Market Overview

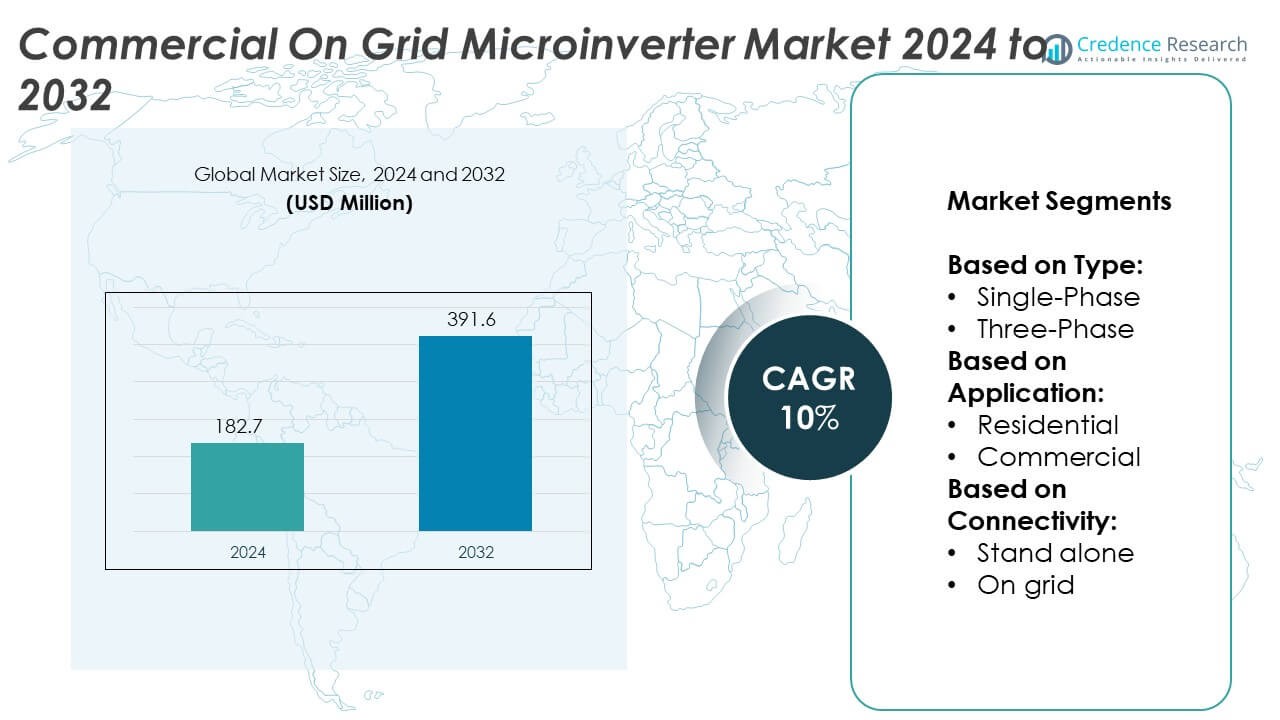

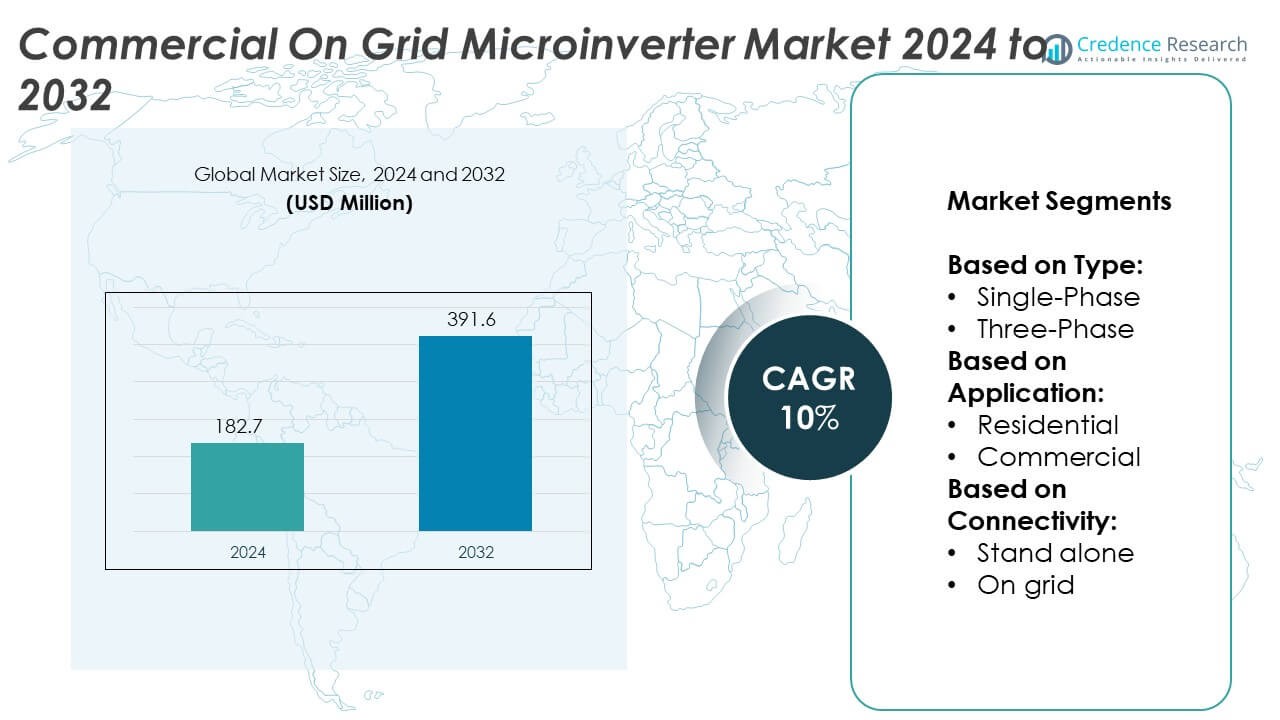

The Commercial On Grid Microinverter Market was valued at USD 182.7 million in 2024 and is expected to reach USD 391.6 million by 2032, growing at a CAGR of 10% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Commercial On Grid Microinverter Market Size 2024 |

USD 182.7 Million |

| Commercial On Grid Microinverter Market, CAGR |

10% |

| Commercial On Grid Microinverter Market Size 2032 |

USD 391.6 Million |

The Commercial On Grid Microinverter market is driven by the increasing demand for efficient solar energy solutions and the growing adoption of renewable energy. Technological advancements, such as improved inverter efficiency and grid integration, enhance energy production and reduce system downtime. The rise in government incentives and policies promoting sustainable energy further accelerates market growth. Additionally, the shift towards energy optimization, cost-effectiveness, and greater reliability in commercial solar installations fosters the adoption of microinverters.

The Commercial On Grid Microinverter market is expanding across key regions including North America, Europe, and Asia-Pacific, driven by increasing solar adoption and supportive government policies. North America leads in technology integration, while Europe focuses on sustainability. Asia-Pacific sees rapid growth due to emerging markets and solar initiatives. Key players in this market include Enphase Energy, a leader in microinverter technology; SMA Solar Technology, known for its efficient solutions; and Hoymiles, which offers reliable microinverters for commercial applications. These companies are innovating to meet growing energy demands and optimize solar energy production worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Commercial On Grid Microinverter market was valued at USD 182.7 million in 2024 and is expected to reach USD 391.6 million by 2032, growing at a CAGR of 10% during the forecast period.

- The demand for energy-efficient solar solutions and government incentives for renewable energy adoption are key drivers of market growth.

- Technological advancements, such as higher efficiency, better grid integration, and smart monitoring, are fueling the market’s expansion.

- The growing popularity of hybrid solar systems that combine energy storage with microinverters is emerging as a major trend.

- Competition is intensifying among key players like Enphase Energy, SMA Solar Technology, and Hoymiles, who are focusing on product innovations and strategic partnerships.

- The market faces restraints from high initial installation costs and complexity in integrating microinverters with existing solar systems, which can limit adoption in cost-sensitive regions.

- North America and Europe lead the market due to strong adoption of solar technologies, with rapid growth also seen in Asia-Pacific as emerging economies ramp up solar energy projects.

