Market Overview

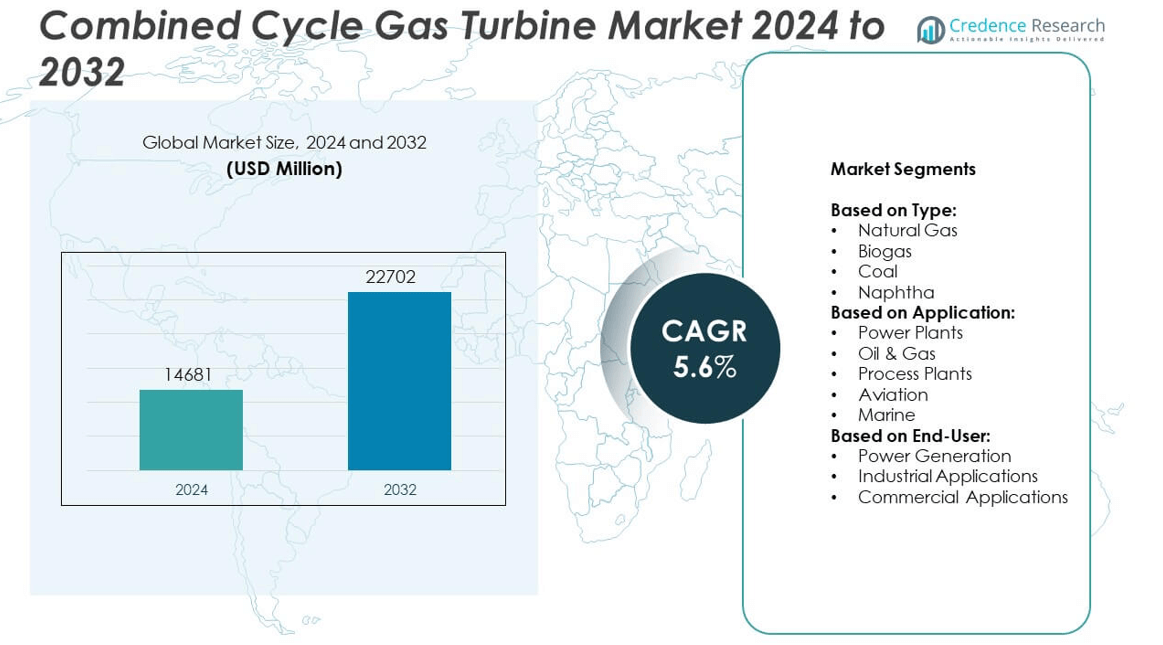

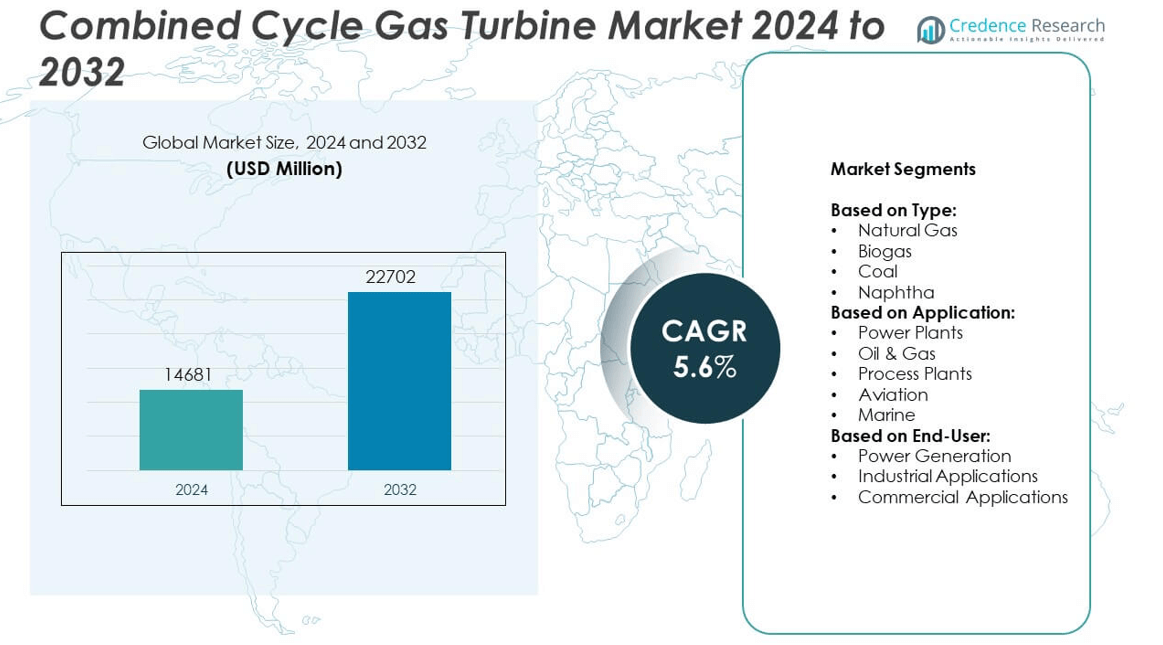

The Combined Cycle Gas Turbine Market size was valued at USD 14,681 million in 2024 and is anticipated to reach USD 22,702 million by 2032, growing at a CAGR of 5.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Combined Cycle Gas Turbine Market Size 2024 |

USD 14,681 million |

| Combined Cycle Gas Turbine Market, CAGR |

5.6% |

| Combined Cycle Gas Turbine Market Size 2032 |

USD 22,702 million |

The Combined Cycle Gas Turbine market grows due to rising global power demand and the need for efficient, low-emission energy solutions. It benefits from technological advancements that enhance turbine efficiency and flexibility, supporting integration with renewable energy sources. Stringent environmental regulations drive utilities to adopt cleaner natural gas-based systems, increasing combined cycle deployment. The market also experiences fluctuating natural gas availability and competitive pricing, which influence project investments. These drivers, combined with digitalization trends and modernization efforts in emerging economies, create a favorable environment for sustained market expansion and innovation.

The Combined Cycle Gas Turbine market spans key regions including North America, Europe, Asia-Pacific, the Middle East, and Latin America, each driven by unique energy demands and regulatory environments. North America and Asia-Pacific lead adoption due to infrastructure development and natural gas availability, while Europe emphasizes emission reduction and efficiency. Major players in this market include General Electric, Siemens, Mitsubishi Power, and Ansaldo Energia. These companies focus on technological innovation, expanding product portfolios, and strategic collaborations to meet growing demand for efficient and sustainable power generation solutions worldwide.

Market Insights

- The Combined Cycle Gas Turbine market was valued at USD 14,681 million in 2024 and is expected to reach USD 22,702 million by 2032, growing at a CAGR of 5.6% during the forecast period.

