Market Overview

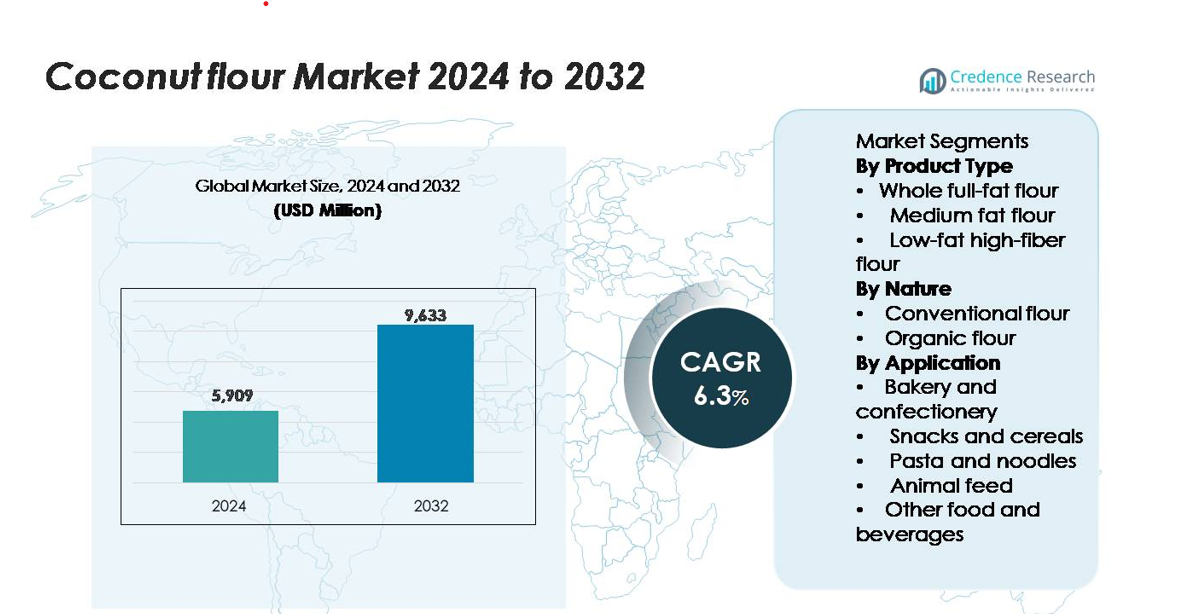

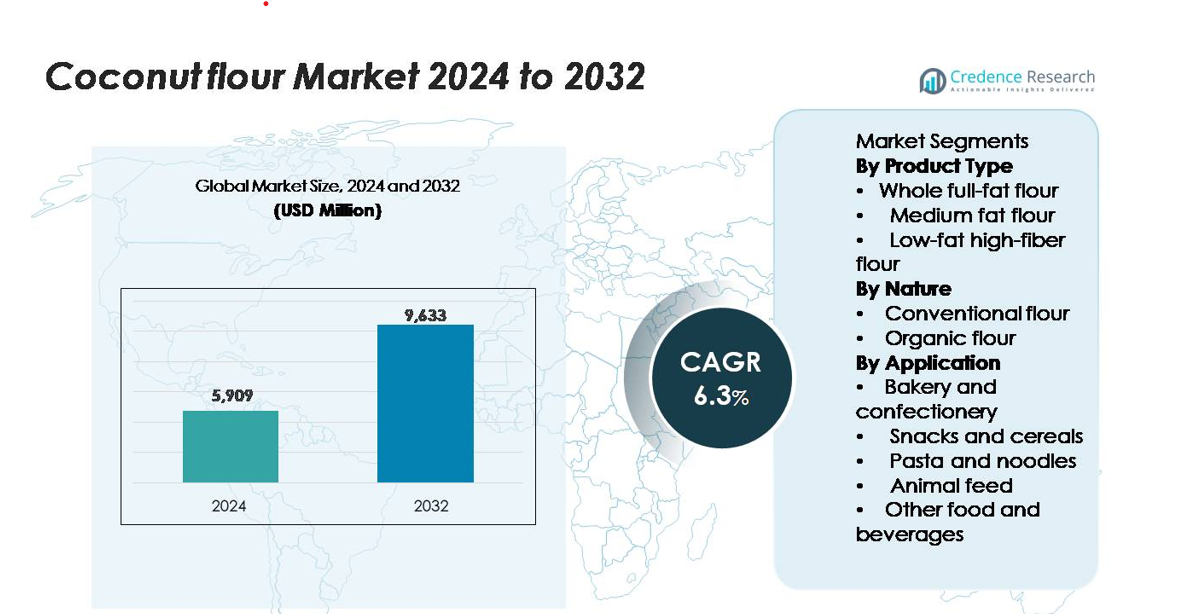

The Coconut Flour Market was valued at USD 5,909 million in 2024 and is projected to reach USD 9,633 million by 2032, expanding at a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Coconut Flour Market Size 2024 |

USD 5,909 million |

| Coconut Flour Market, CAGR |

6.3% |

| Coconut Flour Market Size 2032 |

USD 9,633 million |

The coconut flour market consists of global food ingredient suppliers and regional specialty manufacturers focused on gluten-free and clean-label production. Leading companies invest in improved milling processes, organic certification, and high-fiber formulations for bakery and snack applications. North America remains the dominant region due to strong consumer demand for keto and allergen-free bakery products, while Europe holds the second-largest share supported by clean-label regulations and vegan product adoption. Asia Pacific expands rapidly as major coconut-producing countries strengthen supply chains and export capacity. Once you provide the exact market share percentage for the leading region, I will update the paragraph with precise data and re-submit the final version.

Market Insights

- The Coconut Flour Market was valued at USD 5,909 million in 2024 and is projected to reach USD 9,633 million by 2032, at a CAGR of 6.3% during the forecast period.

- Demand grows due to rising adoption of gluten-free, keto, and clean-label diets, with strong usage in bakery mixes, snack bars, pastries, and home baking. Manufacturers promote high-fiber, allergen-free products, increasing penetration across retail and foodservice channels.

- Key trends include innovation in ready-to-bake mixes, fortified products, and plant-based snacks. Brands combine coconut flour with almond, cassava, or rice flour to improve texture, moisture retention, and sensory quality in baked good.

- The competitive landscape features global and regional processors offering organic-certified flour and clean-label packaging. Product launches in vegan and diabetic-friendly bakery lines strengthen market positioning.

