Market Overview

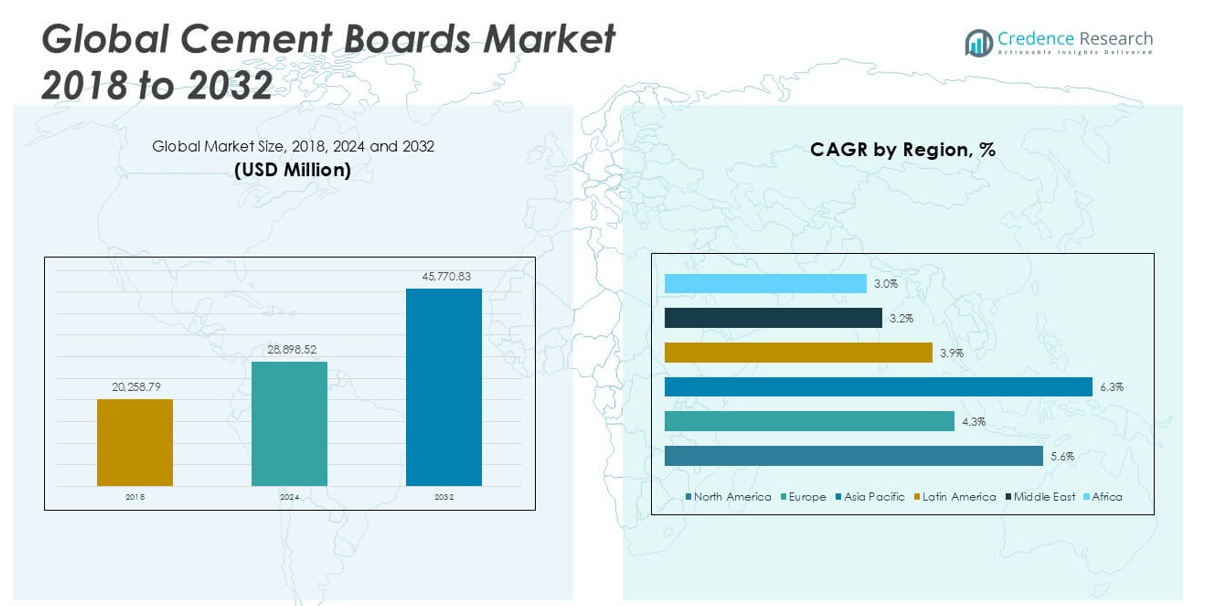

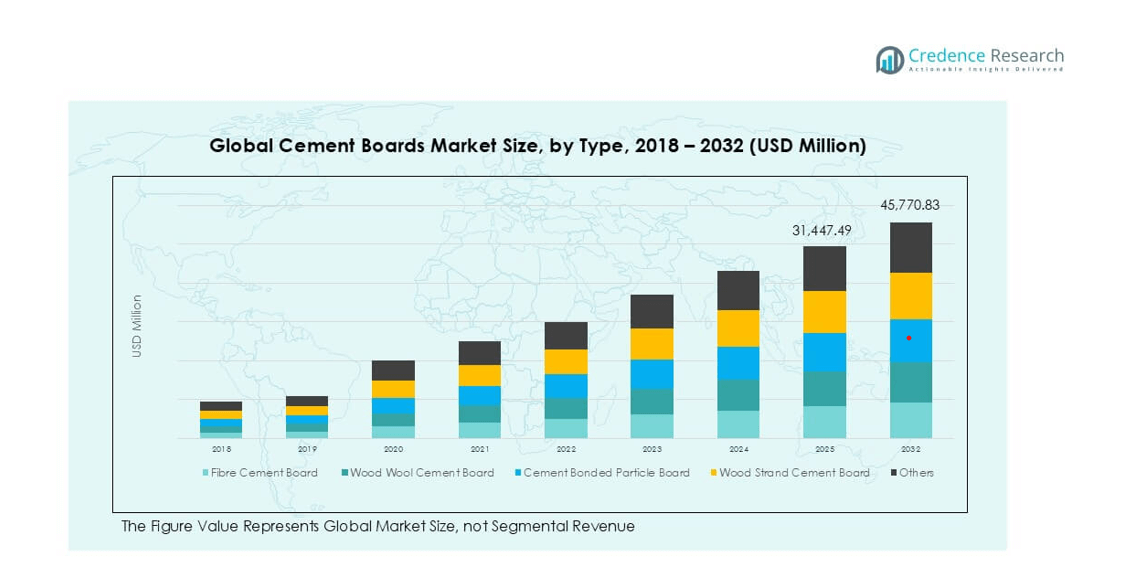

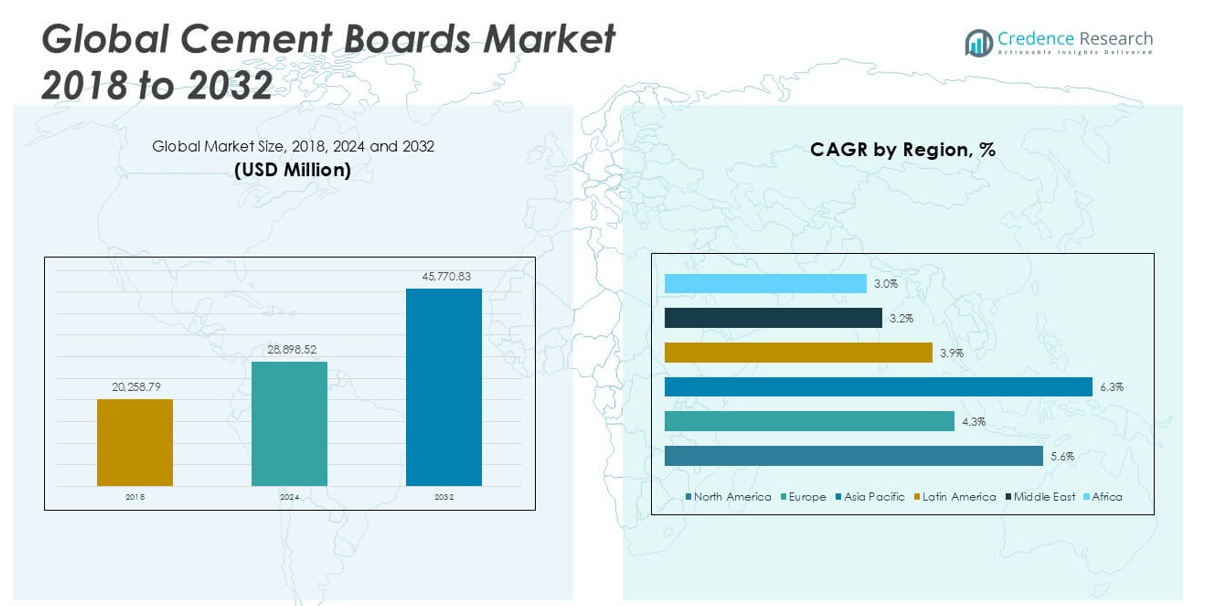

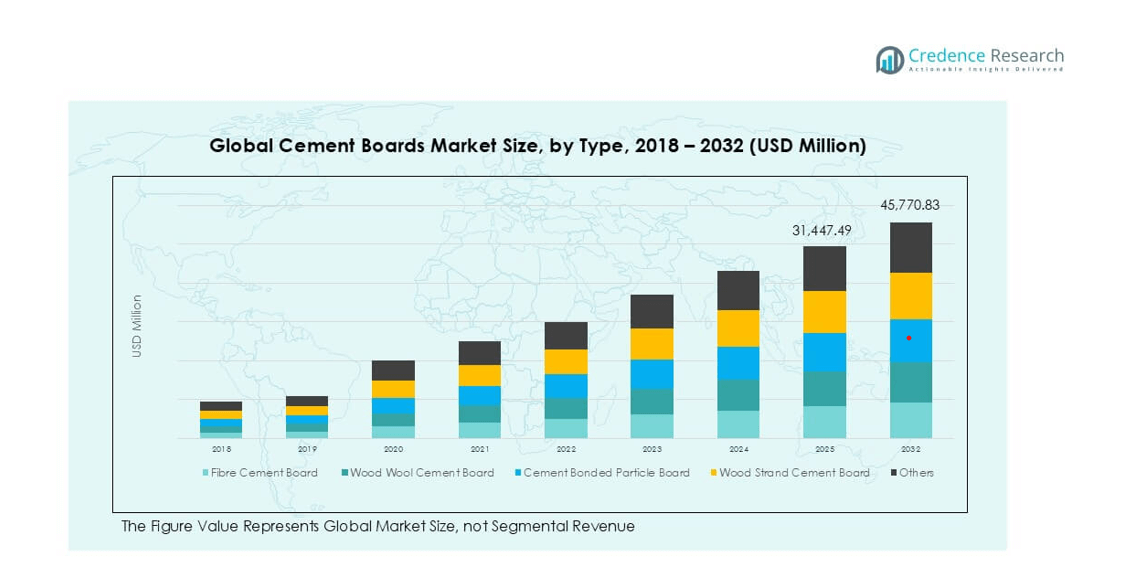

The Cement Boards market size was valued at USD 20,258.79 million in 2018, increased to USD 28,898.52 million in 2024, and is anticipated to reach USD 45,770.83 million by 2032, at a CAGR of 5.51% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cement Boards Market Size 2024 |

USD 28,898.52 million |

| Cement Boards Market, CAGR |

5.51% |

| Cement Boards Market Size 2032 |

USD 45,770.83 million |

Top players in the cement boards market include James Hardie Industries Plc, Etex Group, Saint-Gobain, Johns Manville, and NICHIHA Co., Ltd, all of which maintain a strong global presence through extensive product portfolios and continuous innovation. These companies are focused on developing durable, fire-resistant, and sustainable solutions to meet the rising demand from residential and commercial construction sectors. James Hardie Industries Plc leads the market with a significant share, supported by its strong brand recognition and advanced fibre cement technologies. Regionally, Asia Pacific dominates the cement boards market, accounting for 43.1% of the global market share in 2018. This leadership is driven by rapid urbanization, population growth, and government-led infrastructure development in countries such as China and India. North America and Europe follow, supported by renovation activities and strict building codes. The combined efforts of top players and regional demand continue to shape the competitive dynamics of the market.

