Market Overview

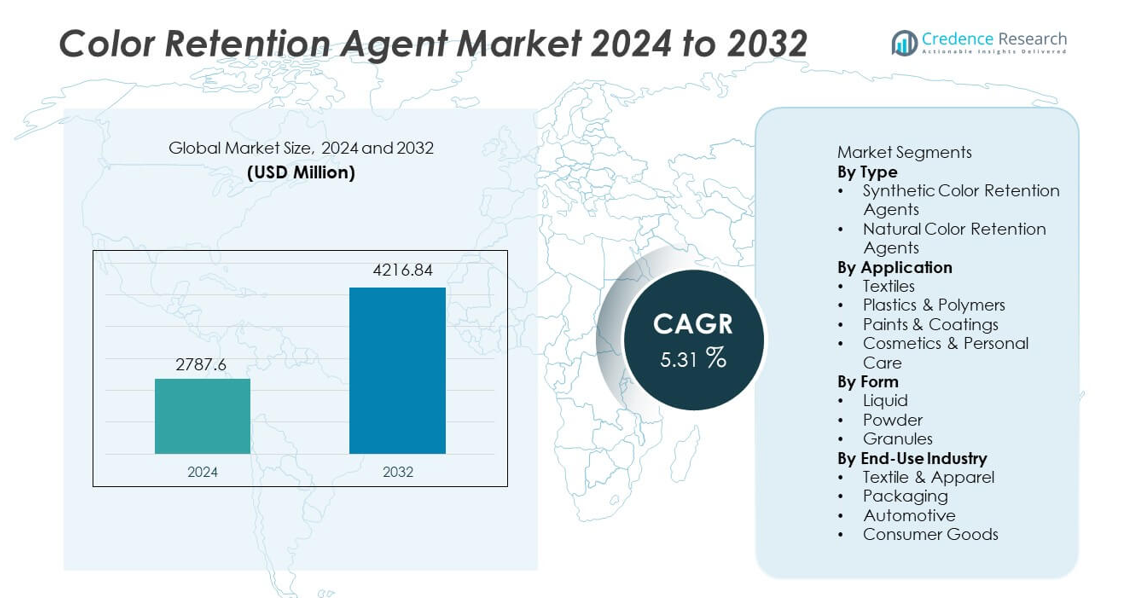

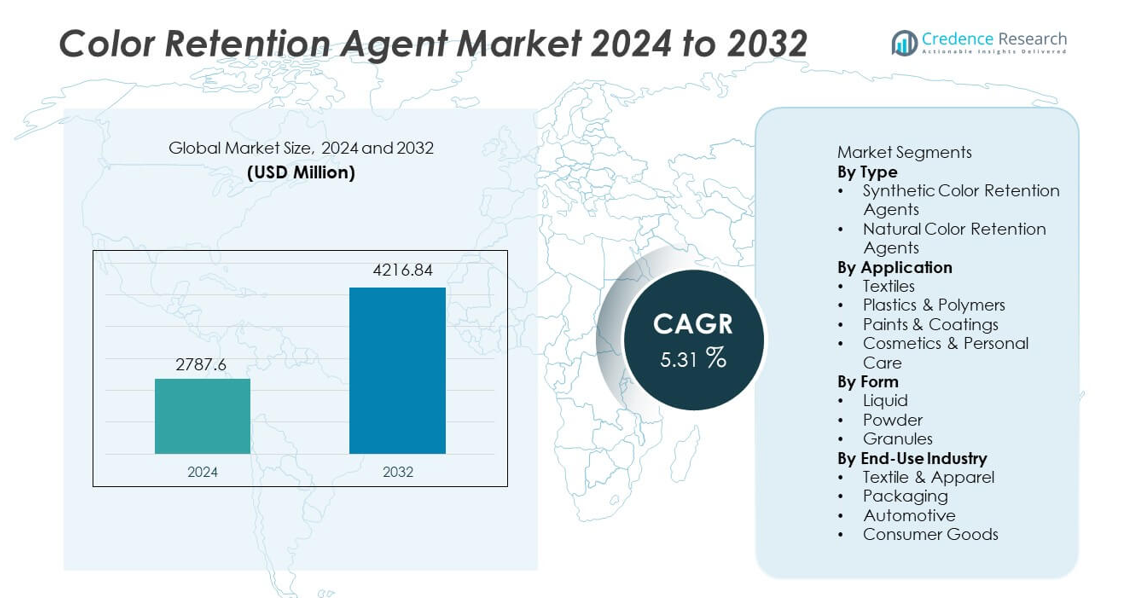

The Color Retention Agent Market reached USD 2,787.6 million in 2024 and is expected to grow to USD 4,216.84 million by 2032, registering a CAGR of 5.31% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Color Retention Agent Market Size 2024 |