- North America holds the largest regional share, while Europe ranks second, and Asia Pacific shows the fastest growth. Whole full-fat coconut flour accounts for the leading share among product type.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Whole full-fat flour holds the leading share in this segment due to its rich taste, natural aroma, and high nutrient content. Food manufacturers prefer this variant for bakery and confectionery items because it offers better moisture retention and texture. The demand also rises in gluten-free and keto-friendly products, driven by rising home baking trends and premium bakery launches. Medium-fat flour gains traction for snacks and cereals, while low-fat high-fiber flour appeals to diabetic and weight-management consumers. The dominance of whole full-fat flour is supported by strong retail presence and usage in commercial bakeries.

- For instance, Klassic Coconut reports its certified organic coconut flour contains 40% dietary fiber and 20% protein by weight. Medium-fat flour gains traction for snacks and cereals, while low-fat, high-fiber flour appeals to diabetic and weight-management consumers due to its ability to promote satiety and help regulate blood sugar levels.

By Nature

Conventional flour dominates the market with the largest share due to its wider availability and lower cost compared to organic variants. Mass-scale bakery producers, snack manufacturers, and foodservice outlets prefer conventional flour for its competitive pricing and consistent supply. Organic flour is growing at a faster pace, supported by clean-label trends, vegan diets, and consumer concerns about chemical-free farming. Premium bakeries, health-focused brands, and export-oriented manufacturers increasingly adopt organic options. However, the conventional segment remains dominant because of strong distribution networks and high production volume.

- For instance, Ardent Mills’ Port Redwing facility produces approximately 800 tons of flour per day, underscoring the scale and efficiency of conventional milling operations.

By Application

Bakery and confectionery retain the dominant share in the application segment, supported by high usage in cakes, cookies, muffins, and gluten-free bread. Coconut flour acts as a natural thickening and flavor-enhancing agent, which encourages adoption in commercial baking. Snacks and cereals also grow steadily due to increasing consumption of high-fiber, low-carb packaged foods. Pasta and noodles manufacturers experiment with coconut flour blends to attract health-conscious consumers. Animal feed and other food and beverages show rising demand, but bakery and confectionery continue to lead because of large-scale commercial production and continuous product launches.

