| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Canada Caffeinated Beverage Market Size 2024 |

USD 7,622.89 million |

| Canada Caffeinated Beverage Market CAGR |

4.17% |

| Canada Caffeinated Beverage Market Size 2032 |

USD 10,570.96 million |

Market Overview

Canada Caffeinated Beverage market size was valued at USD 7,622.89 million in 2024 and is anticipated to reach USD 10,570.96 million by 2032, at a CAGR of 4.17% during the forecast period (2024-2032).

The Canada caffeinated beverage market is primarily driven by increasing consumer demand for functional drinks that enhance alertness, energy, and performance. Growing urbanization and a fast-paced lifestyle have led to a rise in consumption of ready-to-drink coffee, energy drinks, and caffeinated soft drinks. Additionally, the expanding young adult population, coupled with rising health consciousness, is encouraging the adoption of low-calorie and natural caffeine-infused beverages. Manufacturers are responding to evolving preferences by introducing innovative flavors, organic ingredients, and sustainable packaging, further stimulating market growth. The rising influence of social media and digital marketing has also contributed to greater brand visibility and consumer engagement. Trends such as plant-based energy drinks, cold brew coffee, and sugar-free options continue to gain traction, appealing to health-focused consumers. Moreover, increased retail penetration, including online channels, is making caffeinated beverages more accessible across Canada, reinforcing their popularity among a broad demographic base.

The geographical landscape of the Canada caffeinated beverage market is shaped by varied regional preferences, urbanization levels, and consumer lifestyles. Ontario and Quebec lead in consumption due to their large urban populations and well-developed retail infrastructure, while British Columbia and Western Canada exhibit strong demand for health-focused and premium caffeinated products. Atlantic Canada, though smaller in size, shows increasing interest in RTD beverages and energy drinks, especially among younger consumers. Across these regions, evolving taste preferences and wellness trends influence product development and marketing strategies. Key players actively shaping the market include global giants such as Nestlé, Red Bull, PepsiCo, The Coca-Cola Company, and T.C. Pharma. These companies leverage strong distribution networks, diverse product portfolios, and aggressive branding to maintain market dominance. Additionally, the rise of local and niche brands focusing on clean-label and functional beverages is intensifying competition, encouraging continuous innovation and tailored offerings across Canada’s dynamic regional markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Canada caffeinated beverage market was valued at USD 7,622.89 million in 2024 and is projected to reach USD 10,570.96 million by 2032, growing at a CAGR of 4.17% during the forecast period.

- The global caffeinated beverage market was valued at USD 252,050.67 million in 2024 and is expected to reach USD 369,284.04 million by 2032, growing at a CAGR of 4.89%.

- Increasing demand for convenience and functional beverages, particularly RTD coffee and energy drinks, is driving market growth.

- Health-conscious consumers are seeking low-sugar, organic, and plant-based caffeinated options, leading to innovation in product offerings.

- A shift toward natural flavors and cleaner labels is influencing consumer preferences, with a strong focus on wellness ingredients.

- Market competition is fierce, with major players like Nestlé, Red Bull, PepsiCo, and The Coca-Cola Company dominating the space, while niche brands are gaining traction through unique offerings.

- Regulatory concerns regarding caffeine and sugar content are creating challenges, with stricter labeling and marketing rules expected.

- Ontario and Quebec lead market consumption, while British Columbia and Western Canada show a growing demand for premium, health-focused beverages.

