Market Overview:

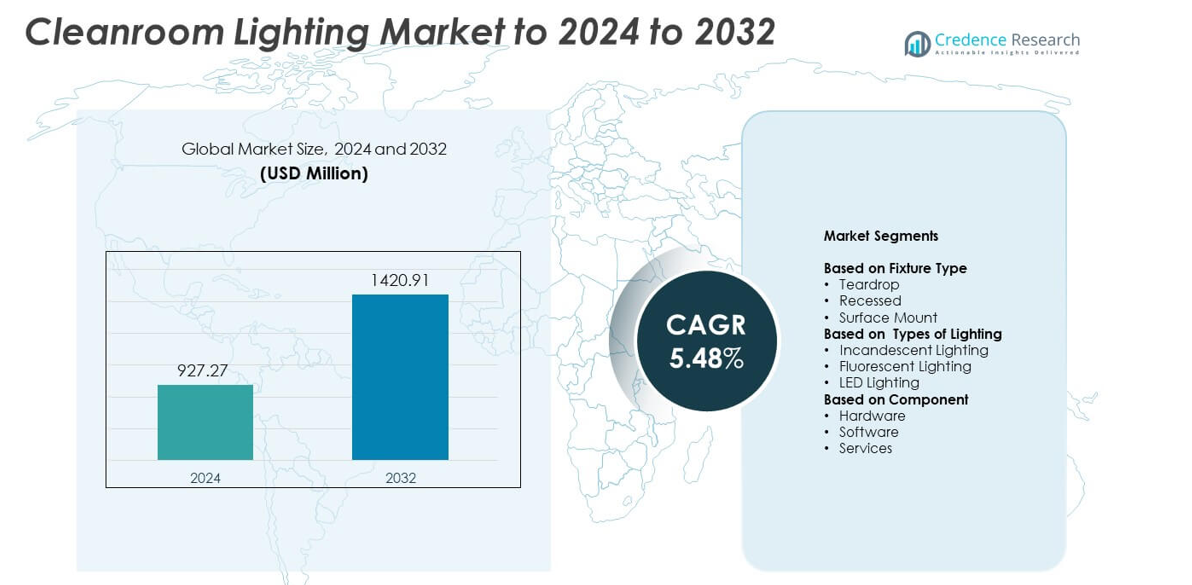

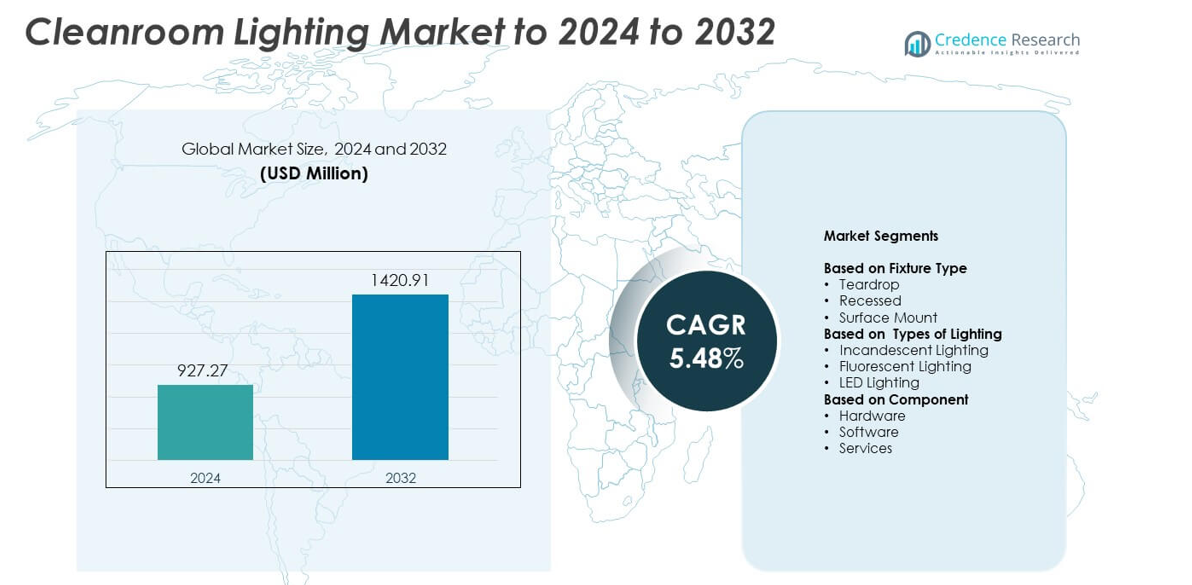

Cleanroom Lighting Market size was valued at USD 927.27 million in 2024 and is anticipated to reach USD 1420.91 million by 2032, at a CAGR of 5.48% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cleanroom Lighting Market Size 2024 |

