. This segment benefits from growing global demand for renewable fuels to reduce carbon emissions and enhance energy security. Ethanol-blended fuels, such as E10 and E85, are widely used in internal combustion engines, further propelled by regulatory policies aimed at promoting clean energy solutions. The shift towards biofuels is fueled by environmental concerns, rising fuel prices, and technological advancements that improve ethanol’s performance and efficiency in vehicles.

- For instance, India is targeting 20% ethanol blending in gasoline by 2025 to cut emissions and boost fuel efficiency in vehicles, supported by government initiatives to expand biofuel infrastructure.

By Feedstock:

The Starch-based feedstock segment leads the Bioethanol market, accounting for 49.7% of the market share in 2024. This segment primarily includes corn, wheat, and other cereal grains, which are abundant and cost-effective sources for bioethanol production. The starch-based route is favored for its established infrastructure and efficiency in fermentation processes. As government mandates and incentives continue to promote renewable energy production, the adoption of starch-based feedstocks is expected to maintain its dominance, further accelerated by technological improvements and favorable agricultural policies.

- For instance, POET LLC, the largest bioethanol producer globally, operates over 30 plants in the U.S., primarily using corn as its starch feedstock.

By Fuel Generation:

The First-generation bioethanol segment holds the largest market share of 62.1% in 2024. This generation primarily utilizes food crops like corn and sugarcane for ethanol production through conventional fermentation processes. The segment benefits from established production technologies, cost efficiency, and significant investment in infrastructure. However, concerns about food vs. fuel debates and sustainability are leading to growing interest in second and third-generation bioethanol, which promise lower environmental impact and better feedstock utilization. Despite this, first-generation bioethanol maintains its dominance due to established global production capabilities and market acceptance.

Key Growth Drivers

Government Regulations and Mandates

Government policies and regulations are one of the major growth drivers for the Bioethanol market. Many countries have implemented stringent mandates for renewable energy usage, particularly in the transportation sector, where bioethanol is blended with gasoline to reduce greenhouse gas emissions. Incentives, tax credits, and subsidies further stimulate the demand for bioethanol. These regulations not only promote the use of clean energy but also contribute to achieving climate goals, encouraging the expansion of bioethanol production and consumption on a global scale.

Growing Environmental Concerns

Rising environmental awareness and the push towards reducing carbon footprints are significantly driving the growth of the Bioethanol market. Bioethanol, as a renewable and cleaner alternative to fossil fuels, is gaining traction due to its potential to reduce greenhouse gas emissions. The adoption of bioethanol-based fuels helps mitigate the impact of traditional gasoline, leading to improved air quality and a reduction in overall environmental damage. This focus on sustainability, coupled with consumer demand for greener energy solutions, accelerates the adoption of bioethanol globally.

- For instance, Borregaard produces approximately 20 million litres of bioethanol annually as a by-product of cellulose production, achieving greenhouse gas emissions that are about 10% of those from synthetic ethanol.

Technological Advancements in Production

Advancements in bioethanol production technologies are further fueling market growth. The development of second- and third-generation bioethanol production processes, which utilize non-food feedstocks such as cellulosic materials and algae, provides a more sustainable and efficient way to produce bioethanol. These innovations help reduce production costs, enhance yield, and address the concerns related to food vs. fuel. As these technologies mature and scale, they provide new opportunities for bioethanol production, driving its market expansion and diversification in the energy sector.

- For instance,in China, the State Development & Investment Corporation is constructing a large-scale ethanol plant with a capacity of 300,000 tons in Liaoning province, planning further expansion across other provinces.

Key Trends & Opportunities

Advancement in Bioethanol Blending

A key trend in the Bioethanol market is the increasing focus on higher bioethanol blending in transportation fuels. The rise in ethanol-blended gasoline, such as E15, E85, and higher ethanol-content fuels, reflects the growing interest in reducing dependence on fossil fuels and enhancing fuel efficiency. This trend is supported by policies and initiatives aimed at reducing carbon emissions and promoting renewable energy solutions. As automotive manufacturers improve engines for higher ethanol blends, opportunities for expanding bioethanol use in transportation and other sectors continue to grow.