Market Insights

- The cement boards market was valued at USD 20,258.79 million in 2018, reached USD 28,898.52 million in 2024, and is projected to reach USD 45,770.83 million by 2032, growing at a CAGR of 5.51% during the forecast period.

- Growth is driven by rising demand for fire-resistant, moisture-proof, and sustainable construction materials across residential and commercial buildings, with fibre cement boards leading the segment due to their durability and versatility.

- Key trends include the increasing adoption of lightweight and eco-friendly boards, technological advancements, and growing application in interior design and modular furniture.

- The competitive landscape features major players such as James Hardie Industries, Etex Group, and Saint-Gobain, who are focusing on product innovation, regional expansion, and strategic partnerships to strengthen market presence.

- Asia Pacific dominates the market with 43.1% share in 2018, followed by North America at 28.6%, with residential construction being the leading application segment globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Fibre cement board dominates the cement boards market by type, accounting for the largest market share due to its superior durability, fire resistance, and suitability for both internal and external applications. Its wide adoption in residential and commercial projects is driven by its versatility and low maintenance needs. Wood wool cement boards are gaining traction in acoustic insulation and sustainable construction due to their eco-friendly properties. Cement bonded particle boards and wood strand cement boards cater to niche applications, offering strength and resistance to moisture. The “Others” category includes innovative composite boards that target customized industrial uses.

- For instance, James Hardie Industries has reported the production of over 2.5 billion square feet of fibre cement boards annually, serving diverse construction needs globally.

By Application

The residential buildings segment leads the market in terms of application, holding the highest revenue share. This dominance is primarily fueled by the growing demand for lightweight, moisture-resistant, and thermally efficient materials in modern housing projects. Cement boards are increasingly used in walls, ceilings, and flooring applications across new construction and renovation projects. Commercial buildings follow as a strong sub-segment, supported by infrastructure expansion and commercial real estate growth. The product’s durability and sound insulation properties make it suitable for office spaces, malls, and institutions, driving its demand in the commercial sector.

