Market Overview

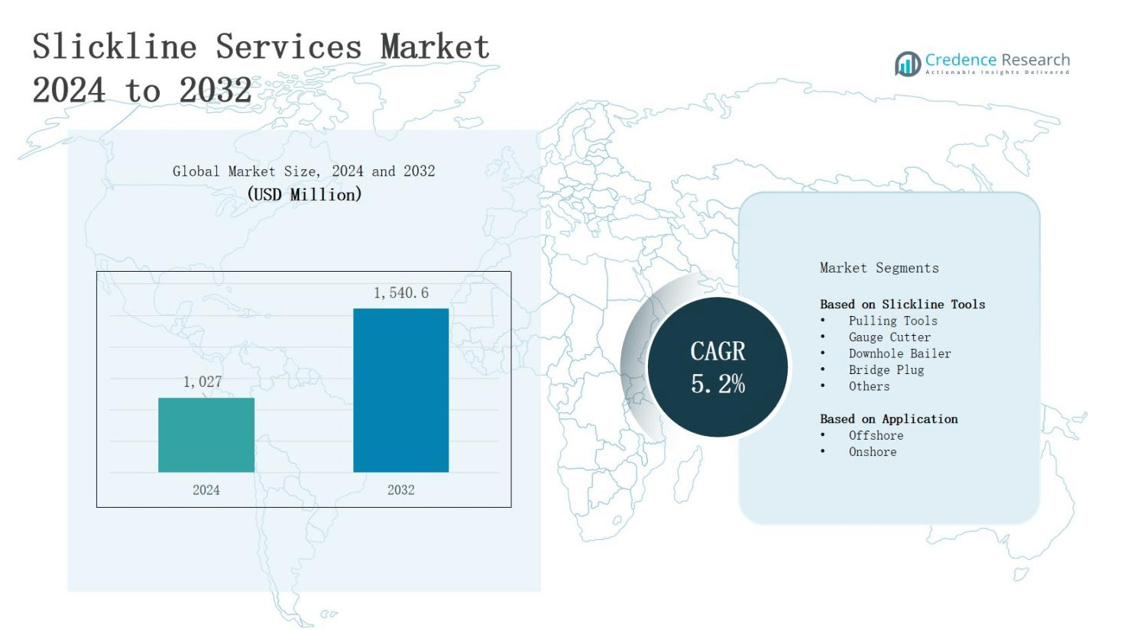

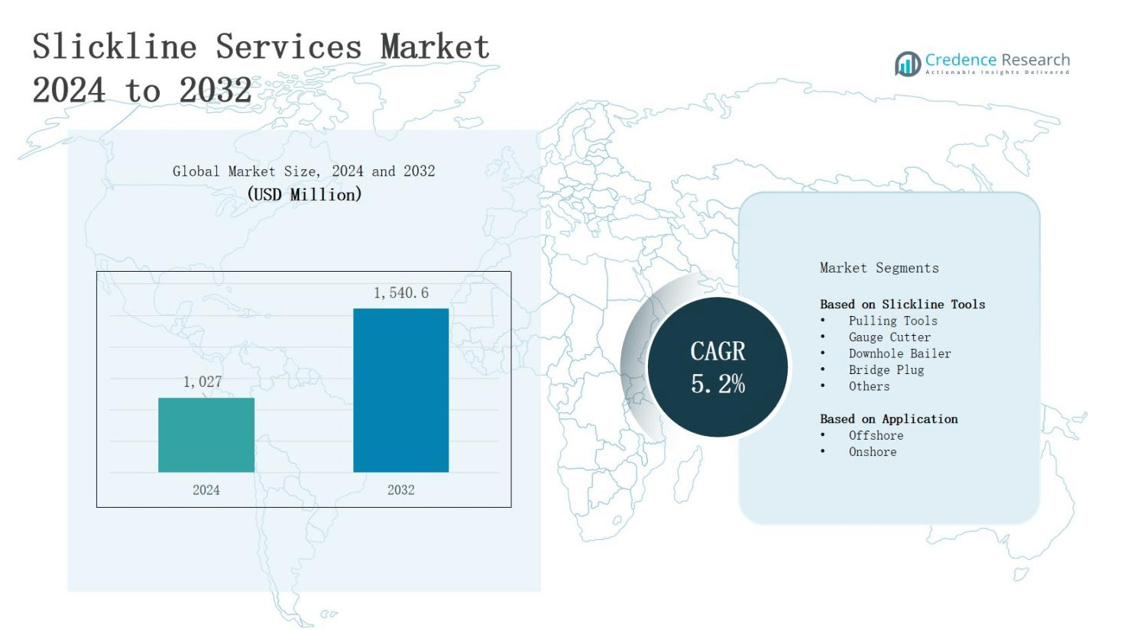

The slickline services market is projected to grow from USD 1,027 million in 2024 to USD 1,540.6 million by 2032, registering a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Slickline Services Market Size 2024 |

USD 1,027 million |

| Slickline Services Market, CAGR |

5.2% |

| Slickline Services Market Size 2032 |

USD 1,540.6 million |

The slickline services market is driven by rising demand for well intervention and maintenance operations to enhance production efficiency and extend well life. Increasing exploration and production activities in both onshore and offshore fields, coupled with the need for cost-effective downhole solutions, is boosting adoption. Technological advancements in slickline equipment, including high-strength materials and digital monitoring tools, are improving operational precision and safety. Growing investments in mature oilfield redevelopment and deepwater projects are further supporting market growth. Trends include integration of real-time data acquisition, automation in slickline operations, and expanding applications in unconventional reservoirs to optimize productivity.

The slickline services market spans North America, Europe, Asia-Pacific, and the Middle East & Africa, each contributing distinct growth drivers. North America leads with advanced technology adoption and extensive mature field operations, while Europe benefits from North Sea offshore activities and strict operational standards. Asia-Pacific experiences rapid growth from rising energy demand and offshore exploration, and the Middle East & Africa thrives on abundant reserves and continuous drilling. Key players include Schlumberger, Halliburton, Baker Hughes, Weatherford, China Oilfield Services, Archer, Expro, AOS Orwell, National Oilwell Varco, Superior Energy Services, and Reliance Oilfield Services.

Market Insights

- The slickline services market is projected to grow from USD 1,027 million in 2024 to USD 1,540.6 million by 2032, registering a CAGR of 5.2% during the forecast period.

