Market Overview:

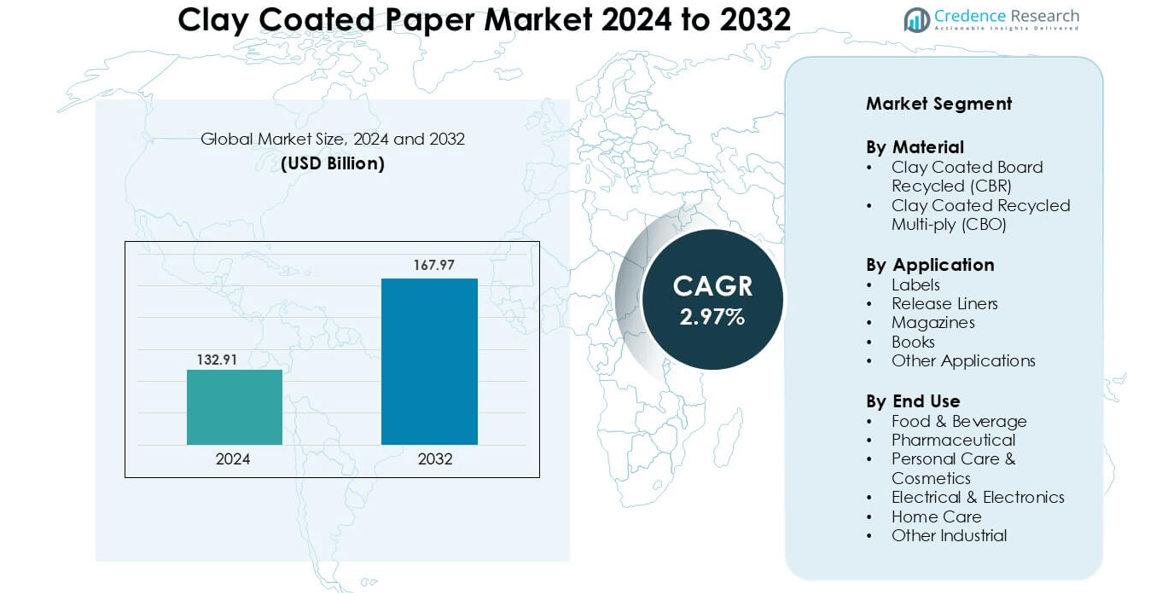

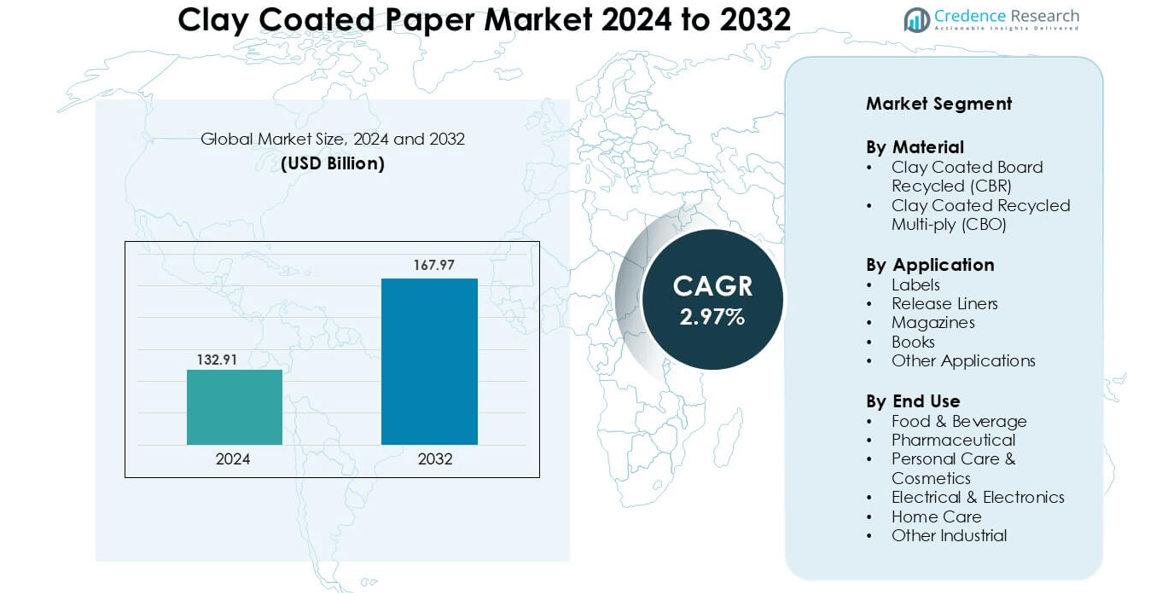

Clay Coated Paper Market was valued at USD 132.91 billion in 2024 and is anticipated to reach USD 167.97 billion by 2032, growing at a CAGR of 2.97 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Clay Coated Paper Market Size 2024 |

