| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Canada Digital Oilfield Solutions Market Size 2024 |

USD 1,056.45 Million |

| Canada Digital Oilfield Solutions Market, CAGR |

6.56% |

| Canada Digital Oilfield Solutions Market Size 2032 |

USD 1,756.83 Million |

Market Overview

The Canada Digital Oilfield Solutions Market is projected to grow from USD 1,056.45 million in 2024 to an estimated USD 1,756.83 million by 2032, with a compound annual growth rate (CAGR) of 6.56% from 2025 to 2032. The increasing demand for digital transformation and automation in the oil and gas sector is driving the market’s expansion.

Key drivers of market growth include the increasing need for enhanced operational efficiency and cost optimization in oilfield operations. Digital oilfield solutions such as remote monitoring, predictive maintenance, and real-time data analytics are gaining traction among oil and gas companies to optimize exploration, production, and maintenance activities. The growing adoption of IoT and cloud-based technologies, alongside the rise in digitalization efforts, is further fueling the demand for these solutions. Additionally, the focus on sustainability and reducing environmental impact in oil and gas operations is propelling the integration of digital technologies.

Geographically, the market in Canada is expected to witness significant growth, supported by strong oil and gas production in key regions such as Alberta and Newfoundland. The key players in the Canada Digital Oilfield Solutions Market include major global and regional players such as Schlumberger, Halliburton, Baker Hughes, and Weatherford International, all of which are actively investing in digital technologies to cater to the evolving needs of the Canadian oil and gas sector.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Canada Digital Oilfield Solutions Market is projected to grow from USD 1,056.45 million in 2024 to USD 1,756.83 million by 2032, at a CAGR of 6.56% from 2025 to 2032.

- The Global Digital Oilfield Solutions Market is projected to grow from USD31,374.00 million in 2024 to USD 54,897.18 million by 2032, with a CAGR of 7.24% from 2025 to 2032.

- The growing demand for automation in oilfield operations is driving market growth, as companies seek to improve operational efficiency, reduce downtime, and enhance decision-making.

- Advancements in AI, IoT, and data analytics are key drivers, enabling oil and gas companies to optimize production, enhance reservoir management, and predict equipment maintenance needs.

- The focus on cost optimization and operational efficiency is pushing the adoption of digital solutions, helping companies reduce operational costs and improve overall productivity.

- The rising emphasis on reducing environmental impact and improving sustainability in the oil and gas sector is accelerating the integration of digital technologies to optimize resource utilization.

- High initial investment costs for digital technologies and concerns regarding cybersecurity risks remain key challenges hindering broader adoption in some segments of the oil and gas industry.

- Alberta and Newfoundland lead the Canadian market, with strong oil and gas production, while other regions like British Columbia and Saskatchewan are also adopting digital solutions to optimize production processes.

Market Drivers

Focus on Sustainability and Environmental Concerns

Environmental sustainability and reducing the carbon footprint are gaining increasing importance in the oil and gas industry. As governments and regulators place more emphasis on environmental standards and climate change policies, oilfield operators are turning to digital solutions to meet sustainability goals and minimize their environmental impact. Digital oilfield technologies play a vital role in optimizing energy consumption, reducing emissions, and enhancing waste management in oil and gas operations. For instance, real-time monitoring systems help track energy consumption and emissions, enabling operators to identify inefficiencies and implement corrective actions to reduce their environmental footprint. Furthermore, digital technologies support the transition to cleaner energy sources by facilitating the integration of renewable energy solutions, such as solar and wind power, into existing oil and gas infrastructure. Digital oilfield solutions also improve well integrity and reduce the risk of leaks and spills by providing precise data on the conditions of pipelines, reservoirs, and equipment. By adopting these digital tools, Canadian oil and gas operators can demonstrate their commitment to sustainability while complying with increasingly stringent environmental regulations, thus supporting the industry’s long-term growth.

