Market Overview

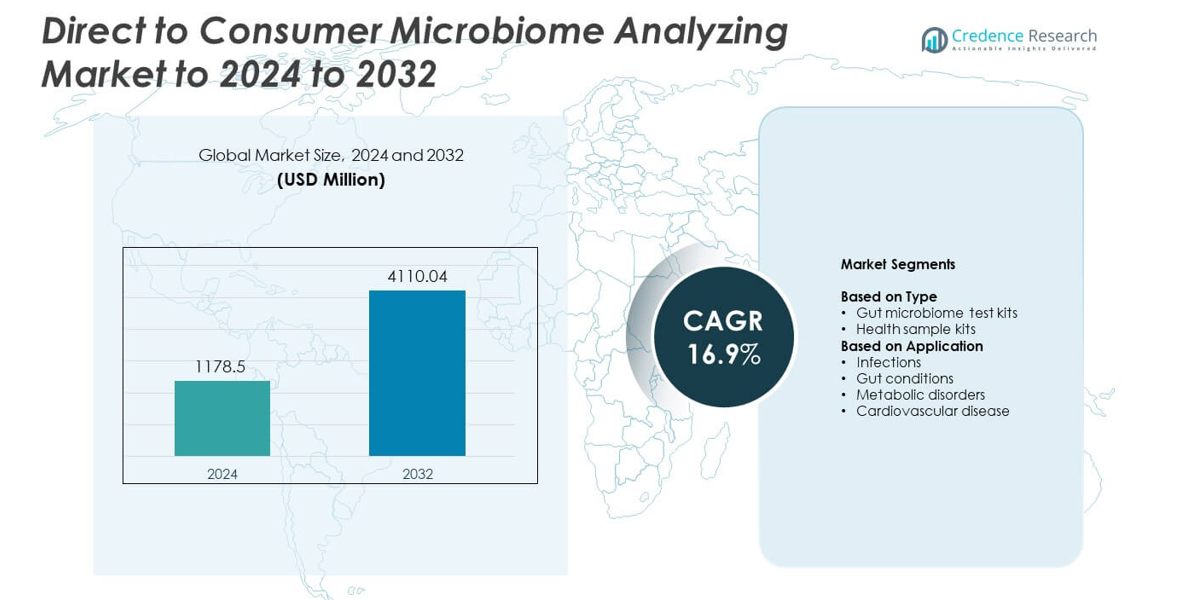

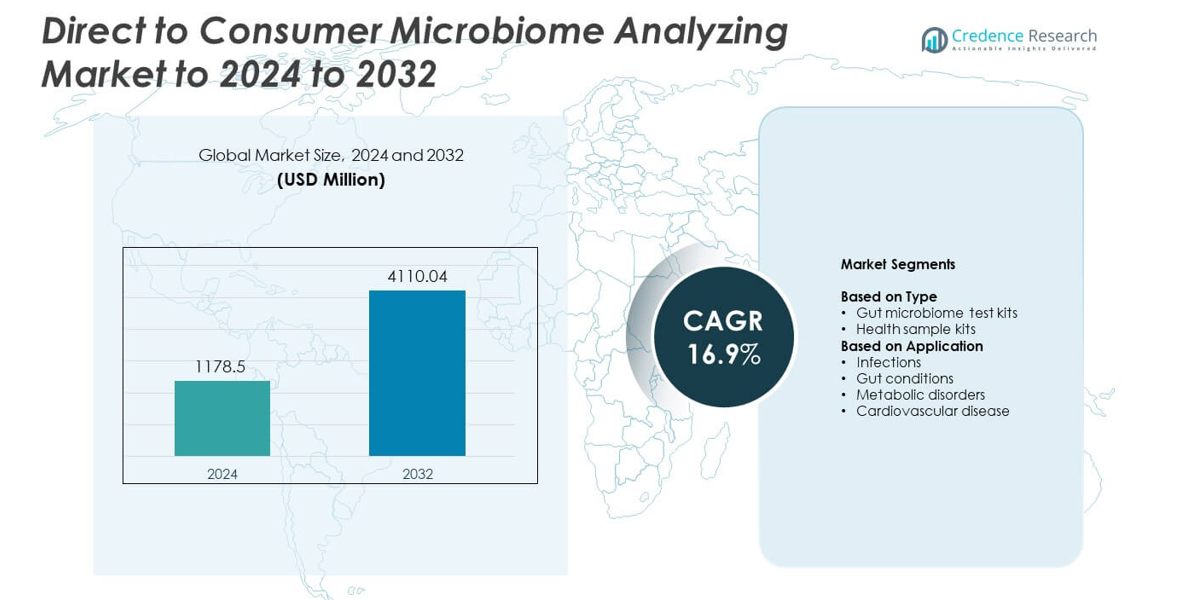

Direct to Consumer Microbiome Analyzing Market size was valued at USD 1178.5 million in 2024 and is anticipated to reach USD 4110.04 million by 2032, at a CAGR of 16.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Direct to Consumer Microbiome Analyzing Market Size 2024 |

USD 1178.5 million |

| Direct to Consumer Microbiome Analyzing Market, CAGR |

16.9% |

| Direct to Consumer Microbiome Analyzing Market Size 2032 |

USD 4110.04 million |

The Direct to Consumer Microbiome Analyzing Market features major players such as DayTwo, Kihealth, 23andMe, Zywie, Everlywell, BiomeSense, Atlas Biomed, Zymo Research, GutCheck, Viome, Thryve, Genomatica, and uBiome. These companies compete through advanced microbiome sequencing, AI-supported interpretation, and personalized nutrition programs that attract a wider consumer base. Growing interest in preventive wellness and home-based diagnostics continues to strengthen their market positions. North America remained the leading region in 2024 with a 39% share, supported by strong digital health adoption, higher healthcare spending, and rapid uptake of personalized testing solutions across major consumer groups.

Market Insights

- The Direct to Consumer Microbiome Analyzing Market reached USD 1178.5 million in 2024 and is projected to hit USD 4110.04 million by 2032 at a CAGR of 16.9%.

- Rising demand for personalized wellness and strong adoption of gut microbiome test kits, which held about 63% share in 2024, continue to drive growth.

- AI-driven insights, personalized nutrition plans, and subscription-based testing services shape major trends across global markets.

- Competition intensifies as companies enhance digital platforms, improve sampling convenience, and expand evidence-backed wellness programs while facing restraints related to high testing costs and limited clinical validation.

