Market Overview

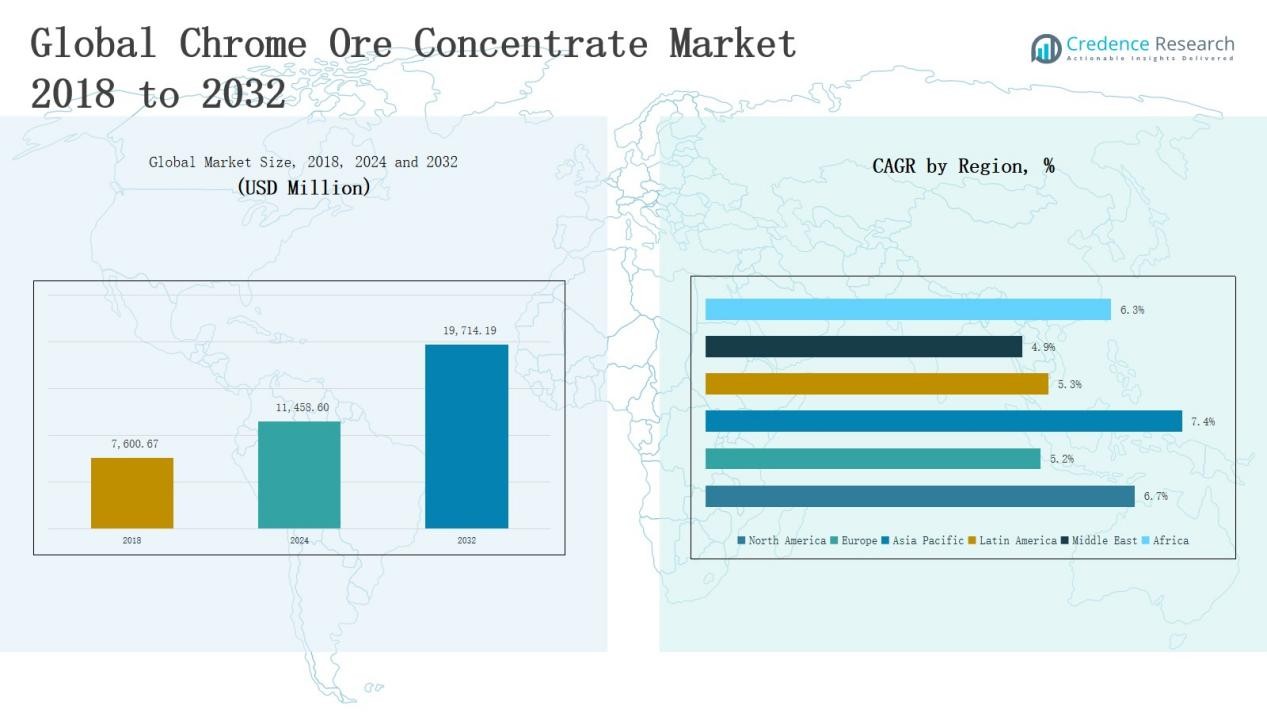

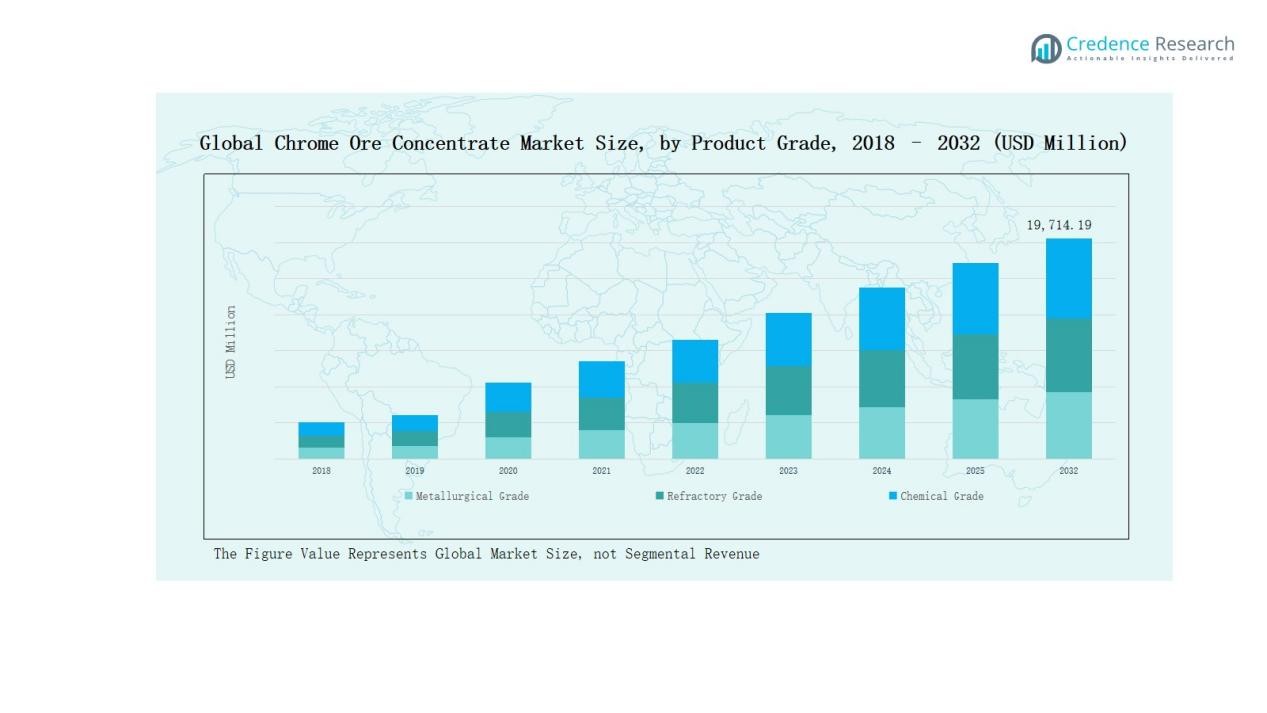

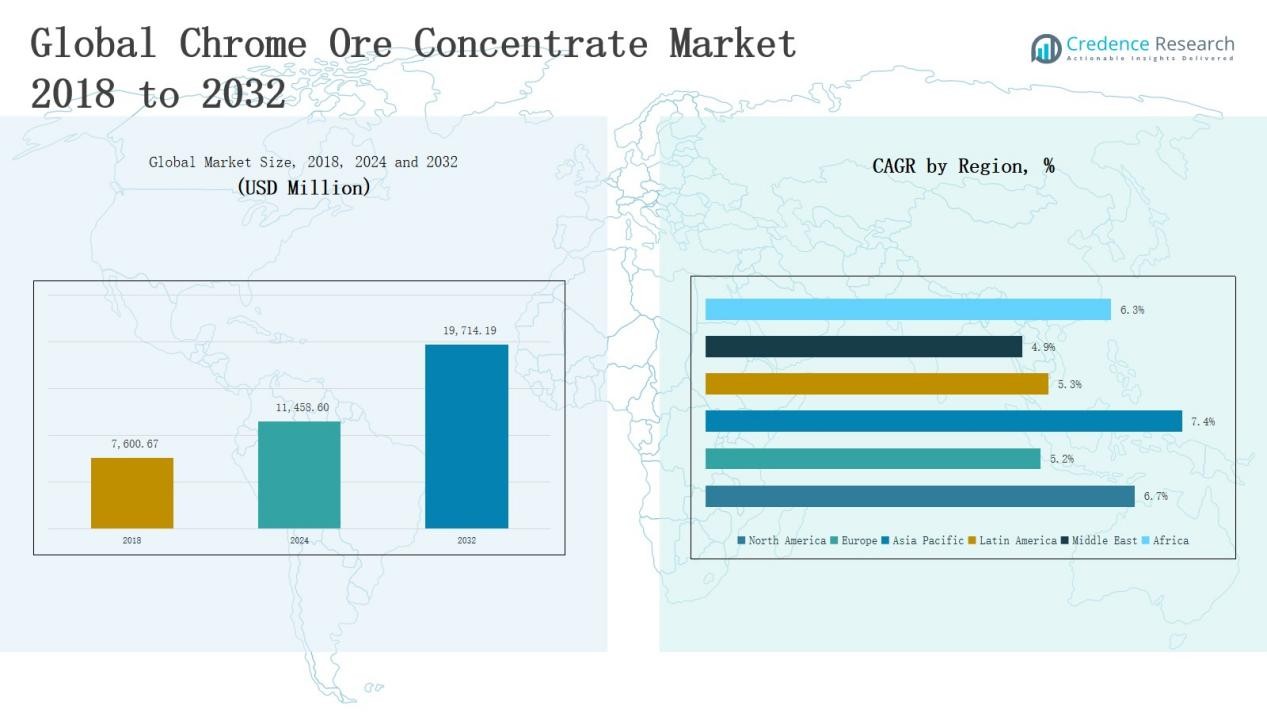

