Market Overview

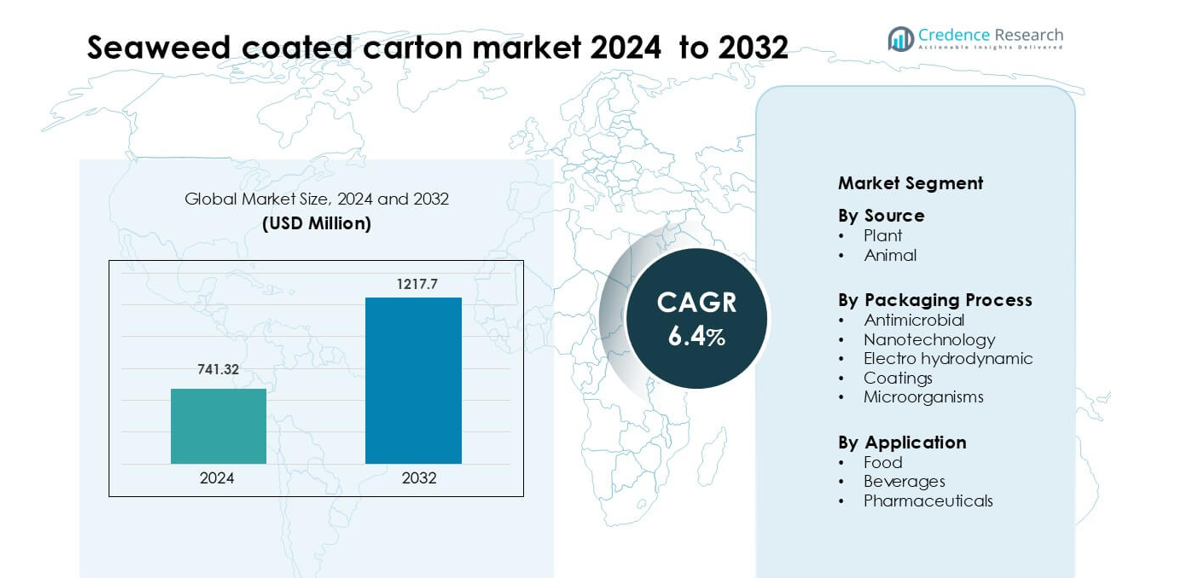

Seaweed coated carton market was valued at USD 741.32 million in 2024 and is anticipated to reach USD 1217.7 million by 2032, growing at a CAGR of 6.4 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Seaweed Coated Carton Market Size 2024 |

USD 741.32 million |

| Seaweed Coated Carton Market, CAGR |

6.4% |

| Seaweed Coated Carton Market Size 2032 |

USD 1217.7 million |

The Seaweed Coated Carton Market is shaped by active competition among leading sustainability-focused companies such as EnviGreen, Monosol LLC, Marine Innovation, JRF Technology LLC, Devro, Amtrex Nature Care Pvt. Ltd., Montrose UK Ltd., Evo & Co., and Regeno. These players focus on developing algae-based coatings that enhance moisture resistance and reduce plastic dependence in food, beverage, and pharmaceutical packaging. Europe leads the global market with a 38% share in 2024, driven by strict single-use plastic regulations, strong retail adoption of biodegradable materials, and continuous investment in seaweed-based biopolymer technologies that support large-scale commercial production.

Market Insights

- Seaweed coated carton market was valued at USD 741.32 million in 2024 and is anticipated to reach USD 1217.7 million by 2032, growing at a CAGR of 6.4 % during the forecast period.

- Strong market drivers include increasing demand for plastic-free packaging and higher use of seaweed-based coatings in food applications, which hold the largest segment share.

- Key trends focus on rapid adoption of biodegradable coatings, rising seaweed farming investments, and expansion of natural barrier technologies across ready-to-eat and fresh produce packaging.

