| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Canada Pea Proteins Market Size 2024 |

USD 75.06 Million |

| Canada Pea Proteins Market, CAGR |

11.54% |

| Canada Pea Proteins Market Size 2032 |

USD 179.82 Million |

Market Overview:

The Canada Pea Proteins Market is projected to grow from USD 75.06 million in 2024 to an estimated USD 179.82 million by 2032, with a compound annual growth rate (CAGR) of 11.54% from 2024 to 2032.

The growth of the Canada pea protein market is primarily driven by increasing health consciousness among consumers, who are shifting towards plant-based protein sources due to their health benefits. Pea protein is gaining popularity for its hypoallergenic, gluten-free, and easily digestible properties, making it an ideal choice for individuals with dietary restrictions, such as those avoiding dairy or soy. Furthermore, the rising demand for sustainable and environmentally friendly food options is pushing consumers towards plant-based alternatives. Pea protein, with its lower environmental footprint compared to animal-based proteins, aligns with the growing focus on sustainability. Technological advancements in protein extraction processes, such as dry and wet fractionation, are also improving the quality and functionality of pea protein, expanding its applications in various food products. Additionally, the increasing adoption of vegan and flexitarian diets is driving the demand for pea protein, as it is widely used in plant-based meats, dairy alternatives, and protein-enriched snacks.

Canada’s favorable agricultural conditions, particularly in provinces like Saskatchewan and Manitoba, position it as a leading producer of peas, which are a primary source of pea protein. This gives Canada a distinct advantage in the global market for pea protein. The country’s established infrastructure for pulse production and processing supports the growing demand for plant-based protein. Regionally, urban centers with high concentrations of health-conscious consumers are seeing a surge in the availability of pea protein-based products, driven by the growing plant-based food industry. The export of Canadian pea protein to international markets, especially to the United States, further supports regional growth. As Canadian manufacturers increase their production of pea protein, they contribute to the country’s role in the global plant-based protein supply chain, meeting the rising demand for sustainable and plant-based alternatives worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Canada Pea Proteins market is projected to grow from USD 75.06 million in 2024 to USD 179.82 million by 2032, reflecting a compound annual growth rate (CAGR) of 11.54% from 2024 to 2032.

- The global pea proteins market is projected to grow from USD 2,229.15 million in 2024 to USD 5,618.92 million by 2032, at a CAGR of 12.25%.

- Increasing health consciousness among consumers is driving the shift towards plant-based protein sources, with pea protein gaining popularity for its hypoallergenic, gluten-free, and easily digestible properties.

- Rising demand for sustainable and environmentally friendly food options is pushing consumers towards plant-based alternatives, as pea protein offers a lower environmental footprint compared to animal-based proteins.

- Technological advancements in protein extraction processes, such as dry and wet fractionation, are improving the quality and functionality of pea protein, expanding its applications in various food products.

- The increasing adoption of vegan and flexitarian diets is driving the demand for pea protein, as it is widely used in plant-based meats, dairy alternatives, and protein-enriched snacks.

- Canada’s favorable agricultural conditions, particularly in provinces like Saskatchewan and Manitoba, position it as a leading producer of peas, which are a primary source of pea protein.

- The export of Canadian pea protein to international markets, especially to the United States, further supports regional growth and positions Canada as a key player in the global plant-based protein supply chain.

Market Drivers:

Health and Wellness Trends

The growing awareness of health and wellness among consumers in Canada is one of the key drivers for the increasing demand for pea protein. With a rising number of individuals becoming more conscious of their dietary choices, there is a significant shift toward plant-based food options. Pea protein, known for its hypoallergenic and easily digestible qualities, caters to consumers with specific dietary needs, including those avoiding soy, dairy, or gluten. This trend towards healthier, plant-based alternatives is accelerating as consumers seek to maintain a balanced and nutritious diet without compromising on taste or functionality.

Environmental Sustainability

Environmental concerns are playing an essential role in driving the adoption of pea protein in Canada. As consumers become more eco-conscious, they are turning away from animal-based proteins due to the significant environmental impact associated with livestock farming, including greenhouse gas emissions, water consumption, and land use. For instance, PIP International, an Alberta-based company, is constructing a facility capable of processing 136,000 metric tons of peas annually, which will be powered primarily by a 17-megawatt solar farm and designed to be net zero electrically. The facility will also reduce water use by a minimum of 30% compared to standard protein extraction processes. Pea protein, as a plant-based alternative, requires fewer resources for production, such as water and land, and contributes to a lower carbon footprint. The sustainability of pea protein appeals to environmentally aware consumers, businesses, and governments who are prioritizing eco-friendly and sustainable solutions to combat climate change.