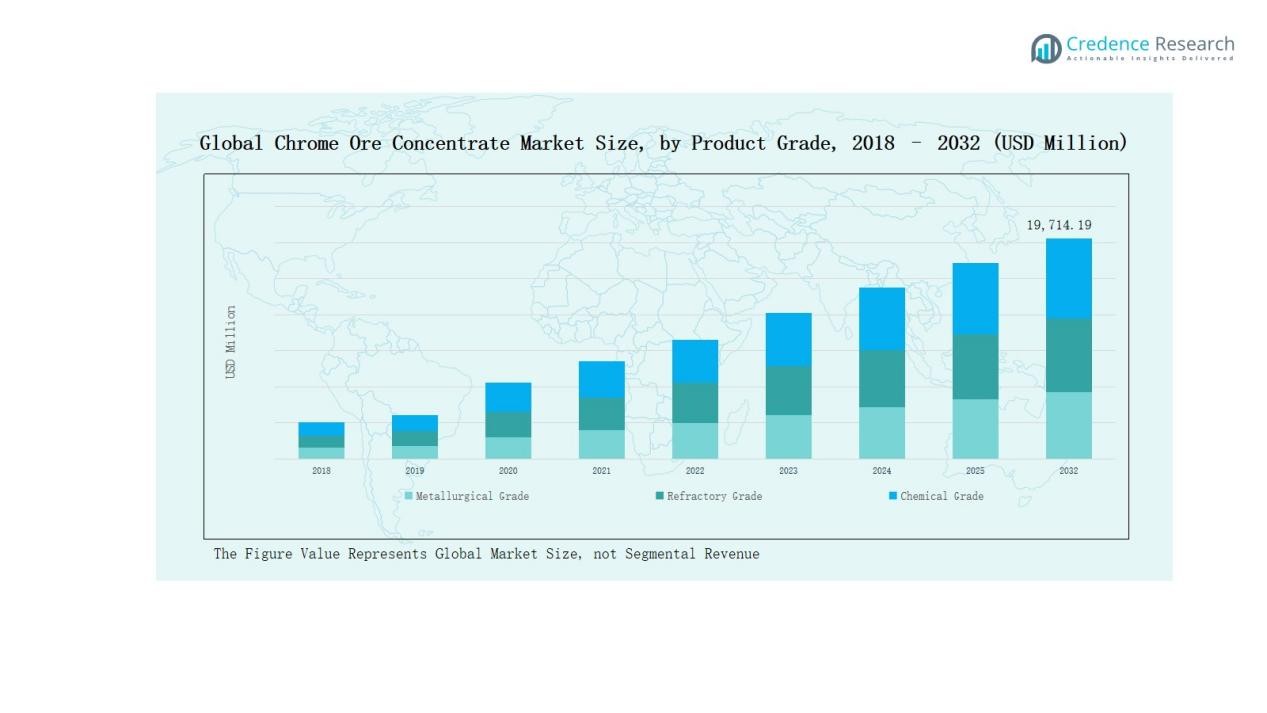

Chrome Ore Concentrate Market size was valued at USD 7,600.67 million in 2018 to USD 11,458.60 million in 2024 and is anticipated to reach USD 19,714.19 million by 2032, at a CAGR of 6.53% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chrome Ore Concentrate Market Size 2024 |