Government Initiatives and Regulatory Support for Digitalization

The Canadian government has been supportive of the adoption of digital technologies in the oil and gas sector, further boosting the growth of the digital oilfield solutions market. Government initiatives that promote digitalization and innovation in the oil and gas industry are instrumental in accelerating the adoption of digital solutions. In particular, the Canadian government has been investing in research and development (R&D) initiatives focused on advancing the digitalization of oil and gas operations. These efforts are aimed at enhancing productivity, safety, and environmental performance through the use of modern technologies. Regulatory frameworks are also evolving to accommodate the integration of digital oilfield solutions. As the government pushes for more efficient and sustainable operations in the oil and gas industry, it provides incentives, funding opportunities, and tax credits to companies that adopt digital technologies that improve energy efficiency and reduce environmental impacts. Additionally, regulatory bodies have been encouraging the use of digital tools to enhance transparency, improve safety standards, and streamline reporting processes. This supportive regulatory environment is creating a conducive atmosphere for the growth of digital oilfield solutions, enabling Canadian oil and gas companies to embrace innovation and remain competitive in a global market.

Increasing Demand for Operational Efficiency and Cost Optimization

The push for greater operational efficiency and cost optimization is a central force driving the adoption of digital oilfield solutions in Canada’s oil and gas industry. Companies are under persistent pressure to maximize productivity while minimizing expenses across their operations. Digital oilfield solutions, such as automation, real-time analytics, and remote monitoring, are transforming how operators manage assets and workflows. For instance, industry surveys and company reports highlight that the integration of digital twins and AI-based simulations enables maintenance teams to anticipate equipment issues and proactively refine maintenance schedules, significantly reducing downtime and associated costs. This digital transformation allows operators to access real-time insights into equipment performance and production rates, empowering them to make informed decisions that directly enhance productivity. Predictive maintenance, powered by advanced analytics, further supports this by identifying potential failures before they escalate, thus preventing costly repairs and unplanned outages. Beyond immediate cost reductions, these technologies provide a comprehensive view of the production lifecycle, from exploration through to maintenance, enabling companies to streamline processes, reduce waste, and improve asset utilization. The cumulative effect is substantial cost savings and improved return on investment, establishing digital oilfield solutions as essential tools for achieving long-term profitability in a highly competitive sector.

Advancements in IoT, Artificial Intelligence, and Big Data Analytics

Technological advancements in the Internet of Things (IoT), artificial intelligence (AI), and big data analytics are fundamentally reshaping the Canadian digital oilfield landscape. IoT technologies connect a vast array of sensors and equipment, continuously gathering real-time operational data across multiple sites. For instance, company case studies and sector analyses reveal that oil and gas operators are leveraging IoT-enabled sensors to monitor pipeline pressures and equipment health, feeding this data into AI-driven analytics platforms that detect anomalies and predict maintenance needs before failures occur. AI-powered analytics are instrumental in optimizing drilling processes, managing reservoirs, and enhancing safety by providing actionable insights from complex datasets. Big data analytics, meanwhile, processes and interprets massive volumes of information, enabling companies to identify operational patterns, forecast risks, and improve decision-making at every stage of the value chain. This integration of IoT, AI, and big data is not only improving exploration accuracy and production optimization but also supporting safer and more sustainable operations. By adopting these technologies, oil and gas companies are able to proactively address challenges, streamline workflows, and unlock new efficiencies, positioning themselves for continued success in an evolving energy market.

