Market Overview

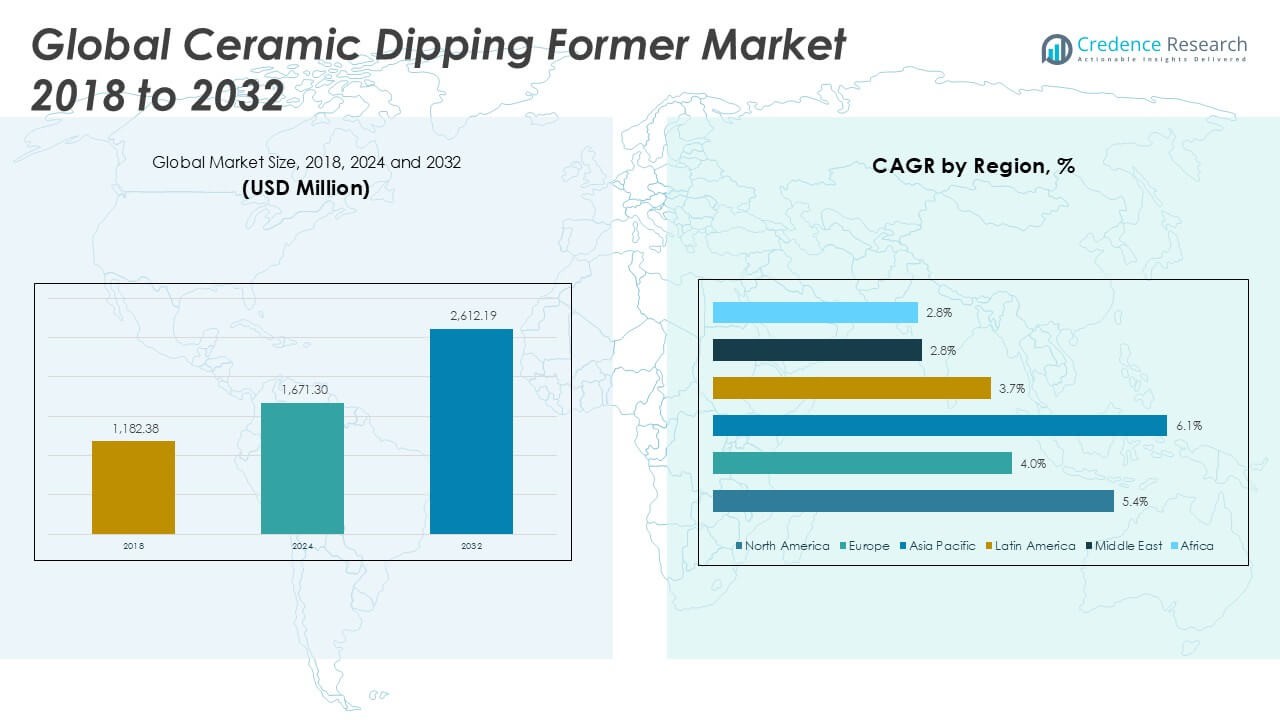

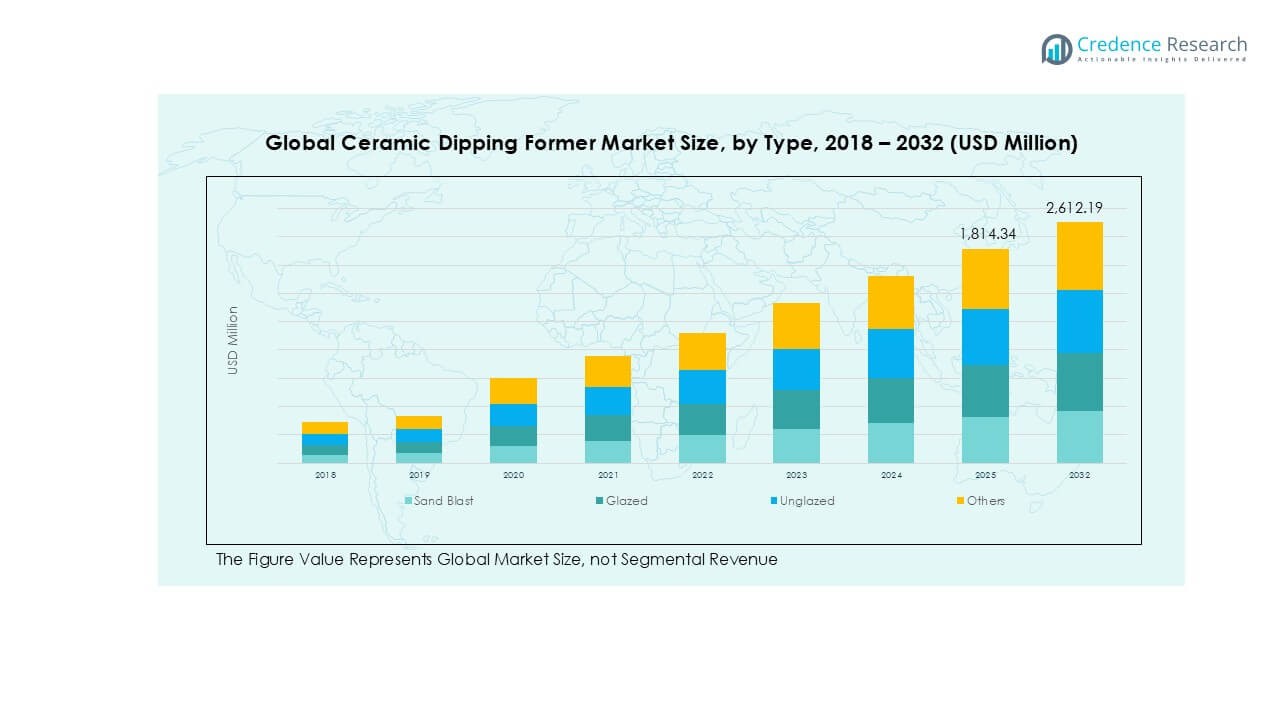

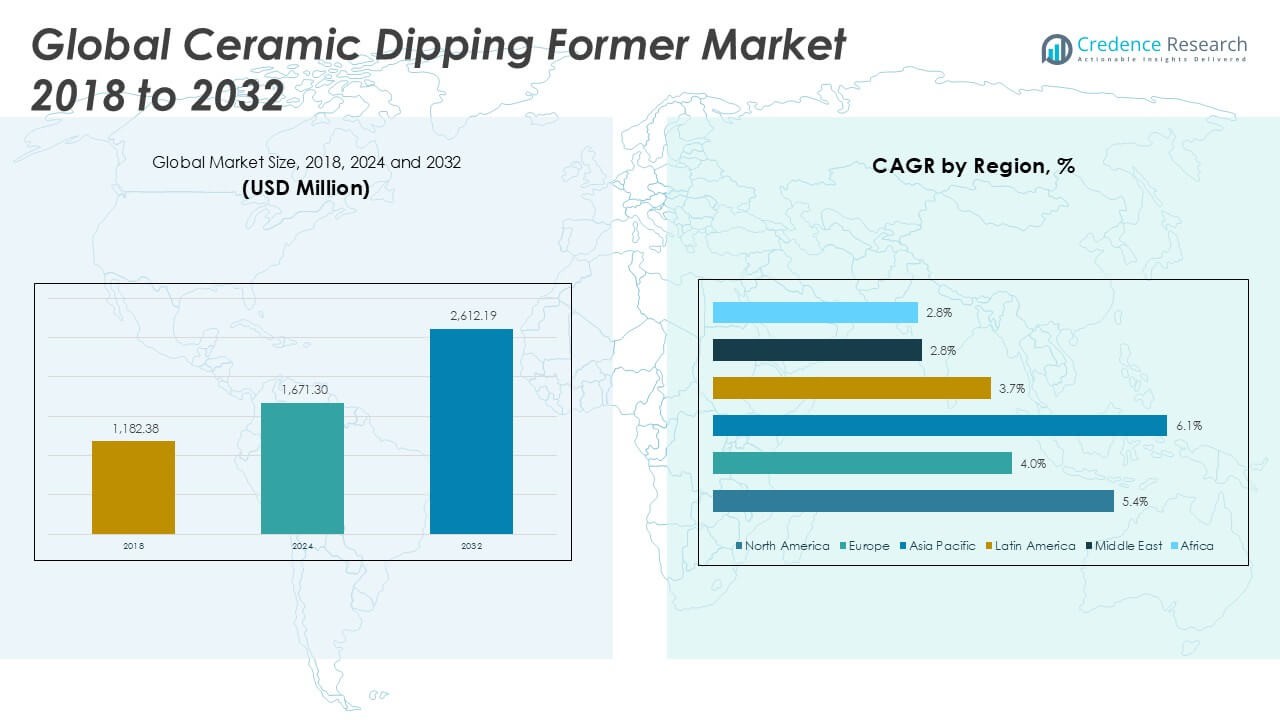

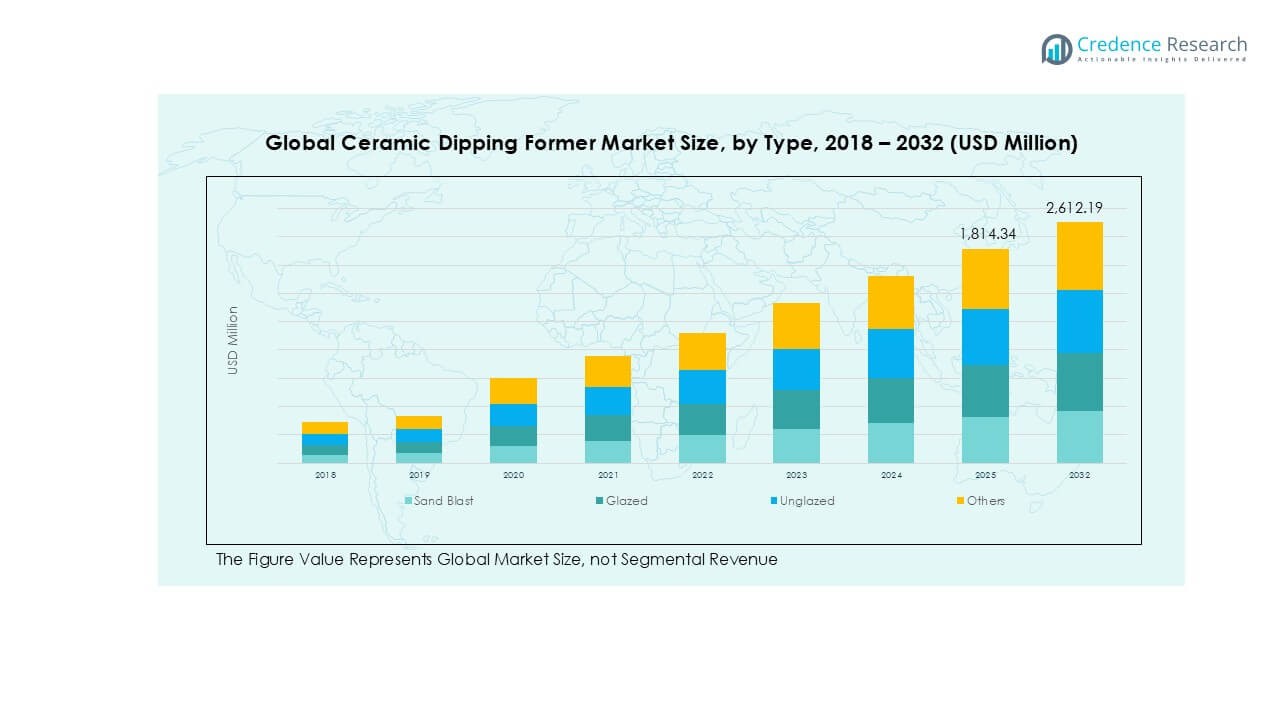

Global Ceramic Dipping Former market size was valued at USD 1,182.38 million in 2018 and reached USD 1,671.30 million in 2024. It is anticipated to reach USD 2,612.19 million by 2032, at a CAGR of 5.34% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ceramic Dipping Former Market Size 2024 |

USD 1,671.30 Million |

| Ceramic Dipping Former Market, CAGR |

5.34% |

| Ceramic Dipping Former Market Size 2032 |

USD 2,612.19 Million |

The global ceramic dipping former market is shaped by prominent players such as CeramTec GmbH, MEKONG TECH, Gotaj Ceramics, Progress Plasmic, GATEWAY INDUSTRIAL, Shinko Ceramics, Nutech DipTech, and Dipping Industries. These companies focus on advanced glazed and sand blast formers to meet the rising demand for medical and industrial gloves. Asia Pacific leads the market with a dominant share of 46% in 2024, supported by strong glove manufacturing bases in Malaysia, Thailand, China, and India. North America follows with 28.5%, driven by strict healthcare safety standards, while Europe accounts for 16.8%, led by regulatory compliance and sustainable manufacturing practices.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Global Ceramic Dipping Former market was valued at USD 1,671.30 million in 2024 and is anticipated to reach USD 2,612.19 million by 2032, growing at a CAGR of 5.34%.

