Market Overview

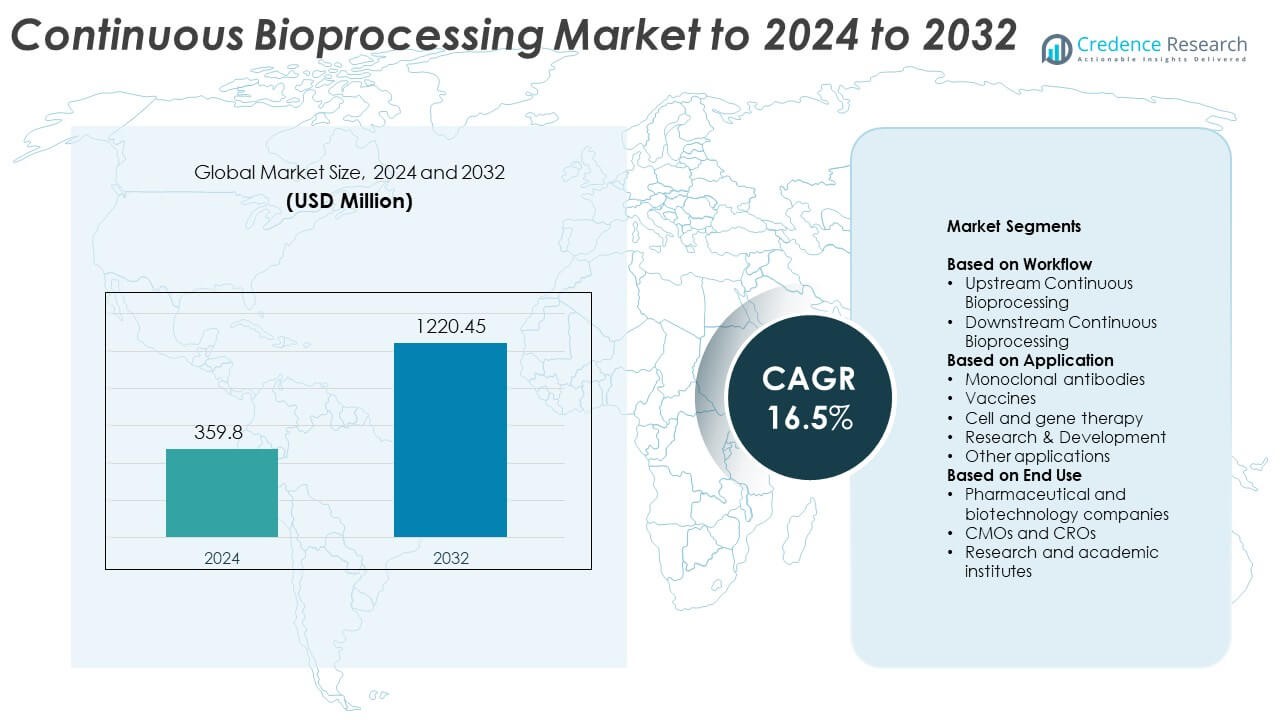

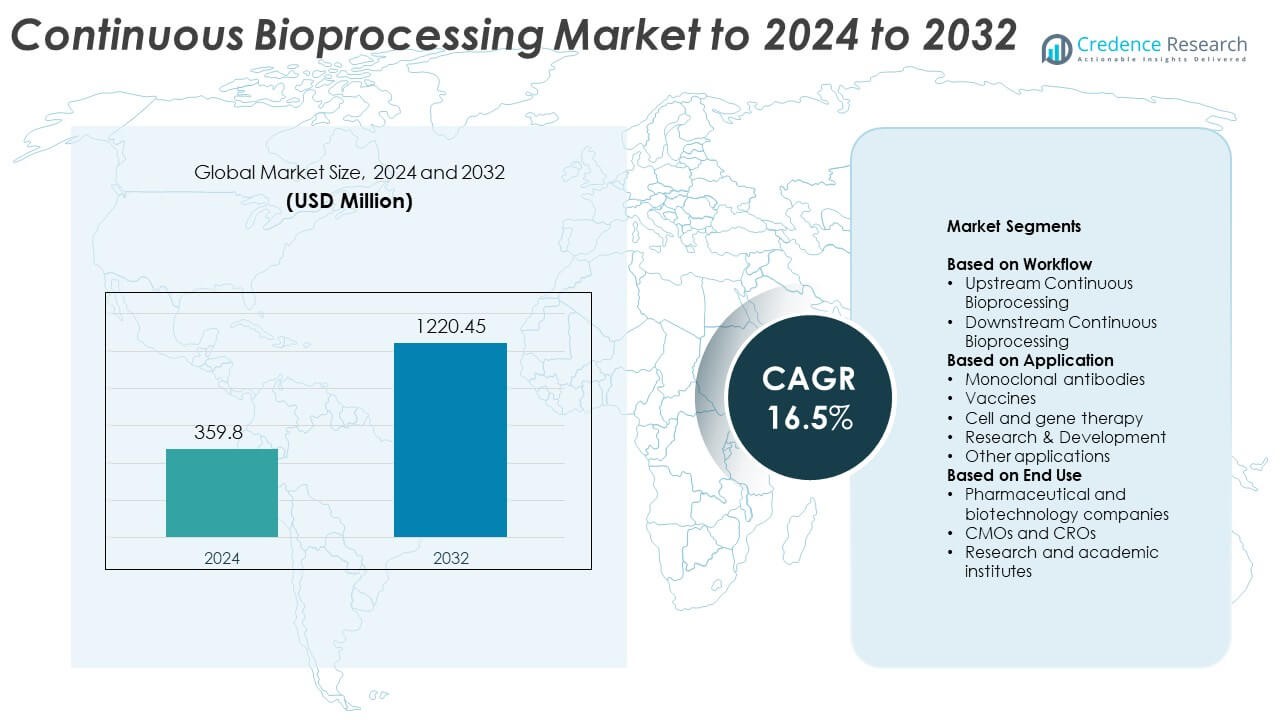

Continuous Bioprocessing Market size was valued at USD 359.8 million in 2024 and is anticipated to reach USD 1220.45 million by 2032, at a CAGR of 16.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Continuous Bioprocessing Market Size 2024 |

USD 359.8 Million |

| Continuous Bioprocessing Market, CAGR |

16.5% |

| Continuous Bioprocessing Market Size 2032 |

USD 1220.45 Million |

Top players in the continuous bioprocessing market include Repligen Corporation, WuXi Biologics, Merck KGaA, Asahi Kasei Bioprocess America, Inc., Sartorius AG, Ginkgo Bioworks, GE Healthcare, Thermo Fisher Scientific Inc., and Danaher, all competing through advanced perfusion systems, single-use platforms, and integrated continuous upstream–downstream solutions. These companies focus on automation, real-time monitoring, and process intensification to support large-scale biologics and advanced therapy production. North America remained the leading region in 2024 with a 41% share, driven by strong biopharma infrastructure, early technology adoption, and expanding commercial-scale continuous manufacturing facilities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The continuous bioprocessing market was valued at USD 359.8 million in 2024 and is projected to reach USD 1220.45 million by 2032 at a CAGR of 16.5%.

- Strong demand for high-throughput biologics production drives market growth, with upstream continuous bioprocessing holding the largest share at about 61% in 2024.

- Integrated end-to-end continuous platforms, single-use technologies, and real-time control systems shape major trends as companies focus on efficiency and faster scale-up.

- Leading companies compete through advanced perfusion systems, automated downstream modules, and digital monitoring, strengthening adoption in commercial biologics and advanced therapies.

- North America led the market in 2024 with a 41% share, followed by Europe with 29%, while monoclonal antibodies remained the top application segment with around 49% share.

