| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| China Feminine Hygiene Products Market Size 2023 |

USD 2,853.07 Million |

| China Feminine Hygiene Products Market, CAGR |

9.18% |

| China Feminine Hygiene Products Market Size 2032 |

USD 6,293.98 Million |

Market Overview:

China Feminine Hygiene Products Market size was valued at USD 2,853.07 million in 2023 and is anticipated to reach USD 6,293.98 million by 2032, at a CAGR of 9.18% during the forecast period (2023-2032).

Several factors are propelling the expansion of the feminine hygiene market in China. Firstly, heightened awareness regarding menstrual health and hygiene is leading to greater adoption of feminine hygiene products. This has resulted in a growing demand for high-quality and innovative products designed to enhance comfort and convenience. Secondly, the growing preference for sustainable and eco-friendly alternatives, such as menstrual cups and reusable pads, is influencing purchasing decisions. As consumers become more conscious of environmental impacts, these alternatives are gaining traction. Additionally, advancements in product innovation—offering enhanced comfort, absorption, and convenience—are attracting a broader consumer base. Companies are increasingly focused on incorporating advanced materials, such as organic cotton and biodegradable components, into their offerings. Government initiatives aimed at promoting menstrual health education and reducing taboos surrounding menstruation further contribute to market growth. These efforts are essential in breaking down cultural barriers and encouraging widespread use of feminine hygiene products across various demographics.

Regionally, China’s feminine hygiene market is characterized by a significant urban-rural divide. Urban areas, particularly tier-1 and tier-2 cities, exhibit higher product penetration and preference for premium products, driven by greater disposable incomes and exposure to global brands. The demand for organic, hypoallergenic, and high-performance products is particularly strong in these regions. In contrast, rural regions are witnessing gradual growth, influenced by targeted awareness campaigns and improved distribution channels. Education and healthcare initiatives focused on menstrual health in these areas are fostering a shift in consumer behavior. E-commerce platforms are playing a pivotal role in bridging this gap, offering accessibility to a wider audience. This growing reliance on online retail is helping to overcome the challenges of distribution in less accessible regions, allowing rural consumers to access a variety of feminine hygiene products from trusted brands.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- China Feminine Hygiene Products size was valued at USD 2,853.07 million in 2023 and is anticipated to reach USD 6,293.98 million by 2032, at a CAGR of 9.18% during the forecast period (2023-2032).

- The global feminine hygiene products market, valued at USD 23,490.00 million in 2023, is projected to reach USD 43,917.35 million by 2032, growing at a CAGR of 7.2% from 2023 to 2032.

- Urban areas, particularly tier-1 and tier-2 cities, exhibit higher product penetration and preference for premium products, driven by greater disposable incomes and exposure to global brands.

- Rural regions are witnessing gradual growth, influenced by targeted awareness campaigns and improved distribution channels, with e-commerce platforms playing a pivotal role in bridging this gap.

- There is an increasing demand for eco-friendly products like menstrual cups and reusable pads, reflecting growing environmental consciousness among consumers.

- Advancements in product design, such as the introduction of disposable period pants, are gaining popularity, particularly for their convenience and comfort.

- Educational campaigns and policy measures are promoting menstrual health awareness, contributing to a cultural shift and increased product adoption.

- Despite growth, challenges such as cultural taboos, high costs of premium products, and distribution issues in rural areas persist, affecting market penetration.

Market Drivers:

Increasing Awareness of Menstrual Health

The growing awareness surrounding menstrual health in China is one of the primary drivers of the feminine hygiene products market. For example, a quasi-experimental study involving 116 adolescent girls in China demonstrated that five interactive education sessions significantly improved menstrual knowledge, confidence in menstrual healthcare behavior, and pain relief practices among participants. As education on menstrual hygiene improves, more women are becoming conscious of the importance of maintaining good hygiene during menstruation. This shift in attitude is encouraging women to adopt feminine hygiene products that ensure better comfort, hygiene, and convenience. Additionally, the increased emphasis on women’s health and wellness, along with more open discussions about menstrual issues, is fostering a cultural change, especially among younger generations. As a result, women are more inclined to use hygienic solutions that promote a healthier lifestyle, thereby driving product adoption across different demographics.

