Market Overview

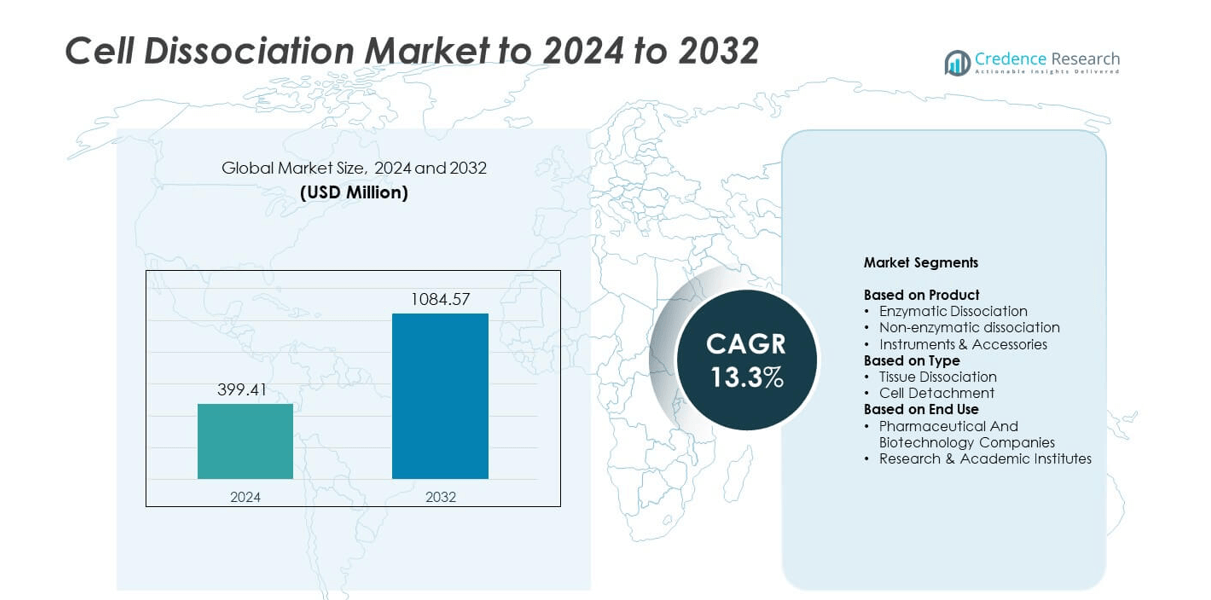

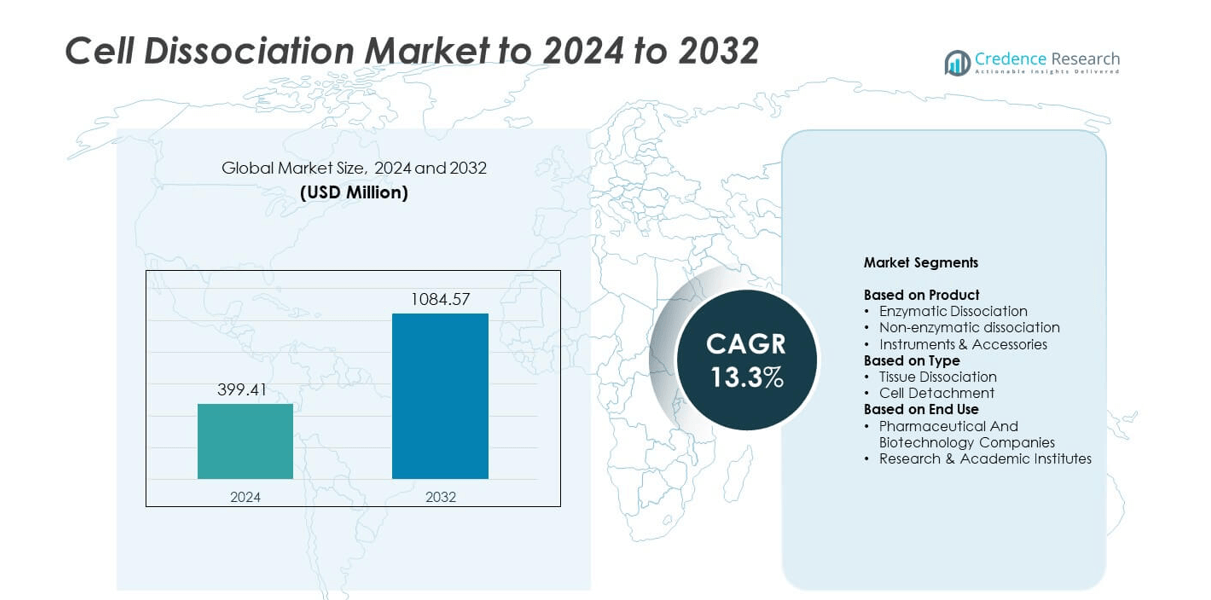

Cell Dissociation Market size was valued at USD 399.41 Million in 2024 and is anticipated to reach USD 1084.57 Million by 2032, at a CAGR of 13.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cell Dissociation Market Size 2024 |