USD 11,458.60 Million |

| Chrome Ore Concentrate Market, CAGR |

6.53% |

| Chrome Ore Concentrate Market Size 2032 |

USD 19,714.19 Million |

The Chrome Ore Concentrate Market features prominent players such as Glencore, Samancor, Tharisa, Yilmaz Holding, Afarak, Clover Alloys, Eurasian Natural Resources Group, Sinosteel, KWG Resources, and Erzkontor. These companies maintain strong competitive positions through extensive mining operations, integrated supply chains, and diversified product portfolios catering to metallurgical, refractory, and chemical applications. Strategic investments in capacity expansion, technology upgrades, and global distribution networks enable them to secure long-term supply agreements with major end users. Regionally, Africa dominates the global chrome ore concentrate market, accounting for 62.4% of the total revenue share, driven by abundant reserves in South Africa, established mining infrastructure, and significant export volumes to key markets in Asia and Europe.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Chrome Ore Concentrate Market grew from USD 7,600.67 million in 2018 to USD 11,458.60 million in 2024 and is projected to reach USD 19,714.19 million by 2032, driven by strong demand from stainless steel, foundry, and chemical applications.

- Key players including Glencore, Samancor, Tharisa, Yilmaz Holding, Afarak, Clover Alloys, Eurasian Natural Resources Group, Sinosteel, KWG Resources, and Erzkontor strengthen market presence through mining assets, supply chain integration, and capacity expansion.

- Africa leads with 62.4% market share, supported by abundant reserves in South Africa, advanced mining infrastructure, and high export volumes to Asia and Europe.

- Growth is propelled by rising stainless steel production, infrastructure development, urbanization, and expanding applications in foundry and refractory industries requiring high thermal stability and corrosion resistance.

- Challenges such as commodity price volatility, stringent environmental regulations, and geopolitical supply risks influence market dynamics, prompting producers to adopt sustainable mining practices and diversify supply chains.

Market Segment Insights

By Product Grade

In the Chrome Ore Concentrate Market, the metallurgical grade segment leads due to its essential role in ferrochrome production, which is a critical input for stainless steel manufacturing. Its dominance is supported by steady demand from the global steel industry, underpinned by infrastructure development, urbanization, and advancements in smelting technology. The refractory grade segment serves high-temperature industrial processes such as furnace linings, while the chemical grade segment caters to specialized applications in pigments, metal finishing, and chemical synthesis.

- For instance, Clover Alloys notes that ferrochrome smelted from metallurgical grade chrome ore is directly added to steelmaking furnaces, serving as a critical chromium source in stainless steel production

By End User

The metallurgy segment is the largest consumer of chrome ore concentrate, driven by its extensive use in producing stainless steel and various alloy steels. Growth in this segment is fueled by industrialization, infrastructure expansion, and rising demand from automotive, construction, and manufacturing industries. The foundry segment benefits from the need for precision casting and high-strength metal components, while the chemical industry utilizes chrome ore concentrate for producing pigments and surface treatment chemicals. The construction and other segments maintain steady contributions through diverse industrial and architectural applications.

- For instance, Eti Krom Inc., the world’s largest producer of hard lumpy marketable chrome ore based in Turkey, supplies high-quality chrome concentrates used primarily in metallurgical applications such as stainless steel and ferrochrome alloy production.