Demand for Sustainable and Eco-Friendly Products

There is a marked increase in demand for sustainable and eco-friendly feminine hygiene products in China. With growing environmental concerns, many Chinese consumers are opting for products that are biodegradable, reusable, or made from natural materials. Menstrual cups, cloth pads, and organic cotton tampons are gaining popularity as alternatives to traditional disposable products. These alternatives not only contribute to reducing environmental waste but also cater to the rising demand for health-conscious products that do not contain harmful chemicals or synthetic materials. As sustainability becomes a key factor in purchasing decisions, brands that offer environmentally friendly options are seeing a positive response from the market.

Product Innovation and Advancements

Technological advancements and innovations in feminine hygiene products are key factors propelling market growth in China. Manufacturers are focusing on the development of high-performance products that provide enhanced comfort, improved absorption, and extended wear time. For example, disposable period pants have become increasingly popular, with about 14% of Chinese menstruators reporting their use during menstruation according to Euromonitor International’s 2024 survey. Innovations in materials, such as hypoallergenic and breathable fabrics, have further driven the popularity of products like sanitary pads, tampons, and menstrual cups. These products are designed to address various consumer needs, including sensitivity, comfort during physical activities, and long-lasting protection. As consumers increasingly prioritize comfort and convenience, the market is witnessing a rise in demand for products that offer superior quality and functional features.

Government Support and Awareness Initiatives

Government support and awareness campaigns are playing a crucial role in boosting the adoption of feminine hygiene products in China. The government has been actively working towards educating women about menstrual health, breaking taboos, and promoting the use of hygienic products. Through educational initiatives and programs, the government is making significant strides in eliminating the cultural stigma surrounding menstruation, especially in rural areas. These efforts are essential in encouraging women to prioritize their health and hygiene needs. Additionally, policy interventions that promote women’s health and ensure access to affordable hygiene products are fostering a favorable environment for market growth. The government’s commitment to improving public health infrastructure further enhances the availability and accessibility of feminine hygiene products across the country.

Market Trends:

Growth of E-Commerce and Online Sales

The Chinese feminine hygiene products market is experiencing a notable shift towards e-commerce, driven by the increasing adoption of digital platforms and enhanced convenience. Online sales in Greater China are projected to account for over 55% of the hygiene e-commerce market by 2025, reflecting a significant consumer preference for online shopping. E-commerce provides consumers with greater privacy and access to a wide range of products, including international and niche brands, facilitating informed purchasing decisions. The integration of e-commerce with social media platforms, such as Xiaohongshu, is further enhancing product discovery and consumer engagement through livestreaming and influencer collaborations. This trend indicates a robust expansion of online retail channels in the feminine hygiene sector, as digital platforms continue to reshape consumer behavior and market dynamics.

Preference for Slim and Ultra-Thin Sanitary Pads

In the Chinese market, slim, thin, and ultra-thin sanitary pads are gaining popularity due to their discreetness, comfort, and convenience. Manufacturers are responding to this trend by innovating and offering a variety of slim and ultra-thin sanitary pads to meet evolving consumer needs. For example, leading companies have introduced ultra-thin pads with enhanced absorbency and odor control, which have been well received by consumers seeking lightweight and breathable options for menstrual care. The demand for premium products with features such as ultra-thin designs and natural materials is increasing, reflecting consumer preferences for comfort and products that align with modern lifestyles. This trend is further evidenced by the growing availability of personalized sanitary pad solutions, such as those designed for sensitive skin or with specific absorbency levels

Emergence of Private Label Brands

Private label brands are becoming more prominent in the Chinese feminine hygiene market. Retailers are launching their own brands to offer consumers cost-effective alternatives to established national and international brands. For instance, retailers such as Aldi have launched their own affordable private label menstrual care lines in China, offering consumers cost-effective alternatives to established brands. These private label products often emphasize quality and affordability, attracting budget-conscious consumers. The rise of private label brands reflects a shift in consumer behavior towards value-oriented purchasing decisions. Retailers are leveraging their distribution networks and consumer insights to develop and promote these in-house brands, contributing to the diversification of product offerings in the market.