Technological Advancements in Protein Extraction

Advancements in protein extraction technologies have significantly boosted the quality and yield of pea protein, further accelerating its adoption. Techniques such as dry fractionation and wet fractionation are improving the efficiency of pea protein production while preserving its nutritional value. These technological improvements enable manufacturers to enhance the functionality of pea protein, making it suitable for a wide range of applications, from plant-based meats to dairy alternatives. The ability to produce pea protein at a larger scale and with better consistency has made it a viable ingredient in the food industry, contributing to its market growth in Canada.

Shift Towards Plant-Based Diets

The growing popularity of plant-based diets, including vegan and flexitarian lifestyles, is a major driver for the Canada pea protein market. With more consumers opting for plant-based diets for reasons ranging from health benefits to animal welfare concerns, the demand for plant-based protein alternatives, including pea protein, has surged. Flexitarians, who primarily follow a plant-based diet but occasionally consume animal products, are also driving the demand for pea protein, particularly in meat alternatives. For instance, Roquette’s NUTRALYS® pea protein ingredients are now used in a wide range of products, from plant-based burgers and protein drinks to dairy alternatives and ice creams, demonstrating the versatility and appeal of pea protein across multiple food categories. This shift in dietary patterns is propelling manufacturers to expand their offerings of pea protein-based products, which range from plant-based burgers to protein powders, further fueling the market’s expansion in Canada.

Market Trends:

Increasing Demand for Plant-Based Meat Alternatives

One of the most notable trends in the Canada pea protein market is the rising demand for plant-based meat alternatives. As more consumers seek to reduce their consumption of animal products, the need for high-quality, plant-based proteins has grown. Pea protein, due to its neutral flavor and versatility, is increasingly being used in the production of meat substitutes such as burgers, sausages, and nuggets. These products cater to the growing segment of vegans, vegetarians, and flexitarians, with the Canadian market witnessing an influx of plant-based offerings. This trend is driven by consumers’ increasing concerns about animal welfare and the environmental impact of meat production, further bolstering the market for plant-based alternatives.

Innovation in Product Formulations

In Canada, innovation in product formulations is another significant trend driving the growth of the pea protein market. Manufacturers are continuously developing new and improved pea protein-based products to meet the evolving needs of health-conscious consumers. This includes pea protein isolates, concentrates, and hydrolysates, which offer varied functional properties such as improved solubility, texture, and taste. The increasing use of pea protein in ready-to-eat meals, snacks, and beverages is a reflection of this trend. For instance, Burcon NutraScience launched Peazazz®C pea protein in December 2024, offering over 90% protein purity, low sodium content, and a neutral flavor profile. Additionally, the trend towards “clean label” products, where consumers demand transparency in ingredient sourcing, is encouraging the use of pea protein as a natural, non-GMO ingredient in food formulations.

Expansion of Pea Protein Applications

The application of pea protein in non-food sectors, such as animal feed and nutraceuticals, is gaining traction in Canada. The growing focus on sustainable agricultural practices has led to the use of pea protein as a high-quality ingredient in animal feed, especially for poultry and fish farming. For instance, protein Industries Canada has partnered with Lovingly Made Flour Mills, TMRW Foods, and Dutton Farms to develop pea and fava protein ingredients and meat alternatives. This initiative aims to improve the affordability, nutritional value, and consistency of these alternative food products. Additionally, pea protein’s potential in the nutraceutical space is expanding, with its use in dietary supplements and protein powders for fitness enthusiasts. As demand for plant-based products extends beyond food into these diverse sectors, the market for pea protein is evolving, creating new opportunities for growth and diversification.

Regional Growth in Plant-Based Protein Consumption

The regional trends within Canada also show significant growth in the adoption of plant-based proteins, especially in urban areas where health and wellness trends are more prominent. Provinces such as Ontario and British Columbia have seen a higher concentration of plant-based product availability due to the growing number of vegan, vegetarian, and flexitarian consumers. These regions are witnessing the expansion of retail outlets, restaurants, and foodservice providers that cater to the demand for plant-based foods. The increasing availability and visibility of pea protein-based products in these areas are contributing to the overall market growth, with demand expected to continue rising as consumer preferences shift towards plant-based diets.

Market Challenges Analysis:

Limited Awareness and Acceptance

One of the key restraints in the Canada pea protein market is the limited awareness and acceptance among certain consumer segments. Despite the growing popularity of plant-based proteins, pea protein is still relatively new to many consumers compared to more established alternatives such as soy or whey. This lack of awareness can hinder the adoption of pea protein-based products, especially in regions where plant-based diets are not as widespread. Additionally, some consumers may be hesitant to try pea protein due to unfamiliarity with its taste, texture, or nutritional profile, which can affect the market’s growth potential.