Market Segmentation Analysis:

By Workflow

Upstream continuous bioprocessing led the workflow segment in 2024 with about 61% share. Strong adoption came from higher demand for intensified perfusion systems, which support steady biomass growth and reduce batch failures. Companies favored upstream technologies because they cut media use, improve volumetric productivity, and shorten production cycles. Wider use of high-density perfusion bioreactors in monoclonal antibody and viral vector manufacturing also pushed this segment ahead of downstream systems. Downstream continuous bioprocessing grew at a steady pace as chromatography and filtration platforms gained better automation and process control.

- For instance, WuXi Biologics reported its WuXiUP continuous platform achieving an average productivity of 6 g/L/day over an 18-day production phase, reaching a cumulative 105 g/L in a 25-day run and delivering more than 3 kg of monoclonal antibody from 40 L of working volume in an integrated continuous upstream-to-downstream process.

By Application

Monoclonal antibodies dominated the application segment in 2024 with nearly 49% share. This dominance came from rising global demand for therapeutic antibodies, strong pipeline activity, and wider adoption of continuous perfusion systems for high-titer processes. Manufacturers used continuous platforms to manage large-scale antibody volumes with better consistency and fewer throughput delays. Vaccines and cell and gene therapy applications also expanded as companies shifted toward scalable viral vector production. Research and development teams increased uptake to reduce experimentation time and improve early-stage productivity.

- For instance, Just-Evotec Biologics operates continuous perfusion runs in its J.POD facilities for approximately 15 to 25 days

By End Use

Pharmaceutical and biotechnology companies held the largest share in 2024 with around 57% share. These companies drove adoption because continuous platforms reduce cost per gram, improve run stability, and offer faster scale-up for commercial molecules. Biopharma firms integrated continuous systems into antibody, vaccine, and advanced therapy production lines to improve efficiency and meet growing clinical demand. CMOs and CROs accelerated adoption as clients requested intensified manufacturing options. Research and academic institutes contributed steady growth through rising use in pilot-scale optimization and process development studies.

Key Growth Drivers

Rising Demand for High-Throughput Biologics Production

The market grows as biopharma companies seek faster, steadier, and more efficient biologics production. Continuous systems help manufacturers increase volumetric productivity while cutting downtime and reducing batch failures. High global demand for monoclonal antibodies, recombinant proteins, and viral vectors pushes companies toward intensified upstream and downstream workflows. The push for lower production cost per gram and strong pressure to meet rising therapy demand further strengthen this driver across commercial and clinical pipelines.

- For instance, Samsung Biologics’ Plant 5 expansion is designed to bring the company’s total bioreactor capacity to 784,000 liters, supporting very high volumes of monoclonal antibody and other biologics production within a single multi-plant complex.

Shift Toward Process Intensification and Smaller Facility Footprints

Manufacturers adopt continuous bioprocessing to reduce facility size, energy use, and operational load. Compact continuous systems replace large stainless-steel setups and allow companies to run high-density processes with fewer resources. This shift helps biopharma firms control operating costs and improve flexibility in multi-product facilities. Growing interest in decentralized and modular biomanufacturing also supports uptake, as firms aim to produce biologics closer to regional markets with faster setup times and better agility.

- For instance, Sanofi’s digitally enabled Framingham biologics site has been recognized with the 2020 ISPE Facility of the Year Award for its intensified and highly efficient manufacturing design, which significantly reduces environmental impact. The site’s innovative approach reduces water and chemical usage by over 90% and energy consumption by 80% compared to traditional facilities.

Strong Adoption in Advanced Therapies and Next-Generation Modalities

Expanding pipelines in cell and gene therapy boost demand for continuous viral vector and plasmid production. Companies rely on continuous systems to handle delicate cell lines with tighter control, higher reproducibility, and stable output. The rise of next-generation biologics, including bispecific antibodies and gene-modified constructs, requires scalable and reliable production platforms, which continuous workflows provide. Broader regulatory support for innovative manufacturing strategies strengthens this driver and encourages industry-wide adoption.