Focus on Product Innovation and Sustainability

There is a growing emphasis on product innovation and sustainability within the Chinese feminine hygiene market. Consumers are increasingly seeking products made from natural, organic, and biodegradable materials, reflecting a broader global trend towards environmental consciousness. Manufacturers are responding by developing products that are free from harmful chemicals and are designed for sustainability. Innovations include the use of organic cotton, eco-friendly packaging, and the development of reusable menstrual products. This focus on sustainability is influencing consumer purchasing decisions and shaping the competitive landscape of the market.

Market Challenges Analysis:

Cultural Taboos and Stigma

One of the primary challenges affecting the growth of the feminine hygiene products market in China is the persistent cultural stigma surrounding menstruation. Despite significant progress in health education, menstruation remains a sensitive topic for many Chinese women, particularly in rural areas. This stigma often discourages open discussions about menstrual hygiene, which in turn limits product adoption. The lack of widespread awareness in some regions still hinders women from fully understanding the importance of using hygienic products during menstruation. Although the government has launched awareness initiatives, overcoming deep-rooted cultural taboos remains a long-term challenge that may slow market penetration in certain segments.

High Cost of Premium Products

While the demand for premium and organic feminine hygiene products is on the rise, the high cost of these products remains a significant barrier to widespread adoption. For example, tampons are about two to six times more expensive than sanitary napkins, costing between 3 and 4 yuan each compared to less than 1 yuan for a pad. Many consumers in China, especially in smaller cities and rural areas, may find these products prohibitively expensive. This price sensitivity can limit the growth of premium brands and eco-friendly alternatives, as budget-conscious consumers tend to opt for more affordable, conventional products. The affordability challenge is exacerbated by the vast disparities in income levels across urban and rural populations, making it difficult for some groups to access higher-quality menstrual products.

Supply Chain and Distribution Challenges

Despite the growth in e-commerce, supply chain and distribution issues continue to challenge the feminine hygiene products market in China. The vast size of the country, coupled with its uneven infrastructure development, poses difficulties in ensuring efficient delivery to rural and remote areas. While urban regions benefit from extensive retail networks, the penetration of feminine hygiene products in rural regions remains limited due to logistics constraints and the lack of reliable local distributors. Addressing these supply chain challenges is critical for brands aiming to increase their reach and market share across diverse geographic areas.

Market Opportunities:

China presents a significant market opportunity for feminine hygiene products due to its large population, increasing urbanization, and evolving consumer behavior. The rising awareness around menstrual health, coupled with changing societal norms, creates a fertile ground for the expansion of feminine hygiene product offerings. As more Chinese women embrace personal hygiene as an essential aspect of health and wellness, the demand for sanitary products, including organic and eco-friendly options, is expected to rise. Additionally, urban areas, with their growing middle class and higher disposable incomes, are increasingly inclined toward premium products, creating a demand for high-quality and innovative solutions. This presents opportunities for both international and local brands to cater to a wide range of consumer preferences, from basic to high-end products.

Furthermore, the continued growth of e-commerce in China offers a key avenue for market penetration. The increasing use of online platforms enables brands to overcome geographical barriers and reach consumers in smaller cities and rural regions. With a growing preference for online shopping, especially among younger generations, companies can capitalize on digital marketing strategies to build brand awareness and offer convenience in product purchases. The rise of private label brands and the expanding awareness of sustainable alternatives also create space for innovation, providing opportunities for new entrants to disrupt the market with unique product offerings. These factors collectively present a substantial opportunity for growth in the Chinese feminine hygiene market.