Price Sensitivity

Price sensitivity remains a significant challenge for the Canadian pea protein market. While the demand for plant-based proteins is rising, pea protein-based products often come at a premium compared to their animal-based counterparts. This price difference may deter some consumers from switching to plant-based alternatives, particularly in price-conscious segments of the population. Although the cost of production for pea protein has been decreasing with advancements in processing technologies, it still remains relatively high when compared to more conventional protein sources, limiting its accessibility and growth potential in certain market segments.

Competition from Other Plant-Based Proteins

The competition from other plant-based protein sources, such as soy, rice, and hemp protein, is another challenge facing the pea protein market in Canada. These alternatives are well-established in the plant-based protein industry and are often seen as more affordable or versatile. While pea protein has distinct advantages, such as being hypoallergenic and non-GMO, its competition with other plant-based proteins could slow its growth rate as consumers and manufacturers may opt for more familiar or cost-effective options.

Supply Chain and Production Limitations

The Canadian pea protein market faces challenges related to supply chain and production limitations. Although Canada is a leading producer of peas, the demand for pea protein is growing rapidly, placing pressure on domestic production capabilities. The availability of high-quality peas for protein extraction is crucial to maintaining consistent product quality. Additionally, fluctuations in weather conditions and agricultural practices can impact pea yields, affecting the overall supply of raw materials and, in turn, the market’s growth potential. For instance, Europe suffered from low yields, with crops in France being severely damaged by wet weather during harvest

Market Opportunities:

The Canada pea protein market presents significant growth opportunities driven by the increasing demand for plant-based and sustainable food products. As consumers continue to prioritize health and wellness, the market for plant-based proteins, including pea protein, is expected to expand. With its hypoallergenic properties and nutritional profile, pea protein is well-positioned to cater to the growing number of consumers seeking alternative protein sources due to dietary restrictions or ethical concerns. The rising popularity of vegan, vegetarian, and flexitarian diets is further fueling this demand, offering a vast opportunity for manufacturers to develop and expand their portfolios of pea protein-based products, from meat alternatives to protein-enriched snacks and beverages.

Moreover, the opportunity for innovation in pea protein applications extends beyond the food and beverage sector. The increasing interest in plant-based nutraceuticals and functional foods presents an untapped market for pea protein. The use of pea protein in dietary supplements, protein powders, and energy bars is gaining traction, catering to fitness enthusiasts and individuals seeking functional food options. Furthermore, the growing emphasis on environmental sustainability provides a unique opportunity for pea protein to position itself as a eco-friendlier alternative to animal-based proteins. With Canada’s strong agricultural infrastructure and commitment to sustainable practices, there is significant potential for the country to lead the global market for pea protein, particularly in the expanding plant-based protein industry.