USD 2,787.6 million |

| Color Retention Agent Market, CAGR |

5.31% |

| Color Retention Agent Market Size 2032 |

USD 4,216.84 million |

Top players in the Color Retention Agent market include BASF SE, Clariant AG, Dow Chemical Company, LANXESS, Croda International Plc, Huntsman Corporation, Evonik Industries AG, Ashland Inc., Solvay S.A., and Nouryon, all of which focus on high-performance formulations that enhance UV resistance, thermal stability, and long-term color durability. These companies strengthen their position through product innovation, sustainable chemistry advancements, and deeper collaboration with textile, plastics, and coatings manufacturers. Asia Pacific leads the global market with a 32% share, driven by large-scale textile production and expanding polymer processing, while North America and Europe follow due to strong quality standards and steady adoption of advanced additives.

Market Insights

- The Color Retention Agent market reached USD 2,787.6 million in 2024 and will grow at a CAGR of 5.31%, driven by rising demand across textiles, plastics, and coatings.

- Strong market drivers include high focus on long-lasting shade stability, with synthetic agents holding a 64% share due to superior heat and UV resistance.

- Key trends highlight growing adoption of eco-friendly formulations and advanced polymer additives, while Asia Pacific leads with 32% regional share, supported by large-scale manufacturing.

- Competitive activity intensifies as major players invest in R&D and sustainable solutions to enhance durability and meet regulatory standards across sectors.

- Market restraints include performance gaps in natural formulations and strict regional chemical regulations, while textiles dominate applications with a 41% share, creating steady demand for high-performance retention technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Synthetic color retention agents lead this segment with a 64% share, driven by strong demand in industries that require high stability during heat, light, and chemical exposure. These agents support consistent shade accuracy in textiles, plastics, and coatings, which strengthens their dominance. Natural agents hold the remaining share as companies explore safer and plant-derived additives. Growth in the natural category rises with clean-label trends, though performance gaps remain. Regulatory support for safer formulations helps both sub-segments expand across major end-use markets.

- For instance, BASF SE developed the Tinopal CBS-X optical brightener which maintains whiteness at temperatures up to 95°C during repeated wash cycles, and offers lightfastness levels above grade 6 under ISO 105-B02 testing standards, demonstrating high stability under heat and light conditions.

By Application

Textiles dominate the application segment with a 41% share, supported by heavy consumption of retention additives to prevent fading during washing, sunlight exposure, and chemical treatments. Manufacturers rely on these agents to maintain uniform color across large production batches. Plastics and polymers follow due to rising demand for color-stable packaging and automotive parts. Paints and coatings continue to gain traction as producers target improved weather resistance. Cosmetics and personal care hold a smaller share but show steady growth as brands seek longer-lasting color performance in makeup and skincare.

- For instance, Clariant AG introduced Hostavin dispersions with good UV absorption and recorded improved colour change results after extensive Xenon arc exposure, which supports textile and coating applications that face sunlight and outdoor conditions.

By Form

Liquid formulations hold the highest share at 52%, driven by strong compatibility with textile dye baths, polymer processing, and coating systems. Liquids enable smooth dispersion, precise dosing, and reduced mixing time, making them preferred in high-speed production lines. Powder formulations follow due to longer shelf life and suitability for dry-blend applications. Granules maintain a smaller share but gain adoption in automated environments that require dust-free, stable handling. Demand across all forms rises with increased focus on production efficiency and consistent color quality.

Key Growth Driver

Rising Demand for High-Performance Color Stability

Industries seek stronger color durability across textiles, plastics, and coatings, which drives adoption of advanced retention agents that resist UV radiation, heat, and chemical exposure. Manufacturers aim to reduce fading during processing and product use, raising the need for improved molecular stability. Expanding production of colored polymers and specialty coatings increases reliance on these additives. Consumer expectations for long-lasting visual appeal support further demand. This focus on enhanced performance encourages suppliers to invest in next-generation technologies that maintain shade accuracy in high-speed and high-stress production environments.

- For instance, Huntsman Corporation reported that its ERIONYL dyes maintain excellent wash fastness ratings and resist significant color shift under the ISO 105-C06 standard, showing stronger resistance to fading during textile processing.