Market Trends

Adoption of Cloud Computing for Data Storage and Collaboration

The adoption of cloud computing is another key trend reshaping the Canada Digital Oilfield Solutions Market. The oil and gas industry has traditionally relied on on-premise data storage and software solutions, but the shift to cloud-based platforms is rapidly gaining momentum. Cloud computing offers numerous advantages, including the ability to store vast amounts of data securely, improve data accessibility, and enable seamless collaboration between teams and departments, regardless of geographic location. In the context of digital oilfield solutions, cloud platforms are being leveraged to store and analyze massive amounts of data generated by IoT devices, sensors, and equipment. This data can be accessed in real time by different stakeholders across the value chain, including engineers, operators, and decision-makers, allowing for quicker and more accurate decision-making. Additionally, the scalability of cloud platforms enables companies to expand their digital infrastructure without the need for significant upfront capital investments. Cloud computing also supports the integration of various technologies, such as AI, machine learning, and big data analytics, creating a unified platform for digital oilfield management. The growing shift toward cloud computing is streamlining operations, reducing costs, and improving collaboration, making it a critical trend in the evolution of the Canadian digital oilfield solutions market.

Focus on Cybersecurity for Digital Oilfield Operations

As digital technologies continue to permeate the oil and gas industry, ensuring robust cybersecurity has become an increasingly important focus. Digital oilfield solutions involve the integration of multiple interconnected systems, including IoT devices, cloud platforms, and AI-powered analytics, which makes the industry more vulnerable to cyberattacks and data breaches. Cybersecurity is now a top priority for oil and gas companies operating in Canada, as the risks associated with cyber threats can lead to operational disruptions, data loss, financial losses, and reputational damage. To mitigate these risks, companies are investing heavily in advanced cybersecurity measures to protect their digital infrastructure. This includes deploying intrusion detection systems, encryption technologies, and multi-factor authentication to safeguard sensitive data and operations. Furthermore, many companies are focusing on creating a culture of cybersecurity awareness among employees, conducting regular security audits, and collaborating with third-party cybersecurity experts to ensure that their digital oilfield solutions are secure. As cyber threats evolve, continuous improvement in security protocols is essential to maintaining the integrity of digital oilfield operations. With the growing reliance on digital solutions, the focus on cybersecurity will continue to be a critical trend in the Canadian digital oilfield market, enabling companies to protect their assets and data while optimizing operations.

Integration of Artificial Intelligence and Machine Learning for Predictive Maintenance and Optimization

A major trend driving the Canada Digital Oilfield Solutions Market is the increasing integration of artificial intelligence (AI) and machine learning (ML) technologies for predictive maintenance and operational optimization. AI and ML are revolutionizing how oil and gas companies approach asset management, enabling them to predict potential equipment failures and optimize maintenance schedules. These technologies analyze vast amounts of data from sensors, machinery, and operational systems, identifying patterns and anomalies that may signal impending failures or inefficiencies. For instance, companies like Baker Hughes and Schlumberger are investing heavily in AI-driven predictive maintenance, with some reporting reductions in unplanned downtime by up to 30 days annually. By predicting equipment malfunctions before they occur, AI-driven solutions allow operators to schedule maintenance activities proactively, minimizing unplanned downtime and reducing repair costs. This shift toward predictive analytics not only improves operational efficiency but also ensures that oil and gas operators can maximize their asset utilization and profitability.

Expansion of IoT-Enabled Solutions for Real-Time Data Collection and Remote Monitoring

The expansion of Internet of Things (IoT)-enabled solutions is another significant trend in the Canada Digital Oilfield Solutions Market. IoT technologies are transforming the way oil and gas companies manage their operations by enabling the seamless collection and transmission of real-time data from equipment, sensors, and machinery in remote and challenging environments. By connecting assets such as pipelines, pumps, and drilling rigs to the cloud, companies can access real-time performance data, enabling them to make informed decisions quickly and efficiently. For instance, a survey by the Canadian Association of Petroleum Producers noted that over 75% of oil and gas companies are now using IoT for real-time monitoring, resulting in a significant reduction in operational costs. IoT-enabled solutions are being utilized for a wide range of applications, including remote monitoring, asset management, and predictive maintenance. As the demand for increased operational efficiency grows, IoT technology is becoming integral to the digital oilfield ecosystem, helping companies optimize their operations while improving safety and reducing costs.

