Market Overview:

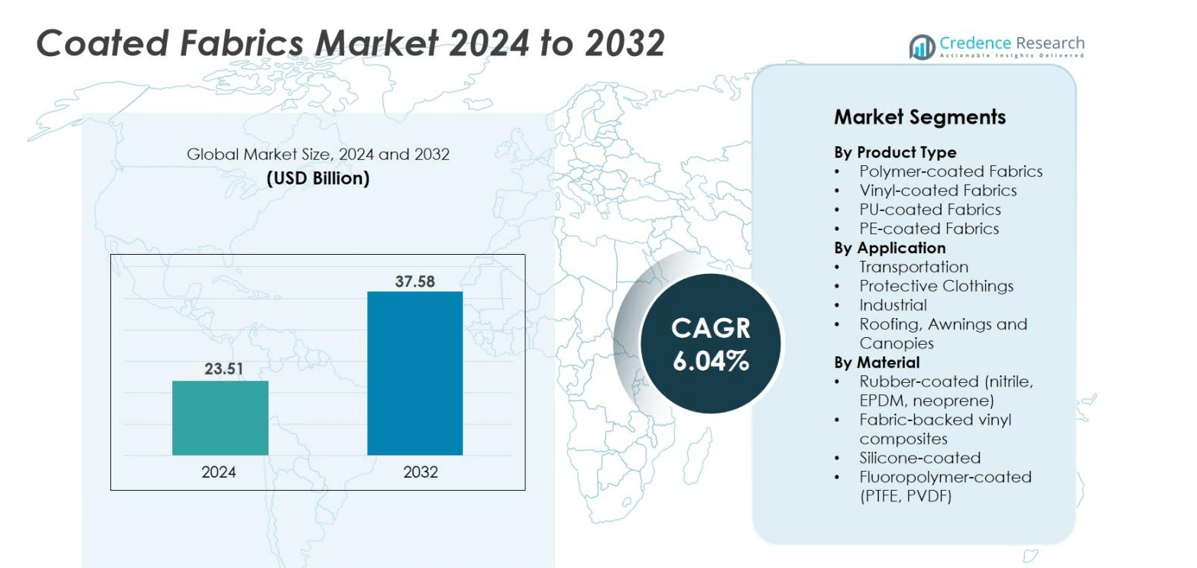

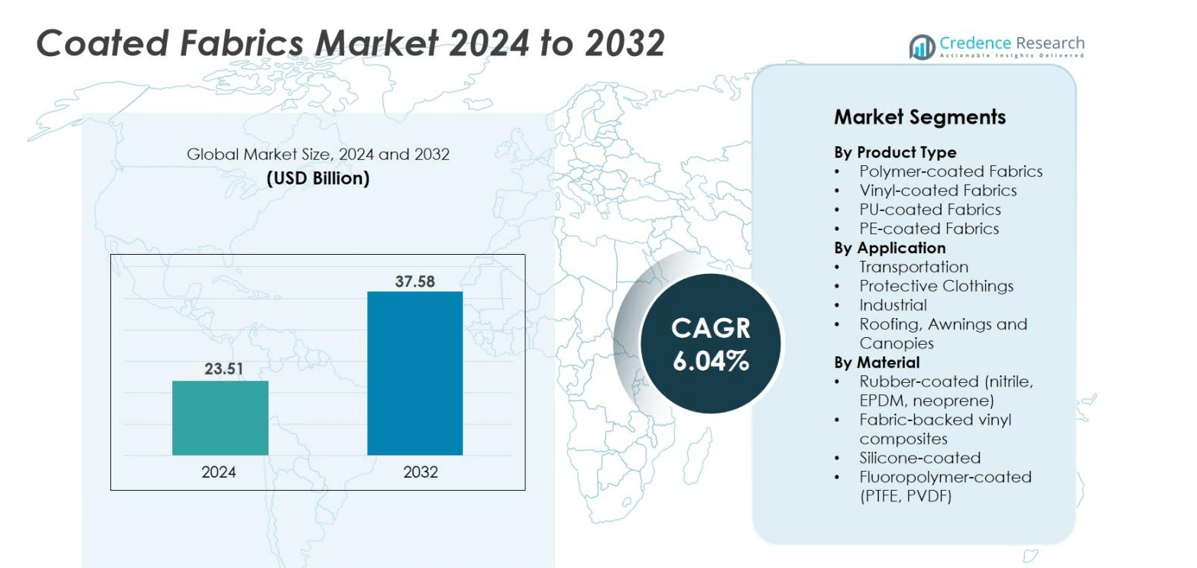

Coated Fabrics market size was valued USD 23.51 Billion in 2024 and is anticipated to reach USD 37.58 Billion by 2032, at a CAGR of 6.04% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Coated Fabrics Market Size 2024 |

USD 23.51 Billion |

| Coated Fabrics Market, CAGR |

6.04% |

| Coated Fabrics Market Size 2032 |

USD 37.58 Billion |

The coated fabrics market includes major companies such as ContiTech AG, Trelleborg AB, Saint-Gobain S.A., Spradling International Inc., Omnova Solutions, Takata Corporation, Isotex S.p.A, Graniteville Specialty Fabrics, Mauritzon Inc., and Bo-Tex Sales Co. These suppliers compete on durability, flame resistance, UV protection, and advanced polymer technologies for automotive, industrial, and protective clothing applications. Asia Pacific remains the leading region with 39% market share, supported by large-scale manufacturing, strong automotive output, and expanding construction activity. North America follows with 28% share, driven by high standards in worker safety, transportation, and industrial infrastructure.

Market Insights

- The coated fabrics market was valued at USD 23.51 billion in 2024 and is expected to reach USD 37.58 billion by 2032, at a CAGR of 6.04%.

- Strong demand in transportation drives the market, with automotive and commercial vehicles using coated fabrics for airbags, seating, and tarpaulins. Transportation accounts for 37% share, supported by durability, flame resistance, and weather protection.

- Sustainability trends promote low-VOC coatings, recycled composites, and bio-based polymers. Technical textiles with antimicrobial, UV-resistant, and heat-shielding properties gain traction in healthcare, industrial, and defense.

- Leading players include ContiTech AG, Trelleborg AB, Saint-Gobain S.A., Omnova Solutions, and Spradling International Inc., competing on regulatory certifications, coating technology, and long-service-life materials.

