Market Overview:

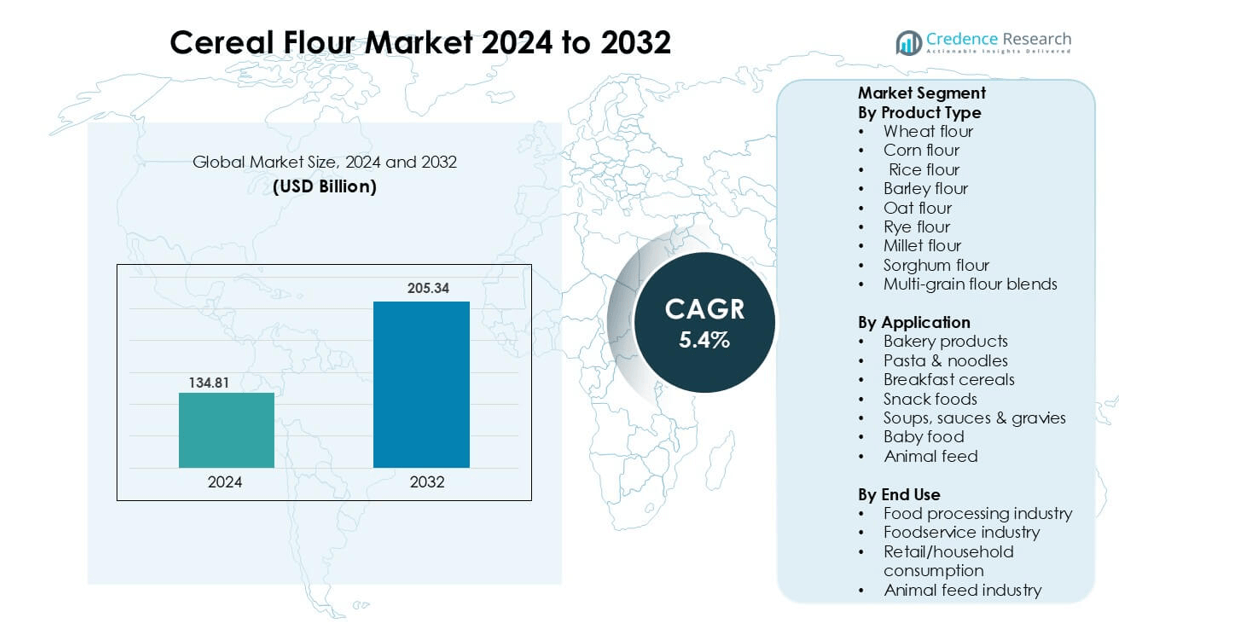

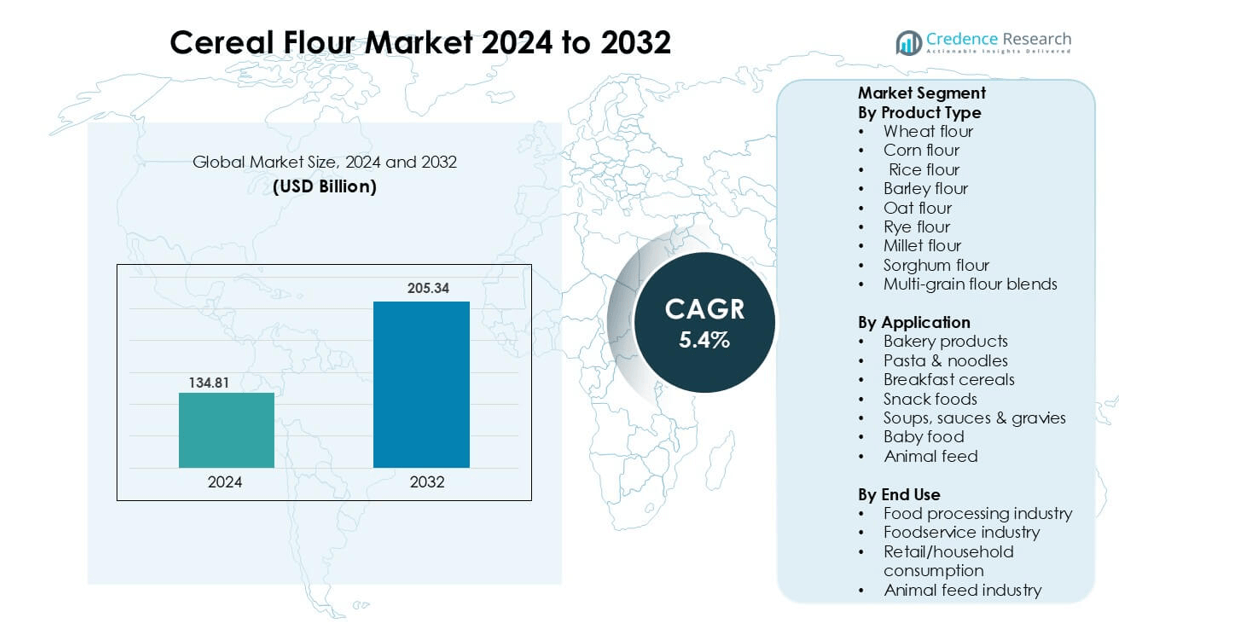

Cereal Flour Market was valued at USD 134.81 billion in 2024 and is anticipated to reach USD 205.34 billion by 2032, growing at a CAGR of 5.4 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cereal Flour Market Size 2024 |

USD 134.81 billion |

| Cereal Flour Market, CAGR |

5.4% |

| Cereal Flour Market Size 2032 |

USD 205.34 billion |

Leading companies in the Cereal Flour Market include Archer Daniels Midland Company, Ardent Mills LLC, Cargill, Bunge Limited, COFCO Corporation, Bob’s Red Mill Natural Foods, Bay State Milling Company, Conagra Brands Inc., Flour Mills of Nigeria Plc, and Associated British Foods plc. large processors dominate bulk supply to packaged food manufacturers and bakeries, while specialty brands focus on organic, gluten-free, and multi-grain blends. Asia-Pacific is the leading regional market with a 36% share, driven by high consumption of noodles, bread, and traditional cereals, supported by strong milling capacity and rising demand for packaged food products.

Market Insights

- The Cereal Flour Market stands at USD 134.81 billion in 2024 and grows at a CAGR of 5.4 % during the forecast period.

- Rising demand for bakery items, noodles, breakfast cereals, and ready mixes drives large-scale flour procurement from food processors and retail brands.

- Multi-grain blends, gluten-free flour, and fortified products gain strong momentum, supported by clean-label, high-fiber, and health-focused consumer trends across urban markets.

- The competitive landscape features Archer Daniels Midland Company, Ardent Mills LLC, Cargill, Bunge Limited, and COFCO Corporation, while Bob’s Red Mill and Bay State Milling strengthen premium and specialty categories.

- Asia-Pacific holds the largest regional share at 36%, while wheat flour leads the product segment with 46% share, supported by strong bakery and packaged food consumption across fast-growing economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Wheat flour leads the product segment with a market share of 46%, driven by high use in bakery, snacks, and household cooking. Wheat supports strong gluten properties, better dough elasticity, and wide consumer acceptance. Corn and rice flour show stable demand in gluten-free snacks and breakfast items, while barley, rye, oats, millet, and sorghum support the healthy-grain category. Multi-grain flour blends are growing due to fiber, protein, and micronutrient benefits, especially in urban retail. Rising clean-label trends and fortified flour products continue to push demand across packaged food brands and private-label manufacturers.

- For instance, Ardent Mills also confirms that it has doubled its organic wheat supply base in the United States by partnering with its grower network, enabling launch of multi‑grain blends with traceability from seed to shelf.