- North America led the market in 2024 with 39% share, followed by Europe at 31% and Asia Pacific at 22%, while gut conditions dominated applications with nearly 47% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Gut microbiome test kits held the dominant share in 2024 with nearly 63% of the market. Demand increased as consumers sought clearer insights into digestion, immunity, and diet response. These kits gained wider acceptance due to simple sampling steps and fast digital reporting. Health sample kits also expanded as users tracked broader wellness markers linked to microbial balance. Rising awareness of personalized nutrition and increasing availability of subscription-based testing platforms continued to push more buyers toward gut microbiome test kits across major regions.

- For instance, Atlas Biomed built a proprietary gut microbiome reference database using data from customers who used direct-to-consumer stool test kits linked with detailed lifestyle questionnaires, a common practice in the personalized health industry

By Application

Gut conditions led the application segment in 2024 with about 47% share. The category grew as users faced rising digestive issues tied to lifestyle, stress, and dietary habits. Microbiome tests helped individuals identify bacterial imbalances, food triggers, and markers linked to bowel health. Infections, metabolic disorders, and cardiovascular disease applications also gained traction with greater acceptance of preventive testing. Growing clinical evidence linking the microbiome to chronic disease risk supported wider adoption, strengthening the leadership of gut-related testing.

- For instance, Ombre sequences stool samples using Illumina MiSeq instruments to profile microbial communities linked to digestive symptoms. In a typical 16S rRNA gene amplicon sequencing protocol for human samples, researchers aim for a sequencing depth of at least 10,000 to 20,000 quality sequences (reads) per sampleto ensure adequate microbial profiling depth, which is achieved by pooling multiple samples on a single high-throughput Illumina MiSeq run.

Key Growth Drivers

Rising Adoption of Personalized Wellness

Demand increased as people shifted toward personalized diets and preventive health plans. Microbiome tests helped users understand digestion, nutrient absorption, and immune response. Growing interest in tailored supplement plans and microbiome-based coaching boosted direct consumer spending. Digital platforms expanded access by offering easy ordering and rapid online reporting. This wider focus on individualized wellness remained the strongest growth driver in the market.