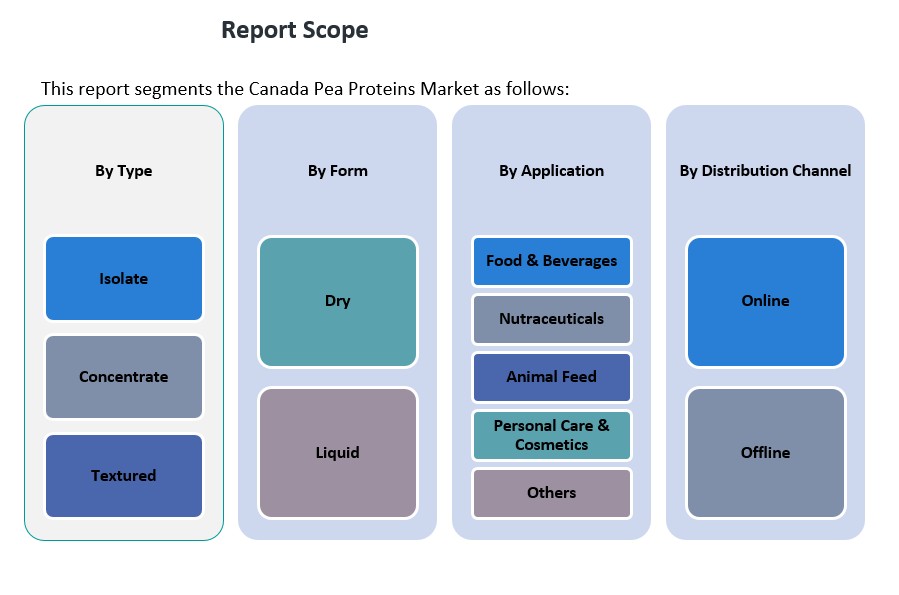

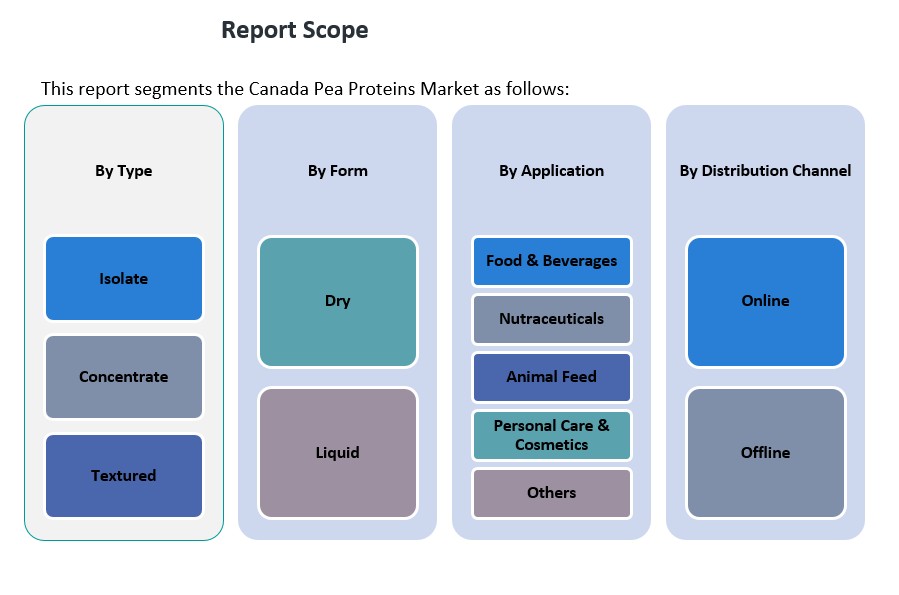

Market Segmentation Analysis:

The Canada pea protein market is segmented into various categories that cater to diverse consumer needs across industries.

By type, the market is divided into Isolate, Concentrate, and Textured pea proteins. Isolates dominate the market due to their high protein content and versatility, making them suitable for a wide range of applications, especially in plant-based meats and protein supplements. Concentrates are also widely used, particularly in food and beverage formulations, due to their balance of protein content and functional properties. Textured pea protein, primarily used in meat alternatives, is experiencing steady growth as demand for plant-based proteins rises.

By application, the Food & Beverages sector holds the largest share, driven by the increasing incorporation of pea protein in plant-based meat products, protein bars, dairy alternatives, and beverages. The Nutraceuticals segment is also growing rapidly as consumers seek plant-based protein supplements for fitness and health purposes. Additionally, Animal Feed is gaining traction, especially in the pet food industry, as pea protein serves as a sustainable alternative to animal-based proteins. The Personal Care & Cosmetics segment is witnessing emerging applications, where pea protein is used in skincare and haircare products due to its nourishing properties.

By form into Dry and Liquid pea proteins, with the Dry form being more commonly used in the food and beverage industry due to its longer shelf life and ease of handling.

By distribution channels, Offline sales dominate, with supermarkets, health food stores, and specialty shops leading the way. However, Online sales are growing rapidly, driven by the increasing trend of e-commerce and consumer preference for convenient shopping options.

Segmentation:

By Type

- Isolate

- Concentrate

- Textured

By Application

- Food & Beverages

- Nutraceuticals

- Animal Feed

- Personal Care & Cosmetics

- Others

By Form

By Distribution Channel

Regional Analysis:

The Canada pea protein market is shaped by regional dynamics, with key areas contributing to the growth and development of the industry. The market is supported by the country’s favorable agricultural conditions, particularly in provinces like Saskatchewan, Manitoba, and Alberta, which are major producers of peas. These regions hold a substantial share of the market due to their high production volumes of pulses, providing the raw material necessary for pea protein extraction. Saskatchewan, for instance, accounts for over 40% of Canada’s pea production, positioning it as the primary supplier of peas used for protein manufacturing. This regional advantage enables local manufacturers to secure a steady supply of raw materials, fostering the growth of the pea protein industry in the country.

