CHAPTER NO. 1 : INTRODUCTION 20

1.1.1. Report Description 20

Purpose of the Report 20

USP & Key Offerings 20

1.1.2. Key Benefits for Stakeholders 20

1.1.3. Target Audience 21

1.1.4. Report Scope 21

CHAPTER NO. 2 : EXECUTIVE SUMMARY 22

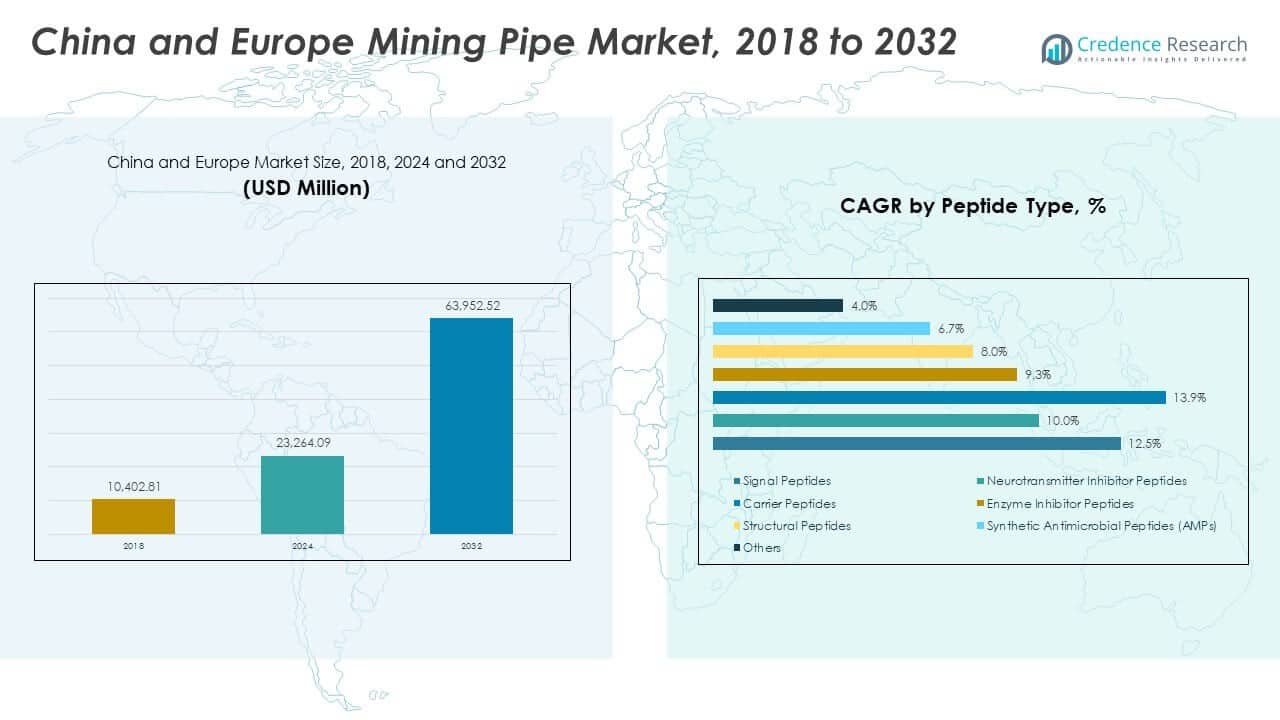

2.1. Peptide Market Snapshot 22

2.1.1. China and Europe Peptide Market, 2018 – 2032 (Metric Tons) (USD Million) 24

2.2. Insights from Primary Respondents 24

CHAPTER NO. 3 : PEPTIDE MARKET – INDUSTRY ANALYSIS 25

3.1. Introduction 25

3.2. Market Drivers 26

3.2.1. Rising demand for high-performance actives & anti-aging solutions 26

3.2.2. Biotechnology and synthesis advancements 27

3.3. Market Restraints 28

3.3.1. High‐cost production & scalability issues 28

3.4. Market Opportunities 29

3.4.1. Market Opportunity Analysis 29

3.5. Porter’s Five Forces Analysis 30

3.6. Value Chain Analysis 31

3.7. Buying Criteria 32

CHAPTER NO. 4 : PRICE ANALYSIS 33

4.1. Price Analysis by Region 33

4.1.1. China and Europe Peptide Market Price, By Region, 2018 – 2023 33

4.1.2. China and Europe Peptide Type Market Price, By Region, 2018 – 2023 33

4.2. Price Analysis by Peptide Type 34

4.2.1. China and Europe Peptide Market Price, By Peptide Type, 2018 – 2023 34

4.2.2. China and Europe Peptide Type Market Price, By Peptide Type, 2018 – 2023 34

CHAPTER NO. 5 : ANALYSIS COMPETITIVE LANDSCAPE 35

5.1. Company Market Share Analysis – 2023 35

5.1.1. China and Europe Peptide Market: Company Market Share, by Volume, 2023 35

5.1.2. China and Europe Peptide Market: Company Market Share, by Revenue, 2023 36

5.1.3. China and Europe Peptide Market: Top 6 Company Market Share, by Revenue, 2023 36

5.1.4. China and Europe Peptide Market: Top 3 Company Market Share, by Revenue, 2023 37

5.2. China Peptide Market Company Volume Market Share, 2023 38

5.3. China Peptide Market Company Revenue Market Share, 2023 39

5.4. Europe Peptide Market Company Volume Market Share, 2023 40

5.5. Europe Peptide Market Company Revenue Market Share, 2023 41

5.6. Company Assessment Metrics, 2023 42

5.6.1. Stars 42

5.6.2. Emerging Leaders 42

5.6.3. Pervasive Players 42

5.6.4. Participants 42