- Rising demand for medical and examination gloves, particularly in hospitals and clinics, is the primary driver, with the medical care segment holding the largest share due to strict hygiene and infection control standards.

- Key trends include the adoption of glazed formers for enhanced durability, automation in glove production lines, and sustainability-focused manufacturing practices to reduce energy use and waste.

- The competitive landscape features major players such as CeramTec GmbH, MEKONG TECH, Gotaj Ceramics, and Shinko Ceramics, focusing on technology upgrades, product diversification, and regional expansion strategies to meet growing demand.

- Asia Pacific leads with 46% share in 2024, followed by North America at 28.5% and Europe at 16.8%, while industrial and personal applications contribute steadily to overall market growth.

Market Segmentation Analysis:

By Type

The ceramic dipping former market by type is led by glazed formers, holding the dominant share due to their superior surface finish, durability, and ease of cleaning. Glazed coatings reduce friction, enhance product consistency, and extend the operational life of formers, driving adoption across large-scale glove manufacturing units. Sand blast types follow, favored for cost efficiency and surface roughness that improves latex adherence. Unglazed and other niche formers cater to small-scale operations, where customization and lower production costs are key drivers. Rising automation in glove production continues to support demand for glazed formers.

- For instance, CeramTec supplies glazed ceramic formers used in glove lines producing over 45,000 gloves per hour at major manufacturers like Hartalega and Top Glove.

By Application

Within applications, medical care accounts for the largest revenue share, driven by high demand for surgical and examination gloves across hospitals and clinics. The growth of infection control protocols and rising healthcare investments globally reinforce this dominance. Industrial applications are also significant, particularly in food processing, cleanroom operations, and manufacturing, where protective gloves are mandatory. The personal segment, though smaller, benefits from increasing consumer awareness of hygiene and safety, especially post-pandemic. Other uses, such as laboratory and specialty environments, create niche opportunities, but healthcare remains the central growth driver.

- For instance, Top Glove alone produced over 100 billion medical gloves in 2022, relying heavily on glazed ceramic formers for consistent quality.

Key Growth Drivers

Rising Demand for Medical Gloves

The increasing consumption of medical gloves in hospitals and clinics strongly drives the ceramic dipping former market. Growing emphasis on infection control, particularly after global health crises, has boosted demand for disposable gloves worldwide. Governments and healthcare organizations continue investing in expanding medical supply chains, creating long-term growth opportunities. Ceramic dipping formers, especially glazed variants, are widely adopted in large-scale glove manufacturing plants to ensure precision, consistency, and durability. The rising need for sterile and high-quality gloves positions the medical sector as a core growth driver.

- For instance, in 2022, Hartalega’s Next-Generation Integrated Glove Manufacturing Complex (NGC) had the capacity to produce up to 42.4 billion medical gloves annually. The NGC’s high-speed production lines were capable of producing up to 45,000 gloves per hour and utilized ceramic formers.

Expanding Industrial Safety Regulations

Stringent workplace safety standards across manufacturing, chemical, and food processing industries are fueling demand for protective gloves. Regulations by OSHA, EU-OSHA, and similar bodies mandate the use of gloves in high-risk environments, directly influencing ceramic dipping former adoption. Industrial operators prefer durable formers capable of producing gloves resistant to punctures, chemicals, and heat. This rising compliance-driven demand ensures steady growth in industrial glove production. As automation increases, manufacturers rely on high-performance ceramic formers to maintain cost efficiency and meet safety-focused standards consistently.