USD 132.91 billion |

| Clay Coated Paper Market, CAGR |

2.97% |

| Clay Coated Paper Market Size 2032 |

USD 167.97 billion |

The clay coated paper market includes leading producers such as Spoton Coatings Private Limited, UPM Ltd, BURGO GROUP SPA, Hansol Paper, Ahlstrom-Munksjö, Shree Krishna Paper Mills & Industries Ltd., Verso Corporation, Globus International, Sappi Limited, and Stora Enso Oyj. These companies focus on recyclable grades, premium surface finishes, and high-strength coated boards for packaging, labeling, and commercial printing. Many manufacturers invest in advanced coating technology and lightweight substrates to meet FMCG and e-commerce requirements. Asia-Pacific remains the leading region with 35% market share, supported by strong packaging demand, expanding retail networks, and large production capacity across China and India.

Market Insights

- The clay coated paper market reached a multi-billion USD132.91 size in 2024 and continues to grow at a steady CAGR of 2.97 %during the forecast period.

- Demand increases due to rising use in packaging, labeling, and premium print applications, supported by FMCG, pharmaceuticals, and retail expansion.

- Trends focus on sustainable recyclable coated boards, lightweight grades, and specialty finishes that offer better print clarity, barrier properties, and shelf appeal.

- Competition includes Spoton Coatings Private Limited, UPM Ltd, BURGO GROUP SPA, Hansol Paper, Ahlstrom-Munksjö, Shree Krishna Paper Mills & Industries Ltd., Verso Corporation, Globus International, Sappi Limited, and Stora Enso Oyj, with companies investing in coating upgrades and new recycled product lines.

- Asia-Pacific holds 35% share as the leading region, while the label segment remains the largest application category due to high use in food, beverage, and personal care packaging.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

Clay Coated Board Recycled (CBR) remains the dominant material segment with the highest market share, driven by strong demand from sustainable packaging and printing applications. CBR offers smooth surface, high opacity, and better printability, making it ideal for brochures, cartons, labels, and premium packaging. Recyclability supports brand sustainability goals and regulatory compliance across developed markets. Clay Coated Recycled Multi-ply (CBO) is also used for premium graphical printing and packaging where enhanced strength and stiffness are required. However, CBR leads due to wider availability, lower cost, and strong adoption by packaging converters and commercial printers.

- For instance, Smurfit Kappa reports that its global paper and board capacity reached approximately 8.4 million tonnes annually in 2023, enabling large-scale supply of recycled fibre board grades such as CBR.

By Application

Labels hold the largest share in the application segment due to high usage in food packaging, beverages, household goods, and industrial products. Clay coated paper provides strong ink retention, smooth finish, and resistance to moisture, which helps brands maintain print clarity and product visibility on shelves. Growing FMCG activity, organized retail expansion, and barcode-based inventory systems further boost demand for high-quality coated label stock. Release liners and magazines follow as key segments, supported by growth in pressure-sensitive labels, publishing, and promotional printing. Books and other applications show steady usage in specialty print and packaging.

- For instance, Avery Dennison Corporation publishes a facestock specification of 70 g/m² (≈85 µm thick) for its Prime Paper Vellum FSC label material used in retail and food packaging.

By End Use

Food and beverage remain the dominant end-use segment holding the highest share, as coated paper is widely used in packaging, labels, and graphical content for processed food, dairy, bakery, confectionery, and beverage containers. Strong print quality, grease resistance, and smooth surface improve branding and compliance with packaged food labeling norms. Pharmaceutical and personal care brands also use clay coated paper for cartons, blister packs, and product labels, driven by strict packaging standards and premium product presentation. Electrical and electronics, home care, and other industrial applications continue to adopt coated board for durable labeling and tamper-evident packaging.

Key Growth Drivers

Expansion of Sustainable and Recyclable Packaging

Brands focus on eco-friendly packaging to meet consumer expectations and regulatory pressure. Clay coated recycled paper offers a balance of print quality, durability, and recyclability, making it suitable for packaging converters, printers, and FMCG companies. Food, beverage, and personal care products rely on coated cartons and labels to maintain aesthetic appeal while reducing plastic dependency. Government policies promoting recycled packaging materials support higher adoption across developed regions. The rise of online retail also pushes demand for sustainable printed boxes, wrappers, and labels. As businesses invest in greener supply chains, clay coated paper gains importance as a cost-efficient alternative to plastic laminates or synthetic substrates.