- Increasing global power demand and the shift toward cleaner energy sources drive market growth, with utilities focusing on high-efficiency and low-emission technologies.

- Technological advancements in turbine efficiency, fuel flexibility, and digital monitoring systems support operational improvements and integration with renewable energy.

- Stringent environmental regulations worldwide encourage adoption of combined cycle systems to reduce greenhouse gas emissions and meet sustainability targets.

- Market challenges include high capital investment requirements and fuel price volatility, which impact project financing and operational costs.

- North America, Europe, and Asia-Pacific dominate the market due to established infrastructure, regulatory support, and expanding natural gas networks. Emerging economies in the Middle East and Latin America show growing interest.

- Leading companies such as General Electric, Siemens, Mitsubishi Power, and Ansaldo Energia compete through innovation, strategic partnerships, and expansion into emerging markets, enhancing their global presence and technological capabilities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Significant Growth in Global Power Demand Drives Market Expansion

Significant growth in global power demand drives the Combined Cycle Gas Turbine market, fueled by expanding industrialization and urbanization. Countries across Asia-Pacific, particularly China and India, increase investments in power infrastructure to support their growing populations and economies. The technology’s ability to deliver high efficiency and low emissions attracts utilities aiming to meet stricter environmental regulations. Governments promote cleaner energy solutions by providing incentives and favorable policies, which encourages adoption of combined cycle systems. The rising need for reliable and flexible power generation in both developed and developing regions reinforces market expansion. It supports grid stability while accommodating intermittent renewable energy sources, boosting its importance.