USD 927.27 million |

| Cleanroom Lighting Market, CAGR |

5.48% |

| Cleanroom Lighting Market Size 2032 |

USD 1420.91 million |

The cleanroom lighting market is shaped by leading players such as Terra Universal Inc., Kenall Manufacturing, Signify Holding, Wipro Enterprises, and Havells India Ltd. These companies focus on energy-efficient LED solutions, modular designs, and compliance with stringent ISO and GMP standards. North America led the market with a 35.4% share in 2024, supported by extensive adoption across pharmaceutical and semiconductor sectors. Europe followed with 28.7%, driven by strong biotechnology and medical device manufacturing. Asia-Pacific accounted for 24.6%, emerging as the fastest-growing region due to expanding production facilities and government support for clean energy and high-tech industries.

Market Insights

- The cleanroom lighting market was valued at USD 927.27 million in 2024 and is projected to reach USD 1420.91 million by 2032, growing at a CAGR of 5.48%.

- Rising demand from pharmaceutical, biotechnology, and semiconductor sectors is driving market expansion, supported by stricter contamination control regulations and energy-efficient infrastructure investments.

- The adoption of LED lighting dominates with a 67.2% share due to its long lifespan, low power use, and superior illumination quality. Smart and IoT-enabled systems are gaining popularity for automated control and monitoring.

- The market remains competitive with players focusing on sustainable, modular, and low-maintenance lighting solutions for ISO and GMP-certified environments. Continuous innovation in design and compliance strengthens product differentiation.

- North America led with a 35.4% share in 2024, followed by Europe at 28.7%, while Asia-Pacific, holding 24.6%, emerged as the fastest-growing region due to expanding semiconductor and healthcare industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Fixture Type

Recessed fixtures dominated the cleanroom lighting market with a 46.7% share in 2024. Their popularity stems from seamless integration into ceilings, providing uniform illumination and minimizing particle accumulation. These fixtures support ISO Class 5–8 environments and enhance energy efficiency with reduced maintenance needs. The rising use of recessed lights in pharmaceutical and semiconductor cleanrooms is driven by their ease of sterilization and space-saving design. Increasing demand for glare-free lighting solutions that maintain cleanroom integrity continues to strengthen this segment’s adoption.

- For instance, Glamox C26 recessed panels are IP65 room-side, deliver up to 132 lm/W at 4000 K, and use CRI ≥ 80 optics.

By Types of Lighting

LED lighting held the largest share of 67.2% in the cleanroom lighting market in 2024. The dominance of LEDs is attributed to their long lifespan, low heat emission, and superior energy efficiency compared to traditional sources. LED systems ensure consistent brightness and color stability, meeting stringent ISO and GMP requirements. Manufacturers prefer LED technology for its reduced operational cost and sustainability benefits. The growing focus on smart lighting controls and dimming capabilities further accelerates LED adoption across biotechnology and microelectronics facilities.

- For instance, Signify’s Cleanroom LED portfolio, which includes the GreenPerform cleanroom recessed family (CR467B/CR468B), offers models with a maximum luminous flux of 5,500 lm and a maximum typical efficacy of 110 lm/W.

By Component

Hardware accounted for a 58.6% share of the cleanroom lighting market in 2024, emerging as the leading component segment. The dominance of hardware is driven by the high demand for durable luminaires, fixtures, and control units compatible with contamination-free environments. Advanced housing materials and sealed enclosures enhance longevity and prevent particle emission. Increasing investments in infrastructure upgrades, particularly in life sciences and semiconductor industries, are boosting demand for robust hardware systems. Continuous innovations in fixture design and modular configurations support this segment’s steady expansion.

Key Growth Drivers

Rising Demand from Pharmaceutical and Biotechnology Industries

The increasing construction of cleanrooms in pharmaceutical and biotechnology sectors is a key growth driver. Strict contamination control requirements in drug manufacturing and biologics production have fueled the need for advanced lighting systems. Cleanroom lighting ensures visibility without compromising air purity, supporting compliance with ISO and GMP standards. The growing focus on sterile environments in vaccine production and precision diagnostics continues to drive lighting system upgrades across global life sciences facilities.

- For instance, TRILUX cleanroom guidance aligns luminaires with DIN EN ISO 14644-1 and VDI 2083; its Fidesca SD line offers IP65 protection with high-efficiency LED optics.