- Asia Pacific holds 39% market share, North America 28%, and Europe 24%. Polymer-coated fabrics dominate product type with 42% share, followed by vinyl at 28%, supported by construction, automotive, marine, and industrial applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Polymer-coated fabrics hold the dominant position with close to 42% market share, driven by strong usage in automotive seating, truck tarpaulins, and protective clothing. Vinyl-coated fabrics account for around 28%, supported by indoor and outdoor furniture, marine upholstery, and tent applications due to high abrasion resistance. PU-coated fabrics represent about 19% of demand in premium consumer goods, while PE-coated fabrics capture nearly 11%, mainly in packaging and industrial liners. Long-term growth is supported by durable, UV-resistant, and fire-retardant coatings demanded across transportation and industrial sectors.

- For instance, Covestro supplies durable thermoplastic polyurethane films and flexible PU foam used in automotive seats for armrests and lumbar support, enhancing comfort and durability.

By Application

Transportation leads the market with nearly 37% share, fueled by airbags, seat covers, truck covers, and marine upholstery. Manufacturers prefer coated fabrics for light weight, flame resistance, and long product life. Protective clothing contributes around 24%, driven by workplace safety rules and standards in construction, chemicals, and oil and gas. Industrial applications hold about 22%, covering conveyor belts, tents, and flexible storage tanks. Roofing, awnings, and canopies account for roughly 17%, supported by weather-resistant building materials for commercial spaces and urban infrastructure.

- For instance, Trelleborg’s Dartex END464-E fabric, launched in 2024, is engineered for healthcare seating and provides exceptional durability and resistance against harsh chemical cleaning agents, using advanced polymer technology and 100% recycled yarn certified to the Global Recycled Standard.

