Market Overview

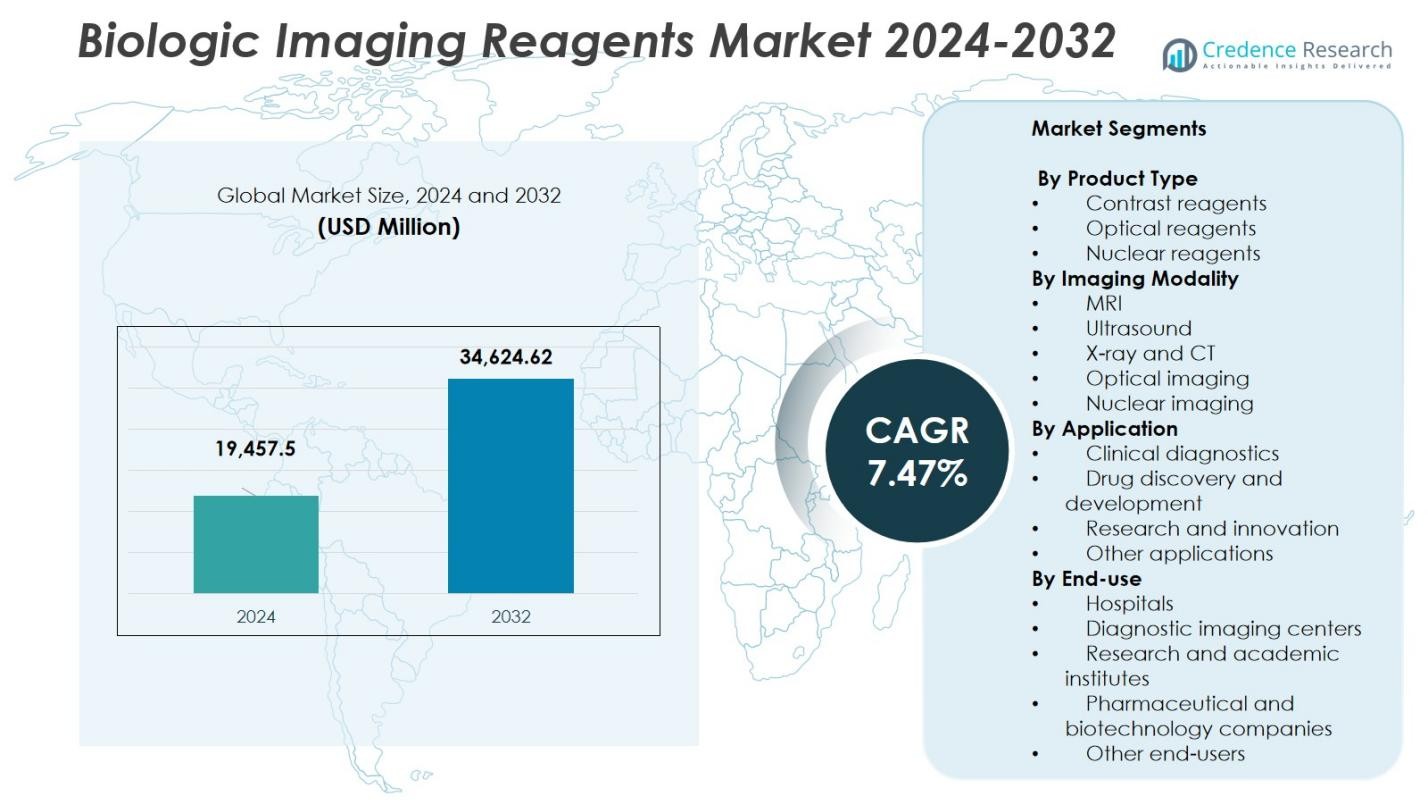

Biologic Imaging Reagents Market size was valued at USD 19,457.5 million in 2024 and is anticipated to reach USD 34,624.62 million by 2032, growing at a CAGR of 7.47% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Biologic Imaging Reagents Market Size 2024 |

USD 19,457.5 Million |

| Biologic Imaging Reagents Market, CAGR |

7.47% |

| Biologic Imaging Reagents Market Size 2032 |

USD 34,624.62 Million |

Biologic Imaging Reagents Market is driven by key players including Bayer AG, Bracco, Carl Zeiss, Cell Signaling Technology, Danaher, General Electric Company, Guerbet, Jubilant Pharmova Limited, Luminex Corporation, and Nikon Corporation, all contributing to advancements in contrast agents, fluorescent probes, and nuclear imaging reagents. These companies focus on improving diagnostic accuracy through innovation, strategic partnerships, and expansion of product portfolios aligned with precision imaging needs. Regional performance highlights North America as the leading market with a 39% share, supported by high imaging procedure volumes and strong R&D infrastructure, while Europe follows with a 28% share driven by technological adoption and robust clinical integration. Asia-Pacific continues to gain momentum with rising healthcare investments and increased access to advanced imaging systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Biologic Imaging Reagents Market reached USD 19,457.5 million in 2024 and is projected to grow at a CAGR of 7.47% through 2032, supported by rising adoption of advanced diagnostic tools.

