Market Overview:

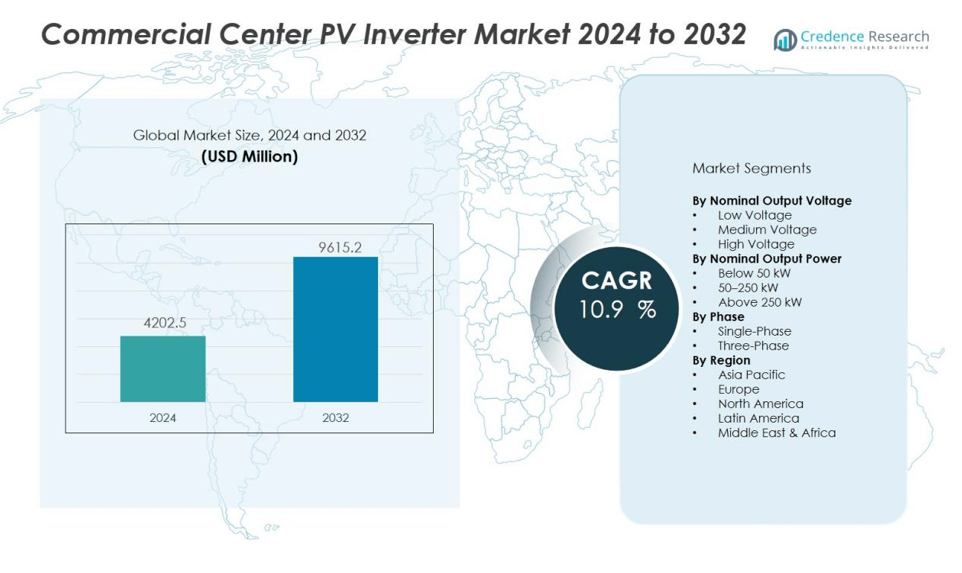

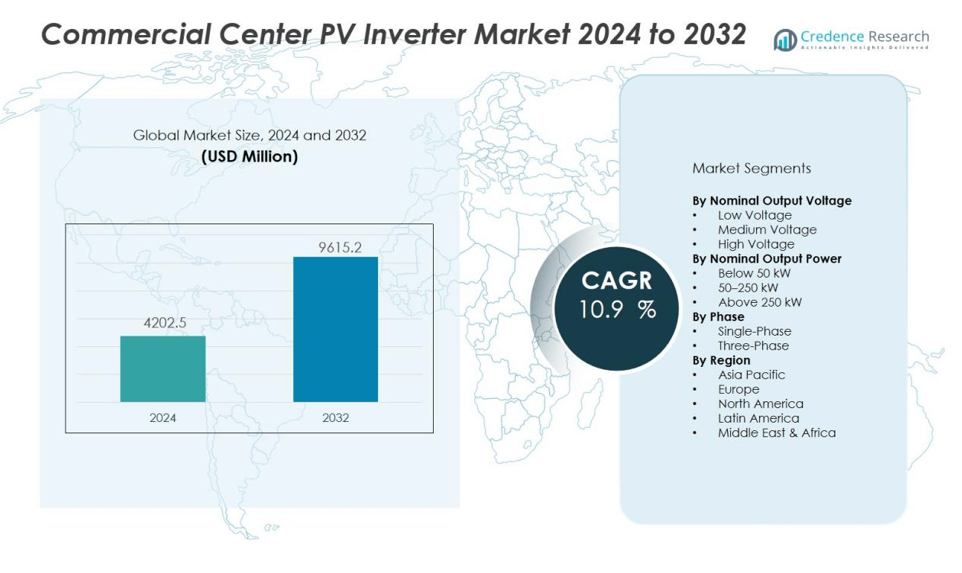

The Commercial center PV inverter market size was valued at USD 4202.5 million in 2024 and is anticipated to reach USD 9615.2 million by 2032, at a CAGR of 10.9 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Commercial Center PV Inverter Market Size 2024 |

USD 4202.5 million |

| Commercial Center PV Inverter Market, CAGR |

10.9% |

| Commercial Center PV Inverter Market Size 2032 |

USD 9615.2 million |

Key growth drivers include rising investments in renewable energy infrastructure, supportive government policies, and attractive incentives for solar adoption in commercial establishments. Growing awareness of sustainability, coupled with the need to reduce operational costs, is prompting businesses to integrate solar PV systems. The shift toward smart energy management systems and hybrid inverter solutions is also fueling market penetration. Technological advancements, such as AI-enabled predictive maintenance and enhanced grid integration, further strengthen market growth prospects.

