Market Overview

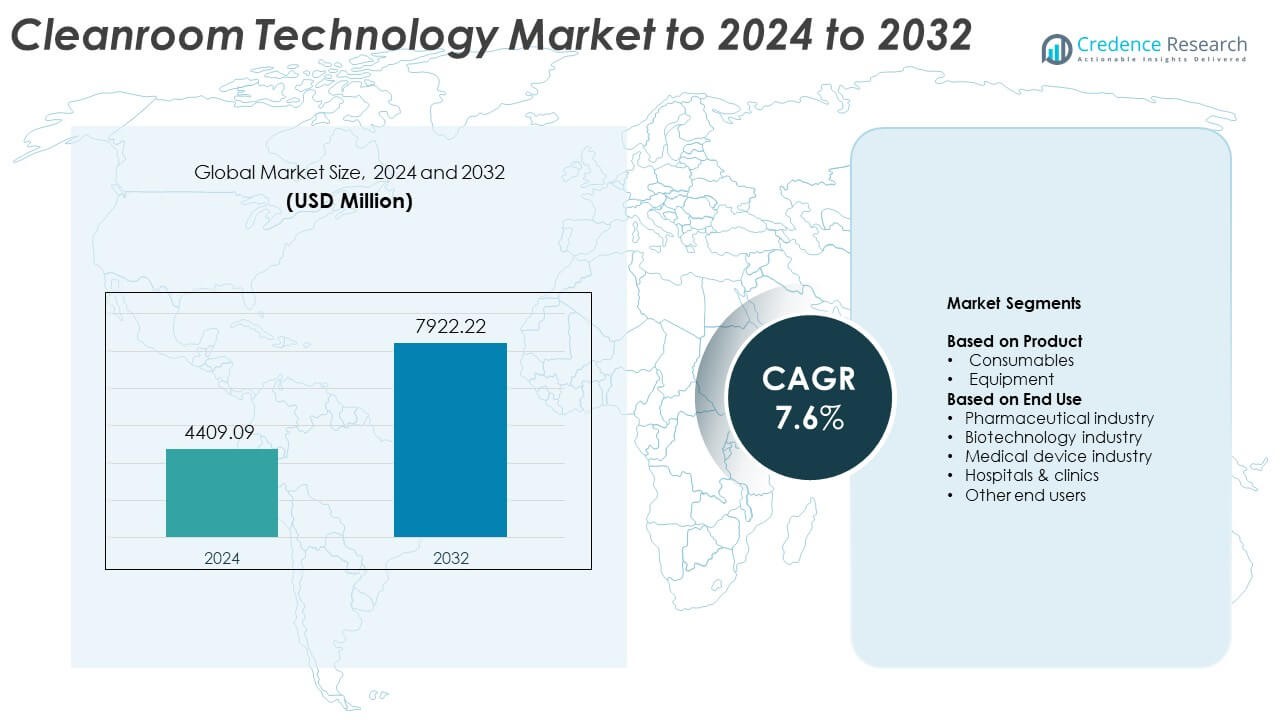

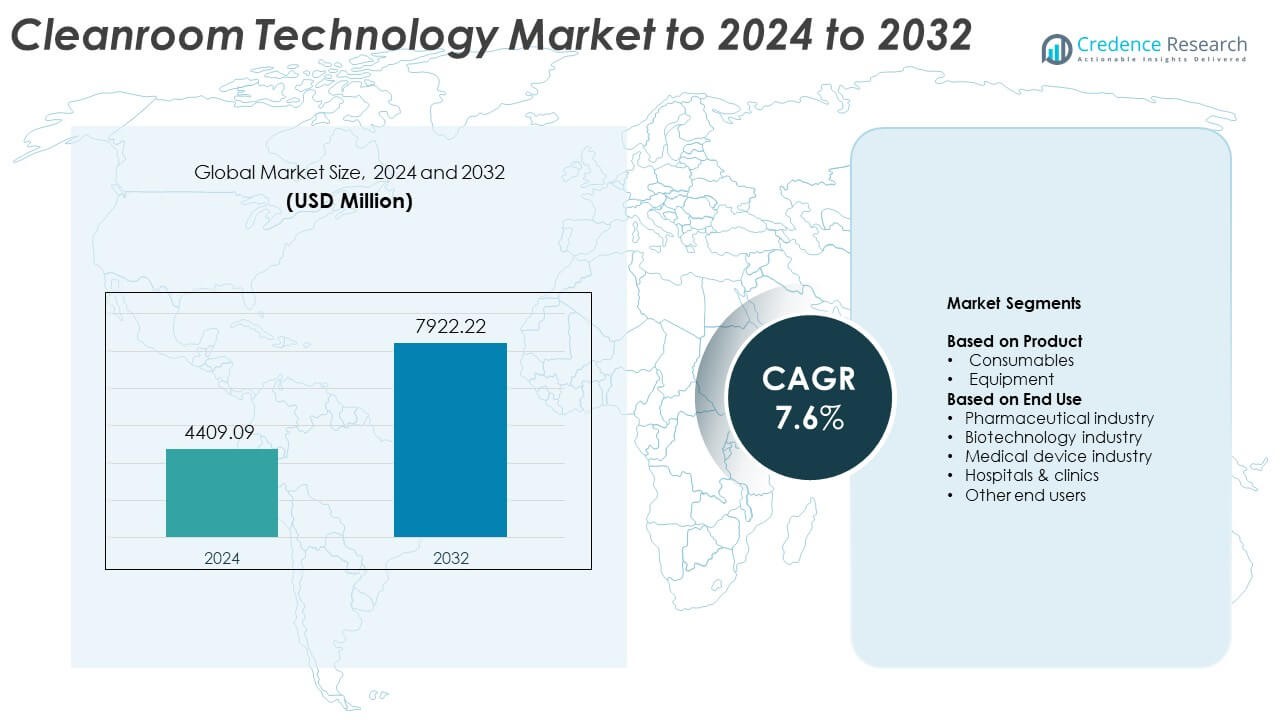

Cleanroom Technology Market size was valued at USD 4409.09 Million in 2024 and is anticipated to reach USD 7922.22 Million by 2032, at a CAGR of 7.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cleanroom Technology Market Size 2024 |

USD 4409.09 Million |

| Cleanroom Technology Market, CAGR |

7.6% |

| Cleanroom Technology Market Size 2032 |

USD 7922.22 Million |

The cleanroom technology market is led by major players such as AES Clean Technology, CIMTechniques (SmartScan Technologies), Thomas Scientific, Angstrom Technology, Terra Universal Inc., and Kojair Tech Oy. These companies focus on modular cleanroom design, advanced air filtration, and automated contamination control systems to serve industries like pharmaceuticals, biotechnology, and semiconductors. North America leads the global market with a 36% share, supported by stringent regulatory standards and advanced manufacturing infrastructure. Europe follows with a 29% share, driven by strong pharmaceutical and medical device production, while Asia Pacific holds 24%, emerging as the fastest-growing region due to rapid industrialization and healthcare expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The cleanroom technology market was valued at USD 4409.09 million in 2024 and is projected to reach USD 7922.22 million by 2032, growing at a CAGR of 7.6% during the forecast period.

- Rising demand from pharmaceutical and biotechnology industries is the key driver, supported by strict regulatory compliance and growing vaccine and biologics production.

- Trends include modular cleanroom systems, IoT-enabled environmental monitoring, and sustainable HVAC designs that improve efficiency and energy management.

- The market is moderately consolidated, with companies focusing on automation, customized cleanroom layouts, and global partnerships to strengthen competitiveness across healthcare and semiconductor sectors.

- Regionally, North America leads with 36% share, followed by Europe with 29% and Asia Pacific with 24%, while equipment holds a dominant 62% segment share and pharmaceuticals lead end-use with 48%, reflecting the sector’s reliance on advanced contamination control systems.

