Market Overview:

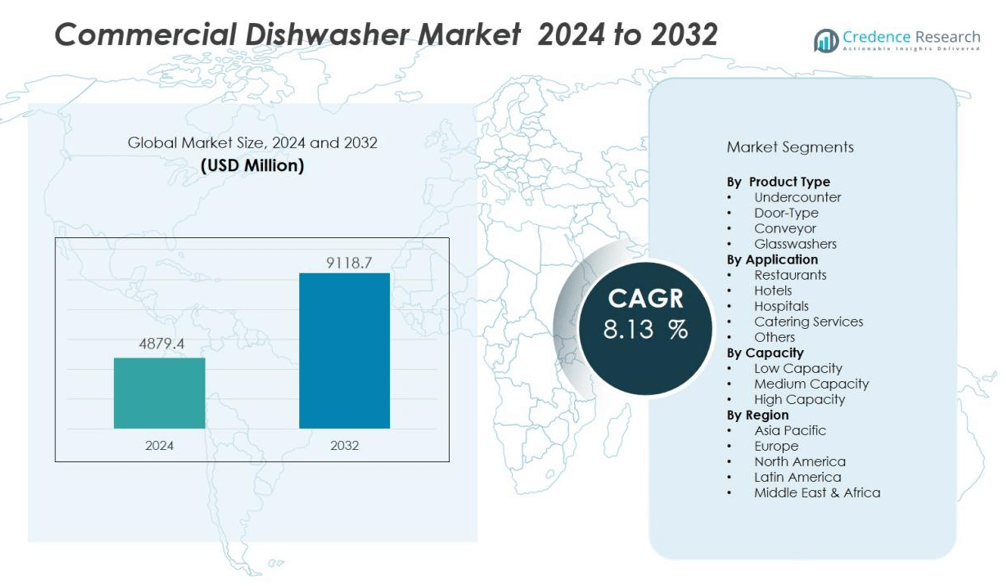

The Commercial dishwasher market size was valued at USD 4879.4 million in 2024 and is anticipated to reach USD 9118.7 million by 2032, at a CAGR of 8.13 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Commercial Dishwasher Market Size 2024 |

USD 4879.4 million |

| Commercial Dishwasher Market, CAGR |

8.13% |

| Commercial Dishwasher Market Size 2032 |

USD 9118.7 million |

Growth in the commercial dishwasher market is driven by the expanding global hospitality industry, rising demand for quick and hygienic cleaning solutions, and stringent food safety regulations. Businesses are investing in advanced dishwashing equipment to reduce labor costs, enhance operational productivity, and ensure compliance with sanitation guidelines. The trend toward eco-friendly appliances with reduced water and energy consumption is also boosting adoption, alongside the integration of smart monitoring and automation features.

Regionally, Europe holds a significant share of the market due to strong environmental regulations, mature hospitality infrastructure, and widespread adoption of energy-efficient equipment. North America follows closely, supported by a robust foodservice industry and high hygiene standards. The Asia-Pacific region is expected to witness the fastest growth, driven by urbanization, rising disposable incomes, and rapid expansion of hotels, restaurants, and catering services.

Market Insights:

- The commercial dishwasher market was valued at USD 4,879.4 million in 2024 and is projected to reach USD 9,118.7 million by 2032, growing at a CAGR of 8.13% during 2024–2032.

- Rising hygiene and sanitation compliance requirements across hospitality, healthcare, and foodservice sectors are accelerating the shift from manual washing to automated, high-temperature, and chemical-sanitizing solutions.

- Expansion of the global hospitality and foodservice industry is boosting demand for high-capacity, durable dishwashers capable of handling large volumes efficiently.

- Technological advancements, including heat recovery systems, low-water consumption designs, and programmable wash cycles, are improving performance and driving adoption.

- Sustainability trends are shaping procurement, with businesses favoring energy-efficient, water-saving models and eco-friendly detergents to meet environmental standards.

- Europe leads with 37% market share, followed by North America at 29%, while Asia-Pacific, with 24% share, is the fastest-growing region due to urbanization and hospitality sector expansion.

