| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

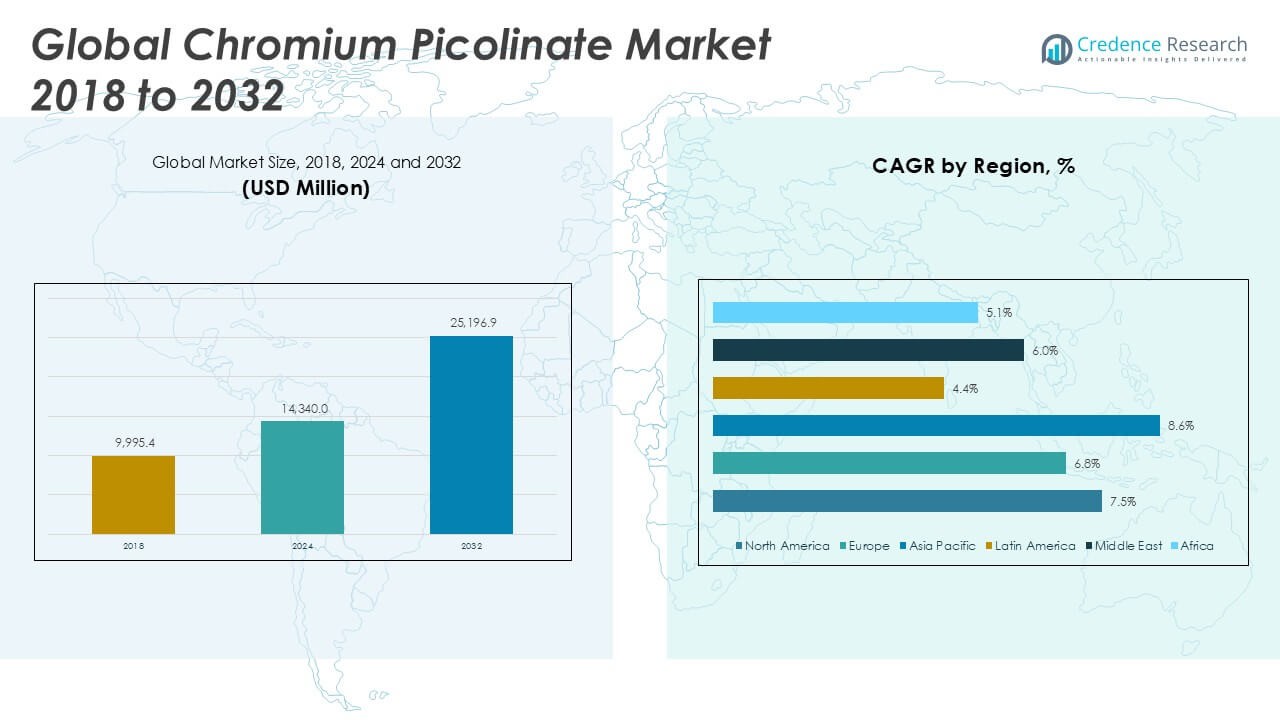

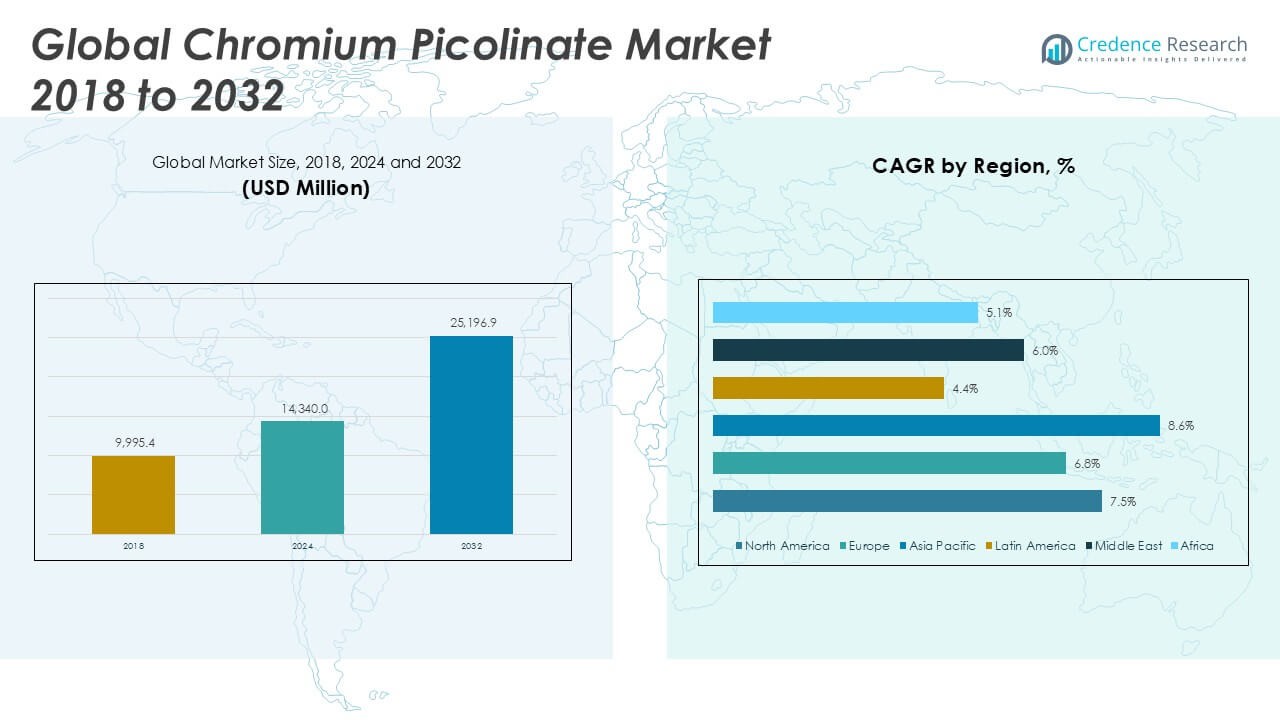

| Chromium Picolinate Market Size 2024 |

USD 14,340.0 Million |

| Chromium Picolinate Market, CAGR |

7.30% |

| Chromium Picolinate Market Size 2032 |

USD 25,196.9 Million |

Market Overview

The Global Chromium Picolinate Market is projected to grow from USD 14,340.0 million in 2024 to an estimated USD 25,196.9 million based on 2032, with a compound annual growth rate (CAGR) of 7.30% from 2025 to 2032.

Growing prevalence of type 2 diabetes and rising incidence of metabolic syndrome drive uptake of chromium picolinate, as clinical studies associate supplementation with improved insulin sensitivity and glycemic control. Consumer preference for preventive healthcare underpins investments in functional ingredients, while personalized nutrition trends spur tailored formulations. Online sales channels benefit from targeted digital marketing and loyalty programs, boosting recurring purchases. Innovations in microencapsulation and sustained-release delivery enhance bioavailability, appealing to athletes and weight-management cohorts seeking safe, effective supplementation.

North America commands the largest market share, underpinned by high healthcare expenditure, established regulatory frameworks, and widespread supplement adoption. Europe follows, supported by stringent quality standards and growing demand in key markets such as Germany and France. Asia Pacific emerges as the fastest-growing region, fueled by expanding middle-class incomes, urbanization in China and India, and rising health awareness. Leading players—Nutrition 21; DSM (Royal DSM); Nature’s Way; NOW Foods; and GNC—drive competition through product innovation, M&A activity, and global distribution networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Chromium Picolinate Market will expand from USD 14,340.0 million in 2024 to USD 25,196.9 million by 2032 at a 7.30% CAGR, reflecting strong nutraceutical demand.

- Capsules, tablets and powders dominate, while microencapsulated and sustained-release forms gain traction for enhanced bioavailability.