Key Growth Drivers

Rising Demand from Stainless Steel Production

Stainless steel manufacturing remains the primary driver for chrome ore concentrate demand, as ferrochrome derived from the concentrate is essential for achieving corrosion resistance and strength in steel products. Expanding infrastructure projects, construction activities, and automotive manufacturing are creating sustained consumption. Emerging economies are further accelerating steel output, ensuring long-term demand stability for metallurgical-grade chrome ore concentrate. Technological advancements in smelting and alloying processes also enhance efficiency, making chrome ore concentrate a critical and irreplaceable raw material for global stainless steel industries.

- For instance, Glencore, a major player in chrome ore mining and ferrochrome production, supplies key stainless steel manufacturers worldwide, supporting automotive and infrastructure sectors with high-quality chrome ore concentrate.

Expanding Infrastructure and Urbanization

Rapid urbanization across Asia-Pacific, Africa, and Latin America is significantly increasing the demand for steel-intensive construction materials, indirectly boosting chrome ore concentrate consumption. The development of transport networks, commercial complexes, and industrial facilities is driving higher steel output, where ferrochrome plays a central role. Government infrastructure investment programs and public-private partnerships are sustaining demand growth. The ability of chrome ore concentrate to meet high-performance material requirements positions it as a vital raw material in supporting large-scale urban development worldwide.

Growth in Foundry and Refractory Applications

Beyond metallurgy, chrome ore concentrate is experiencing steady growth in foundry and refractory applications. Its high thermal stability and resistance to corrosion make it suitable for furnace linings, molds, and casting processes. Increasing industrial manufacturing activities and the expansion of heavy engineering sectors are driving consumption in these niches. The material’s ability to enhance durability and withstand extreme temperatures is particularly valuable in high-performance foundry operations, contributing to broader market diversification and reducing dependency on stainless steel demand alone.

- For instance, Henan Sicheng Abrasives Tech Co., Ltd in China produces foundry-grade chrome ore concentrate with Cr2O3 levels of 46%, used globally as highly fireproof chromite sand for molds and cores in casting processes.

Key Trends & Opportunities

Shift Toward Sustainable Mining Practices

Sustainability is emerging as a defining trend in the chrome ore concentrate market, with leading producers adopting environmentally responsible mining and beneficiation practices. Stricter environmental regulations and rising investor focus on ESG compliance are pushing companies toward energy-efficient processing, waste reduction, and water recycling. This shift not only enhances brand value but also opens opportunities for market differentiation, especially in premium-grade supply. Technological innovation in ore processing further supports the development of greener value chains, aligning with global sustainability goals.

- For instance, Tharisa Mine has developed a redox flow battery using chrome from their operations as a low-cost, safe, and sustainable electrolyte, illustrating innovation toward green energy storage solutions in the chrome value chain.

Increasing Downstream Integration

Producers are increasingly pursuing downstream integration by investing in ferrochrome production facilities and stainless steel manufacturing units. This strategy helps secure demand, stabilize revenue streams, and reduce exposure to raw material price fluctuations. Integrated operations also improve supply chain efficiency and profitability. Growing demand for value-added products in emerging economies presents a significant opportunity for chrome ore concentrate suppliers to capture larger market shares through forward integration and long-term partnerships with steel and alloy manufacturers.

- For instance, Jindal Stainless operates chrome ore mines in Odisha to support its 250,000 tons per annum ferrochrome plant and has integrated captive power plants and furnaces to produce ferro alloys efficiently.

Key Challenges

Price Volatility in Global Commodity Markets

The chrome ore concentrate market is highly sensitive to fluctuations in global commodity prices, driven by changes in supply-demand balance, energy costs, and geopolitical factors. Price instability affects profitability for both miners and end users, often leading to delayed investments and procurement decisions. Dependence on export markets further amplifies vulnerability, as currency fluctuations and trade policy shifts can significantly impact margins, making strategic pricing and risk management essential for market stability.

Regulatory and Environmental Compliance

Stringent environmental regulations, particularly regarding mining operations, waste disposal, and emissions control, pose operational and financial challenges for market participants. Compliance often requires substantial investment in advanced processing technologies, dust suppression systems, and waste treatment facilities. Failure to meet regulatory standards can result in fines, operational halts, or loss of operating licenses. For smaller producers, these requirements can significantly strain resources, limiting their ability to compete with larger, well-capitalized players.