5.7. Start-ups /SMEs Assessment Metrics, 2023 42

5.7.1. Progressive Companies 42

5.7.2. Responsive Companies 42

5.7.3. Dynamic Companies 42

5.7.4. Starting Blocks 42

5.8. Strategic Developments 43

5.8.1. Acquisitions & Mergers 43

New Product Launch 43

Regional Expansion 43

5.9. Key Players Product Matrix 44

CHAPTER NO. 6 : PESTEL & ADJACENT MARKET ANALYSIS 45

6.1. PESTEL 45

6.1.1. Political Factors 45

6.1.2. Economic Factors 45

6.1.3. Social Factors 45

6.1.4. Technological Factors 45

6.1.5. Environmental Factors 45

6.1.6. Legal Factors 45

6.2. Adjacent Market Analysis 45

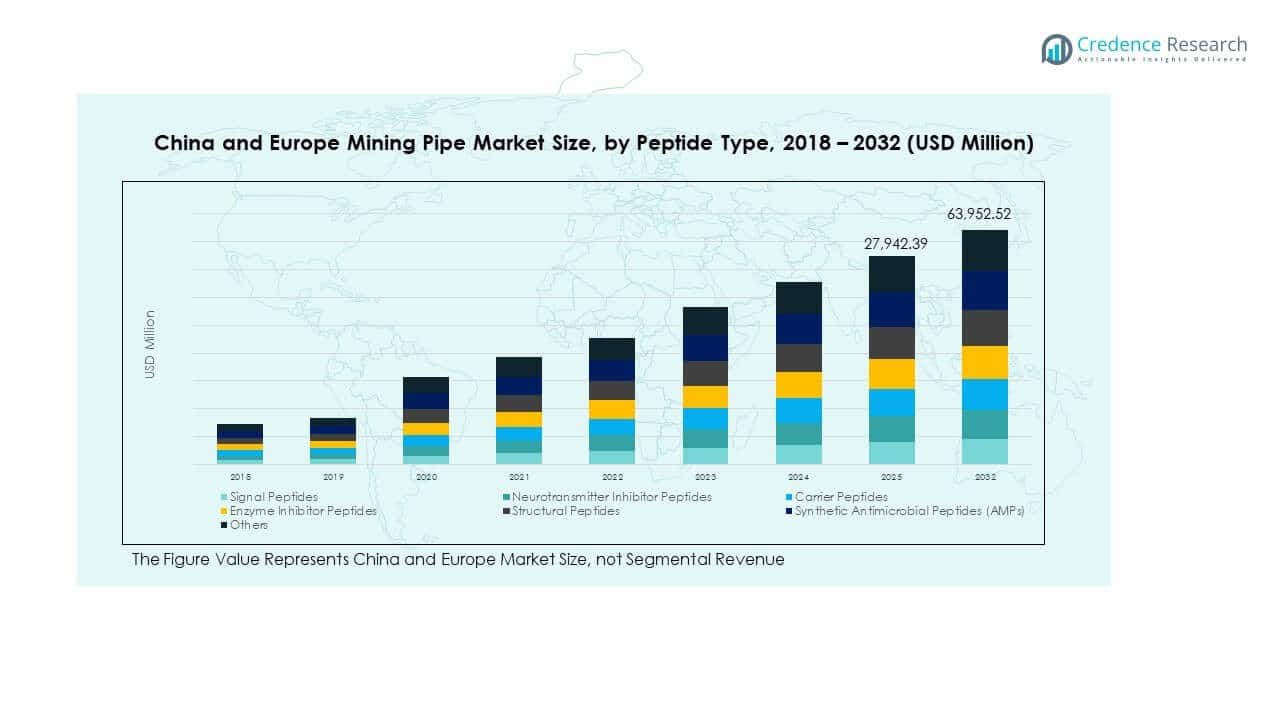

CHAPTER NO. 7 : PEPTIDE MARKET – BY PEPTIDE TYPE SEGMENT ANALYSIS 46

7.1. Peptide Market Overview, by Peptide Type Segment 46

7.1.1. Peptide Market Volume Share, By Peptide Type, 2023 & 2032 47

7.1.2. Peptide Market Revenue Share, By Peptide Type, 2023 & 2032 47

7.1.3. Peptide Market Attractiveness Analysis, By Peptide Type 48

7.1.4. Incremental Revenue Growth Opportunity, by Peptide Type, 2024 – 2032 48

7.1.5. Peptide Market Revenue, By Peptide Type, 2018, 2023, 2027 & 2032 49

7.2. Signal Peptides 50

7.3. Neurotransmitter Inhibitor Peptides 51

7.4. Carrier Peptides 52

7.5. Enzyme Inhibitor Peptides 53

7.6. Structural Peptides 54

7.7. Synthetic Antimicrobial Peptides (AMPs) 55

7.8. Others 56

CHAPTER NO. 8 : PEPTIDE MARKET – BY APPLICATION SEGMENT ANALYSIS 57

8.1. Peptide Market Overview, by Application Segment 57

8.1.1. Peptide Market Volume Share, By Application, 2023 & 2032 58

8.1.2. Peptide Market Revenue Share, By Application, 2023 & 2032 58

8.1.3. Peptide Market Attractiveness Analysis, By Application 59

8.1.4. Incremental Revenue Growth Opportunity, by Application, 2024 – 2032 59

8.1.5. Peptide Market Revenue, By Application, 2018, 2023, 2027 & 2032 60

8.2. Hair / Eyelash / Eyebrow Care Series (Peptides) 61

8.3. Whitening Series (Peptides) 62

8.4. Anti-Aging Series (Peptides) 63

8.5. Skin Renewal Series (Peptides) 64

8.6. Anti-allergic & Anti-inflammatory Series (Peptides) 65

8.7. Slimming & Breast Enhancement Series (Peptides) 66

8.8. Others 67