Market Challenges

High Initial Investment and Operational Costs

One of the key challenges in the Canada Digital Oilfield Solutions Market is the high initial investment required for implementing digital technologies. While digital oilfield solutions, such as IoT sensors, AI-driven analytics, and cloud-based platforms, offer long-term cost savings and operational efficiencies, the upfront capital costs can be significant. For instance, a survey by the Canadian Association of Petroleum Producers reported that the average cost of implementing IoT sensors in oilfields can range from $500,000 to $1 million per well. Furthermore, ongoing maintenance, software upgrades, and cybersecurity measures also contribute to the operational costs of digital solutions. As a result, companies need to carefully evaluate the return on investment (ROI) and ensure that the benefits of digital oilfield solutions outweigh the costs. Financial constraints can delay the adoption of these technologies, hindering the overall growth of the market. The adoption of digital oilfield solutions in Canada is driven by the need for operational efficiency and cost reduction. Digital technologies enable real-time monitoring, predictive maintenance, and data-driven decision-making, which are crucial for optimizing oilfield operations. For instance, a study by Natural Resources Canada highlighted that the use of AI and IoT in oilfields can reduce downtime by up to 30 days per year, resulting in significant cost savings. Additionally, the integration of digital solutions can enhance safety and environmental compliance by providing real-time insights into equipment health and operational conditions. However, the high initial investment required for these technologies remains a significant barrier, particularly for smaller companies or those operating in remote regions. As such, companies must balance the benefits of digital oilfield solutions with the financial constraints they face.

Cybersecurity Risks and Data Privacy Concerns

As oil and gas companies increasingly rely on digital solutions, the risk of cybersecurity threats and data breaches has become a major concern. The integration of IoT devices, cloud computing, and AI systems in oilfield operations creates multiple points of vulnerability for cyberattacks. Hackers could exploit these vulnerabilities to disrupt operations, steal sensitive data, or compromise critical infrastructure. The vast amounts of real-time data generated by digital oilfield solutions—such as production data, equipment status, and sensor readings—are valuable targets for cybercriminals. Moreover, the remote and decentralized nature of many Canadian oilfields increases the complexity of ensuring robust cybersecurity measures. Companies are faced with the challenge of safeguarding their digital infrastructure from increasingly sophisticated cyber threats while maintaining smooth and efficient operations. As a result, oil and gas companies must invest heavily in cybersecurity technologies and continuously update their security protocols to mitigate risks. However, these additional investments in cybersecurity infrastructure further add to the operational costs, creating a challenge for businesses seeking to balance the benefits of digitalization with the need for robust protection.

Market Opportunities

Integration of Renewable Energy Solutions in Oil and Gas Operations

One of the significant opportunities in the Canada Digital Oilfield Solutions Market lies in the integration of renewable energy sources, such as solar and wind power, into traditional oil and gas operations. As Canadian oil and gas companies face increasing pressure to reduce their carbon footprint and comply with stringent environmental regulations, the adoption of renewable energy solutions is becoming more attractive. Digital oilfield solutions can facilitate this transition by enabling the seamless integration of renewable energy systems with conventional oilfield operations. For example, cloud-based platforms can manage hybrid energy systems, optimizing energy consumption and minimizing emissions in real-time. As the demand for cleaner energy sources continues to grow, Canadian oil and gas operators have a unique opportunity to leverage digital technologies to support sustainability initiatives while maintaining profitability and operational efficiency. By incorporating renewable energy into their operations, companies can enhance their market competitiveness and contribute to Canada’s broader climate goals.

Expansion of Digital Oilfield Solutions in Untapped and Remote Regions

Another significant opportunity lies in expanding digital oilfield solutions to untapped and remote oilfields in Canada. Many of these regions, such as northern Alberta and Newfoundland, remain underexplored or face logistical challenges due to their isolation and harsh environmental conditions. However, the advancement of digital oilfield technologies, such as IoT sensors, remote monitoring, and cloud computing, can significantly enhance the feasibility of operations in these areas. By implementing real-time data collection and automated monitoring, oil and gas companies can optimize exploration and production activities while reducing the need for physical presence, improving safety, and lowering operational costs. As the demand for energy grows and remote exploration becomes increasingly viable through digital solutions, there is a considerable market opportunity for companies to expand their reach in these challenging regions.