- Rising demand for well intervention and maintenance operations in mature fields is driving adoption, enabling efficient downhole tasks while reducing downtime and extending well life.

- Expansion of exploration and production activities in both onshore and offshore oilfields, including deepwater projects, is boosting service demand.

- Technological advancements such as high-strength cables, advanced tool designs, and digital monitoring solutions are improving reliability, safety, and operational efficiency.

- Redevelopment of mature oilfields and growth in unconventional reservoirs are creating strong opportunities for frequent and cost-effective well interventions.

- Key challenges include operational risks in high-pressure and high-temperature environments, technical limitations in ultra-deep wells, fluctuating oil prices, and high capital investment needs.

- Regional shares stand at North America 34%, Europe 21%, Asia-Pacific 28%, and Middle East & Africa 17%, with major players including Schlumberger, Halliburton, Baker Hughes, Weatherford, China Oilfield Services, Archer, Expro, AOS Orwell, National Oilwell Varco, Superior Energy Services, and Reliance Oilfield Services.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand for Well Intervention and Maintenance

The slickline services market is experiencing growth due to the rising requirement for efficient well intervention and maintenance operations. It enables operators to perform downhole tasks such as setting plugs, retrieving valves, and conducting surveys without heavy equipment. The demand is high in mature fields where production optimization is critical. It supports cost-effective operations, reduces downtime, and extends well life, making it an essential service for operators globally.

- For instance, Baker Hughes executes over 2,000 slickline operations annually, deploying tools to set plugs and retrieve safety valves efficiently, reducing the need for costly workover rigs.

