Market Overview

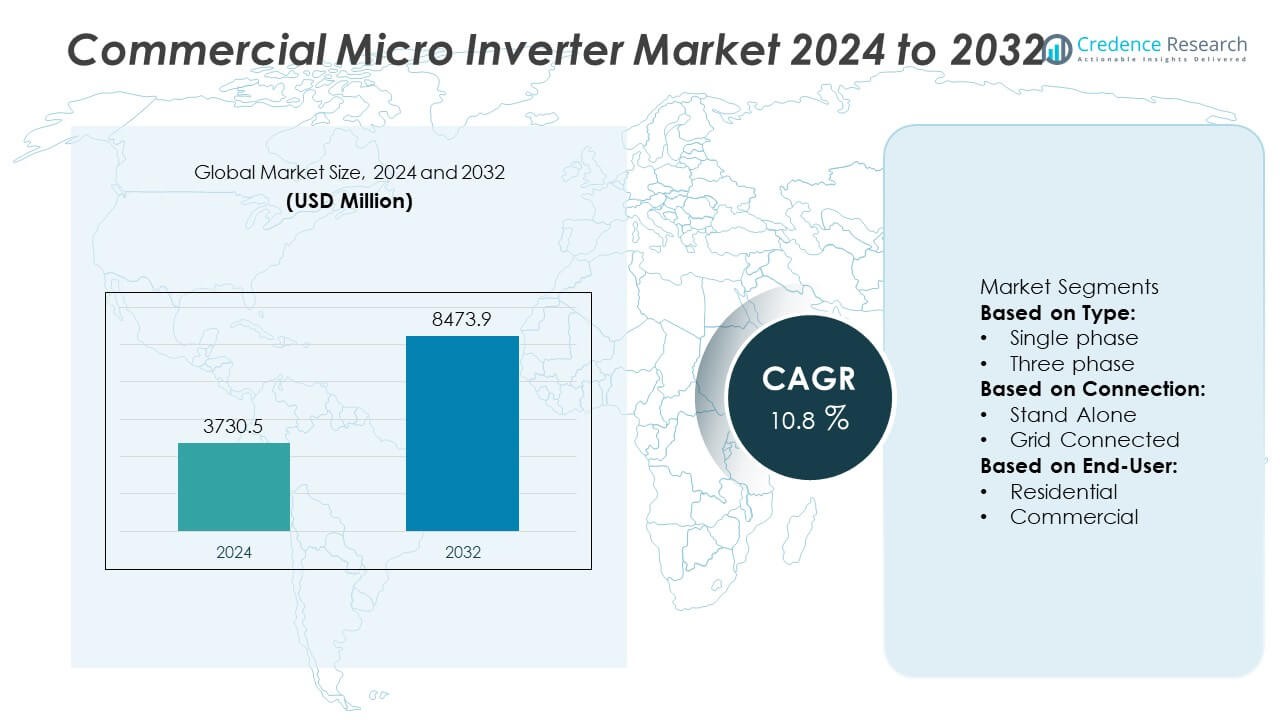

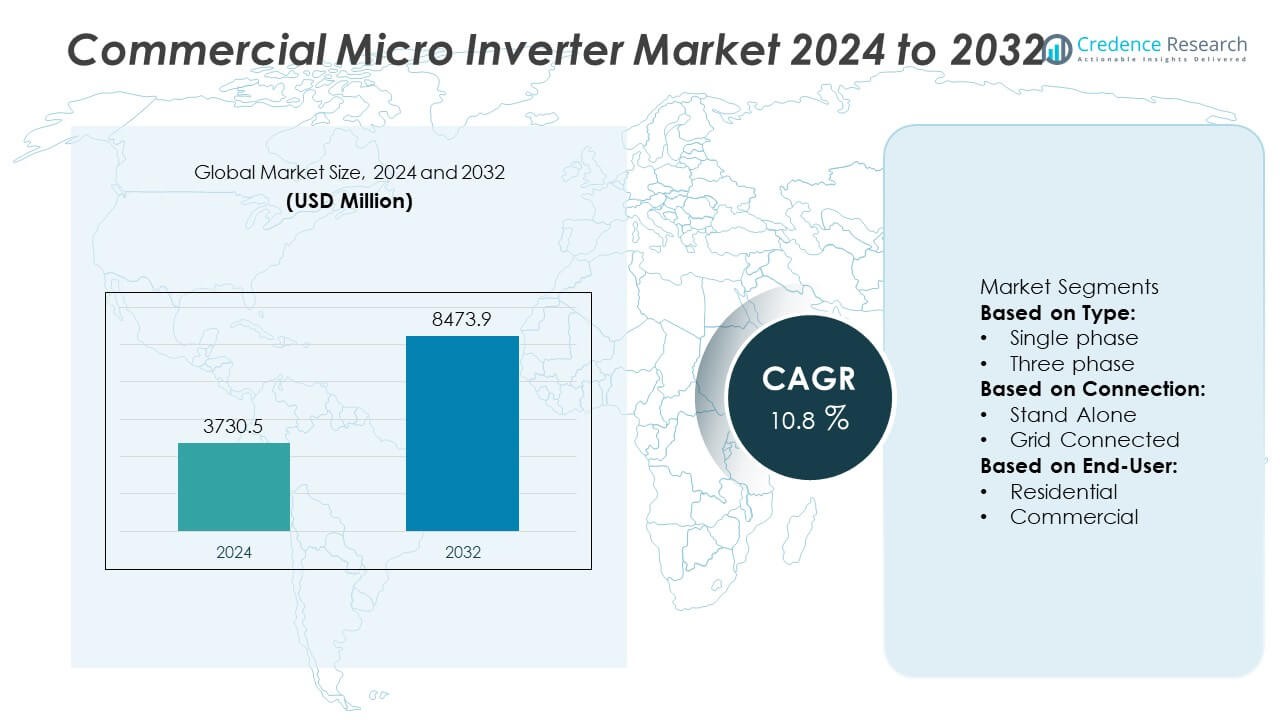

The Commercial Micro Inverter Market size was valued at USD 3,730.5 million in 2024 and is projected to reach USD 8,473.9 million by 2032, registering a CAGR of 10.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Commercial Micro Inverter Market Size 2024 |

USD 3,730.5 Million |

| Commercial Micro Inverter Market, CAGR |

10.8% |

| Commercial Micro Inverter Market Size 2032 |

USD 8,473.9 Million |

The Commercial Micro Inverter Market is driven by the rising adoption of solar energy solutions, increasing demand for high-efficiency power conversion, and growing emphasis on decentralized energy generation. It benefits from advancements in module-level power electronics that enhance system performance, reliability, and safety. Trends include integration of IoT and AI-based monitoring for real-time energy management, expanding adoption in large-scale commercial projects.

The Commercial Micro Inverter Market shows strong adoption across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, supported by expanding solar infrastructure and favorable renewable energy policies. North America leads in technological innovation and large-scale commercial installations, driven by advanced grid integration standards and high adoption of module-level power electronics. Europe benefits from stringent carbon reduction targets and strong incentives for distributed solar generation. Asia Pacific is experiencing rapid growth due to rising investments in solar projects in countries like China, India, and Australia, alongside increasing demand for energy efficiency in commercial buildings. Latin America and the Middle East & Africa are emerging markets, focusing on decentralized power solutions to address energy access challenges.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Commercial Micro Inverter Market was valued at USD 3730.5 million in 2024 and is projected to reach USD 8473.9 million by 2032, growing at a CAGR of 10.8% during the forecast period.

- Growth is driven by increasing adoption of solar PV systems in commercial buildings, demand for higher energy yield, and growing focus on renewable energy integration into smart grids.

- Key trends include the adoption of advanced MPPT technology, integration of IoT-enabled monitoring, and expansion of hybrid-ready micro inverters supporting both solar and storage systems.

- The market is competitive, with leading players such as Enphase, Deye Inverter, Darfon Electronics Corporation, Fimer Group, and Solis Solar focusing on high-efficiency designs, improved thermal performance, and scalable product ranges.

- High initial installation costs, complex maintenance in large-scale deployments, and dependency on semiconductor supply chains act as restraints for wider adoption.

- North America leads in adoption due to strong solar incentives and advanced grid regulations, Europe follows with carbon reduction mandates, and Asia Pacific is rapidly expanding due to large-scale solar investments in China, India, and Australia.

- Emerging markets in Latin America and the Middle East & Africa are witnessing growing demand driven by decentralized power needs, rural electrification programs, and government-backed renewable initiatives, creating opportunities for technology providers with adaptable product designs.