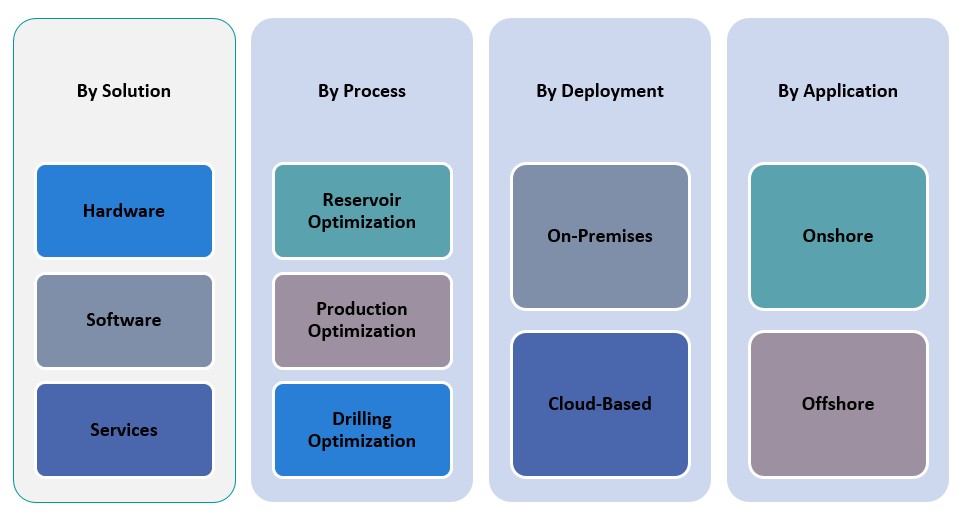

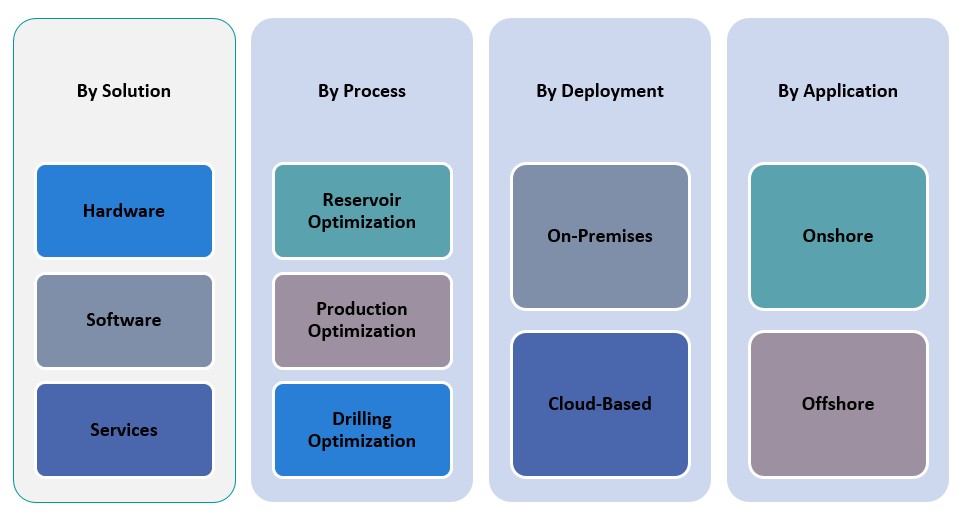

Market Segmentation Analysis

By Solution

The Canada Digital Oilfield Solutions Market is segmented into three main categories: hardware, software, and services. Hardware accounts for a significant share, driven by the demand for IoT sensors, automated equipment, and real-time monitoring devices that are essential for data collection and operational optimization in oilfields. As companies continue to invest in automation and efficiency, hardware solutions remain a critical component for the successful implementation of digital oilfield technologies. Software solutions are also vital for data analytics, machine learning, and AI-powered decision-making. The growing need for real-time data processing and predictive analytics to improve drilling accuracy, optimize reservoir management, and predict equipment failures has fueled the demand for advanced software tools. Companies increasingly rely on these software platforms to process vast amounts of data and enhance operational efficiency. Services, including consulting, installation, training, and ongoing support, complement both hardware and software solutions. As digital transformation in oil and gas operations accelerates, companies require specialized services to deploy, manage, and maintain complex digital systems effectively.

