Market Overview:

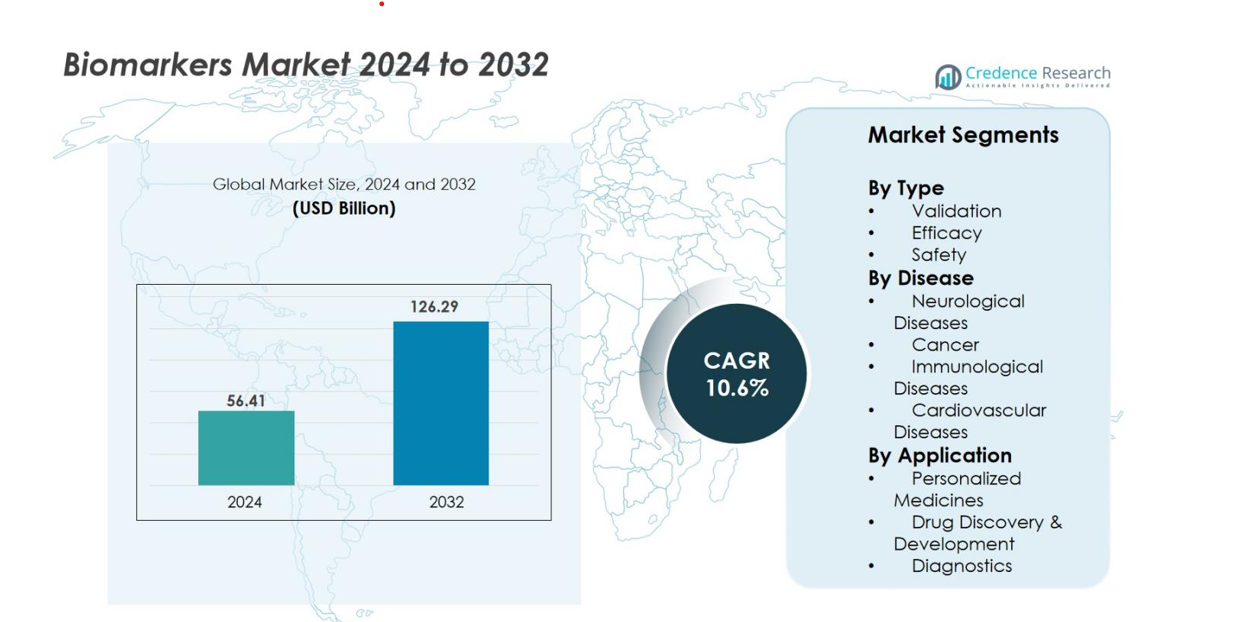

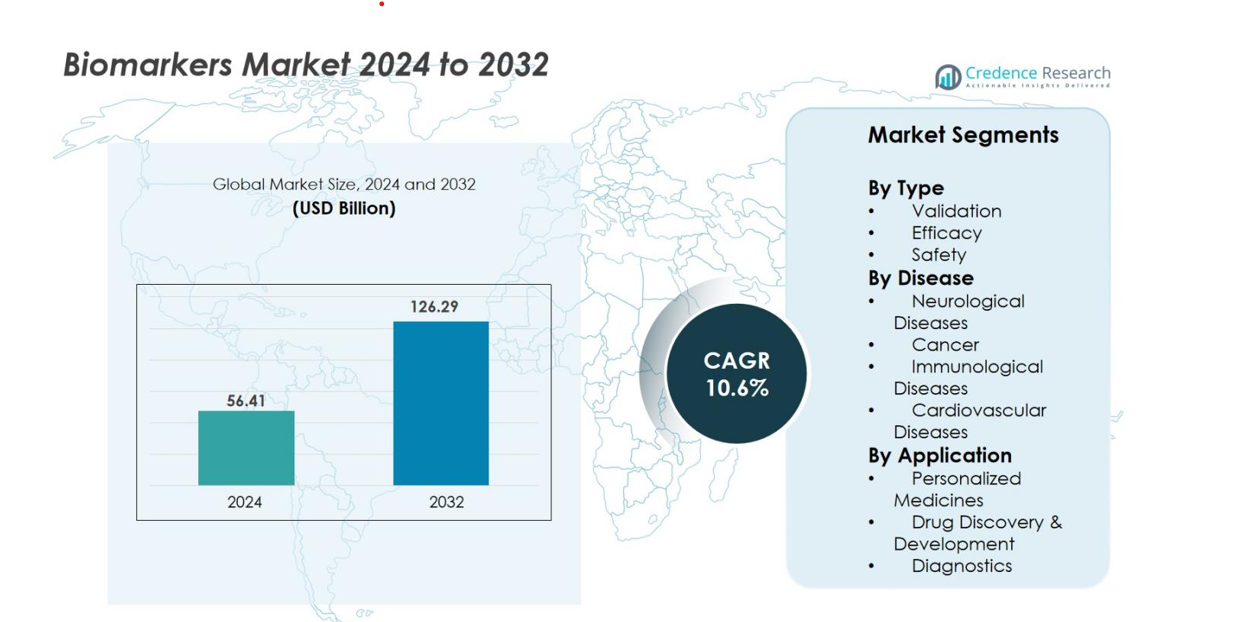

Biomarkers Market size was valued at USD 56.41 Billion in 2024 and is anticipated to reach USD 126.29 Billion by 2032, at a CAGR of 10.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Biomarkers Market Size 2024 |

USD 56.41 Billion |

| Biomarkers Market, CAGR |

10.6% |

| Biomarkers Market Size 2032 |

USD 126.29 Billion |

Biomarkers Market features strong participation from leading global companies such as Thermo Fisher Scientific, Agilent Technologies, Bio-Rad Laboratories, Qiagen, Abbott, Hoffmann-La Roche, Johnson & Johnson Services, Siemens, and Epigenomics AG. These players focus on advanced assay development, multi-omics integration, and expanded companion diagnostics portfolios to strengthen their competitive position. North America leads the global market with a 38.2% share in 2024, driven by high R&D spending, strong clinical adoption, and robust pharmaceutical activity. Europe follows with a 29.4% share, supported by extensive precision medicine initiatives and well-established diagnostic infrastructure.

Market Insights

- The Biomarkers Market was valued at USD 56.41 Billion in 2024 and is projected to reach USD 126.29 Billion by 2032, growing at a CAGR of 10.6% during the forecast period.

- Market growth is driven by rising adoption of precision medicine, increasing prevalence of cancer and chronic diseases, and expanding use of biomarkers in drug discovery, diagnostics, and clinical decision-making.

- Key trends include rapid advancements in multi-omics technologies, increasing demand for non-invasive liquid biopsy biomarkers, and growing integration of AI-enabled analytics to enhance clinical accuracy.

- Leading players such as Thermo Fisher Scientific, Qiagen, Bio-Rad Laboratories, Abbott, Siemens, and Roche strengthen competition through innovation, partnerships, and expansion of biomarker-based diagnostics and companion tests.