Expansion of Exploration and Production Activities

Increased exploration and production activities in both onshore and offshore oilfields are driving the slickline services market forward. It is widely used in new well completions and ongoing production monitoring, supporting operational efficiency. Offshore deepwater projects particularly benefit from slickline services due to their adaptability and precision. It helps operators access remote and challenging environments while maintaining cost control and operational safety standards in demanding conditions.

- For instance, Petrobras in Brazil relies heavily on slickline services to maintain stability in production from its pre-salt deepwater reservoirs, demonstrating the technique’s critical role in complex offshore environments.

Advancements in Slickline Technology

Technological innovations in slickline equipment are strengthening its market adoption. The integration of high-strength cables, advanced tool designs, and digital monitoring solutions enhances reliability and data accuracy. It allows for precise well intervention, reducing risks during complex operations. These advancements improve operational efficiency and extend tool life, leading to better returns on investment. The slickline services market benefits from continuous R&D aimed at delivering safer and faster field operations.

Increased Focus on Unconventional and Mature Reservoirs

The redevelopment of mature oilfields and expansion into unconventional reservoirs are boosting demand for slickline services. It offers a cost-effective approach for maintaining and enhancing production in challenging formations. Operators rely on slickline to perform frequent interventions without costly workover rigs. Growing investment in enhanced oil recovery techniques also fuels demand. The slickline services market supports sustainable production strategies while enabling operators to maximize hydrocarbon recovery efficiently.

Market Trends

Integration of Real-Time Data Acquisition Technologies

The slickline services market is witnessing a shift toward real-time data acquisition to enhance operational accuracy and decision-making. It enables operators to monitor downhole conditions instantly, improving efficiency in well intervention tasks. Advanced sensors and telemetry systems are being incorporated into slickline tools to provide precise depth control and performance feedback. This integration supports predictive maintenance strategies and minimizes operational risks. It also strengthens the role of slickline in optimizing production outcomes for complex wells.

- For instance, Paradigm’s Slick-E-Line digitally enabled slickline combines traditional slickline versatility with real-time electric line data capabilities, allowing operators to monitor downhole conditions and make immediate operational decisions, thereby enhancing efficiency during well interventions.

Adoption of Automation in Slickline Operations

Automation is emerging as a significant trend in the slickline services market, driven by the need to reduce human intervention and improve safety. It enhances consistency, lowers operational costs, and minimizes the potential for errors. Automated winches, tool handling systems, and digital control panels are becoming standard in advanced operations. The trend supports faster job execution and improves overall efficiency. It is particularly valuable in remote and high-risk oilfield environments.

- For instance, Schlumberger partnered with Aker BP to deploy digitalized autonomous wireline and slickline systems, which achieved up to 25% faster running speeds and nearly 30% reduction in speed variance during over 50 automated runs, demonstrating greater efficiency and predictability than manual operations.

Rising Application in Deepwater and Harsh Environments

The expansion of oil and gas projects into deepwater and harsh environments is increasing the reliance on slickline services. It offers high adaptability, enabling safe and precise operations under extreme pressure and temperature conditions. Specialized slickline tools are being developed to withstand these challenges while maintaining performance. The slickline services market benefits from this shift, as operators seek cost-effective yet robust solutions. It also drives innovation in material design and equipment durability.

Focus on Unconventional Resource Development

The growing interest in unconventional resource development, such as shale and tight oil formations, is boosting the demand for slickline services. It supports frequent and efficient well interventions needed to sustain production rates in these challenging reservoirs. Operators use slickline to deploy tools for downhole measurements, cleanouts, and equipment adjustments. The trend aligns with the industry’s emphasis on maximizing recovery while controlling costs. The slickline services market continues to evolve to meet these demands effectively.

Market Challenges Analysis

Operational Risks and Technical Limitations

The slickline services market faces challenges related to operational risks and technical constraints in complex well environments. It requires precise execution, and any miscalculation can lead to tool sticking, wire breakage, or downhole equipment damage. Harsh conditions such as high pressure, extreme temperatures, and corrosive fluids increase the likelihood of operational failures. Equipment limitations in ultra-deep wells or unconventional reservoirs can reduce efficiency. It demands constant maintenance, skilled personnel, and advanced technology to ensure safe and reliable performance.