- The competitive landscape includes active players such as EnviGreen, Monosol LLC, Marine Innovation, JRF Technology LLC, Devro, Amtrex Nature Care Pvt. Ltd., Montrose UK Ltd., Evo & Co., and Regeno, each strengthening coating performance and production scale.

- Europe leads the market with about 38% share in 2024, followed by North America at 34% and Asia-Pacific at 22%, while food applications remain the dominant segment due to strong demand for compostable packaging.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

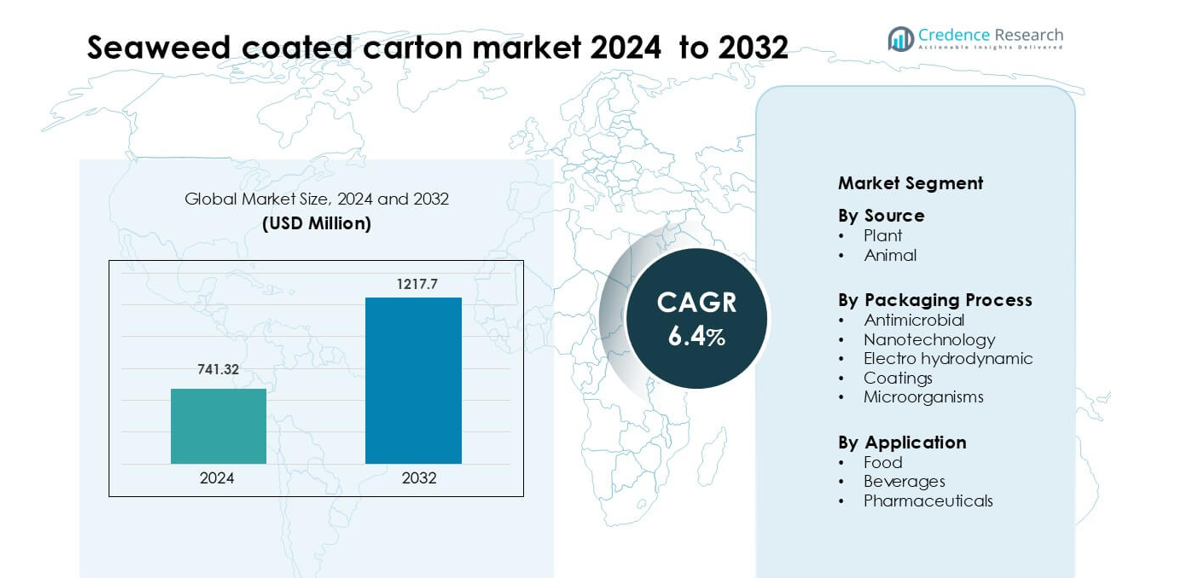

By Source

Plant-based sources lead this segment with about 74% share in 2024. Strong adoption comes from rising demand for natural coatings that improve strength, reduce plastic use, and support compostable packaging rules. Seaweed extracts from red and brown algae help producers create uniform films with better barrier control. Animal-based sources hold a smaller role due to supply limits and higher processing needs. Growth stays steady as food brands prefer plant-derived materials for safe and clean-label packaging.

- For instance, Notpla has 10 granted patents covering its seaweed-derived coatings and films, and the company reports its seaweed sachets (used in pilots with brands such as Heinz) are made to hold between 10 and 60 millilitres; the material is stated to biodegrade in about 4–6 weeks in typical composting conditions.

By Packaging Process

Coatings dominate this segment with nearly 52% share in 2024 because manufacturers rely on seaweed-based layers to improve moisture resistance and extend product life. The process is easy to integrate into existing carton lines and supports scalable production. Antimicrobial and nanotechnology methods gain traction as brands adopt advanced film structures to control spoilage. Electro-hydrodynamic and microorganism-based approaches grow slowly due to higher setup costs and technical complexity.

- For instance, A research team at the University of Malaysia Sabah developed a carrageenan-nanocellulose–silver-nanoparticle bionanocomposite seaweed film that achieved a water vapour transmission rate (WVTR) of 5.62 g/m²·day, while also preventing mold growth on bread for 30 days.