By Application

Bakery products dominate the application segment with 41% share, owing to strong consumption of bread, biscuits, cookies, cakes, and pastries. Flour offers structure, volume, and texture benefits that make bakery production consistent and scalable. Breakfast cereals and pasta & noodles also show firm growth due to higher convenience food intake in urban regions. Snack foods adopt corn, rice, and multi-grain flour for extruded chips, crackers, and ready-to-eat packs. Soups, sauces, gravies, baby food, and animal feed rely on flour for viscosity, binding, and nutritional enrichment, supporting steady industrial demand.

- For instance, First Milling Company in Saudi Arabia reported that its bakery‑flour product extraction rate reached 80% of the wheat grain at one of its modern mills, optimising yield for bread and pastry applications.

By End Use

The food share as dominant end use, driven by large-scale bakery processing industry holds 57% chains, packaged food manufacturers, and cereal processors. Companies demand uniform particle size, longer shelf stability, and safe additive-free flour grades. The foodservice sector also uses bulk flour in bakeries, restaurants, and quick-service outlets. Retail or household consumption continues to rise with increasing home baking and interest in millet, sorghum, and multi-grain blends. The animal feed industry uses barley, sorghum, and corn flour as energy-rich additives. Growing packaged food penetration and higher disposable income support volume expansion across all channels.

Key Growth Drivers

Rising Consumption of Bakery and Convenience Foods

Demand for packaged bakery goods, ready-to-cook mixes, noodles, and breakfast cereals continues to expand, especially in urban markets. Busy lifestyles and the preference for quick meal options support higher use of wheat, corn, rice, and multi-grain flour across commercial bakeries and food processors. Growing café culture, organized retail, and QSR chains fuel flour consumption for breads, pastries, pizzas, and desserts. Many brands also launch instant mixes and ready-to-heat bakery products for at-home preparation. This steady shift toward convenience food keeps large volumes flowing into industrial production lines. Manufacturers focus on consistent quality, refined milling, and extended shelf life to meet bulk procurement standards from food companies.

- For instance, Ardent Mills operates more than 35 community flour mills and bakery-mix facilities in the U.S. and Canada, supplying large QSR chains with consistent high-protein flour that supports dough strength and stability. The company produces a vast number of specialty blends used in burger buns, tortillas, and pizzas. Their dedicated gluten-free facility in Harvey, North Dakota, processes certified gluten-free oat, quinoa, and amaranth flour that support premium bakery products.

Shift Toward Healthy, High-Fiber and Gluten-Free Alternatives

Demand for specialty flour such as oats, sorghum, millet, rice, and barley rises due to growing interest in natural fibers, whole grains, and clean-label ingredients. Health-conscious buyers prefer flour that supports weight management, digestive wellness, and nutrient-rich diets. Gluten-free bakery and snack launches increase adoption of rice and corn flour, while millet and sorghum attract attention for high mineral and protein content. Governments in several regions promote millet-based products through food programs and awareness campaigns, which encourages wider use in cereals, snacks, and school meals. Brands leverage this shift by developing healthier variants of traditional staples, strengthening product portfolios across retail and e-commerce platforms.

- For instance, Bob’s Red Mill introduced its whole‑grain millet flour product—stone‑ground from hulled millet and positioned for gluten‑free baking.

Expansion of Packaged Food Production and Modern Milling Technologies

Large-scale flour mills invest in high-capacity rollers, advanced grain sorting, and fortified formulations to serve industrial buyers. Improved packaging, moisture control, and hygienic milling help maintain freshness, reduce contamination, and extend storage life during long supply cycles. Food manufacturers prefer premium flour grades that offer uniform particle size, stable dough properties, and predictable baking results. Automation and digital monitoring reduce operational losses and enhance product consistency, making bulk production more cost-efficient. Growing exports of packaged flour and ready-mix bakery products also contribute to industry revenue, supported by international demand for ethnic breads, noodles, and convenience meals.

Key Trend and Opportunity

Growth of Multi-Grain Blends and Nutrient-Fortified Products

Health-focused consumers increasingly select flour blends containing oats, barley, millet, sorghum, or rye for digestive benefits, natural fiber, and better micronutrient intake. Bakery brands reformulate recipes using multi-grain mixes to offer healthier bread, cookies, crackers, and breakfast products. Fortification of flour with iron, vitamins, and minerals becomes common in both retail and industrial supply to address nutritional gaps in developing regions. Companies also market ancient grains and heritage cereals to appeal to premium, organic, and wellness-driven segments. The trend supports value-added pricing and product differentiation across supermarkets and specialty food outlets.