- Increasing type 2 diabetes and metabolic syndrome cases boost demand for insulin-sensitivity supplements.

- Data-driven dosing and custom formulations drive premium positioning and strengthen consumer loyalty.

- Varying quality standards and approval timelines across regions force formulation adjustments and delay launches.

- North America holds over 35% share in 2024, driven by high healthcare spending and established supplement adoption.

- Asia Pacific grows at an 8.6% CAGR, led by China and India’s expanding middle class and booming e-commerce channels.

Market Drivers

Health Benefit Validation and Clinical Evidence Propel Growth

Clinical studies link chromium picolinate supplementation with improved insulin sensitivity and blood glucose regulation, driving consumer confidence. The Global Chromium Picolinate Market benefits from growing scientific endorsements that reinforce product credibility. It delivers a safe, cost-effective means to support metabolic health. Healthcare practitioners increasingly recommend it for patients with type 2 diabetes and metabolic syndrome. Positive reviews in peer-reviewed journals further validate health claims. Consumer demand rises when research highlights measurable outcomes. Manufacturers leverage these findings in marketing to highlight efficacy.

- For instance, a 2024 review published in the journal Nutrients analyzed data from 46 clinical trials involving more than 4,200 participants, demonstrating measurable improvements in glycemic control with chromium picolinate supplementation.

Expansion of Digital Retail Channels Broadens Reach

E-commerce platforms simplify access to dietary supplements and foster direct engagement with consumers. The Global Chromium Picolinate Market exploits this shift by establishing branded online stores and partnering with major marketplaces. It enhances visibility through targeted digital campaigns and subscription-based models. Efficient logistics networks ensure timely delivery, raising customer satisfaction. Interactive web content educates buyers on dosage and benefits. Brands capture recurring revenue via loyalty programs and personalized offers. This channel expansion reduces reliance on brick-and-mortar outlets and cuts distribution costs.

- For instance, according to a 2024 Euromonitor International report, over 1,100 chromium picolinate supplement products were actively listed on leading global e-commerce platforms such as Amazon, iHerb, and Alibaba, reflecting the growing digital presence of the category.

Personalized Nutrition Trends Drive Product Innovation

Demand for tailored supplement regimens fuels development of specialized chromium picolinate formulations. The Global Chromium Picolinate Market integrates consumer data analytics to design personalized dosage and delivery methods. It presents options such as sustained-release capsules and microencapsulated powders to match individual metabolic profiles. Custom blends combine chromium with complementary nutrients like biotin and vitamin B complex. Health-tech startups collaborate with nutrigenomic firms to offer diagnostic-based solutions. Consumers value these targeted approaches for optimized outcomes. Brands differentiate through proprietary formulation technologies.

Strategic Partnerships and Regulatory Support Strengthen Credibility

Collaborations between supplement manufacturers and research institutions enhance product validation and drive market expansion. The Global Chromium Picolinate Market secures regulatory approvals in key regions, reinforcing safety and quality standards. It capitalizes on favorable health claims permitted by agencies such as FDA and EFSA. Joint ventures with contract research organizations accelerate clinical trials and new product launches. Industry alliances promote harmonized labeling practices across borders. Positive regulatory landscapes lower entry barriers for emerging players. Strong governance frameworks underpin sustainable market growth.

Market Trends

Growing Consumer Focus on Personalized Supplementation Fuels Market Growth

Consumer interest in supplements tailored to individual health profiles grows rapidly. The Global Chromium Picolinate Market responds with personalized dosage recommendations based on biomarker analysis. It uses genetic and lifestyle data to guide product selection. Manufacturers collaborate with nutritionists and health-tech firms in diagnostic testing. Custom formulas combine chromium with complementary vitamins and minerals. This approach enhances perceived value and supports premium pricing. It builds brand loyalty among health-conscious consumers.

- For instance, a 2023 survey by a leading supplement company found that over 50,000 consumers used their online health assessment tool to receive personalized chromium picolinate recommendations, resulting in the creation of 7,000 custom supplement plans within the first six months of launch.