Shift Toward Energy-Efficient and Sustainable Lighting Solutions

Energy efficiency has become a major priority for cleanroom facility operators. LED-based lighting systems offer long lifespans, reduced energy consumption, and minimal maintenance compared to traditional lighting options. Manufacturers are adopting LED fixtures with dimmable controls and motion sensors to optimize power usage. The transition toward sustainable infrastructure and carbon reduction goals is accelerating the demand for eco-friendly lighting systems in cleanrooms used across healthcare, electronics, and research applications.

- For instance, LEDVANCE panels list up to 120 lm/W, L80/B10 60,000 h, UGR < 19 variants, and IP54/IP40 models for controlled environments.

Expansion of Semiconductor and Electronics Manufacturing

The rapid growth of semiconductor fabrication and advanced electronics production is driving cleanroom lighting installations. These industries require ultra-clean environments with precise illumination for assembly and inspection processes. High-lumen and glare-free lighting solutions improve accuracy and reduce contamination risks. The rise of microchip and display panel manufacturing in Asia-Pacific is further stimulating demand for advanced cleanroom lighting systems that support automated and high-precision production environments.

Key Trends & Opportunities

Integration of Smart and Connected Lighting Technologies

The adoption of smart cleanroom lighting systems with IoT connectivity is a key trend. Intelligent lighting solutions allow remote monitoring, brightness adjustment, and predictive maintenance through centralized platforms. These systems enhance operational efficiency and reduce downtime by automatically adapting to activity levels and energy needs. Integration with building management systems and cleanroom automation platforms presents new opportunities for manufacturers focusing on digitalized lighting infrastructure.

- For instance, Signify Interact Pro supports up to 200 light points per gateway and offers cloud-based monitoring with over-the-air updates.

Growing Adoption of Modular Cleanroom Infrastructure

The increasing preference for modular cleanrooms is creating new opportunities for the lighting market. Modular systems offer faster installation, scalability, and easier integration of lighting fixtures that meet ISO standards. Lighting solutions designed for modular environments are gaining traction due to their flexibility and compact design. This trend supports growing demand from contract manufacturers and research facilities seeking quick deployment and easy reconfiguration of controlled environments.

- For instance, MECART panels are 4-inch-thick galvannealed steel and accommodate pre-wired lighting inside wall cavities for turnkey builds.

Key Challenges

High Initial Installation and Maintenance Costs

The high upfront cost of cleanroom lighting systems poses a major challenge for market growth. Specialized lighting fixtures require advanced sealing, corrosion resistance, and certification, increasing capital investment. Regular maintenance and validation processes further add to operating expenses. Smaller facilities and emerging manufacturers often face financial constraints when adopting high-quality lighting systems, limiting broader market penetration despite long-term operational benefits.

Complex Regulatory Compliance and Standardization Issues

Meeting diverse international standards for cleanroom lighting remains a key challenge. Manufacturers must ensure compliance with ISO, GMP, and regional safety requirements, which vary across industries and countries. Frequent updates in energy and performance regulations require constant product testing and certification. The complexity of maintaining standardization across global supply chains increases design and production costs, creating obstacles for smaller market entrants and regional suppliers.

Regional Analysis

North America

North America held the largest share of 35.4% in the cleanroom lighting market in 2024. The region’s growth is supported by strong demand from pharmaceutical, biotechnology, and semiconductor manufacturing facilities. Increased investments in biologics production and advanced microelectronics drive continuous adoption of high-efficiency LED lighting. The United States leads due to stringent FDA and ISO compliance requirements, pushing cleanroom upgrades. Additionally, the region’s growing focus on sustainability and energy-efficient facilities encourages the integration of smart lighting systems to enhance performance and reduce operational costs across clean manufacturing environments.

Europe

Europe accounted for a 28.7% share of the cleanroom lighting market in 2024. The region’s dominance is driven by robust pharmaceutical and medical device manufacturing activities. Germany, the UK, and France are key contributors, emphasizing quality compliance under GMP and ISO standards. Expansion in biotechnology research and the presence of established cleanroom solution providers support regional market growth. European manufacturers are also investing in LED-based and low-emission lighting technologies to meet EU energy efficiency targets. Ongoing development of green cleanroom infrastructure and digital monitoring systems further enhances the regional demand outlook.