- For instance, ITC Limited under its Aashirvaad Nature s Super Foods brand launched Atta with Millets, Ragi Flour and Multi‑Millet Batter Mix to cater to value‑added, health‑oriented segments across staples, biscuits and noodles.

Rising Adoption in Gluten-Free and Plant-Based Foods

Gluten-free diets drive stronger demand for rice, corn, sorghum, and millet flour in bakery, snacks, and ready meals. Food brands expand their range of biscuits, pizza bases, cakes, and pasta made without wheat. Plant-based and vegan product lines use cereal flour for meat analogs, coatings, and texturing blends. Start-ups enter the market with artisan breads and gourmet health snacks using alternative flour sources. Growing awareness of food intolerances and clean-label eating makes this segment attractive for innovation. Higher retail visibility and online sales create opportunities for both established manufacturers and small niche producers.

- For instance, Rani launched a 1.81 kg (4 lbs) gluten‑free flour blend mixing sorghum, amaranth, chick‑peas, millet, soya and rice labelled vegan, non‑GMO and designed for flatbreads indicating niche product entry leveraging alternative flours.

Key Challenge

Price Fluctuations in Raw Grains

Weather changes, crop disease, geopolitical trade restrictions, and poor storage conditions affect wheat, corn, and rice availability. Price instability impacts flour mill margins and leads to cost pressure on food processors. Small mills struggle to compete when grain prices surge, while multinational players rely on long-term sourcing and large procurement contracts. Any disruption in supply pushes retail flour prices higher, which affects household consumption patterns. Import-dependent regions face currency issues and freight costs, creating uneven pricing across markets. These fluctuations make stable production and forecasting difficult for manufacturers.

Quality Consistency and Food Safety Concerns

Maintaining hygienic processing, pure grain sourcing, and controlled moisture levels is essential for safe flour production. Contamination from pesticides, storage insects, and mycotoxins can lead to product recalls and regulatory action. Traditional mills in developing regions may lack advanced cleaning and detection systems, increasing safety risks. Industrial buyers demand strict compliance with food-grade standards, pushing small producers to upgrade facilities or lose contracts. Shelf stability is another challenge, as temperature and humidity influence flour texture and freshness. These factors force manufacturers to invest in better milling equipment, lab testing, and packaging to protect brand reputation and consumer trust.

Regional Analysis

North America

North America holds a market share of 28%, driven by high consumption of bakery goods, packaged snacks, breakfast cereals, and ready-to-cook mixes. Large milling companies supply premium refined flour, gluten-free blends, and fortified variants to food manufacturers and retail chains. Demand for oat, barley, and multi-grain flour is strong due to clean-label and high-fiber preferences. The U.S. dominates regional use, supported by a mature food processing sector and strong exports of wheat-based products. Growing interest in plant-based and gluten-free bakery items continues to boost rice, sorghum, and corn flour across specialty brands and online sales channels.

Europe

Europe accounts for 31% market share, led by milling advancements, artisanal bakery culture, and long-established wheat consumption. The region uses high-quality refined and whole-grain flour for bread, pastries, biscuits, and confectioneries. Germany, Italy, France, and the U.K. drive large-scale industrial demand. Multi-grain products and rye, barley, and oat flour enjoy wide preference due to health-focused regulations and labeling standards. Foodservice outlets, cafés, and packaged bakery producers create consistent procurement for bulk flour. Strong retail presence of organic, fortified, and clean-label flour also helps sustain premium pricing across supermarkets and specialty bakeries.