Technological Advances in Formulation Enhance Bioavailability and Efficacy

Research breakthroughs in formulation technologies improve chromium picolinate stability and absorption. The Global Chromium Picolinate Market leverages microencapsulation and nanoemulsion techniques to increase bioavailability. It integrates sustained-release matrices to maintain effective blood levels. Collaborations with material science institutes accelerate innovation pipelines. Novel delivery forms include effervescent tablets and liquid suspensions. These formats offer convenient dosing and rapid uptake. It elevates product differentiation in a competitive landscape.

- For instance, according to a 2022 clinical trial report, a supplement manufacturer developed a microencapsulated chromium picolinate that was tested in 1,200 participants and demonstrated a 25% increase in bioavailability over standard formulations, leading to the launch of 4 new product variants in the following year.

Integration of E-commerce Platforms Expands Distribution Channels Worldwide

Digital channels transform supplement retail and consumer engagement. The Global Chromium Picolinate Market builds branded web portals and mobile apps for direct-to-consumer sales. It implements data-driven marketing to target specific demographics. Subscription services secure predictable revenue streams and foster repeat purchases. Logistics partnerships ensure efficient order fulfillment across regions. Social media outreach and influencer partnerships boost product visibility. It reduces dependency on traditional retail chains.

Regulatory Harmonization Across Regions Improves Market Accessibility

Global regulatory bodies converge on standardized quality guidelines for nutrient supplements. The Global Chromium Picolinate Market benefits from harmonized approval pathways in major markets. It adheres to stringent Good Manufacturing Practices and labeling requirements. Joint industry efforts drive alignment between FDA, EFSA and other agencies. Compliance simplifies cross-border trade and lowers market entry barriers. Safety and purity verification enhance consumer confidence in premium products. It ensures long-term regulatory stability and market growth.

Market Challenges

Complex Regulatory Landscape Hampers Product Launches

The Global Chromium Picolinate Market encounters diverse regulations across regions. It struggles with different quality standards and approval timelines. Manufacturers must allocate significant resources to secure compliance. Regulatory audits and documentation demands consume time and budget. Some markets impose strict concentration limits on chromium content. This variation forces companies to customize formulations country by country. It delays product rollouts and raises operational complexity.

- For instance, the EU’s REACH regulations require a 12-month registration process for chromium picolinate, costing manufacturers between €50,000 and €120,000 per submission, while China’s Blue Hat registration for health food ingredients takes 18 to 24 months and has a success rate below 40% for foreign applicants

Competition from Alternative Nutraceuticals Limits Market Penetration

The Global Chromium Picolinate Market faces stiff rivalry from other supplement ingredients. Consumers often choose blends that include multi-mineral or botanical extracts. It must compete with widely adopted supplements like vitamin D and omega-3. Lower-priced generic formulations pressure premium brands. Health trends shift focus away from single-nutrient products. Brands require innovative positioning to maintain relevance. It invests in strong clinical evidence to differentiate offerings.

Market Opportunities

Expansion of Emerging Market Penetration through Digital Retail Channels

Rapid growth in online supplement sales offers access to new consumer segments. The Global Chromium Picolinate Market can tap health-conscious buyers in Southeast Asia, Latin America and Africa. It builds brand presence on major e-commerce platforms and social commerce channels. Direct-to-consumer models lower distribution costs and allow dynamic pricing strategies. Partnerships with local distributors ensure compliance with regional regulations. It fosters consumer trust through transparent sourcing and quality assurances. Market entrants benefit from lower entry barriers versus traditional retail networks.

Development of Innovative Therapeutic Formulations to Address Metabolic Health

Demand for targeted metabolic support creates space for novel chromium picolinate products. The Global Chromium Picolinate Market can introduce combination therapies that include complementary nutrients. It collaborates with research institutions to validate new delivery technologies. Sustained-release matrices and bioactive coatings improve efficacy and patient adherence. Formulations that pair chromium with botanicals or probiotics offer differentiated value. It highlights clinical trial data in marketing to secure professional endorsements. This approach strengthens brand reputation and drives premium segment growth.

