Market Overviews

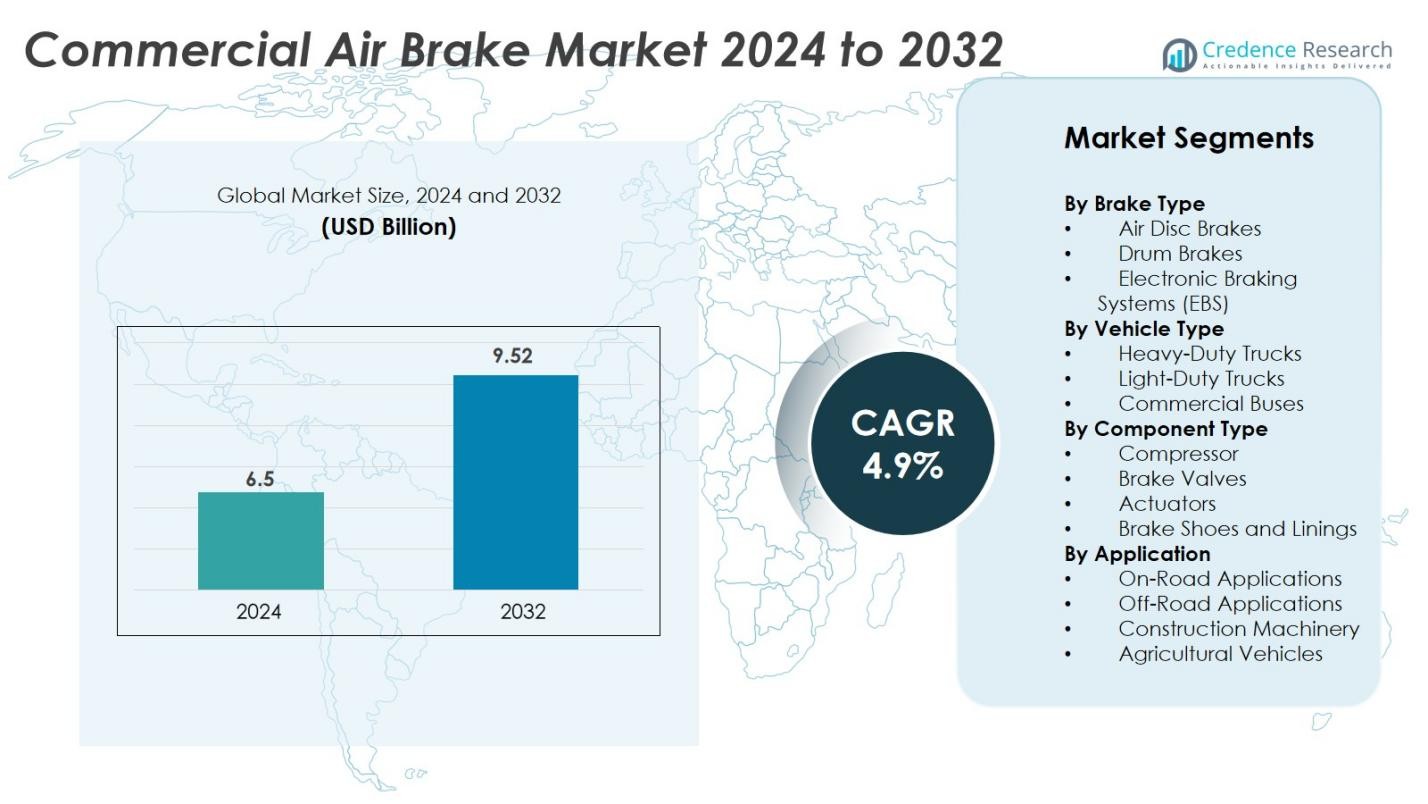

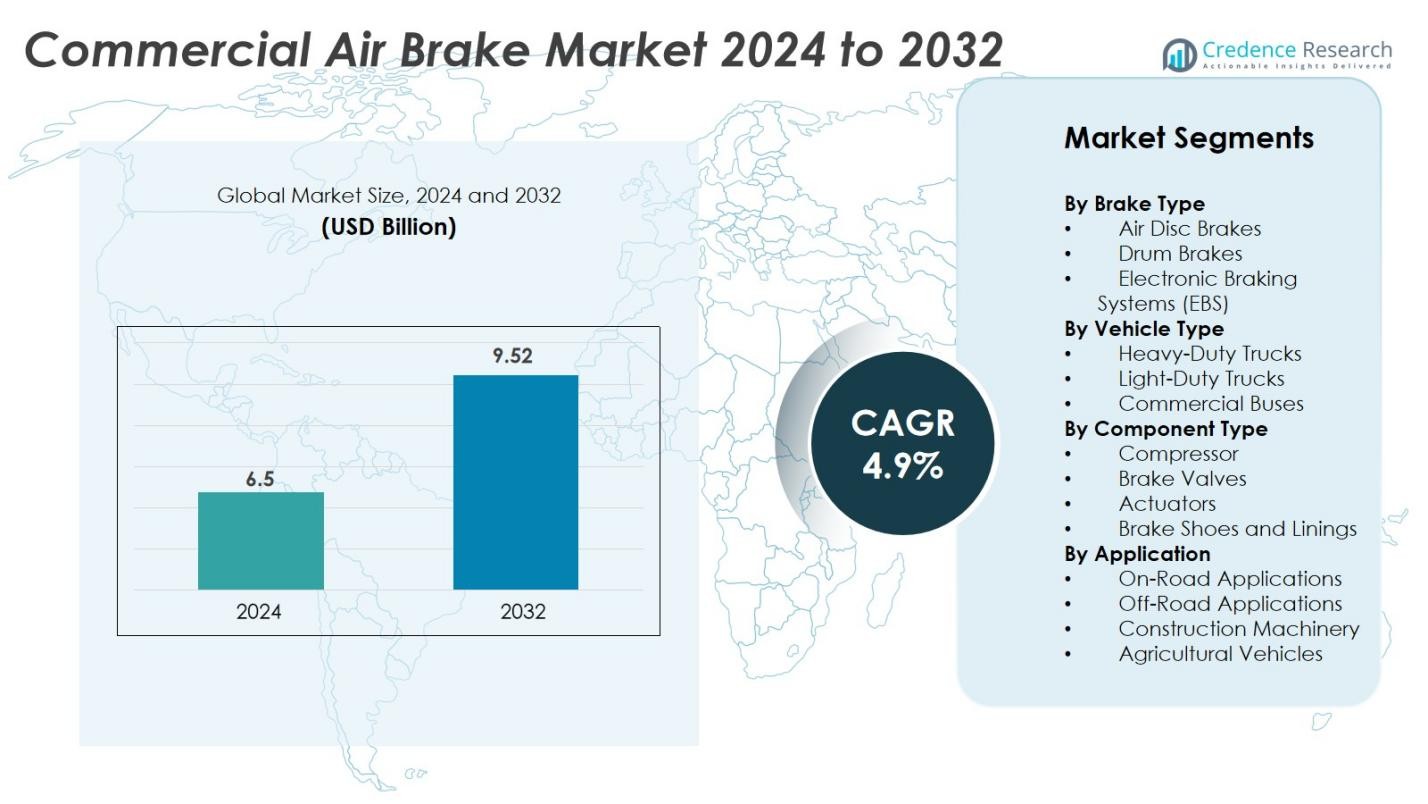

Commercial Air Brake market size was valued USD 6.5 Billion in 2024 and is anticipated to reach USD 9.52 Billion by 2032, at a CAGR of 4.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Commercial Air Brake Market Size 2024 |

USD 6.5 Billion |

| Commercial Air Brake Market, CAGR |

4.9% |

| Commercial Air Brake Market Size 2032 |

USD 9.52 Billion |

The Commercial Air Brake market is shaped by established global suppliers focused on safety, durability, and smart braking integration. Key players include Meritor, Haldex, ZF Friedrichshafen, Knorr-Bremse, Wabtec Corporation, Nabtesco Automotive, Sorl Auto Parts, TSE Brakes, UNO Minda, and Aventics. These companies compete through advanced air disc brakes, electronic braking systems, and sensor-based diagnostics that reduce maintenance time for fleet operators. North America leads the market with a 32% share, supported by strict safety regulations, faster adoption of EBS, and strong aftermarket demand from large logistics and long-haul trucking fleets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Commercial Air Brake market is valued at USD 6.5 Billion in 2024 and will reach USD 9.52 Billion by 2032 at a 4.9% CAGR, supported by steady replacement demand and rising fleet modernization.

- Safety rules that mandate shorter stopping distance, ABS, and stability control drive OEM adoption of air disc brakes, giving the segment a 53% share, while fleets shift away from drum systems due to lower maintenance needs.

- Digitalization boosts market growth as Electronic Braking Systems with real-time diagnostics reduce downtime and support predictive maintenance across large logistics fleets.

- Competition remains strong among Meritor, Haldex, ZF Friedrichshafen, Knorr-Bremse, and Wabtec Corporation, with companies expanding aftermarket services, compressors, valves, actuators, and long-life brake linings to secure recurring revenue.

