Market Overview:

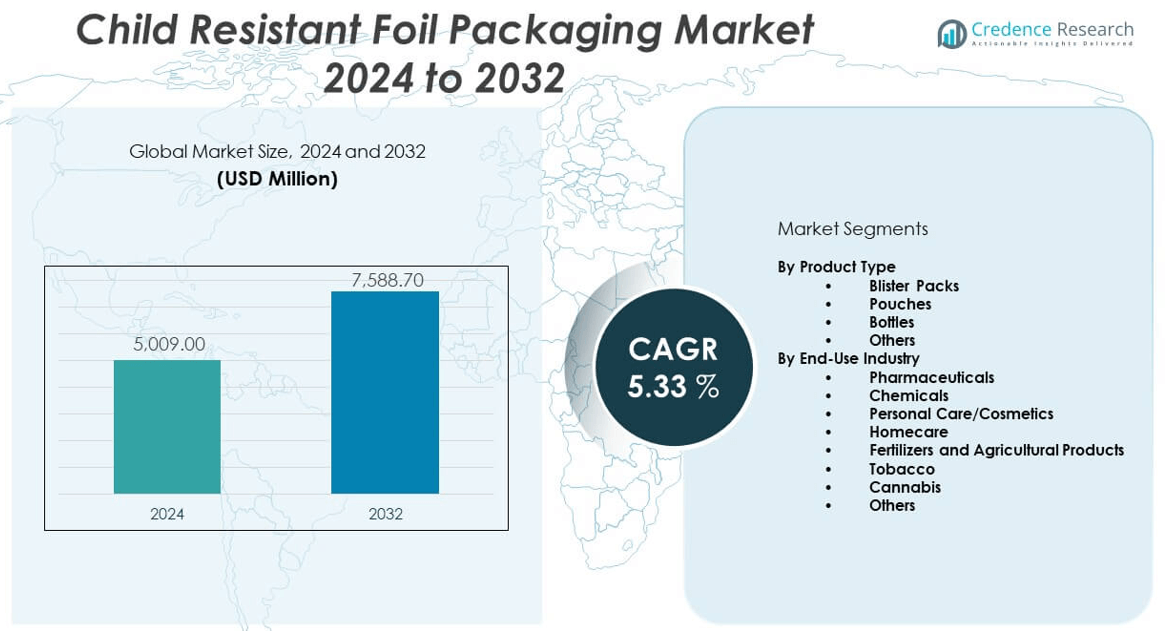

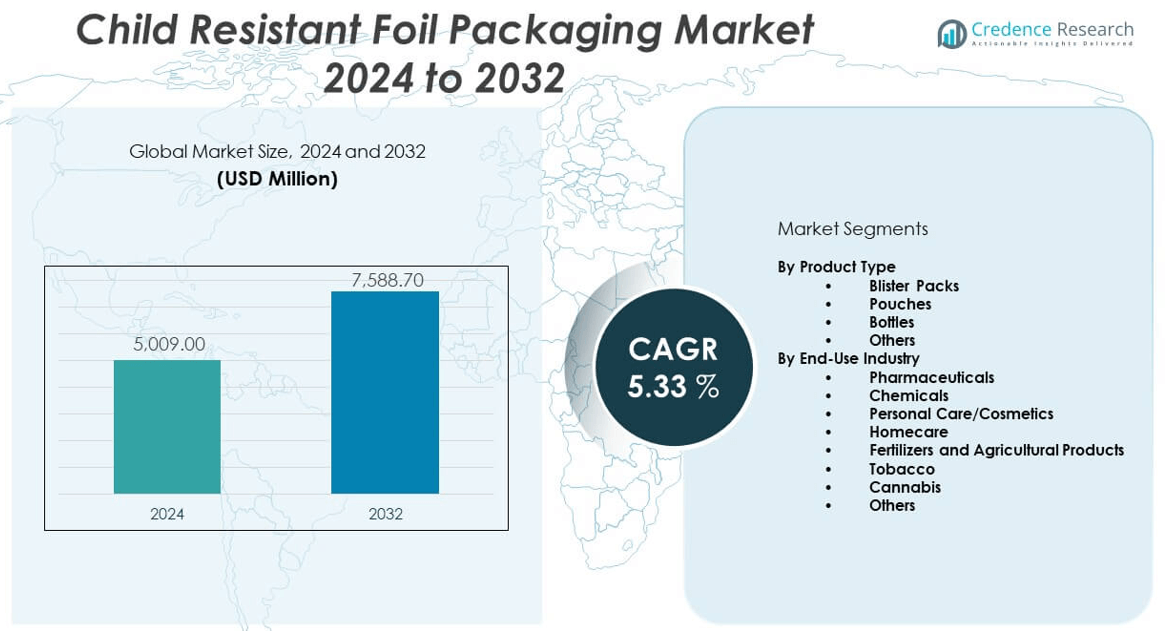

The Child resistant foil packaging market is projected to grow from USD 5,009 million in 2024 to an estimated USD 7,588.7 million by 2032, with a compound annual growth rate (CAGR) of 5.33% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Child Resistant Foil Packaging Market Size 2024 |