- For instance, Noom reported around 1.5 million paying subscribers using its smartphone app for personalized coaching programs that combine nutrition tracking with behavior-change techniques.

Growing Burden of Gut-Related Disorders

Digestive disorders such as IBS, bloating, and food sensitivities pushed more consumers toward microbiome analysis. Rising stress levels and poor dietary habits increased gut imbalance cases, encouraging individuals to seek at-home testing. Many people used results to adjust diets, track symptom patterns, and monitor long-term conditions. Awareness campaigns by wellness brands and healthcare influencers strengthened the shift toward early detection. This trend remained a major driver for expanding adoption.

- For instance, dsm-firmenich sponsored a synbiotic trial in 120 adults with irritable bowel syndrome (IBS), where participants took two capsules daily for twelve weeks.

Expansion of At-Home Testing Platforms

Improved sampling kits and user-friendly apps encouraged faster uptake of home-based microbiome solutions. Companies added subscription models, personalized diet tips, and AI-based microbiome insights. These services reduced clinic visits and offered greater privacy and convenience. Wider e-commerce availability also improved access across urban and semi-urban regions. This development remained a key growth driver due to its strong influence on customer adoption.

Key Trends & Opportunities

AI-Driven Microbiome Interpretation

AI algorithms enhanced result accuracy and made personalized guidance easier to understand. Companies used machine learning to identify microbial patterns linked to lifestyle and nutrition. Better interpretation tools created opportunities for precision wellness programs. This remained a leading trend as consumers preferred clear, actionable results supported by technology. The shift opened strong market potential for advanced software-driven testing.

- For instance, Viome’s platform has analyzed over one millionat-home health tests across 106 countries, and its AI engine interprets more than 10 quadrillion biological data points derived from its extensive gene expression database.

Integration with Personalized Supplements

Brands developed microbiome-linked supplement plans that targeted digestion, immunity, or metabolic balance. Users received personalized formulas based on their bacterial profile, creating a stronger value proposition. This integration allowed companies to build recurring revenue through monthly subscription packs. Growing demand for customized nutrition made this a major opportunity for expansion. The trend supported cross-selling between testing, diet plans, and supplements.

- For instance, Seed Health’s DS-01 Daily Synbiotic combines 24 clinically studied bacterial strains, delivering 53.6 billion active fluorescent units per standard adult daily dose through a two-capsule system that separates probiotic and prebiotic components.

Partnerships with Digital Health Platforms

Testing firms collaborated with telehealth and wellness apps to expand their reach. These partnerships enabled smooth data sharing, remote consultations, and improved user engagement. Wider digital health adoption created fresh opportunities for global scaling. As more consumers used virtual health services, microbiome platforms gained stronger visibility. This trend continued to open new revenue streams for service providers.

Key Challenges

Limited Clinical Validation

Many microbiome insights lacked widely accepted clinical guidelines, creating uncertainty for users. Variability in test interpretation reduced confidence for individuals seeking medical-grade accuracy. Regulatory bodies continued to evaluate test claims, increasing scrutiny on product quality. Companies needed robust scientific data to maintain credibility and strengthen consumer trust. This challenge remained a major restraint for wider adoption.

High Testing Costs and Low Awareness

Premium pricing restricted access in cost-sensitive regions, slowing market penetration. Many consumers still lacked awareness of microbiome science and its health relevance. Limited education on report interpretation also reduced long-term engagement. Companies required strong outreach and affordable pricing models to address these gaps. This barrier continued to challenge broader adoption across emerging markets.

Regional Analysis

North America

North America held the leading position in 2024 with nearly 39% share. Strong consumer awareness of personalized wellness, high adoption of at-home diagnostics, and widespread digital health integration supported market expansion. The region benefited from established testing brands, strong e-commerce penetration, and higher healthcare spending. Growing interest in gut health, rising digestive disorder prevalence, and broader acceptance of preventive lifestyle habits continued to drive demand. Supportive regulatory visibility and frequent product launches also strengthened the regional ecosystem. These factors kept North America the largest contributor to overall market growth.