- Growing demand for early disease detection and precision diagnostics drives the market, with contrast reagents leading the product segment at a 48% share due to extensive use in MRI, CT, and ultrasound imaging.

- Trends such as hybrid imaging, AI-assisted diagnostics, and the rapid shift toward molecular and multimodal visualization continue to accelerate technological innovation in imaging reagents.

- Key players including Bayer AG, Bracco, Carl Zeiss, GE Healthcare, and Guerbet strengthen market presence through R&D investments, product launches, and expansion into molecular imaging solutions.

- North America dominates with a 39% regional share, followed by Europe at 28% and Asia-Pacific at 22%, while clinical diagnostics remains the leading application segment with a 44% share in 2024.

Market Segmentation Analysis:

By Product Type

In the biologic imaging reagents market, contrast reagents hold the dominant position with a 48% market share in 2024, supported by their extensive integration in MRI, CT, and ultrasound procedures. Their growth is driven by continual enhancements in gadolinium-based, iodinated, and microbubble agents that improve diagnostic precision. Optical reagents account for 33%, propelled by expanding adoption of fluorescence and bioluminescence technologies in life-science research. Nuclear reagents, holding 19%, benefit from rising PET and SPECT imaging demand, particularly in oncology and metabolic disease monitoring.

- For instance, gadopiclenol, developed by Guerbet, offers two to three times higher relaxivity than earlier gadolinium-based agents, enabling high-quality MRI scans at a 50% lower dose.

By Imaging Modality

Within imaging modalities, MRI leads with a 36% market share, driven by increasing use in neurological, cardiovascular, and musculoskeletal evaluations alongside advancements in high-resolution contrast agents. X-ray and CT contribute 29%, supported by their widespread clinical accessibility and demand for enhanced contrast formulations. Optical imaging holds 19%, reflecting its expanding role in molecular visualization and real-time biological analysis. Nuclear imaging accounts for 12%, driven by PET and SPECT applications, while ultrasound captures 10%, supported by the growing use of targeted microbubble reagents.

- For instance, Siemens Healthineers introduced the MAGNETOM Free.Max, a groundbreaking MRI system, which offers high-resolution imaging with reduced scan times, contributing to more efficient patient care and improved diagnostic capabilities

By Application

In terms of application, clinical diagnostics dominate with a 44% market share, fueled by rising imaging volumes in oncology, cardiology, and neurology, along with increasing adoption of precision diagnostic tools. Drug discovery and development represents 29%, driven by the integration of fluorescent, radiolabeled, and bioluminescent probes in preclinical and translational research workflows. Research and innovation accounts for 21%, supported by expanded use of molecular imaging tracers in academic and biotech R&D. Other applications hold the remaining 6%, including veterinary imaging and niche industrial uses.

Key Growth Drivers

Rising Demand for Advanced Diagnostic Imaging

The biologic imaging reagents market grows significantly due to rising global dependence on advanced diagnostic procedures, particularly in oncology, cardiovascular diseases, and neurological disorders. Increasing imaging volumes in hospitals and diagnostic centers accelerate the adoption of high-performance contrast, optical, and nuclear reagents. The shift toward early disease detection and precision diagnostics encourages healthcare providers to invest in reagents that deliver enhanced clarity, better tissue differentiation, and improved visualization of molecular processes. Innovations in targeted contrast agents further strengthen this demand and expand diagnostic accuracy across modalities.

- For instance, Revvity, Inc. introduced the next-generation IVIS SpectrumCT 2 and IVIS Spectrum 2 imaging systems, designed to deliver enhanced sensitivity and versatility in in-vivo optical imaging, supporting more accurate biomedical research applications.

Expansion of Precision Medicine and Molecular Imaging

Precision medicine continues to fuel the adoption of biologic imaging reagents by enabling clinicians to visualize cellular and molecular activity with high specificity. As genomic insights become more integrated into clinical workflows, imaging reagents play a critical role in tracking biomarkers, monitoring therapeutic response, and assessing disease progression at the molecular level. The growing use of PET tracers, fluorescent probes, and targeted optical markers enhances diagnostic precision and supports personalized treatment decisions. This trend strengthens the adoption of reagents across oncology, immunology, and metabolic disorder management.

- For instance, Body Vision Medical received regulatory approval in March 2025 from the Australian Therapeutic Goods Administration (TGA) for its LungVision AI-powered intraoperative imaging system, which enhances early and accurate lung cancer diagnosis.