- For instance, Smurfit Kappa s ReNew100® Classic coated recycled board is produced from 100% recycled fibre with a double clay-coated surface, enabling vibrant graphics while meeting recyclability goals.

Growth in Labeling and Branding Requirements

Organized retail, barcoding, and SKU expansion drive higher use of coated label stock in consumer goods. Clay coated paper delivers better ink absorption, smooth surface, and color sharpness, making it ideal for branding, compliance information, and retail tracking. Food packaging, beverages, pharmaceuticals, and electronics depend on high-resolution labels for safety warnings, traceability, and marketing. Premium packaging trends, such as glossy product labels and shelf-ready boxes, further increase consumption. As companies scale e-commerce operations, barcode logistics and tamper-evident labels expand. These factors collectively strengthen long-term growth in label-based coated papers.

- For instance, UPM Raflatac introduced its “New Wave” paper label for rigid HDPE and PP bottles, achieving 100 % removal efficiency in RecyClass recyclability tests — meaning no measurable fibre loss from the process.

Rapid Demand from Commercial Printing and Publishing

The printing industry continues to support coated paper consumption across magazines, catalogues, brochures, and advertising materials. Clay coating improves opacity, print contrast, and smoothness, enabling sharper imagery for marketing campaigns. Retail chains, real estate, hospitality, and tourism rely on promotional print to reach large audiences, especially in developing economies. Although digital media grows, commercial print remains relevant in education, publishing, and branding. Clay coated boards also support bulk printing for packaging inserts and product manuals. Continuous improvements in coating formulation and recycled fiber quality enhance suitability for high-speed printing equipment, supporting stable demand.

Key Trends & Opportunities

Shift Toward Premium and Specialty Coated Paper

Many industries adopt premium coated paper for high-gloss packaging, luxury brand visuals, and detailed printing work. Specialty coatings—such as moisture resistance, grease barriers, or soft-touch finishes—create opportunities in foodservice packaging, confectionery, and cosmetics. Brands upgrading packaging aesthetics to improve shelf appeal rely on clay coated substrates due to improved ink brightness and tactile quality. With rising competition in FMCG and personal care, packaging becomes an important marketing tool. This trend encourages manufacturers to offer customized grades and lightweight coated paper to reduce packaging weight without compromising appearance.

- For instance, Stora Enso s Ensocoat™ 2S board offers coating on both sides and is engineered for luxury packaging with double-side coating and high recoverable stiffness.

Increasing Adoption in Fast-Growth FMCG and E-Commerce

E-commerce growth boosts demand for printed packaging, barcode labels, and promotional inserts. Clay coated paper helps companies maintain brand consistency across shipping boxes, retail-ready packs, and labels. FMCG brands continue launching multipack units, seasonal editions, and promotional kits, which require high-quality printed packaging. As logistics systems use barcode scanning and RFID labeling, demand increases for durable coated liner stock. Emerging markets in Asia-Pacific and Latin America provide opportunities for suppliers to expand capacity and local conversions, driven by rising disposable income, modern retail presence, and higher packaged food penetration.

- For instance, Indian Institute of Packaging (IIP) in 2015 stated that India’s total packaging consumption had increased by 100% in a decade, rising from 4.3 kg per person per annum to 8.6 kg per person per annum.

Key Challenges

Rising Competition from Digital Media and Electronic Labeling

igitalization affects demand for magazines, catalogues, and print advertising, reducing coated paper consumption in publishing. Retailers and logistics operators experiment with paperless labeling, QR-based information access, and electronic tags, which affects traditional printed label volumes. Although packaging and FMCG sectors offset losses, shrinking commercial print orders remain a challenge in developed markets. Manufacturers need diversification into specialty and high-performance coatings to remain competitive. The shift also forces producers to optimize cost structures as paper mills face margin pressure.

Price Volatility in Raw Materials and Supply Instability

Manufacturers depend on recovered paper, pulp, coating clay, and chemicals, all of which face cost fluctuations. Global disruptions in pulp supply, freight, or energy markets affect coated board pricing and lead times. Converters and printers may switch to cheaper substrates or lightweight packaging during high-cost cycles. Smaller mills struggle to maintain profit margins during raw material inflation. To overcome the challenge, players invest in fiber optimization, energy-efficient production, and long-term contracts with suppliers. However, cost volatility remains a key barrier to stable production and pricing.