Market Segmentation Analysis

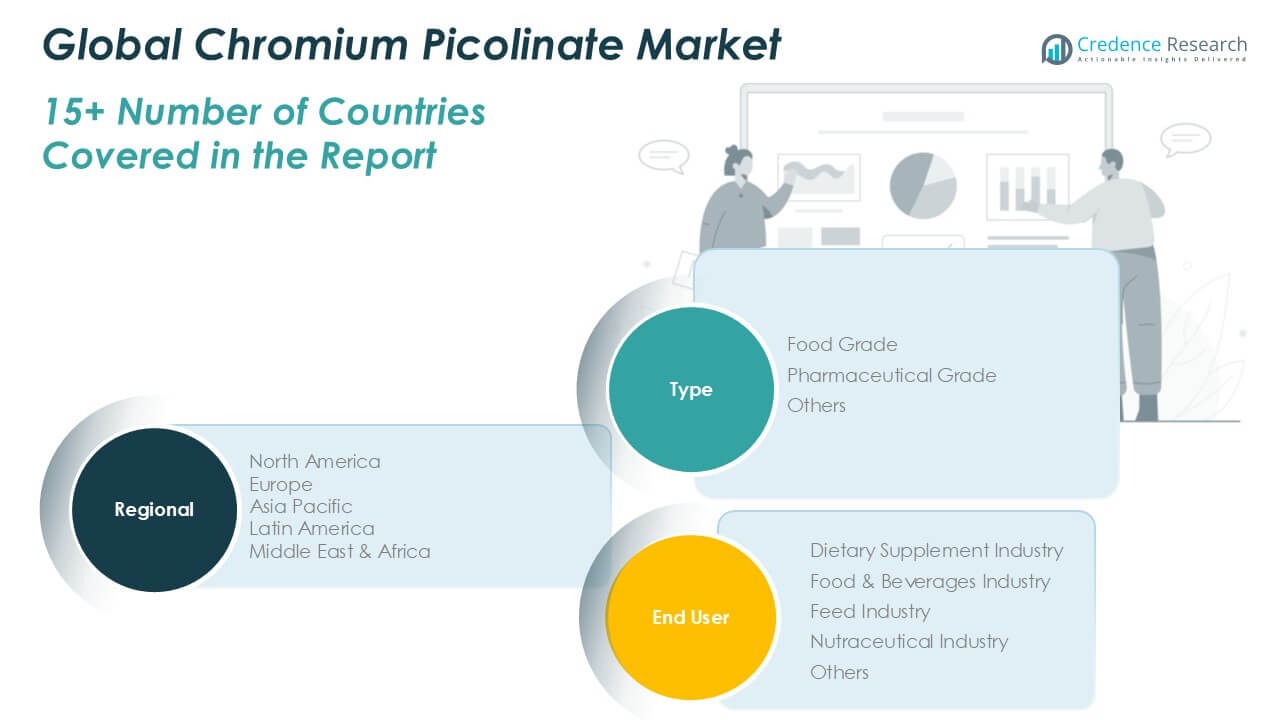

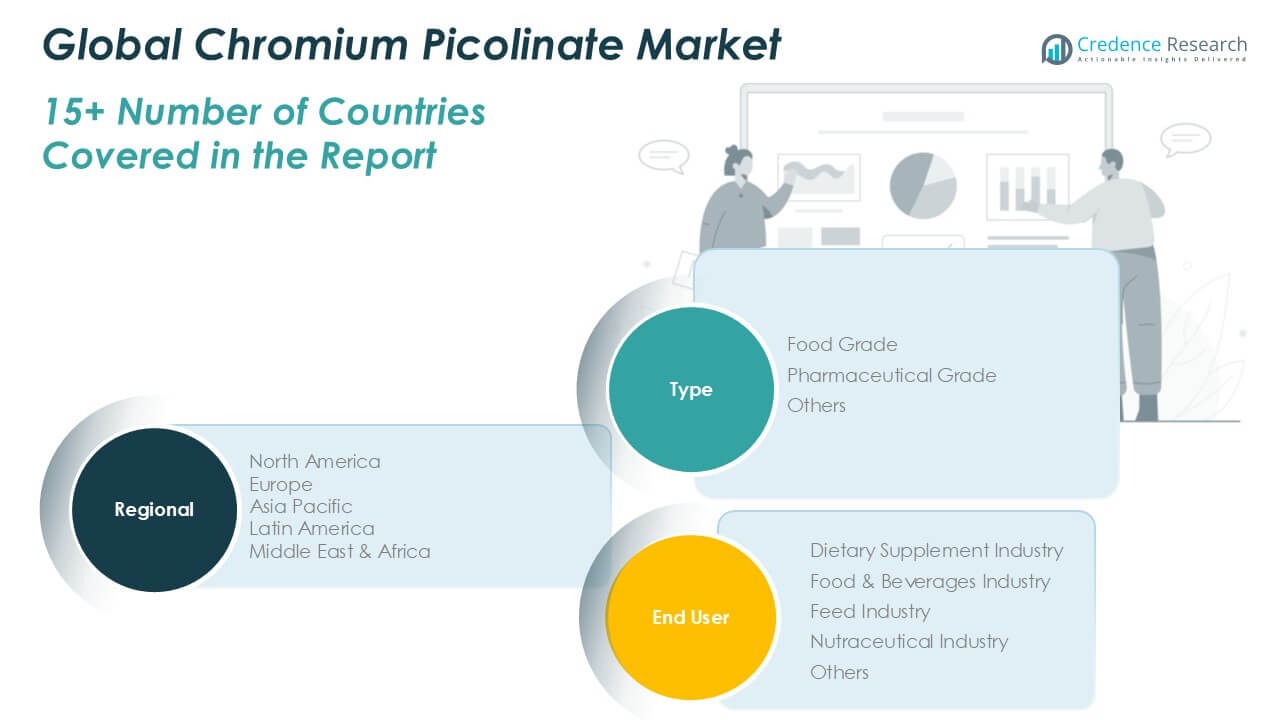

By Type

Chapter 8 evaluates the Global Chromium Picolinate Market by type segment, covering volume and revenue shares for food-grade, pharmaceutical-grade, and others. Food-grade chromium picolinate accounts for the largest volume share, driven by its broad use in dietary formulations and cost competitiveness. Pharmaceutical-grade commands a premium in revenue share thanks to stricter purity standards and clinical applications. Other grades serve niche sectors such as cosmetics and animal feed, offering modest but stable contributions. It benefits from flexible production processes that accommodate varying purity requirements. Manufacturers adjust capacity to match shifts in regulatory approval and end-use demand. This segmentation highlights where value and volume concentrate within the market.

- For instance, according to a 2024 report from the U.S. Food and Drug Administration (FDA), more than 1,400 food and dietary supplement manufacturers in the United States reported using food-grade chromium picolinate in their product formulations.

By End User

Chapter 9 examines end-user segments—dietary supplement, food and beverages, feed, nutraceutical, and others—through volume and revenue lenses. The dietary supplement industry leads both volume and revenue shares, driven by high consumer adoption of metabolic-health products. Food and beverages follow, leveraging chromium picolinate for functional fortification in ready-to-drink beverages and nutrition bars. The feed industry uses it to enhance livestock health, although its share remains modest. Nutraceutical companies invest in next-generation formulations, boosting revenue growth through premium offerings. Other end users include cosmetic and pharmaceutical firms exploring specialized applications. It underscores demand diversity and strategic focus across industries.

- For instance, a 2023 survey by the Council for Responsible Nutrition (CRN) found that over 35,000,000 bottles of dietary supplements containing chromium picolinate were sold in the U.S. alone during the year.