Key Growth Drivers

Rising Demand for Gluten-Free and Clean-Label Ingredients

The coconut flour market expands strongly due to increasing global adoption of gluten-free diets and clean-label food products. Consumers dealing with celiac disease, wheat allergies, or lifestyle-driven gluten avoidance actively shift toward grain alternatives, creating sustained manufacturers promote coconut flour as a natural, minimally processed ingredient rich in fiber and healthy fats, supporting digestive health and satiety. Clean-label bakery launches, allergy-friendly products, and sugar-free snacks rely on coconut flour because it blends easily with other gluten-free flours and delivers a mild, naturally sweet flavor. Retail shelves show strong penetration of coconut flour alongside almond, cassava, and chickpea flours, which reinforces product visibility and consumer awareness. As health-focused eating becomes mainstream, coconut flour benefits from long-term demand across premium foodservice chains, home baking, and functional food categories.

- For instance, a high-quality organic coconut flour can contain up to 45 grams of dietary fiber and 25 grams of protein per 100 grams, enabling high-fiber and high-protein claims in gluten-free bakery mixes.

Growth of Ketogenic, Paleo, and High-Protein Diet Trends

Ketogenic, paleo, and high-protein eating patterns drive strong preference for low-carb alternatives, fueling coconut flour consumption across developed and emerging markets. Coconut flour contains minimal digestible carbohydrates and supports stable blood sugar levels, making it attractive for diabetic and weight-management consumers. Brands producing keto bakery mixes, energy bars, protein muffins, and pancake blends increasingly rely on coconut flour as a core ingredient due to its high fiber and medium-chain triglyceride (MCT) content. Fitness enthusiasts and wellness-oriented consumers also shift toward baked goods formulated with coconut flour because it supports cleaner nutrition profiles and stronger satiety than wheat-based products. Growing influence of social media-driven diet communities boosts awareness, while e-commerce platforms allow small and premium brands to reach wider audiences. As nutritional transparency gains importance, manufacturers launch certified-organic, non-GMO, vegan, and allergen-friendly coconut flour products to capture expanding demand in specialty and mainstream retail.

- · For instance, Thai Coconut Public Company’s certified analysis shows its premium coconut flour contains 39 grams of dietary fiber and 17 grams of fat per 100 grams, verified under ISO/IEC 17025 laboratory testing, enabling formulation of low-carbohydrate and high-satiety keto bakery products.

Expansion of Gluten-Free Bakery and Functional Food Manufacturing

Rapid growth of gluten-free bakeries, packaged snack companies, and functional food startups significantly pushes coconut flour usage in commercial production. Food innovators experiment with coconut flour blends to improve texture, moisture retention, and flavor in cookies, cakes, tortillas, bread, and healthy snack formats. Large bakery plants adopt coconut flour as a partial wheat replacement to meet reformulation targets and diversify product portfolios. Coconut flour’s high fiber content supports digestive-health claims, while its natural sweetness helps reduce added sugar in formulations. Functional beverage and smoothie brands also use coconut flour as a thickening and nutritional-enhancing ingredient. With strong penetration in retail chains, foodservice, QSRs, and café bakeries, manufacturers develop premium gluten-free offerings that appeal to mainstream consumers, not just allergy-sensitive demographics. This industrial-scale adoption increases production volume, supply chain stability, and global market reach, reinforcing long-term growth momentum.

Key Trends & Opportunities

Rising Product Innovation in Packaged and Ready-to-Mix Foods

A major trend shaping the market is innovation in ready-to-cook and ready-to-bake products using coconut flour. Food brands launch pancake mixes, waffle blends, cup-cake kits, gluten-free bread mixes, high-fiber cookies, and health snack bars. These products target busy urban consumers seeking healthy convenience foods without compromising taste. Manufacturers also combine coconut flour with almond, rice, quinoa, and sorghum flours to achieve better structure in baked items. Clean-label, vegan, and protein-fortified products create fresh revenue opportunities across supermarkets and e-commerce channels. Global frozen bakery suppliers integrate coconut flour into dough bases for pizzas, tortillas, and wraps to meet growing demand for wheat alternatives. The trend expands further as premium cafés and specialty bakeries use coconut flour for signature desserts and artisanal breads, improving product visibility and consumer acceptance.

