Market Overview

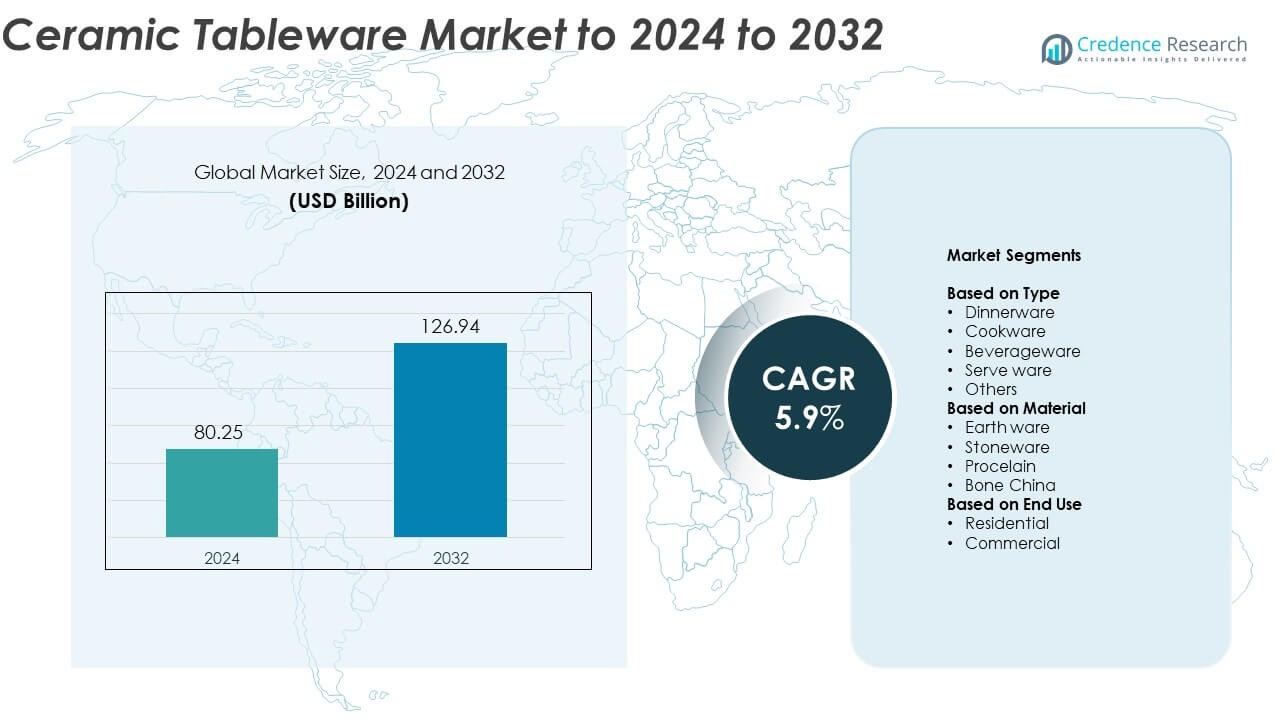

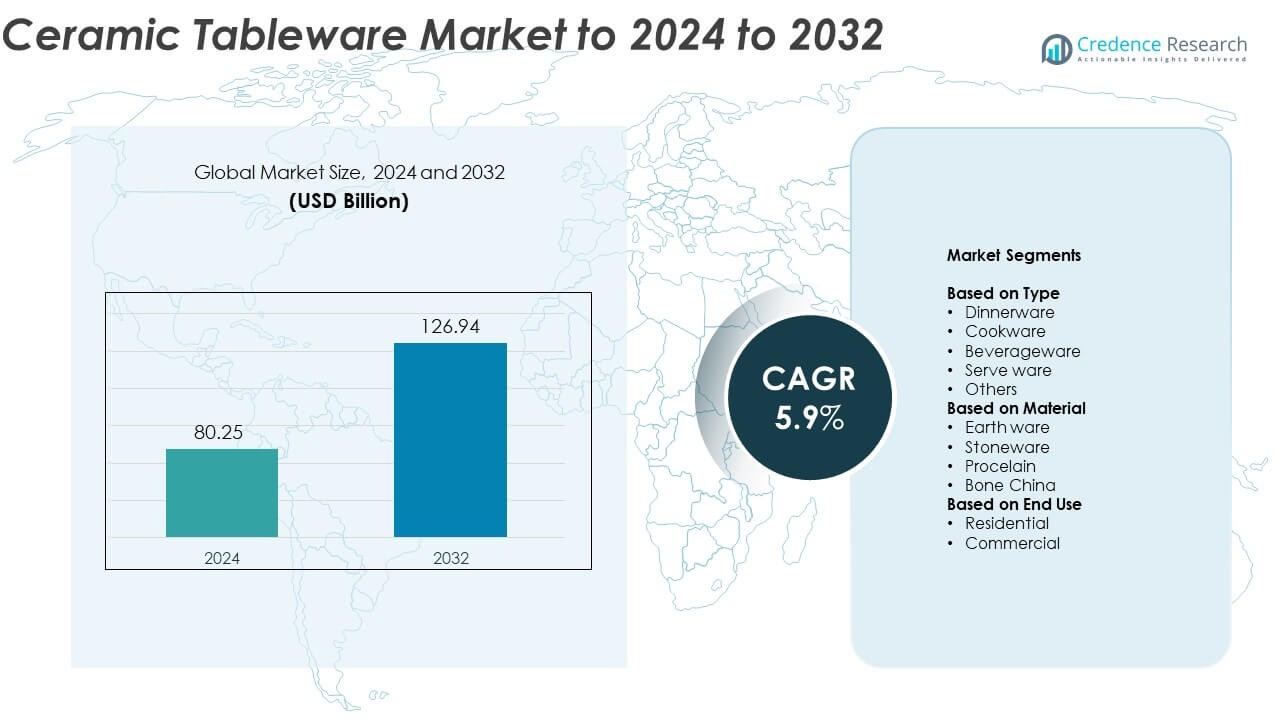

The Ceramic Tableware Market size was valued at USD 80.25 Billion in 2024 and is anticipated to reach USD 126.94 Billion by 2032, at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ceramic Tableware Market Size 2024 |

USD 80.25 Billion |

| Ceramic Tableware Market, CAGR |

5.9% |

| Ceramic Tableware Market Size 2032 |

USD 126.94 Billion |

The ceramic tableware market features strong participation from major players such as Villeroy & Boch, Denby Pottery Company, Corelle Brands, Rosenthal GmbH, Arabia, and Steelite. These companies focus on quality craftsmanship, modern designs, and sustainable production practices to meet evolving consumer preferences. North America leads the market with around 34% share in 2024, supported by high household spending and an expanding hospitality industry. Europe follows with about 28% share, driven by established luxury brands and strong cultural ties to fine dining. Asia-Pacific, holding nearly 27% share, remains the fastest-growing region due to large-scale production, urbanization, and rising consumer incomes.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The ceramic tableware market was valued at USD 80.25 Billion in 2024 and is projected to reach USD 126.94 Billion by 2032, growing at a CAGR of 5.9%.

- Rising demand for premium and stylish tableware, coupled with increasing hospitality sector expansion, is driving steady market growth across both residential and commercial applications.

- Sustainable production methods and growing interest in artisanal and handmade ceramics are key trends shaping product innovation and consumer preference.

- The market is moderately fragmented, with global and regional players competing through design innovation, material quality, and sustainability-driven differentiation.

- North America leads with 34% share, followed by Europe at 28% and Asia-Pacific at 27%, while dinnerware remains the top segment, holding about 44% share of the overall market.

Market Segmentation Analysis:

By Type