- For example, Ansell is a major manufacturer of personal protective equipment (PPE) that produces billions of gloves and other safety products annually. The company uses durable ceramic formers in the manufacturing process for many of its glove lines. Ansell’s products are designed and tested to meet specific industry standards and regulations, such as the European Union’s EN standards, that are referenced by regulatory bodies like OSHA and EU-OSHA.

Advancements in Manufacturing Automation

The integration of automation in glove production is a major growth enabler for the ceramic dipping former market. Automated dipping lines require precision-designed formers that deliver consistent quality and high output. Manufacturers are investing in advanced glazed and sand blast formers to minimize downtime and improve operational efficiency. Automation also reduces manual intervention, improving hygiene and product uniformity, which is essential for medical and industrial applications. These technological advancements not only increase production capacity but also reduce long-term costs, reinforcing demand for advanced ceramic formers globally.

Key Trends & Opportunities

Shift Toward Sustainable Production

Sustainability is emerging as a significant trend in ceramic dipping former manufacturing. Producers are focusing on energy-efficient kilns, eco-friendly glazing materials, and longer-lasting products to minimize waste. The shift aligns with global regulatory frameworks promoting green manufacturing practices. Opportunities exist for companies that can develop recyclable or low-carbon formers to meet the sustainability goals of glove manufacturers. As industries move toward circular production models, suppliers of sustainable ceramic formers can strengthen their market position and attract eco-conscious buyers.

- For instance, CeramTec has been pursuing energy efficiency improvements, including kiln upgrades and waste heat recovery systems, as part of its sustainability strategy.

Growing Demand in Emerging Economies

Emerging economies, particularly in Asia-Pacific, present major growth opportunities for the ceramic dipping former market. Expanding healthcare infrastructure, coupled with rapid industrialization, fuels demand for gloves across medical, food processing, and manufacturing sectors. Governments in countries like India, Indonesia, and Vietnam are investing heavily in domestic glove production facilities. This expansion increases the requirement for high-performance dipping formers. Additionally, low labor costs and favorable trade policies in these regions make them attractive for global glove producers, creating a strong growth pipeline for ceramic former suppliers.

- For instance, Top Glove announced its intention to build its first factory in Vietnam in 2019, with production starting in 2020. That facility initially had an annual capacity of 4 billion PVC gloves.

Key Challenges

High Initial Investment Costs

Ceramic dipping former production involves significant capital expenditure due to kiln operations, precision tooling, and advanced glazing processes. Small- and medium-scale manufacturers often find it difficult to invest in high-quality formers, which limits market penetration in cost-sensitive regions. Furthermore, the requirement for continuous replacement in large-scale operations adds to capital intensity. These financial barriers can restrict new entrants and slow adoption rates among glove producers with limited budgets, creating challenges for market expansion, particularly in developing economies.

Fluctuations in Raw Material Prices

The market faces challenges due to volatility in raw material prices, particularly ceramic powders, glazing compounds, and refractory materials. Sudden price increases can raise production costs and compress profit margins for manufacturers. Dependence on global supply chains for specific high-grade materials makes the market vulnerable to trade disruptions, geopolitical issues, or energy cost surges. Such fluctuations impact not only production stability but also the pricing strategies of dipping former suppliers, making long-term planning difficult for both producers and buyers.

Regional Analysis

North America

North America accounted for a significant share of the ceramic dipping former market, valued at USD 341.98 million in 2018 and projected to reach USD 746.81 million by 2032, growing at a CAGR of 5.4%. The region’s market strength comes from its advanced healthcare infrastructure and strong glove demand across hospitals, laboratories, and industrial sectors. In 2024, North America represented nearly 28.5% of global revenue, supported by strict occupational safety regulations and automation in glove manufacturing. Continuous investments in medical safety standards ensure the region maintains steady dominance over the forecast period.

Europe

Europe held a considerable position with the market valued at USD 209.69 million in 2018 and forecast to reach USD 394.75 million by 2032, expanding at a CAGR of 4.0%. The region’s share stood at approximately 16.8% in 2024, driven by regulatory compliance for hygiene and worker safety across healthcare and industrial applications. Countries like Germany, France, and the UK remain key contributors, with rising glove demand in pharmaceutical manufacturing and laboratories. The emphasis on sustainable production and eco-friendly processes also stimulates adoption of advanced glazed ceramic formers.