- For instance, General Electric’s 9HA gas turbine achieves a net combined cycle efficiency exceeding 62%, demonstrating high efficiency, with over 450 units deployed in more than 40 countries and reliability that meet the demands of expanding power grids.

Technological Advancements Enhance Performance and Reduce Operational Costs

Advancements in gas turbine technology enhance the competitiveness of the Combined Cycle Gas Turbine market by improving performance and reducing operational costs. Innovations in materials and cooling techniques allow turbines to operate at higher temperatures, increasing efficiency. These improvements lower fuel consumption and emissions, aligning with global sustainability goals. It enables operators to extend maintenance intervals, reducing downtime and improving profitability. Technology upgrades also facilitate integration with digital monitoring systems, enabling predictive maintenance and optimized performance. The continuous development of efficient turbines makes it a preferred choice for modern power plants.

- For instance, Siemens’ SGT-8000H gas turbine operates at turbine inlet temperatures of over 1,500°C, improving thermal efficiency and enabling maintenance intervals of up to 25,000 operating hours.

Stringent Environmental Regulations Accelerate Adoption of Cleaner Technologies

Stringent environmental regulations worldwide accelerate the shift toward cleaner energy generation methods, benefiting the Combined Cycle Gas Turbine market. Governments enforce emission limits that challenge conventional coal-based power plants, driving the transition to natural gas-based systems. The combined cycle technology produces significantly lower greenhouse gases and pollutants, helping utilities comply with regulatory frameworks. It plays a critical role in achieving carbon reduction targets while maintaining energy reliability. Regulatory pressure encourages investments in upgrading or replacing outdated power plants with more efficient combined cycle units. This regulatory landscape creates strong demand for combined cycle solutions.

Rising Natural Gas Availability and Competitive Pricing Support Market Growth

Rising natural gas availability and competitive pricing provide a favorable environment for market growth. The expansion of natural gas infrastructure, including pipelines and storage facilities, improves supply security and accessibility in various regions. Lower fuel costs compared to oil and coal increase the economic attractiveness of combined cycle plants. Energy producers capitalize on these cost benefits to reduce overall generation expenses while maintaining output levels. Market players leverage abundant natural gas resources to expand power generation capacity efficiently. The growing global natural gas trade supports stable supply chains, reinforcing the viability of combined cycle technology.

Market Trends

Increasing Integration of Renewable Energy Sources with Combined Cycle Gas Turbine Systems

The Combined Cycle Gas Turbine market experiences a growing trend toward hybrid power systems that integrate renewable energy sources such as solar and wind. Utilities use combined cycle plants to provide reliable backup power and balance grid fluctuations caused by intermittent renewables. It supports smoother grid operation by quickly ramping up or down to match demand variations. This hybrid approach enhances overall system efficiency and reduces reliance on fossil fuels alone. Market participants invest in developing flexible combined cycle units capable of operating alongside renewables. The integration trend reflects the broader shift toward decarbonized energy systems while maintaining stability and reliability.

- For instance, Mitsubishi Power’s M501JAC gas turbine meets ultra-low NOx emission standards with levels below 9 ppm without requiring additional exhaust treatment technologies and achieves power generation efficiency exceeding 64%.

Focus on Digitalization and Advanced Monitoring Technologies to Optimize Performance

Digital transformation influences the Combined Cycle Gas Turbine market through the adoption of advanced monitoring, diagnostics, and control systems. Operators employ real-time data analytics and predictive maintenance tools to improve plant availability and reduce operational costs. It enables early detection of faults, minimizing unplanned outages and extending equipment life. Digital twin technology gains traction, allowing virtual simulation and optimization of turbine performance under varying conditions. The move toward Industry 4.0 solutions enhances decision-making and operational efficiency. This trend aligns with the demand for more cost-effective and sustainable power generation assets.

- For instance, Ansaldo Energia’s AE94.3A gas turbine has demonstrated robust performance with high fuel flexibility and and it’s designed for hydrogen co-firing, with some units already operating with blends up to 40% hydrogen operating efficiently on natural gas with quick start-up times under 30 minutes, supporting operational adaptability in fluctuating fuel markets.