Market Segmentation Analysis:

By Product

The equipment segment dominates the cleanroom technology market, accounting for around 62% share in 2024. Its leadership stems from the growing demand for modular cleanroom systems, HVAC units, HEPA filters, and air showers used in pharmaceutical and semiconductor facilities. The surge in biologics and precision manufacturing has accelerated investments in high-performance cleanroom equipment ensuring contamination control. Automation in air filtration, temperature regulation, and particle monitoring also boosts adoption. In contrast, consumables like gloves, gowns, wipes, and disinfectants continue to expand due to frequent replenishment needs in research and clinical settings.

- For instance, Camfil’s Megalam ES H14 panels are rated 99.995% @ MPPS per EN 1822 and are available up to 48″×48″ or 72″ length formats.

By End Use

The pharmaceutical industry leads the cleanroom technology market with about 48% share in 2024. The dominance is driven by stringent regulatory norms for sterile production and the growing output of biopharmaceuticals, vaccines, and injectables. The biotechnology industry also shows robust growth as advanced therapies like cell and gene treatments demand ultra-clean environments. Meanwhile, hospitals and clinics increasingly adopt compact cleanrooms for surgical and diagnostic applications. Rising contamination control standards in medical device manufacturing further strengthen the end-use expansion across both established and emerging markets.

- For instance, Samsung Biologics’ Plant 4 has a total floor area of 238,000 m², adding large-scale GMP cleanroom capacity for biologics.

Key Growth Drivers

Rising Demand in Pharmaceutical and Biotech Manufacturing

The expansion of biopharmaceutical and vaccine production facilities is driving strong demand for cleanroom technologies. Stringent contamination control standards and the need for aseptic processing environments have made cleanrooms essential in drug formulation and quality assurance. Manufacturers are upgrading to modular cleanroom systems to support flexible production and faster validation. The growing prevalence of chronic diseases and new biologics development further reinforces cleanroom adoption across pharmaceutical and biotechnology industries.

- For instance, the Lonza Biologics facility in Guangzhou, China, utilizes a Cytiva KUBio modular facility within a 17,000 m² site that includes 6,500 m² of labs to speed biologics manufacturing.

Technological Advancements in Cleanroom Design and Automation

Advances in HVAC systems, air filtration, and digital monitoring are improving operational efficiency in cleanrooms. Automated airflow control, particle tracking, and IoT-enabled environment monitoring reduce human errors and enhance compliance with ISO and GMP standards. Integration of smart sensors and AI-based analytics enables predictive maintenance, extending equipment life cycles. These innovations help minimize downtime, optimize energy use, and meet evolving regulatory demands, making advanced cleanroom designs a critical investment for manufacturers.

- For instance, TSI’s AeroTrak 6510 remote counter measures 0.5–5.0 µm channels at 1 CFM (28.3 L/min), enabling continuous ISO/GMP particle tracking.

Rising Adoption in Medical Device and Healthcare Facilities

The growing complexity of medical devices and sterile surgical procedures has increased cleanroom installations in hospitals and clinics. Cleanrooms ensure the sterile assembly of implants, catheters, and diagnostic kits, reducing infection risks. Healthcare institutions are expanding isolation and contamination-controlled zones to meet stricter hygiene requirements. The shift toward minimally invasive procedures and the expansion of diagnostic laboratories further accelerate cleanroom demand across healthcare environments.

Key Trends and Opportunities

Expansion of Modular and Portable Cleanrooms

Modular cleanrooms are gaining popularity due to their scalability, quick installation, and cost efficiency. These pre-engineered structures allow flexible configuration for varying cleanroom classes and applications. Companies are investing in prefabricated systems that can be easily expanded or relocated to meet project-specific needs. This trend caters to industries seeking faster deployment without compromising compliance, particularly in emerging markets with growing manufacturing capacities.

- For instance, G-CON expanded its U.S. POD manufacturing from 252,900 square feet to a total of 396,900 square feet across its facilities to meet growing demand for prefabricated cleanrooms.