USD 399.41 Million |

| Cell Dissociation Market , CAGR |

13.3% |

| Cell Dissociation Market Size 2032 |

USD 1084.57 Million |

The Cell Dissociation Market is shaped by leading companies such as Miltenyi Biotec, Sartorius AG, PAN-Biotech, Danaher Corp., F. Hoffmann-La Roche Ltd., S2 Genomics, HiMedia Laboratories, BD, Thermo Fisher Scientific, Merck KGaA, and STEMCELL Technologies. These players compete through advanced enzymatic formulations, animal-origin-free reagents, and automated tissue-processing systems that support single-cell analysis, organoid research, and cell therapy workflows. North America stands as the leading region with about 38% share, driven by strong biopharmaceutical activity and high adoption of automated and high-throughput platforms. Europe and Asia Pacific follow with growing demand from cancer research, stem-cell programs, and expanding academic infrastructure.

Market Insights

- The Cell Dissociation Market reached USD 399.41 Million in 2024 and is projected to hit USD 1084.57 Million by 2032, registering a CAGR of 13.3% during the forecast period.

• Strong demand for enzymatic dissociation, holding about 58% share, drives growth as biopharma companies scale cell therapy, oncology studies, and high-throughput screening workflows.

• Key trends include rising use of automated tissue processors, animal-origin-free reagents, and single-cell sequencing workflows that require high-viability and low-damage dissociation tools.

• Competition intensifies as global players expand GMP-grade portfolios, enhance distribution networks, and develop standardized digestion systems for research and therapeutic applications.

• North America leads with nearly 38% share, followed by Europe at about 30% and Asia Pacific at 24%, while tissue dissociation dominates by type with around 63% share in 2024.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Enzymatic dissociation leads this segment with about 58% share in 2024 due to strong adoption in stem-cell workflows, primary cell isolation, and bioprocessing tasks that require high yield and viability. Labs prefer enzymatic solutions because trypsin, collagenase, and papain deliver consistent performance and shorten processing time. Demand rises as regenerative medicine and cell-based therapy pipelines expand worldwide. Non-enzymatic dissociation grows steadily as researchers shift toward gentler formulations for sensitive cell lines, while instruments and accessories support automated workflows in high-throughput labs.

- For instance, Thermo Fisher Scientific confirms in its 2024 Gibco TrypLE Express specification sheet that the reagent enables cell detachment in 3–5 minutes and is validated in more than 1,200 peer-reviewed cell-culture publications.

By Type

Tissue dissociation dominates this segment with nearly 63% share in 2024 because it supports key applications such as tumor digestion, organoid preparation, and single-cell sequencing. Growth accelerates as cancer research programs require reliable methods to break complex extracellular matrices. Automated tissue processors and optimized enzyme mixes further push adoption in translational labs. Cell detachment maintains stable use in routine culture work, driven by rising demand for adherent cell expansion and quality-controlled biomanufacturing processes.

- For instance, Miltenyi Biotec reports in its gentleMACS Octo Dissociator documentation that the instrument processes eight samples in parallel and supports over 80 standardized tissue-dissociation protocols (known as gentleMACS Programs).

By End Use

Pharmaceutical and biotechnology companies hold the largest share with around 54% in 2024, driven by strong use of dissociation tools in drug discovery, bioproduction, and safety testing. These organizations rely on high-efficiency reagents to maintain viable cells for screening, scaling, and assay development. Growth rises as biologics pipelines expand and advanced therapy programs demand accurate single-cell isolation. Research and academic institutes continue steady adoption due to increasing cell-based studies, single-cell genomics, and government-funded projects.

Key Growth Drivers

Rising Demand for Single-Cell Analysis

Single-cell sequencing, spatial biology, and advanced cytometry workflows accelerate the need for precise and high-yield dissociation tools. Research labs rely on optimized enzymatic and mechanical methods to free cells from complex tissues without damaging surface markers. Growth continues as cancer research, immunology studies, and regenerative programs expand globally. High adoption in biopharma strengthens demand for standardized protocols that support downstream characterization and assay sensitivity.

- For instance, 10x Genomics confirms in its technical specifications that the Chromium Controller processes up to 10,000 cells per channel (sample) in a standard assay.

