Market Overview

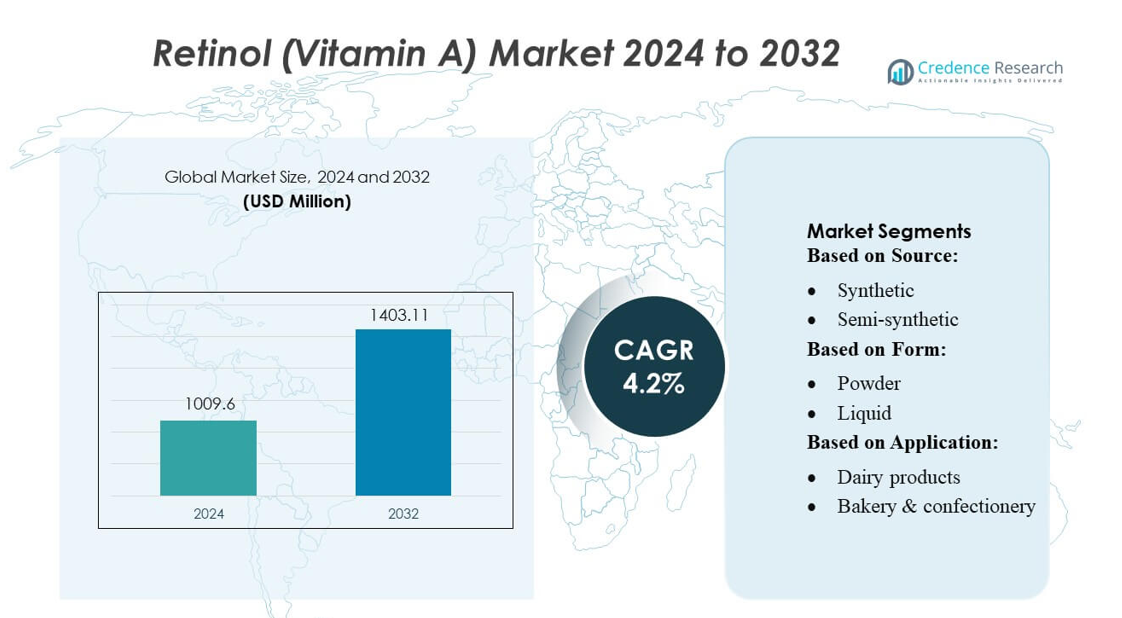

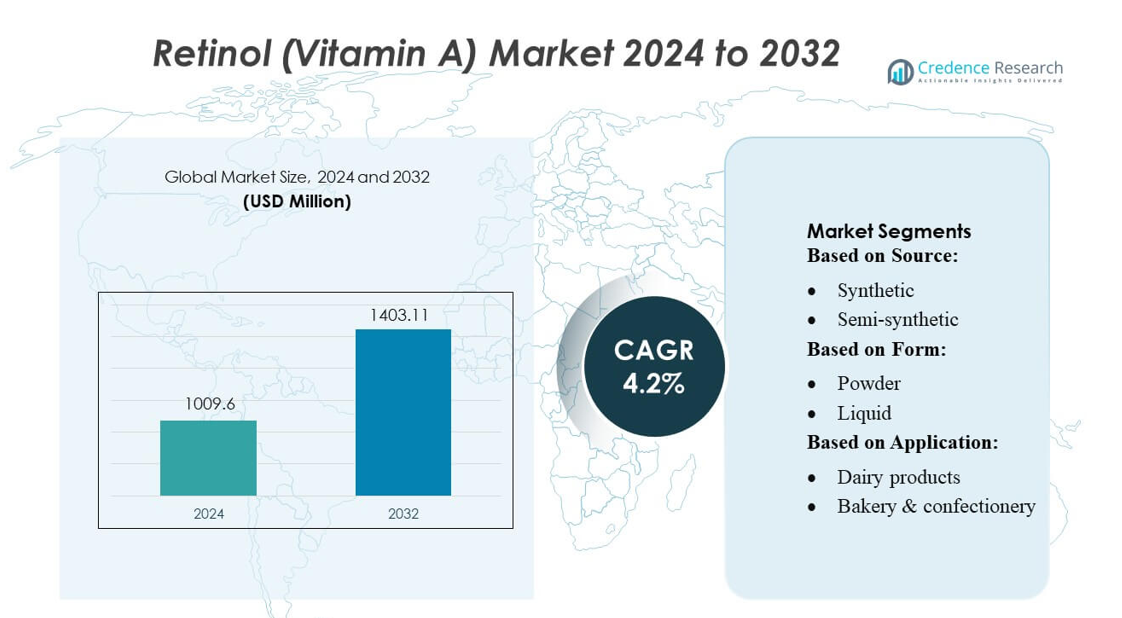

Retinol (Vitamin A) Market size was valued USD 1009.6 million in 2024 and is anticipated to reach USD 1403.11 million by 2032, at a CAGR of 4.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Retinol (Vitamin A) Market Size 2024 |

USD 1009.6 million |

| Retinol (Vitamin A) Market, CAGR |

4.2% |

| Retinol (Vitamin A) Market Size 2032 |

USD 1403.11 million |

The Retinol (Vitamin A) market is led by prominent companies including Botanic Healthcare, Fengchen Group Co., Ltd, CSPC Pharmaceutical Group Limited, Global Calcium PVT LTD, Northeast Pharmaceutical Group Co., Ltd (NEPG), Sinofi Ingredients, Foodchem International Corporation, DSM Jiangshan Pharmaceutical (Jiangsu) Co., Ltd, Fooding, and Spectrum Chemical. These players focus on technological innovations such as microencapsulation, beadlets, and stabilized powders to enhance bioavailability, stability, and shelf life, while expanding product portfolios across fortified foods, functional beverages, and infant nutrition. North America emerges as the leading region, accounting for 28% of the global market, driven by high consumer awareness, regulatory support for vitamin A fortification, and strong adoption of functional and fortified products. Strategic partnerships, R&D investments, and growing demand for clean-label and plant-based retinol are further strengthening competitive positioning and market growth in this region.

Market Insights

- The Retinol (Vitamin A) market size was valued at USD 1009.6 million in 2024 and is projected to reach USD 1403.11 million by 2032, growing at a CAGR of 4.2% during the forecast period.

- North America leads the market with a 28% share, driven by high consumer awareness, regulatory support for vitamin A fortification, and strong adoption of fortified foods, functional beverages, and infant nutrition products.

- Synthetic and plant-based sources dominate the market, while powder and beadlet forms are the most widely used due to stability, bioavailability, and versatility in fortified and functional food applications.