Fluctuating Oil Prices and Capital Investment Constraints

Volatility in global oil prices significantly impacts the slickline services market by influencing operators’ budgets and project timelines. It often leads to reduced investment in well intervention and maintenance activities during downturns. The high cost of advanced slickline equipment and the need for specialized training create additional financial burdens for service providers. Regulatory compliance requirements further add to operational costs. It forces companies to adopt cost-control measures while maintaining service quality and safety standards.

Market Opportunities

Expansion in Offshore and Deepwater Projects

The slickline services market holds significant growth potential from the expansion of offshore and deepwater oil and gas projects. It provides a reliable and cost-effective solution for well intervention in challenging subsea environments. The demand for specialized slickline tools capable of operating under extreme pressures and temperatures is rising. Emerging offshore fields in Africa, South America, and Asia-Pacific present new opportunities. It enables operators to maintain production efficiency while minimizing operational downtime in remote locations.

Growing Demand from Unconventional Reservoir Development

The increasing focus on unconventional reservoirs, such as shale and tight oil formations, creates strong prospects for the slickline services market. It supports frequent interventions required to sustain output in these resource-intensive wells. Service providers offering advanced slickline solutions for cleanouts, equipment adjustments, and downhole measurements are well-positioned to benefit. Expanding drilling activities in North America and Asia-Pacific enhance this opportunity. It also aligns with industry efforts to maximize recovery while optimizing operational expenditure.

Market Segmentation Analysis:

By Slickline Tools

The slickline services market is segmented into pulling tools, gauge cutters, downhole bailers, bridge plugs, and others. Pulling tools dominate due to their critical role in retrieving downhole equipment efficiently. Gauge cutters are widely used for removing scale or debris, ensuring optimal wellbore conditions. Downhole bailers support cleaning operations, while bridge plugs provide temporary or permanent well isolation. It also includes specialized tools in the “others” category, offering tailored solutions for unique well intervention needs.

- For instance, Baker Hughes deploys specialized gauge cutters in wells to ensure thorough removal of obstructions and maintain uninterrupted production.

By Application

Based on application, the slickline services market is divided into offshore and onshore segments. Offshore operations account for a significant share due to increasing deepwater exploration and the need for precise well intervention in high-pressure environments. It enables cost-effective maintenance in remote and challenging subsea locations. The onshore segment remains strong, driven by extensive use in mature fields requiring frequent interventions to sustain output. Both segments benefit from ongoing technological advancements that improve safety and efficiency.

- For instance, Petrobras relies heavily on slickline services to maintain production stability in Brazil’s deepwater pre-salt reservoirs.

Segments:

Based on Slickline Tools

- Pulling Tools

- Gauge Cutter

- Downhole Bailer

- Bridge Plug

- Others

Based on Application

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds 34% share of the slickline services market, driven by extensive oil and gas exploration and production activities in the United States and Canada. It benefits from a well-established upstream sector, advanced technology adoption, and a high number of mature fields requiring regular intervention. Offshore operations in the Gulf of Mexico contribute significantly to demand. The region’s strong focus on enhancing well productivity supports ongoing investment in slickline tools and services. It remains a key hub for innovation and specialized service offerings in the global market.

Europe

Europe accounts for 21% share of the slickline services market, supported by activities in the North Sea and other offshore basins. It is driven by the need for efficient intervention in aging oilfields and compliance with strict environmental and operational standards. Countries such as Norway and the United Kingdom lead in adopting advanced slickline technologies. The region emphasizes cost-effective maintenance solutions to extend well life. It also benefits from a skilled workforce and established oilfield service providers.

Asia-Pacific

Asia-Pacific captures 28% share of the slickline services market, fueled by rising energy demand, expanding offshore projects, and active onshore production in countries like China, India, and Australia. It experiences growth from increased investment in deepwater exploration in Southeast Asia. Mature fields in the region require frequent intervention, boosting service demand. National oil companies play a crucial role in driving technological upgrades. It is poised for sustained growth supported by regional E&P expansion.