Growing Focus on Energy Efficiency and Sustainability

Manufacturers are emphasizing sustainable cleanroom designs with reduced energy consumption and carbon emissions. The adoption of energy-efficient HVAC systems, variable airflow controls, and low-maintenance filtration materials supports operational sustainability. Use of recyclable materials and intelligent monitoring systems also enhances environmental performance. This trend aligns with global sustainability goals, prompting companies to invest in green-certified facilities and eco-friendly cleanroom technologies.

- For instance, Daikin notes correct HVAC filter maintenance can save about 10% energy, supporting lower cleanroom utility loads.

Rising Investment in Semiconductor and Electronics Manufacturing

Cleanroom technology demand is expanding in semiconductor and electronics industries as device miniaturization continues. These sectors require ultra-clean environments for wafer fabrication and microchip assembly. Increasing investments in advanced manufacturing clusters across Asia-Pacific and North America are creating new opportunities. Companies focusing on contamination-free production and high precision assembly are driving cleanroom infrastructure upgrades globally.

Key Challenges

High Installation and Maintenance Costs

The significant capital required for cleanroom setup and upkeep remains a major challenge for small and mid-sized enterprises. Maintaining controlled air quality, temperature, and humidity demands continuous power supply and technical expertise. Frequent filter replacements, calibration, and regulatory audits further increase operational expenses. These cost constraints limit adoption in developing regions, where budget-conscious manufacturers seek lower-cost contamination control alternatives.

Complex Regulatory Compliance and Certification Requirements

Compliance with ISO 14644, GMP, and FDA standards involves extensive documentation, testing, and periodic validation. Any deviation from these standards can lead to production delays and penalties. The increasing complexity of multi-regional certification adds to the regulatory burden for global manufacturers. Companies must invest heavily in personnel training, quality control systems, and digital monitoring to ensure full compliance, creating operational challenges for firms with limited technical capacity.

Regional Analysis

North America

North America holds the largest share of the cleanroom technology market at around 36% in 2024. The region’s dominance is supported by a strong pharmaceutical manufacturing base and advanced biotechnology research infrastructure. The United States leads with significant investments in vaccine production, biologics, and semiconductor fabrication facilities. Stringent FDA and ISO standards have accelerated adoption of modular cleanrooms and automated contamination control systems. Increasing collaborations between cleanroom equipment manufacturers and healthcare institutions also enhance market growth, ensuring continuous innovation and compliance with evolving regulatory frameworks across North American industries.

Europe

Europe accounts for about 29% of the cleanroom technology market in 2024, driven by strong regulatory frameworks and expanding pharmaceutical and medical device sectors. Countries such as Germany, France, and the United Kingdom emphasize GMP compliance and sterile manufacturing processes. Rising demand for biologics, precision medicines, and cleanroom-integrated diagnostic labs supports steady growth. The region’s focus on energy-efficient and sustainable cleanroom systems aligns with the EU’s green manufacturing initiatives, encouraging technological upgrades. Increasing investments in research centers and production modernization continue to reinforce Europe’s leadership in contamination control solutions.

Asia Pacific

Asia Pacific represents approximately 24% of the cleanroom technology market in 2024 and is the fastest-growing regional segment. Rapid industrialization, expanding electronics manufacturing, and rising biopharmaceutical production in China, Japan, South Korea, and India are driving strong demand. Government incentives for domestic drug and semiconductor production have increased the installation of advanced cleanroom infrastructure. Growing foreign investments in contract manufacturing and stringent quality standards from global clients further accelerate adoption. The region’s cost-effective labor and expanding healthcare sector position Asia Pacific as a key growth hub for cleanroom technology.