Europe

Europe accounted for about 31% share in 2024, supported by strong demand for preventive health tools and rising interest in diet-microbiome links. Consumers in major markets such as Germany, the U.K., and France adopted self-testing kits as part of broader wellness routines. High digital literacy and well-developed home sampling infrastructure enabled smoother market adoption. Government-backed awareness of gut health and lifestyle-related disorders supported further expansion. Increasing partnerships between microbiome firms and nutrition platforms continued to improve regional penetration. Europe remained a strong second-leading region with steady growth momentum.

Asia Pacific

Asia Pacific held nearly 22% share in 2024 and recorded the fastest expansion due to rising urban wellness spending and growing demand for home diagnostics. Countries like China, Japan, South Korea, and Australia showed higher adoption as digestive issues and lifestyle diseases became more common. E-commerce growth improved access to microbiome kits, while health-conscious younger consumers embraced personalized diet plans. Local companies invested in AI-driven analysis tools, enhancing user engagement and report quality. Rapid digital healthcare adoption kept Asia Pacific on a strong upward trajectory and positioned the region for wider future gains.

Latin America

Latin America captured close to 5% share in 2024, driven by rising awareness of gut health and gradual adoption of home-based wellness testing. Urban consumers in Brazil, Mexico, and Argentina showed increased interest in affordable test kits supported by expanding online distribution. Growing digestive disorder prevalence and higher use of digital wellness apps helped strengthen demand. Market penetration remained slower due to pricing sensitivity and limited provider presence. However, improving healthcare engagement and broader preventive health trends supported steady regional growth, keeping Latin America on a modest but developing trajectory.

Middle East & Africa

Middle East & Africa held nearly 3% share in 2024, representing an emerging but growing market. Higher adoption occurred in urban centers such as the UAE, Saudi Arabia, and South Africa as awareness of personalized health solutions increased. Consumers showed rising interest in diet-linked gut insights, and e-commerce helped improve kit accessibility. Limited availability of advanced microbiome services and lower awareness levels kept growth moderate. However, expanding digital health ecosystems and wellness-focused initiatives continued to create new entry points. The region remained small but showed stable long-term potential.

Market Segmentations:

By Type

- Gut microbiome test kits

- Health sample kits

By Application

- Infections

- Gut conditions

- Metabolic disorders

- Cardiovascular disease

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Direct to Consumer Microbiome Analyzing Market includes key players such as DayTwo, Kihealth, 23andMe, Zywie, Everlywell, BiomeSense, Atlas Biomed, Zymo Research, GutCheck, Viome, Thryve, Genomatica, and uBiome. Companies in this space compete by improving sampling convenience, enhancing algorithm-based insights, and offering personalized diet and wellness plans. Many firms focus on integrating AI-driven interpretation tools that deliver clearer health guidance to users. Expansion through subscription models, digital reporting platforms, and partnerships with wellness apps strengthens customer retention. Providers also invest in stronger scientific validation to build trust and differentiate their services. Growing interest in preventive health creates opportunities for market expansion, encouraging firms to scale their at-home testing capabilities and broaden their regional presence.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- DayTwo

- Kihealth

- 23andMe

- Zywie

- Everlywell

- BiomeSense

- Atlas Biomed

- Zymo Research

- GutCheck

- Viome

- Thryve

- Genomatica

- uBiome

Recent Developments

- In 2024, Zymo Research Entered a strategic partnership with BluMaiden Biosciences to offer comprehensive clinical trial analytics and reporting services using the KEYSTONE AI platform.

- In 2024, Kihealth Partnered with Genova Diagnostics to make comprehensive gut health testing more accessible to consumers, allowing direct purchase through retail or online.

- In 2023, 23andMe launched the Health Action Plan for 23andMe+ Premium members, integrating genetic data, medical history, and biomarkers to provide personalized health recommendations and early risk detection measures.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as more consumers adopt personalized wellness solutions.

- At-home microbiome testing will gain wider use due to easier sampling methods.

- AI-based interpretation tools will improve accuracy and strengthen user engagement.

- Testing firms will integrate personalized supplements to build recurring revenue models.

- Partnerships with digital health platforms will increase global accessibility.

- Rising digestive disorders will drive greater interest in gut-focused insights.

- Subscription-based microbiome monitoring will become a common wellness practice.

- Regulatory clarity will improve trust and support broader adoption.

- Emerging markets will show faster uptake with growing e-commerce penetration.

- Expanded clinical research will enhance scientific validation and strengthen credibility.