- Key drivers include rising health-conscious consumers, government fortification initiatives, and demand for immunity-boosting and clean-label products, while challenges include stability issues and stringent regulatory compliance across regions.

- The market is highly competitive, with leading players focusing on technological innovations, strategic partnerships, R&D investments, and expansion into emerging markets to strengthen presence and meet growing demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Source:

The Retinol market is predominantly driven by synthetic sources, accounting for approximately 55% of the global market share. Synthetic retinol is favored due to its consistent potency, cost-effectiveness, and scalability compared to natural sources. Among natural sources, plant-based retinol is increasingly adopted in response to rising consumer preference for clean-label and vegan-friendly products. Key growth drivers in this segment include regulatory support for fortification, growing awareness of vitamin A deficiency, and the food and supplement industry’s demand for stable, high-purity retinol ingredients. Animal-based and microbial sources remain niche, often used in specialty applications.

- For instance, synthetic‑retinol segment represented around 82.8% of total retinol revenues. Research and Markets. Among natural sources, plant‑based retinol is increasingly adopted in response to rising consumer preference for clean‑label and vegan‑friendly products.

By Form:

Powder forms dominate the retinol market, holding around 60% share due to their stability, ease of handling, and incorporation across multiple applications, including fortified foods and dietary supplements. Liquid and beadlet forms are also significant, valued for controlled release, bioavailability, and versatility in beverage and functional food products. Encapsulated retinol is gaining traction in premium applications, protecting against degradation and enhancing shelf life. Market growth is driven by manufacturers’ focus on stability enhancement, innovations in microencapsulation technology, and increasing demand for forms compatible with heat-processed and long-shelf-life products.