By Material

Fabric-backed vinyl composites dominate the material segment with almost 39% market share, due to broad use in automotive interiors, furniture, covers, and heavy-duty industrial applications. Rubber-coated fabrics, including nitrile, EPDM, and neoprene, hold around 27%, supported by oil-resistant and outdoor environments. Silicone-coated materials represent near 18%, used in high-temperature and non-stick applications. Fluoropolymer-coated options such as PTFE and PVDF account for roughly 16%, serving extreme chemical exposure and harsh industrial conditions. Demand rises as industries seek durable and regulatory-compliant coatings.

Key Growth Drivers

Rising Demand from Transportation and Automotive Applications

Transportation remains a major driver for coated fabrics due to strong consumption in airbags, seat covers, truck tarpaulins, and marine upholstery. Automakers prefer coated fabrics for their durability, flame resistance, water resistance, and long service life. The material also supports lightweight vehicle design, which helps improve fuel efficiency and meets global emission regulations. Commercial vehicle manufacturers use coated fabrics for cargo covers and protective interior surfaces that withstand heavy use. Electric vehicles add new demand for heat-resistant and chemical-resistant interiors. Marine and aviation industries adopt coated fabrics for seating, inflatable structures, and protective gear. Urban logistics fleets rely on coated fabrics for tarpaulins and container coverings that resist UV, weather, and abrasion.

- For instance, truck manufacturers use PVC-coated polyester tarpaulins for cargo protection due to their waterproof and UV-resistant properties, with companies such as SATTLER PRO-TEX providing durable tarps suited for long-haul trucking.

Growth in Protective Clothing and Industrial Safety Standards

Protective clothing drives significant demand because coated fabrics offer chemical resistance, puncture resistance, flame retardancy, and waterproofing. Industries such as construction, mining, oil and gas, and chemical processing require protective suits, gloves, boots, and gear that can withstand harsh environments. Governments enforce strict worker safety rules, pushing organizations to replace traditional textiles with coated alternatives. Hospitals and emergency response agencies use coated fabrics for contamination suits, medical gowns, and firefighting gear. The material’s ability to block liquids and toxic particles increases its adoption in hazardous locations. Heavy industrial factories, power plants, and warehouses purchase coated fabrics for conveyor belts, lifting bags, and protective screens.

- For instance, DuPont’s Tychem® QC fabric, which combines Tyvek® with a polyethylene coating, provides chemical protection against more than 40 hazardous chemicals and is widely used in chemical processing and emergency response garments.

Expansion of Building, Construction, and Architectural Projects

Buildings and commercial infrastructure create strong demand for coated fabrics in roofing membranes, canopies, awnings, tarps, and fabric-based architectural structures. These products offer weatherproofing, UV resistance, high tensile strength, and tear resistance, making them ideal for outdoor installations. Urban development and smart city projects increase the need for lightweight, flexible construction materials. Retail malls, airports, sports venues, and transport terminals install coated fabric canopies and tensile structures for both shade and aesthetic appeal. Waterproof industrial shelters and storage facilities also prefer coated materials because they resist corrosion and handle long-term outdoor exposure. The construction industry uses coated fabrics for temporary enclosures, scaffolding covers, and insulation layers.

Key Trends & Opportunities

Growth of Eco-Friendly and Sustainable Coating Technologies

Sustainability reshapes the coated fabrics market as industries move away from traditional solvent-based coatings toward water-based, bio-based, and low-VOC chemical formulations. Manufacturers invest in recyclable substrates and non-toxic additives that reduce environmental impact. Automotive and consumer brands demand greener materials to meet corporate sustainability goals and environmental regulations. Bio-PU and bio-PVC coatings create opportunities for furniture, footwear, and interior design. Recycled polyester and fabric-backed composites reduce waste and carbon emissions. Governments promote eco-certified materials, boosting market adoption. Companies also explore biodegradable fabrics and coating systems that maintain durability without harmful chemicals.

- For instance, Autoliv introduced airbags made from 100% recycled polyester in 2024, demonstrating how safety-critical automotive components can incorporate reclaimed materials without compromising performance.