Regionally, Asia-Pacific dominates the commercial center PV inverter market, led by China, Japan, and India, due to large-scale solar installations and aggressive renewable energy targets. Europe follows, supported by stringent carbon reduction policies and a well-established solar infrastructure. North America shows robust growth potential, driven by favorable net metering policies and increasing corporate sustainability commitments. Emerging markets in Latin America and the Middle East & Africa are expected to witness rising adoption as solar costs decline and infrastructure development accelerates.

Market Insights

- The commercial center PV inverter market was valued at USD 4,202.5 million in 2024 and is projected to reach USD 9,615.2 million by 2032, reflecting a CAGR of 10.9% from 2024 to 2032.

- Rising integration of solar PV systems in malls, office parks, and retail hubs is boosting demand, driven by the need for long-term cost savings and corporate sustainability goals.

- Government incentives, tax credits, and net metering schemes are making large-scale commercial solar projects financially viable and accelerating inverter adoption.

- Technological innovations, including AI-enabled predictive maintenance, IoT connectivity, and enhanced grid stability, are improving inverter efficiency and operational reliability.

- High upfront costs, complex installation requirements, and inconsistent grid regulations remain key challenges, particularly for small and mid-sized commercial properties.

- Asia-Pacific leads with 43% market share, supported by aggressive solar targets in China, India, Japan, and Australia, followed by Europe with 28% and North America with 19%.

- Growing adoption of smart energy management systems and hybrid inverter solutions is positioning PV inverters as a critical component of future-ready commercial energy infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Adoption of Renewable Energy in Commercial Infrastructure:

The commercial center PV inverter market is gaining traction due to the increasing integration of solar power in malls, business complexes, and retail hubs. Rising electricity costs and the need for long-term operational savings are prompting commercial property owners to invest in solar photovoltaic systems. PV inverters play a critical role in converting solar energy into usable power, ensuring consistent and efficient energy supply. This shift is further supported by corporate sustainability goals and a strong focus on reducing carbon footprints.

- For instance, Apple’s revolutionary Apple Park campus demonstrates cutting-edge inverter technology with a 17 MW rooftop solar array integrated into its ring-shaped headquarters, where high-efficiency inverters power 75% of daytime operations through sophisticated energy management systems.

Government Incentives and Supportive Regulatory Frameworks:

Supportive measures, including tax credits, subsidies, and net metering schemes, are driving large-scale adoption of solar inverters in commercial centers. Governments are implementing renewable energy targets that directly encourage businesses to deploy solar installations. These incentives lower upfront investment costs, making solar projects financially attractive for commercial entities. It strengthens the long-term viability of PV inverter deployment in large commercial facilities.

- For instance, Tata Power Solar successfully commissioned a 974 kW rooftop solar system at Maharaj Sawan Singh Charitable Hospital in Punjab, generating 13,81,660 kWh annually and saving the hospital over 70% on their electricity bills.receiving full retail-rate credits that offset nearly one-third of its annual electricity costs.

Technological Advancements Enhancing Efficiency and Reliability:

Continuous innovation in inverter technology is expanding the capabilities of commercial PV systems. Modern inverters now feature higher conversion efficiencies, advanced monitoring systems, and improved grid stability functions. Integration of AI-driven predictive maintenance and IoT connectivity is enabling real-time performance tracking. It enhances operational reliability while reducing downtime and maintenance costs for commercial users.

Growing Demand for Smart Energy Management Solutions:

Commercial facilities are increasingly adopting PV inverters integrated with smart energy management systems. These solutions allow optimization of energy generation, storage, and consumption patterns based on real-time data. Businesses are leveraging such systems to maximize return on investment and ensure compliance with energy efficiency standards. It is positioning PV inverters as a core component of future-ready commercial energy infrastructure.

Market Trends:

Integration of Hybrid and Energy Storage-Ready Inverter Solutions:

The commercial center PV inverter market is witnessing a growing shift toward hybrid inverter systems capable of integrating solar generation with battery storage. Businesses are prioritizing energy resilience and backup capabilities to mitigate the impact of grid fluctuations or outages. Hybrid inverters allow seamless switching between solar, stored energy, and grid supply, optimizing power usage and reducing peak-time costs. It is driving adoption in commercial complexes where uninterrupted operations are critical. Manufacturers are introducing modular designs that enable future scalability, giving commercial users flexibility to expand capacity without significant infrastructure changes. This trend is strengthening the market’s alignment with the evolving energy storage ecosystem.

- For instance, GoodWe’s ETC commercial hybrid inverters feature UPS-level switching with response times under 10 milliseconds and support battery systems ranging from 101kWh to 156kWh capacity.