Market Drivers

Growing Demand for Renewable Energy Solutions

The Commercial On Grid Microinverter market benefits from the increasing global shift towards renewable energy sources, particularly solar power. Businesses are increasingly adopting solar technologies to reduce energy costs and improve sustainability. As governments implement stricter environmental regulations and incentivize the use of green energy, the demand for efficient solar power systems, such as microinverters, is rising. The ability of microinverters to optimize energy production at the panel level contributes significantly to their adoption in commercial applications. It enables businesses to enhance energy efficiency, reduce wastage, and meet renewable energy targets.

- For instance, Solax Power’s X1 Boost microinverter, with an efficiency rating of 98.6%, is engineered to optimize energy production, ensuring greater reliability and cost-effectiveness in large-scale commercial solar applications.

Technological Advancements in Microinverter Efficiency

Continuous advancements in microinverter technology enhance system performance and energy output. The Commercial On Grid Microinverter market benefits from innovations in inverter designs that offer higher efficiency and greater durability. These technological improvements allow businesses to achieve more reliable energy production and faster return on investment. It also facilitates integration with other solar technologies, further promoting the growth of microinverters in commercial installations. Increased efficiency is essential to meeting energy demands while ensuring cost-effectiveness for businesses.

- For instance, APsystems’ YC600 microinverter, designed for commercial applications, requires the purchase of multiple units to cover a large solar installation, increasing initial costs. In a recent project, a commercial property in Texas had to purchase more than 250 units of the YC600 microinverters to cover the solar system, significantly raising the initial expenditure.

Cost-Effectiveness and Energy Optimization

The cost-effectiveness of Commercial On Grid Microinverter systems makes them an attractive option for commercial solar power applications. Businesses increasingly seek solutions that provide long-term savings while ensuring optimal performance. Microinverters enable energy optimization by converting power at the panel level, reducing the impact of shading or panel malfunctions. This level of control ensures the maximization of solar energy use, making it an efficient alternative to traditional string inverters. The growing preference for cost-effective solutions boosts market demand.

Supportive Government Policies and Incentives

Government incentives and policies play a crucial role in driving the adoption of solar technologies, including Commercial On Grid Microinverters. Tax rebates, grants, and subsidies encourage businesses to transition to renewable energy sources. Many regions are also implementing renewable energy targets, motivating companies to invest in efficient solar solutions. These policies create a favorable environment for the growth of the microinverter market, making it more accessible to businesses looking to reduce energy consumption.

Market Trends

Increasing Adoption of Smart Grid Integration

The integration of smart grid technologies is a prominent trend in the Commercial On Grid Microinverter market. Smart grids enable real-time monitoring and control of energy distribution, improving the efficiency of power systems. Microinverters contribute to the optimization of energy production by providing real-time data, which aids in better grid management. As commercial facilities seek to integrate renewable energy sources with advanced grid technologies, microinverters play a key role in enhancing system performance. This trend fosters greater reliability and energy management, making microinverters an integral component of smart grid systems.

- For instance, SMA Solar Technology microinverter system, used in commercial settings, ensures seamless grid integration. The system has been deployed in installations such as a 2.2 MW solar array at a manufacturing plant, where the on-grid connectivity allowed excess energy to be fed back into the grid while optimizing energy production across 6,500 solar panels.

Rising Popularity of Hybrid Solar Systems

Hybrid solar systems, which combine solar power with energy storage solutions, are gaining traction in the Commercial On Grid Microinverter market. These systems allow businesses to store excess solar energy generated during the day and use it during periods of low sunlight or high demand. Microinverters enhance the performance of hybrid systems by ensuring that each panel operates independently, optimizing energy use and storage. The growing interest in hybrid systems, driven by the need for energy independence and reliability, is pushing the demand for microinverters as a key technology in energy-efficient solutions.

- For example, modular design makes it easy for companies like Walmart, which have installed over 600 solar systems, to scale their solar energy capacity as needed while maintaining system efficiency and minimizing space requirements. This trend aligns with the growing demand for space-saving, efficient solar technologies in commercial applications.