Ontario and British Columbia are also significant contributors to the Canadian pea protein market, particularly in terms of demand. These provinces are home to a large population of health-conscious consumers and are key hubs for the plant-based food industry. The demand for pea protein in Ontario is driven by its diverse consumer base, with increasing adoption of plant-based diets, particularly in urban centers like Toronto. British Columbia, with its strong focus on sustainability and health trends, also shows growing consumer interest in plant-based protein products. Both provinces account for approximately 30% of the total market share, driven by the rising demand for plant-based meat alternatives, protein-enriched foods, and nutraceuticals.

The Atlantic provinces, including Nova Scotia, New Brunswick, and Prince Edward Island, hold a smaller share of the market but are seeing growth in plant-based food product availability. While these regions contribute less than 10% to the overall market share, they are witnessing an increase in retail outlets and foodservice providers offering pea protein-based products. This regional growth is in line with the increasing consumer interest in plant-based diets and the expansion of pea protein applications beyond food and beverage products, such as in animal feed and personal care.

Key Player Analysis:

- Cargill, Inc.

- DuPont (IFF)

- Ingredion Incorporated

- Axiom Foods, Inc.

- The Scoular Company

- Puris Proteins LLC

- ADM (Archer Daniels Midland)

- Manitoba Harvest

- AGT Food and Ingredients

- Glanbia plc

Competitive Analysis:

The competitive landscape of the Canada pea protein market is characterized by a mix of established global players and local manufacturers. Major companies such as Roquette Frères, Cargill, and The Greenleaf Foods lead the market due to their strong supply chains, advanced technology in protein extraction, and extensive product portfolios. These players focus on innovation in pea protein formulations, catering to the growing demand for plant-based proteins across various applications, including food, beverages, and nutraceuticals. In addition to large players, regional companies like NutriPea and Canadian Protein are gaining market share by capitalizing on Canada’s agricultural strengths in pea production. They offer a range of pea protein products, emphasizing sustainable sourcing and local production. Competitive strategies in the market include product differentiation, strategic partnerships, and investments in R&D to enhance product functionality and expand market reach. The growing demand for plant-based solutions ensures a dynamic and competitive environment within the Canadian pea protein market.

Recent Developments:

- In July 2024, Ingredion Incorporated launched VITESSENCE® Pea 100 HD, a new pea protein ingredient optimized for cold-pressed bars in the U.S. and Canada. This product is designed to maintain the softness of cold-pressed bars throughout their shelf life while delivering superior texture, taste, and nutritional value.

- In November 2024, Axiom Foods announced the launch of its new pea protein ingredient, Vegotein N, produced in North America. This product is soy-free, gluten-free, and non-GMO, and the company plans to continue expanding the Vegotein N line by the first quarter of 2025.

Market Concentration & Characteristics:

The Canada pea protein market is characterized by a moderately concentrated structure, with a blend of global corporations and regional enterprises. While the market is not dominated by a single entity, major international players such as Roquette Frères, DuPont de Nemours Inc., and Ingredion Inc. hold significant shares due to their advanced processing capabilities and extensive distribution networks. These companies leverage Canada’s rich agricultural resources and established infrastructure to maintain a competitive edge. Additionally, domestic firms like NutriPea and Verdient Foods contribute to the market’s diversity by focusing on sustainable sourcing and local production, thereby catering to the growing demand for clean-label and ethically produced ingredients. The Canadian pea protein market is distinguished by its strong alignment with sustainability and health-conscious consumer trends. Pea protein is increasingly favored for its hypoallergenic properties, plant-based origin, and environmental benefits, such as lower water usage and reduced greenhouse gas emissions compared to animal-based proteins. This aligns with the rising consumer preference for clean-label products and plant-based diets. The market is also marked by innovation, with companies investing in research and development to enhance the functional properties of pea protein, such as improving solubility and texture, to meet the diverse needs of the food, beverage, and nutraceutical sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Form and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Canada pea protein market is poised for steady growth, driven by increasing demand for plant-based products.

- The growing adoption of plant-based diets will continue to expand the use of pea protein in various food categories.

- Advancements in protein extraction technologies will enhance the quality and versatility of pea protein, broadening its applications.

- Rising interest in vegan, vegetarian, and flexitarian lifestyles will contribute to sustained demand for pea protein-based offerings.

- New applications for pea protein in sectors like animal feed and personal care will present additional growth opportunities.

- Canada’s strong agricultural infrastructure ensures a consistent and high-quality supply of peas for protein extraction.

- The country’s export potential to key global markets will strengthen its position in the international pea protein market.

- Increasing environmental concerns will further solidify pea protein’s appeal as a sustainable alternative to animal-based proteins.

- Ongoing research and development will lead to innovative pea protein formulations that cater to changing consumer needs.

- Regional growth in provinces with a high concentration of health-conscious consumers will support continued market expansion.