- North America leads with a 32% regional share, followed by Europe at 28% and Asia-Pacific at 25%, as growing freight movement and urban bus networks strengthen demand for durable braking components and electronic control modules.

Market Segmentation Analysis

By Brake Type

Air disc brakes hold the dominant share of 53% due to faster heat dissipation, shorter stopping distance, and lower maintenance requirements. Fleets adopt disc systems to meet strict safety rules and reduce downtime in long-haul operations. Drum brakes retain demand in cost-sensitive markets and off-road vehicles, but adoption continues to shift toward disc technology. Electronic Braking Systems (EBS) expand in modern trucks with integration of ABS, stability control, and intelligent diagnostics. Growth is driven by regulations for braking efficiency, reduced stopping distance, and the need for predictive maintenance across commercial fleets.

- For example, Scania trucks use EBS systems that feature real-time diagnostics, significantly reducing the time spent on fleet maintenance checks and boosting fleet productivity.

By Vehicle Type

Heavy-duty trucks lead the market with 58% share as long-distance freight transport relies on robust air brake systems for high load capacity and reliable stopping power. The increase in cross-border logistics and fleet expansion strengthens demand for advanced braking solutions with faster response time. Light-duty trucks gain traction with the rise of e-commerce delivery fleets, while commercial buses adopt safer, low-noise braking systems for urban transit. Regulations on braking distance, passenger safety, and emission compliance support wider adoption across all vehicle classes.

- For instance, International Truck & Engine Corporation (International Trucks) made all long‑haul tractor axles standard with Bendix ADB22X® air disc brakes, improving safety and uptime.

By Component Type

Compressors account for the largest share at 42% because every air brake system depends on a reliable compressed air source for safe braking. Brake valves and actuators follow, driven by the need for precise pressure control and improved response time in modern fleets. Brake shoes and linings grow steadily as replacement demand remains high in heavy-duty vehicles with frequent wear cycles. Fleet operators invest in durable materials and automated diagnostics to extend component life. Rising maintenance standards and the shift toward safety-certified parts support growth across components.

Key Growth Drivers

Rising Safety Regulations and Mandatory Braking Standards

Government agencies enforce strict braking rules for commercial fleets to reduce road accidents and improve driver safety. Regulators mandate shorter stopping distances, anti-lock braking systems, and stability control in heavy vehicles. Fleet operators respond by upgrading older drum systems to air disc brakes and adopting electronic braking systems with diagnostic tools. These systems offer improved heat tolerance, fade resistance, and real-time monitoring that reduces collision risk in long-haul and urban freight operations. Safety bodies in North America, Europe, and Asia introduce compliance checks for braking performance, vibration control, and wear monitoring. OEMs integrate sensors, ABS modules, and automated pressure control to meet legislation and avoid penalties.

- For instance, Knorr-Bremse’s Electronic Braking System (EBS) uses analogue lining wear sensors to detect brake wear and applies differential slip control to optimize braking forces, significantly reducing brake lining wear variance between axles and improving brake system longevity.

Growth of Commercial Logistics, E-Commerce, and Fleet Expansion

Rising freight activity and booming e-commerce networks drive commercial vehicle production, expanding the demand for durable air brake systems. Logistics companies operate larger fleets with high delivery frequency, requiring reliable braking under heavy payload and intensive daily operation. Long-haul transport in mining, construction, and cross-border routes creates sustained wear on braking components, fueling aftermarket replacement sales of compressors, valves, actuators, and brake shoes. Urban delivery fleets favor low-maintenance air disc brakes that reduce downtime and fleet idling. Countries invest in highway networks, warehouse hubs, and industrial corridors, increasing vehicle utilization and braking stress.

- For instance, Bendix Commercial Vehicle Systems has doubled its air disc brake production capacity, installing a high-volume assembly line that increased output by more than 40%, supporting the replacement needs of long-haul fleets.

Shift Toward Smart Braking, Telematics, and Predictive Maintenance

Fleet operators adopt smart braking systems that support real-time monitoring, fault detection, and data-driven maintenance planning. Electronic Braking Systems with telematics components measure temperature, pressure, lining wear, and braking cycles. These sensors alert operators before component failure, lowering repair cost and preventing unplanned breakdowns. OEMs partner with software providers to offer IoT dashboards that track braking health, boosting operational reliability. Intelligent pressure control enhances stopping stability on wet roads and steep gradients, improving safety for long-haul trucks and buses. Smart braking reduces manual checks, supports small maintenance teams, and ensures compliance during safety audits.