Adoption of Digitalization and AI-Driven Monitoring Platforms:

Rapid digitalization is transforming PV inverter operations in the commercial sector, with AI and IoT-enabled platforms becoming standard. Advanced monitoring solutions allow operators to track performance metrics, detect faults, and conduct predictive maintenance remotely. It enhances operational efficiency, minimizes downtime, and extends the lifespan of inverter systems. Cloud-based analytics are enabling detailed energy consumption insights, supporting informed decision-making for energy management strategies. The demand for smart, connected inverters is rising, driven by the need for real-time responsiveness to dynamic grid conditions. This trend reflects the market’s transition toward intelligent, self-optimizing systems that support both cost savings and sustainability goals.

- For instance, ABB’s IoT-based monitoring solutions have achieved a significant milestone by surpassing 10 gigawatts in delivering automation solutions for renewable energy plants across India, with their system enabling real-time data analysis to optimize plant performance.

Market Challenges Analysis:

High Initial Investment and Installation Complexities:

The commercial center PV inverter market faces challenges from the significant upfront costs associated with large-scale solar installations. High-capacity inverters, along with supporting infrastructure, require substantial capital, which can deter small and mid-sized commercial property owners. Complex installation processes, including electrical integration and compliance with safety regulations, add to project timelines and costs. It creates financial and logistical barriers, particularly in regions with limited skilled workforce and installation expertise. Extended payback periods can further impact investment decisions for cost-sensitive businesses.

Regulatory Variability and Grid Compatibility Issues:

Inconsistent regulations and varying grid standards across regions create operational challenges for PV inverter deployment. Commercial properties often need customized inverter configurations to meet local compliance and grid interconnection requirements. This can slow adoption and increase engineering costs. It also complicates scaling for manufacturers targeting multiple markets. Grid stability concerns, especially in areas with weak or outdated infrastructure, limit inverter performance and efficiency. These factors can hinder the pace of market expansion despite growing demand for renewable energy solutions.

Market Opportunities:

Rising Demand for Sustainable Commercial Infrastructure:

The commercial center PV inverter market is positioned to benefit from the accelerating shift toward green and energy-efficient buildings. Businesses are prioritizing renewable energy integration to meet environmental regulations and corporate ESG commitments. Large shopping malls, office complexes, and mixed-use developments are adopting solar solutions to reduce operational costs and carbon emissions. It creates significant opportunities for inverter manufacturers offering high-capacity, scalable, and reliable systems. Growing urbanization in emerging economies is expanding the market base, with new commercial projects incorporating solar infrastructure from the planning stage.

Expansion of Smart Grid and Energy Storage Integration:

Advancements in smart grid technology and falling battery storage costs are creating lucrative opportunities for PV inverter suppliers. Inverters capable of supporting bidirectional power flow, demand response, and storage integration are in high demand. It enables commercial centers to optimize energy usage, participate in grid services, and enhance energy resilience. Manufacturers that develop intelligent, grid-interactive inverters can tap into new revenue streams, including energy trading and peak shaving solutions. The convergence of digital control systems, AI-based analytics, and storage-ready designs is expected to open new growth avenues in developed and developing markets alike.

Market Segmentation Analysis:

By Nominal Output Voltage:

The commercial center PV inverter market is segmented into low voltage, medium voltage, and high voltage categories. Low voltage inverters dominate installations for small to medium-sized commercial centers due to ease of integration and lower upfront costs. Medium voltage inverters are gaining traction in large complexes requiring higher capacity and efficiency. High voltage inverters serve specialized applications with extensive power needs and centralized configurations.

- For instance, Texas Instruments produced a high-voltage solar inverter DC-AC kit with a nominal input of 400V DC and an output power of 600W, suitable for grid integration and large-scale systems.

By Nominal Output Power:

Segments include below 50 kW, 50–250 kW, and above 250 kW. Inverters rated 50–250 kW hold a significant share, catering to medium and large commercial buildings with substantial energy consumption. Below 50 kW units are preferred for smaller facilities and partial-load solar integration. Above 250 kW inverters are deployed in large-scale commercial solar farms or integrated energy systems where centralized power management is essential.

- For instance, the Fronius Tauro ECO 50-3-D inverter boasts a continuous power rating of 50kW and is designed for robust, high-performance operation, even in challenging environmental conditions.

By Phase:

The market is divided into single-phase and three-phase inverters. Single-phase units are used in small commercial setups with lower energy requirements, offering simpler installation and cost efficiency. Three-phase inverters dominate high-demand commercial applications, ensuring stable power supply, reduced losses, and better grid compatibility. It benefits from widespread adoption in large malls, corporate parks, and mixed-use developments seeking reliable energy performance.