By Application

Food applications lead this segment with about 61% share in 2024. Demand rises as retailers shift to sustainable cartons for bakery, produce, and ready-to-eat items. Seaweed coatings help reduce oxidation, maintain freshness, and improve handling strength. Beverage brands adopt these materials at a stable pace for secondary packaging. Pharmaceuticals also expand use cases, mainly in eco-safe cartons designed for dry formulations and non-reactive storage.

Key Growth Drivers

Rising Demand for Sustainable and Compostable Packaging

Global demand for eco-friendly packaging drives strong adoption of seaweed-coated cartons. Many brands shift from petroleum-based coatings to natural alternatives that offer compostability and reduced emissions. Seaweed biopolymers provide strong barrier protection for moisture, grease, and oxygen, helping companies meet sustainability goals without losing performance. Governments push stricter waste regulations, creating new market pathways for renewable materials. Large food and beverage retailers prefer seaweed coatings as these solutions meet circular-economy targets and support certification requirements for biodegradable packaging. This shift encourages investment in seaweed processing, material extraction, and coating technologies, strengthening market growth across multiple applications.

- For instance, Duni Group, in collaboration with Notpla, launched its Alga series in 2024: a range of four fully plastic-free cardboard products (a mealbox, a box, and two tray formats) coated with Notpla’s seaweed-based barrier that resists moisture and oil, yet is fully recyclable with paper/cardboard waste streams.

Expanding Use in Perishable Food and Fresh Produce Packaging

Demand rises in the food sector as seaweed-based coatings extend shelf life and reduce spoilage. Many brands look for natural coatings that avoid synthetic additives while maintaining product quality. Seaweed extracts offer antimicrobial and antioxidant benefits, making them suitable for fruits, vegetables, baked goods, and ready-to-eat items. Retailers focus on packaging solutions that reduce food waste, especially in fresh and chilled categories, which creates strong adoption opportunities. Seaweed-coated cartons help balance durability with sustainability, supporting cold-chain stability and improving handling strength. Growth accelerates as more producers adopt plant-based coatings to meet safety, shelf-life, and environmental demands.

- For instance, in a study, researchers applied a Caulerpa lentillifera (green seaweed) edible coating to tomato, red chili, eggplant, and carrot; under refrigeration, the coated tomatoes retained their firmness and appealing appearance for 7–10 days, while uncoated controls showed wilting by day 5.

Advancement in Coating Technologies and Processing Methods

Innovation in coating processes boosts market expansion as manufacturers adopt advanced methods such as nanotechnology, antimicrobial layering, and precision film-forming techniques. These technologies enhance barrier control and help tailor coatings for specific product needs, including humidity resistance, grease protection, and microbial prevention. Automated production lines also enable consistent application of seaweed solutions, improving scale and reducing defects. Research programs explore new seaweed species for stronger film properties, creating more functional and flexible coatings. Growing collaboration between material scientists, packaging companies, and food producers accelerates commercialization. As technology matures, the market benefits from higher reliability and broader application potential.

Key Trend & Opportunity

Rising Interest in Plastic-Free Packaging Alternatives

Many companies shift toward plastic-free packaging, creating strong opportunities for seaweed-coated cartons. Consumers prefer clean and natural materials, pushing brands to replace polyethylene coatings with renewable layers made from algae extracts. This trend aligns with global bans on single-use plastics and extended producer-responsibility rules. Market leaders explore hybrid coatings using seaweed blended with natural fibers to improve strength and reduce waste. E-commerce and food delivery operators also test plastic-free cartons to meet environmental commitments. As demand for regenerative materials grows, seaweed-coated cartons gain visibility as a high-impact, low-carbon alternative in mainstream packaging portfolios.

- For instance, Notpla did partner with Levy UK + Ireland, the sports and entertainment arm of Compass Group UK & Ireland. The partnership was announced in early March 2024, with Prince William visiting the Kia Oval to mark the occasion.

