Market Overview

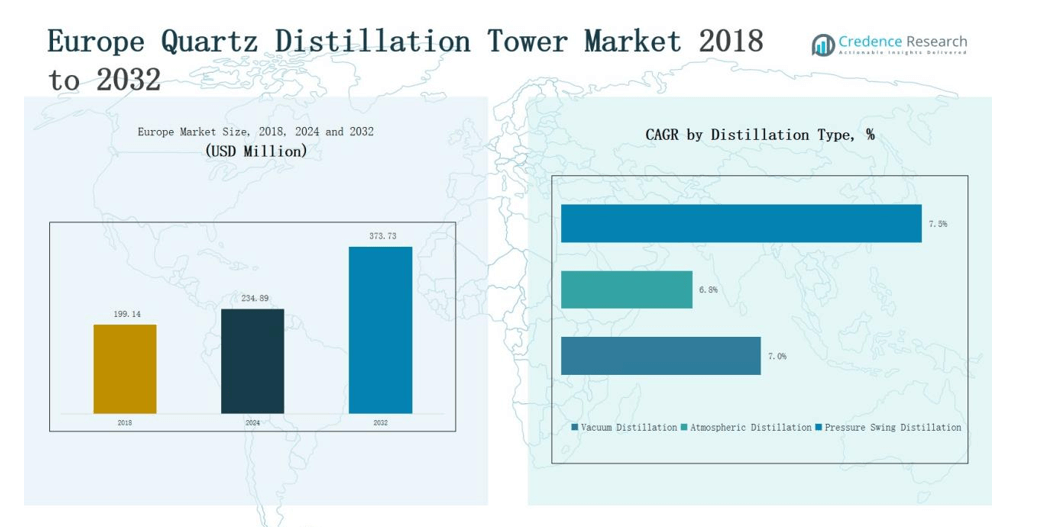

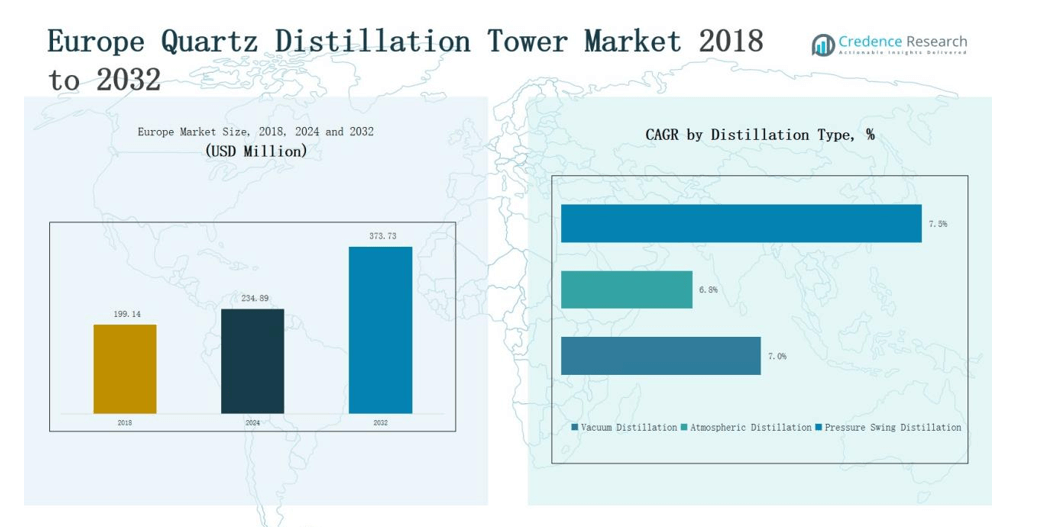

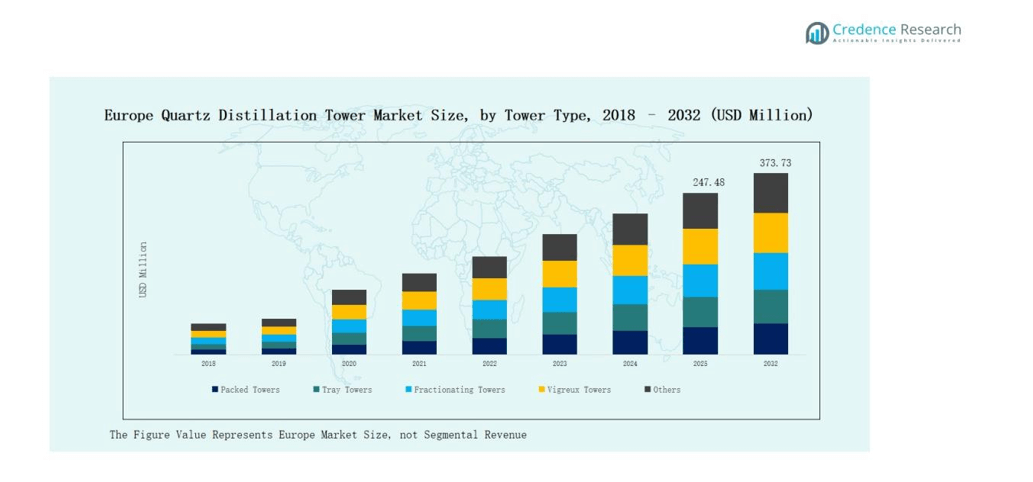

The Europe Quartz Distillation Tower Market size was valued at USD 199.14 million in 2018, increasing to USD 234.89 million in 2024, and is projected to reach USD 373.73 million by 2032, growing at a CAGR of 6.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Quartz Distillation Tower Market Size 2024 |

USD 234.89 million |

| Europe Quartz Distillation Tower Market, CAGR |

6.1% |

| Europe Quartz Distillation Tower Market Size 2032 |

USD 373.73 million |

The Europe Quartz Distillation Tower Market is led by prominent companies such as Raschig GmbH, Montz GmbH, Saint-Gobain, Fenix Process Technologies, HAT International Ltd., Ferrotec, Hoya Corporation, Tosoh Quartz, Inc., Nikon Corporation, and Pall Corporation. These firms focus on