USD 5,009 million |

| Child Resistant Foil Packaging Market , CAGR |

5.33% |

| Child Resistant Foil Packaging Market Size 2032 |

USD 7,588.7 million |

This market is expanding due to increasing regulatory requirements for safe pharmaceutical packaging and a heightened focus on preventing accidental ingestion by children. Manufacturers are responding by adopting multilayer laminated foils with advanced barrier properties and tamper-evident features. Rising demand for over-the-counter drugs, medical cannabis, and nutraceuticals further drives the need for packaging that combines child resistance with user-friendly access for adults. Innovations in design and compliance are shaping competitive strategies.

Regionally, North America leads the child resistant foil packaging market due to stringent safety regulations, a large pharmaceutical industry, and high consumer awareness. Europe follows closely, driven by strong compliance frameworks and sustainable packaging initiatives. Meanwhile, Asia Pacific is emerging rapidly, with countries like China and India witnessing growing pharmaceutical production, healthcare reforms, and increased exports. Latin America and the Middle East & Africa show gradual growth, supported by evolving regulatory standards and rising investments in drug safety packaging infrastructure.

Market Insights:

- The Child resistant foil packaging market is projected to grow from USD 5,009 million in 2024 to USD 7,588.7 million by 2032, at a CAGR of 5.33% during the forecast period.

- Regulatory mandates by agencies such as the FDA and EMA are driving demand for certified child-resistant packaging across pharmaceuticals and medical cannabis.

- Rising accidental ingestion incidents at home are pushing manufacturers to innovate tamper-evident and child-safe foil sealing technologies.

- High production costs and material volatility, especially in aluminum and multilayer films, are restraining scalability for smaller packaging players.

- Complex global certification standards slow product development and create hurdles for companies operating across multiple regions.

- North America leads the market due to strict safety regulations and mature pharmaceutical infrastructure, while Europe closely follows.

- Asia Pacific is emerging as a high-growth region, fueled by increasing drug manufacturing, expanding healthcare access, and rising exports.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Stringent global regulations enforcing child-resistant packaging compliance:

Governments around the world continue to impose strict packaging regulations to prevent accidental drug ingestion by children. Regulatory bodies such as the FDA and EMA require pharmaceutical companies to adopt certified child-resistant solutions for prescription and OTC medications. These mandates create sustained demand for tamper-evident foil packaging formats. The Child resistant foil packaging market directly benefits from regulatory enforcement in healthcare and consumer safety. Manufacturers adopt multi-layered barrier materials to align with evolving legal standards. Compliance becomes a key differentiator in packaging procurement and supplier selection. Innovation focuses on ensuring that packaging resists child access while remaining accessible to elderly or disabled users. These developments make regulation one of the strongest market drivers.

- For instance, Amcor plc reports its Formpack® Cold Form Blister is tested and passes the U.S. CPSC protocol for child resistance, and is used in over 400 pharmaceutical packaging applications globally meeting regulatory standards.

Rising demand for pharmaceutical and cannabis products globally:

Pharmaceutical growth, including prescription drugs and over-the-counter medications, fuels demand for protective packaging formats. The Child resistant foil packaging market gains significant momentum from the increasing sales of tablets, capsules, and powders requiring regulated storage. Medical cannabis products in legalized markets require packaging that complies with both child safety and branding requirements. It offers high-barrier protection against moisture, air, and UV exposure, extending product shelf life. Consumers prefer unit-dose formats that use blister packs sealed with child-resistant foil layers. Growing chronic disease prevalence further increases volume in the pharmaceutical supply chain. Packaging companies develop proprietary foil-based sealing technologies for a variety of dosage forms. Consumer confidence in safe packaging supports long-term adoption.

- For instance, Cannabis compliance standards as set by the U.S. Code of Federal Regulations Title 16, Section 1700.15 require all legal cannabis packaging in regulated U.S. states to be certified, as referenced in packaging guides by state governments (e.g., California Department of Cannabis Control).