By Application

The market is further segmented by application into onshore and offshore operations. Onshore oilfields represent a significant share of the market, driven by large-scale exploration and production activities in regions like Alberta. Onshore operations are increasingly adopting digital solutions to optimize production, enhance well monitoring, and minimize environmental impacts. Offshore oilfield operations also present significant growth opportunities due to the complex challenges of remote and deepwater drilling. The use of digital oilfield solutions in offshore applications focuses on improving safety, optimizing production rates, and managing harsh environmental conditions effectively.

Segments

Based on Solution

- Hardware

- Software

- Services

Based on Application

Based on Process

- Reservoir Optimization

- Production Optimization

- Drilling Optimization

Based on Deployment

Based on Region

- Alberta

- Newfoundland

- Labrador

- British Columbia

- Saskatchewan

- Quebec

Regional Analysis

Alberta (40%)

Alberta is the largest and most significant region in the Canadian Digital Oilfield Solutions Market, holding approximately 40% of the market share. The province is home to Canada’s vast oil sands reserves and has a long history of oil and gas exploration and production. As the largest oil-producing region in the country, Alberta presents a high demand for digital oilfield solutions to optimize operations, reduce costs, and improve environmental performance. The integration of digital technologies, including IoT sensors, AI-driven analytics, and cloud computing, is prevalent in both onshore and unconventional oilfield operations. Companies in Alberta are increasingly adopting digital solutions to enhance production efficiency, monitor equipment health, and manage reservoirs more effectively. As sustainability remains a key focus in Alberta, digital solutions help companies meet environmental regulations by reducing emissions and improving waste management.

Newfoundland and Labrador (25%)

Newfoundland and Labrador account for approximately 25% of the market share, largely due to offshore oil exploration and production. The region’s offshore oilfields are technologically advanced and require sophisticated digital solutions for monitoring, predictive maintenance, and production optimization. With the growing complexity of offshore drilling and exploration, digital oilfield technologies enable operators to improve safety, optimize resource extraction, and reduce operational costs. As offshore exploration continues to expand, Newfoundland and Labrador remains a significant region for digital oilfield solution providers, with strong growth potential in the coming years.

Key players

- Schlumberger Limited

- Halliburton Company

- Baker Hughes Company

- Weatherford International plc

- Emerson Electric Co.

- Honeywell International Inc.

- Rockwell Automation, Inc.

- ABB Ltd.

- IBM Corporation

- GE Digital

Competitive Analysis

The Canada Digital Oilfield Solutions Market is highly competitive, with leading players such as Schlumberger, Halliburton, Baker Hughes, and Weatherford International dominating the landscape. These companies have strong global presences and are driving technological advancements in the market through innovations in IoT, AI, and data analytics. Schlumberger and Halliburton are particularly well-positioned due to their extensive service portfolios, ranging from reservoir optimization to drilling and production technologies. Meanwhile, companies like Emerson Electric, Honeywell, and Rockwell Automation are focusing on providing cutting-edge automation, control systems, and IoT solutions to enhance operational efficiency. Additionally, technology giants like IBM and GE Digital are leveraging their expertise in data analytics and cloud computing to offer integrated solutions that improve decision-making processes. As digital transformation accelerates, these companies are intensifying their research and development efforts to cater to the evolving needs of the Canadian oil and gas industry.