CHAPTER NO. 9 : PEPTIDE MARKET – BY END PRODUCT SEGMENT ANALYSIS 68

9.1. Peptide Market Overview, by End Product Segment 68

9.1.1. Peptide Market Volume Share, By End Product, 2023 & 2032 69

9.1.2. Peptide Market Revenue Share, By End Product, 2023 & 2032 69

9.1.3. Peptide Market Attractiveness Analysis, By End Product 70

9.1.4. Incremental Revenue Growth Opportunity, by End Product, 2024 – 2032 70

9.1.5. Peptide Market Revenue, By End Product, 2018, 2023, 2027 & 2032 71

9.2. Skin Care 72

9.3. Hair Care 73

9.4. Eye Care 74

CHAPTER NO. 10 : PEPTIDE MARKET – BY END USER SEGMENT ANALYSIS 75

10.1. Peptide Market Overview, by End User Segment 75

10.1.1. Peptide Market Volume Share, By End User, 2023 & 2032 76

10.1.2. Peptide Market Revenue Share, By End User, 2023 & 2032 76

10.1.3. Peptide Market Attractiveness Analysis, By End User 77

10.1.4. Incremental Revenue Growth Opportunity, by End User, 2024 – 2032 77

10.1.5. Peptide Market Revenue, By End User, 2018, 2023, 2027 & 2032 78

10.2. Cosmetic Manufacturers 79

10.3. Cosmetic Contract Manufacturers (OEM/ODM) 80

10.4. Biopharmaceutical / Personal Care Industries 81

CHAPTER NO. 11 : PEPTIDE MARKET – CHINA 82

11.1. China 82

11.1.1. Key Highlights 82

11.1.2. China Peptide Market Volume, By Peptide Type, 2018 – 2023 (Metric Tons) 83

11.1.3. China Peptide Market Revenue, By Peptide Type, 2018 – 2023 (USD Million) 84

11.1.4. China Peptide Market Volume, By Application, 2018 – 2023 (Metric Tons) 85

11.1.5. China Peptide Market Revenue, By Application, 2018 – 2023 (USD Million) 86

11.1.6. China Peptide Market Volume, By End Product, 2018 – 2023 (Metric Tons) 87

11.1.7. China Peptide Market Revenue, By End Product, 2018 – 2023 (USD Million) 88

11.1.8. China Peptide Market Volume, By End User, 2018 – 2023 (Metric Tons) 89

11.1.9. China Peptide Market Revenue, By End User, 2018 – 2023 (USD Million) 90

CHAPTER NO. 12 : PEPTIDE MARKET – EUROPE 91

12.1. Europe 91

12.1.1. Key Highlights 91

12.1.2. Europe Peptide Market Volume, By Country, 2018 – 2032 (Metric Tons) 92

12.1.3. Europe Peptide Market Revenue, By Country, 2018 – 2023 (USD Million) 93