Geopolitical and Supply Chain Risks

Concentration of chrome ore reserves in politically and economically volatile regions exposes the market to significant supply chain risks. Political instability, labor disputes, and infrastructure challenges in key producing countries can disrupt production and exports. Additionally, reliance on maritime transport makes the supply chain vulnerable to logistical disruptions, port delays, and changes in international trade policies. These factors necessitate robust supply diversification strategies to mitigate the impact of sudden supply shocks on global markets.

Regional Analysis

North America

North America accounts for 13.4% of the global chrome ore concentrate market in 2024, with a market size rising from USD 976.31 million in 2018 to USD 1,419.89 million in 2024, and projected to reach USD 2,466.54 million by 2032. Growth at a CAGR of 6.7% is supported by strong demand from metallurgy and foundry sectors, particularly in the United States. The region benefits from advanced industrial infrastructure, steady stainless steel production, and infrastructure renewal projects. Investments in sustainable sourcing and advanced processing technologies are expected to sustain long-term market expansion.

Europe

Europe holds 18.2% of the global market share in 2024, increasing from USD 1,356.34 million in 2018 to USD 1,927.60 million in 2024, with projections to reach USD 3,000.95 million by 2032. The region’s demand is driven by stainless steel manufacturing hubs in Germany, Italy, and Spain. Growth, at a CAGR of 5.2%, is supported by modernization of production facilities and stringent environmental regulations. The emphasis on high-quality metallurgical and refractory grades positions Europe as a stable consumer, with sustainable sourcing practices driving further market resilience.

Asia Pacific

Asia Pacific dominates the market with a 44.7% share in 2024, expanding from USD 3,020.09 million in 2018 to USD 4,737.90 million in 2024, and anticipated to reach USD 8,696.32 million by 2032. The region’s growth at a CAGR of 7.4%—the highest globally—is fueled by its leadership in stainless steel production, rapid industrialization, and large-scale infrastructure projects. Major economies like China, India, and Japan drive demand across metallurgy, construction, and automotive sectors. Continuous investment in manufacturing capacity and downstream processing strengthens the region’s supply chain dominance.

Latin America

Latin America represents 6.7% of the global market in 2024, with value increasing from USD 473.83 million in 2018 to USD 707.60 million in 2024, and projected to reach USD 1,111.74 million by 2032. The market grows at a CAGR of 5.3%, led by Brazil’s role as a key consumer and exporter. Growth is supported by an expanding metallurgy sector, infrastructure development, and rising alloy demand in construction and manufacturing. Strategic investments in mining operations and improved logistics are set to enhance regional competitiveness in global supply chains.

Middle East

The Middle East holds 3.8% of the market share in 2024, with market size moving from USD 283.85 million in 2018 to USD 400.35 million in 2024, and forecast to reach USD 609.93 million by 2032. Growing at a CAGR of 4.9%, demand is primarily driven by GCC countries, supported by infrastructure megaprojects and high-performance steel requirements in oil & gas applications. The region is pursuing downstream ferrochrome production and capacity expansion, aiming to reduce import dependency and strengthen self-sufficiency.

Africa

Africa accounts for 13.5% of the global market in 2024, with revenues rising from USD 1,490.26 million in 2018 to USD 2,265.26 million in 2024, and expected to reach USD 3,828.71 million by 2032. The market, growing at a CAGR of 6.3%, is anchored by South Africa’s dominant production capacity, abundant reserves, and established export channels to Asia and Europe. Investment in beneficiation plants and modernization of mining operations is set to enhance Africa’s strategic role as a key supplier in the global chrome ore concentrate value chain.