- Integration of automation and IoT-enabled smart monitoring is enhancing operational efficiency, enabling remote management, and reducing downtime in high-volume kitchens.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Hygiene and Sanitation Compliance:

The commercial dishwasher market benefits from increasing awareness of food safety and hygiene regulations across the hospitality, healthcare, and foodservice sectors. It enables businesses to meet stringent cleaning standards while ensuring consistent and thorough sanitation. Growing concerns over cross-contamination and foodborne illnesses are pushing operators to replace manual washing with automated, high-temperature, and chemical-sanitizing solutions. This shift aligns with global and regional regulatory requirements, reinforcing the market’s long-term growth prospects.

- For instance, Winterhalter commercial dishwashers fully comply with microbiological hygiene standards in accordance with DIN EN 17735, certifying that they deliver hygienic wash results as required for hospitals, care homes, and other high-risk environments.

Expansion of the Global Hospitality and Foodservice Industry:

The expansion of hotels, restaurants, cafes, and catering services is a significant growth driver for the commercial dishwasher market. It supports higher demand for efficient cleaning systems that can handle large volumes of tableware in minimal time. With increasing dining-out culture and large-scale events, businesses require durable and high-capacity equipment to maintain operational flow. The need for speed and efficiency in busy kitchens directly influences equipment upgrades and new purchases.

- For instance, the Hobart PROFI AMX hood-type dishwasher can process up to 1,080 plates per hour under continuous operation, ensuring rapid turnaround in high-volume kitchens.

Technological Advancements and Energy Efficiency:

Manufacturers are introducing advanced models with improved water and energy efficiency, automated cycles, and smart monitoring capabilities. It helps operators reduce operating costs while meeting sustainability goals. Features such as heat recovery systems, low-water consumption designs, and programmable wash cycles enhance both performance and environmental compliance. These innovations strengthen adoption rates across developed and emerging markets.

Labor Cost Reduction and Operational Efficiency:

Rising labor costs in many regions are driving foodservice operators to adopt automated dishwashing solutions. The commercial dishwasher market offers a reliable way to reduce manual labor requirements while increasing productivity. It allows staff to focus on customer service and core food preparation tasks instead of repetitive cleaning work. Improved cycle speeds and load capacities also enable faster table turnovers, supporting higher revenue generation.

Market Trends:

Adoption of Energy-Efficient and Sustainable Technologies:

The commercial dishwasher market is witnessing a strong shift toward energy-efficient and environmentally sustainable solutions. Manufacturers are integrating advanced water filtration, heat recovery, and low-energy consumption systems to reduce operating costs and comply with environmental regulations. It is also driving the use of eco-friendly detergents and biodegradable cleaning agents to meet growing consumer and corporate sustainability expectations. Compact designs with optimized wash cycles are gaining traction among small and medium-sized establishments, where space and resources are limited. The trend toward greener operations is influencing procurement decisions, particularly in regions with strict energy and water usage standards. Sustainability certifications are becoming a competitive differentiator for leading brands.

- For instance, Hobart has received ENERGY STAR Partner of the Year recognition for 14 consecutive years, with its entire commercial dishmachine product line meeting the latest ENERGY STAR 3.0 criteria, which requires a 17% improvement in energy efficiency over older models.

Integration of Automation and Smart Monitoring Features:

Automation and digital connectivity are becoming defining features in the commercial dishwasher market. It is transforming dishwashing operations through the use of programmable cycles, IoT-enabled diagnostics, and real-time performance monitoring. Operators can now track water and energy usage, receive maintenance alerts, and optimize washing cycles based on load requirements. Touchscreen interfaces and user-friendly controls are enhancing operational efficiency and reducing training time for staff. The demand for high-speed models with advanced automation is increasing in high-volume kitchens, where operational uptime is critical. Remote monitoring capabilities are enabling centralized management across multi-location foodservice chains, improving consistency and reducing downtime.

- For instance, Winterhalter’s CONNECTED WASH system has over 1,000 deployed units, enabling remote monitoring and sending real-time usage statistics for performance optimization across multiple locations.

Market Challenges Analysis:

High Initial Investment and Maintenance Costs:

The commercial dishwasher market faces challenges from the high upfront cost of advanced models, which can deter adoption among small and medium-sized businesses. It requires substantial capital expenditure for purchase, installation, and integration into existing kitchen layouts. Regular maintenance, replacement parts, and compliance with safety and hygiene regulations add to operational expenses. These costs can be prohibitive for establishments operating on thin margins. Limited financing options and budget constraints often delay equipment upgrades, impacting market penetration in cost-sensitive regions.