12.1.4. Europe Peptide Market Volume, By Peptide Type, 2018 – 2023 (Metric Tons) 94

12.1.5. Europe Peptide Market Revenue, By Peptide Type, 2018 – 2023 (USD Million) 95

12.1.6. Europe Peptide Market Volume, By Application, 2018 – 2023 (Metric Tons) 96

12.1.7. Europe Peptide Market Revenue, By Application, 2018 – 2023 (USD Million) 97

12.1.8. Europe Peptide Market Volume, By End Product, 2018 – 2023 (Metric Tons) 98

12.1.9. Europe Peptide Market Revenue, By End Product, 2018 – 2023 (USD Million) 99

12.1.10. Europe Peptide Market Volume, By End User, 2018 – 2023 (Metric Tons) 100

12.1.11. Europe Peptide Market Revenue, By End User, 2018 – 2023 (USD Million) 101

12.2. UK 102

12.3. France 102

12.4. Germany 102

12.5. Italy 102

12.6. Spain 102

12.7. Russia 102

12.8. Belgium 102

12.9. Netherland 102

12.10. Austria 102

12.11. Sweden 102

12.12. Poland 102

12.13. Denmark 102

12.14. Switzerland 102

12.15. Rest of Europe 102

CHAPTER NO. 13 : COMPANY PROFILES 103

13.1. Croda International Plc 103

13.1.1. Company Overview 103

13.1.2. Product Portfolio 103

13.1.3. Swot Analysis 103

13.1.4. Business Strategy 104

13.1.5. Financial Overview 104

China 105

13.2. Symrise AG 105

13.3. Croda International Plc 105

13.4. Ashland Inc. 105

13.5. Zhejiang Peptites Biotech Co., Ltd 105

13.6. Lifeworth 105

13.7. Creative Peptides 105

13.8. Shijiazhuang Xindong Technology Service Co., Ltd 105

13.9. Company 8 105

13.10. Company 9 105

13.11. Company 10 105

Europe 105

13.12. Koninklijke DSM NV (DSM) 105

13.13. Symrise AG 105

13.14. Croda International Plc 105

13.15. Merck KGaA 105

13.16. The Lubrizol Corporation 105

13.17. Ashland Inc. 105

13.18. Creative Peptides 105

13.19. Company 8 105

13.20. Company 9 105

13.21. Company 10 105

List of Figures

FIG NO. 1. China and Europe Peptide Market Volume & Revenue, 2018 – 2032 (Metric Tons) (USD Million) 24

FIG NO. 2. Porter’s Five Forces Analysis for China and Europe Peptide Market 30

FIG NO. 3. Value Chain Analysis for China and Europe Peptide Market 31

FIG NO. 4. China and Europe Peptide Market Price, By Region, 2018 – 2023 33

FIG NO. 5. China and Europe Peptide Market Price, By Peptide Type, 2018 – 2023 34