precision engineering, advanced materials, and energy-efficient tower designs to serve semiconductor, pharmaceutical, and chemical sectors. They emphasize R&D collaboration and product innovation to enhance system durability and purity performance. Among regions, Germany emerged as the leading market in 2024, commanding 26% of the total share, supported by its strong industrial infrastructure, high R&D investment, and leadership in process automation and material science.

Market Insights

- The Europe Quartz Distillation Tower Market grew from USD 199.14 million in 2018 to USD 234.89 million in 2024 and is projected to reach USD 373.73 million by 2032, expanding at a 6.1% CAGR.

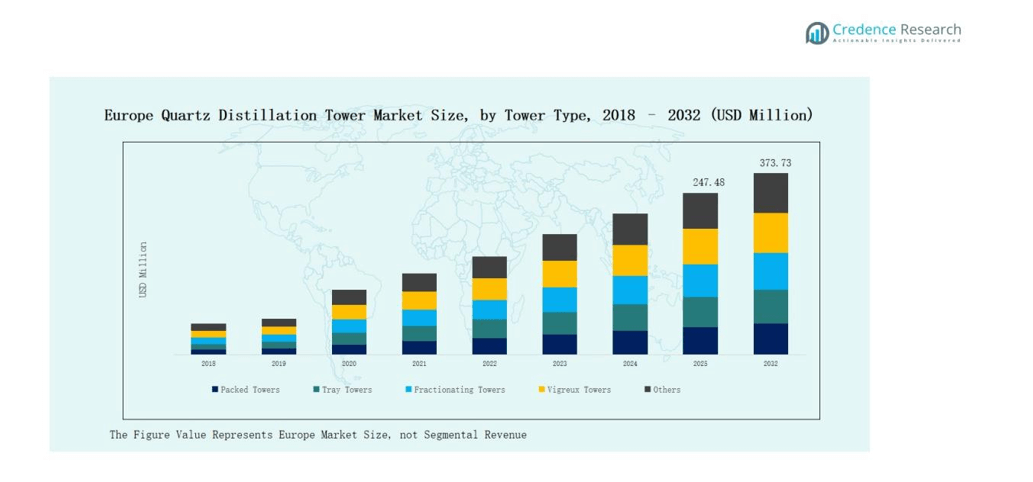

- Packed Towers led the market with a 34.7% share in 2024, driven by high efficiency, low pressure drop, and strong use in pharmaceutical and chemical industries.