Rapid Growth of Technical Textiles and Smart Coated Surfaces

Technical textile innovation leads to advanced coated fabrics with antimicrobial, heat-resistant, anti-fungal, reflective, and self-cleaning properties. Smart coatings integrate sensors, conductive layers, and fire-protective finishes for defense, aerospace, and emergency response. Medical facilities adopt antimicrobial and barrier-grade coated fabrics for beds, curtains, and protective clothing. Flame-retardant and UV-stabilized coatings support expanding industrial and outdoor applications. Military and defense agencies demand coated fabrics for tents, inflatable boats, protective gear, and camouflage covers. As industries require specialized performance, high-value technical textiles present strong opportunities for premium product categories.

- For instance, Nobletex Industries supplies medical fabrics with antibacterial coatings that repel body fluids and inhibit pathogen growth, with privacy curtains tested to reduce bacteria by 99%, supporting safer hospital environments.

Key Challenges

Environmental and VOC-Based Regulatory Restrictions

Traditional PVC and solvent-based coatings generate environmental concerns due to high VOC emissions and hazardous chemical content. Governments implement strict rules on plasticizers, wastewater disposal, flue gas treatment, and manufacturing emissions. Companies must redesign production lines and invest in expensive purification technologies. Shifting to eco-friendly materials increases cost and slows production for smaller manufacturers. Compliance challenges raise product pricing and limit market access in developed economies. These regulatory pressures push the industry toward water-based coatings and alternative polymers, but development and scaling remain expensive.

Price Fluctuations in Raw Materials and Supply Chain Disruptions

Coated fabric manufacturing depends on polymers, resins, rubber, and industrial fabrics, all of which face price volatility. Oil-based raw materials such as PVC, PU, neoprene, and nitrile fluctuate based on crude oil markets and global supply disruptions. Transportation delays, trade restrictions, and shortages of chemical additives increase operational costs. Manufacturers face margin pressure because end-users often resist price increases. Small firms struggle to balance procurement cost and production quality. Consistent raw material inflation affects profitability, forcing companies to adopt long-term supply contracts, backward integration, or recycled inputs.

Regional Analysis

North America

North America holds 28% market share, supported by strong demand from automotive interiors, protective clothing, and industrial applications. The U.S. leads consumption due to advanced vehicle manufacturing, construction projects, and strict worker-safety regulations. Coated fabrics are widely used in airbags, seating, tarpaulins, tents, and fire-resistant protective gear. The region invests in high-performance polymers and eco-friendly coating technologies to meet environmental standards. Growth also comes from military tents, aviation seating, and healthcare protective materials. Increased adoption of lightweight and durable fabrics in commercial transport and marine sectors boosts long-term sales across the United States and Canada.

Europe

Europe accounts for 24% market share, driven by strong demand from automotive OEMs, industrial equipment producers, and architectural projects. Germany, France, Italy, and the UK remain major buyers of PU-coated and fluoropolymer-coated fabrics due to premium upholstery and stringent safety standards. Construction companies use coated fabrics for roofing membranes, canopies, and tensile structures. Strict REACH and sustainability regulations encourage the shift to low-VOC and recyclable coatings. Protective clothing demand rises in chemical, mining, and oil and gas operations. The region also exports advanced technical coated textiles for military, medical, and weather-resistant outdoor structures.

Asia Pacific

Asia Pacific dominates with 39% market share, making it the largest regional market. China, India, Japan, and South Korea drive consumption through automotive production, transportation fleets, industrial manufacturing, and infrastructure growth. Large coating facilities, cost-efficient labor, and rising urbanization increase demand for tarpaulins, seat covers, conveyor belts, and protective clothing. Construction projects adopt coated roofing membranes and awning materials for commercial developments. Expanding marine logistics and container transport also boost sales. The presence of major coated fabric producers and flexible export policies support rapid market expansion across regional economies.

Latin America

Latin America captures 6% market share, driven by commercial vehicle fleets, agricultural storage covers, and construction projects. Brazil and Mexico lead demand for PVC-coated fabrics in automotive seating, tarpaulins, and truck covers. Industrial users adopt coated fabrics for conveyor systems and protective workplace gear. The region increases usage of weather-resistant roofing membranes, canopies, and shading structures in urban commercial spaces. Growth in marine transport and mining boosts heavy-duty coated textiles. Although price sensitivity affects premium products, rising safety regulations and expanding logistics networks support long-term demand.