Asia-Pacific

Asia-Pacific dominates the market with 36% share, supported by high consumption of noodles, bread, snacks, and traditional foods. Wheat flour demand rises with growth in urban bakeries, fast-food chains, and instant noodle producers. India and China lead large-scale production and consumption, backed by strong milling capacity and government food programs. Rice and corn flour supply gluten-free and baby food segments, while millet and sorghum gain popularity for nutritional benefits. Expanding packaged food industries, rising disposable incomes, and modern retail formats make the region a key growth driver for global flour manufacturers.

Latin America

Latin America holds 8% market share, driven by growing use of wheat and corn flour in bakery, snacks, tortillas, and breakfast items. Brazil, Mexico, and Argentina support large milling operations and processed food output. Corn flour shows strong penetration in traditional foods and snack manufacturing. Health-conscious consumers shift toward whole-grain and multi-grain blends, especially in urban supermarkets. Expanding foodservice chains and investment in packaged food brands contribute to higher flour demand. However, fluctuating grain costs and import dependency in some countries affect pricing and supply consistency.

Middle East & Africa

Middle East & Africa account for 7% market share, supported by wheat-based breads, flatbreads, biscuits, and ready mixes. Gulf countries depend on imports for high-quality milling wheat, while local processors add value through fortified flour and bakery premixes. Expanding retail infrastructure, café culture, and consumer shift toward packaged food promote flour demand. Africa sees rising consumption in noodles, baby food, and biscuits, supported by government nutrition programs. However, supply limitations, high logistics costs, and occasional raw grain shortages challenge market stability, creating opportunities for regional milling expansion and local crop development.

Market Segmentations

By Product Type

- Wheat flour

- Corn flour

- Rice flour

- Barley flour

- Oat flour

- Rye flour

- Millet flour

- Sorghum flour

- Multi-grain flour blends

By Application

- Bakery products

- Pasta & noodles

- Breakfast cereals

- Snack foods

- Soups, sauces & gravies

- Baby food

- Animal feed

By End Use

- Food processing industry

- Foodservice industry

- Retail/household consumption

- Animal feed industry

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Cereal Flour Market features a strong mix of multinational grain processors, regional milling companies, and specialty flour brands competing through product quality, geographic reach, and value-added offerings. Major players such as Archer Daniels Midland Company, Ardent Mills LLC, Cargill, Bunge, and COFCO Corporation operate large milling networks and supply bulk quantities to food manufacturers, bakeries, and foodservice chains. These companies focus on high-capacity production, fortified flour blends, and improved grain sourcing to maintain consistent quality. Specialty producers like Bob’s Red Mill and Bay State Milling expand demand for whole-grain, gluten-free, and organic flour targeting health-conscious consumers and premium retail stores. Many companies invest in modern milling, automated packaging, and grain quality testing to meet strict food safety standards. Partnerships with packaged food brands, rising e-commerce distribution, and premium multi-grain blends help increase market penetration and brand visibility across global and regional markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Bob’s Red Mill Natural Foods

- COFCO Corporation

- Conagra Brands, Inc.

- Ardent Mills LLC

- Flour Mills of Nigeria Plc

- Bunge Limited

- Cargill, Incorporated

- Archer Daniels Midland Company

- Bay State Milling Company

- Associated British Foods plc

Recent Developments

- In May 2025, a bulk carrier unloaded 10,600 tons of Canadian durum wheat at a port in Shanghai, purchased by COFCO International, COFCO’s international trading arm.

- In March 2025, Bob’s Red Mill Natural Foods was named to Fast Company’s annual list of the world’s most innovative companies

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for healthy and whole-grain flour continues to rise in global retail.

- Gluten-free and multi-grain blends gain wider acceptance in bakery and snacks.

- Automation in milling and packaging improves product safety and consistency.

- Specialty flour producers expand into premium and organic product ranges.

- Foodservice chains drive higher consumption of refined and ready-mix flour.

- E-commerce strengthens distribution of retail flour and bakery mixes.

- Fortified flour adoption increases due to nutritional awareness campaigns.

- Emerging markets invest in local milling to reduce import dependency.

- Clean-label and additive-free flour becomes a major product focus.

- Demand from baby food, breakfast cereals, and instant meals keeps rising.