Market Overview:

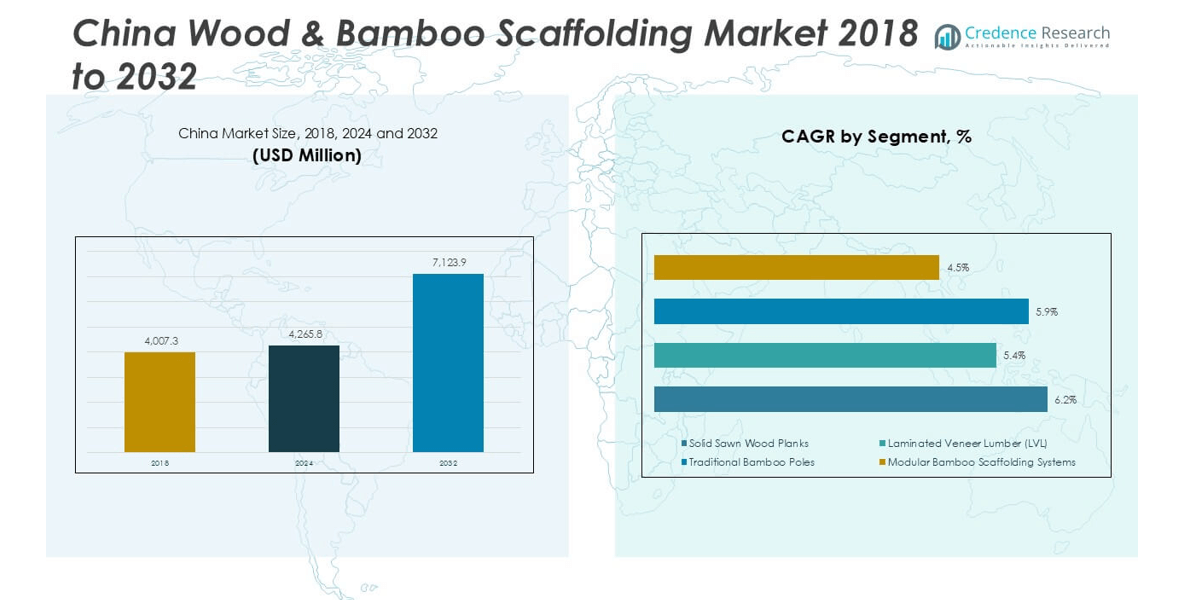

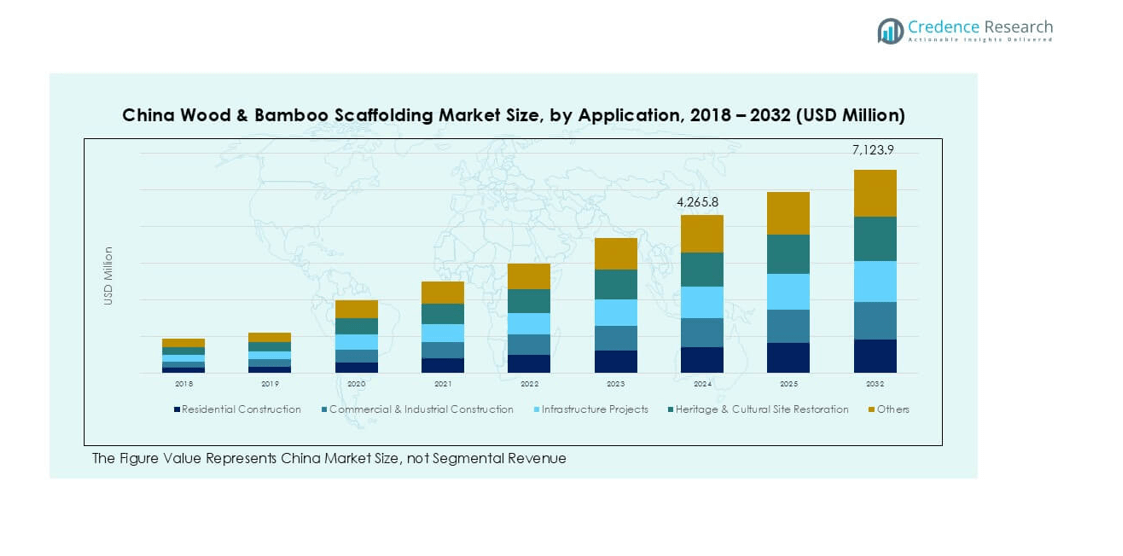

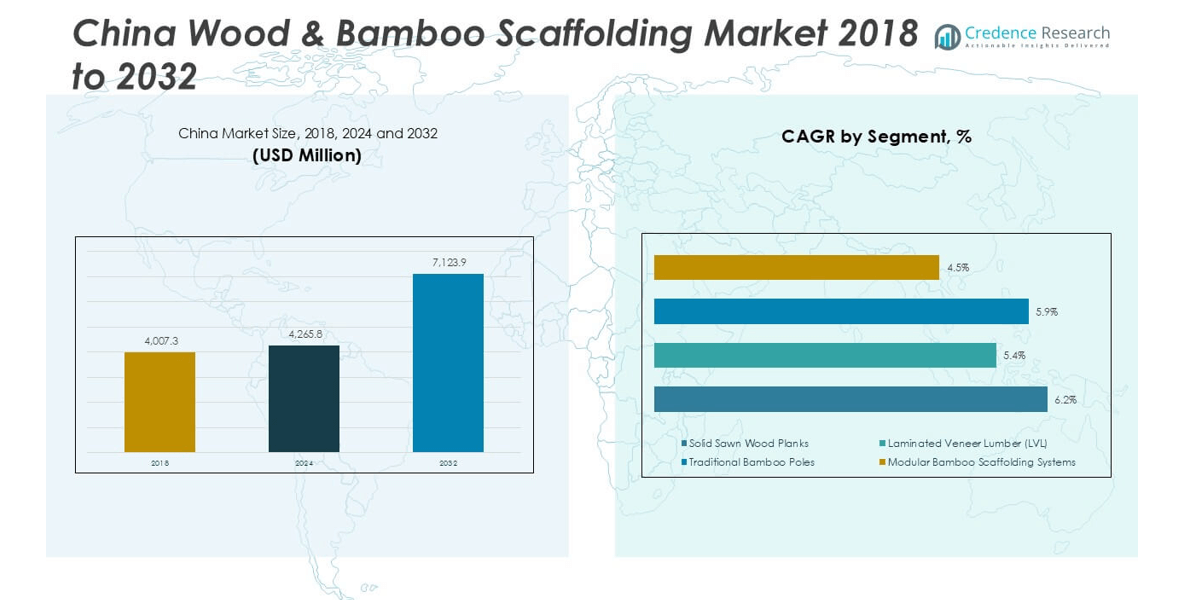

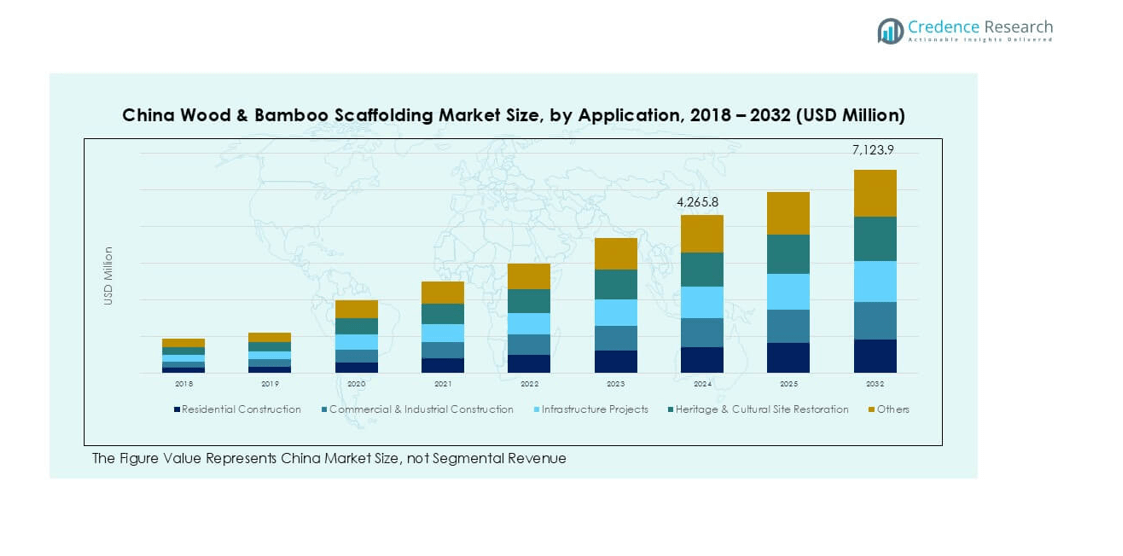

China Wood & Bamboo Scaffolding Market size was valued at USD 4,007.31 million in 2018 and grew to USD 4,265.79 million in 2024. The market is anticipated to reach USD 7,123.91 million by 2032, expanding at a CAGR of 6.62% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| China Wood & Bamboo Scaffolding Market Size 2024 |