Expansion of Cell Therapy and Regenerative Medicine

Cell therapy developers require reliable dissociation systems to isolate, expand, and prepare stem cells, immune cells, and engineered cell lines. Tissue digestion and cell-release solutions play a central role in producing viable inputs for CAR-T, iPSC, and MSC-based treatments. As global clinical trials increase, manufacturers invest in high-purity reagents and closed-system tools to improve reproducibility and reduce contamination risk. This momentum positions regenerative medicine as a major driver of market growth.

- For instance, Cytiva reports in its product data that the platform supports automated processing of initial volumes up to 1,200 milliliters per run and is used in numerous cell-therapy development programs.

Growing Use of 3D Cultures and Organoids

The shift toward organoids and 3D tissue models boosts demand for controlled dissociation methods that preserve morphology and viability. Researchers require gentle enzyme blends and automated processors to fragment dense matrices without compromising structural fidelity. Adoption rises in oncology, toxicology, and disease-modeling applications where organoids mimic real human tissue. The expansion of bioengineered tissues and advanced screening platforms further elevates the need for high-performance dissociation workflows.

Key Trends and Opportunities

Automation and High-Throughput Platforms

Companies adopt automated tissue processors, closed digestion systems, and programmable cell-release units to reduce manual variability. High-throughput workflows enable parallel digestion of multiple samples, supporting large studies in genomics and drug discovery. This trend opens opportunities for scalable, GMP-ready platforms designed for biomanufacturing and clinical testing. Integration with digital monitoring and workflow software strengthens consistency and improves data traceability across labs.

- For instance, Beckman Coulter states in the Biomek i7 system specifications that the workstation supports up to 45 deck positions and runs numerous automated workflows.

Shift Toward Gentler and Animal-Free Reagents

Researchers increasingly adopt non-enzymatic, animal-origin-free, and low-toxicity formulations to support sensitive cell lines and regulatory compliance. The trend aligns with global preferences for ethical sourcing and reduced immunogenicity in clinical workflows. Manufacturers respond by developing synthetic enzymes, recombinant collagenases, and chemically defined buffers. This shift creates new opportunities for suppliers delivering high-purity reagents tailored for advanced therapy production and long-term culture.

- For instance, Fujifilm Irvine Scientific reports in its product literature that its Chemically Defined Dissociation Reagent is tested across numerous human pluripotent stem-cell lines and consistently maintains viability above 90% across repeated passages.

Rising Adoption of AI-Optimized Protocols

AI-driven optimization enhances dissociation workflows by predicting ideal enzyme concentrations, time intervals, and temperature profiles. Automated systems use machine learning to reduce variability and improve cell recovery outcomes. Adoption grows across cell therapy, disease modeling, and precision medicine research. Vendors investing in software-enabled tools stand to gain from increasing market demand for reproducible, data-validated protocols.

Key Challenges

Cell Damage and Loss of Surface Markers

A major challenge is the risk of damaging cells or stripping surface proteins during digestion. This affects downstream applications such as flow cytometry, functional assays, and therapeutic manufacturing. Achieving a balance between strong matrix breakdown and gentle cell handling remains difficult across tissue types. Labs seek more controlled reagents, yet variability in biological samples continues to limit consistency.

Lack of Standardized Protocols Across Applications

Dissociation procedures vary widely by tissue type, species, and downstream workflow, creating challenges in reproducibility. The absence of unified guidelines complicates regulatory approval for cell therapies and GMP manufacturing. Researchers often rely on trial-and-error methods, leading to performance inconsistencies. This limits scalability and increases operational costs for both academic and industrial users.

Regional Analysis

North America

North America holds the largest share of the Cell Dissociation Market at about 38% in 2024 due to strong investment in single-cell analysis, bioprocessing, and cell therapy development. The region benefits from advanced research facilities, high adoption of automated dissociation systems, and favorable funding for oncology and immunology studies. Pharmaceutical and biotechnology companies maintain high consumption of enzymatic and non-enzymatic reagents to support large-scale R&D pipelines. Growth continues as the United States expands its focus on precision medicine and stem-cell applications, strengthening the region’s position in the global market.

Europe

Europe accounts for roughly 30% share in 2024, supported by strong demand from research institutes, biopharmaceutical manufacturers, and academic consortia. The region sees rising adoption of tissue dissociation tools for cancer genomics, organoid research, and translational medicine. Countries such as Germany, the United Kingdom, and France invest heavily in high-throughput workflows and ethical, animal-free reagents. Regulatory focus on high-quality materials encourages manufacturers to supply GMP-ready solutions. Growth remains steady as EU-funded life science programs expand clinical research activities across major biomedical hubs.