Report Scope

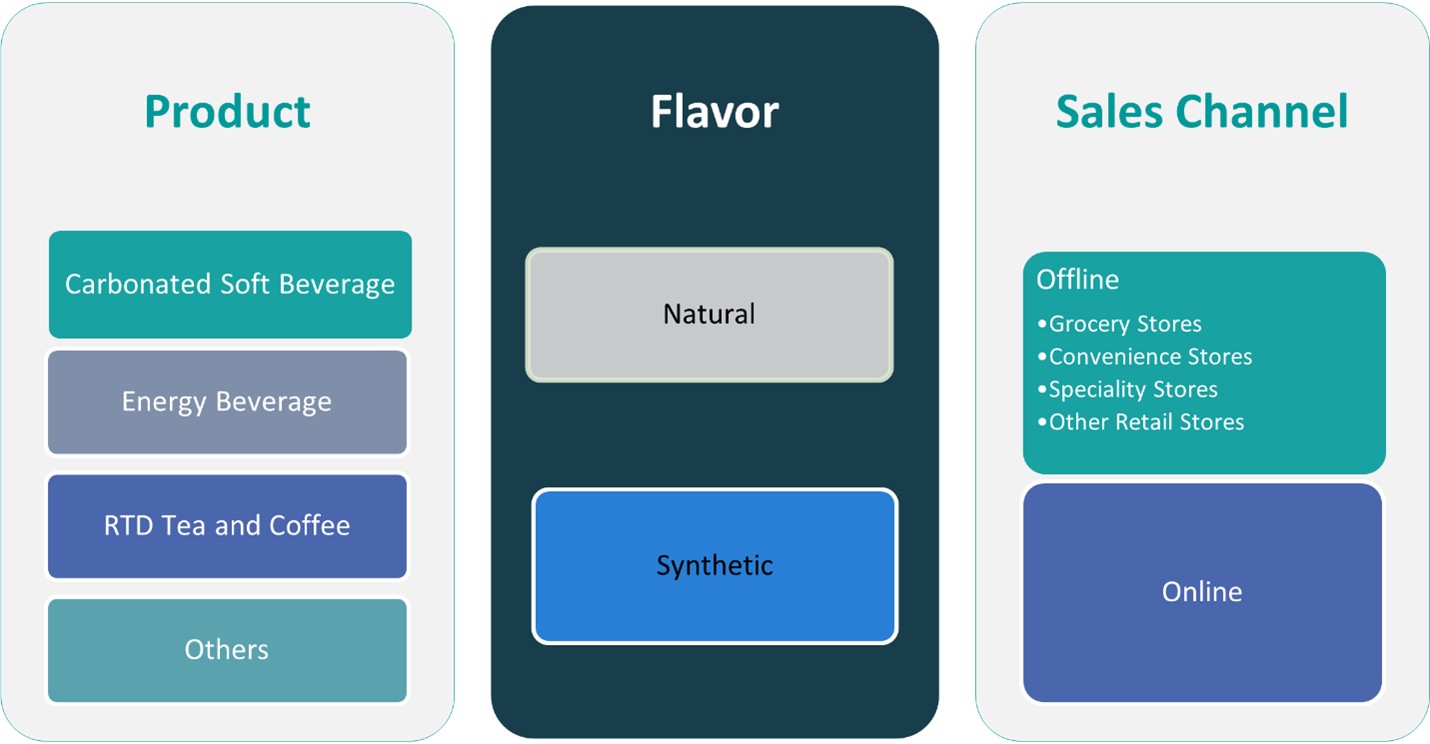

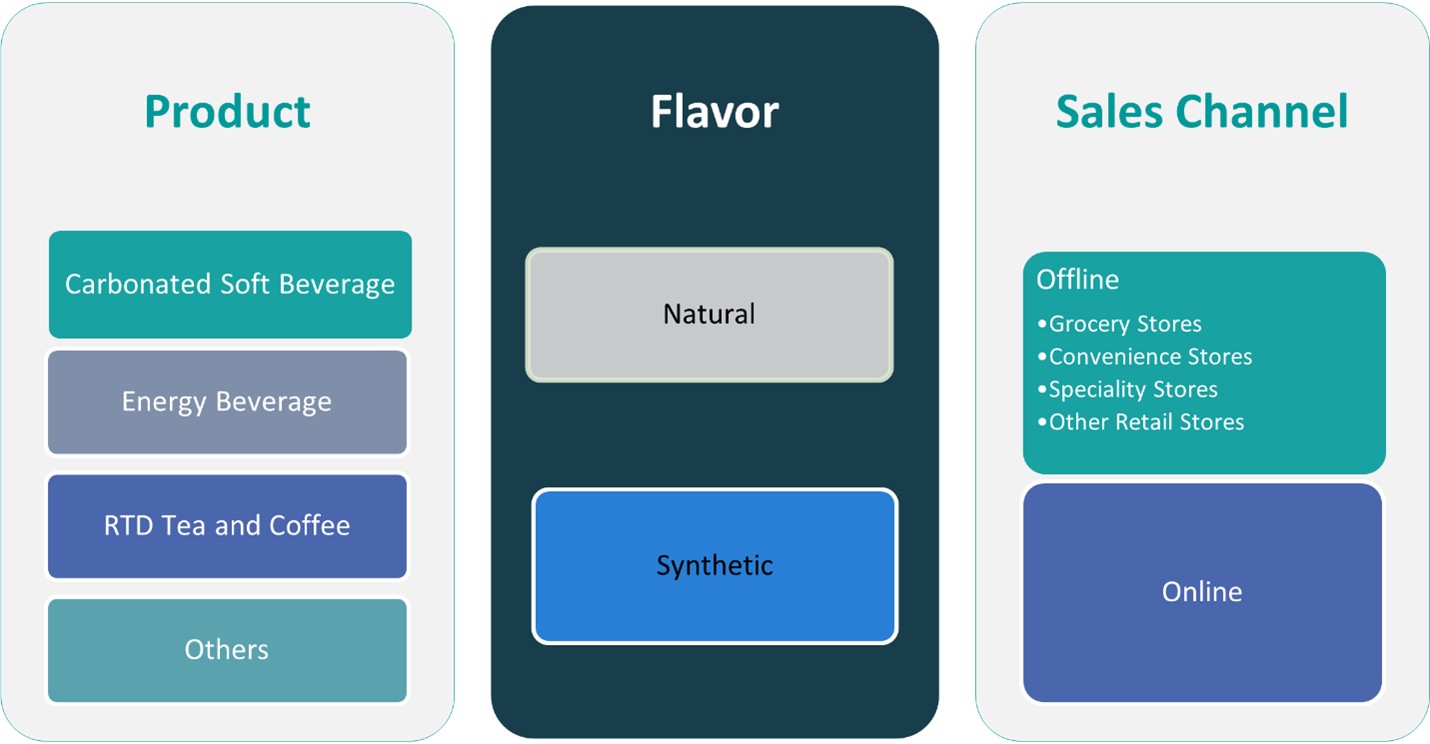

This report segments the Canada Caffeinated Beverage Market as follows:

Market Drivers

Rising Demand for Functional and Energy-Boosting Beverages

The increasing demand for functional beverages that enhance mental alertness, stamina, and overall performance is a primary driver of the Canadian caffeinated beverage market. As consumers lead increasingly busy and demanding lifestyles, especially in urban areas, there is a growing preference for beverages that offer a quick and effective energy boost. For instance, the Canadian caffeinated beverage market is expanding due to increasing consumer demand for energy-boosting drinks and evolving lifestyle preferences. Products such as energy drinks, ready-to-drink (RTD) coffee, and other caffeine-infused beverages are becoming staples for professionals, students, and athletes alike. This trend is further amplified by the growing awareness of caffeine’s cognitive and physical performance benefits, encouraging more consumers to incorporate such beverages into their daily routines. The convenience of portable, grab-and-go caffeinated drinks aligns with on-the-go consumption patterns, contributing to market expansion.

Health-Conscious Shifts Driving Innovation in Product Formulation

While traditional caffeinated drinks like sugary sodas remain popular, there is a noticeable shift toward healthier alternatives. Consumers in Canada are increasingly prioritizing wellness and clean-label products, prompting manufacturers to introduce beverages with natural caffeine sources, reduced