USD 4,265.79 million |

| China Wood & Bamboo Scaffolding Market, CAGR |

6.62% |

| China Wood & Bamboo Scaffolding Market Size 2032 |

USD 7,123.91 million |

The China wood & bamboo scaffolding market is led by key players such as Rizhao Fast & Fasten Scaffold Co., Ltd, Tianjin Wellmade Scaffold Co., Ltd, Qingdao Scaffolding Import & Export Co., Ltd, Guangzhou AJ Scaffolding Co., Ltd, and Jiangsu World Scaffolding Co., Ltd. These companies focus on producing high-strength wood planks and modular bamboo systems that meet national safety and green building standards. East China dominated the market with 32% share in 2024, driven by dense urbanization, industrial projects, and strong construction activities across Shanghai, Jiangsu, and Zhejiang. North China followed with 22% share, supported by transportation infrastructure development and commercial real estate expansion. Together, these regions form over half of the market demand, creating opportunities for suppliers to strengthen distribution networks and offer standardized scaffolding systems for faster adoption.

Market Insights

- The China wood & bamboo scaffolding market was valued at USD 4,265.79 million in 2024 and is projected to reach USD 7,123.91 million by 2032, expanding at a CAGR of 6.62%.

- Growing residential and commercial construction activities, supported by infrastructure investments and government housing programs, are driving strong demand for cost-effective scaffolding solutions.

- Modular bamboo scaffolding systems and treated wood planks are trending due to faster assembly, higher safety compliance, and alignment with China’s green building and carbon neutrality goals.

- The market is competitive, with major players like Rizhao Fast & Fasten Scaffold, Tianjin Wellmade Scaffold, and Guangzhou AJ Scaffolding focusing on innovation, quality improvement, and strategic partnerships with rental companies.

- East China holds 32% share, followed by North China with 22% share; solid sawn wood planks dominate the product type segment with over 40% share, driven by affordability and high load-bearing capacity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

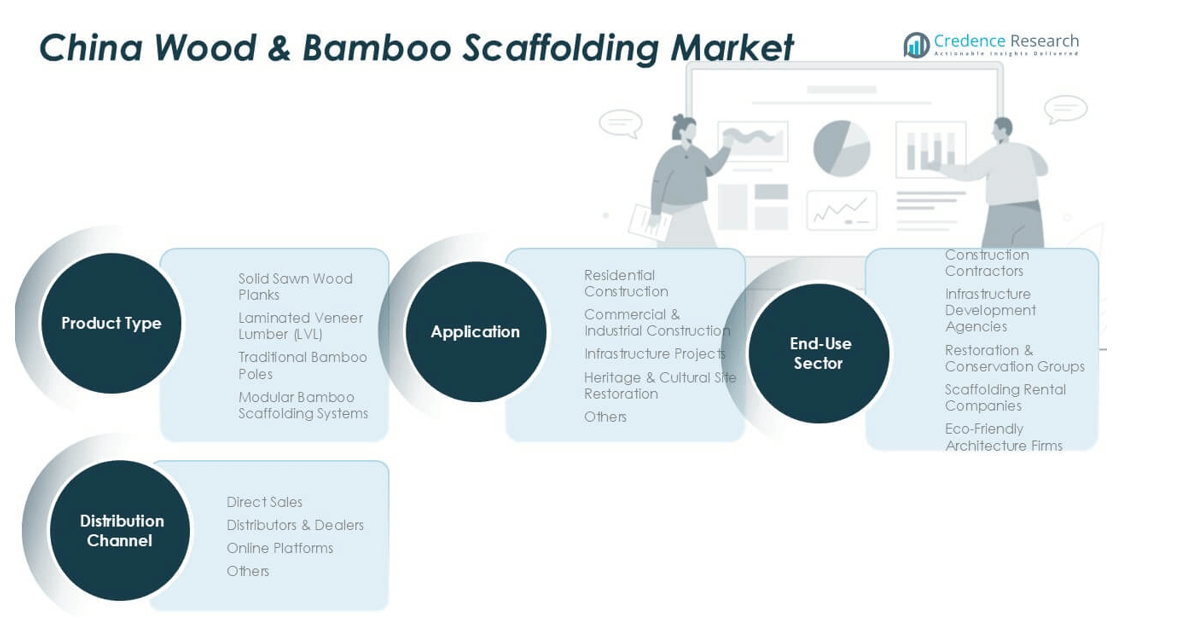

Market Segmentation Analysis:

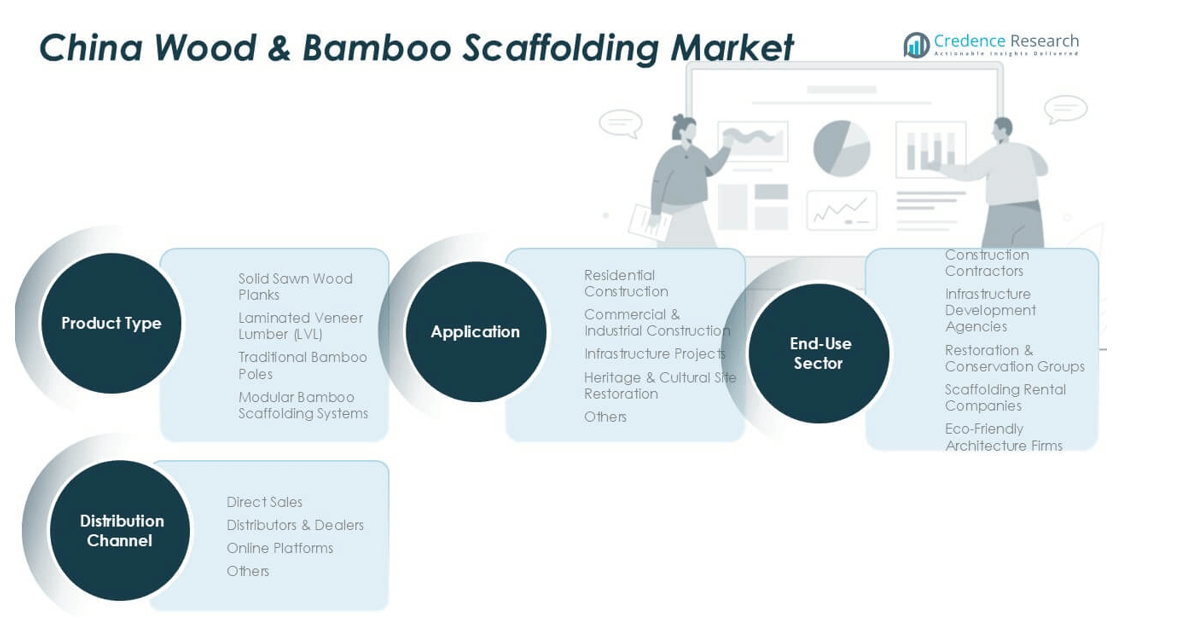

By Product Type

Solid sawn wood planks dominated the China wood & bamboo scaffolding market in 2024, capturing over 40% market share. Their dominance is driven by high structural strength, easy availability, and cost-effectiveness for large-scale construction projects. Laminated veneer lumber (LVL) is gaining traction due to consistent quality and durability, preferred in urban projects where safety standards are strict. Traditional bamboo poles continue to be popular in rural regions due to low cost and eco-friendliness. Modular bamboo scaffolding systems are expanding rapidly, driven by demand for faster assembly and compliance with green building codes.

- For instance, Shanghai Liancheng (Group) Co., Ltd. is a large-scale enterprise specializing in the manufacturing of pumps, valves, and fluid delivery systems. Its products are widely used in infrastructure projects.

By Application

Commercial & industrial construction accounted for the largest share, holding 38% of total demand in 2024. The growth is fueled by rising industrial infrastructure projects, manufacturing plant expansions, and real estate development in tier-1 and tier-2 cities. Residential construction follows closely, supported by government housing initiatives and urbanization trends. Infrastructure projects, including bridges and metro networks, contribute significantly, creating opportunities for modular scaffolding adoption. Heritage and cultural restoration projects are a niche but growing application, as China invests in preserving historical monuments and temples using eco-friendly bamboo solutions.