- For instance, General Motors revived flex-fuel vehicles with the 2025 Chevrolet Trax FFV, capable of running on E85 up to 85% ethanol blended with gasoline for lower carbon emissions and driver choice at the pump.

Increasing Demand from Emerging Markets

Emerging economies, particularly in Asia-Pacific and Latin America, present significant growth opportunities for the Bioethanol market. These regions are experiencing rapid industrialization, rising income levels, and increasing demand for cleaner fuels. Governments in these regions are also pushing for renewable energy adoption, which is fostering the growth of bioethanol infrastructure. The rising adoption of bioethanol in countries like India and Brazil, where agriculture-based economies can benefit from biofuel production, presents a promising market for bioethanol, driving demand for renewable energy sources.

- For instance,in India, companies like Shree Renuka Sugars are major ethanol producers benefiting from the country’s ethanol blending mandates, supporting the renewable energy transition and agricultural economy.

Key Challenges

Feedstock Availability and Cost

One of the main challenges facing the Bioethanol market is the availability and cost of feedstocks. While starch-based feedstocks like corn and wheat are currently the dominant sources, the competition for these crops with the food industry raises concerns over price volatility and supply security. Additionally, the increasing demand for bioethanol puts pressure on agricultural resources, potentially leading to price fluctuations and limited availability. This challenge intensifies as global demand for bioethanol grows, creating uncertainties in the cost structure and sustainability of feedstock supply chains.

Food vs. Fuel Debate

The food vs. fuel debate remains a significant challenge in the Bioethanol market. The use of food crops like corn, wheat, and sugarcane as feedstocks for bioethanol production has raised concerns about its impact on global food security and food prices. In times of economic strain, this debate becomes more pronounced, with critics arguing that biofuel production competes with agricultural land that could be used to grow food. This challenge calls for more sustainable feedstock alternatives and technological innovations to reduce the reliance on food-based crops for bioethanol production.

Regional Analysis

North America

North America leads the global bioethanol market, holding a market share of 36.0% in 2024. The region’s strong position reflects its well‑developed agriculture sector, abundant corn feedstock, and extensive biofuel infrastructure. Regulatory mandates and blending requirements in the United States and Canada continue to drive demand for ethanol‑blended gasoline. High production capacity and established supply chains reinforce North America’s dominance and support ongoing growth in consumption and distribution of bioethanol fuels.

Asia‑Pacific

The Asia‑Pacific region accounts for 28.7% of the global bioethanol market in 2024, with the fastest growth trajectory among major regions. Increasing energy demand, expanding automotive fleets, and growing emphasis on renewable fuels in economies such as China and India support rising bioethanol adoption. Government policies and incentives encouraging ethanol blending further stimulate regional demand. As energy consumption and regulatory support grow, Asia‑Pacific is set to play a progressively larger role in global bioethanol supply and consumption.

Latin America (South America)

Latin America holds 17.2% of the global bioethanol market in 2024. The region, led by major agricultural producers such as Brazil, contributes significantly to global bioethanol production and consumption. Countries with abundant sugarcane supply support cost-efficient, sugar‑based ethanol production, which underpins domestic fuel‑blending programmes and export potential. While the region’s market share is smaller compared to North America and Asia, its natural resource advantage and established production infrastructure make it a key regional player—especially for cane‑based ethanol.

Europe

Europe maintains a market share of 12.8% in the global bioethanol market in 2024. Sustainability initiatives, renewable‑energy targets, and environmental regulations across the European Union promote uptake of biofuels. However, lower feedstock availability compared with major producers and reliance on imports constrain rapid growth. Consequently, Europe’s market share remains moderate compared with regions with large native feedstock supply and strong scale economies.