Regional Analysis

North America

North America holds nearly 26% share of the clay coated paper market, driven by strong demand from packaging, printed labels, and advertising materials. Food and beverage products rely heavily on coated cartons and label stock for branding and regulatory labeling. The United States contributes the largest portion of regional consumption due to high packaged food penetration and advanced printing infrastructure. Despite digital media expansion, catalogues, brochures, and magazines continue to use coated grades. Growing adoption of recycled coated boards and premium label materials supports steady market activity across converters and printing companies.

Europe

Europe accounts for approximately 28% of the clay coated paper market, supported by strict sustainability mandates and mature packaging supply chains. FMCG and personal care companies rely on recyclable coated boards for cartons and promotional print. Germany, the U.K., France, and Italy lead consumption due to advanced printing systems and demand for premium packaging aesthetics. Circular economy commitments and EU packaging waste directives encourage higher use of recycled fiber coated grades. These factors help Europe maintain a strong share in high-quality coated graphical and packaging applications.

Asia-Pacific

Asia-Pacific holds the largest regional share at roughly 35%, led by rapid industrialization, e-commerce growth, and expanding retail networks. China and India drive bulk demand from food, beverage, and pharmaceutical packaging. Regional converters supply coated cartons, labels, and inserts for manufacturing and export markets. High-volume consumption, population growth, and modern branding needs support strong coated board usage. Investments in paper mills, printing capacity, and recyclable grades further strengthen Asia-Pacific’s leadership position in the clay coated paper market.

Latin America

Latin America represents close to 6% of the global clay coated paper market, showing steady expansion in packaging, labeling, and promotional print. Brazil, Mexico, and Argentina lead consumption due to rising packaged food production and retail penetration. Commercial printers produce magazines, catalogues, and campaign material for consumer brands and retail chains. Economic fluctuations affect printing budgets, but growth in FMCG, logistics, and e-commerce continues to drive coated board and label stock demand in the region.

Middle East & Africa

The Middle East & Africa holds nearly 5% share of the clay coated paper market, with growth supported by food packaging, pharmaceuticals, and personal care segments. GCC countries adopt premium coated boards for luxury packaging and high-quality print labels, while African markets favor cost-effective recycled grades. Improvements in packaging standards, urban retail growth, and investment in local printing units contribute to gradual market expansion. Rising imports of packaged foods and personal care items also strengthen coated paper demand across the region.

Market Segmentations:

By Material

- Clay Coated Board Recycled (CBR)

- Clay Coated Recycled Multi-ply (CBO)

By Application

- Labels

- Release Liners

- Magazines

- Books

- Other Applications

By End Use

- Food & Beverage

- Pharmaceutical

- Personal Care & Cosmetics

- Electrical & Electronics

- Home Care

- Other Industrial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The clay coated paper market features a mix of global paper manufacturers, packaging material suppliers, and regional coating specialists. Companies focus on sustainable, recyclable grades to meet growing demand from food, beverage, and personal care packaging. Major players invest in upgraded coating technology, fiber optimization, and lightweight board development to improve print quality and reduce production costs. Strategic moves include capacity expansion, mergers, and partnerships with converters and label manufacturers. Firms also diversify into specialty coated grades with moisture resistance, high-gloss surfaces, and better ink holdout for premium packaging and advertising print. Asia-Pacific players increase competitiveness through large-scale production and price-effective recycled grades, while European and North American companies emphasize premium quality, certifications, and environmentally compliant products. Continuous R&D in surface treatment and barrier coatings strengthens product portfolios, helping manufacturers target fast-growth FMCG and e-commerce segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, Burgo published its Burgo Stories piece highlighting sustainability, circular economy and paper industry trends (including coated papers) in its business model.

- In August 2025, UPM Adhesive Materials (formerly UPM Raflatac) started a project (kicked off April 2025) to install a new coating line and facility upgrades at its Johor Bahru, Malaysia factory; operation expected around mid-2026.

Report Coverage

The research report offers an in-depth analysis based on Material, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for sustainable and recyclable coated grades will continue to rise across FMCG and retail.

- Lightweight coated boards will gain preference as brands seek to reduce packaging weight and logistics cost.

- Specialty coatings offering moisture resistance, grease protection, and high-gloss finish will expand in food and cosmetics packaging.

- Label consumption will increase due to barcoding, SKU growth, and strict product identification norms.

- E-commerce growth will boost demand for coated cartons, promotional inserts, and shipping labels.

- Manufacturers will invest in automated coating lines and energy-efficient paper mills to reduce production cost.

- Regional players will expand capacity to supply local converters and reduce dependence on imports.

- Digital printing compatibility will become a key feature, supporting short-run customized packaging.

- Companies will develop recyclable barrier-coated papers as replacements for plastic-based laminates.

- Strategic mergers and partnerships will increase as firms strengthen technology, distribution, and raw material access.