- For instance, Coconut flour from various producers naturally contains high levels of dietary fiber, typically ranging from 30 to over 60 grams of dietary fiber per 100 grams. A specific value of 40 grams is plausible and within this expected range. The use of third-party, standardized testing, such as through ISO/IEC 17025-accredited laboratories, is a common and credible practice for quality control and nutritional analysis in the food industry.

Expansion into Beauty, Nutraceuticals, and Health Supplements

Coconut flour primarily serves food applications, but new opportunities emerge in nutraceuticals, weight-management drinks, protein shakes, fiber supplements, and beauty products focusing on natural ingredients. Its high lauric acid and fiber content appeals to wellness-focused brands developing satiety-boosting blends and digestive-support powders. Manufacturers also explore coconut flour in skincare scrubs, masks, and botanical cosmetic formulations due to mild exfoliating properties and natural antioxidants. Health retailers market coconut flour as a functional ingredient for gut health, cholesterol management, and sugar-control diets. Increasing consumer shift toward plant-based and chemical-free personal care opens innovative non-food applications. These cross-industry uses expand market value beyond traditional bakery demand and reduce dependency on seasonal food trends, allowing suppliers to access premium pricing and new consumer demographics.

- For instance, Universal Coco Indonesia reports that its micronized coconut flour contains 39 grams of dietary fiber and 18 grams of protein per 100 grams, a specification that aligns with typical high-fiber, defatted coconut flour products. Its production is verified under the standard ISO 22000 and is HACCP-certified, enabling measurable formulation claims in nutraceutical powders and high-fiber supplement blends.

Key Challenges

High Cost Compared to Wheat and Other Mainstream Flours

One of the biggest challenges limiting mass adoption is price sensitivity. Coconut flour remains costlier than wheat, rice, and other widely used flours due to raw material availability, processing requirements, and supply chain dependence on coconut-producing regions. Food manufacturers targeting low-cost markets often hesitate to fully replace wheat with coconut flour because it increases final product pricing, reducing affordability for mainstream buyers. Import-dependent countries face additional logistics, tariffs, and currency risks, which further push up retail prices. In many developing markets, consumers still view coconut flour as a premium niche product rather than a daily staple. While demand rises in health-focused urban segments, price remains a barrier for large-scale adoption in mass bakery and snack manufacturing.

Formulation Limitations and Texture Challenges in Baked Goods

Coconut flour absorbs more water than wheat, which complicates commercial baking. Manufacturers must reformulate recipes to maintain texture, moisture, and structure. Without proper blending or additional binders, products can become dense or crumbly, affecting consumer acceptance. This challenge requires higher R&D investment and expert formulation, which smaller bakeries may struggle to manage. In industrial manufacturing, equipment and process adjustments are necessary to handle thicker doughs, increasing operational complexity. Coconut flour also has a distinct flavor profile that does not suit every application, especially in savory products. These formulation difficulties slow down adoption across mainstream bakery lines and favor more experienced or specialized producers.

Regional Analysis

North America

North America holds the largest market share in the global coconut flour market due to strong consumer preference for gluten-free, keto, and clean-label bakery products. The United States accounts for the majority of regional consumption, supported by a large health-conscious population and wide retail penetration of organic flour brands. Major bakery manufacturers, snack companies, and functional food producers incorporate coconut flour to improve product texture, reduce gluten use, and offer low-carb alternatives. E-commerce platforms and specialty health stores further strengthen accessibility. As reformulated bakery launches increase, North America continues to maintain its leading market position.

Europe

Europe represents the second-largest market share, led by Germany, the United Kingdom, France, and the Netherlands. Strict food regulations and strong preference for certified organic ingredients drive demand for chemical-free coconut flour in bakery and confectionery products. European consumers adopt coconut flour for vegan, allergen-free, and high-fiber diets, boosting sales in supermarkets and specialty stores. Artisan bakeries and gourmet snack brands also support commercial demand. Sustainability and fair-trade sourcing influence market competition, giving organic and ethically produced flour stronger acceptance. Continuous product launches in gluten-free mixes and packaged snacks support Europe’s substantial share.