Asia-Pacific

Asia-Pacific captured a 24.6% share of the cleanroom lighting market in 2024. Rapid industrialization and expansion in semiconductor fabrication plants across China, Japan, South Korea, and Taiwan are driving growth. The rise of contract manufacturing in pharmaceuticals and electronics boosts demand for advanced lighting systems. Governments in the region are promoting clean energy initiatives and industrial automation, further accelerating LED adoption. The surge in local production of cleanroom components and lower installation costs make Asia-Pacific a key growth hub for global cleanroom lighting manufacturers.

Latin America

Latin America represented a 6.3% share of the cleanroom lighting market in 2024. Market expansion is supported by increasing pharmaceutical production in Brazil and Mexico and the gradual growth of biotechnology research facilities. The adoption of energy-efficient lighting is encouraged by infrastructure modernization efforts and regulatory alignment with international cleanroom standards. Although investment levels remain moderate, the rising demand for contamination-free environments in healthcare and food processing is fostering gradual adoption of certified lighting systems across the region’s developing economies.

Middle East & Africa

The Middle East & Africa accounted for a 5.0% share of the cleanroom lighting market in 2024. Growth is primarily driven by expanding healthcare infrastructure and rising pharmaceutical manufacturing capacity in Gulf countries. The UAE and Saudi Arabia are leading investments in new hospitals and medical research facilities with integrated cleanroom environments. Government initiatives supporting localization of drug and vaccine production are boosting demand for cleanroom lighting. Although at an early stage, the region’s push toward high-tech healthcare and industrial diversification supports steady market development.

Market Segmentations:

By Fixture Type

- Teardrop

- Recessed

- Surface Mount

By Types of Lighting

- Incandescent Lighting

- Fluorescent Lighting

- LED Lighting

By Component

- Hardware

- Software

- Services

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Key players in the cleanroom lighting market include Terra Universal Inc., Kenall Manufacturing, Signify Holding, Jansen Cleanrooms & Labs, Wipro Enterprises, LUG Light Factory Sp. z o.o., Total Clean Air, Havells India Ltd, LEDspan Ltd, Eaton Corporation Inc., Crompton Greaves Consumer Electricals Ltd., Thorlux Lighting, and CleanAir Solutions. The market is highly competitive, driven by innovation in LED technology, energy efficiency, and compliance with ISO and GMP standards. Companies focus on durable and contamination-free lighting designs tailored for pharmaceuticals, semiconductors, and healthcare applications. Strategic partnerships with cleanroom constructors and automation solution providers are increasing to deliver customized, high-performance lighting systems. The competition continues to intensify as firms adopt digital monitoring, smart lighting integration, and sustainable materials to meet evolving industrial standards and expand their global reach in advanced manufacturing environments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Terra Universal Inc.

- Kenall Manufacturing

- Signify Holding

- Jansen Cleanrooms & Labs

- Wipro Enterprises

- LUG Light Factory Sp. z o.o.

- Total Clean Air

- Havells India Ltd

- LEDspan Ltd

- Eaton Corporation Inc.

- Crompton Greaves Consumer Electricals Ltd.

- Thorlux Lighting

- CleanAir Solutions

Recent Developments

- In 2025, Jansen Cleanrooms & Labs Launched a new cleanroom construction product line called J’Clean, which includes advanced lighting systems alongside modular walls, hinged doors, interlock systems, and pass boxes.

- In 2024, LEDspan Ltd Completed a cleanroom LED lighting installation for an animal health drug manufacturer in Ireland, featuring its Rigel Lay-in luminaires designed for in-ceiling access and maintaining cleanroom integrity.

- In 2023, Kenall Manufacturing Unveiled the CSSGI series, a low-profile plenum troffer luminaire designed for cleanrooms and controlled environments such as pharmaceutical manufacturing and laboratories

Report Coverage

The research report offers an in-depth analysis based on Fixture Type, Types of Lighting, Component and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The cleanroom lighting market will expand with increasing demand from pharmaceutical and semiconductor industries.

- LED lighting will remain the preferred technology due to energy efficiency and long service life.

- Smart and connected lighting systems will gain traction for real-time monitoring and control.

- Growing adoption of modular cleanrooms will boost demand for flexible lighting solutions.

- Rising focus on sustainability will drive development of eco-friendly and low-emission lighting products.

- Integration of IoT and automation will enhance performance and reduce maintenance costs.

- Asia-Pacific will witness rapid growth driven by large-scale semiconductor and biotech projects.

- Advancements in cleanroom certification standards will encourage innovation in compliant lighting systems.

- Manufacturers will focus on lightweight, easy-to-install fixtures for faster cleanroom deployment.

- Partnerships between lighting companies and cleanroom builders will strengthen customized solution offerings.