Growing Investments in Seaweed Farming and Biorefinery Infrastructure

Expansion of large-scale seaweed cultivation creates long-term growth opportunities for coated carton producers. Many countries support seaweed farming due to its low land use, zero freshwater requirement, and strong carbon-sequestration profile. Growing supply improves the availability of high-quality extracts and reduces manufacturing costs. Biorefineries process seaweed into carrageenan, alginate, and other biopolymers required for coating solutions. This infrastructure growth ensures stable raw-material supply and encourages wider commercial production. As governments and investors fund sustainable aquaculture, packaging companies gain more reliable access to materials needed for coating technologies.

- For instance, the company has established the world’s first large-scale mechanized tropical seaweed farm using its proprietary SeaCombine technology for automated seeding and harvesting.

Key Challenge

Limited Industrial-Scale Production and High Processing Costs

Scaling seaweed-based coatings to industrial volumes remains a major challenge. Extraction, purification, and coating processes require specialized equipment, driving higher upfront investment and slower adoption among small manufacturers. The cost of processing seaweed biopolymers remains higher than synthetic coatings, making price competitiveness difficult in mass-market segments. Variability in seaweed supply due to weather and seasonal harvesting also affects consistency. Without efficient large-scale systems, producers struggle to maintain stable pricing and uniform coating quality. This creates barriers for wider adoption in cost-sensitive sectors such as beverages and large-volume packaged foods.

Technical Limitations in Barrier Performance Compared to Conventional Coatings

Although seaweed coatings offer strong environmental benefits, they still face challenges in matching the full barrier performance of petroleum-based coatings. Humidity resistance, mechanical strength, and long-term durability may vary based on seaweed type and processing quality. High-moisture or high-fat products often require stronger barriers, limiting use in certain packaging formats. Manufacturers work to improve rigidity, water resistance, and printability through advanced formulations, but performance gaps still restrict rapid market penetration. Achieving industry-standard barrier levels remains a key technical hurdle, especially for high-shelf-life or export-oriented products.

Regional Analysis

North America

North America holds about 34% share of the Seaweed Coated Carton Market in 2024. Growth strengthens as food and beverage brands adopt plastic-free packaging to meet state-level sustainability mandates. Retailers in the United States expand trials of seaweed-based coatings for bakery, produce, and chilled categories. Strong investment in biopolymer research supports improved barrier performance and scalable coating processes. Canada accelerates adoption due to national waste-reduction targets and interest in compostable packaging. Regional demand rises as companies integrate seaweed coatings into premium cartons aimed at reducing synthetic layers while maintaining strength and moisture resistance.

Europe

Europe commands nearly 38% share in 2024, making it the leading regional market. The region benefits from strict regulations targeting single-use plastics and strong consumer preference for biodegradable packaging. Countries like Germany, the U.K., and France adopt seaweed-coated cartons for ready-to-eat meals, organic products, and sustainable retail packaging. Large packaging converters incorporate algae-based coatings into paperboard lines to comply with circular-economy standards. Investments in seaweed farming across Norway and Ireland further support supply stability. Demand grows as retailers push for low-carbon solutions that maintain durability and align with sustainability commitments.

Asia-Pacific

Asia-Pacific holds around 22% share in 2024 and grows rapidly due to strong seaweed availability and expansion of biopolymer manufacturing. Countries such as Indonesia, South Korea, China, and Japan leverage abundant seaweed resources to scale coating production at competitive costs. Food and beverage expansion drives adoption in bakery, confectionery, and fresh produce packaging. Local governments support seaweed aquaculture as a climate-positive industry, improving material supply for coatings. Rising interest in plant-based, compostable materials accelerates market penetration. The region’s strong export-oriented packaging sector boosts demand for sustainable cartons with natural barrier layers.