Market Segmentation Analysis:

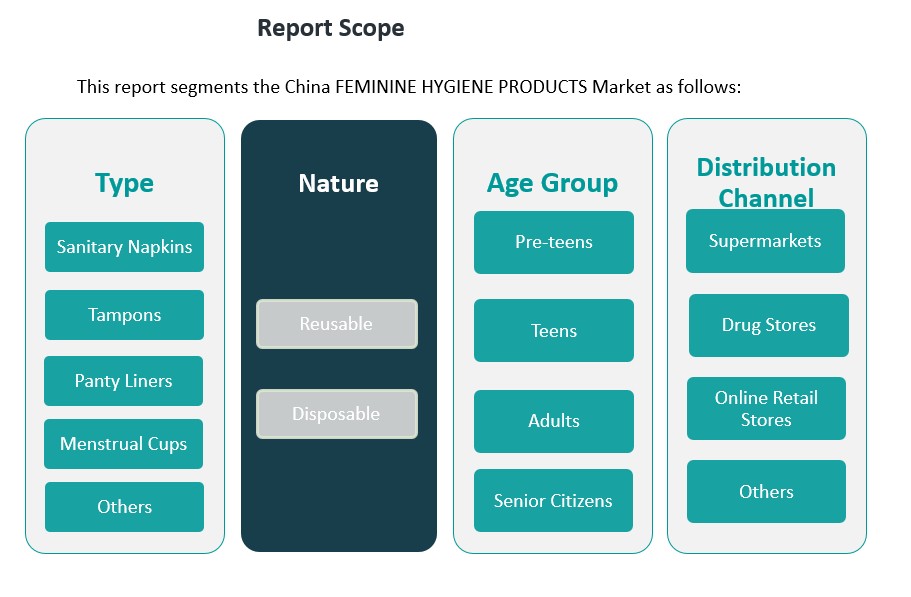

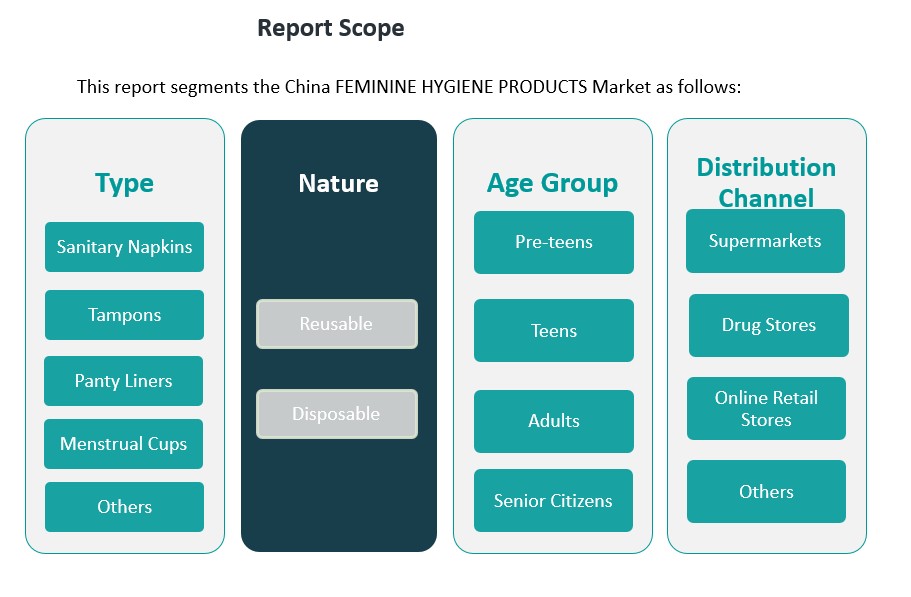

The Chinese feminine hygiene products market is segmented based on product type, nature, age group, and distribution channel, each offering distinct growth opportunities.