Focus on Enhanced Durability and Longevity

A significant trend in the Commercial On Grid Microinverter market is the growing emphasis on product durability and longevity. With increasing investments in solar infrastructure, businesses require reliable systems that can withstand harsh environmental conditions. Modern microinverters are designed for enhanced resilience, with advanced protection features against extreme temperatures and weather conditions. This trend ensures that commercial solar systems remain efficient and cost-effective over extended periods, reducing the need for maintenance and replacement, and contributing to the overall growth of the market.

Shift Towards Compact and Modular Designs

There is a noticeable shift towards compact and modular designs in the Commercial On Grid Microinverter market. These designs allow for more flexible installation and easier scalability of solar systems. Microinverters with smaller form factors and modular capabilities enable businesses to expand their solar energy capacity without significant infrastructure changes. This trend provides greater versatility in installation, particularly in commercial buildings with limited space for energy systems. The move towards compact solutions aligns with the growing demand for more efficient, space-saving solar technologies in commercial applications.

Market Challenges Analysis

High Initial Installation Costs

One of the key challenges in the Commercial On Grid Microinverter market is the high initial installation costs. Although microinverters offer long-term savings through improved energy efficiency, the upfront investment required for their installation can be significant. The price of purchasing and installing multiple microinverters for large commercial solar systems can be a barrier for businesses, particularly those with budget constraints. The cost factor often makes businesses hesitant to switch from traditional inverters to microinverter-based systems. Despite the long-term benefits, such as lower maintenance costs and enhanced performance, the high initial expenditure remains a challenge to broader market adoption.

Complexity in System Integration and Compatibility

Another challenge facing the Commercial On Grid Microinverter market is the complexity of system integration and compatibility with existing solar infrastructure. Many commercial properties already have established solar systems, and upgrading to microinverters requires compatibility with current components, such as panels, batteries, and grid systems. This integration process can be technically challenging and may require significant modifications to existing infrastructure. Businesses may also face challenges in training personnel to manage and operate these advanced systems effectively. The need for seamless integration and the technical expertise required to optimize microinverter performance can slow down adoption, especially in regions where technical resources are limited.

Market Opportunities

Expansion in Emerging Markets

The Commercial On Grid Microinverter market presents significant opportunities for growth in emerging markets, where the demand for renewable energy solutions is rapidly increasing. As these regions experience industrialization and urbanization, the need for reliable and efficient power systems becomes critical. Microinverters, with their ability to enhance energy output and reduce maintenance costs, offer an attractive solution to businesses seeking to adopt solar technologies. As governments in these markets introduce supportive policies and incentives for solar adoption, businesses are more inclined to invest in sustainable energy systems. This growing trend opens up a substantial market for microinverters, particularly in Asia-Pacific, Africa, and Latin America.

Technological Advancements Driving Market Growth

Ongoing technological advancements present significant opportunities for the Commercial On Grid Microinverter market. Innovations in microinverter designs, such as improved efficiency and enhanced monitoring capabilities, are making these systems more attractive to commercial users. Businesses are increasingly adopting advanced microinverter solutions to optimize energy production and integrate them with smart grid technologies. Furthermore, the increasing integration of energy storage systems with microinverters creates additional growth opportunities, as businesses seek to store excess energy and reduce dependence on the grid. The continuous development of more cost-effective, high-performance microinverters will expand market reach and drive further adoption across various industries.

Market Segmentation Analysis:

By Type:

The Commercial On Grid Microinverter market is segmented into single-phase and three-phase microinverters. Single-phase microinverters are ideal for smaller installations, typically found in residential applications. They are cost-effective and simpler to install, making them popular in low-power demand settings. Three-phase microinverters, on the other hand, are more suitable for larger commercial and industrial applications, where higher power and efficiency are required. These inverters can handle higher loads and provide better grid stability, making them the preferred choice for businesses looking to optimize energy usage in larger solar installations. The growth in both segments is driven by the expanding demand for solar energy solutions across various sectors.

- For instance, Enphase Energy’s microinverters have been implemented in over 1 million residential solar installations globally, enhancing system reliability and energy yield with panel-level optimization.