Middle East & Africa

The Middle East & Africa represent 3% market share, but growth remains steady due to oil and gas projects, construction sites, and extreme climate conditions that require weather-resistant coated fabrics. Coated roofing membranes, tents, shade structures, and protective clothing see strong demand in GCC countries. Industrial facilities use coated conveyor belts, storage covers, and chemical-resistant materials. Infrastructure projects in Saudi Arabia, UAE, and Qatar create opportunities for architectural fabrics in stadiums, airports, and retail centers. Limited local manufacturing capacity results in heavy reliance on imports, which supports international suppliers.

Market Segmentations:

By Product Type

- Polymer-coated Fabrics

- Vinyl-coated Fabrics

- PU-coated Fabrics

- PE-coated Fabrics

By Application

- Transportation

- Protective Clothings

- Industrial

- Roofing, Awnings and Canopies

By Material

- Rubber-coated (nitrile, EPDM, neoprene)

- Fabric-backed vinyl composites

- Silicone-coated

- Fluoropolymer-coated (PTFE, PVDF)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The coated fabrics market is moderately fragmented, with global and regional manufacturers competing through product performance, material innovation, and industry certifications. Leading companies focus on durable coatings, flame retardancy, UV resistance, chemical stability, and abrasion strength to serve transportation, industrial, and protective clothing applications. Multinational brands strengthen portfolios with PU, PVC, rubber, silicone, and fluoropolymer-coated products designed for long service life and regulatory compliance. Many firms expand through strategic partnerships with automotive OEMs, construction contractors, and industrial equipment suppliers to secure recurring contracts. Investments in eco-friendly coatings, bio-based polymers, and water-based production processes help producers meet environmental standards and replace solvent-basedsystems. Companies also explore technical textiles with heat shielding, antimicrobial properties, and self-cleaning surfaces for premium markets. Asia Pacific players benefit from large-scale manufacturing and lower production costs, while North American and European manufacturers gain an edge in high-performance and specialty coated fabrics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ContiTech AG

- Mauritzon Inc.

- Spradling International Inc.

- Trelleborg AB

- Graniteville Specialty Fabrics

- Takata Corporation

- Saint-Gobain S.A.

- Isotex S.p.A

- Bo-Tex Sales Co.

- Omnova Solutions

Recent Developments

- In December 2024, Trelleborg Engineered Coated Fabrics partnered with Taiwan-based True Source to supply Dartex stretch TPU mattress covers for next-generation alternating-pressure medical beds. The partnership strengthens Trelleborg’s position in the premium healthcare coated fabrics segment.

- In September 2024, Freudenberg Performance Materials expanded its coated technical textiles business by acquiring key assets from the Heytex Group for approximately EUR 100 million. The acquisition includes three production facilities in Germany and China, boosting the company’s global manufacturing presence.

- In August 2024, Carnegie, a provider of sustainable textiles and acoustical management solutions, expanded its Conscious Collection with the addition of Botanic Print and Embellish Print in its silicone hybrid coated upholstery line. Leveraging digital printing technology, the new designs enhance cleanability, durability, and aesthetics inspired by historic embroidery craftsmanship.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, Material and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise in transportation and automotive interiors due to safety and durability needs.

- Protective clothing will gain traction as industries enforce stronger worker safety regulations.

- Eco-friendly coatings and recycled substrates will replace solvent-based systems and traditional PVC in many applications.

- Technical textiles with antimicrobial, flame-retardant, and UV-resistant surfaces will see higher adoption in premium markets.

- Construction projects will continue using coated roofing membranes, tensile structures, and awnings for commercial infrastructure.

- Defense and aerospace sectors will expand purchases of weatherproof, chemical-resistant, and heat-shielded coated fabrics.

- Manufacturers will invest in water-based and bio-based polymer coatings to meet environmental compliance.

- Automation and advanced coating lines will improve production speed, product quality, and material uniformity.

- Asia Pacific will strengthen its leadership due to large-scale manufacturing and automotive output.

- Strategic mergers and supply agreements with OEMs will boost long-term contract stability for major producers.