By Type: Sanitary napkins dominate the market, driven by their wide availability and familiarity among consumers. Tampons and panty liners are also popular, though their adoption remains lower compared to sanitary napkins. Menstrual cups, while a smaller segment, are gaining traction due to their eco-friendly appeal and increasing awareness of sustainable menstrual care. The “Others” category includes alternative products such as organic cotton products, which are gaining interest due to rising health-consciousness among Chinese consumers.

By Nature: The market is divided into reusable and disposable products. Disposable products, including sanitary napkins and tampons, hold the largest market share due to convenience and widespread usage. However, the demand for reusable products, such as menstrual cups and cloth pads, is increasing, driven by growing environmental concerns and the shift toward sustainable products.

By Age Group: The market is further segmented by age, with products for adults making up the largest share, followed by products for teens. Pre-teens and senior citizens represent smaller but emerging segments. For pre-teens, educational products and those designed for comfort are gaining popularity. Senior citizens are increasingly seeking products tailored for comfort and specific needs, such as incontinence products.

By Distribution Channel: Supermarkets and drugstores are the leading distribution channels, providing consumers with easy access to feminine hygiene products. Online retail is rapidly expanding, particularly among younger generations, offering convenience and a wider range of options. Other channels include specialty stores and pharmacies that cater to niche markets.

Segmentation:

By Type

- Sanitary Napkins

- Tampons

- Panty Liners

- Menstrual Cups

- Others

By Nature

By Age-Group

- Pre-teens

- Teens

- Adults

- Senior Citizens

By Distribution Channel

- Supermarkets

- Drug Stores

- Online Retail Stores

- Others

Regional Analysis:

China’s feminine hygiene products market demonstrates notable regional variations, influenced by factors such as urbanization, cultural norms, and economic development. These regional disparities provide both challenges and opportunities for market growth across different parts of the country.

Eastern and Southern China: Market Leaders

Eastern and southern regions, which include major cities such as Shanghai, Beijing, Guangzhou, and Shenzhen, account for the largest share of the market. These areas represent the most developed regions in China, where high disposable incomes, advanced retail infrastructure, and increased awareness of menstrual health contribute to a dominant market presence. Urban centers in these regions are characterized by higher usage rates of feminine hygiene products, with women in these areas adopting products such as sanitary napkins, tampons, and menstrual cups at a faster rate compared to other regions. Together, eastern and southern China hold the majority share of the market, representing nearly 60% of the total market.

Central and Western China: Emerging Markets

The central and western regions, including cities like Chengdu, Xi’an, and Chongqing, are experiencing significant growth in feminine hygiene product adoption. Although these areas have traditionally lagged behind in terms of product penetration, increasing urbanization, rising income levels, and better access to health education are driving market expansion. This region is showing a rising demand for hygiene products, with market share slowly increasing and expected to reach around 25% of the overall market. Central and western China are considered emerging markets with strong growth potential.

Rural Areas: Challenges and Opportunities

Rural areas in China, which traditionally face challenges in terms of access to feminine hygiene products, still represent a smaller segment of the market. Due to lower income levels, cultural taboos, and limited distribution channels, rural areas account for about 15% of the market. However, with ongoing awareness initiatives and improved access through local health programs and distribution channels, there is a growing opportunity to penetrate this segment. Although rural markets are currently less developed, they present long-term growth opportunities as education and access to hygiene products improve.