Dinnerware dominates the ceramic tableware market, accounting for nearly 44% share in 2024. Its dominance is driven by extensive use in households, restaurants, and hospitality establishments. The rising trend of premium dining culture and the growing popularity of home décor-driven dining sets further boost demand. Manufacturers focus on aesthetic designs, durability, and dishwasher-safe features, strengthening adoption across both residential and commercial spaces. Cookware and beverageware segments are expanding steadily due to innovations in heat-resistant and lightweight materials catering to modern kitchen preferences.

- For instance, RAK Porcelain lifted tableware capacity to 34–36 million pieces annually in 2024.

By Material

Porcelain leads the market with around 39% share in 2024, owing to its superior finish, translucence, and high durability. Its popularity stems from wide acceptance in premium restaurants and high-end households. The growing preference for luxurious and elegant table settings supports porcelain’s dominance. Stoneware follows due to its strength and affordability, appealing to mid-range consumers. Continuous advancements in glazing and eco-friendly production techniques also drive material innovation, ensuring sustainable growth across product lines.

- For instance, the Fiesta Tableware Company produces approximately 3,000 dozen to 5,000 dozen dishes per week at its West Virginia plant, which is roughly 60,000 pieces per day.

By End Use

The residential segment holds the largest market share of approximately 61% in 2024. Growth is supported by rising urbanization, increasing disposable incomes, and lifestyle shifts favoring home dining experiences. Consumers are investing in stylish, coordinated tableware sets that reflect modern aesthetics and functionality. Online retail expansion and growing awareness of ceramic durability further accelerate residential demand. The commercial segment continues to gain traction through the hospitality sector’s expansion, including hotels, cafés, and catering services emphasizing design consistency and quality presentation.