sugar content, and functional additives such as vitamins, adaptogens, and antioxidants. The rise of organic coffee and tea-based drinks, as well as beverages formulated with green coffee extract and yerba mate, reflects this changing preference. For instance, the Canadian caffeinated beverage market is witnessing a shift toward functional drinks with added vitamins and antioxidants. Companies are also addressing concerns over artificial ingredients by launching products that are non-GMO, preservative-free, and made with sustainably sourced ingredients. These innovations are attracting health-conscious consumers and creating new growth opportunities within the caffeinated beverage space.

Youth Population and Changing Consumer Preferences

Canada’s growing population of young adults and teenagers plays a crucial role in driving demand for caffeinated beverages. This demographic is highly receptive to novel flavors, trendy packaging, and lifestyle-oriented branding. Younger consumers are more likely to experiment with emerging categories such as cold brew coffee, energy shots, and plant-based energy drinks. Their preference for socially and environmentally responsible brands is also encouraging companies to invest in sustainable practices, from ethically sourced ingredients to recyclable packaging. Additionally, digital platforms and influencer marketing have emerged as powerful tools for engaging younger audiences, thereby accelerating the adoption of new products and expanding brand reach. The intersection of caffeine consumption with lifestyle and identity continues to shape market dynamics among the youth segment.