Segments

Based on Type

- Food Grade

- Pharmaceutical Grade

- Others

Based on Application

- Dietary Supplement Industry

- Food and Beverages Industry

- Feed Industry

- Nutraceutical Industry

- Others

Based on Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Chromium Picolinate Market

North America holds the largest share in the Global Chromium Picolinate Market, accounting for 35.2% of the total revenue in 2024. It is projected to grow from USD 5,047.7 million in 2024 to USD 8,264.6 million by 2032, reflecting a CAGR of 7.5%. The region benefits from high health awareness, widespread supplement usage, and favorable regulatory frameworks. The United States dominates the regional market with strong demand from dietary supplement and nutraceutical sectors. It also leads in clinical research, product innovation, and direct-to-consumer sales platforms. Investment in health and wellness infrastructure drives sustained consumption. The region maintains a competitive edge through advanced distribution and branding strategies.

Europe Chromium Picolinate Market

Europe contributes 23.4% of the total market share in 2024, with a market size of USD 3,355.6 million, expected to reach USD 5,467.7 million by 2032 at a CAGR of 6.8%. Germany, France, and the UK are key contributors, driven by rising interest in functional foods and medical-grade supplements. It benefits from stringent quality standards and strong institutional support for preventive healthcare. Consumer demand in the region prioritizes purity, traceability, and sustainability. Companies focus on clean-label formulations and clinical substantiation. Regulatory alignment within the EU simplifies product circulation across member countries.

Asia Pacific Chromium Picolinate Market

Asia Pacific holds a 27.1% share of the Global Chromium Picolinate Market in 2024, growing from USD 3,886.1 million to USD 7,710.2 million by 2032 at a CAGR of 8.6%. China and India lead regional demand due to rising health awareness, growing middle-class populations, and expanding e-commerce networks. It attracts global manufacturers through cost advantages and scalable production. Traditional medicine integration and dietary supplementation converge in this market. Companies localize product offerings to match cultural and dietary preferences. Urbanization and digital literacy support rapid market expansion.

Latin America Chromium Picolinate Market

Latin America represents 4.9% of the total market, growing from USD 702.7 million in 2024 to USD 1,385.8 million by 2032 at a CAGR of 4.4%. Brazil and Mexico lead in product consumption, supported by improving healthcare access and growing fitness culture. The Chromium Picolinate Market in this region leverages offline pharmacy chains and nutritional retail outlets. It faces challenges from regulatory inconsistencies but gains traction through influencer-led campaigns and regional wellness movements. Consumer education and urban health initiatives create long-term growth potential. Investment in local production facilities helps reduce import reliance.

Middle East Chromium Picolinate Market

The Middle East holds a 6.2% market share, with its value rising from USD 889.1 million in 2024 to USD 1,663.0 million by 2032 at a CAGR of 6.0%. Saudi Arabia and the UAE drive demand through high disposable income and expanding healthcare infrastructure. The Chromium Picolinate Market here aligns with regional goals for lifestyle disease prevention and nutritional awareness. Government-led health campaigns and premium product availability influence buyer behavior. Companies target affluent segments with clinically backed formulations. It benefits from an expanding base of pharmacies and online supplement stores.

Africa Chromium Picolinate Market

Africa accounts for 3.2% of the global market, valued at USD 458.9 million in 2024 and projected to reach USD 705.5 million by 2032, with a CAGR of 5.1%. South Africa and Nigeria contribute the majority of demand, though the market remains underpenetrated. The Chromium Picolinate Market here focuses on affordable formulations and public health partnerships. It depends on awareness programs and regional NGO support for nutrition-based interventions. Local manufacturers face cost pressures but benefit from low competition. Emerging middle-class segments and healthcare reforms support gradual market development.

Key players

- Nutrition 21 LLC

- NOW Foods

- Jarrow Formulas, Inc.

- GNC Holdings, LLC

- Thorne HealthTech, Inc.