Key Trends & Opportunities

Rising Adoption of Air Disc Brakes and Lightweight Components

Air disc brakes replace conventional drum units due to better heat management, shorter stopping distance, and lower maintenance needs. Fleets operating high-frequency urban routes prefer disc systems to reduce pad wear and improve response time in stop-and-go conditions. Manufacturers introduce lightweight calipers, rotors, and composite brake components to enhance fuel efficiency and load capacity. Integration of coatings and corrosion-resistant materials extends product life and reduces warranty claims. Aftermarket suppliers benefit from rising retrofits as older trucks transition to disc setups to meet global safety rules.

- For instance, Bendix Commercial Vehicle Systems has introduced an optimized air disc brake unit, the ADB22X®-LT, designed for lighter-duty applications such as line haul and pickup and delivery.

Expansion of Electronic Braking Systems and Digital Services

Electronic Braking Systems gain traction as commercial vehicles move toward automation, stability control, and driver-assist features. EBS modules integrate with advanced driver assistance systems, including collision avoidance, roll stability, and automatic emergency braking. Manufacturers offer subscription-based digital services for diagnostics, remote calibration, and software updates. Fleets with multiple depots use cloud dashboards to analyze braking health and schedule predictive replacement. This trend increases revenue for OEMs and technology suppliers while improving fleet uptime, safety, and regulatory compliance.

- For instance, Mercedes-Benz has introduced an EBS system in its Actros truck series, incorporating collision avoidance technology and adaptive cruise control. Their EBS integrates seamlessly with their digital service platform, which tracks vehicle performance, enabling predictive maintenance.

Growth of Aftermarket Demand and Replacement Cycles

Heavy-duty trucks and buses experience high braking wear due to frequent stops, heavy loads, and long mileage. Components such as brake linings, valves, and actuators require periodic replacement, fueling a large aftermarket ecosystem. Fleets prefer branded spare parts with longer life and better heat tolerance to reduce maintenance intervals. Distributors expand regional warehouses and mobile servicing units to support quick turnaround for commercial vehicles. Rising branded part penetration, along with strict inspection rules, creates sustained aftermarket revenue opportunities.

Key Challenges

High Cost of Advanced Braking Systems and Retrofit Expenses

Air disc brakes and electronic braking modules cost significantly more than conventional drum solutions. Small fleet owners, rental companies, and transporters in developing nations often delay upgrades due to upfront costs, even though long-term benefits include lower maintenance and improved safety. Retrofitting older trucks requires replacing hubs, calipers, electronic sensors, and control units, increasing downtime and installation expense. This slows adoption in price-sensitive markets despite regulatory pressure. Manufacturers respond by offering modular kits and financing programs, but cost remains a major barrier for widespread deployment.

Maintenance Skill Gaps and Limited Availability of Trained Technicians

Modern air brake systems integrate EBS, telematics, and diagnostic sensors that require skilled technicians for servicing. Many workshops lack expertise in electronic pressure control, brake calibration, and sensor troubleshooting. Incorrect servicing increases accident risk, braking inefficiency, and component failure. Developing regions face shortages of certified mechanics, slowing the adoption of advanced systems. OEMs conduct training programs, while fleet operators invest in digital manuals and predictive tools to reduce errors. However, the industry still struggles with standardization, technician certification, and availability of spare parts in remote transport routes.

Regional Analysis

North America

North America holds the leading share of 32%, driven by strong adoption of advanced braking technologies in heavy-duty trucks, logistics fleets, and commercial buses. The U.S. enforces strict braking standards that require ABS, stability control, and reduced stopping distance, encouraging fleets to replace drum brakes with air disc systems and electronic braking modules. Major OEMs supply high-performance compressors, valves, and actuators for long-haul freight operations. Fleet modernization, high replacement rates, and strong aftermarket networks support continued demand. Growing cross-border transport with Canada and Mexico further strengthens the role of air braking systems in highway logistics.

Europe

Europe accounts for 28% of the market, supported by stringent road safety regulations, advanced fleet modernization, and early adoption of electronic braking systems. Commercial vehicle manufacturers integrate sensors, standardized modules, and telematics to comply with ECE braking requirements. High penetration of air disc brakes and low-emission commercial fleets drives demand across Germany, France, and the U.K. Urban freight and public bus networks prioritize noise reduction, shorter stopping distance, and low-maintenance components. Strong aftermarket infrastructure and partnerships between OEMs and digital service providers support long-term system upgrades and predictive maintenance initiatives.