Operational Limitations and Infrastructure Constraints:

Operational limitations also restrict growth in the commercial dishwasher market. It depends on reliable water and power supply, which can be inconsistent in certain emerging markets. High energy and water consumption in older models raise utility expenses, discouraging long-term use. Noise levels and heat emissions from some units can disrupt kitchen operations and affect staff comfort. Businesses with limited space may struggle to accommodate larger capacity machines. These factors compel operators to balance equipment capabilities with operational feasibility, slowing widespread adoption in specific market segments.

Market Opportunities:

Growing Demand in Emerging Economies:

The commercial dishwasher market has significant growth potential in emerging economies experiencing rapid urbanization and expansion of the hospitality sector. It benefits from rising disposable incomes, an increasing dining-out culture, and greater emphasis on hygiene in foodservice operations. Government initiatives promoting food safety compliance are further encouraging the adoption of automated dishwashing equipment. Hotels, restaurants, and catering services in these regions are upgrading to meet international service standards. Local manufacturing and distribution partnerships can help brands penetrate these markets more effectively. The expanding quick-service restaurant segment presents a particularly attractive opportunity for high-volume, compact, and cost-efficient models.

Innovation in Compact and Modular Designs:

Innovation in compact, modular, and customizable dishwasher systems is creating new market opportunities. The commercial dishwasher market can leverage this trend to target small and medium-sized foodservice establishments with limited space. It allows operators to invest in scalable solutions that can expand with business growth. Integration of advanced filtration, reduced water usage, and faster wash cycles addresses operational efficiency demands. Smart connectivity features also appeal to multi-location operators seeking centralized monitoring and control. By offering flexible and energy-efficient models, manufacturers can reach a broader customer base and strengthen their competitive positioning.

Market Segmentation Analysis:

By Product Type:

The commercial dishwasher market is segmented into undercounter, door-type, conveyor, and glasswashers. Undercounter models are preferred by small and medium-sized establishments due to their compact design and ease of installation. Door-type dishwashers hold strong demand in mid to high-volume kitchens for their balance between capacity and space efficiency. Conveyor dishwashers dominate large-scale operations such as hotels, institutions, and catering facilities due to their high throughput. Glasswashers maintain a steady niche in bars, cafes, and fine dining restaurants where delicate glassware care is critical.

- For example, the Hobart AM16 door-type dishwasher delivers robust performance with the ability to process 60 racks per hour and includes a built-in Sense-a-Temp™ booster to ensure high-temperature sanitization for every load.

By Capacity:

Capacity segments include low, medium, and high capacity units. Low-capacity models suit smaller establishments with limited dishwashing needs and space constraints. Medium-capacity units serve mid-sized restaurants and commercial kitchens seeking efficiency with moderate volumes. High-capacity dishwashers dominate in high-traffic facilities, offering faster cycles and larger load handling to meet peak demands.

- For instance, the Winterhalter C50 rack conveyor dishwasher achieves up to 260 racks per hour capacity with a 95-liter tank capacity and 18 kW standard tank heating power.

By Application:

Applications span restaurants, hotels, hospitals, catering services, and others. Restaurants represent the largest segment, driven by high turnover and strict hygiene standards. Hotels adopt a mix of capacity levels to serve restaurants, banquet halls, and room service efficiently. Hospitals prioritize sanitization and reliability to meet healthcare safety requirements. Catering services demand portable and high-capacity solutions to support large events and off-site operations.

Segmentations:

By Product Type:

- Undercounter

- Door-Type

- Conveyor

- Glasswashers

By Capacity:

- Low Capacity

- Medium Capacity

- High Capacity

By Application:

- Restaurants

- Hotels

- Hospitals

- Catering Services

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Europe:

Europe accounts for 37% market share in the commercial dishwasher market, driven by mature hospitality infrastructure and stringent environmental regulations. It benefits from high adoption of energy-efficient and water-saving models across restaurants, hotels, and institutional kitchens. Countries such as Germany, France, and the United Kingdom lead demand due to advanced foodservice industries and strong regulatory compliance requirements. Manufacturers focus on innovation to meet EU eco-design directives and sustainability targets. The presence of established brands and a dense distribution network supports steady replacement demand. Seasonal tourism influx in Mediterranean countries also contributes to higher equipment usage and repeat sales.