- North America leads with 38.2% share, followed by Europe at 29.4%, while diagnostics dominate applications with 49.8% share and cancer biomarkers lead disease segments with 46.3% share, supporting strong global market momentum.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Type

The Biomarkers Market demonstrates strong traction across validation, efficacy, and safety categories, with Validation biomarkers emerging as the dominant sub-segment, holding 41.6% market share in 2024. Their leadership is driven by their essential role in establishing clinical relevance, improving reproducibility, and supporting regulatory approvals for new therapeutics. Growing adoption by pharmaceutical companies to streamline clinical trials and reduce development timelines further accelerates demand. Enhanced analytical platforms, rising emphasis on precision medicine, and increasing use of surrogate endpoints contribute to the rapid expansion of validation biomarkers within the overall biomarker ecosystem.

- For instance, Thermo Fisher Scientific expanded its biomarker validation capabilities through its Orbitrap Exploris Mass Spectrometer series, enabling detection of over 8,000 proteins in a single run, while Illumina’s TruSight Oncology 500 assay supports validation of more than 500 genomic biomarkers across tumor types, strengthening clinical decision-making accuracy.

By Disease

In disease-based segmentation, the market spans neurological diseases, cancer, immunological disorders, and cardiovascular conditions, with Cancer biomarkers holding the dominant position at 46.3% market share in 2024. Their leadership is fueled by the rising global cancer burden, strong demand for early detection tools, and widespread integration of biomarker-driven companion diagnostics in oncology. Continuous advancements in liquid biopsy, genomics, and proteomics enhance the accuracy of cancer biomarker tests. Increased R&D funding, expanding clinical adoption, and the growing shift toward targeted therapies further strengthen this segment’s rapid and sustained growth.

- For instance, Guardant Health’s Guardant360 CDx assay analyses 74 genes using cell-free tumour DNA in blood samples.