- Vacuum Distillation dominated by distillation type with a 46.2% share, favored for processing heat-sensitive materials and improving energy efficiency in high-purity chemical operations.

- Stainless Steel remained the preferred material, accounting for 51.8% of the 2024 market, supported by its corrosion resistance, thermal strength, and compatibility with quartz components.

- Germany held the leading regional share at 26% in 2024, driven by its advanced process engineering, robust industrial base, and strong R&D ecosystem supporting semiconductor and chemical manufacturing.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

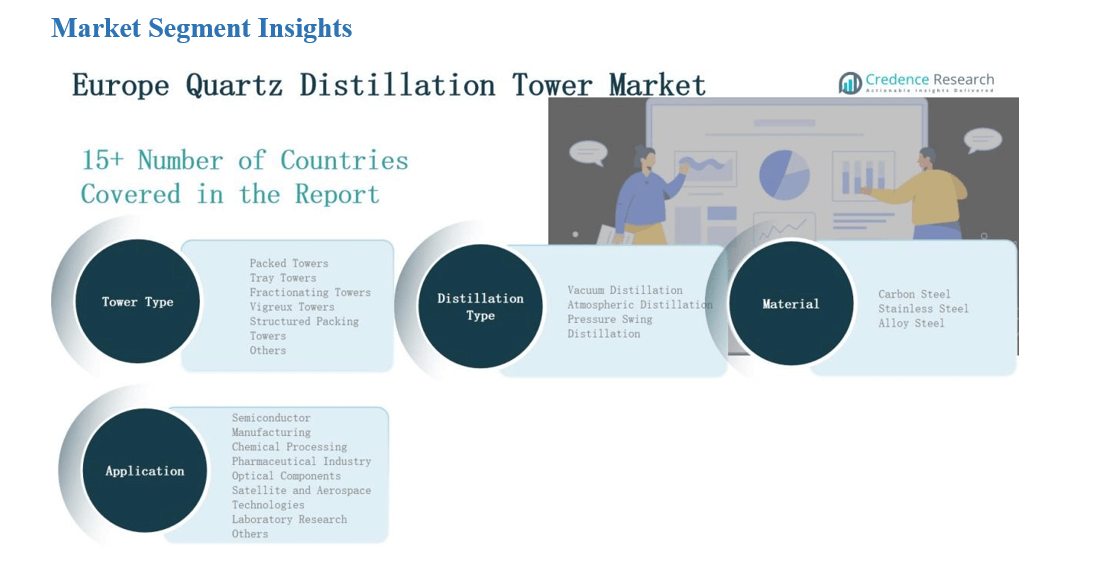

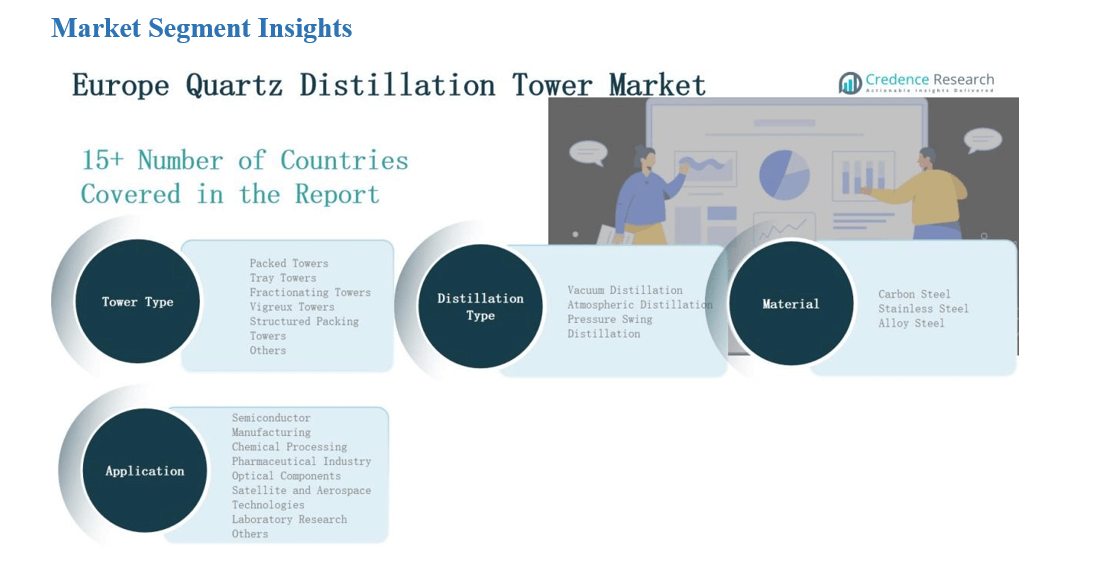

Market Segment Insights

By Tower Type

The Packed Towers segment dominated the Europe Quartz Distillation Tower Market in 2024, accounting for 34.7% of the total share. Its high efficiency, lower pressure drop, and ease of cleaning make it preferred in chemical and pharmaceutical industries. Structured Packing Towers followed closely due to their superior separation performance and lower energy consumption. The growing demand for precision distillation in semiconductor and optical applications supports the adoption of advanced tower designs across Europe.

- For instance, Borosil launched its 3.3kW Vertical All Quartz Double Distillation Unit, demonstrating robust purity standards with a pyrogen-free design and a minimum output of 1.5 liters per hour, used in laboratory and pharmaceutical segment distillations.

By Distillation Type

The Vacuum Distillation segment led the market with a 46.2% share in 2024. It is favored for its ability to process heat-sensitive materials and reduce energy usage. Atmospheric Distillation remained significant for large-scale chemical operations, while Pressure Swing Distillation gained traction in specialized separation processes. The rising focus on high-purity chemical recovery and efficient material processing drives demand for vacuum-based systems.

- For instance, Sulzer introduced the MellapakEvo™ structured packing at ACHEMA 2024 in Frankfurt, delivering up to 40% greater efficiency or 20% higher capacity compared to previous designs, and targeting advanced distillation processes in chemical manufacturing across Europe.

By Material