Development of High-Efficiency and Low-Emission Turbines to Meet Regulatory and Market Demands

The Combined Cycle Gas Turbine market witnesses ongoing efforts to develop turbines with higher efficiency and lower emissions to comply with stringent environmental standards. Manufacturers focus on increasing turbine inlet temperatures and improving combustion systems to reduce NOx and CO2 emissions. It supports utilities in meeting regulatory requirements without compromising output or reliability. Emerging technologies, including hydrogen co-firing, present opportunities to further reduce the carbon footprint of combined cycle plants. Continuous innovation in turbine design and materials remains critical to addressing market and environmental challenges.

Expansion in Emerging Economies Drives Capacity Addition and Modernization Projects

Emerging economies in Asia, Latin America, and Africa lead capacity additions and modernization of existing power plants using combined cycle technology. Growing electricity demand and urbanization drive investments in efficient and flexible power generation solutions. It enables these regions to improve grid reliability while transitioning from older, less efficient power plants. Many governments support these projects through public-private partnerships and favorable financing mechanisms. The trend includes both new greenfield projects and retrofitting of aging infrastructure with modern combined cycle systems. This expansion strengthens the global footprint of the market and boosts technological adoption.

Market Challenges Analysis

High Capital Investment and Long Project Development Timelines Limit Market Expansion

The Combined Cycle Gas Turbine market faces challenges related to the substantial initial capital required for plant construction and commissioning. Investors and utilities must commit significant financial resources upfront, which can slow project approvals and financing. It involves complex engineering, permitting, and infrastructure development that extend project timelines and increase risks. These factors make stakeholders cautious, particularly in regions with uncertain regulatory environments or fluctuating energy demand. The long lead times also affect the ability to respond quickly to market shifts or technological changes. Overcoming these barriers requires strong financial planning and supportive policy frameworks to encourage investment in new combined cycle projects.

Volatility in Natural Gas Prices and Competition from Alternative Energy Sources Affect Market Growth

Fluctuations in natural gas prices introduce uncertainty in operating costs, impacting the economic viability of combined cycle plants. The Combined Cycle Gas Turbine market experiences pressure from variable fuel expenses, which can reduce profitability for power producers. It competes with increasingly cost-competitive renewable energy sources and energy storage solutions that attract policy support and investor interest. These alternatives often benefit from lower operational costs and shorter development cycles. Market players must balance fuel supply risks with efficiency improvements and flexible operations to maintain competitiveness. Managing fuel price volatility remains a critical challenge for sustaining growth in this sector.

Market Opportunities

Growing Demand for Flexible and Efficient Power Generation Creates Expansion Opportunities

The Combined Cycle Gas Turbine market benefits from increasing demand for flexible power generation capable of supporting variable renewable energy sources. It offers rapid start-up and load-following capabilities, making it ideal for balancing grid fluctuations. Utilities seek to expand their generation mix with reliable and efficient assets to ensure energy security and operational stability. The market can capitalize on this trend by developing advanced turbines that deliver improved performance with lower emissions. Investments in modernization and capacity additions in emerging economies also create growth potential. These factors position combined cycle technology as a key solution for evolving energy systems.

Adoption of Hydrogen and Other Alternative Fuels Opens New Market Frontiers

The transition toward low-carbon energy presents significant opportunities for the Combined Cycle Gas Turbine market through the adoption of hydrogen and blended fuels. It supports the integration of hydrogen into existing infrastructure, enabling decarbonization without full replacement of assets. Research and pilot projects focus on fuel flexibility, allowing turbines to operate on varying hydrogen mixtures alongside natural gas. This innovation addresses stringent environmental regulations and enhances the market’s sustainability profile. Expanding fuel options increase the lifespan and relevance of combined cycle plants in future energy scenarios. The evolving fuel landscape offers avenues for technological leadership and expanded market share.

Market Segmentation Analysis:

By Type:

It include natural gas, biogas, coal, and naphtha. Natural gas dominates the market due to its abundant availability, lower emissions, and cost-effectiveness compared to other fuels. It remains the preferred choice for combined cycle plants aiming to achieve high efficiency and compliance with environmental regulations. Biogas presents emerging opportunities, especially in regions focusing on renewable energy integration and waste-to-energy initiatives. Coal and naphtha-based turbines have a limited share, primarily due to higher emissions and declining regulatory support. However, these fuels continue to serve specific industrial and geographic niches where alternative options remain less accessible.