Latin America

Latin America holds nearly 7% share of the global cleanroom technology market in 2024, supported by the rising pharmaceutical and healthcare manufacturing presence. Brazil and Mexico are leading markets, driven by government initiatives to strengthen drug production and medical device exports. Growing awareness about contamination control and the expansion of hospital cleanrooms contribute to regional adoption. However, high equipment costs and limited technical expertise restrict broader implementation. Continuous regulatory reforms and increasing foreign collaborations are expected to improve cleanroom accessibility and operational efficiency in Latin American production environments.

Middle East and Africa

The Middle East and Africa region accounts for around 4% share of the cleanroom technology market in 2024. The growing healthcare infrastructure, particularly in Saudi Arabia, the United Arab Emirates, and South Africa, supports steady market expansion. Cleanroom installations are increasing in pharmaceutical manufacturing, research centers, and hospital facilities to meet global hygiene standards. Government-backed healthcare modernization and diversification of industrial sectors enhance opportunities for local manufacturers. However, dependence on imports and limited skilled workforce pose challenges, though rising investment in regional production facilities indicates gradual long-term growth potential.

Market Segmentations:

By Product

By End Use

- Pharmaceutical industry

- Biotechnology industry

- Medical device industry

- Hospitals & clinics

- Other end users

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The cleanroom technology market features a competitive landscape dominated by key players such as AES Clean Technology, CIMTechniques (SmartScan Technologies), Thomas Scientific, EAZER Maintenance, Angstrom Technology, Spetec GmbH, Elsisan (YI-BA Engineering. Ltd. Sti.), Advanced Technology Group, Terra Universal Inc., Kojair Tech Oy, Cleanrooms By United, and HEMCO Corporation. The competition is defined by continuous innovation in modular design, energy-efficient systems, and advanced contamination control solutions. Companies are focusing on automation, IoT integration, and real-time monitoring to enhance efficiency and meet evolving regulatory standards. Strategic collaborations with pharmaceutical, semiconductor, and healthcare industries are expanding global footprints. Product differentiation through customized cleanroom layouts, rapid installation capabilities, and sustainable materials remains a key success factor. Additionally, market leaders are investing in AI-based analytics and remote management platforms to strengthen operational performance. Continuous R&D investments and expanding service portfolios are expected to further intensify competition across the cleanroom technology landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- AES Clean Technology

- CIMTechniques (SmartScan Technologies)

- Thomas Scientific

- EAZER Maintenance

- Angstrom Technology

- Spetec GmbH

- Elsisan (YI-BA Engineering. Ltd. Sti.)

- Advanced Technology Group

- Terra Universal Inc.

- Kojair Tech Oy

- Cleanrooms By United

- HEMCO Corporation

Recent Developments

- In 2024, AES Clean Technology launched the CleanLock Module, a prefabricated airlock solution for controlled environments like cleanrooms, which enhances cleanliness and operational efficiency

- In 2024, EAZER Maintenance, ABN Cleanroom Technology, and Hasselt University collaborated to develop CleanAR, a digital tool using augmented reality (AR) to provide real-time visual guidance for cleanroom cleaning processes.

- In 2023, Angstrom Technology Launched its new Life Sciences Division, aiming to enhance its technical service offerings and deliver a superior range of options in the field.

Report Coverage

The research report offers an in-depth analysis based on Product, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Increasing investments in biopharmaceutical and vaccine production will continue driving cleanroom adoption.

- Modular and prefabricated cleanroom systems will gain wider acceptance for flexible installations.

- Integration of IoT and AI technologies will enhance real-time environmental monitoring and automation.

- Rising demand from semiconductor and electronics industries will strengthen cleanroom infrastructure expansion.

- Energy-efficient HVAC and filtration systems will become a key focus for sustainability compliance.

- Asia Pacific will emerge as the fastest-growing region due to industrial and healthcare advancements.

- Pharmaceutical companies will prioritize contamination-free manufacturing for biologics and advanced therapies.

- Hospitals and clinics will increasingly use compact cleanrooms for infection control and diagnostics.

- Manufacturers will invest in digital validation tools to meet evolving regulatory standards.

- Partnerships between cleanroom suppliers and end-users will accelerate innovation and customized solutions.