By Application

Across key applications including personalized medicine, drug discovery & development, and diagnostics the Diagnostics segment leads the market with a 49.8% share in 2024, driven by rising emphasis on early disease detection and rapid point-of-care testing. Increased utilization of biomarker-based assays for screening chronic and infectious diseases supports its dominance. Advancements in multiplex platforms, growing preference for non-invasive tests, and integration of biomarkers into routine clinical workflows amplify adoption. Expanding regulatory approvals for diagnostic biomarkers and their critical role in improving clinical decision-making continue to fuel robust market growth across healthcare systems.

Key Growth Drivers

Rising Adoption of Precision Medicine

The growing emphasis on precision medicine serves as a major driver for the Biomarkers Market, as healthcare systems increasingly transition from generalized treatment pathways to highly targeted therapies. Biomarkers play a central role in identifying patient-specific molecular signatures, enabling clinicians to select therapies with higher efficacy and fewer adverse effects. The expansion of genomic sequencing programs, integration of pharmacogenomics, and advancements in omics technologies further accelerate biomarker utilization in clinical decision-making. Pharmaceutical companies actively incorporate biomarkers into clinical trials to improve success rates and reduce attrition. Moreover, the rising prevalence of chronic diseases fosters demand for early diagnosis and personalized treatment, strengthening biomarkers’ clinical relevance. As precision medicine ecosystems mature globally, biomarker-driven stratification, treatment monitoring, and response prediction continue to underpin market expansion across oncology, neurology, immunology, and cardiology.

- For instance, Illumina’s NovaSeq 6000 platform enables whole-genome sequencing at up to 6 terabases per run, supporting large-scale biomarker discovery, while Foundation Medicine’s FoundationOne CDx profiles 324 genes to guide precision oncology decisions based on actionable genomic alterations.

Increasing R&D Investments and Clinical Trial Expansion

Accelerated R&D spending from biopharmaceutical companies, academic institutions, and government agencies fuels the development of innovative biomarker solutions. Clinical trials increasingly rely on biomarkers to guide patient selection, optimize study designs, and generate actionable endpoints. This shift enhances trial efficiency, shortens approval timelines, and improves therapeutic success rates. The growth of translational research and biomarker-based validation frameworks encourages the integration of multi-omics platforms, including proteomics, metabolomics, and transcriptomics. Emerging technologies such as digital biomarkers, AI-driven predictive algorithms, and high-throughput screening systems strengthen discovery pipelines. Supportive government initiatives, public–private partnerships, and regulatory encouragement for companion diagnostics further drive biomarker adoption. As drug development complexity rises, biomarkers remain essential tools for enabling precision-based clinical evaluations and improving overall R&D productivity.

- For instance, Pfizer’s clinical development platform incorporates biomarker-driven patient stratification using next-generation sequencing panels analyzing over 300 genomic regions, while QIAGEN’s QIAcuity digital PCR system performs up to 1,248 reactions per run, accelerating biomarker quantification workflows across translational research programs.

Advancement in Diagnostic Technologies and Non-Invasive Testing

Rapid progress in diagnostic technologies significantly accelerates biomarker adoption, particularly with the shift toward minimally invasive and non-invasive testing modalities. Innovations in liquid biopsy, microfluidics, molecular imaging, and multiplex assays enhance sensitivity, reduce sample requirements, and allow real-time disease monitoring. These advancements improve patient comfort, expand screening capabilities, and enable earlier detection of chronic and life-threatening conditions. The rising use of point-of-care testing, digital pathology, and AI-enhanced diagnostic workflows further strengthens market growth. Commercialization of biomarker-based panels for cancer, cardiovascular disorders, neurodegenerative diseases, and autoimmune conditions expands their clinical utility. As healthcare systems prioritize early intervention and preventive diagnostics, biomarker-enabled testing becomes integral to improving care outcomes and reducing long-term treatment costs.

Key Trends & Opportunities

Expansion of Multi-Omics Integration and Systems Biology

A major trend reshaping the Biomarkers Market is the increasing integration of multi-omics approaches, combining genomics, proteomics, epigenomics, and metabolomics to generate comprehensive biological insights. This multi-layered data architecture enhances biomarker accuracy, supports disease mechanism discovery, and enables deeper patient stratification. Systems biology models and computational analytics further accelerate biomarker identification by uncovering complex molecular interactions. The approach generates opportunities for developing multi-marker panels, advanced companion diagnostics, and predictive disease models. This trend also enhances R&D collaboration across academic, clinical, and industrial sectors. As multi-omics platforms become more affordable and scalable, their integration is expected to transform diagnostic and therapeutic pathways, offering vast opportunities for personalized medicine advancement.