Increased consumer awareness of accidental ingestion risks at home:

Rising cases of accidental ingestion among children influence purchasing decisions across pharmacies and retail outlets. The Child resistant foil packaging market responds to these concerns by integrating tamper-evident and push-through features into product designs. Parents seek packaging that combines safety with clarity of usage instructions. Brand owners emphasize safety communication through packaging graphics and instructional labelling. It becomes a vital risk mitigation tool for household medical storage. Incidents involving nutraceuticals, vitamins, and OTC analgesics increase demand for single-use child-safe packs. Consumer advocacy groups lobby for broader application of such packaging beyond pharmaceuticals. Public health campaigns further raise awareness, aligning with market growth objectives.

Adoption of unit-dose and on-the-go formats by healthcare providers:

Healthcare systems prefer pre-dosed, hygienic delivery methods for solid and semi-solid medications. The Child resistant foil packaging market benefits from hospitals, nursing homes, and home care providers adopting these formats. Unit-dose packs reduce medication errors and simplify tracking during administration. It aligns with pharmaceutical automation and robotics in production environments. Foil packaging ensures sterility, barrier integrity, and user safety across distribution channels. Portable, easy-to-carry formats find increasing use in personal and travel medicine kits. Demand grows across both branded and generic drug manufacturers serving aging populations. Innovations in thermoforming and cold-forming techniques support design flexibility for complex therapies. Packaging solutions that meet both regulatory and clinical needs gain traction in institutional settings.

Market Trends:

Integration of digital features for authentication and compliance tracking:

Manufacturers embed QR codes, RFID tags, and serialization codes to improve product verification. The Child resistant foil packaging market evolves to include traceable and interactive packaging solutions. It supports pharmaceutical compliance with DSCSA and FMD standards. Digital elements enable patients to verify authenticity and access usage instructions. Supply chain stakeholders monitor movement and storage conditions in real time. Smart packaging reduces the risk of counterfeit drugs entering the market. High-value therapies benefit from increased security during transit. These advancements transform foil packaging into a connected, data-driven platform.

- For instance, Constantia Flexibles’ digital printing technology supports over 1 billion uniquely serialized, digitally coded drug packages annually for pharmaceutical traceability and anti-counterfeiting, compliant with the Falsified Medicines Directive

Rising demand for sustainable and recyclable foil materials:

Sustainability shapes investment in aluminum-based and recyclable multilayer films. The Child resistant foil packaging market shifts toward low-impact production and end-of-life recovery. It responds to growing consumer and regulatory demand for environmentally responsible packaging. Leading manufacturers replace PVC layers with bio-based or recyclable barrier coatings. Waste reduction goals in pharma drive interest in mono-material foil systems. Brands communicate sustainability credentials on primary and secondary packaging. Eco-conscious buyers prioritize products with minimal environmental impact. Manufacturers highlight recyclability without compromising child safety or barrier performance. This trend fosters innovation in material science.

- For instance, Amcor’s 2023 sustainability report confirms that 67% of its pharmaceutical packaging portfolio is now designed to be recyclable or reusable, and the company targets full portfolio recyclability by 2025.

Expansion of e-commerce drug distribution and at-home therapies:

Online pharmacies and home-based treatment plans accelerate demand for secure packaging. The Child resistant foil packaging market adapts to distribution models requiring tamper-proof and durable formats. It supports longer transit times and exposure to varied temperatures and handling. E-commerce channels require protective packaging that maintains brand presentation and dosage clarity. Blister packs with foil sealing remain dominant in direct-to-consumer shipments. At-home infusion therapies and specialty care kits rely on packaging that ensures child resistance and user convenience. Packaging must also meet labelling and instruction readability standards for remote use. Growth in mail-order prescriptions sustains this trend.

Design innovation in senior-friendly child-resistant mechanisms:

Packaging engineers design formats that balance security with ease of access for seniors. The Child resistant foil packaging market incorporates ergonomic features that aid those with limited dexterity. It enables single-handed opening while maintaining required resistance levels. New standards assess both adult accessibility and child safety simultaneously. Pharmaceutical companies adopt foil structures with scored or pressure-sensitive layers. Market feedback leads to testing protocols that reflect real-life usage conditions. User-centered design becomes a priority in regulatory approvals and brand development. Improved user experience increases product adherence and reduces misuse. Innovation focuses on enabling safe independence for aging populations.

Market Challenges Analysis:

Complex regulatory landscape slows product development and innovation:

The Child resistant foil packaging market faces hurdles due to evolving, region-specific regulatory compliance. Global players must navigate distinct certification protocols across the U.S., EU, and Asia-Pacific. Designing packaging that meets multiple regional standards delays product launches and increases testing costs. Frequent updates to child resistance performance testing guidelines require continuous investment. It must balance strict regulatory performance with cost-efficient design. Smaller manufacturers struggle with compliance documentation and third-party validation. Regulatory uncertainty discourages risk-taking in novel materials or structural designs. Delays in approval reduce speed to market and impact profitability across packaging portfolios.