The Stainless Steel segment held a 51.8% share of the Europe Quartz Distillation Tower Market in 2024. Its superior corrosion resistance, thermal durability, and compatibility with quartz components make it ideal for semiconductor and pharmaceutical applications. Alloy Steel followed, driven by its strength and adaptability in high-temperature operations. Carbon Steel towers retained moderate use in cost-sensitive industries, particularly in chemical and research laboratories requiring reliable yet affordable solutions.

Key Growth Drivers

Expansion of Semiconductor and Optoelectronic Manufacturing

Rising semiconductor production across Germany, France, and the UK drives demand for high-purity quartz distillation towers. These towers ensure contamination-free processing of chemicals and ultrapure water required in wafer fabrication. The shift toward advanced microchips and optoelectronic devices further boosts adoption. Continuous investments in cleanroom infrastructure and chemical vapor purification systems strengthen market growth across Europe’s high-tech manufacturing hubs.

- For instance, SemiMat in Germany produces precision quartz components such as process tubes and wafer carriers, ensuring high purity and reliability for advanced semiconductor manufacturing.

Increasing Focus on Precision Chemical Processing

European chemical producers are investing in high-efficiency distillation systems to improve product purity and reduce waste. Quartz distillation towers offer superior chemical resistance and heat stability, supporting operations in pharmaceuticals and fine chemical manufacturing. Growing regulatory pressure for sustainable and precise separation methods encourages the replacement of conventional metal units with quartz-based systems. This trend aligns with the region’s move toward low-emission and high-yield industrial processes.

- For instance, major suppliers like Borosil Scientific launched new all-quartz double distillation equipment in 2025, specifically engineered for ultra-pure water production with output capacities up to 5 liters per hour and conductivity below 1×10−61×10-6 S/cm, demonstrating their utility in critical laboratory environments.

Rising Demand from Pharmaceutical and Life Sciences Sector

The pharmaceutical industry’s expansion, driven by biologics and sterile manufacturing, has accelerated the adoption of quartz distillation towers. These systems provide exceptional thermal stability and maintain ultra-high purity, ensuring safe solvent recovery and chemical separation. The EU’s focus on boosting domestic drug production and supply chain resilience supports installation in research facilities and production plants. Increasing R&D expenditure in life sciences continues to enhance long-term market potential.