Key Trends & Opportunities

Growth of Integrated Continuous End-to-End Platforms

A major trend is the shift from isolated continuous steps toward fully integrated end-to-end platforms. Vendors develop connected upstream and downstream modules that share digital controls and automated analytics. This approach reduces transfer losses, lowers human error, and supports real-time quality monitoring. Companies gain opportunities to streamline entire production lines, unlock cost savings, and reduce release timelines. Growing interest in smart factories accelerates demand for these unified system architectures.

- For instance, Lonza’s mammalian manufacturing site in Vacaville provides around 330,000 liters of bioreactor capacity, enabling integrated large-scale biologics production trains that can link upstream and downstream steps within one campus.

Expansion of Single-Use Continuous Technologies

Single-use perfusion systems, chromatography devices, and filtration modules gain traction as firms look for flexible and contamination-free operations. These systems reduce sterilization needs, shorten changeover time, and support multi-product workflows. The trend creates strong opportunities for small and mid-scale manufacturers seeking faster deployment and lower capital investment. Adoption increases in vaccines, monoclonal antibodies, and viral vector processes as standardized single-use components improve reliability and global supply availability.

- For instance, Syngene International’s purchase of Emergent’s Baltimore Bayview facility will raise its total single-use bioreactor capacity from 20,000 liters to 50,000 liters, expanding flexible single-use capacity for large-molecule development and manufacturing.

Integration of PAT and Real-Time Control Systems

The adoption of process analytical technology and AI-enabled monitoring increases across the continuous landscape. Real-time sensors, advanced control loops, and predictive analytics support better product consistency and faster decision-making. This trend opens opportunities for high-quality manufacturing with reduced deviations and greater operational stability. Companies invest in these tools to meet global regulatory expectations and enhance transparency in commercial-scale operations.

Key Challenges

Complex Regulatory and Validation Requirements

Regulatory bodies support continuous manufacturing, yet companies still face complex validation demands. Firms must demonstrate process stability, define control strategies, and manage extensive data packages before implementing commercial systems. The transition from batch to continuous workflows requires revised documentation, new analytical frameworks, and specialized staff. These factors slow adoption and increase compliance costs for both large and emerging manufacturers across global markets.

High Initial Investment and Integration Complexity

Continuous platforms require advanced bioreactors, automation tools, digital control systems, and trained teams. These upfront investments remain difficult for smaller firms and academic facilities with limited capital budgets. Integrating continuous steps into existing batch-based plants also creates engineering challenges, including layout changes and compatibility issues. This complexity delays implementation timelines and raises the financial risk for organizations planning large-scale transformation.

Regional Analysis

North America

North America led the continuous bioprocessing market in 2024 with about 41% share. Strong adoption came from the presence of major biopharma manufacturers, extensive investments in advanced biologics pipelines, and early use of perfusion and continuous downstream systems. The region benefited from mature regulatory support and wide integration of automated control technologies across commercial plants. Growing demand for monoclonal antibodies, cell therapies, and vaccine production supported faster deployment of continuous platforms. Expansion of contract manufacturing facilities in the United States further strengthened the regional leadership.

Europe

Europe held roughly 29% share of the continuous bioprocessing market in 2024. The region saw strong adoption due to active biologics research programs, rising focus on modular and flexible biomanufacturing, and steady investment in single-use continuous systems. Countries such as Germany, Switzerland, and the United Kingdom pushed growth through expanding biosimilar production and digitalized process control initiatives. Supportive regulatory frameworks encouraged companies to shift toward higher-efficiency manufacturing. Growing collaborations between academic centers and bioprocessing technology suppliers continued to boost innovation and process optimization across the region.