By Application:

The Commercial On Grid Microinverter market is divided into residential and commercial applications. Residential applications primarily focus on small-scale solar installations for homes, where microinverters optimize energy production at the panel level, enhancing system reliability and energy yield. Commercial applications, however, involve larger-scale solar systems, often requiring robust microinverters that can handle higher capacity demands. These systems are critical for businesses looking to reduce energy costs, improve sustainability, and meet renewable energy goals. The demand in the commercial sector is growing due to the increasing focus on energy efficiency and the shift toward renewable energy sources in commercial buildings, factories, and warehouses.

- For instance, SMA Solar Technology’s Sunny Boy Storage system, which combines a battery inverter with energy storage, allowing for the storage of up to 10 kWh of solar energy for later use and provide 10 years warrenty. This system integrates stand-alone microinverters, enabling the system to efficiently store and utilize solar energy.

By Connectivity:

The connectivity segment of the Commercial On Grid Microinverter market includes stand-alone and on-grid systems. Stand-alone microinverters operate independently, storing excess energy and allowing the user to use it during off-peak hours, providing energy autonomy. These systems are typically employed in remote areas where grid access is limited or unavailable. On-grid systems, in contrast, are connected directly to the electrical grid, allowing excess energy to be fed back into the grid. On-grid microinverters are more widely used in urban and commercial settings, offering benefits such as grid stability and reduced dependency on energy suppliers. The preference for on-grid systems is growing due to their integration with smart grid technology and ease of monitoring.

Segments:

Based on Type:

Based on Application:

Based on Connectivity:

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a significant share of the Commercial On Grid Microinverter market, accounting for 35% of the global market. The demand for microinverters in this region is driven by the increasing adoption of renewable energy solutions, particularly in the United States and Canada. Government policies and incentives, such as tax rebates and subsidies for solar installations, have played a crucial role in supporting the growth of solar energy systems, further boosting microinverter demand. The region also sees substantial investments in both residential and commercial solar projects, with businesses focusing on energy cost reduction and sustainability goals. Moreover, technological advancements in microinverter efficiency and grid integration have made these systems more attractive to commercial entities, fueling further market growth in North America.

Europe

Europe follows closely with a 28% market share of the Commercial On Grid Microinverter market. This region has seen a rapid increase in renewable energy adoption, driven by strong policy support for green energy and sustainability. Countries such as Germany, France, and the United Kingdom have been at the forefront of solar power integration, encouraging both residential and commercial solar installations. The European Union’s renewable energy goals and its commitment to reducing carbon emissions have created an environment conducive to the growth of solar technologies, including microinverters. The market in Europe is expected to continue growing as businesses and governments focus on enhancing energy efficiency and reducing dependency on traditional energy sources.

Asia-Pacific

Asia-Pacific represents 25% of the global market for Commercial On Grid Microinverters, with significant growth in countries like China, India, Japan, and Australia. China, being the largest producer of solar energy equipment, contributes significantly to the market share in this region. The rapid industrialization, urbanization, and government-driven solar energy initiatives in countries like India and China create a strong demand for efficient solar systems. In addition, the growing need for energy-efficient solutions in both residential and commercial sectors is propelling the market for microinverters. The increasing awareness of environmental issues and energy security concerns in these nations further supports the market growth in the region.

Latin America

Latin America holds 7% of the Commercial On Grid Microinverter market, with Brazil, Mexico, and Argentina being key contributors. The region is gradually moving towards adopting renewable energy solutions, driven by the need for sustainable development and energy diversification. Although the market share is currently smaller than in other regions, it is witnessing steady growth. Governments in Latin American countries have started offering incentives for solar energy investments, and businesses are increasingly looking at microinverters to optimize energy production and reduce reliance on fossil fuels. The market for commercial solar systems is expanding, presenting growth opportunities for the microinverter market.