Key Growth Drivers

Rising Demand for Premium and Aesthetic Tableware

The growing consumer inclination toward elegant, durable, and design-oriented ceramic tableware is a major driver. Urban households and hospitality sectors increasingly favor high-quality products that enhance dining experiences. Rising disposable incomes and the popularity of home décor trends further stimulate demand for luxury and handcrafted ceramic collections. Manufacturers are introducing new designs and glazing technologies to cater to style-conscious consumers, strengthening the premiumization trend in both residential and commercial segments.

- For instance, Villeroy & Boch is now active in around 140 markets worldwide and has approximately 12,000 employees globally, as of its 2024 annual reports and 2025 press releases.

Expansion of the Hospitality and Foodservice Sector

Rapid growth in the hospitality and foodservice industries is fueling market expansion. Restaurants, hotels, and catering businesses are investing in durable, heat-resistant, and visually appealing ceramic tableware to enhance presentation. Global tourism recovery and rising café culture encourage bulk procurement of standardized designs. The increasing focus on aesthetic dining experiences across luxury and mid-tier establishments continues to boost steady demand for ceramic tableware across developed and emerging economies.

- For instance, Steelite manufactures ~500,000 tableware pieces weekly and ships to 140+ countries.

Advancements in Manufacturing and Sustainable Materials

Innovations in ceramic production processes, such as improved kiln technologies and energy-efficient glazing, are key contributors to market growth. Manufacturers are increasingly adopting eco-friendly raw materials and water-saving techniques to align with sustainability goals. The development of lightweight and chip-resistant ceramics enhances usability and lifespan, attracting both consumers and commercial buyers. These technological and environmental advancements improve product quality, cost efficiency, and environmental compliance, driving broader market adoption.

Key Trends & Opportunities

Growth of Online and Omnichannel Retail

The surge in e-commerce platforms is reshaping ceramic tableware distribution. Consumers prefer online shopping due to access to diverse designs, competitive pricing, and home delivery options. Brands are expanding their digital presence through direct-to-consumer models and collaborations with online retailers. Enhanced visualization tools and virtual catalogs support customer engagement, offering opportunities for manufacturers to reach global markets while optimizing inventory and logistics through data-driven insights.

- For instance, Maisons du Monde reported that online sales accounted for 30.9% of its total sales in Q2 2023.

Shift Toward Sustainable and Artisanal Products

Rising environmental awareness is boosting demand for eco-friendly, handmade, and locally sourced ceramic products. Consumers increasingly choose lead-free, recyclable, and ethically produced tableware. Artisanal ceramics, characterized by unique designs and cultural craftsmanship, appeal to niche and premium buyers. This trend encourages small-scale producers and global brands alike to adopt sustainable practices, enhancing their market positioning and brand value in an environmentally conscious marketplace.

- For instance, Denby treats ~20 million litres of process water and recycles 100,000 litres of glaze yearly.

Key Challenges

High Production Costs and Energy Dependence

Ceramic tableware manufacturing requires significant energy for firing and glazing, making production costs sensitive to fuel and electricity price fluctuations. The expense of maintaining quality control and skilled labor also increases overall operational costs. These factors limit profit margins and hinder scalability, particularly for small and medium-sized producers. Manufacturers are exploring renewable energy sources and process optimization to mitigate these challenges and maintain competitiveness.

Competition from Substitute Materials

Alternative materials such as glass, stainless steel, and melamine present strong competition to ceramic products. These substitutes offer durability, lightweight handling, and lower cost, making them attractive to both residential and commercial users. The challenge intensifies as new materials incorporate appealing designs and colors that rival ceramics. To sustain market relevance, ceramic producers focus on product differentiation through design innovation, sustainability credentials, and premium quality assurance.

Regional Analysis

North America

North America holds the largest share of about 34% in the ceramic tableware market in 2024. Growth is supported by high consumer spending on home décor and dining aesthetics. The strong presence of hospitality chains and premium restaurant culture further enhances product adoption. Manufacturers emphasize innovative designs and durable materials to match the region’s preference for luxury and sustainability. The increasing trend of home dining and e-commerce retail channels also boosts sales, particularly in the United States and Canada, where premium ceramic dinnerware enjoys consistent demand across both residential and commercial sectors.