Key Trends & Opportunities

Shift Toward Energy-Efficient Tower Designs

Manufacturers are developing structured packing and hybrid quartz towers to minimize energy use and pressure drops. These systems enhance throughput while maintaining purity standards essential in electronics and chemical industries. Adoption of automation, digital sensors, and process monitoring is improving operational reliability. This trend reflects Europe’s commitment to sustainability and carbon reduction targets, encouraging process optimization across distillation operations.

- For instance, Alfa Laval deployed its digital monitoring platform, Optimyze™, to enhance heat‑transfer efficiency and cut energy usage in tower operations.

Integration of Advanced Materials and Coatings

Research efforts are focused on combining quartz with advanced coatings to improve chemical resistance and extend service life. Developments in nanocoatings and surface treatment technologies help minimize fouling and enhance heat transfer efficiency. The integration of smart materials and corrosion-proof alloys creates new growth opportunities for specialized applications in aerospace, optics, and biotechnology sectors.

- For instance, Saint-Gobain Quartz recently launched a high-purity quartz substrate featuring a nano-ceramic coating designed for semiconductor production environments, increasing durability against plasma corrosion.

Key Challenges

High Manufacturing and Installation Costs

Quartz distillation towers involve complex fabrication and high-precision assembly, driving up production costs. The need for specialized equipment and custom engineering limits large-scale deployment. Small and mid-sized manufacturers often find it difficult to justify the investment compared to conventional steel systems. This cost barrier restricts adoption, particularly in lower-margin industries and emerging Eastern European markets.

Limited Skilled Workforce and Technical Expertise

Operating and maintaining quartz-based distillation systems require advanced technical knowledge and specialized training. A shortage of skilled professionals across Europe delays installation and increases maintenance costs. Manufacturers face challenges in scaling operations and providing consistent technical support across diverse industrial environments. Expanding workforce training programs and collaboration with research institutes are essential to address this gap.

Competition from Alternative Distillation Technologies

The market faces competition from polymer-lined and hybrid metallic distillation systems offering lower costs and easier fabrication. These alternatives appeal to industries that do not require ultra-high purity levels. Continuous improvements in alloy technology and membrane-based separation also pose a threat. To remain competitive, quartz tower manufacturers must focus on innovation, performance differentiation, and integration of digital control technologies.

Regional Analysis

United Kingdom

The United Kingdom held 21% share of the Europe Quartz Distillation Tower Market in 2024. Strong growth in semiconductor fabrication, optical material processing, and chemical production drives demand for high-purity quartz towers. Government support for advanced materials and clean energy manufacturing supports market expansion. Local research facilities and universities enhance innovation in distillation tower design. Continuous investments in sustainable process technology and pharmaceutical purification further strengthen market penetration. It remains a key hub for precision engineering and material refinement technologies in Europe.

Germany

Germany accounted for 26% share of the regional market in 2024, supported by its robust industrial base and leadership in process engineering. The country’s strong presence in chemical manufacturing and semiconductor equipment production promotes consistent demand for quartz distillation systems. Its engineering expertise, advanced infrastructure, and stringent purity standards enhance adoption across sectors. German manufacturers emphasize energy-efficient and corrosion-resistant tower designs. Industrial clusters in Bavaria and Baden-Württemberg drive regional sales growth through high export activity and R&D collaborations.

France

France represented 18% of the regional share in 2024, driven by expansion in the pharmaceutical, optics, and fine chemical industries. It benefits from strong government initiatives to advance sustainable and high-purity manufacturing technologies. The nation’s growing semiconductor base and optical material research facilities increase adoption of quartz distillation systems. Domestic producers focus on customized solutions for laboratory and industrial operations. It continues to attract investments in quartz processing facilities to meet precision and safety requirements.