FIG NO. 6. Company Share Analysis, 2023 35

FIG NO. 7. Company Share Analysis, 2023 36

FIG NO. 8. Company Share Analysis, 2023 36

FIG NO. 9. Company Share Analysis, 2023 37

FIG NO. 10. Peptide Market – Company Volume Market Share, 2023 38

FIG NO. 11. Peptide Market – Company Revenue Market Share, 2023 39

FIG NO. 12. Peptide Market – Company Volume Market Share, 2023 40

FIG NO. 13. Peptide Market – Company Revenue Market Share, 2023 41

FIG NO. 14. Peptide Market Volume Share, By Peptide Type, 2023 & 2032 47

FIG NO. 15. Peptide Market Revenue Share, By Peptide Type, 2023 & 2032 47

FIG NO. 16. Market Attractiveness Analysis, By Peptide Type 48

FIG NO. 17. Incremental Revenue Growth Opportunity by Peptide Type, 2024 – 2032 48

FIG NO. 18. Peptide Market Revenue, By Peptide Type, 2018, 2023, 2027 & 2032 49

FIG NO. 19. China and Europe Peptide Market for Signal Peptides, Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 50

FIG NO. 20. China and Europe Peptide Market for Neurotransmitter Inhibitor Peptides, Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 51

FIG NO. 21. China and Europe Peptide Market for Carrier Peptides, Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 52

FIG NO. 22. China and Europe Peptide Market for Enzyme Inhibitor Peptides, Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 53

FIG NO. 23. China and Europe Peptide Market for Structural Peptides, Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 54

FIG NO. 24. China and Europe Peptide Market for Synthetic Antimicrobial Peptides (AMPs), Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 55

FIG NO. 25. China and Europe Peptide Market for Others, Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 56

FIG NO. 26. Peptide Market Volume Share, By Application, 2023 & 2032 58

FIG NO. 27. Peptide Market Revenue Share, By Application, 2023 & 2032 58

FIG NO. 28. Market Attractiveness Analysis, By Application 59

FIG NO. 29. Incremental Revenue Growth Opportunity by Application, 2024 – 2032 59

FIG NO. 30. Peptide Market Revenue, By Application, 2018, 2023, 2027 & 2032 60

FIG NO. 31. China and Europe Peptide Market for Hair / Eyelash / Eyebrow Care Series (Peptides), Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 61

FIG NO. 32. China and Europe Peptide Market for Whitening Series (Peptides), Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 62

FIG NO. 33. China and Europe Peptide Market for Anti-Aging Series (Peptides), Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 63

FIG NO. 34. China and Europe Peptide Market for Skin Renewal Series (Peptides), Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 64

FIG NO. 35. China and Europe Peptide Market for Anti-allergic & Anti-inflammatory Series (Peptides), Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 65

FIG NO. 36. China and Europe Peptide Market for Slimming & Breast Enhancement Series (Peptides), Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 66

FIG NO. 37. China and Europe Peptide Market for Others, Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 67

FIG NO. 38. Peptide Market Volume Share, By End Product, 2023 & 2032 69

FIG NO. 39. Peptide Market Revenue Share, By End Product, 2023 & 2032 69

FIG NO. 40. Market Attractiveness Analysis, By End Product 70

FIG NO. 41. Incremental Revenue Growth Opportunity by End Product, 2024 – 2032 70

FIG NO. 42. Peptide Market Revenue, By End Product, 2018, 2023, 2027 & 2032 71

FIG NO. 43. China and Europe Peptide Market for Skin Care, Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 72

FIG NO. 44. China and Europe Peptide Market for Hair Care, Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 73

FIG NO. 45. China and Europe Peptide Market for Eye Care, Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 74

FIG NO. 46. Peptide Market Volume Share, By End User, 2023 & 2032 76

FIG NO. 47. Peptide Market Revenue Share, By End User, 2023 & 2032 76

FIG NO. 48. Market Attractiveness Analysis, By End User 77

FIG NO. 49. Incremental Revenue Growth Opportunity by End User, 2024 – 2032 77

FIG NO. 50. Peptide Market Revenue, By End User, 2018, 2023, 2027 & 2032 78

FIG NO. 51. China and Europe Peptide Market for Cosmetic Manufacturers, Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 79

FIG NO. 52. China and Europe Peptide Market for Cosmetic Contract Manufacturers (OEM/ODM), Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 80

FIG NO. 53. China and Europe Peptide Market for Biopharmaceutical / Personal Care Industries, Volume & Revenue (Metric Tons) (USD Million) 2018 – 2032 81

FIG NO. 54. China Peptide Market Volume & Revenue, 2018 – 2032 (Metric Tons) (USD Million) 82

FIG NO. 55. Europe Peptide Market Volume & Revenue, 2018 – 2032 (Metric Tons) (USD Million) 9