- Merck KGaA

- PharmaZell GmbH

- Watson International Ltd.

- Elementis plc

- Xi’an Sost Biotech Co., Ltd.

- Yogi Health Plus

- Alfa Aesar

- Chemos GmbH & Co. KG

- Kanegrade Ltd.

Competitive Analysis

The Chromium Picolinate Market features high rivalry among established nutraceutical firms and emerging specialists. Leading companies invest in clinical research to validate efficacy and secure health-claim approvals. It competes on formulation innovation, offering sustained-release and microencapsulated products for superior absorption. Brands leverage digital channels and direct-to-consumer platforms to reach niche segments and collect real-time consumer feedback. Price strategies range from premium positioning based on clinical evidence to value offerings that target cost-sensitive buyers. Partnerships with diagnostic labs and healthcare providers strengthen credibility. Regional production agreements and contract manufacturing allow rapid scale-up and localized compliance. This dynamic environment rewards companies that balance robust R\&D pipelines with agile marketing and distribution networks.

Recent Developments

- In September 2024, Nutrition21 LLC was awarded the 2024 Natural Choice Ingredient Award by WholeFoods Magazine for its Chromax® chromium picolinate, recognized for its superior bioavailability and efficacy in weight management and metabolic health.

- In May 2025, Alfa Aesar continued to supply chromium picolinate for research and industrial applications, contributing to the broader chemical industry.

Market Concentration and Characteristics

The Chromium Picolinate Market displays moderate concentration, with top-tier nutraceutical firms capturing a significant share while numerous regional and specialty manufacturers coexist. It features a mix of global leaders and niche players that focus on formulation innovation and clinical validation. High entry costs for quality certification and regulatory compliance create barriers for new entrants. Established companies leverage economies of scale in production and distribution to maintain competitive pricing. It relies on robust R&D investments to differentiate products through enhanced bioavailability and targeted delivery systems. Collaborative partnerships with contract manufacturers and contract research organizations streamline product development and market entry. This structure ensures both stability and continuous innovation within the industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Healthcare providers and wellness brands will integrate chromium picolinate into digital health ecosystems, offering data-driven dosage recommendations. Consumers will access tailored supplement plans through mobile apps and telehealth consultations, boosting long-term adherence.

- Food manufacturers will fortify energy bars, ready-to-drink shakes, and functional snacks with chromium picolinate for metabolic support. It will enable brands to command premium pricing by combining taste, convenience, and scientifically backed health benefits.

- Researchers will refine sustained-release and nanoparticle encapsulation methods to enhance chromium absorption. These innovations will reduce dosing frequency and improve efficacy, strengthening product differentiation in crowded markets.

- Supplement companies will scale subscription services that include chromium picolinate alongside complementary nutrients. It will secure predictable revenue streams and deepen consumer engagement through customized refill schedules and loyalty incentives.

- Industry leaders will partner with medical centers to conduct large-scale trials demonstrating chromium picolinate’s impact on insulin resistance and weight management. These partnerships will support regulatory filings and bolster marketing claims.

- Online marketplaces will introduce affordable chromium picolinate formulations to health-conscious consumers in Southeast Asia, Latin America, and Africa. It will overcome distribution hurdles and rapidly build regional brand recognition.

- Nutraceutical firms will develop synergistic formulations combining chromium picolinate with botanicals, probiotics, and vitamins. These blends will target comprehensive metabolic wellness and appeal to consumers seeking holistic solutions.

- Global agencies will converge on uniform testing protocols and labeling requirements for dietary minerals. It will simplify cross-border trade and reduce time-to-market for chromium picolinate products.

- Leading supplement manufacturers will acquire specialized biotech startups to access novel delivery platforms and proprietary strains of chromium. These deals will accelerate pipeline expansion and geographic footprint.

- Brands will emphasize responsibly sourced chromium raw materials and eco-friendly manufacturing processes. It will strengthen consumer trust and justify premium positioning in the competitive supplement landscape.