- For instance, Pacific Biosciences’ HiFi sequencing delivers read lengths averaging 15,000 base pairs with accuracy above 99.9%, enabling high-resolution multi-omics analysis, while Bruker’s timsTOF Pro mass spectrometry platform can quantify more than 5,000 proteins in a single run, supporting advanced proteogenomic biomarker discovery.

Growing Commercialization of Digital and AI-Driven Biomarkers

The emergence of digital biomarkers and AI-enabled analytics offers substantial opportunities in disease monitoring, drug development, and patient management. Wearable devices, smartphone-based health trackers, and remote monitoring systems now generate real-time physiological and behavioral data that can be used as biomarkers for chronic diseases and neurological disorders. Machine learning models analyze high-volume datasets to detect subtle patterns, predict disease progression, and support clinical decision-making. Digital biomarkers shorten trial durations, improve endpoint accuracy, and support adaptive trial designs. As telehealth adoption rises, digital monitoring becomes increasingly valuable for continuous patient assessment. The commercialization of validated digital biomarkers opens new avenues for predictive healthcare, decentralized clinical trials, and personalized therapy optimization.

- For instance, Fitbit’s Sense device incorporates an ECG sensor capturing electrical signals at 250 samples per second, enabling detection of atrial fibrillation and supporting development of cardiac digital biomarkers.

Key Challenges

Regulatory Complexity and Standardization Barriers

Regulatory challenges remain a major hurdle for the Biomarkers Market, as achieving consistent validation, clinical utility, and approval standards is complex. Biomarkers often require extensive evidence to demonstrate reproducibility, clinical relevance, and analytical performance across diverse patient populations. Variability in regulatory frameworks across regions—especially between the U.S., Europe, and Asia—creates additional compliance burdens. The absence of universally accepted biomarker qualification pathways slows development timelines. Moreover, ensuring standardization across assay methodologies, platforms, and data interpretation creates technical barriers. These challenges delay commercialization and discourage smaller companies from investing in high-cost biomarker programs, ultimately affecting market scalability.

High Development Costs and Limited Reimbursement Coverage

Developing clinically validated biomarkers involves substantial investment in discovery, analytical testing, clinical studies, and regulatory documentation. High failure rates during validation further increase cost burden, making biomarker development economically challenging, particularly for smaller biotech firms. Limited reimbursement coverage for biomarker-based tests in several regions restricts clinical adoption despite strong diagnostic value. Payers often demand robust evidence demonstrating improved outcomes and cost-effectiveness, which requires extensive real-world and clinical data. Additionally, integration of advanced technologies such as sequencing, digital diagnostics, and multi-omics platforms adds to overall costs. These financial pressures slow market penetration and hinder the widespread use of biomarker-driven diagnostics and therapeutics.

Regional Analysis

North America

North America holds the leading position in the Biomarkers Market, accounting for 38.2% share in 2024. Growth is driven by advanced healthcare infrastructure, strong presence of pharmaceutical and biotechnology companies, and high adoption of companion diagnostics and precision medicine. Robust clinical research activity, favorable reimbursement for select biomarker-based tests, and extensive use of biomarkers in oncology and cardiovascular disease management further strengthen regional dominance. The U.S. remains the primary revenue contributor, supported by large R&D budgets, strong regulatory focus on personalized therapies, and increasing use of multi-omics platforms in clinical and translational research.

Europe

Europe represents a significant share of the Biomarkers Market, contributing 29.4% of global revenue in 2024. The region benefits from strong public–private research collaborations, growing adoption of biomarker-based diagnostics in national health systems, and active participation in large-scale clinical trials. Regulatory support for companion diagnostics and increasing focus on early disease detection, particularly in cancer and neurological disorders, underpin demand. Key markets such as Germany, the U.K., France, and the Nordics drive innovation in genomics, proteomics, and liquid biopsy, while EU initiatives around precision medicine and digital health further accelerate biomarker integration.

Asia Pacific

Asia Pacific is the fastest-growing region in the Biomarkers Market, holding 23.7% share in 2024 and expanding rapidly on the back of rising healthcare expenditure and large patient populations. Increasing cancer prevalence, growing awareness of early diagnosis, and expanding clinical trial activity in China, India, Japan, and South Korea support strong adoption. Governments and private players are investing in genomics programs, diagnostic infrastructure, and localized biomarker panels tailored to regional disease patterns. Improving regulatory frameworks, growing pharma outsourcing, and rising demand for personalized medicine position Asia Pacific as a critical growth engine for the global market.