High production costs and material sourcing limitations restrict scalability:

Foil-based packaging materials require specialized conversion processes and advanced equipment. The Child resistant foil packaging market experiences cost pressures due to raw material volatility, especially in aluminum. Limited availability of recyclable or sustainable multilayer films inflates sourcing costs. It demands precise lamination and sealing technologies that elevate capital investment. Manufacturers must train operators and maintain high-speed machinery, increasing overhead. Complex blister pack geometries reduce production throughput and elevate waste rates. Smaller batches for clinical trials or niche therapies lack economies of scale. These factors challenge price competitiveness and reduce adoption among cost-sensitive players.

Market Opportunities:

Growing demand for safe pediatric and geriatric drug packaging formats:

Population aging and increased pediatric medication usage open significant new revenue channels. The Child resistant foil packaging market can expand by offering solutions tailored to vulnerable patient groups. It supports pediatric-friendly unit-dose packs that simplify administration while ensuring safety. Geriatric-friendly formats promote adherence and reduce errors. Pharmaceutical brands can differentiate through accessible, inclusive packaging designs. Long-term care facilities, clinics, and home health providers represent growing buyers. Customized solutions help capture niche therapeutic segments. This opportunity supports volume growth and product line diversification.

Emergence of regional pharmaceutical hubs in developing economies:

Countries like India, Brazil, and Indonesia are building pharmaceutical infrastructure to serve global markets. The Child resistant foil packaging market can penetrate these regions by aligning with local compliance and production capabilities. Packaging providers can establish regional plants to serve fast-growing domestic drug markets. Partnerships with generic drug manufacturers enable high-volume contract packaging services. Localized production reduces shipping costs and lead times. It allows flexible customization for regional needs while meeting export regulations. This opens strong potential for geographic expansion.

Market Segmentation Analysis:

By Product Type

The Child resistant foil packaging market is led by blister packs, which remain the most widely used format, especially in pharmaceuticals. Their unit-dose structure, high-barrier protection, and tamper-evident features make them ideal for regulated drugs. Pouches are expanding in use across cannabis, personal care, and chemical applications due to their resealability and design flexibility. Bottles equipped with foil induction seals provide secure closures for liquids and are common in homecare and pharma products. Others, such as specialized cartons and advanced closure systems, address niche needs in sectors that require tailored child resistance mechanisms.

- For instance, Berry Global’s CR closures are compatible with at least 500 unique bottle formats, including pharma and cannabis bottles in North America and Europe.

By End-Use Industry

Pharmaceuticals dominate the Child resistant foil packaging market, driven by stringent regulatory demands and the need for dosage security. Chemicals benefit from child-safe packaging that minimizes exposure risks in both industrial and domestic environments. Personal care and cosmetics adopt foil solutions for products with active ingredients that require controlled access. Homecare items, such as disinfectants and detergents, depend on sealed packaging to ensure child safety. Fertilizers and agricultural products utilize foil closures to prevent accidental misuse during storage and application. Tobacco and cannabis, both sensitive and increasingly regulated sectors, demand certified child-resistant formats. Others, including wellness, pet care, and dietary supplements, further diversify demand for secure, tamper-evident foil packaging.

- For instance, Glenroy supports 80+ client projects annually in the homecare, pet care, and personal care sectors using foil-based CR pouches, as per their 2023 project portfolio highlights.

Segmentation:

By Product Type

- Blister Packs

- Pouches

- Bottles

- Others (e.g., specialized cartons or closure systems)

By End-Use Industry

- Pharmaceuticals

- Chemicals

- Personal Care/Cosmetics

- Homecare

- Fertilizers and Agricultural Products

- Tobacco

- Cannabis

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Dominates Due to Strong Regulations and Mature Pharmaceutical Sector

North America holds the largest share of the Child resistant foil packaging market, accounting for approximately 34% of the global revenue in 2024. Strict regulations from the U.S. Consumer Product Safety Commission (CPSC) and the FDA require pharmaceutical and cannabis packaging to meet rigorous child-resistant standards. High awareness among consumers and widespread use of over-the-counter medications contribute to strong demand. The region benefits from a well-established pharmaceutical industry and a growing medical cannabis sector, both of which require compliant packaging solutions. Packaging providers in the U.S. and Canada invest in innovation, focusing on tamper-evident and senior-friendly formats. It remains a high-value, compliance-driven market with consistent regulatory oversight.

Europe Benefits from Compliance-Driven Growth and Sustainability Focus

Europe contributes around 28% of the Child resistant foil packaging market, driven by regulatory bodies such as the European Medicines Agency (EMA) and widespread pharmaceutical exports. The region emphasizes sustainability in packaging, prompting manufacturers to use recyclable and non-toxic foil materials without compromising safety. Germany, France, and the U.K. lead the market due to their strong healthcare systems and extensive drug distribution networks. Demand continues to grow for high-barrier, unit-dose packaging formats that meet both EU safety and environmental criteria. Companies adopt circular economy models and invest in compliance-friendly design technologies. It maintains growth by balancing consumer safety, sustainability, and regulatory alignment.

Asia Pacific Emerges as a Fast-Growing Manufacturing and Export Hub

Asia Pacific holds approximately 23% of the global Child resistant foil packaging market and shows the fastest growth trajectory. China and India drive regional momentum through expanding pharmaceutical production, increasing healthcare access, and rising exports to regulated markets. Local packaging manufacturers adopt international safety standards to serve both domestic and global clients. Japan, South Korea, and Southeast Asian nations also invest in protective packaging to meet aging population needs. The rise of generic drug manufacturing and contract packaging services supports market expansion. It offers long-term potential due to cost advantages, regulatory evolution, and growing institutional demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Amcor plc

- Berry Global

- Winpak

- Mondi Group

- Constantia Flexibles

- Bilcare Limited

- WestRock Company

- Sonoco Products Company

- Oliver Healthcare Packaging

- Svam Packaging Industries Pvt Ltd

- Glenroy

- PAXXUS

- Printpack

- CCL Industries

- Tekni-Plex

- ProAmpac LLC

- Others

Competitive Analysis:

The Child resistant foil packaging market features strong competition among global and regional players focused on innovation, regulatory compliance, and material sustainability. Key companies such as Amcor, Berry Global, Mondi Group, and Constantia Flexibles invest heavily in developing multi-layered barrier foils with certified child-resistant properties. These firms maintain leadership by offering customized solutions to pharmaceutical, cannabis, and chemical industries. Mid-sized players like Glenroy, Svam Packaging, and PAXXUS compete through specialized designs and agile manufacturing. It emphasizes partnerships with healthcare brands and compliance with evolving safety standards. Product differentiation, patent portfolios, and adherence to regional certifications remain vital to competitive positioning.

Recent Developments:

- In July 2025, Amcor plc launched the Hector Child Resistant Closure, an ultra-lightweight, eco-friendly closure made for household and cleaning product packaging. This polypropylene closure merges sustainability with robust child-resistance and is designed for compatibility with PET and HDPE bottles, offering brands significant material and CO2 savings while maintaining industry-leading safety features.

- In March 2023, Berry Global introduced the Berry Digi-Cap™, a child-resistant pharmaceutical closure with integrated digital technology. The Digi-Cap includes a microprocessor that records patient access and tracks storage conditions, supporting both medication adherence and regulatory research requirements. The closure is compatible with standard pharmaceutical bottles and can transmit data to healthcare systems for improved patient safety and compliance.

Market Concentration & Characteristics:

The Child resistant foil packaging market is moderately concentrated, with leading players holding significant global shares due to technological capabilities, regulatory certifications, and supply chain reach. It displays high entry barriers driven by material science complexity, compliance mandates, and certification costs. Large players dominate regulated sectors like pharmaceuticals and cannabis, while regional firms serve niche or local markets. Product innovation, cost efficiency, and speed-to-market define success in this compliance-driven industry.

Report Coverage:

The research report offers an in-depth analysis based on Product Type and End-Use Industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand will grow steadily due to rising pharmaceutical and over-the-counter drug usage across global markets.

- Regulatory agencies will continue tightening packaging safety standards, especially for child protection compliance.

- Technological innovations will drive adoption of recyclable, high-barrier foil laminates with certified resistance.

- Medical cannabis legalization will expand the need for tamper-proof and odor-resistant child-safe packaging.

- E-commerce distribution of drugs and personal care products will push demand for durable, secure foil formats.

- Growth in unit-dose formats and on-the-go packaging will increase the use of blister and pouch solutions.

- Asia Pacific will emerge as a manufacturing hub for export-oriented pharmaceutical packaging.

- Sustainability concerns will shift focus toward low-impact foil combinations and mono-material systems.

- Healthcare access expansion in emerging economies will drive localized demand for compliant packaging.

- Industry players will focus on ergonomic designs that combine child resistance with senior accessibility.