Expanding Retail Channels and E-Commerce Accessibility

The increased availability of caffeinated beverages through both traditional retail and online platforms is significantly boosting market growth. Supermarkets, convenience stores, cafes, and specialty health outlets are expanding their beverage assortments to include a wide range of caffeinated options, making them more accessible to consumers across the country. Simultaneously, the rapid growth of e-commerce and food delivery platforms has made it easier for consumers to discover and purchase new and niche caffeinated beverages from the comfort of their homes. Subscription models, direct-to-consumer websites, and digital promotions are also helping brands reach a broader customer base. The convenience and variety offered through these channels are enabling consumers to explore diverse product offerings, thus propelling market expansion across Canada.

Market Trends

Surging Popularity of Ready-to-Drink (RTD) Beverages

One of the most notable trends in the Canadian caffeinated beverage market is the rising demand for ready-to-drink (RTD) products. As consumers increasingly seek convenience without compromising on quality, RTD coffee and tea options have gained significant traction. For instance, busy routines and the growing occurrence of on-the-go consumption have enhanced the demand for suitable and portable caffeinated beverages. These beverages appeal particularly to working professionals and students who prefer portable, time-saving solutions. In response, manufacturers are expanding their product lines with cold brews, nitro coffees, and specialty teas, often infused with natural caffeine sources. The RTD segment also benefits from innovative packaging and premium branding, enhancing shelf appeal and encouraging impulse purchases. This trend reflects broader consumer preferences for convenience, quality, and on-the-go lifestyle compatibility.

Health and Wellness Influencing Product Development

Health consciousness is increasingly shaping the formulation and positioning of caffeinated beverages in Canada. Consumers are becoming more mindful of their caffeine intake and the health impacts of added sugars and artificial ingredients. As a result, brands are focusing on cleaner labels, reduced-calorie options, and plant-based formulations. Natural caffeine sources such as green tea extract, guarana, and yerba mate are gaining prominence due to their perceived health benefits. Additionally, the inclusion of functional ingredients such as adaptogens, nootropics, and vitamins is helping transform caffeinated beverages into wellness-supporting products. This shift reflects consumers’ desire to achieve a balance between energy enhancement and long-term health.

Innovation in Flavors and Sustainable Packaging

Flavor innovation is another trend transforming the Canadian caffeinated beverage landscape. Consumers, especially younger demographics, are increasingly drawn to unique and bold flavor combinations, including exotic fruits, spices, and floral infusions. For instance, beverage manufacturers in Canada are investing in R&D to develop new formulations and flavors to cater to diverse consumer preferences. Brands are leveraging this demand to differentiate their offerings and foster brand loyalty. Alongside flavor experimentation, there is a strong push toward sustainable and eco-friendly packaging. Environmentally conscious consumers are prompting companies to adopt recyclable materials, biodegradable containers, and minimalist packaging designs. This trend is aligned with Canada’s broader commitment to sustainability and reflects growing consumer expectations for ethical and environmentally responsible product choices.

Digital Engagement and Direct-to-Consumer Expansion

The rise of digital marketing and e-commerce is reshaping how caffeinated beverages are marketed and sold in Canada. Social media platforms, influencer partnerships, and targeted online advertising have become critical tools for brand building and consumer engagement. Additionally, direct-to-consumer (DTC) channels are expanding rapidly, allowing brands to foster deeper connections with customers through personalized experiences, subscription services, and exclusive online launches. These digital strategies are not only enhancing brand visibility but also enabling companies to gather real-time feedback and tailor offerings to consumer preferences. This trend highlights the growing importance of digital ecosystems in driving market innovation and customer loyalty.