- For instance, in 2024, China State Construction Engineering Corporation (CSCEC) was one of the world’s largest construction companies by revenue and was actively involved in real estate, infrastructure, and industrial projects in China, including in Jiangsu and Guangdong provinces.

By End-use Sector

Construction contractors dominated the market with 45% share in 2024, as they are the primary users of scaffolding materials for both small and large-scale projects. Infrastructure development agencies form the second-largest segment, driven by government-backed transportation and energy projects requiring durable and safe scaffolding solutions. Scaffolding rental companies are witnessing strong growth due to rising demand from small contractors seeking cost-effective access solutions. Restoration and conservation groups are key users for heritage sites, while eco-friendly architecture firms drive demand for bamboo-based systems to meet green building certifications and sustainability goals.

Market Overview

Rising Construction Activities

Rapid urbanization and infrastructure development are driving demand for wood and bamboo scaffolding in China. Large-scale residential and commercial construction projects, including high-rise buildings and manufacturing facilities, require durable scaffolding systems. Government investments in public infrastructure, metro networks, and smart city initiatives further boost market growth. Bamboo scaffolding remains a preferred choice for cost efficiency and eco-friendly construction. This strong construction pipeline ensures steady consumption of solid sawn wood planks and bamboo poles, supporting market expansion over the forecast period.

- For instance, Guangxi is a significant bamboo-producing province in China and an important source for the country’s extensive bamboo industry. However, suppliers do not primarily deliver raw bamboo poles for modern urban housing, which is now dominated by steel and concrete. Instead, they supply the raw materials for a wide range of sophisticated, higher-value products. These engineered bamboo products, which have strength comparable to steel, are used in flooring, sustainable building projects, and for specific rural infrastructure needs, reflecting China’s broader shift towards advanced bamboo processing.

Eco-Friendly Building Practices

China’s focus on sustainability and green construction is fueling demand for bamboo-based scaffolding. Bamboo offers renewable, biodegradable, and lightweight properties, making it suitable for eco-conscious projects. Developers and contractors adopt bamboo systems to comply with green building certifications and national carbon reduction goals. Modular bamboo scaffolding systems support faster installation, lower waste, and improved reusability. This shift aligns with China’s targets under the “Dual Carbon” policy, encouraging adoption of environmentally friendly construction materials across both urban and rural development projects.

- For instance, in 2024, China Resources Land significantly expanded its green building portfolio, reaching 373 certified projects covering 57.17 million square meters.

Cost-Effectiveness and Availability

Wood and bamboo scaffolding offer a lower-cost alternative to steel scaffolding, attracting contractors focused on budget optimization. The abundant availability of bamboo and domestic wood supply in China ensures stable pricing and uninterrupted procurement. Bamboo’s natural flexibility and strength make it suitable for diverse applications, including heritage restoration and infrastructure work. The cost advantage, combined with easy handling and reusability, drives preference among small and medium construction firms. This affordability factor is especially crucial for rural and mid-scale construction projects.

Key Trend & Opportunity

Adoption of Modular Systems

Modular bamboo scaffolding systems are gaining popularity due to their quick installation and dismantling advantages. These systems improve worker safety and reduce labor costs, aligning with stricter construction safety standards in China. The opportunity lies in expanding production capacity and standardizing components for nationwide adoption. Manufacturers focusing on modular solutions can cater to large infrastructure projects and commercial buildings where time efficiency and compliance are critical. This trend also supports digital monitoring and better project management integration for construction firms.

- For instance, in 2024, innovations in sustainable and modular scaffolding systems gained traction, featuring advancements like enhanced connections and lightweight materials. For instance, certain modular systems using bamboo and other sustainable composites focus on reducing setup time and extending reusability through improved manufacturing and material treatments.

Heritage Restoration and Tourism Projects

China’s growing investments in heritage site preservation create opportunities for bamboo scaffolding manufacturers. Bamboo’s lightweight and non-damaging properties make it ideal for restoring temples, pagodas, and cultural landmarks. The tourism sector benefits from the safe and quick restoration of these sites, improving visitor experience. Government-led initiatives to protect cultural heritage provide long-term demand for traditional bamboo scaffolding. This niche market allows suppliers to cater to specialized restoration contractors and conservation agencies, building a strong presence in a high-value segment.