Middle East & Africa

The Middle East & Africa region holds 17% share of the slickline services market, driven by abundant hydrocarbon reserves and continuous drilling activities. It benefits from large-scale onshore production and an increasing number of offshore developments in the Arabian Gulf and West Africa. National oil companies invest heavily in maintaining and enhancing well productivity. The region prioritizes operational efficiency to optimize output from both mature and new wells. It continues to attract global service providers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Archer Ltd. (UK)

- Baker Hughes Company (US)

- Expro Holdings UK 2 Ltd. (UK)

- National Oilwell Varco (US)

- AOS Orwell Ltd. (Nigeria)

- Halliburton Company (US)

- China Oilfield Services Limited (China)

- Reliance Oilfield Services (US)

- Superior Energy Services Inc. (US)

- Weatherford International Plc. (US)

- Schlumberger Limited (US)

Competitive Analysis

The slickline services market is highly competitive, with global and regional players focusing on technological innovation, operational efficiency, and service quality to strengthen market presence. It is characterized by companies offering a wide portfolio of slickline tools and integrated well intervention solutions to meet diverse onshore and offshore demands. Leading players such as Schlumberger Limited, Halliburton Company, Baker Hughes Company, Weatherford International Plc., and China Oilfield Services Limited invest heavily in R&D to enhance tool durability, data acquisition capabilities, and automation in operations. Regional specialists like AOS Orwell Ltd., Archer Ltd., Expro Holdings UK 2 Ltd., Reliance Oilfield Services, Superior Energy Services Inc., and National Oilwell Varco focus on tailored solutions for specific geographies and customer needs. Strategic collaborations, long-term service contracts, and expansion into emerging markets are common approaches to gain a competitive edge. The market rewards providers that can deliver cost-effective, safe, and timely services while adapting to evolving exploration, production, and maintenance requirements across both mature and new oilfields.

Recent Developments

- In November 2023, Schlumberger completed the acquisition of Welltec’s slickline and fishing tool business, strengthening its well intervention service offerings.

- In October 2023, Halliburton introduced its iConnect digital platform for slickline operations, enabling real-time data visualization and remote monitoring.

- In September 2023, Weatherford International Plc. partnered with National Energy Services Reunited Corp. to deliver integrated slickline and coiled tubing well intervention solutions.

- In March 2025, SLB also launched its EWC™ electric well control technologies, transitioning from hydraulic systems to electric power to cut costs, boost safety, and offer real‑time operational insights.

Market Concentration & Characteristics

The slickline services market demonstrates a moderate to high level of concentration, with a mix of global oilfield service leaders and regional specialists competing for market share. It is dominated by established players such as Schlumberger, Halliburton, Baker Hughes, Weatherford, and China Oilfield Services, supported by strong technical expertise, global reach, and extensive service portfolios. Regional companies like Archer, Expro, AOS Orwell, and Reliance Oilfield Services strengthen competition through localized solutions and cost efficiency. The market is characterized by high entry barriers due to capital-intensive equipment, specialized workforce requirements, and strict regulatory compliance. It relies heavily on long-term contracts, advanced tool designs, and operational reliability to retain clients. Demand is influenced by oil price cycles, field maturity, and offshore exploration trends. Innovation in high-strength slickline materials, digital monitoring, and automation continues to shape competitive positioning, with service providers focusing on enhancing safety, efficiency, and adaptability in diverse operational environments.

Report Coverage

The research report offers an in-depth analysis based on Slickline Tools, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for slickline services will grow with increasing well intervention activities in mature oilfields.

- Offshore deepwater projects will create stronger opportunities for specialized slickline tools.

- Adoption of automation and digital monitoring in slickline operations will expand.

- Service providers will focus on enhancing tool strength and operational precision.

- Unconventional reservoir development will drive frequent well intervention needs.

- Regional players will strengthen their position through cost-effective localized solutions.

- Investment in R&D will improve safety and efficiency in challenging environments.

- Collaboration between oilfield service companies and operators will increase for long-term contracts.

- Expansion into emerging oil and gas markets will support global service growth.

- Sustainability and operational efficiency will remain key priorities for market competitiveness.