Segmentations:

By Nominal Output Voltage:

- Low Voltage

- Medium Voltage

- High Voltage

By Nominal Output Power:

- Below 50 kW

- 50–250 kW

- Above 250 kW

By Phase:

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific :

Asia-Pacific holds 43% market share in the commercial center PV inverter market, driven by large-scale solar integration in China, India, Japan, and Australia. Strong government incentives, renewable energy targets, and rapid urban development are fueling demand for high-capacity inverters in malls, office parks, and mixed-use complexes. It benefits from abundant solar potential and falling PV system costs, making adoption financially viable. China leads the region with aggressive solar expansion, while India is experiencing significant growth through commercial rooftop programs. Japan’s focus on advanced inverter technologies and grid stability further supports market development. Emerging Southeast Asian economies are becoming key growth areas due to rising infrastructure investments.

Europe :

Europe accounts for 28% market share, supported by strict carbon reduction laws and high penetration of renewable energy in commercial infrastructure. Countries such as Germany, France, Italy, and the Netherlands are deploying PV inverters in retail centers and business hubs to meet energy efficiency mandates. It benefits from mature solar markets with established installation networks and advanced grid systems. The EU’s Green Deal initiatives and funding programs accelerate adoption, particularly in upgrading existing commercial buildings with solar capabilities. High energy costs in Western Europe are further motivating businesses to invest in PV solutions. Eastern Europe is emerging with growth potential through modernization projects.

North America :

North America holds 19% market share, driven by strong adoption in the United States and Canada. Favorable net metering policies, tax incentives, and corporate ESG goals are pushing commercial properties to integrate PV systems. It is experiencing growth in large-scale retail chains, shopping malls, and office complexes seeking energy independence and cost stability. The presence of advanced inverter manufacturers and strong R&D capabilities supports market innovation. U.S. states with high solar irradiation, such as California, Texas, and Florida, are leading deployment. Mexico is also expanding adoption through energy reform policies and commercial sector investments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The commercial center PV inverter market is moderately competitive, with global players and regional manufacturers competing on technology, efficiency, and service capabilities. Key companies include Delta Electronics, Inc., Emerson Electric Co., Omron Corporation, Power Electronics S.L., Eaton, Fimer Group, and Siemens Energy. Leading players focus on developing high-efficiency, grid-compatible inverters with advanced monitoring and control features to meet the diverse needs of commercial installations. It is characterized by continuous innovation in hybrid systems, AI-based diagnostics, and modular designs to support scalability. Strategic partnerships with EPC contractors, commercial property developers, and energy service providers enhance market reach. Competitive advantage is often determined by product reliability, cost-effectiveness, after-sales support, and the ability to meet stringent regulatory requirements across regions.

Recent Developments:

- In July 2025, Omron entered a strategic partnership with Japan Activation Capital to leverage its resources and network for growth acceleration.

- In May 2025, Emerson released an enhanced version (v15) of AspenTech software with expanded industrial AI capabilities including generative AI, sustainability features, and improved operational performance.

- In July 2025, Delta partnered with Microchip Technology to collaborate on silicon carbide (SiC) solutions aimed at energy-saving products and systems for AI, mobility, automation, and infrastructure sectors.

Market Concentration & Characteristics:

The commercial center PV inverter market displays moderate to high concentration, with a mix of global leaders and regional specialists competing on technology, efficiency, and service capabilities. It is characterized by continuous innovation, with manufacturers focusing on advanced power conversion, smart monitoring, and grid integration features. Leading players maintain strong distribution networks, strategic partnerships, and after-sales service to strengthen market presence. The market favors companies with the ability to deliver scalable, high-capacity solutions tailored to diverse commercial applications. Price competitiveness, product reliability, and compliance with evolving regulatory standards are critical success factors influencing buyer decisions.

Report Coverage:

The research report offers an in-depth analysis based on Nominal Output Voltage, Nominal Output Power, Phase and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Rising commercial adoption of rooftop and ground-mounted solar systems will drive sustained demand for high-capacity PV inverters.

- Integration of hybrid inverter solutions with energy storage will gain traction for enhancing energy resilience in commercial facilities.

- Advanced digital monitoring and AI-enabled predictive maintenance will become standard features to improve operational efficiency.

- Growing focus on net-zero energy goals in commercial real estate will boost large-scale inverter deployments.

- Manufacturers will increasingly develop modular, scalable inverter designs to support future capacity expansion in commercial complexes.

- Expansion of smart grid infrastructure will create new opportunities for grid-interactive and bidirectional inverter technologies.

- Declining costs of solar components and storage systems will make PV inverter installations more financially attractive for commercial entities.

- Emerging markets in Asia-Pacific, Latin America, and the Middle East will witness accelerated adoption due to infrastructure development and supportive policies.

- Stringent regulatory standards for energy efficiency and grid compliance will shape product innovation and design priorities.

- Strategic partnerships between inverter manufacturers, EPC contractors, and commercial developers will strengthen market penetration and project execution capabilities.