- For instance, the Lingyin Temple in Hangzhou has undergone numerous restorations throughout its long history, with modern efforts often combining traditional aesthetics with contemporary building materials and techniques. For example, a significant restoration of the main hall took place in the 1970s after the Cultural Revolution, and earlier parts of the temple date back to the Qing dynasty.

Key Challenge

Safety and Load-Bearing Limitations

Wood and bamboo scaffolding face challenges in meeting modern safety and load-bearing standards. Bamboo poles may degrade faster under harsh weather, requiring regular inspection and replacement. Heavy industrial projects often prefer steel scaffolding for its superior strength, limiting market penetration. Accidents linked to improper bamboo usage or inadequate quality control can affect adoption rates. Manufacturers must focus on standardization, treatment processes, and certification to ensure compliance with China’s evolving construction safety regulations and reassure contractors about product reliability.

Competition from Steel Scaffolding

Steel scaffolding poses a major threat to the wood and bamboo scaffolding market. It offers longer service life, higher load capacity, and better compatibility with modern construction methods. Urban developers and large contractors often prefer steel for high-rise projects, where safety and precision are critical. This preference gradually reduces demand for traditional scaffolding materials. To stay competitive, bamboo and wood suppliers must innovate with hybrid systems, improve durability through chemical treatments, and promote sustainability benefits as a differentiating factor.

Regional Analysis

East China

East China dominated the China wood & bamboo scaffolding market in 2024, holding 32% market share. The region benefits from dense urbanization, large-scale commercial construction, and strong manufacturing activities in Shanghai, Jiangsu, and Zhejiang. High-rise building projects and rapid metro expansions drive demand for modular bamboo systems and solid sawn wood planks. Government-backed housing schemes and industrial parks create consistent demand for cost-efficient scaffolding solutions. Local availability of bamboo resources supports supply stability, enabling competitive pricing. Contractors in East China prefer quick-assembly scaffolding to meet project deadlines, further boosting market growth in this leading region.

North China

North China accounted for 22% of the market share in 2024, driven by infrastructure development and industrial projects in Beijing, Tianjin, and Hebei. Rapid expansion of transportation networks, including high-speed rail projects, fuels the adoption of durable wood and bamboo scaffolding. Beijing’s focus on green building initiatives encourages the use of eco-friendly bamboo systems in public works. The commercial real estate sector continues to grow, supporting steady demand for scaffolding rental services. The region also benefits from strong regulatory oversight, promoting the adoption of safer, standardized scaffolding systems for both residential and commercial applications.

South China

South China captured 18% market share in 2024, supported by thriving construction activity in Guangdong, Shenzhen, and Fujian. The region is a hub for real estate development, with rising demand for high-rise residential towers and mixed-use complexes. Bamboo scaffolding remains popular due to its flexibility and cost-effectiveness, especially for mid-scale contractors. Government investment in transportation and port infrastructure fuels additional growth. The presence of export-oriented manufacturing industries drives construction of new warehouses and facilities, creating steady demand for scaffolding materials. Rapid project cycles in this region favor modular bamboo systems for faster installation and dismantling.

Central China

Central China represented 12% of market share in 2024, with growth largely driven by infrastructure projects in Hunan, Hubei, and Henan provinces. Expansion of roadways, bridges, and public utility projects creates significant opportunities for wood and bamboo scaffolding suppliers. The region benefits from lower construction costs, encouraging developers to choose affordable bamboo scaffolding solutions. Urbanization in secondary cities also boosts demand for residential and commercial construction. Central China is emerging as a growth hotspot as government initiatives promote regional economic development and attract investment into manufacturing and logistics infrastructure, supporting consistent scaffolding consumption.

Western China

Western China accounted for 9% of the market share in 2024, with growth primarily supported by infrastructure development under the Belt and Road Initiative. Large-scale projects, including highways, tunnels, and energy infrastructure, require durable scaffolding solutions. While adoption of bamboo scaffolding is growing, wood planks dominate due to their strength and stability in challenging terrains. Demand is concentrated in provinces such as Sichuan and Chongqing, where industrial expansion drives construction activities. Suppliers are focusing on improving logistics and distribution networks to meet rising demand in remote locations, which remains a key challenge for market penetration.