Market Drivers

Rising Demand for Distributed Solar Generation

The Commercial Micro Inverter Market benefits from the growing adoption of distributed solar generation systems across commercial buildings, retail complexes, and industrial facilities. Micro inverters enable module-level conversion, improving system performance in shaded or partially obstructed installations. It supports flexible system design and allows for incremental capacity expansion without complex rewiring. Enhanced safety features, such as rapid shutdown compliance, strengthen their adoption in regulated markets. Growing urban solar rooftop deployments create a consistent demand for solutions that maximize energy harvest. Technological improvements in efficiency and reliability further enhance their appeal to commercial users.

- For instance, Enphase’s IQ8 Series microinverters have undergone more than one million cumulative hours of powered-on testing and now carry an industry-leading warranty of 25 years.

Shift Toward Module-Level Power Optimization

Commercial solar projects increasingly prioritize module-level power optimization to address performance losses from panel mismatches, shading, or debris accumulation. The Commercial Micro Inverter Market responds with advanced designs that operate each panel independently, ensuring consistent energy output across the array. It reduces the impact of underperforming modules and simplifies troubleshooting. Integration with real-time monitoring platforms allows operators to track performance at a granular level. This capability improves maintenance efficiency and extends system lifespan. Demand is particularly strong in markets with diverse roof orientations and complex layouts.

- For instance, Deye’s microinverters boast maximum efficiencies up to 96.5%, with MPPT accuracy above 99%, and operate reliably within a wide temperature range from –40°C to +65°C.

Regulatory Support and Renewable Energy Policies

Government incentives, net metering programs, and renewable energy mandates strongly influence the Commercial Micro Inverter Market. Many jurisdictions require compliance with safety standards that micro inverters meet more easily than string inverters. It aligns with grid modernization goals by enabling better energy management and integration with storage solutions. Policies supporting carbon reduction targets accelerate adoption in both developed and emerging markets. Regional subsidies and tax credits reduce the payback period, improving investment attractiveness. Growing utility participation in distributed generation projects also supports market growth.

Technological Advancements in Efficiency and Reliability

Continuous innovation drives the Commercial Micro Inverter Market, with manufacturers focusing on higher conversion efficiencies, extended product warranties, and improved thermal management. It enhances overall system output and reduces operational costs for commercial users. Integration with smart energy management systems enables load balancing and peak shaving capabilities. Advances in semiconductor technology improve power density and reduce component failure rates. Wireless communication features allow seamless integration with monitoring portals. These developments reinforce micro inverters as a preferred choice for high-performance commercial solar installations.

Market Trends

Growing Integration with Energy Storage Systems

The Commercial Micro Inverter Market is experiencing a shift toward solutions that seamlessly integrate with commercial-scale battery storage systems. This trend enables facilities to store excess solar power and use it during peak demand or grid outages. It supports energy independence and reduces reliance on conventional power sources. Manufacturers are developing micro inverters with bidirectional capabilities, allowing both charging and discharging functions. Compatibility with emerging battery chemistries, including lithium-ion and sodium-based storage, is expanding adoption. The combination of solar generation and storage enhances overall project ROI and grid resilience.

- For instance, Enphase has developed a bidirectional EV charger that can power a home during outages by discharging energy from the EV battery to the home or grid using their existing microinverter platform. This technology, called vehicle-to-home (V2H) and vehicle-to-grid (V2G).

Advancements in Monitoring and IoT Connectivity

Enhanced monitoring capabilities are shaping the Commercial Micro Inverter Market, with IoT-enabled devices providing real-time performance data at the module level. It allows operators to detect inefficiencies, faults, or shading issues quickly. Cloud-based dashboards and AI-driven analytics help optimize energy output and reduce maintenance costs. Remote firmware updates ensure systems remain compliant with evolving grid codes. Integration with building energy management systems offers centralized control and improved operational visibility. These innovations improve long-term reliability and performance transparency for commercial solar projects.

- For instance, data from the National Renewable Energy Laboratory showed that systems with IoT-enabled micro inverters achieved a 22% faster fault detection rate and reduced unscheduled maintenance visits by over 15 service hours per year compared to conventional monitoring setups.