Market Challenges Analysis

Health Concerns and Regulatory Pressures

One of the primary challenges facing the Canada caffeinated beverage market is the growing concern over health implications associated with excessive caffeine and sugar intake. Although these beverages are popular for their energy-boosting benefits, they are often scrutinized for contributing to health issues such as insomnia, anxiety, dehydration, and cardiovascular risks, especially among adolescents and sensitive individuals. For instance, Health Canada provides caffeine consumption guidelines to help Canadians avoid adverse effects such as insomnia, headaches, irritability, and nervousness. Furthermore, high sugar content in many energy drinks and sodas raises red flags in light of rising obesity and diabetes rates in the country. Health advocacy groups and public health authorities are increasingly pushing for stricter labeling regulations, age restrictions, and limits on marketing practices—particularly those targeting youth. These regulatory developments may hinder the market’s growth trajectory by imposing additional compliance costs and limiting the promotional scope for certain product categories.

Market Saturation and Intense Competition

The Canadian caffeinated beverage market is also grappling with saturation and stiff competition, particularly in urban centers where multiple brands and product variants are widely available. Large multinational players dominate the shelf space with extensive product portfolios, strong distribution networks, and aggressive marketing budgets, making it difficult for new entrants and smaller brands to establish a foothold. Additionally, consumer preferences are rapidly evolving, and brands must continually innovate to stay relevant, which increases the cost and complexity of product development. Fluctuating raw material costs, especially for high-quality coffee beans and natural flavoring agents, also add pressure to manufacturers’ margins. Moreover, the growing popularity of caffeine-free wellness beverages and alternative energy sources such as protein shakes and adaptogenic drinks may divert consumer attention away from traditional caffeinated options, further intensifying the competition within an already crowded marketplace.

Market Opportunities

The Canada caffeinated beverage market presents strong growth opportunities driven by evolving consumer preferences and emerging health and wellness trends. As more Canadians seek functional beverages that align with active lifestyles, there is rising demand for products offering clean energy with added health benefits. This shift opens avenues for innovation in low-sugar, organic, and plant-based caffeine alternatives such as green tea, yerba mate, and guarana-based drinks. Additionally, the growing popularity of beverages enriched with vitamins, adaptogens, and nootropics allows brands to position their offerings as both energizing and wellness-supporting. These formulations appeal to health-conscious consumers and help differentiate products in a competitive landscape. As consumers move away from sugary sodas and traditional energy drinks, there is clear potential for premium, natural, and personalized beverage solutions to gain traction in the market.

Moreover, the rapid expansion of digital retail and direct-to-consumer channels in Canada provides beverage companies with increased market reach and brand visibility. E-commerce platforms, subscription-based models, and influencer-driven marketing strategies enable businesses to directly engage with niche customer segments, test new flavors, and receive immediate feedback. This agility supports faster innovation cycles and deeper consumer loyalty. Furthermore, regional and artisanal brands have a chance to capitalize on localized ingredients and storytelling to create unique value propositions. With the increasing importance of sustainability among Canadian consumers, brands investing in eco-friendly packaging and ethical sourcing can also enhance their competitive edge. These opportunities, coupled with Canada’s diverse and multicultural consumer base, provide a fertile ground for product diversification and expansion across untapped demographic segments, especially within younger and health-conscious populations.

Market Segmentation Analysis:

By Product:

The Canada caffeinated beverage market is segmented by product into carbonated soft beverages, energy beverages, RTD (ready-to-drink) tea and coffee, and others. Among these, energy beverages and RTD tea and coffee are experiencing robust growth due to changing consumer lifestyles and preferences for convenient, on-the-go energy solutions. Energy drinks are particularly favored by younger consumers and athletes seeking performance enhancement, while RTD coffee and tea attract working professionals looking for quick, premium caffeine options. Meanwhile, carbonated soft beverages maintain a steady presence but face increasing competition from healthier alternatives. The “Others” category, which includes innovative drinks such as caffeine-infused water and functional beverages, is gradually gaining traction as consumers explore novel formats. This product diversification reflects the market’s dynamic nature, where brands are continuously evolving to meet varied taste preferences, caffeine tolerances, and health goals. Companies that offer product versatility while addressing the demand for clean-label, low-sugar, and functional options are better positioned to gain a competitive edge.