Asia Pacific

Asia Pacific dominated the global ceramic dipping former market with the highest share, valued at USD 523.94 million in 2018 and projected to reach USD 1,271.86 million by 2032, at a CAGR of 6.1%. In 2024, the region contributed nearly 46% of global revenue, making it the leading market. Strong growth in glove manufacturing hubs like Malaysia, Thailand, China, and India drives this dominance. Rapid healthcare expansion, cost-effective labor, and high exports of disposable gloves fuel rising demand for ceramic formers. Government investments in domestic production further reinforce Asia Pacific’s leadership.

Latin America

Latin America’s ceramic dipping former market was valued at USD 55.85 million in 2018 and is forecast to reach USD 107.85 million by 2032, with a CAGR of 3.7%. The region accounted for around 4.7% of global revenue in 2024, supported by steady demand in Brazil and Mexico. Rising industrial glove adoption in food processing and chemical sectors, coupled with healthcare improvements, drives moderate growth. However, limited domestic production capabilities and reliance on imports constrain market expansion. Nevertheless, growing awareness of workplace safety and medical hygiene supports stable opportunities in the region.

Middle East

The Middle East market was valued at USD 29.83 million in 2018 and is projected to reach USD 49.17 million by 2032, growing at a CAGR of 2.8%. In 2024, the region represented about 2.3% of global revenue, with growth driven by investments in healthcare infrastructure in Saudi Arabia and the UAE. Demand for medical gloves in hospitals and clinics, alongside industrial safety standards, sustains market potential. However, slower diversification of manufacturing facilities and heavy dependence on imports restrict broader expansion. Future growth will rely on healthcare modernization initiatives across the Gulf states.

Africa

Africa’s ceramic dipping former market stood at USD 21.09 million in 2018 and is expected to reach USD 41.75 million by 2032, registering a CAGR of 2.8%. The region accounted for approximately 2% of global revenue in 2024, with South Africa and Egypt being the primary markets. Rising glove demand in healthcare settings due to infectious disease management supports growth, while industrial adoption remains limited. Dependence on imports and slow industrial development restrict faster expansion. However, increasing healthcare awareness and government investments in medical facilities present gradual growth opportunities across African countries.

Market Segmentations:

By Type

- Sand Blast

- Glazed

- Unglazed

- Others

By Application

- Industries

- Medical Care

- Personal

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Competitive Landscape

The global ceramic dipping former market features a moderately consolidated landscape with both multinational and regional players competing to strengthen their market positions. Leading companies such as CeramTec GmbH, MEKONG TECH, Gotaj Ceramics, Progress Plasmic, GATEWAY INDUSTRIAL, Shinko Ceramics, Nutech DipTech, and Dipping Industries focus on expanding product portfolios and enhancing production technologies to meet rising glove demand across healthcare and industrial sectors. Innovation in glazed and durable ceramic formers remains a key differentiator, with firms investing in automation-compatible designs and eco-friendly manufacturing. Strategic collaborations with glove producers, capacity expansions in Asia-Pacific, and new product launches are prominent growth strategies. Financial performance among leading players reflects steady revenue growth, driven by healthcare-driven demand surges and industrial safety compliance. However, intense price competition, raw material cost fluctuations, and dependence on global glove manufacturing hubs create challenges. Overall, competitive dynamics are shaped by technological innovation, cost optimization, and strong regional supply chain presence.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2023, Shinko Ceramics secured a major contract for the supply of formers to a leading electronics manufacturer.

- In 2022, Mekong Tech introduced automated dipping systems.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to expand with strong demand from medical glove production.

- Asia Pacific will maintain dominance due to large-scale manufacturing hubs and export capacity.

- North America and Europe will see steady growth supported by strict safety and hygiene regulations.

- Advancements in automated glove production lines will boost demand for precision-designed ceramic formers.

- Glazed formers will remain the most preferred type due to durability and ease of maintenance.

- Industrial applications will expand as safety regulations tighten across food, chemical, and cleanroom sectors.

- Personal hygiene awareness will drive additional demand for gloves, supporting ceramic former adoption.

- Companies will focus on eco-friendly production methods to align with sustainability goals.

- Strategic collaborations and capacity expansions will shape competitive positioning in key markets.

- Emerging economies in Latin America, Middle East, and Africa will provide gradual growth opportunities.