Middle East & Africa

The Middle East and Africa hold 5% of the global market share for the Commercial On Grid Microinverter market. The region’s solar energy sector has been growing steadily, particularly in countries like the United Arab Emirates, Saudi Arabia, and South Africa. The abundant sunlight in this region makes solar energy an attractive option for businesses looking to lower energy costs. While still in its early stages, the demand for microinverters in the Middle East and Africa is expected to rise as more large-scale commercial and industrial solar projects are implemented. Government initiatives supporting solar power adoption and increasing awareness of renewable energy benefits will likely continue to drive market growth in this region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- SMA Solar Technology

- Yotta Energy

- Solax Power

- Enphase Energy

- Hoymiles

- Omnik New Energy

- Sparq System

- Sungrow Power

- NingBo Deye Inverter Technology

- APsystems

Competitive Analysis

The Commercial On Grid Microinverter market is highly competitive, with leading players such as Enphase Energy, SMA Solar Technology, Hoymiles, APsystems, Sungrow Power, and Solax Power driving innovation and market growth. These companies focus on enhancing product efficiency, reliability, and smart grid integration to meet the increasing demand for renewable energy solutions.Enphase Energy continues to lead the market with its highly efficient microinverters and advanced monitoring solutions, offering superior grid compatibility. SMA Solar Technology is known for its robust solar inverter solutions and has strengthened its position through strategic partnerships and innovations in energy storage integration. Hoymiles has gained recognition for its reliable and cost-effective microinverters, which cater to both small and large-scale commercial applications.Sungrow Power and Solax Power are focusing on expanding their global reach, leveraging their technological expertise in energy conversion systems. Both companies are innovating in product design and performance to enhance their offerings for commercial solar installations. APsystems is also a key player, known for its high-performance and compact microinverters designed to maximize energy output in commercial applications.These companies are expanding through new product developments, partnerships, and acquisitions, continuously enhancing their market presence and competitiveness. Their ability to provide innovative, efficient, and scalable solutions positions them strongly in the growing commercial solar market.

Recent Developments

- In April 2025, SMA showcased its latest innovations at The Smarter E Europe 2025 trade fair from May 7 to 9, including solutions like the Sunny Boy Smart Energy hybrid inverter and modular battery system aimed at reliable solar power supply and optimized self-consumption. They introduced new energy management functions for commercial visitors and advanced SiC MOSFET technology in their Sunny Central Storage UP-S inverter.

- In 2024, Enphase expanded its strategic partnership with Semper Solaris to deploy Enphase IQ8 and IQ Battery 5P microinverters and use its cloud-based engineering and permitting software platform.

- In 2024, Hoymiles launched a 5 kW three-phase microinverter model MIT-5000-8T at the SNEC tradeshow in Shanghai, which claims to be about 20% cheaper than smaller microinverters and supports eight solar modules.

Market Concentration & Characteristics

The Commercial On Grid Microinverter market is characterized by moderate to high concentration, with a few dominant players driving the majority of the market share. These players, such as Enphase Energy, SMA Solar Technology, and Hoymiles, possess significant technological expertise and strong market presence, enabling them to lead the industry in terms of product innovation and efficiency. The market is competitive, with companies focusing on advancing microinverter technology to enhance energy efficiency, grid compatibility, and system reliability. New entrants continue to emerge, offering cost-effective solutions to cater to various segments, especially small- to mid-scale commercial applications. The market remains highly driven by technological advancements and the increasing demand for renewable energy solutions across the globe. Strong regional competition, particularly in North America, Europe, and Asia-Pacific, fosters continuous product development. As the industry matures, partnerships and strategic alliances are becoming essential for maintaining a competitive edge, with leading players expanding their product portfolios to address evolving market needs.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Connectivity and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to continue its strong growth, driven by the increasing adoption of solar energy solutions in commercial sectors.

- Technological innovations, such as higher efficiency and integration with smart grids, will be key factors shaping the market.

- A rise in hybrid solar systems combining energy storage and microinverters will boost demand for advanced solutions.

- Strong government policies and incentives supporting renewable energy adoption will create a favorable environment for growth.

- The need for cost-effective and energy-efficient solutions will push businesses towards microinverter-based solar installations.

- Increasing concerns about environmental sustainability will drive more commercial entities to invest in solar power systems.

- Competitive pressures will lead to more product diversification, with companies focusing on enhancing system reliability and ease of installation.

- Partnerships and strategic collaborations among key players will accelerate market expansion and foster innovation.

- Emerging markets in Asia-Pacific and Latin America will see significant growth opportunities due to rising energy demands and solar initiatives.

- As energy efficiency becomes more critical, microinverters will be increasingly adopted in large-scale commercial installations for optimal performance.