Market Overview

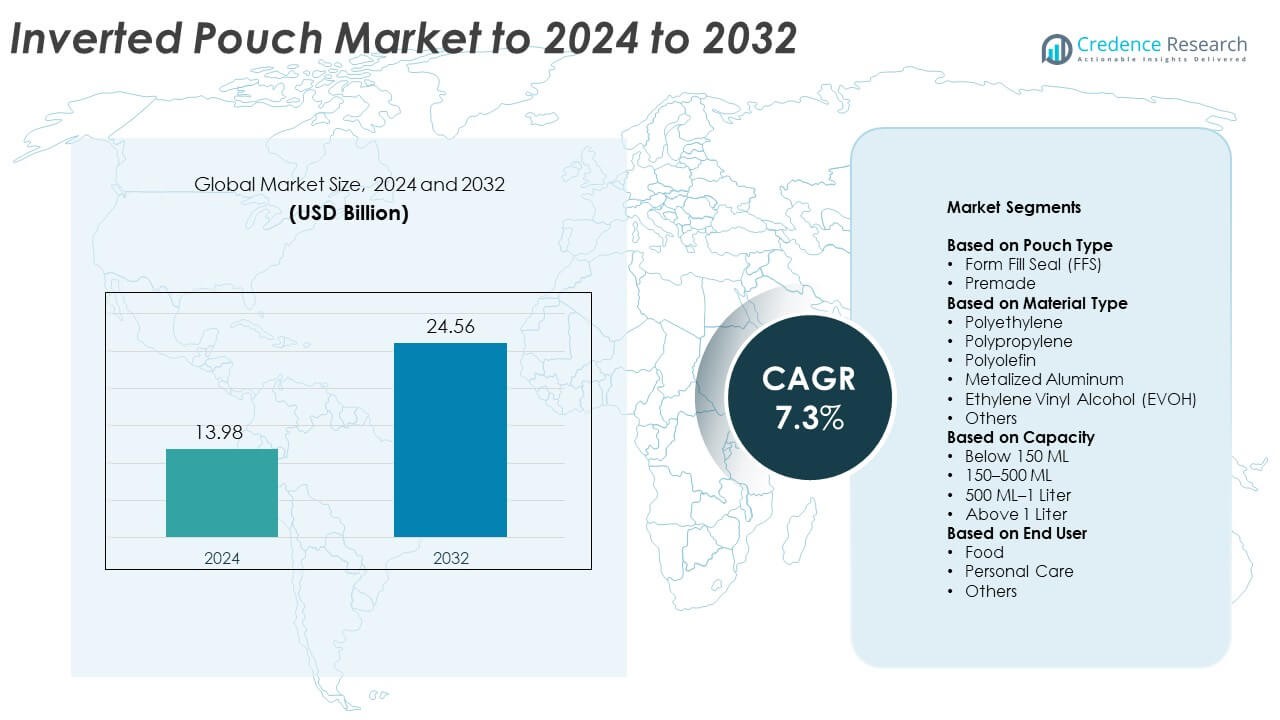

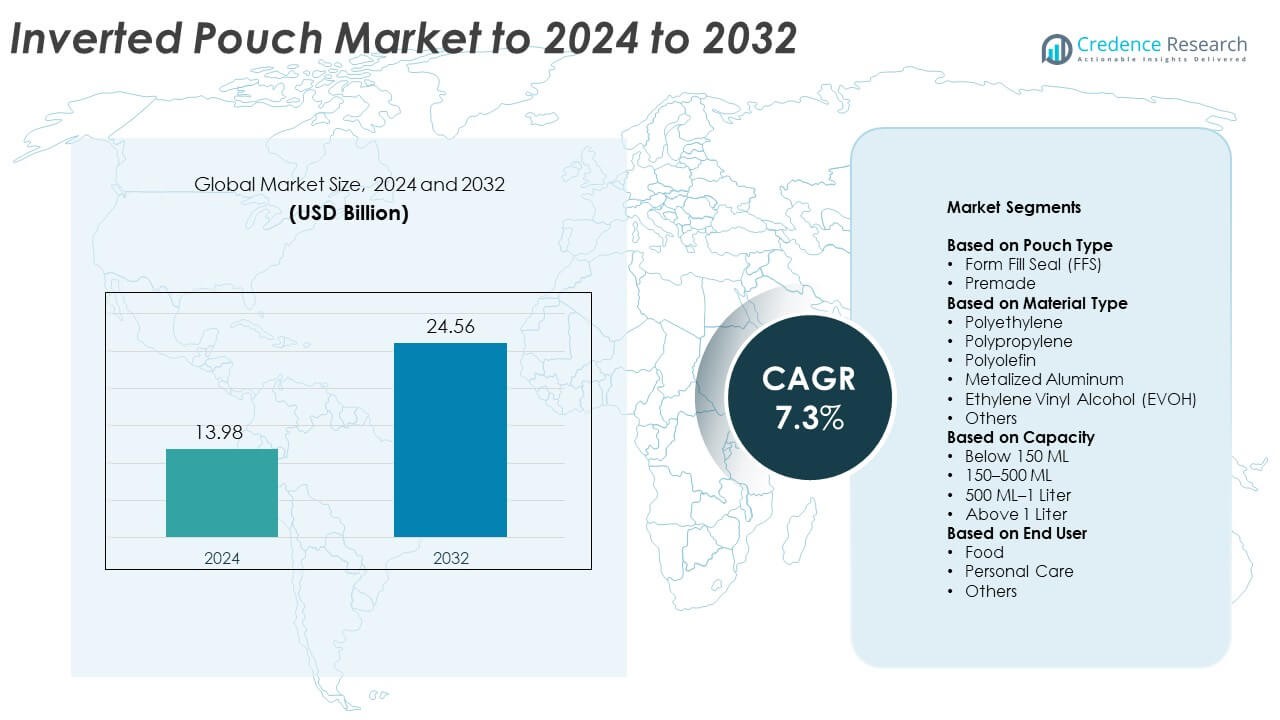

Inverted Pouch Market size was valued USD 13.98 Billion in 2024 and is anticipated to reach USD 24.56 Billion by 2032, at a CAGR of 7.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Inverted Pouch Market Size 2024 |

USD 13.98 Billion |

| Inverted Pouch Market, CAGR |

7.3% |

| Inverted Pouch Market Size 2032 |

USD 24.56 Billion |

The inverted pouch market is shaped by leading players such as Goglio SpA, Mondi, Glenroy Inc., APTAR, Mattpack Inc., Cheer Pack, Constantia, Coveris, and Amcor Plc, each focusing on advanced film structures, improved dispensing systems, and scalable production capabilities. These companies strengthen their positions through investments in recyclable materials, barrier-enhanced laminates, and efficient filling technologies that support food, personal care, and household applications. North America remained the leading region in 2024 with a 34% share, driven by strong retail penetration, wide acceptance of easy-dispense formats, and rapid adoption of sustainable flexible packaging solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The inverted pouch market reached USD 13.98 Billion in 2024 and will reach USD 24.56 Billion by 2032 at a CAGR of 7.3%.

- Strong demand for convenient dispensing in sauces, condiments, and personal care drives adoption, with the 150–500 ML segment holding 41% share in 2024.

- Lightweight and recyclable mono-material pouches gain traction as brands shift from rigid plastics, supported by rising investment in advanced high-barrier films.