- For instance, vitamin A palmitate offering, they specify potency levels like 500,000 IU/g, 1,000,000 IU/g, and up to 1.7 Million IU/g (for oil form) as per their product data.

By Application:

Functional foods lead the retinol application segment, capturing roughly 45% of the market share, driven by rising health-conscious consumer behavior and fortified product innovations. Dairy products, bakery, and confectionery follow, benefiting from fortification mandates and convenience-focused consumption trends. Infant formula is a high-value sub-segment, experiencing robust growth due to stringent nutritional standards and growing awareness of vitamin A’s role in child development. Key drivers include increasing fortification programs, rising disposable incomes, and manufacturers leveraging retinol for immunity-boosting and eye-health claims in everyday food products.

Key Growth Drivers

Rising Health Awareness and Nutritional Deficiency Concerns

Increasing global awareness of vitamin A deficiency, particularly in developing regions, is driving demand for retinol-fortified foods and supplements. Consumers are actively seeking products supporting eye health, immunity, and overall wellness. Government initiatives promoting mandatory fortification in staple foods and beverages further accelerate adoption. The combination of rising disposable incomes and growing health-conscious populations in Asia-Pacific, Latin America, and parts of Europe creates a favorable environment for market expansion, positioning retinol as a vital nutrient across functional foods, dairy, and infant nutrition segments.

- For instance, CSPC maintains multiple first‑class R&D centers (in China and the U.S.), and possesses a broad regulatory/quality infrastructure: as of recent disclosures, they hold 16 CEP certificates, 33 DMF registrations, and have passed numerous on‑site inspections including by the U.S. FDA.

Growth of Functional and Fortified Food Applications

The surge in functional foods, fortified beverages, and infant nutrition products is a major driver of the retinol market. Manufacturers increasingly incorporate retinol into bakery, dairy, cereals, and ready-to-drink formulations to enhance nutritional value. Technological advancements in encapsulation and stabilization ensure product efficacy even during heat processing and extended storage. As consumers seek convenience without compromising health benefits, fortified and functional products gain traction, expanding the retinol market and prompting innovation in product forms such as powders, beadlets, and encapsulated formulations.

- For instance, Global Calcium operates 14 manufacturing plants, spans over 40+ acres, and is certified under multiple global standards (cGMP, EU‑GMP, COFEPRIS, WHO‑cGMP, HACCP, ISO 9001:2015, ISO 14001:2015, FSSC, kosher & halal) — giving them regulatory and quality credentials for supplying raw materials or premixes for global food, nutraceutical, or fortification uses.

Technological Advancements in Retinol Formulation and Delivery

Innovations in microencapsulation, beadlet, and encapsulated liquid technologies have significantly improved the stability, bioavailability, and shelf life of retinol in food and supplement products. Such advancements allow manufacturers to integrate vitamin A into diverse applications without compromising efficacy, taste, or appearance. Enhanced delivery systems also support controlled release, targeted absorption, and compatibility with heat-processed or long-shelf-life products. These technological developments drive broader adoption, enabling companies to cater to both mass-market and premium segments while addressing regulatory and quality compliance globally.

Key Trends & Opportunities

Plant-Based and Clean-Label Retinol Demand

Consumer preference for plant-based, vegan-friendly, and clean-label ingredients is driving opportunities for natural retinol sources. Plant-derived vitamin A is gaining traction in functional foods, beverages, and dietary supplements as health-conscious and environmentally aware populations prioritize sustainable nutrition. Manufacturers are responding with innovations in extraction, fortification, and stability solutions that align with clean-label trends, creating premium positioning opportunities. This shift allows companies to diversify offerings while meeting regulatory and consumer-driven demand for transparency, ethical sourcing, and traceable ingredient supply chains.

- For instance, Sinofi reportedly handles more than 10,000 metric tons of food additives and industrial products per year in its supply network.