- For instance, General Electric’s LMS100 combined cycle plant can reach full load in less than 10 minutes, providing fast response capabilities essential for grid balancing in renewable-integrated power systems.

By Application:

The Combined Cycle Gas Turbine market covers power plants, oil and gas, process plants, aviation, and marine sectors. Power plants represent the largest segment, driven by the growing need for efficient and flexible electricity generation worldwide. Combined cycle technology supports the power sector’s transition toward cleaner and more reliable energy production. The oil and gas sector uses these turbines for on-site power generation and mechanical drive applications, benefiting from high efficiency and operational reliability. Process plants in industries such as chemicals and petrochemicals leverage combined cycle systems to optimize energy use and reduce operational costs. Aviation and marine applications represent smaller but specialized segments where gas turbines provide high power-to-weight ratios and performance advantages.

- For instance, Mitsubishi Power’s M501J gas turbine delivers output exceeding 400 MW with fast start-up times, making it suitable for both power plants and industrial applications requiring quick load adjustments.

By End-User:

Industrial applications, and commercial applications. Power generation accounts for the largest share due to the critical role combined cycle turbines play in electricity supply. Industrial applications encompass manufacturing facilities and heavy industries that require dependable power and steam generation for operations. The commercial sector includes large buildings and complexes that benefit from combined cycle units for combined heat and power solutions, improving energy efficiency and reducing operational expenses. Each end-user segment drives demand based on specific operational needs and regulatory pressures.

Segments:

Based on Type:

- Natural Gas

- Biogas

- Coal

- Naphtha

Based on Application:

- Power Plants

- Oil & Gas

- Process Plants

- Aviation

- Marine

Based on End-User:

- Power Generation

- Industrial Applications

- Commercial Applications

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest market share of approximately 30%, driven by well-established power infrastructure, abundant natural gas resources, and strong regulatory frameworks favoring cleaner energy technologies. The region’s focus on replacing aging coal plants with efficient and low-emission combined cycle gas turbines fuels steady demand. The United States, in particular, leads the adoption due to supportive government policies, technological advancements, and significant investments in power generation capacity expansion.

Europe

Europe commands around 25% of the global Combined Cycle Gas Turbine market, supported by stringent environmental regulations and ambitious carbon neutrality targets. Countries like Germany, the United Kingdom, and France actively pursue energy transition strategies that prioritize high-efficiency natural gas power plants. The European market benefits from advanced engineering capabilities and integration of combined cycle plants with renewable energy sources. It also sees growth through retrofitting older plants to improve efficiency and reduce emissions. The drive to meet the European Union’s climate goals strengthens the market outlook in this region.

Asia-Pacific

Asia-Pacific holds approximately 28% market share, reflecting rapid industrialization, urbanization, and growing energy demand in countries such as China, India, Japan, and South Korea. The region experiences significant capacity additions and modernization projects to support expanding power grids and improve energy access. China leads in market growth due to government initiatives aimed at reducing coal dependency and increasing natural gas utilization. India follows with a focus on expanding reliable electricity supply to meet industrial and residential demand. Investment in infrastructure and increasing natural gas pipeline networks further propel combined cycle gas turbine adoption in the region.

The Middle East & Africa

The Middle East & Africa captures around 10% of the market, driven by abundant natural gas reserves and ongoing efforts to diversify energy portfolios beyond oil. Gulf Cooperation Council (GCC) countries like Saudi Arabia, UAE, and Qatar invest heavily in combined cycle gas turbines to support industrial growth and power generation capacity. The region prioritizes efficient and low-emission technologies to meet rising domestic energy needs and improve environmental standards. Africa’s emerging economies also present opportunities for combined cycle projects aimed at addressing power shortages and modernizing aging infrastructure.