Adoption of Higher Power Output Models

Increasing solar panel wattages are driving the demand for micro inverters capable of handling higher power outputs. The Commercial Micro Inverter Market is responding with designs supporting modules exceeding 500 W. It enables compatibility with the latest high-efficiency panels, ensuring optimal energy conversion. This evolution reduces the number of inverters required per installation, lowering installation complexity. Manufacturers are focusing on heat dissipation improvements to maintain performance under higher loads. Higher power handling capacity aligns with the trend toward maximizing energy generation in limited rooftop spaces.

Focus on Compliance with Grid Safety Standards

Evolving electrical safety standards are influencing product development in the Commercial Micro Inverter Market. It is driving innovation in rapid shutdown functions, anti-islanding protection, and voltage regulation. Compliance with codes such as NEC 2017 and IEC standards is now a competitive differentiator. Micro inverters inherently meet many of these requirements, which accelerates their acceptance in regulated markets. Manufacturers are incorporating advanced fault detection and arc-fault circuit interrupter (AFCI) technologies to enhance safety. This focus on regulatory alignment ensures long-term viability and market expansion opportunities.

Market Challenges Analysis

High Initial Costs and Installation Complexity

The Commercial Micro Inverter Market faces challenges from the higher upfront costs compared to traditional string inverters. It requires more units per installation, which increases material and labor expenses for large-scale projects. The distributed architecture also demands careful planning to ensure compatibility with existing electrical systems and local grid regulations. Installers must possess specialized training to manage module-level electronics effectively, adding to operational costs. This complexity can discourage adoption among cost-sensitive commercial operators, particularly in emerging markets. Manufacturers are working to streamline installation processes and reduce per-unit pricing, but economic barriers remain a significant constraint.

Durability Concerns in Harsh Operating Environments

Micro inverters operate in close proximity to solar panels, exposing them to extreme temperatures, humidity, and UV radiation. The Commercial Micro Inverter Market must address concerns about long-term reliability under such conditions. Failures at the module level can require more frequent maintenance interventions compared to centralized systems. Downtime in commercial applications leads to revenue losses, intensifying the impact of reliability issues. Manufacturers are enhancing enclosure protection ratings, thermal management systems, and component quality to extend service life. However, the perception of shorter operational lifespans compared to central inverters continues to challenge wider market adoption.

Market Opportunities

Rising Demand for Module-Level Power Optimization

The Commercial Micro Inverter Market is positioned to benefit from the growing need for module-level performance optimization in diverse installation environments. It allows individual solar panels to operate independently, reducing output losses from shading, soiling, or module mismatch. This capability is particularly valuable for complex commercial rooftops with varied orientations and obstructions. The shift toward high-efficiency solar modules further strengthens demand for inverters that can maximize power harvest from each unit. Businesses seeking to enhance return on investment are adopting micro inverters to achieve higher energy yields over system lifetimes. This trend creates strong opportunities for manufacturers that offer scalable, high-reliability solutions tailored for large commercial arrays.

Integration with Smart Energy Management Systems

The integration of micro inverters with advanced monitoring and smart energy management platforms presents a significant growth avenue for the Commercial Micro Inverter Market. It enables real-time tracking of energy production, system diagnostics, and predictive maintenance at the module level. These features align with the increasing adoption of IoT and AI-driven analytics in commercial energy infrastructure. The capability to integrate with battery storage systems and demand response programs also enhances value for building owners. As energy regulations push for greater grid interactivity, micro inverters with advanced communication protocols and remote control capabilities will gain preference. Vendors that deliver seamless interoperability with energy management ecosystems can capture a competitive advantage in this expanding segment.

Market Segmentation Analysis:

By Type

The Commercial Micro Inverter Market is segmented by type into single-phase and three-phase micro inverters. Single-phase units are commonly deployed in smaller commercial installations and facilities with lower load requirements. They offer ease of installation, cost efficiency, and compatibility with smaller arrays. Three-phase micro inverters dominate larger commercial projects where higher power output and balanced load distribution are critical. It ensures improved grid stability, reduced transmission losses, and optimized performance for industrial-scale systems. The increasing deployment of high-capacity solar modules in commercial rooftops is boosting demand for three-phase micro inverters, particularly in manufacturing facilities, warehouses, and large retail complexes.

- For instance, Enphase’s IQ8A three-phase micro inverter delivers a peak output power of 366 VA per phase with 97% CEC efficiency, enabling stable operation in commercial rooftops exceeding 500 kW capacity as documented in its 2024 technical datasheet.