Growing Investment in Drug Discovery and Preclinical Research

Pharmaceutical companies and research institutions increasingly rely on advanced imaging reagents to accelerate drug discovery and development. These reagents allow real-time visualization of biological pathways, enabling accurate evaluation of drug-target interactions, biodistribution, and therapeutic efficacy. Expanded use of fluorescence, radiolabeled, and bioluminescent reagents in preclinical models enhances data quality and shortens R&D timelines. Rising investment in translational research, coupled with the growth of CROs offering imaging-based services, drives further demand for specialized reagents that support high-throughput screening and advanced molecular evaluation.

Key Trends & Opportunities

Shift Toward Hybrid and Multimodal Imaging Techniques

The market benefits from growing adoption of hybrid imaging technologies such as PET-CT, PET-MRI, and optical-CT systems, which require sophisticated reagents compatible with multiple modalities. These techniques offer superior spatial and molecular insights, creating strong opportunities for developing dual-label or multifunctional imaging probes. As clinicians prioritize comprehensive diagnostic outputs from a single scan, reagent manufacturers focus on agents with enhanced sensitivity and cross-platform compatibility. This trend fosters innovation in nanomaterial-based probes, multimodal contrast agents, and molecular tracers designed for integrated imaging platforms.

- For instance, United Imaging launched next-generation PET/CT systems incorporating an integrated molecular technology platform that enhances diagnostic accuracy in oncology and neurology.

Rapid Adoption of AI-Enhanced and High-Resolution Imaging

The integration of AI, machine learning, and high-resolution imaging technologies opens new opportunities for biologic imaging reagents. Enhanced image analytics allow the use of ultra-sensitive probes that detect early-stage abnormalities and subtle molecular activity. AI-driven image reconstruction increases clarity, enabling development of reagents with lower dosage requirements and improved signal-to-noise ratios. High-resolution fluorescent and nuclear probes benefit particularly from this shift, supporting innovations in real-time imaging, digital pathology, and molecular-guided surgeries. These advancements encourage long-term investment in next-generation reagent platforms.

- For instance, MedGAN, an AI-based deep learning framework, has been applied for PET–CT translation and PET image denoising, substantially improving image quality and reducing noise, as validated by radiologists’ perceptual analyses.

Key Challenges

Safety Concerns and Regulatory Complexity

The market faces challenges related to stringent regulatory frameworks governing contrast agents, nuclear tracers, and optical probes. Safety concerns such as gadolinium retention, radiation exposure, and toxicity risks in fluorescent markers require extensive validation and long approval cycles. Regulatory agencies demand robust clinical evidence, significantly increasing development time and costs for manufacturers. These hurdles limit the pace of innovation and affect the commercialization of next-generation reagents. Ensuring biocompatibility, patient safety, and long-term stability remains a critical barrier for market expansion.

High Cost of Advanced Imaging and Limited Accessibility

The adoption of biologic imaging reagents is constrained by the high cost of advanced imaging systems, procedure fees, and specialized reagents. Many healthcare facilities, particularly in developing regions, lack the financial and technical infrastructure needed to support PET, MRI, and molecular imaging technologies. Budget limitations, inadequate reimbursement models, and shortage of skilled imaging professionals further restrict market penetration. These factors create disparities in diagnostic access and slow the uptake of innovative reagents, especially those designed for complex or hybrid imaging modalities.

Regional Analysis

North America

North America holds a 39% market share in the biologic imaging reagents market, driven by strong adoption of advanced diagnostic technologies and a well-established healthcare infrastructure. The region benefits from high imaging procedure volumes in oncology, cardiology, and neurology, supported by widespread availability of MRI, CT, PET, and fluorescence imaging systems. Robust R&D activity, backed by government funding and leading biotechnology clusters, accelerates development of innovative reagents. Major manufacturers, academic research centers, and CROs strengthen market growth, while increasing emphasis on precision medicine continues to expand demand for high-performance molecular imaging reagents.

Europe

Europe accounts for a 28% market share, supported by strong clinical adoption of diagnostic imaging and growing investments in molecular imaging research. The region’s emphasis on early disease detection, particularly in cancer and cardiovascular disorders, drives demand for contrast, optical, and nuclear imaging reagents. Countries such as Germany, the U.K., and France lead in deploying hybrid imaging systems and PET-based radiopharmaceuticals. Regulatory initiatives promoting standardized imaging protocols and cross-border research collaborations further stimulate technological advancements. The expansion of academic imaging centers and biotech innovation hubs continues to strengthen reagent utilization across both clinical and research settings.