Expansion in Emerging Markets

Emerging regions such as Asia-Pacific, Latin America, and Africa present significant growth opportunities due to rising urbanization, increasing disposable incomes, and growing awareness of vitamin A benefits. Governments in these regions are increasingly enforcing fortification programs for staple foods like flour, cereals, and dairy. Additionally, the expanding retail network, e-commerce penetration, and rising demand for convenience and fortified products support market growth. Companies investing in localized formulations, cost-effective production, and distribution strategies can capture substantial market share in these high-potential geographies.

- For instance, Foodchem provides specification data: for its “500/1000 Feed Grade” vitamin A powder the content is specified as ≥ 500,000 IU/g or ≥ 1,000,000 IU/g depending on grade.

Innovation in Infant Nutrition and Specialty Applications

Infant formula and specialty nutrition products present a high-value growth avenue for retinol due to strict nutritional guidelines and growing parental awareness. Innovations in microencapsulation and beadlet technology enable safe, stable incorporation into infant formulas and ready-to-eat products. Opportunities also exist in sports nutrition, clinical supplements, and premium functional foods where retinol is marketed for immunity, skin health, and eye health benefits. Continuous product development and targeted marketing in these niche but high-margin applications can strengthen brand positioning and drive incremental revenue growth globally.

Key Challenges

Stability and Shelf-Life Concerns

Retinol is highly sensitive to heat, light, oxygen, and moisture, making formulation and storage challenging. Degradation during processing or extended storage reduces efficacy, limiting its incorporation in certain applications. Manufacturers must invest in advanced encapsulation, beadlet, or microemulsion technologies, which can increase production costs. Maintaining bioavailability while ensuring product stability in diverse food matrices remains a critical challenge, especially in heat-processed or long-shelf-life products. Failure to address stability issues may impact consumer trust and regulatory compliance, restricting market expansion.

Regulatory and Compliance Barriers

Stringent regulations on fortification levels, labeling, and safety testing vary across countries, posing challenges for global distribution of retinol products. Companies must navigate complex regulatory frameworks to ensure compliance with maximum permissible levels in foods, supplements, and infant nutrition. Frequent changes in legislation, combined with differing regional standards, increase the cost and time for product approvals. Non-compliance can result in product recalls, reputational damage, or legal penalties, creating a significant barrier for both established and new entrants in the competitive retinol market.

Regional Analysis

North America:

North America leads the retinol market with an estimated 28% share, driven by high consumer awareness of health and wellness, widespread fortification programs, and strong demand for functional foods and dietary supplements. The U.S. dominates due to established regulations supporting vitamin A enrichment in dairy, cereals, and infant nutrition products. Technological advancements in encapsulation and beadlet forms support product stability, while premiumization trends boost adoption in skincare and specialty nutrition. Rising investment in R&D, coupled with a growing preference for clean-label and plant-based retinol sources, continues to fuel steady regional growth.

Europe:

Europe holds approximately 25% of the global retinol market, with significant adoption in fortified foods, functional beverages, and infant formula. Stringent regulatory standards, such as EU directives on micronutrient fortification, ensure high-quality and safe product offerings. Germany, France, and the U.K. are key contributors due to strong consumer demand for nutritional and wellness products. Increasing popularity of plant-based and vegan-friendly retinol sources presents growth opportunities. Additionally, the region’s emphasis on preventive healthcare, immunity-boosting foods, and technological innovations in retinol encapsulation drives steady expansion across both mainstream and premium segments.

Asia-Pacific:

Asia-Pacific represents a rapidly growing market, capturing around 30% share due to increasing urbanization, rising disposable incomes, and government-led vitamin A fortification programs. India, China, and Southeast Asia are primary growth drivers, with high demand in fortified staples, dairy products, and infant nutrition. The region’s expanding middle class and rising health-conscious population support functional food and supplement adoption. Manufacturers are leveraging localized formulations, cost-effective production, and advanced encapsulation technologies to enhance stability and bioavailability. The combination of regulatory support, awareness campaigns, and expanding retail and e-commerce networks positions Asia-Pacific as the fastest-growing region globally.

Latin America:

Latin America accounts for roughly 10% of the retinol market, driven by rising awareness of vitamin A deficiency and increasing consumption of fortified foods and dietary supplements. Brazil and Mexico are major contributors, supported by government-led fortification initiatives and public health programs. The growing retail sector and expanding urban populations enable broader distribution of functional and fortified products. Additionally, technological improvements in retinol stabilization and encapsulation support product longevity in tropical climates. Challenges include price sensitivity and regulatory variations across countries, yet opportunities exist in premium fortified foods and infant nutrition segments, offering potential for incremental market growth.