By Connection

Market segmentation by connection includes wired and wireless configurations. Wired micro inverters maintain strong adoption in the Commercial Micro Inverter Market due to their proven reliability, reduced interference risks, and robust data transmission in harsh environments. They are preferred in large-scale projects where stable, high-speed communication between modules and monitoring systems is essential. Wireless micro inverters are gaining traction for their flexibility in installation, lower cabling costs, and simplified system expansion. It supports easier deployment in complex roof layouts and retrofitting scenarios. The advancement of secure wireless protocols and improved signal range is expected to strengthen the appeal of wireless solutions for future commercial installations.

- For instance, APsystems’ DS3 wireless-ready micro inverter uses a 2.4 GHz Zigbee communication module with an effective outdoor range of 300 m, while maintaining encrypted data transfer as verified in its UL 1741 compliance report.

By End-User

The Commercial Micro Inverter Market serves diverse end-user segments, including commercial buildings, industrial facilities, and institutional establishments. Commercial buildings such as office complexes, shopping centers, and hospitality venues deploy micro inverters to maximize rooftop solar efficiency while maintaining aesthetics and minimizing downtime. Industrial facilities adopt these systems to power high-load operations with reliable, module-level performance monitoring, ensuring minimal production disruption. It also finds adoption in institutions like schools, hospitals, and government buildings, where energy reliability and operational continuity are critical. Growing sustainability commitments and renewable energy targets across these sectors are driving investments in micro inverter-based solar systems, reinforcing their role as a key component of commercial solar infrastructure.

Segments:

Based on Type:

Based on Connection:

- Stand Alone

- Grid Connected

Based on End-User:

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds 37% of the Commercial Micro Inverter Market, supported by strong renewable energy adoption, favorable government incentives, and mature solar infrastructure. The United States leads regional demand, driven by state-level clean energy mandates and investment tax credits that encourage commercial solar deployment. Canada is expanding its adoption through net metering policies and corporate sustainability commitments. It benefits from the presence of leading micro inverter manufacturers and strong supply chain networks that ensure consistent product availability. Technological advancements, such as integrated monitoring platforms and high-efficiency three-phase models, further strengthen adoption across commercial rooftops and industrial installations. Rising energy costs and the shift toward decentralized power generation continue to drive market penetration in this region.

Europe

Europe accounts for 29% of the Commercial Micro Inverter Market, fueled by ambitious renewable energy targets under the European Green Deal and country-specific solar incentives. Germany, France, and the Netherlands are key contributors, with widespread rooftop solar integration in commercial and industrial sectors. The region’s strict grid compliance standards and focus on high-quality installations favor micro inverters due to their safety features, module-level optimization, and ability to meet EN 50549 and other local standards. It also benefits from increased adoption in southern Europe, where high solar irradiation supports greater returns on investment. The integration of storage solutions with micro inverters is gaining traction in markets like Italy and Spain, supporting energy independence and peak shaving strategies for businesses.

Asia Pacific

Asia Pacific holds 23% of the Commercial Micro Inverter Market, with rapid growth driven by urbanization, industrial expansion, and rising corporate investments in clean energy. Australia leads in adoption due to favorable feed-in tariffs and high solar penetration in commercial properties. China is emerging as a strong market with large-scale manufacturing capabilities and supportive solar policies in industrial parks and export-driven facilities. Japan’s strict building regulations and demand for high-efficiency, space-saving systems contribute to micro inverter deployment in dense urban environments. India’s growing commercial solar segment benefits from falling installation costs and corporate sustainability programs. It is further boosted by government-led rooftop solar initiatives that encourage SMEs and institutions to adopt distributed solar solutions.

Latin America

Latin America represents 6% of the Commercial Micro Inverter Market, led by Brazil, Mexico, and Chile. Brazil’s net metering regulations and expanding commercial rooftop installations drive demand, while Mexico leverages solar to reduce operational costs in retail and manufacturing. Chile’s mining sector increasingly integrates solar power to offset high energy expenses in remote locations. It is supported by partnerships between international inverter suppliers and local EPC (Engineering, Procurement, and Construction) companies, enabling efficient deployment in diverse geographical conditions. The region’s abundant solar resources and supportive policy frameworks are expected to sustain steady growth in the coming years.