Key Player Analysis:

- Johnson & Johnson

- Procter & Gamble

- Kimberly-Clark

- Essity Aktiebolag

- Kao Corporation

- Daio Paper Corporation

- Unicharm Corporation

- Premier FMCG

- Ontex

- Hengan International Group Company Ltd

- Drylock Technologies

- Natracare LLC

- First Quality Enterprises, Inc

- Yoni

Competitive Analysis:

The competitive landscape of China’s feminine hygiene products market is characterized by the presence of both established global brands and emerging local players. Leading international brands, such as Procter & Gamble (Always), Kimberly-Clark (Huggies), and Unicharm (Sofy), dominate the market with a wide range of products, from sanitary napkins to menstrual cups. These companies leverage their strong brand recognition, advanced distribution networks, and significant marketing budgets to maintain a competitive edge. However, local brands such as Jieling, Shiseido, and Yijie are gaining ground by focusing on price competitiveness and catering to consumer preferences for eco-friendly, organic, and reusable products. The growing trend towards sustainability has prompted innovation in product offerings, with several companies now introducing biodegradable materials and chemical-free options. The increasing popularity of online retail platforms has further intensified competition, as both local and international brands are enhancing their e-commerce presence to reach a broader consumer base.

Recent Developments:

- In January 2025, a significant partnership was formed in the Chinese feminine hygiene products sector with the establishment of Youdun (Fujian) Care Products Co., Ltd. This new company is a joint venture between Sichuan Youdun Youpin Medical Technology Co., Ltd. and Xiamen C&D Paper & Pulp Group Co., Ltd. The collaboration aims to create a comprehensive industrial park for disposable hygiene products, including sanitary napkins, sanitary pants, and other related items.

- In March 2025, Kimberly-Clark began the third phase of its expansion project in Nanjing, China, which will significantly increase its manufacturing capacity for baby diapers and feminine hygiene products. The new 27,000-square-foot facility in the Jiangning Development Zone is expected to be completed by September 2025, with production commencing in February 2026. This move is aimed at strengthening Kimberly-Clark’s presence and meeting growing demand in the Chinese market.

Market Concentration & Characteristics:

The Chinese feminine hygiene products market is moderately concentrated, with leading multinational corporations and prominent local manufacturers commanding a significant share. International brands such as Procter & Gamble (Always), Kimberly-Clark (Huggies), and Unicharm (Sofy) maintain strong market positions through extensive distribution networks and brand recognition. Local companies like Hengan International Group and Jieling also hold substantial shares, leveraging localized production and consumer insights. The market is characterized by high brand loyalty, with the top three brands accounting for a significant portion of consumer purchases. Consumers often exhibit strong preferences for specific brands, influenced by factors such as product quality, comfort, and perceived value. This loyalty presents both opportunities and challenges for new entrants seeking to capture market share. Product innovation plays a crucial role in maintaining competitive advantage. Companies are increasingly focusing on developing products that cater to evolving consumer preferences, such as eco-friendly materials and enhanced comfort features. The rise of e-commerce platforms has further intensified competition, providing consumers with greater access to a variety of products and brands. This digital shift necessitates brands to adapt their marketing and distribution strategies to remain competitive in the evolving market landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Nature, Age-Group and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Chinese feminine hygiene market is expected to continue its steady growth, driven by increasing urbanization and higher disposable incomes.

- Growing awareness of menstrual health will lead to higher adoption of feminine hygiene products across various age groups.

- Sustainable and eco-friendly products will gain market share as consumers increasingly prefer organic, reusable, and biodegradable options.

- Online retail will play a larger role, with e-commerce expected to account for a significant portion of sales, particularly in rural areas.

- The demand for premium products will rise as more consumers seek high-quality, comfortable, and innovative solutions.

- Government initiatives focused on menstrual health education will drive further adoption, particularly in rural regions.

- Product innovation will remain a key differentiator, with brands focusing on advanced materials and improved comfort.

- The penetration of feminine hygiene products in central and western China will increase, contributing to market expansion.

- Private label brands will continue to gain traction as consumers seek affordable yet high-quality alternatives.

- Technological advancements in product design and packaging will further enhance convenience and sustainability, appealing to environmentally conscious consumers.