North America:

North America holds 29% market share in the commercial dishwasher market, supported by a robust foodservice industry and high hygiene standards. The United States dominates regional demand due to the extensive network of restaurants, catering services, and quick-service chains. It benefits from a strong focus on automation, energy efficiency, and advanced sanitization features. Rising labor costs are accelerating the shift toward fully automated dishwashing systems. Canada contributes to growth with investments in sustainable kitchen operations and hospitality expansion. Manufacturers targeting this region prioritize smart features, compact designs, and compliance with NSF sanitation standards.

Asia-Pacific:

Asia-Pacific captures 24% market share in the commercial dishwasher market, fueled by rapid urbanization, growing disposable incomes, and an expanding hospitality sector. China, Japan, and India lead adoption, with increasing investments in hotels, restaurants, and large-scale catering facilities. It benefits from government initiatives promoting food safety and hygiene in commercial kitchens. Rising popularity of international cuisine and organized dining formats is increasing equipment demand. The region is witnessing higher interest in energy-efficient and affordable models tailored to local needs. Domestic manufacturing capabilities and competitive pricing strategies are enabling faster market penetration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Asber Professional Solutions

- Jet-Tech Systems Inc.

- LG Electronics

- Comenda Ali Group S.r.l.

- Champion Industries, Inc.

- CMA Dishmachines

- Electrolux Professional AB

- Insinger Machine Company

- Fagor Industrial S. Coop

- Hobart Corporation

- Jackson WWS, Inc.

- Mash Appliances

Competitive Analysis:

The commercial dishwasher market is highly competitive, with global brands and regional players focusing on product innovation, efficiency, and reliability. Leading companies such as Asber Professional Solutions, Jet-Tech Systems Inc., LG Electronics, Comenda Ali Group S.r.l., Champion Industries, Inc., CMA Dishmachines, Electrolux Professional AB, and Insinger Machine Company compete through advanced technology integration and expanded product portfolios. It is driven by the need to meet evolving customer demands for energy efficiency, water conservation, and enhanced sanitation performance. Players invest in research and development to introduce smart monitoring, modular designs, and eco-friendly solutions. Strategic partnerships with distributors and service providers strengthen market presence and ensure timely aftersales support. Competitive advantage often depends on customization capabilities, pricing strategies, and the ability to address diverse end-user requirements across hospitality, healthcare, and foodservice sectors.

Recent Developments:

- In June 2025, LG Electronics launched webOS Hub 3.0, an upgraded TV platform with advanced AI features for third-party brands.

- In August 2024, Jet-Tech Systems Inc.’s related company Jet Technology Group formed a strategic partnership with Fujifilm in the UK to sell print-on-demand products and services.

Market Concentration & Characteristics:

The commercial dishwasher market demonstrates moderate to high concentration, with a mix of global leaders and regional manufacturers competing on technology, efficiency, and service reliability. It is characterized by strong brand loyalty, driven by consistent performance, aftersales support, and compliance with hygiene regulations. Leading players focus on product innovation, integrating energy-efficient designs, smart monitoring features, and sustainable materials to meet evolving customer demands. The market caters to diverse end users, from large hospitality chains to small foodservice outlets, requiring a range of capacities and configurations. Competitive pricing, distribution reach, and customization capabilities remain critical factors influencing market positioning.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Capacity, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Growing emphasis on sustainability will drive demand for energy-efficient and water-saving dishwasher models.

- Integration of IoT and smart monitoring will enhance operational control and predictive maintenance capabilities.

- Rising food safety regulations will push operators toward high-temperature and chemical sanitizing systems.

- Compact and modular designs will gain traction among small and medium-sized foodservice establishments.

- Expanding hospitality and foodservice sectors in emerging economies will create new growth opportunities.

- Manufacturers will focus on developing low-noise and low-heat emission units to improve kitchen working conditions.

- Demand for fully automated dishwashing systems will increase in response to labor shortages and rising wages.

- Customizable wash cycles and advanced filtration systems will become key differentiators for premium models.

- Growth in cloud kitchens and delivery-focused restaurants will open niche markets for specialized dishwashing equipment.

- Strategic partnerships between manufacturers and distributors will strengthen market penetration in underserved regions.