- For instance, Etex Group supplies over 800,000 homes annually with fibre cement boards for interior and exterior cladding.

Market Overview

Rising Demand for Sustainable and Fire-Resistant Materials

The global shift towards sustainable construction practices is significantly driving the demand for cement boards, particularly fibre cement variants. These boards offer fire resistance, termite protection, and longer service life compared to traditional plywood and drywall. With stricter fire safety regulations and growing awareness of green building certifications such as LEED and BREEAM, developers are increasingly opting for eco-friendly, non-combustible materials. As governments and private developers prioritize energy-efficient and disaster-resilient buildings, cement boards are emerging as a preferred material in both residential and commercial applications.

- For instance, Hume Cemboard Industries received certification for supplying fire-rated panels (BS 476 Part 22, 2-hour rating) to more than 250 LEED projects across Southeast Asia.

Urbanization and Infrastructure Development

Rapid urbanization, particularly in developing economies across Asia-Pacific, the Middle East, and Africa, is fueling construction activities. The rising demand for high-rise apartments, smart cities, and commercial spaces has led to increased use of prefabricated and modular building materials such as cement boards. These boards reduce construction time, offer design flexibility, and are easy to install, making them ideal for fast-paced urban infrastructure development. Additionally, public infrastructure projects, including hospitals, schools, and office buildings, continue to contribute to market expansion.

- For instance, SCG (Siam Cement Group) reported a 15% year-over-year increase in cement board demand from metropolitan construction projects in Thailand and Vietnam.

Growth in Renovation and Retrofitting Activities

The growing emphasis on renovation and retrofitting of aging buildings in developed regions like North America and Europe is another key driver. Cement boards are increasingly used in wall cladding, roofing, and flooring replacements due to their moisture resistance and structural reliability. Homeowners and building managers are investing in long-lasting materials that offer both performance and aesthetic appeal. Furthermore, government incentives and energy efficiency mandates for retrofitting old structures are positively influencing demand for cement board products in refurbishment projects.

Key Trends & Opportunities

Innovation in Lightweight and High-Performance Boards

Manufacturers are focusing on developing lightweight cement boards with improved thermal and acoustic insulation. Innovations in composite materials, surface finishes, and installation technologies are enhancing product performance and application scope. These innovations cater to evolving architectural needs and reduce labor and structural costs, creating opportunities in both developed and emerging markets. Additionally, the rise of dry construction techniques is encouraging the adoption of engineered cement boards as a substitute for wet materials like brick and plaster.

- For instance, Swisspearl Group introduced a new product line with density below 1,200 kg/m³ and sound reduction index (Rw) of 36 dB, suited for high-end architectural use. The rise of dry construction techniques encourages the adoption of engineered cement boards as a substitute for wet materials like brick and plaster.

Expansion of Green Buildings and Smart Cities

The cement boards market is benefiting from the global push toward green building construction and smart urban development. These boards contribute to energy efficiency and environmental compliance, aligning with international standards for sustainable construction. Their recyclability and minimal VOC emissions position them well in public and private projects aimed at carbon footprint reduction. Government-backed smart city initiatives in countries such as India, China, and the UAE are creating robust demand for cement board applications across diverse infrastructure segments.

Increased Use in Furniture and Interior Design

A growing trend in using cement boards in furniture design and interior applications is creating a niche but promising growth opportunity. Their textured finish, fire resistance, and modern industrial look make them suitable for modular kitchens, tabletops, cabinets, and decorative panels. This design-forward approach is appealing to both residential and commercial consumers seeking durability along with aesthetic value. Manufacturers are responding with customizable and pre-finished boards tailored to this expanding application segment.

- For instance, the Indian Smart Cities Mission utilized over 400,000 m² of cement boards in 2023 alone across Tier 1 city projects.

Key Challenges

High Installation and Processing Costs

Despite their advantages, cement boards typically require specialized tools and skilled labor for cutting and installation, which can elevate project costs. This is especially challenging for small-scale developers and DIY users who may find conventional materials more cost-effective. Moreover, transportation costs can be significant due to the boards’ weight and bulk. These factors limit market penetration, particularly in price-sensitive regions and among budget-conscious customers.