Expansion of Textile and Packaging Production

Rising textile output and rapid growth in flexible packaging boost usage of color retention additives across large manufacturing cycles. High-speed dyeing, extrusion, and printing lines depend on these molecules to ensure color uniformity despite variations in temperature, chemicals, and processing time. Global apparel consumption and increased use of colored polymer films strengthen demand. Producers expand color ranges and adopt deeper shades that require better stability. Emerging markets across Asia and Latin America further support adoption as manufacturers modernize equipment and focus on higher quality standards.

- For instance, Dow offers specific PARALOID™ acrylic modifiers and processing aids for use in rigid and flexible vinyl packaging films that help to provide excellent surface finish, gloss, and stability against environmental exposure. These additives improve durability, processing efficiency, and the final appearance of the polymer without compromising performance.

Shift Toward Quality Enhancement in End-Use Products

Producers in consumer goods, automotive, and cosmetics industries prioritize improved visual consistency and longer product lifespan, which drives heavier use of retention additives. Strict quality benchmarks push manufacturers to adopt agents that withstand mechanical stress, storage conditions, and environmental exposure. Stable color performance enhances brand identity across packaging, fabrics, and molded components. Growing demand for premium and performance-driven products increases the need for formulations that keep colors vibrant over time. This shift supports steady expansion across both mass-market and specialized applications.

Key Trend and Opportunity

Growing Preference for Eco-Friendly and Low-Toxicity Formulations

The move toward safer, greener chemicals creates strong opportunities for suppliers offering bio-based, low-VOC, and non-hazardous color retention agents. Brands pursue sustainable solutions to meet regulatory demands and consumer expectations in textiles, cosmetics, and packaging. Producers work on eco-friendly molecules that deliver performance levels closer to synthetic agents. Companies investing in renewable raw materials gain early advantage in markets shifting toward environmental compliance. Rising awareness of chemical exposure accelerates the adoption of safer formulations across multiple end-use industries.

- For instance, Croda International offers a wide range of plant-derived additives that are readily biodegradable according to OECD guidelines, suitable for various applications including cosmetics and textiles.

Advancements in Polymer Additive Engineering

New developments in polymer technology enable multi-functional retention agents that enhance UV protection, improve thermal stability, and support complex material systems. Producers combine additives to strengthen color performance during extrusion, molding, and coating operations. Growth in engineered plastics, 3D printing, and high-performance coatings expands application potential. These advanced materials demand precision additives that maintain consistent aesthetics. As manufacturers introduce new polymer grades, opportunities increase for retention solutions designed to reduce shade variation and support premium product quality.

- For instance, Evonik Industries AG offers various TEGO and other brand additives designed to provide heat resistance and color stability in numerous high-temperature applications, including coatings, polymers, and insulation materials.

Key Challenge

Performance Limitations in Natural and Bio-Based Agents

Natural formulations struggle to match the durability, heat tolerance, and UV resistance of synthetic variants, limiting use in high-stress applications such as automotive and outdoor equipment. Their performance variation across batches creates stability concerns in large-scale production. Higher costs and limited supply add to the challenge for producers aiming to scale greener options. Although demand for sustainable solutions grows, these constraints slow adoption. Significant R&D is required to improve stability and functional performance without compromising environmental goals.

Compliance Pressure from Evolving Chemical Regulations

Manufacturers face increasing complexity as global regulations tighten around chemical safety, emissions, and permissible ingredients in textiles, packaging, and cosmetics. Frequent updates require continuous reformulation and revalidation, raising development costs and slowing time-to-market. Smaller producers struggle with the testing and documentation burden. Restricted substances lists and regional compliance rules reduce flexibility in additive selection. This regulatory pressure forces companies to invest in safer chemistries and advanced testing capabilities, creating operational and financial challenges across the supply chain.

Regional Analysis

North America

North America holds a market share of 28%, driven by strong demand from the textiles, packaging, and specialty coatings industries that prioritize high durability and shade consistency. Manufacturers invest in advanced additives to meet strict quality, safety, and environmental standards. Growth in premium fabrics, automotive interiors, and engineered plastics strengthens adoption. Rising interest in sustainable and low-VOC formulations further supports product development. Continuous innovation across polymer processing and color-stable consumer goods enhances market growth, while strong R&D capabilities and established manufacturing infrastructure position the region as a key adopter of high-performance retention technologies.

Europe

Europe accounts for a market share of 25%, supported by rigorous chemical regulations that encourage the use of high-quality and eco-friendly retention agents. The region’s strong textile, automotive, and packaging sectors rely on these additives to maintain long-term visual integrity across diverse applications. Adoption accelerates as manufacturers shift toward sustainable formulations aligned with REACH and other regulatory frameworks. Growth in luxury textiles and high-performance coatings adds new opportunities. Continuous focus on circular economy initiatives and material innovation drives demand for advanced retention technologies with improved safety and environmental profiles.