Asia Pacific

Asia Pacific holds about 24% share in 2024 and remains the fastest-growing region due to rising investment in stem-cell therapy, biotech startups, and clinical research facilities. China, Japan, South Korea, and India increase their use of enzymatic and automated dissociation systems to support expanding oncology and regenerative medicine programs. Local manufacturing growth and cost-effective research infrastructure attract global companies to form regional partnerships. Demand rises as academic institutions adopt advanced workflows for organoid development and single-cell sequencing, driving rapid market expansion across diverse applications.

Latin America

Latin America represents nearly 5% share in 2024, driven by expanding biomedical research activities in Brazil, Mexico, and Argentina. Regional labs adopt tissue dissociation tools for oncology, vaccine development, and cell culture studies. Increasing awareness of single-cell technologies supports gradual uptake of higher-quality reagents and accessories. Although infrastructure varies across countries, growing collaborations with North American and European research institutions strengthen market penetration. Continued investment in academic research and public health programs helps the region advance its capabilities in cellular analysis.

Middle East and Africa

The Middle East and Africa hold about 3% share in 2024, supported by increasing adoption of dissociation tools in developing biomedical sectors. Growth is driven by expanding research centers in the UAE, Saudi Arabia, South Africa, and Egypt, where investment in genomics and cell-based studies is rising. Healthcare modernization encourages use of advanced reagents for cancer research and diagnostic development. Limited local manufacturing remains a challenge, but improving laboratory infrastructure and government initiatives in life sciences gradually raise market participation across the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Product

- Non-enzymatic dissociation

- Instruments & Accessories

By Type

- Tissue Dissociation

- Cell Detachment

By End Use

- Pharmaceutical And Biotechnology Companies

- Research & Academic Institutes

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Cell Dissociation Market features strong competition among Miltenyi Biotec, Sartorius AG, PAN-Biotech, Danaher Corp., F. Hoffmann-La Roche Ltd., S2 Genomics, Inc., HiMedia Laboratories, BD, Thermo Fisher Scientific, Merck KGaA, and STEMCELL Technologies. Companies strengthen their position by expanding portfolios of enzymatic blends, synthetic reagents, and automated tissue-processing systems. Many players invest in technologies that deliver higher cell viability, reduced marker loss, and improved reproducibility for single-cell sequencing, organoid preparation, and therapeutic manufacturing. Strategic moves include upgrading GMP-ready products, enhancing distribution networks, and launching digital workflow tools that support precise digestion control. Rising demand for closed systems, animal-origin-free reagents, and high-throughput platforms drives firms to accelerate innovation. Partnerships with research institutes and biopharmaceutical developers help suppliers address new cell therapy and regenerative medicine requirements. Growing focus on standardization, quality compliance, and scalable solutions continues to shape competitive dynamics across global markets.

Key Player Analysis

- Miltenyi Biotec

- Sartorius AG

- PAN-Biotech

- Danaher Corp.

- Hoffmann-La Roche Ltd.

- S2 Genomics, Inc.

- HiMedia Laboratories

- BD

- Thermo Fisher Scientific

- Merck KGaA

- STEMCELL Technologies

Recent Developments

- In 2025, Sartorius expanded its bioprocess division product portfolio, including advanced filtration solutions and new software for bioprocesses.

- In 2025, BD introduced the FACSDiscover A8 Cell Analyzer, which includes real-time imaging and spectral flow capabilities, enhancing cell analysis and dissociation workflows.

- In 2024, Thermo Fisher Scientific signed an agreement with Multiply Labs to automate cell therapy manufacturing, integrating robotic technology with Thermo Fisher instruments to improve scalability and reduce costs.

Report Coverage

The research report offers an in-depth analysis based on Product, Type, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see wider adoption of automated dissociation platforms across global research labs.

- Demand for animal-origin-free and chemically defined reagents will increase in clinical workflows.

- Single-cell sequencing growth will push suppliers to develop higher-yield and low-damage enzyme blends.

- Regenerative medicine expansion will drive investment in GMP-grade dissociation products.

- AI-optimized digestion protocols will gain traction for improving reproducibility and efficiency.

- Organoid and 3D culture research will boost demand for gentle matrix-breakdown solutions.

- Instrument manufacturers will integrate digital tracking and workflow analytics into new systems.

- Biopharma companies will adopt closed and sterile processing tools to meet regulatory standards.

- Suppliers will expand portfolios to support large-scale cell therapy manufacturing.

- Emerging markets in Asia-Pacific will experience faster adoption due to rising biomedical R&D.