Asia-Pacific

Asia-Pacific captures 25% market share as China, India, Japan, and South Korea expand commercial vehicle production, highway freight movement, and public transportation. Economic growth and infrastructure investment increase heavy truck utilization, boosting demand for compressors, valves, and brake linings. Adoption of air disc brakes accelerates as safety rules tighten and OEMs introduce smart braking units in premium trucks and buses. India shows strong aftermarket growth, while China strengthens regional exports of brake components. Fleet electrification and urban transit upgrades create additional opportunities for modern electronic braking systems.

Latin America

Latin America holds 8% market share, led by Brazil and Mexico with active commercial vehicle sales and heavy logistics operations. Fleet operators primarily use drum brakes due to cost sensitivity, but adoption of disc brakes and EBS grows in premium trucks and passenger buses. Road safety reforms, cross-border freight movement, and modernization of mining and agricultural fleets support demand for durable braking components. Replacement markets expand as vehicles undergo frequent wear due to road conditions and high load cycles. Regional suppliers focus on low-maintenance parts and localized servicing networks.

Middle East & Africa

The Middle East & Africa represent 7% of the market, supported by construction, mining, and oilfield logistics that require heavy-duty trucks with reliable braking power. Gulf countries adopt premium braking solutions with advanced air management systems, while African nations show stronger demand in aftermarket components like brake shoes and actuators. Harsh operating conditions, high temperatures, and heavy payloads drive frequent maintenance cycles. Investments in road transport fleets, trade expansion, and bus modernization strengthen future growth. Limited technician availability and budget-sensitive buyers slow the adoption of electronic braking systems, keeping demand concentrated in mechanical components.

Market Segmentations:

By Brake Type

- Air Disc Brakes

- Drum Brakes

- Electronic Braking Systems (EBS)

By Vehicle Type

- Heavy-Duty Trucks

- Light-Duty Trucks

- Commercial Buses

By Component Type

- Compressor

- Brake Valves

- Actuators

- Brake Shoes and Linings

By Application

- On-Road Applications

- Off-Road Applications

- Construction Machinery

- Agricultural Vehicles

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Commercial Air Brake market features a mix of global OEMs, component manufacturers, and aftermarket suppliers competing on technology, durability, and regulatory compliance. Companies invest in advanced air disc brakes, electronic braking systems, and compressor technologies to meet strict safety and emission rules across developed markets. Partnerships with fleet operators support software-driven diagnostics, remote monitoring, and predictive maintenance services. Manufacturers expand regional assembly units and distribution networks to serve replacement demand for valves, actuators, and brake linings. Leading players, including Aventics (Emerson), UNO Minda, TSE Brakes, Nabtesco Automotive Corporation, and Knorr-Bremse, pursue acquisitions to strengthen product portfolios and enter high-growth regions. Cost-sensitive markets encourage suppliers to offer high-performance components with longer service life and reduced maintenance cycles. Aftermarket growth remains a priority, as commercial fleets require frequent brake replacement due to heavy wear.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sorl Auto Parts

- Aventics (Emerson)

- UNO Minda

- TSE Brakes

- Nabtesco Automotive Corporation

- Knorr-Bremse

- Wabtec Corporation

- Meritor

- ZF Friedrichshafen

- Haldex

Recent Developments

- In July 2025, Bendix Commercial Vehicle Systems announced a collaboration with Aeva Technologies to integrate 4D LiDAR for next‑generation active safety in heavy trucks.

- In April 2025, SAF‑HOLLAND SE acquired the remaining 40% stake in Haldex ANAND India Private Limited from the ANAND Group, gaining full ownership of the joint‑venture.

- In December 2023, Knorr‑Bremse AG introduced the new generation trailer braking system iTEBS® X, featuring a modular design and enhanced connectivity.

Report Coverage

The research report offers an in-depth analysis based on Break Type, Vehicle Type, Component Type, Application, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of air disc brakes will rise as fleets reduce maintenance time and improve stopping performance.

- Electronic Braking Systems will expand due to demand for real-time diagnostics and predictive maintenance.

- Telematics and connected braking platforms will create recurring revenue through software updates and service subscriptions.

- Aftermarket sales will grow as heavy-duty trucks and buses require frequent replacement of linings, valves, and actuators.

- Fleet modernization programs will increase retrofit demand in developing regions.

- Lightweight brake components will gain traction to support fuel efficiency and higher payload capacity.

- Safety regulations will continue to push OEMs toward advanced braking controls and shorter stopping distances.

- Integration of braking systems with ADAS and autonomous driving will accelerate in long-haul fleets.

- Regional suppliers will expand distribution networks to improve servicing and parts availability.

- Partnerships between OEMs and telematics providers will enhance fleet uptime and reduce downtime.