Health and Environmental Concerns During Manufacturing

Cement board manufacturing involves high energy consumption and emissions of dust and silica, which pose environmental and occupational health risks. Regulations surrounding air quality and industrial emissions are becoming more stringent, compelling manufacturers to invest in cleaner production technologies. Non-compliance can lead to penalties and reputational damage, acting as a restraint on market growth. Addressing these environmental concerns while maintaining competitive pricing remains a key challenge for industry players.

Regional Analysis

North America

North America held a significant share of the cement boards market, accounting for approximately 28.6% of the global market in 2018, with a valuation of USD 5,801.00 million. By 2024, the market reached USD 8,143.89 million and is projected to grow to USD 12,953.60 million by 2032, registering a robust CAGR of 5.6%. The region’s growth is driven by rising renovation activities, stringent building codes, and increasing demand for fire-resistant and energy-efficient construction materials. The U.S. remains the primary contributor, with a strong focus on sustainable infrastructure and commercial construction projects.

Europe

Europe contributed about 18.8% of the global cement boards market in 2018, valued at USD 3,815.64 million. The market expanded to USD 5,147.34 million in 2024 and is forecasted to reach USD 7,420.26 million by 2032, at a moderate CAGR of 4.3%. The region benefits from strict energy regulations, widespread adoption of green building practices, and significant investments in public infrastructure. Countries like Germany, the UK, and France are leading consumers, with rising demand for prefabricated and durable building materials enhancing the regional market outlook.

Asia Pacific

Asia Pacific emerged as the dominant regional market, capturing the largest share of around 43.1% in 2018, with a value of USD 8,738.43 million. This figure surged to USD 12,931.37 million in 2024 and is expected to reach USD 21,746.41 million by 2032, registering the highest CAGR of 6.3%. Rapid urbanization, population growth, and government-led infrastructure development in China, India, and Southeast Asia are the primary growth drivers. The region’s extensive construction activities and rising adoption of cost-effective, high-performance materials further support its strong market position.

Latin America

Latin America accounted for about 4.8% of the global cement boards market in 2018, valued at USD 979.41 million. The market grew to USD 1,380.13 million in 2024 and is projected to reach USD 1,940.58 million by 2032, at a CAGR of 3.9%. Regional growth is supported by increasing residential construction, particularly in Brazil and Mexico, along with rising investments in commercial and retail infrastructure. However, economic volatility and budgetary constraints in some countries may temper expansion, despite growing demand for durable and affordable building materials.

Middle East

In 2018, the Middle East cement boards market stood at USD 553.98 million, representing about 2.7% of the global share. It reached USD 720.69 million in 2024 and is estimated to attain USD 958.37 million by 2032, growing at a CAGR of 3.2%. The market is primarily driven by infrastructural expansion across the UAE, Saudi Arabia, and Qatar, including hospitality, healthcare, and education projects. While the region shows steady demand for fire- and moisture-resistant materials, growth may be moderated by fluctuating oil revenues and project financing limitations.

Africa

Africa held a minimal market share of around 1.8% in 2018, with a valuation of USD 370.33 million. The market increased to USD 575.11 million in 2024 and is expected to reach USD 751.61 million by 2032, reflecting a CAGR of 3.0%. Infrastructure development and housing demand, particularly in countries like Nigeria, Kenya, and South Africa, are driving market growth. However, the region faces challenges such as limited industrial capacity and high import dependency. Despite this, increasing investments in affordable housing and urban expansion present potential growth avenues for cement board adoption.