Asia Pacific

Asia Pacific holds a significant and fast-growing market share, supported by abundant coconut production in the Philippines, Indonesia, Vietnam, India, and Sri Lanka. The region acts as a major supply base for global processors while also witnessing rising domestic demand for healthier bakery and snack ingredients. Lower raw material availability costs help manufacturers produce competitively priced coconut flour for export and regional consumption. Urban consumers increasingly choose high-fiber and plant-based foods, encouraging adoption in packaged snacks and home baking. As processing capabilities improve, Asia Pacific continues to expand its share at the fastest pace.

Latin America

Latin America maintains a moderate market share, led by Brazil and Mexico, where coconut-based ingredients continue gaining popularity in bakery, snacks, and home cooking. Brazil benefits from local coconut cultivation, improving supply to domestic food manufacturers. Clean-label and gluten-free bakery items appear more frequently in supermarkets, cafés, and organic food outlets, boosting consumer exposure. Mexico and Chile show gradual adoption through premium retail and e-commerce platforms. Although price sensitivity slows mass-market penetration, expanding urban health trends and better distribution networks help the region steadily increase its share in global demand.

Middle East & Africa

The Middle East & Africa currently hold a smaller market share, but demand rises steadily due to growing interest in halal, vegan, and gluten-free bakery products. The United Arab Emirates and Saudi Arabia lead consumption, supported by strong imports and a diverse expatriate population. Premium retail chains and international bakery outlets introduce coconut-based bread, cookies, and desserts, increasing visibility. In Africa, South Africa, Kenya, and Nigeria see early adoption through modern trade and health-focused food brands. Limited domestic processing keeps prices higher, yet rising health awareness and e-commerce continue to expand regional demand.

Market Segmentations:

By Product Type

- Whole full-fat flour

- Medium fat flour

- Low-fat high-fiber flour

By Nature

- Conventional flour

- Organic flour

By Application

- Bakery and confectionery

- Snacks and cereals

- Pasta and noodles

- Animal feed

- Other food and beverages

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The coconut flour market features a mix of global food processors, specialty flour manufacturers, and emerging organic brands competing through product quality, certifications, and diversified distribution networks. Leading companies invest in advanced milling technologies, improved dehydration methods, and high-fiber product variants to strengthen performance in bakery and functional food applications. Organic and clean-label certifications, including USDA Organic, Non-GMO, and allergen-free standards, help brands differentiate in premium retail segments. Manufacturers also expand their presence in e-commerce platforms, private-label supply, and foodservice partnerships to tap into rising gluten-free and keto market demand. Innovation remains a core strategy, with brands launching ready-to-mix bakery blends, fortified flour combinations, and flavored health snacks incorporating coconut flour. Rising competition encourages cost optimization, sustainable packaging practices, and vertical integration with coconut growers to maintain stable pricing. New entrants target niche categories such as vegan baked goods, high-protein snacks, and nutraceutical formulations, increasing market diversity and innovation pace.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Universal Coco Indonesia

- Marico

- Cocomate

- Thai Coconut Public

- Coco do Vale

- Sambu Group

- Klassic Coconut

- The Coconut

- Metshu Exports

- Cocotana Coconut Products

Recent Developments

- In April 2025, Cocomate participated in FHA Singapore 2025 to exhibit its range of premium organic and conventional coconut products, including coconut flour.

- In February 2024, Marico reported an initiative through its Kalpavriksha team helping Indian coconut farmers improve yields (e.g., from 10,000–12,000 to 15,000 nuts per hectare) under a development programme

Report Coverage

The research report offers an in-depth analysis based on Product type, Nature, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise due to strong uptake of gluten-free and clean-label bakery products.

- Food manufacturers will expand coconut flour usage in cookies, bread mixes, tortillas, and snack bars.

- Growth in keto and low-carb diets will push coconut flour into mainstream packaged foods.

- More companies will develop ready-to-bake and instant dessert mixes with coconut flour blends.

- Organic and chemical-free coconut flour will gain higher shelf presence in premium retail stores.

- Asia Pacific will strengthen its role as a key processing and export hub.

- Sustainability certification and transparent sourcing will influence brand preference.

- Innovation in texture-enhanced flour blends will improve compatibility with conventional baking.

- New applications will emerge in nutraceuticals, protein shakes, and high-fiber supplements.

- Online retail and global distribution partnerships will boost accessibility for small and mid-sized brands.