Asia-Pacific

Asia-Pacific captures a 22% market share, emerging as the fastest-growing region due to rapid improvements in healthcare infrastructure, rising diagnostic imaging capacity, and increasing disease prevalence. Expanding access to MRI, CT, PET, and advanced optical imaging technologies in China, Japan, South Korea, and India accelerates reagent demand. Government investments in biomedical research, coupled with the growth of local manufacturers producing cost-effective imaging reagents, support market expansion. The adoption of precision diagnostics and rising participation in clinical research trials further strengthen the market, positioning Asia-Pacific as a major hub for future imaging-focused innovation.

Latin America

Latin America holds a 7% market share, supported by expanding diagnostic imaging capabilities and rising demand for advanced visualization tools in major countries such as Brazil, Mexico, and Argentina. The growing burden of chronic diseases drives the need for high-quality contrast and nuclear imaging reagents. Although adoption is slower compared to developed regions, increasing investments in hospital infrastructure and the establishment of modern imaging centers contribute to steady market growth. Partnerships with global manufacturers, improvements in healthcare insurance coverage, and the gradual introduction of hybrid imaging technologies further enhance reagent demand across the region.

Middle East & Africa

The Middle East & Africa region accounts for a 4% market share, with growth driven by expanding healthcare modernization initiatives in the Gulf Cooperation Council (GCC) countries. Investments in advanced diagnostic imaging equipment, including MRI, CT, and PET systems, support rising consumption of biologic imaging reagents. The market also benefits from increasing private-sector healthcare spending and the development of specialized oncology and cardiovascular centers. However, limited access to high-end imaging and shortages of trained professionals in several African nations restrain broader adoption. Gradual improvements in infrastructure and diagnostic capabilities continue to support moderate market expansion.

Market Segmentations:

By Product Type

- Contrast reagents

- Optical reagents

- Nuclear reagents

By Imaging Modality

- MRI

- Ultrasound

- X-ray and CT

- Optical imaging

- Nuclear imaging

By Application

- Clinical diagnostics

- Drug discovery and development

- Research and innovation

- Other applications

By End-use

- Hospitals

- Diagnostic imaging centers

- Research and academic institutes

- Pharmaceutical and biotechnology companies

- Other end-users

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Biologic Imaging Reagents Market features leading players such as Bayer AG, Bracco, Carl Zeiss, Cell Signaling Technology, Danaher, General Electric Company, Guerbet, Jubilant Pharmova Limited, Luminex Corporation, and Nikon Corporation. These companies strengthen their market presence through continuous innovation in contrast agents, fluorescent probes, nuclear tracers, and multimodal imaging reagents. The landscape is shaped by strategic investments in R&D, expansion of molecular imaging capabilities, and advancements in targeted and high-sensitivity reagents tailored for precision diagnostics. Firms increasingly pursue partnerships with research institutions, imaging equipment manufacturers, and pharmaceutical companies to enhance technology integration and broaden clinical applications. Regulatory approvals for next-generation reagents, including safer gadolinium formulations and advanced PET tracers, further influence market growth. Competition intensifies as emerging biotechnology companies introduce novel optical and radiolabeled probes aimed at specialty applications in oncology, immunology, and translational research.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2025, Saguaro Biosciences entered a partnership with Bio‑Techne Corporation to distribute its next‑generation live‑cell imaging reagents globally—a new product / distribution initiative in the biologic imaging reagents space.

- In June 2025, Molecular Instruments and Alpenglow Biosciences partnered to advance 3D RNA imaging in intact biological specimens including the launch of their “3D Imaging World Cup 2025”.

- In March 2024, Lunaphore Technologies (a division of Bio‑Techne Corporation) partnered with Nikon Instruments Inc. to expand access to the COMET™ spatial biology platform & reagent workflows.

- In August 2024, VION Biosciences acquired Echelon Biosciences, a specialist in lipid‑based excipients and lipid nanoparticle engineering, to enhance their platform for biologic imaging reagents and mRNA/gene‑therapy supply.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Imaging Modality, Application, End Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily as demand for advanced diagnostic imaging increases across clinical and research settings.

- Adoption of molecular and precision imaging reagents will accelerate as personalized medicine becomes more widely integrated into clinical workflows.

- Hybrid imaging technologies such as PET-MRI and PET-CT will drive development of multifunctional and multimodal imaging probes.

- AI-enhanced imaging platforms will support the use of ultra-sensitive reagents optimized for high-resolution analytics.

- Pharmaceutical R&D growth will boost demand for fluorescent, radiolabeled, and bioluminescent reagents in drug discovery.

- Innovation will intensify around safer, biocompatible, and targeted contrast agents to address regulatory and safety concerns.

- Investments in radiopharmaceutical production and nuclear imaging reagents will rise as cancer diagnostics increase globally.

- Emerging regions will witness strong adoption as imaging infrastructure and healthcare spending continue improving.

- Industry players will pursue collaborations with academic institutions and technology companies to accelerate reagent development.

- New applications in digital pathology, intraoperative imaging, and real-time molecular visualization will broaden market opportunities.