Europe

Europe accounts for nearly 28% share of the ceramic tableware market in 2024, driven by strong cultural ties to fine dining and artisanal craftsmanship. Countries like Germany, France, and the United Kingdom lead with high consumption of premium and designer ceramics. Sustainability-focused consumers increasingly prefer eco-friendly materials and ethically sourced products. The region’s established hospitality and tourism sectors further support market growth. Rising demand for handmade and locally produced tableware continues to strengthen Europe’s position as a key hub for both traditional and modern ceramic innovations.

Asia-Pacific

Asia-Pacific represents around 27% share of the ceramic tableware market in 2024 and is the fastest-growing region. Expanding middle-class income, urbanization, and growth in restaurant culture drive regional demand. China, Japan, and India dominate production and consumption due to strong manufacturing capabilities and local cultural use of ceramics. The rise of e-commerce platforms and affordable product ranges also expand consumer reach. Increasing export opportunities and government support for sustainable manufacturing enhance competitiveness, making Asia-Pacific a critical hub for global ceramic tableware production and innovation.

Latin America

Latin America captures nearly 7% share of the ceramic tableware market in 2024. Market growth is supported by expanding urban populations and growing interest in premium lifestyle products. Brazil and Mexico lead regional consumption due to a rise in middle-income households and hospitality development. Increasing adoption of Western dining trends and the popularity of artisanal designs strengthen regional demand. Local manufacturers focus on cost-effective production while importing advanced ceramic technologies to improve product quality and aesthetic appeal across residential and commercial applications.

Middle East & Africa

The Middle East & Africa hold about 4% share in the ceramic tableware market in 2024. Growth is driven by rapid expansion in the hospitality and tourism industries, especially in the United Arab Emirates and Saudi Arabia. Rising demand for elegant and high-quality dining ware in hotels, restaurants, and luxury homes supports market development. The growing expatriate population and increasing investment in retail and catering sectors further contribute to regional sales. Imported premium brands and growing local ceramic production are enhancing availability across diverse consumer segments.

Market Segmentations:

By Type

- Dinnerware

- Cookware

- Beverageware

- Serve ware

- Others

By Material

- Earth ware

- Stoneware

- Procelain

- Bone China

By End Use

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the ceramic tableware market includes prominent players such as Villeroy & Boch, Denby Pottery Company, Corelle Brands, Rosenthal GmbH, Arabia, Steelite, Portmeirion Group, Royal Doulton, Fiskars Group, Lenox Corporation, Mikasa, Noritake Co., Ltd., Spode, Churchill China PLC, and Royal Worcester. The market is characterized by a blend of global manufacturers and regional producers focusing on design innovation, product quality, and sustainability. Leading companies emphasize durable, aesthetic, and eco-friendly offerings to meet evolving consumer preferences. Continuous investments in automated production, new glazing techniques, and energy-efficient processes support operational efficiency and consistency. The shift toward premium and artisanal collections, coupled with strategic collaborations across retail and hospitality sectors, strengthens market presence. Digital sales channels and customization options are gaining importance as brands expand their reach through e-commerce and omnichannel strategies. The competition remains intense, driven by design differentiation, brand heritage, and sustainability-focused innovation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Villeroy & Boch

- Denby Pottery Company

- Corelle Brands

- Rosenthal GmbH

- Arabia

- Steelite

- Portmeirion Group

- Royal Doulton

- Fiskars Group

- Lenox Corporation

- Mikasa

- Noritake Co., Ltd.

- Spode

- Churchill China PLC

- Royal Worcester

Recent Developments

- In 2025, Spode’s parent company, the Portmeirion Group, announced an increased focus and investment to bring a substantial portion of its ceramic production back to Stoke-on-Trent, UK, over the next 24 months.

- In 2025, Rosenthal GmbH Launched “Rosenthal meets Versace” children’s tableware sets. Designs include Barocco Rose/Blue and Medusa Gala.

- In 2023, Steelite International acquired Diversified Ceramics Corporation, a strategic move aimed at expanding its ovenware and specialty product offerings for the global hospitality sector.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to expand with steady demand from residential and hospitality sectors.

- Growing consumer preference for premium and designer ceramic tableware will boost sales.

- Sustainable and eco-friendly production practices will gain higher importance among manufacturers.

- E-commerce and omnichannel retail platforms will enhance product visibility and accessibility.

- Technological innovations in glazing and lightweight materials will improve product performance.

- Asia-Pacific will strengthen its position as a major production and export hub.

- Customization and limited-edition collections will attract high-end consumers globally.

- Rising urban lifestyles will drive consistent replacement demand for tableware products.

- Partnerships between global brands and local artisans will promote design diversity.

- Increased use of digital marketing and virtual product showcasing will enhance global competitiveness.