Middle East & Africa

The Middle East & Africa hold 5% of the Commercial Micro Inverter Market, with growth concentrated in Gulf Cooperation Council (GCC) countries and South Africa. The UAE and Saudi Arabia are driving demand through large-scale commercial solar projects aligned with their national renewable energy targets. South Africa’s adoption is fueled by the need for reliable power supply in response to grid instability and load-shedding issues. It benefits from falling solar component costs and the integration of micro inverters with battery storage systems to provide consistent energy for commercial operations. Ongoing infrastructure investments and favorable climate conditions offer strong potential for market expansion in this region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fenice Energy

- Sparq Systems

- Sensol

- SunEvo Solar

- Fimer Group

- Enphase

- Solis Solar

- Statcon Energiaa

- Darfon Electronics Corporation

- Deye Inverter

Competitive Analysis

The Commercial Micro Inverter Market features strong competition among established global players and emerging regional manufacturers. Leading companies include Enphase, Deye Inverter, Darfon Electronics Corporation, Fimer Group, Fenice Energy, Sparq Systems, Sensol, Statcon Energiaa, SunEvo Solar, and Solis Solar. Enphase maintains a dominant position with its high-efficiency IQ series, offering advanced grid support features and remote monitoring capabilities. Deye Inverter focuses on scalable micro inverter solutions with multiple MPPT inputs for optimal energy harvesting in varying conditions. Darfon Electronics Corporation delivers compact, lightweight designs targeting ease of installation and low maintenance in commercial solar arrays. Fimer Group emphasizes durability and high power output for large-scale deployments, supported by strong service networks. Fenice Energy and Solis Solar are expanding through cost-competitive offerings tailored for high-growth markets in Asia and Latin America. Sparq Systems and Sensol drive innovation in modular designs and integrated storage compatibility. Statcon Energiaa and SunEvo Solar strengthen their regional presence through customized solutions meeting local regulatory and grid requirements. Together, these players compete through efficiency advancements, product reliability, and integration with smart energy management platforms.

Recent Developments

- In November 2024, Enphase enabled seamless system expansions by allowing IQ8 Series microinverters to integrate with existing IQ7 microinverters through automatic software updates—no additional gateway required.

- In February 2024, Enphase Energy announced the launch of its new IQ8P Microinverter, designed to support higher-powered solar panels up to 480 W. This innovation aligns with the growing trend toward more powerful residential PV systems. It offers improved energy harvesting and faster installation.

- In July 2023, Enphase Energy has started shipping its first U.S.-made microinverters from Columbia, South Carolina. This move is part of their strategy to expand manufacturing within the United States.

Market Concentration & Characteristics

The Commercial Micro Inverter Market is moderately concentrated, with a mix of established multinational manufacturers and emerging regional players competing through product innovation and geographic expansion. It is characterized by rapid technological advancements, particularly in high-efficiency, grid-compliant designs that enhance energy harvest and operational reliability. Leading vendors focus on integrating advanced MPPT (Maximum Power Point Tracking) capabilities, higher power ratings, and IoT-based monitoring features to differentiate their offerings. The market benefits from strong demand in regions with high solar adoption rates, where stringent grid standards and incentive programs drive performance-focused solutions. Competitive dynamics are shaped by partnerships with EPC contractors, distribution networks, and solar module manufacturers to expand market reach. Vendors with strong R&D pipelines, scalable manufacturing, and proven installation track records maintain a distinct advantage. It continues to evolve toward solutions that offer simplified installation, longer warranty periods, and compatibility with diverse commercial solar configurations, supporting wider adoption across global markets.

Report Coverage

The research report offers an in-depth analysis based on Type, Connection, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will increase with the expansion of commercial solar installations across developed and emerging markets.

- Integration of advanced MPPT technology will enhance system efficiency and energy yield.

- Adoption of IoT-enabled micro inverters will grow for real-time performance monitoring and predictive maintenance.

- Hybrid and energy storage-compatible models will gain traction in regions promoting self-consumption.

- Manufacturers will focus on expanding global distribution networks to capture new markets.

- Stringent grid compliance regulations will drive innovation in safety and reliability features.

- Modular and scalable designs will support larger commercial rooftop and ground-mounted systems.

- Partnerships between inverter manufacturers and solar module producers will strengthen product integration.

- Increased investment in R&D will lead to higher power ratings and extended product lifespans.

- Asia Pacific and Middle East markets will see rapid adoption supported by favorable policy frameworks.