By Flavor:

Based on flavor, the Canada caffeinated beverage market is segmented into natural and synthetic categories. A clear shift is underway as consumers increasingly favor natural flavors derived from plant-based or organic sources, such as green coffee extract, herbal infusions, and fruit essences. This trend aligns with growing health consciousness and demand for cleaner, more transparent product labels. Natural flavors are perceived as safer and healthier, contributing to the popularity of beverages positioned as organic or minimally processed. On the other hand, synthetic flavors still hold a considerable share, particularly in the carbonated and energy drink segments where bold, vibrant taste profiles are valued. However, as regulations around artificial ingredients tighten and public awareness of their potential health effects grows, companies are gradually reformulating products to include more natural alternatives. This transition toward natural flavoring not only supports product differentiation but also helps brands align with evolving consumer values centered around wellness, sustainability, and ingredient authenticity.

Segments:

Based on Product:

- Carbonated Soft Beverage

- Energy Beverage

- RTD Tea and Coffee

- Others

Based on Flavor:

Based on Sales Channel:

- Offline

- Grocery Stores

- Convenience Stores

- Speciality Stores

- Other Retail Stores

- Online

Based on the Geography:

- Ontario

- Quebec

- Western Canada

- British Columbia

- Atlantic Canada

Regional Analysis

Ontario

Ontario leads the caffeinated beverage market in Canada, accounting for approximately 38% of the total market share in 2024. As the most populous province, Ontario benefits from a high concentration of urban consumers with diverse preferences and high purchasing power. Major cities such as Toronto and Ottawa serve as key consumption hubs, where demand is driven by a fast-paced lifestyle, a strong café culture, and widespread availability of premium RTD coffee and energy drinks. The presence of leading retail chains, convenience stores, and specialty beverage outlets further supports widespread product accessibility. Ontario’s dynamic consumer base also shows a strong inclination toward health-conscious choices, prompting brands to introduce organic and natural caffeinated beverages. The region’s well-developed logistics and marketing infrastructure additionally enable faster product rollouts and better engagement with consumers across different age groups and income levels.

Quebec

Quebec holds a significant portion of the market, contributing around 25% to Canada’s caffeinated beverage segment. The province’s strong cultural identity and distinct consumer behavior influence both the type and format of beverages in demand. RTD tea and coffee have gained popularity among Quebec’s bilingual and multicultural population, with a growing preference for artisanal and locally inspired flavors. Additionally, traditional carbonated caffeinated soft drinks continue to perform steadily in rural and suburban areas. Quebec’s regulatory environment, which emphasizes clear labeling and nutritional awareness, supports the growth of healthier beverage options. Local manufacturers and regional brands have found success by aligning with consumer values related to sustainability and quality. As the province increasingly embraces wellness trends and functional ingredients, opportunities are emerging for innovation in caffeine sources and flavor development tailored to Quebecois preferences.

Western Canada

Western Canada, including Alberta, Saskatchewan, and Manitoba, collectively represents about 20% of the national market share. This region exhibits strong demand for energy drinks and RTD beverages, largely driven by active lifestyles and youth-oriented marketing. Alberta, with its robust sporting culture and higher disposable income levels, serves as a key growth market for performance-enhancing caffeinated beverages. Meanwhile, RTD tea and specialty coffees are gaining traction among health-conscious consumers in Saskatchewan and Manitoba. The region also favors sustainability, with growing interest in locally sourced and environmentally friendly packaging solutions. However, geographic dispersion and seasonal purchasing patterns can present logistical challenges for brands operating in this market.

British Columbia

British Columbia commands roughly 14% of the market share and stands out for its progressive consumer base that prioritizes wellness and sustainability. The province’s residents exhibit strong demand for natural, organic, and low-sugar caffeinated beverages, particularly those that align with plant-based or clean-label trends. RTD tea and specialty cold brews are especially popular in urban centers like Vancouver and Victoria, where health-conscious millennials and working professionals drive consumption. British Columbia’s established café scene also supports the popularity of premium and craft caffeine options. Additionally, local manufacturers focusing on eco-friendly packaging and ethically sourced ingredients have gained favor among environmentally aware consumers. This market’s openness to innovation makes it an ideal testing ground for new product launches and marketing strategies centered on holistic wellness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nestlé