Northeast China

Northeast China held 7% of market share in 2024, reflecting slower construction growth compared to other regions. However, urban renewal projects in cities such as Shenyang, Dalian, and Harbin support moderate demand for scaffolding materials. The region focuses on industrial plant upgrades and public infrastructure maintenance, creating steady opportunities for suppliers. Bamboo scaffolding adoption is increasing gradually as contractors seek eco-friendly and cost-effective alternatives to steel. Market players are targeting this region by offering competitive rental services and modular scaffolding systems to capture opportunities from ongoing urban redevelopment projects and state-backed construction initiatives.

Market Segmentations:

By Product Type

- Solid Sawn Wood Planks

- Laminated Veneer Lumber (LVL)

- Traditional Bamboo Poles

- Modular Bamboo Scaffolding Systems

By Application

- Residential Construction

- Commercial & Industrial Construction

- Infrastructure Projects

- Heritage & Cultural Site Restoration

- Others

By End-use Sector

- Construction Contractors

- Infrastructure Development Agencies

- Restoration & Conservation Groups

- Scaffolding Rental Companies

- Eco-Friendly Architecture Firms

By Distribution Channel

- Direct Sales

- Distributors & Dealers

- Online Platforms

- Others

By Geography

- East China

- North China

- South China

- Central China

- Western China

- Northeast China

Competitive Landscape

The China wood & bamboo scaffolding market is highly fragmented, with a mix of regional and national players competing on price, quality, and innovation. Leading companies include Rizhao Fast & Fasten Scaffold Co., Ltd, Tianjin Wellmade Scaffold Co., Ltd, Qingdao Scaffolding Import & Export Co., Ltd, Guangzhou AJ Scaffolding Co., Ltd, Wuxi Worldbest KAMA Power Co., Ltd, Changli Xinyuan Scaffolding Co., Ltd, Jiangsu World Scaffolding Co., Ltd, Yangzhou Yongsheng Scaffold Co., Ltd, Hebei Wuxin Garden Tools Co., Ltd, and Nantong Huayuan Metal Products Co., Ltd. These companies focus on delivering high-strength, durable wood planks and bamboo scaffolding systems that meet evolving safety and quality standards. Many are investing in modular bamboo systems to support faster installation and compliance with green building initiatives. Strategic partnerships with construction contractors and rental firms strengthen market presence, while innovation in treatment processes and product standardization remains a key competitive differentiator.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Rizhao Fast & Fasten Scaffold Co., Ltd

- Tianjin Wellmade Scaffold Co., Ltd

- Qingdao Scaffolding Import & Export Co., Ltd

- Guangzhou AJ Scaffolding Co., Ltd

- Wuxi Worldbest KAMA Power Co., Ltd

- Changli Xinyuan Scaffolding Co., Ltd

- Jiangsu World Scaffolding Co., Ltd

- Yangzhou Yongsheng Scaffold Co., Ltd

- Hebei Wuxin Garden Tools Co., Ltd

- Nantong Huayuan Metal Products Co., Ltd

Recent Developments

- In 2025, ULMA Construction’s innovation focus has been on engineering advancements and digital integration for scaffolding systems, especially for modular and steel variants. There is little emphasis from ULMA on wood or bamboo materials, as their recent solutions highlight sustainability efforts and technological enhancements more applicable to metal-based systems.

- In April 2025, at the bauma trade show in Munich, PERI showcased sustainable formwork innovations, including the introduction of a universal formwork system made from biopolymer. Their market direction is toward resource-saving solutions and modularity, with digital tools and even robotic assistance being trialed for assembly.

- In March 2025, the Hong Kong government announced plans to phase out bamboo scaffolding for most public projects, mandating a shift to modern metal alternatives for improved safety and fire resistance.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-use Sector, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily, supported by rising residential, commercial, and infrastructure construction projects.

- Adoption of modular bamboo scaffolding systems will increase due to faster installation and improved safety.

- Demand will rise from heritage and cultural restoration projects as China invests in tourism infrastructure.

- Construction contractors will continue to lead consumption, with rental companies gaining market share.

- Eco-friendly bamboo solutions will see higher adoption due to China’s carbon neutrality and green building goals.

- Investment in product standardization and quality certification will strengthen market reliability and safety compliance.

- Urbanization in tier-2 and tier-3 cities will drive demand for cost-effective scaffolding materials.

- Competition will intensify as local manufacturers expand production and improve supply chain networks.

- Hybrid scaffolding systems combining wood, bamboo, and metal components will gain popularity in complex projects.

- Digital monitoring and smart project management integration will enhance scaffolding planning and utilization.