Latin America

Latin America accounts for 5.1% share of the Biomarkers Market in 2024, with steady growth driven by gradual modernization of healthcare systems and improving access to advanced diagnostics. Brazil, Mexico, and Argentina are key contributors, where rising cancer and cardiovascular disease burden pushes demand for biomarker-based tests. Adoption remains concentrated in urban tertiary-care centers and private hospitals, supported by selective reimbursement and collaborations with multinational diagnostics and pharma companies. Limited funding, uneven infrastructure, and cost constraints restrict widespread penetration; however, ongoing investments in laboratory capabilities and clinical research are expected to support long-term market expansion.

Middle East & Africa

The Middle East & Africa region holds a relatively smaller 3.6% share of the Biomarkers Market in 2024, but exhibits emerging growth potential. Gulf Cooperation Council (GCC) countries lead adoption, supported by high per capita healthcare spending, investments in cancer centers, and partnerships with global diagnostics providers. Growing focus on non-communicable diseases and expansion of private healthcare networks drive interest in biomarker-based diagnostics and monitoring. In Africa, market development is hindered by limited infrastructure and affordability issues, but donor-funded programs, regional reference laboratories, and pilot precision medicine initiatives are gradually creating opportunities for future biomarker deployment.

Market Segmentations

By Type

- Validation

- Efficacy

- Safety

By Disease

- Neurological Diseases

- Cancer

- Immunological Diseases

- Cardiovascular Diseases

By Application

- Personalized Medicines

- Drug Discovery & Development

- Diagnostics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Biomarkers Market is characterized by strong participation from global diagnostics companies, biotechnology firms, and pharmaceutical manufacturers that continually invest in research, technology innovation, and product expansion. Leading players such as Thermo Fisher Scientific, Agilent Technologies, Bio-Rad Laboratories, Qiagen, Abbott, Roche, Johnson & Johnson Services, Siemens Healthineers, Epigenomics AG, and others focus on developing advanced biomarker-based assays, liquid biopsy platforms, and multi-omics solutions to strengthen market presence. Strategic collaborations, acquisitions, and co-development partnerships with pharma companies are common as firms work to accelerate biomarker discovery and companion diagnostics integration. Many companies also expand their portfolios through high-throughput sequencing, proteomics, multiplex immunoassays, and AI-powered analytical tools. Increasing regulatory approvals and companion diagnostic linkages further intensify competition. As personalized medicine and targeted therapies continue to gain traction, market leaders emphasize clinical validation, scalable platforms, and global distribution networks to maintain competitive advantage in the rapidly evolving biomarker ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2024, AMLo Biosciences obtained the UKCA mark for AMBLor®, a histopathological biomarker test developed to identify melanoma progression.

- In April 2024, Owlstone Medical secured a USD 1.5 million grant from the Bill & Melinda Gates Foundation to advance breath-based diagnostics and identify breath biomarkers for tuberculosis and HIV.

- In April 2024, Bio-Rad Laboratories introduced the ddPLEX ESR1 mutation detection kit, an ultrasensitive multiplexed digital PCR assay designed to detect breast cancer mutations in clinical research.

Report Coverage

The research report offers an in-depth analysis based on Type, Disease, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand rapidly as precision medicine becomes integral to clinical decision-making across major therapeutic areas.

- Adoption of liquid biopsy biomarkers will increase, driven by demand for non-invasive early detection and real-time disease monitoring.

- Multi-omics integration will enhance biomarker discovery, enabling more accurate diagnostic and prognostic tools.

- AI and machine learning will play a greater role in analyzing complex biomarker datasets to improve clinical outcomes.

- Pharmaceutical companies will increasingly rely on biomarkers to optimize clinical trials and reduce drug development timelines.

- Digital biomarkers from wearables and remote monitoring devices will gain wider acceptance in chronic disease management.

- Companion diagnostics will witness stronger regulatory support as personalized therapies become more prevalent.

- Emerging markets will accelerate adoption due to improving healthcare infrastructure and rising demand for early diagnosis.

- Strategic partnerships between diagnostics companies and biopharma firms will intensify to expand biomarker pipelines.

- Standardization efforts and improved regulatory pathways will enhance market confidence and boost global biomarker deployment.