Market Segmentations:

By Product Grade

- Metallurgical Grade

- Refractory Grade

- Chemical Grade

By End User

- Metallurgy

- Foundry

- Chemical Industry

- Construction

- Others

By Region

North America

Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Argentina

- Rest of Latin America

Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The competitive landscape of the Chrome Ore Concentrate Market is characterized by the presence of established multinational mining corporations and regionally focused producers competing across metallurgical, refractory, and chemical grade segments. Leading companies such as Glencore, Samancor, Tharisa, Yilmaz Holding, Afarak, Clover Alloys, Eurasian Natural Resources Group, Sinosteel, KWG Resources, and Erzkontor leverage extensive mining assets, advanced beneficiation technologies, and integrated supply chains to secure market share. These players maintain long-term supply agreements with stainless steel and ferrochrome manufacturers, ensuring demand stability. Competitive strategies focus on capacity expansion, operational efficiency improvements, and compliance with stringent environmental standards. Regional producers strengthen their positions through cost-competitive offerings and proximity to high-growth end-user markets. Increasing emphasis on sustainable mining practices and downstream integration is reshaping competition, with leading players investing in green technologies, beneficiation facilities, and value-added processing to enhance product quality, capture premium markets, and mitigate the impact of raw material price volatility.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Glencore

- Samancor

- Tharisa

- Yilmaz Holding

- Afarak

- Clover Alloys

- Eurasian Natural Resources Group

- Sinosteel

- KWG Resources

- Erzkontor

Recent Developments

- In August 2025, Tianci International Inc., through its Hong Kong subsidiary Roshing International, signed an agreement to purchase 5,000 DMT of high-quality chromite ore concentrate, marking its entry into the global mineral resources market.

- In June 2025, Jubilee Metals Group Plc received a binding offer of up to USD 90 million from a private mining and metals trading company to acquire its chrome and PGM operations in South Africa, subject to final agreements and shareholder approval.

- In July 2025, Mantengu obtained official consent to acquire and restart the Blue Ridge PGM and chrome mining operation, initiating recovery of chrome and PGM concentrates from existing stockpiles with plans for phased underground development.

- In June 2025, Glencore restructured by consolidating its coal and ferroalloys assets, including South African manganese and chrome operations, into its Australian-based entity to reduce costs and unlock value.

Market Concentration & Characteristics

The Chrome Ore Concentrate Market exhibits a moderately consolidated structure, with a few global mining majors and several regional players controlling a significant share of production and exports. It is characterized by high entry barriers due to the capital-intensive nature of mining operations, stringent environmental regulations, and the need for advanced beneficiation technologies. The market is supply-driven, with production concentrated in resource-rich regions such as Africa, which plays a pivotal role in meeting global demand. Long-term contracts with ferrochrome and stainless steel manufacturers provide stability for leading producers, while price volatility in commodity markets influences profitability. It is also shaped by growing emphasis on sustainable mining practices, operational efficiency, and downstream integration to capture more value within the supply chain. Competitive advantage often depends on securing high-grade ore reserves, maintaining cost leadership, and ensuring reliable logistics to serve key industrial and infrastructure-driven end-user sectors worldwide.

Report Coverage

The research report offers an in-depth analysis based on Product Grade, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Global stainless steel production growth will remain the primary driver for chrome ore concentrate demand.

- Large-scale infrastructure projects in emerging economies will sustain consistent chrome ore concentrate consumption globally.

- Increased ferrochrome production capacity expansions will strengthen upstream chrome ore concentrate market demand.

- Adoption of sustainable mining practices will enhance competitiveness and market positioning for key producers.

- Advancements in beneficiation technology will improve chrome ore concentrate quality and operational efficiency.

- Producers pursuing downstream integration will gain stronger control over chrome ore concentrate value chains.

- Strategic investments in resource-abundant regions will ensure long-term chrome ore concentrate supply stability.

- Stringent environmental regulations will shape operational strategies and influence mining sector capital investments.

- Expansion into diversified export destinations will reduce reliance on limited regional chrome ore markets.

- Rising demand in foundry and refractory applications will drive chrome ore concentrate market diversification.