Asia Pacific

Asia Pacific leads the global market with a market share of 32%, driven by large-scale textile manufacturing, expanding packaging production, and rapid industrialization. China, India, and Southeast Asia remain major growth hubs due to high dye consumption and rising output of colored polymers. Manufacturers adopt retention agents to improve color consistency across high-speed and high-volume production lines. Increasing adoption of modern dyeing technologies and advanced coatings enhances market penetration. Growing consumer demand for vibrant and durable products strengthens the need for stable formulations, while regional investments in manufacturing infrastructure accelerate overall market expansion.

Latin America

Latin America holds a market share of 8%, supported by growing textile, automotive, and consumer goods sectors that require improved shade stability and material durability. Expansion of regional dyeing, printing, and plastics processing facilities drives adoption. Manufacturers increasingly seek additives that enhance performance under intense sunlight and high humidity, common across the region. Demand rises as brands aim for better product differentiation and longer color life. Adoption of sustainable chemicals continues to progress, although cost limitations slow widespread use. Steady industrial development and improving regulatory structures contribute to gradual market growth.

Middle East & Africa

The Middle East & Africa region represents a market share of 7%, driven by rising demand in packaging, automotive parts, and construction materials that require long-lasting color retention under extreme climatic conditions. High UV exposure increases reliance on additives that provide superior light and heat stability. Growth in textile production and polymer processing in markets such as Turkey, UAE, and South Africa supports adoption. Investment in manufacturing diversification and import substitution boosts regional opportunities. Although market maturity remains lower compared to other regions, rising industrialization and infrastructure development continue to expand the need for color retention technologies.

Market Segmentations:

By Type

- Synthetic Color Retention Agents

- Natural Color Retention Agents

By Application

- Textiles

- Plastics & Polymers

- Paints & Coatings

- Cosmetics & Personal Care

By Form

By End-Use Industry

- Textile & Apparel

- Packaging

- Automotive

- Consumer Goods

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape includes BASF SE, Clariant AG, Dow Chemical Company, LANXESS, Croda International Plc, Huntsman Corporation, Evonik Industries AG, Ashland Inc., Solvay S.A., and Nouryon. Companies compete by expanding product portfolios, improving formulation stability, and developing eco-friendly alternatives that meet tightening regulatory standards. Leading players invest in R&D to enhance UV resistance, thermal stability, and compatibility with diverse substrates across textiles, plastics, and coatings. Strategic partnerships with manufacturers support customized solutions for high-volume production lines. Firms also focus on supply chain optimization and regional expansion to strengthen market presence. Growing demand for sustainable and high-performance additives drives continuous innovation, prompting competitors to refine technologies that deliver long-lasting color retention while reducing environmental impact.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF SE

- Clariant AG

- Dow Chemical Company

- LANXESS

- Croda International Plc

- Huntsman Corporation

- Evonik Industries AG

- Ashland Inc.

- Solvay S.A.

- Nouryon

Recent Developments

- In September 2025, Evonik Industries AG was indeed recognized as a top performer with a Gold rating by EcoVadis for its sustainability performance.

- In 2024, BASF SE (Germany) introduced loopamid®, a circular polyamide 6 made entirely from textile waste via a new chemical recycling process. The company also presented various other sustainable solutions for the textile industry at the Techtextil 2024 trade fair, including biomass-balanced (BMB) polyamides and thermoplastic polyurethanes (Elastollan®) which use biowaste feedstock

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Form, End-Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-performance retention agents will rise as industries target longer color durability.

- Adoption of eco-friendly and low-toxicity formulations will increase due to stronger sustainability goals.

- Synthetic agents will continue to lead, but improved natural formulations will gain momentum with better stability.

- Textile and packaging sectors will expand usage as producers seek consistent shade across high-volume lines.

- Advances in polymer engineering will create new opportunities for multi-functional retention additives.

- Regulatory pressure will push manufacturers to reformulate products with safer and compliant chemistries.

- Asia Pacific will maintain its lead due to strong manufacturing growth and rising dye consumption.

- Automation in production lines will drive demand for additives that deliver precise and uniform color control.

- Partnerships between chemical suppliers and end-use industries will accelerate development of customized solutions.

- Continuous R&D investment will support next-generation agents with enhanced UV protection and thermal stability.