- Red Bull

- C. Pharma

- PepsiCo

- The Coca-Cola Company

Competitive Analysis

The Canada caffeinated beverage market is highly competitive, with several global and regional players driving innovation and shaping consumer preferences. Leading companies include Nestlé, Red Bull, T.C. Pharma, PepsiCo, and The Coca-Cola Company. Nestlé, with its strong presence in both coffee and energy drinks, focuses on leveraging its extensive distribution networks and premium product offerings. Major players compete fiercely by leveraging robust distribution networks and strategic partnerships with retailers. Companies are also emphasizing strong brand recognition, creating consumer loyalty through targeted marketing campaigns and sponsorships, especially in the energy drink and RTD coffee segments. The introduction of novel products such as adaptogenic drinks, plant-based caffeine sources, and functional beverages enriched with vitamins, minerals, and nootropics is gaining attention. Moreover, there is a rising trend toward sustainability, with many brands incorporating eco-friendly packaging and ethical sourcing practices to appeal to environmentally conscious consumers. To stay ahead of competition, companies are investing in research and development to meet the evolving preferences for healthier and more natural alternatives, further intensifying market rivalry.

Recent Developments

- In March 2025, PepsiCo expanded its Pepsi MAX Caffeine Free line with a new 500ml bottle in the UK, responding to rising demand for caffeine-free and sugar-free colas among younger consumers.

- In February 2025, Coca-Cola introduced Simply Pop, a prebiotic, fruit juice-enriched soda targeting the “better-for-you” market segment, competing with brands like Poppi and Olipop.

- In January 2025, Nestlé implemented a new global organizational structure for its Waters & Premium Beverages division, operating as a standalone business.

- In June 2024, the Starbucks Corporation, one of the renowned brands in caffeinated beverages industry launched new range of Caramel Vanilla Swirl Iced Coffee, handcrafted energy drinks and few other products. Starbucks Tripleshot Energy drink, recently launched offering is characterized by 65mg of caffeine content, protein, B vitamins. The products is provided in three flavor choices including dark caramel, bold mocha, and rich vanilla.

- In February 2024, Dunkin’, one of the applauded brands in food & beverages industry introduced SPARKD’ Energy by Dunkin’, iced beverages equipped with minerals, vitamins and some amount of caffeine. The flavors include berry burst entailing strawberry and raspberry, and peach sunshine featuring lychee and juicy peach flavors.

Market Concentration & Characteristics

The Canada caffeinated beverage market exhibits a moderate level of concentration, dominated by a few major global players who hold significant market share, particularly in the energy drink, carbonated soft beverage, and RTD coffee sectors. These leading companies benefit from well-established distribution networks, extensive marketing budgets, and strong brand loyalty. However, the market also features a growing presence of regional and niche brands, which are gaining traction by offering specialized, health-focused products such as low-sugar, organic, and plant-based options. This has led to increased competition and innovation, driving companies to diversify their portfolios to cater to evolving consumer preferences. The market is characterized by high product differentiation, with companies continuously introducing new flavors, formulations, and functional ingredients to appeal to health-conscious consumers. Additionally, the shift towards sustainability is becoming a key market characteristic, with brands adopting eco-friendly packaging and ethical sourcing practices to attract environmentally aware buyers.

Report Coverage

The research report offers an in-depth analysis based on Product, Flavor, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Canada caffeinated beverage market is projected to maintain a positive growth trajectory through 2032, driven by evolving consumer preferences and increasing demand for functional beverages.

- Health-conscious consumers are increasingly seeking low-sugar, organic, and plant-based caffeinated options, prompting brands to innovate and diversify their product offerings.

- The popularity of ready-to-drink (RTD) coffee and tea is on the rise, particularly among busy professionals and younger demographics, contributing to market expansion.

- Energy drinks continue to be a significant segment, with sustained demand among active individuals and those seeking quick energy boosts.

- Sustainable and eco-friendly packaging solutions are becoming a priority for both consumers and manufacturers, aligning with growing environmental concerns.

- Digital platforms and e-commerce are reshaping distribution channels, offering brands new avenues to reach consumers and enhance customer engagement.

- Technological advancements in brewing and production processes are enabling companies to improve product quality and operational efficiency.

- Personalized beverage experiences, facilitated by advancements in technology, are gaining popularity, allowing consumers to tailor products to their preferences.

- Regulatory frameworks concerning labeling, caffeine content, and marketing practices are evolving, requiring companies to adapt and ensure compliance.

- The competitive landscape is intensifying, with both established players and emerging brands vying for market share through innovation, branding, and strategic partnerships.