Middle East & Africa:

The Middle East & Africa holds around 7% market share, influenced by increasing awareness of micronutrient deficiencies and gradual adoption of fortified foods and beverages. Gulf Cooperation Council countries, South Africa, and Egypt are key markets, where urbanization and rising disposable income drive demand for functional nutrition products. Infant nutrition and dairy fortification present significant opportunities. However, market growth is constrained by regulatory inconsistencies, limited distribution networks, and cost-sensitive consumers. Investment in stable retinol formulations, localized fortification strategies, and awareness campaigns could enhance adoption, creating potential for steady growth across both urban and emerging rural markets in the region.

Market Segmentations:

By Source:

By Form:

By Application:

- Dairy products

- Bakery & confectionery

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Retinol (Vitamin A) market is highly competitive, with key players such as Botanic Healthcare, Fengchen Group Co., Ltd, CSPC Pharmaceutical Group Limited, Global Calcium PVT LTD, Northeast Pharmaceutical Group Co., Ltd (NEPG), Sinofi Ingredients, Foodchem International Corporation, DSM Jiangshan Pharmaceutical (Jiangsu) Co., Ltd, Fooding, and Spectrum Chemical. The Retinol (Vitamin A) market is highly competitive, driven by continuous innovation in formulation and delivery technologies such as microencapsulation, beadlets, and stabilized powders to enhance bioavailability, stability, and shelf life. Companies are increasingly investing in research and development to introduce fortified foods, functional beverages, and infant nutrition products that meet rising consumer demand for health, immunity, and wellness benefits. Strategic initiatives, including mergers, partnerships, and regional expansion, are common to strengthen market position. Additionally, adherence to stringent regulatory standards, focus on clean-label and sustainable sourcing, and adaptation to emerging market trends enable companies to differentiate their offerings and capture growth opportunities in both mature and high-growth regions globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Botanic Healthcare

- Fengchen Group Co., Ltd

- CSPC Pharmaceutical Group Limited

- Global Calcium PVT LTD

- Northeast Pharmaceutical Group Co., Ltd (NEPG)

- Sinofi Ingredients

- Foodchem International Corporation

- DSM Jiangshan Pharmaceutical (Jiangsu) Co., Ltd

- Fooding

- Spectrum Chemical

Recent Developments

- In April 2024, P&G Health’s Evion launched a new Vitamin E enriched cream, co-branded with Aloe Vera, to be used as a daily moisturizer or with sunscreen for enhanced nourishment. The new formulation aims to provide deep hydration, protect the skin from environmental damage, and reduce dullness and dark spots, resulting in more radiant and healthy-looking skin.

- In March 2024, Lonza announced an agreement with Roche to acquire Genentech’s biologics manufacturing site in California. This is expected to significantly enhance Lonza’s biologics manufacturing capability and make it one of the largest sites globally.

- In February 2024, Performance Lab, a UK-based company, launched new supplements including vitamin C, vitamin B complex, and magnesium, stating they are 100% plant-based and free from artificial binders and fillers.

Report Coverage

The research report offers an in-depth analysis based on Source, Form, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for fortified and functional foods will continue to drive market growth globally.

- Innovative delivery technologies like microencapsulation and beadlets will expand product applications.

- Increasing consumer awareness of eye health, immunity, and overall wellness will boost retinol adoption.

- Clean-label and plant-based retinol sources will gain popularity among health-conscious consumers.

- Infant nutrition and specialized dietary products will remain high-growth segments.

- Emerging markets will see accelerated growth due to urbanization and rising disposable incomes.

- Regulatory support for vitamin A fortification will encourage wider product incorporation.

- Manufacturers will invest in R&D to enhance stability, bioavailability, and shelf life of retinol.

- E-commerce and modern retail channels will facilitate greater accessibility of fortified products.

- Collaboration and partnerships within the industry will drive innovation and market expansion.