Asia Pacific

Asia Pacific accounted for nearly 22% share in 2024 and remained the fastest-growing regional market. Rising biologics demand in China, India, South Korea, and Japan drove strong interest in scalable continuous systems. Local manufacturers adopted continuous upstream and downstream platforms to cut production costs and support export-oriented biologics pipelines. Government incentives to strengthen domestic biopharma capacity further accelerated deployment. Growing investment from global CDMOs in regional manufacturing hubs also supported market expansion. Rapid expansion of vaccine and advanced therapy development programs contributed to sustained growth across Asia Pacific.

Latin America

Latin America captured close to 5% share in the continuous bioprocessing market in 2024. Adoption increased gradually as regional manufacturers upgraded facilities to support biologics and vaccine production. Brazil and Mexico led demand due to expanding pharmaceutical capacity and partnerships with global technology suppliers. Continuous systems helped reduce operating costs and improve manufacturing stability in resource-limited settings. Slow but steady modernization of production plants supported growth, although investment constraints and limited technical expertise remained key barriers for wider adoption across the region.

Middle East and Africa

Middle East and Africa held about 3% share in 2024, driven by gradual development of biologics manufacturing capabilities. Countries in the Gulf region invested in modern bioprocessing facilities to strengthen healthcare independence and reduce reliance on imports. Adoption grew as continuous systems offered better efficiency and lower long-term costs for vaccine and therapeutic protein production. Partnerships with international biopharma companies supported technology transfer and training programs. Despite progress, limited infrastructure and high investment requirements continued to slow large-scale adoption across broader parts of the region.

Market Segmentations:

By Workflow

- Upstream Continuous Bioprocessing

- Downstream Continuous Bioprocessing

By Application

- Monoclonal antibodies

- Vaccines

- Cell and gene therapy

- Research & Development

- Other applications

By End Use

- Pharmaceutical and biotechnology companies

- CMOs and CROs

- Research and academic institutes

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Repligen Corporation, WuXi Biologics, Merck KGaA, Asahi Kasei Bioprocess America, Inc., Sartorius AG, Ginkgo Bioworks, GE Healthcare, Thermo Fisher Scientific Inc., and Danaher lead the competitive landscape of the continuous bioprocessing market. Competition centers on advanced perfusion systems, single-use continuous platforms, and integrated end-to-end solutions that reduce cost and improve process reliability. Companies focus on expanding bioreactor capacity, strengthening chromatography and filtration technologies, and enhancing automation with real-time monitoring tools. Strategic partnerships with biopharma manufacturers and CDMOs help expand global reach and accelerate adoption of intensified workflows. Vendors also invest in digital ecosystems that support process control, predictive analytics, and quality management. Growing demand for high-throughput biologics and next-generation therapies pushes competitors to innovate rapidly and deliver flexible systems suitable for multi-product facilities.

Key Player Analysis

Recent Developments

- In 2025, Danaher continued to drive innovation with precision, scalability, and advanced process analytics to support flexible manufacturing across various therapeutic modalities.

- In 2023, WuXi Biologics announced the successful implementation of a fully integrated continuous drug substance manufacturing process at pilot scale using its proprietary WuXiUP™ platform.

- In 2023, Sartorius In collaboration with Repligen Corporation, Sartorius launched an integrated system that combines the Repligen XCell ATF upstream intensification technology into Sartorius’ Biostat STR bioreactor.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Workflow, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as biopharma firms shift to fully integrated continuous manufacturing lines.

- Adoption will rise as companies target higher productivity and lower operating costs.

- Continuous systems will gain traction in next-generation biologics, including cell and gene therapies.

- Vendors will develop smarter automation tools to support real-time quality control.

- Single-use continuous platforms will grow as manufacturers seek faster facility turnaround.

- CDMOs will increase investment to meet client demand for intensified production models.

- Regulatory support will strengthen as agencies refine guidelines for continuous workflows.

- Emerging markets will adopt continuous systems to boost regional biologics capacity.

- Process analytical technology will become a core requirement for commercial-scale operations.

- Industry collaboration will deepen to accelerate innovation and reduce technical barriers.