Latin America

Latin America holds the remaining 7% market share, supported by investments in natural gas infrastructure and power generation expansion in countries such as Brazil, Argentina, and Mexico. The region focuses on reducing reliance on hydropower and coal by integrating flexible and efficient combined cycle gas turbines. Government incentives and international partnerships facilitate technology adoption and capacity enhancement. Increasing electricity demand from industrial sectors and urban growth sustains market momentum in Latin America.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- RollsRoyce

- Emerson Electric

- General Electric

- Ansaldo Energia

- Snam

- Wärtsilä

- Bharat Heavy Electricals Limited

- Siemens

- Mitsubishi Power

- Wood Group

- Alstom

- Kawasaki Heavy Industries

- Toshiba

Competitive Analysis

Key players in the Combined Cycle Gas Turbine market include General Electric, Siemens, Mitsubishi Power, Ansaldo Energia, RollsRoyce, and Alstom. These companies dominate the industry through continuous innovation, strategic collaborations, and broad product portfolios that address varying customer needs worldwide. They focus on developing high-efficiency turbines with improved fuel flexibility and lower emissions to comply with stringent environmental regulations. Emphasis on digitalization and advanced monitoring technologies helps enhance operational reliability and reduce maintenance costs, providing a competitive edge. Market leaders invest heavily in research and development to improve turbine performance, reduce carbon footprints, and integrate renewable energy compatibility. They also expand their global footprint by entering emerging markets, where demand for efficient and flexible power generation is growing rapidly. Strategic acquisitions and partnerships strengthen their capabilities and service networks, enabling faster project delivery and customized solutions.Competition intensifies around product innovation, cost-effectiveness, and after-sales support. Companies differentiate themselves by offering turnkey solutions, extended warranties, and performance guarantees. This approach helps maintain strong customer relationships and secure long-term contracts. Overall, the competitive landscape in the Combined Cycle Gas Turbine market reflects the players’ commitment to technological advancement, operational excellence, and sustainable growth.

Recent Developments

- In 2025, Ansaldo Energia signed a contract with MVM Tisza Erőmű for supplying and maintaining two gas turbines, two steam turbines, and two generators for a 1,000-MW combined-cycle power plant in Hungary, expected to be the largest and most efficient in the country.

- In 2025, Kawasaki will showcase its centrifugal hydrogen compressor, “KM Comp-H2”, and a hydrogen gas turbine at the World Hydrogen 2025 Summit & Exhibition in Rotterdam

- In 2025, Toshiba continues R&D on gas turbine advancements for flexible, low-emission operation with some project developments announced, and actively involved in hydrogen fueled gas turbines.

Market Concentration & Characteristics

The Combined Cycle Gas Turbine market exhibits a moderately concentrated structure dominated by a few global players with strong technological expertise and extensive service networks. Leading companies hold significant market shares due to their ability to deliver high-efficiency turbines, customized solutions, and comprehensive after-sales support. It operates in a highly competitive environment where innovation, performance reliability, and regulatory compliance drive differentiation. The market features long project cycles and high capital investments, creating entry barriers for smaller players. Partnerships and strategic alliances play a crucial role in expanding regional presence and enhancing product offerings. Market participants focus on continuous development of fuel-flexible and low-emission turbines to meet evolving environmental standards and customer demands. It serves diverse end-users across power generation, industrial, and commercial sectors, requiring tailored solutions that balance efficiency, cost, and sustainability. The concentration of key players and the need for advanced technological capabilities underscore the market’s emphasis on quality, innovation, and operational excellence.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily due to increasing global electricity demand and energy transition goals.

- Combined cycle technology will play a key role in balancing grids with high renewable energy penetration.

- Advancements in hydrogen fuel blending will expand opportunities for low-carbon power generation.

- Digitalization and AI-based predictive maintenance will enhance operational efficiency and reduce downtime.

- Emerging economies will drive capacity additions to improve energy access and modernize infrastructure.

- Stricter environmental regulations will accelerate replacement of older, less efficient plants.

- Manufacturers will focus on developing turbines with higher efficiency and lower emissions.

- Integration with energy storage systems will improve overall power system flexibility.

- Collaboration between technology providers and utilities will increase to develop tailored solutions.

- The market will face challenges from volatile fuel prices but will adapt through innovation and diversification.