Italy

Italy captured 14% share of the Europe Quartz Distillation Tower Market in 2024. The country’s chemical and industrial processing sectors are adopting high-purity quartz equipment to improve product consistency and energy efficiency. Growth in glass, ceramic, and pharmaceutical manufacturing strengthens regional demand. Italian engineering firms focus on compact tower designs for small to mid-scale operations. It benefits from strong export activity across Southern Europe and growing collaboration with international component suppliers.

Spain

Spain held 11% market share in 2024, supported by a growing chemical production base and investment in laboratory research infrastructure. Rising demand from energy, optics, and biotechnology sectors enhances adoption. Local manufacturers focus on affordable yet durable distillation towers for small-scale applications. It benefits from EU-funded modernization projects emphasizing sustainable process technologies.

Rest of Europe

The Rest of Europe, including Russia and other Eastern European countries, accounted for 10% of total regional revenue in 2024. Expanding industrialization and government investment in chemical and material processing sectors support gradual market development. Rising demand for quartz-based purification systems from research institutions and industrial laboratories drives adoption. It remains a developing market with significant potential for future growth through technology transfer and infrastructure investment.

Market Segmentations:

By Tower Type

- Packed Towers

- Tray Towers

- Fractionating Towers

- Vigreux Towers

- Structured Packing Towers

- Others

By Distillation Type

- Vacuum Distillation

- Atmospheric Distillation

- Pressure Swing Distillation

By Material

- Carbon Steel

- Stainless Steel

- Alloy Steel

By Application

- Semiconductor Manufacturing

- Chemical Processing

- Pharmaceutical Industry

- Optical Components

- Satellite and Aerospace Technologies

- Laboratory Research

- Others

By Region

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Competitive Landscape

The Europe Quartz Distillation Tower Market is characterized by moderate consolidation, with a mix of established European manufacturers and global technology providers. Key companies such as Raschig GmbH, Montz GmbH, and Saint-Gobain lead through their expertise in advanced distillation design and material engineering. They focus on precision manufacturing, corrosion-resistant materials, and high-efficiency configurations suited for semiconductor, chemical, and pharmaceutical applications. Fenix Process Technologies, Ferrotec, and Tosoh Quartz, Inc. emphasize R&D partnerships and product customization to meet evolving purity and sustainability standards. Emerging players are expanding capacity and automation to improve productivity and reduce costs. Competitive differentiation relies on energy-efficient operation, design flexibility, and long service life. Continuous investments in digital process control and high-performance quartz components strengthen regional competitiveness. The market shows rising collaboration between European and Asian manufacturers to enhance innovation and expand product availability across high-demand industrial sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Raschig GmbH

- Montz GmbH

- Saint-Gobain

- Fenix Process Technologies

- HAT International Ltd.

- Ferrotec

- Hoya Corporation

- Tosoh Quartz, Inc.

- Nikon Corporation

- Pall Corporation

Recent Developments

- On 12 November 2024, Montz signed a supplier framework agreement with Carbon Clean to supply packing for the modular CycloneCC system.

- In September 2025, Pall Corporation launched Membralox® GP-IC ceramic membrane systems, claiming higher processing efficiency and up to 95% value recovery.

- In July 2025, Ferrotec completed a new ceramic components factory (Ishikawa Factory No. 3) to expand capacity.

- In December 2023, Nikon Corporation released the NSR-S636E ArF immersion lithography scanner, designed to enhance semiconductor manufacturing precision, a process that heavily depends on quartz distillation towers.

Report Coverage

The research report offers an in-depth analysis based on Tower Type, Distillation Type, Material, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-purity distillation systems will rise with expanding semiconductor and optical manufacturing.

- Adoption of energy-efficient and low-emission tower designs will strengthen across European industries.

- Integration of automation and digital monitoring systems will enhance operational control and reliability.

- Pharmaceutical and life sciences applications will remain key drivers of long-term market growth.

- Collaboration between European and Asian manufacturers will increase to improve supply stability and innovation.

- Replacement of conventional steel towers with quartz-based systems will accelerate in high-precision sectors.

- R&D investment will focus on corrosion-resistant coatings and hybrid material combinations.

- Regional governments will promote sustainable manufacturing technologies through funding and regulatory incentives.

- Growth in laboratory and pilot-scale installations will support educational and research-based demand.

- Advancements in modular and compact tower configurations will cater to small and medium industrial facilities.