Middle East & Africa (MEA)

The Middle East & Africa region holds a small share of 5.3% in the global bioethanol market in 2024. Limited feedstock availability, underdeveloped biofuel infrastructure, and lack of large‑scale production capacity constrain market penetration. Nonetheless, growing interest in renewable energy and emerging environmental policies in parts of the region suggest potential for future growth, particularly as global decarbonization efforts accelerate.

Market Segmentations:

By Application

- Transportation

- Alcoholic Beverages

- Cosmetics

- Pharmaceuticals

- Others (chemical, paint & coatings)

By Feedstock

- Starch based

- Sugar based

- Cellulose-based

By Fuel Generation

- First generation

- Second generation

- Third generation

By Blend

- E5

- E10

- E15 to E70

- E75 & E85

- Others (E85 to E100)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Bioethanol market is highly competitive, with major players such as Archer Daniels Midland Company (ADM), POET LLC, Green Plains Inc., Valero Energy Corporation, and BP plc leading the charge in production, innovation, and distribution. These companies have established a strong presence globally, capitalizing on the rising demand for renewable fuels. They focus on leveraging their robust production capacities, advanced technologies, and vast feedstock networks to maintain market dominance. Strategic collaborations, acquisitions, and partnerships are pivotal in their growth strategies. For example, POET LLC has been actively involved in expanding its bioethanol production facilities and improving process efficiencies. Additionally, firms are increasingly investing in second and third-generation bioethanol technologies, which utilize non-food feedstocks like algae and cellulose, addressing the concerns around food versus fuel. As governments worldwide strengthen renewable fuel mandates, competition in the bioethanol sector is expected to intensify, pushing companies toward greater innovation and market expansion.

Key Player Analysis

- POET LLC

- Tereos S.A. (Cristal Union)

- Flint Hills Resources (Koch Industries)

- BP plc

- Raízen

- Archer Daniels Midland Company (ADM)

- Valero Energy Corporation

- Südzucker AG (CropEnergies AG)

- Green Plains Inc.

- Cristalco (Cristal Union)

Recent Developments

- In August 2025, POET LLC agreed to acquire a 120‑million‑gallon ethanol plant from Green Plains Inc. in Tennessee, expanding its production footprint.

- In November 2025, Archer Daniels Midland Company (ADM) launched the world’s largest bioethanol carbon‑capture and storage (CCS) facility at its Columbus, Nebraska corn processing complex, marking a major step toward decarbonized ethanol production.

- In September 2025, POET LLC completed the acquisition of the bioethanol facility from Green Plains Inc. the plant located near Obion, Tennessee adding a capacity of 120 million gallons per year.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Application, Feedstock, Fuel Generation, Blend and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Bioethanol market is expected to grow significantly as demand for renewable energy sources increases globally.

- Government regulations and mandates promoting renewable fuel use will continue to drive bioethanol consumption, particularly in the transportation sector.

- Advancements in second- and third-generation bioethanol technologies will reduce production costs and improve sustainability.

- The growing shift toward sustainable and green energy solutions will create new opportunities for bioethanol in various applications beyond transportation, such as in chemicals and cosmetics.

- Increased adoption of ethanol-blended fuels in emerging economies, especially in Asia-Pacific and Latin America, will propel market growth.

- Technological innovation in feedstock alternatives, including algae and non-food crops, will address the food versus fuel debate and expand production potential.

- Strategic partnerships and acquisitions by leading players in the market will foster industry consolidation and accelerate production capacities.

- Rising environmental concerns, particularly air pollution and climate change, will support government incentives for bioethanol adoption.

- Investment in bioethanol infrastructure and distribution networks will increase, facilitating smoother market penetration in regions with limited biofuel availability.

- As consumer awareness about sustainability grows, bioethanol’s role in reducing carbon emissions and supporting energy security will gain further importance in global energy transitions.

Market Segmentation Analysis:

Market Segmentation Analysis: