Market Overview

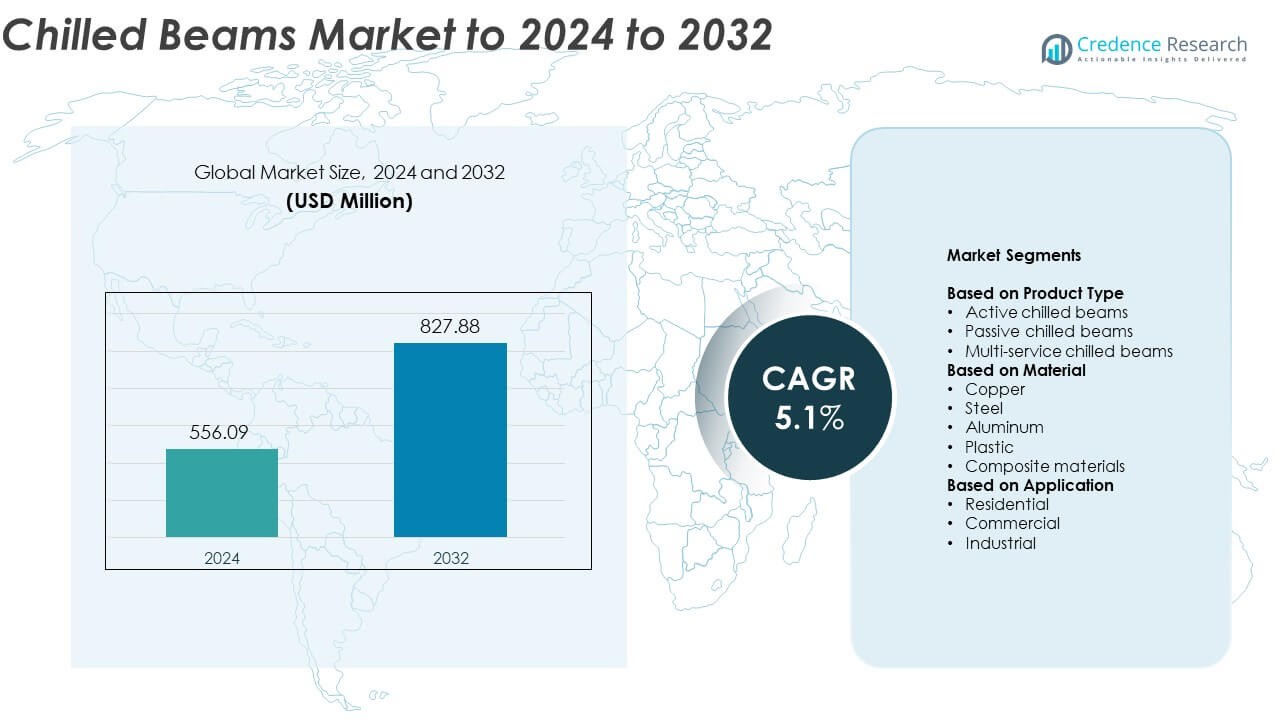

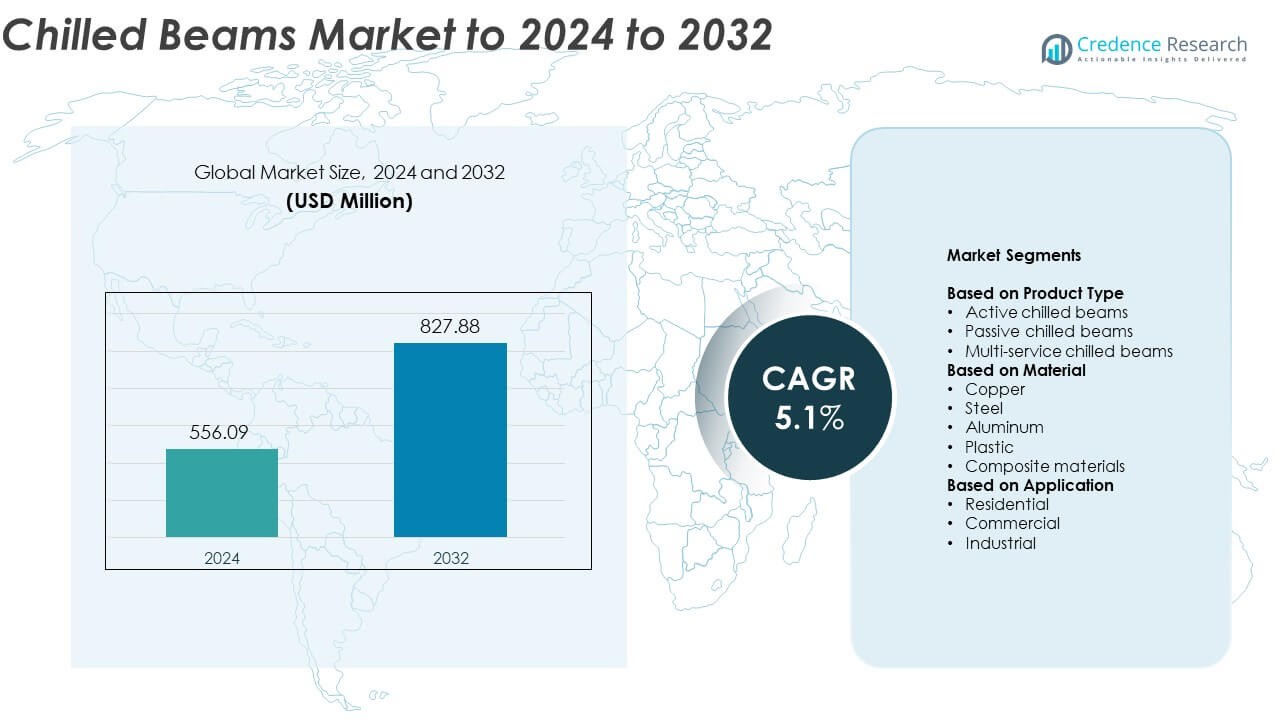

Chilled Beams market size was valued at USD 556.09 million in 2024 and is anticipated to reach USD 827.88 million by 2032, at a CAGR of 5.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chilled Beams Market Size 2024 |

USD 556.09 Million |

| Chilled Beams Market, CAGR |

5.1% |

| Chilled Beams Market Size 2032 |

USD 827.88 Million |

The chilled beams market is led by key players such as Johnson Controls International Plc, FlaktGroup, Halton Group, Caverion Corporation, Barcol Air Group AG, Emco Bau- und Klimatechnik GmbH & Co. KG, Aermec, FTF Group, and Dadanco Europe. These companies compete through advanced energy-efficient solutions, modular system designs, and smart integration technologies. North America remains the leading region with around 37% market share in 2024, supported by strong adoption across commercial and institutional buildings. Europe follows closely with about 33% share, driven by sustainability-focused construction and stringent energy efficiency standards across major economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The chilled beams market was valued at USD 556.09 million in 2024 and is projected to reach USD 827.88 million by 2032, growing at a CAGR of 5.1% during the forecast period.

- Rising demand for energy-efficient HVAC systems in commercial and institutional buildings is a major driver, supported by government initiatives promoting sustainable construction.

- Smart building integration, modular beam designs, and the use of recyclable materials represent key trends enhancing adoption across modern infrastructure projects.

- The market remains competitive, with leading manufacturers focusing on R&D, product innovation, and strategic partnerships to expand global presence and improve operational efficiency.

- North America leads with 37% share in 2024, followed by Europe at 33% and Asia Pacific at 21%, while the active chilled beams segment dominates with 58% share, driven by superior energy performance and lower maintenance requirements.

Market Segmentation Analysis:

By Product Type

The active chilled beams segment dominates the market, accounting for nearly 58% share in 2024. Their leadership is driven by high energy efficiency, superior thermal comfort, and reduced operational noise compared to conventional HVAC systems. Active chilled beams integrate air supply with chilled water systems, making them suitable for large commercial and institutional spaces. Their growing use in offices, hospitals, and educational buildings reflects the rising demand for energy-saving and low-maintenance cooling solutions that meet modern indoor air quality standards and sustainability targets.

- For instance, Carrier’s 36CBAL active beams handle 8–180 cfm at 0.2–0.8 in. wg.

By Material

Copper leads the chilled beams market with approximately 46% share in 2024. The dominance of copper stems from its superior thermal conductivity, corrosion resistance, and reliability in heat exchange systems. Manufacturers prefer copper tubing for its efficiency in transferring cooling energy and maintaining system longevity. The ongoing focus on sustainable and durable materials in HVAC applications continues to drive copper adoption, while aluminum and composite materials are gaining steady traction for their lightweight and cost-effective characteristics in modern building projects.

- For instance, Wieland lists the thermal conductivity for some of its pure copper materials (such as Wieland-K08 and Wieland-K30) as greater than 394 W/m·K.

By Application

The commercial segment holds the largest share of around 63% in 2024. Growth in this segment is supported by increasing installation of chilled beam systems in office complexes, airports, hospitals, and educational institutions. The need for energy-efficient and low-noise cooling technologies in green-certified buildings strengthens adoption. Rising investments in smart infrastructure and compliance with energy efficiency regulations in developed economies further enhance market growth, as chilled beams offer reduced carbon footprints and improved occupant comfort compared to traditional air-conditioning systems.

Key Growth Drivers

Rising Demand for Energy-Efficient Cooling Solutions

The growing emphasis on energy conservation across commercial and institutional sectors is a key driver for chilled beam adoption. These systems use water-based cooling, which consumes less energy than traditional air-based HVAC systems. Increasing regulatory pressure to reduce carbon emissions and enhance building energy performance is accelerating installations in modern office complexes and healthcare facilities. Developers are favoring chilled beams for their operational efficiency and ability to meet sustainability certifications such as LEED and BREEAM.

- For instance, TROX DID 632 beams deliver cooling capacity up to 2,450 W with 6–85 l/s primary air.

Expansion of Smart and Green Building Projects

Rapid expansion of green and smart building infrastructure globally is driving chilled beam demand. Modern construction projects prioritize energy efficiency, thermal comfort, and flexible space utilization, aligning with the benefits of chilled beam systems. Governments and developers are investing heavily in sustainable infrastructure supported by digital building management systems. Integration with intelligent HVAC controls enables automated temperature regulation, further improving operational efficiency and indoor air quality, which strengthens adoption across both new and retrofit projects.

- For instance, the Swegon WISE Parasol Zenith comfort module does offer a variable airflow range, according to technical data sheets from Swegon, the maximum heating output can exceed 2,700 W, with specific models having different heating capacities depending on their size and operating conditions.

Growing Adoption in Healthcare and Educational Facilities

The healthcare and education sectors are increasingly adopting chilled beams due to their quiet operation, consistent air distribution, and low maintenance requirements. Hospitals and universities are emphasizing better air quality and comfort for occupants, making these systems ideal for controlled environments. Their ability to minimize airborne contaminants by reducing air recirculation enhances indoor hygiene. Rising construction of healthcare infrastructure and institutional buildings worldwide is fueling this segment’s contribution to the overall market growth.

Key Trends & Opportunities

Integration with Smart Building Automation Systems

The integration of chilled beams with advanced building automation and IoT-based monitoring systems represents a major trend. These technologies allow remote temperature control, predictive maintenance, and real-time energy optimization. Facility managers are adopting these solutions to improve operational efficiency and reduce downtime. This trend aligns with the global shift toward connected, data-driven infrastructure that enhances comfort while reducing energy and maintenance costs in large commercial buildings.

- For instance, Lindab Pascal beams support 0–100% variable airflow and expose Modbus points for actual l/s, CO₂, and damper position.

Sustainable Material Innovation and Modular Design

Manufacturers are focusing on sustainable materials such as recyclable metals and lightweight composites for chilled beam construction. Modular and prefabricated designs are gaining traction, enabling faster installation and reduced labor costs. These innovations support large-scale green building initiatives while addressing lifecycle sustainability goals. The trend also opens opportunities for customized beam configurations suited for hybrid HVAC systems, creating new avenues for growth in both developed and emerging markets.

- For instance, SAS International supplied 2,850 m² of integrated service modules with passive chilled beams at Wakefield One.

Key Challenges

High Initial Installation and Retrofit Costs

One of the major challenges in the chilled beams market is the high upfront installation and integration cost. The need for specialized piping systems, ceiling space, and compatibility with building designs increases capital expenditure. Retrofitting existing HVAC systems with chilled beams can be complex and expensive, especially in older infrastructures lacking suitable water distribution layouts. These cost barriers limit adoption in small and mid-scale projects, particularly in price-sensitive regions.

Limited Cooling Capacity in Humid Environments

Chilled beams face operational limitations in regions with high humidity levels. Excess moisture can cause condensation, reducing system efficiency and comfort. To counter this, additional dehumidification equipment is often required, raising operational costs and complexity. Such challenges restrict the system’s suitability in tropical or poorly ventilated buildings. Manufacturers are developing humidity control solutions, yet the need for auxiliary systems remains a concern for widespread adoption in certain climates.

Regional Analysis

North America

North America dominates the chilled beams market with around 37% share in 2024. The region’s leadership is supported by strong adoption in commercial and institutional buildings, especially in the United States and Canada. Increasing focus on green building certifications and energy-efficient cooling technologies drives demand. The presence of advanced HVAC manufacturers and strict energy regulations further enhance market growth. Widespread use in office complexes, hospitals, and universities highlights a steady shift toward sustainable and low-maintenance climate control solutions.

Europe

Europe holds approximately 33% share of the chilled beams market in 2024, driven by early technology adoption and strong environmental policies. Countries such as Germany, the United Kingdom, and the Nordic nations lead installations due to their commitment to carbon reduction and smart building construction. The region’s mature commercial real estate sector and emphasis on thermal comfort in public infrastructure projects support consistent demand. Manufacturers are expanding offerings with advanced beam systems integrated with building automation and renewable energy technologies.

Asia Pacific

Asia Pacific accounts for nearly 21% share of the global chilled beams market in 2024. The region’s growth is fueled by rapid urbanization, commercial construction, and increasing awareness of energy efficiency in emerging economies like China, India, and Japan. Rising investments in smart cities and sustainable infrastructure projects are boosting adoption. The expanding corporate and healthcare sectors in major urban centers continue to generate strong demand. Technological advancements and growing collaborations between local developers and global HVAC companies enhance market penetration.

Latin America

Latin America captures about 6% share of the chilled beams market in 2024. Market expansion is supported by improving commercial infrastructure and the growing focus on sustainable cooling technologies in countries such as Brazil, Mexico, and Chile. Increasing awareness of energy efficiency and environmental benefits encourages gradual adoption. However, higher installation costs and limited technical expertise in some areas slightly restrain market acceleration. Efforts to modernize public and corporate buildings are expected to support steady growth over the forecast period.

Middle East & Africa

The Middle East & Africa region holds nearly 3% share in 2024, reflecting early but rising adoption levels. Demand is gradually increasing in high-end commercial buildings, hotels, and institutional projects within the Gulf Cooperation Council countries. Harsh climatic conditions are encouraging developers to invest in energy-efficient cooling alternatives. Governments promoting sustainable construction and LEED-certified projects contribute to market opportunities. However, high initial installation costs and humidity challenges in certain regions limit large-scale deployment, keeping adoption rates moderate.

Market Segmentations:

By Product Type

- Active chilled beams

- Passive chilled beams

- Multi-service chilled beams

By Material

- Copper

- Steel

- Aluminum

- Plastic

- Composite materials

By Application

- Residential

- Commercial

- Industrial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The chilled beams market features several established players, including Johnson Controls International Plc, FlaktGroup, Halton Group, Caverion Corporation, Barcol Air Group AG, Emco Bau- und Klimatechnik GmbH & Co. KG, Aermec, FTF Group, and Dadanco Europe. The competitive landscape is characterized by strong emphasis on energy efficiency, product customization, and sustainable HVAC technologies. Companies are expanding their portfolios with advanced beam designs that integrate smart controls, modular structures, and improved thermal performance. Strategic collaborations with construction firms and building automation providers are enhancing market presence. Continuous innovation in low-noise and high-efficiency cooling systems is enabling participants to address diverse climate requirements. Additionally, rising investments in R&D and participation in green building projects are strengthening brand positioning. Regional expansion, coupled with focus on retrofit-friendly designs, is expected to shape future competition, as manufacturers aim to align with global sustainability and energy-saving goals.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Johnson Controls International Plc

- FlaktGroup

- Halton Group

- Caverion Corporation

- Barcol Air Group AG

- Emco Bau- und Klimatechnik GmbH & Co. KG

- Aermec

- FTF Group

- Dadanco Europe

Recent Developments

- In 2025, Caverion Corporation involved in providing heating and cooling systems to the expansion of the German Federal Chancellery in Berlin, a 57,000 m² building with multiple facilities, showcasing their capabilities in large-scale, sustainable HVAC integration using chilled beam systems.

- In 2025, FläktGroup launched the Nova II IQFI active chilled beam system, designed for ventilation, cooling, and heating in exposed applications such as entryways and atriums.

- In 2023, Aermec introduced its new active chilled beam technology, called the EHT hybrid induction terminal, to improve indoor air quality and energy efficiency in commercial buildings.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Increasing demand for energy-efficient cooling systems will continue to drive market expansion.

- Integration with smart building management systems will enhance operational performance and control.

- Adoption in green-certified and sustainable infrastructure projects will strengthen across major economies.

- Manufacturers will focus on lightweight, modular, and recyclable material innovations.

- Retrofitting of existing commercial buildings with chilled beams will gain steady traction.

- Rising healthcare and educational infrastructure development will boost system installations.

- Asia Pacific will emerge as the fastest-growing regional market through expanding urban projects.

- Hybrid HVAC designs combining chilled beams and ventilation systems will see wider acceptance.

- Increasing awareness of low-noise and comfort-driven cooling will enhance user preference.

- Government incentives promoting energy efficiency will create favorable growth opportunities globally.