Market Segmentations:

By Type:

- Fibre Cement Board

- Wood Wool Cement Board

- Cement Bonded Particle Board

- Wood Strand Cement Board

- Others

By Application:

- Residential Buildings

- Commercial Buildings

- Road Construction

- Furniture

- Others

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The cement boards market features a moderately consolidated competitive landscape, with key players focusing on strategic expansions, product innovation, and mergers to strengthen their market positions. Leading companies such as James Hardie Industries Plc, Etex Group, and Saint-Gobain dominate through broad product portfolios, global manufacturing capabilities, and strong distribution networks. These companies invest heavily in R&D to introduce advanced, lightweight, and eco-friendly cement board solutions aligned with green building trends. Additionally, firms such as Knauf Industries and Georgia-Pacific LLC are leveraging automation and digital tools to improve operational efficiency and customer engagement. The market sees growing competition from local and emerging manufacturers, particularly in Asia-Pacific, where construction demand is high. Overall, the landscape is marked by a mix of global dominance and regional agility, driving continuous innovation and pricing competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- James Hardie Industries Plc.

- Etex Group

- Saint-Gobain

- Johns Manville

- NICHIHA Co., Ltd

- Everest Industries

- Georgia-Pacific LLC

- Knauf Industries

- Cembrit Group

- Normek

Recent Developments

- In April 2025, the China Building Materials Federation, Conch Group, and Huawei unveiled the industry’s first AI model for cement building materials at an event in Wuhu, China, marking a major advance in the sector’s digital transformation.

- In April 2025, James Hardie solidified its position in the US residential construction market by expanding its multi-year exclusive agreements with major homebuilders like Davidson Homes. These agreements focus on ensuring a consistent supply of James Hardie’s fiber cement siding and trim products for new construction projects.

- In March 2025, James Hardie Industries agreed to acquire AZEK for USD 8.75 billion, aiming to expand its presence in the United States housing market by combining complementary renovation products.

- In February 2025, Xuan Son Group officially launched Xuan Son Cement at their new plant in Hoa Binh province. Covering 40 hectares with a US$196 million investment, the facility boasts a production capacity of 3.5 million tons per year.

- In January 2025, Ecocem announced plans to build its first production facility for ACT, its low-carbon cement technology, at the Dunkirk site. The new line, set to operate by 2026, will have an initial capacity of 300,000 tons per year.

- In June 2023, Saint-Gobain signed an agreement to acquire cement board producer Hume Cemboard Industries. Through this acquisition, the company strengthened its lightweight product offering in Malaysia.

- In February 2023, Everest Industries Limited intends to invest USD 22.5 million to establish a manufacturing unit on a 20-acre site in the Badanaguppe Kellambali KIADB layout of Chamarajanagar, Karnataka, India. The new facility aims to produce 72,000 metric tons (MT) of fiber cement board and 19,000 MT of Rapicon wall panels. This state-of-the-art, highly automated plant is projected to generate approximately 127 job opportunities.

Market Concentration & Characteristics

The Cement Boards Market exhibits moderate concentration, with a few dominant players accounting for a significant share of global revenue. Companies such as James Hardie Industries Plc, Etex Group, and Saint-Gobain maintain strong positions through technological expertise, broad distribution networks, and diversified product portfolios. It remains highly competitive, with regional manufacturers entering the market to cater to local construction needs and regulatory standards. The market shows strong product standardization, particularly in fibre cement boards, which are preferred for their fire resistance, durability, and low maintenance. Demand is largely influenced by the pace of urbanization, infrastructure investment, and housing development across emerging and developed economies. Asia Pacific leads in consumption, supported by large-scale construction and manufacturing capacity. Product innovation and sustainability concerns continue to shape competitive strategies. Market entry requires significant capital and compliance with building codes, limiting the number of new entrants. It demonstrates stable long-term growth potential with increasing application in interiors and modular construction.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow steadily, driven by rising demand for durable and fire-resistant construction materials.

- Fibre cement boards will remain the preferred product type due to their versatility and performance benefits.

- Asia Pacific will retain its leading position, supported by ongoing urbanization and infrastructure development.

- North America and Europe will see consistent growth due to strong renovation and retrofitting activities.

- Sustainable and eco-friendly product innovations will influence purchasing decisions and regulatory approvals.

- Dry construction practices will increase adoption of cement boards across residential and commercial segments.

- Companies will focus on digital integration and automation to improve manufacturing efficiency and reduce costs.

- Product customization and design-forward applications will expand use in interior and furniture segments.

- Entry barriers such as capital investment and regulatory compliance will limit new competition.

- Strategic partnerships and regional expansions will remain central to long-term growth strategies.