Latin America

Latin America accounts for about 4% share in 2024 and grows steadily as sustainability adoption rises. Brazil, Chile, and Mexico lead regional demand, driven by growing regulations on single-use plastics and interest in renewable coatings. Food producers explore seaweed-coated cartons for produce, spices, and bakery categories to improve shelf life and support eco-focused branding. Local seaweed resources in Chile strengthen material supply for emerging coating applications. Market visibility rises as regional converters test bio-based layers to enhance moisture resistance and reduce synthetic components in paper packaging.

Middle East & Africa

Middle East & Africa holds nearly 2% share in 2024, with early adoption concentrated in the UAE, Saudi Arabia, and South Africa. Demand increases as retailers and food-service chains evaluate sustainable packaging to meet corporate ESG goals. Seaweed-coated cartons gain traction in premium food, confectionery, and pharmaceutical secondary packaging. Limited local seaweed cultivation slows scale-up, but imports support small-batch production. Governments promote waste-management reforms and plastic-reduction initiatives, creating long-term opportunities. Growth remains moderate but consistent as companies test bio-coated cartons that reduce environmental impact while improving packaging performance.

Market Segmentations:

By Source

By Packaging Process

- Antimicrobial

- Nanotechnology

- Electro hydrodynamic

- Coatings

- Microorganisms

By Application

- Food

- Beverages

- Pharmaceuticals

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Seaweed Coated Carton Market features a growing mix of material innovators, packaging technology firms, and sustainability-driven manufacturers. Companies such as EnviGreen, Monosol LLC, Marine Innovation, JRF Technology LLC, Devro, Amtrex Nature Care Pvt. Ltd., Montrose UK Ltd., Evo & Co., and Regeno lead the competitive landscape by developing algae-based coatings that improve moisture resistance, extend shelf stability, and replace petroleum-derived layers. Most players invest in R&D to enhance film strength, barrier control, and processing compatibility with existing carton lines. Partnerships between seaweed processors, packaging converters, and food brands accelerate commercial adoption, especially in ready-to-eat, bakery, and fresh produce categories. Competition intensifies as firms expand capacity, secure regional seaweed supply chains, and pursue certifications for compostability and food safety. Emerging start-ups add pressure through rapid innovation and specialized sustainable product portfolios, pushing established companies to scale technology and meet rising regulatory and corporate sustainability demands.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- EnviGreen

- Monosol LLC

- Marine Innovation

- JRF Technology, LLC

- Devro

- Amtrex Nature Care Pvt. Ltd.

- Montrose UK Ltd.

- Evo & Co.

- Regeno

Recent Developments

- In February 2025, Marine Innovation announced its expansion into Greater Seattle through the K-Startup Center, aiming to scale seaweed-based packaging such as to-go containers and industrial packing formats in the U.S. market. Earlier research on seaweed food-contact materials already cited Marine Innovation for developing eco-friendly seaweed-based egg trays, cartons, fruit trays, and paper cups, which are directly relevant to seaweed-coated carton solutions.

- In February 2025, Evo & Co. (Evoware), European packaging analysts selected Evoware s seaweed-based edible sachets as Packaging of the Month, noting their use for foods, powders, and hygiene items and a shelf life of up to two years

Report Coverage

The research report offers an in-depth analysis based on Source, Packaging Process, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as brands increase adoption of plastic-free and compostable packaging.

- Seaweed coating technologies will advance to deliver stronger moisture and grease barriers.

- Large retailers will integrate seaweed-based cartons into more food and fresh produce categories.

- Global seaweed farming capacity will rise, improving raw-material availability and pricing stability.

- Packaging converters will upgrade production lines to support bio-coating scalability.

- Regulatory pressure on plastics will accelerate switching to algae-derived coating solutions.

- New coating blends using seaweed and natural fibers will improve carton durability.

- Partnerships between seaweed processors and packaging manufacturers will strengthen supply chains.

- Asia-Pacific will emerge as a major production hub due to abundant seaweed resources.

- Innovation will focus on enhancing printability, shelf-life performance, and cold-chain compatibility.