Recent Developments

- In March 2025, Schneider Electric unveiled the One Digital Grid Platform, an AI-powered platform designed to enhance grid resiliency and efficiency. This platform is set to be available later in 2025. The company announced a $700 million investment plan in the U.S. to enhance energy infrastructure and AI capabilities.

- In April 2025, ABB India delivered integrated automation and digital solutions for IndianOil’s cross-country pipeline network, enhancing efficiency and safety through real-time monitoring and robust cybersecurity.

- In March 2025, Kongsberg Digital participated in the IPTC 2025, focusing on digital transformation in the oil and gas sector.

- In January 2025, SAP S/4HANA Cloud was highlighted as a key enabler for a smarter, more efficient energy ecosystem in the oil and gas industry.

- In April 2025, Schlumberger (SLB) announced a partnership with Shell to deploy Petrel™ subsurface software across Shell’s global assets. This collaboration aims to enhance digital capabilities and operational efficiencies through advanced AI-driven seismic interpretation workflows. This development underscores SLB’s ongoing commitment to advancing subsurface digital technology and fostering strategic partnerships in the energy sector.

Market Concentration and Characteristics

The Canada Digital Oilfield Solutions Market exhibits moderate market concentration, with a few dominant global players, such as Schlumberger, Halliburton, and Baker Hughes, leading the market. These companies control a significant portion of the market share due to their extensive service portfolios, strong technological capabilities, and established relationships with major oil and gas operators in Canada. While the market is primarily driven by these large players, there is also space for regional and niche players to contribute, especially in specialized services or emerging technologies like AI, IoT, and cloud-based solutions. The market is characterized by rapid technological advancements, a strong focus on operational efficiency, cost optimization, and sustainability, and a growing demand for data-driven decision-making tools. As the oil and gas sector in Canada continues to embrace digital transformation, the competitive landscape is expected to remain dynamic, with continuous innovations and strategic partnerships shaping the market’s evolution.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Solution, Application, Process, Deployment and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The adoption of automation technologies will continue to rise, enabling operators to reduce human intervention, improve safety, and optimize oilfield operations. Automation will be integral to enhancing operational efficiency and minimizing costs.

- Artificial intelligence and machine learning will play a key role in predictive maintenance, drilling optimization, and reservoir management, offering substantial improvements in decision-making and performance. These technologies will increasingly automate complex tasks and improve forecasting accuracy.

- As data volumes grow, cloud-based platforms will become even more critical for storing, processing, and analyzing large datasets. This will help oil and gas companies manage operations more efficiently and scale their digital infrastructures.

- Remote monitoring solutions will expand, especially in offshore and remote onshore locations, enabling real-time tracking of equipment performance, reducing operational downtime, and improving safety protocols. This trend will be driven by the need for efficient management of distributed assets.

- As digitalization increases, robust cybersecurity solutions will become more essential to protect critical infrastructure and sensitive data. Companies will continue to invest in advanced security technologies to mitigate cyber threats and maintain operational integrity.

- The integration of renewable energy sources like solar and wind into digital oilfield solutions will grow as companies aim to reduce their environmental footprint and comply with stringent regulatory frameworks. Hybrid energy solutions will optimize both cost and sustainability.

- With an increasing focus on environmental sustainability, digital oilfield solutions will aid in monitoring and reducing emissions, improving resource utilization, and minimizing environmental impact across oil and gas operations.

- As oil exploration continues to shift towards remote and underexplored areas, regions like northern Alberta and Newfoundland will increasingly adopt digital oilfield technologies to improve operational efficiency and access hard-to-reach resources.

- Strategic collaborations between tech companies and oilfield service providers will accelerate innovation and enhance the development of integrated digital solutions. Partnerships will allow for the exchange of expertise and resources to address industry-specific challenges.

- Changing regulatory environments will further drive the adoption of digital solutions, as oil and gas companies need to meet new standards for environmental impact, efficiency, and safety. Companies will focus on leveraging digital technologies to comply with evolving regulations and reduce operational risks.