- Leading players focus on improved sealing systems, precision filling, and sustainable laminates, while competition intensifies through regional capacity expansion and co-development with FMCG brands.

- North America led in 2024 with 34% share, followed by Europe at 29% and Asia Pacific at 28%, supported by strong retail uptake and growing preference for cost-efficient flexible packaging.

Market Segmentation Analysis:

By Pouch Type

Form Fill Seal (FFS) led the pouch type segment in 2024 with about 58% share. FFS systems gained traction due to high production speed, reduced material waste, and improved sealing accuracy for food, dairy, and personal care products. Brands prefer FFS because it supports efficient mass output and allows faster changeovers for varied SKU sizes. Premade pouches continue to grow as small and premium brands adopt flexible packaging formats for better shelf appeal and lower setup requirements.

- For instance, Tetra Pak’s A3/Speed line fills 15,000 Tetra Brik packs per hour.

By Material Type

Polyethylene dominated the material type segment in 2024 with nearly 46% share. Its strong lead came from durability, flexibility, and high compatibility with liquid and semi-liquid products. Polyethylene also supports heat sealing and offers strong barrier performance when combined with multilayer structures. Polypropylene and EVOH gained steady use as manufacturers focus on improved oxygen resistance and recyclable formats. Metalized aluminum held niche demand in premium applications requiring strong light and moisture barriers.

- For instance, ExxonMobil’s Exceed XP 7021 polyethylene film has a typical dart impact resistance of up to 900 g for a 1 mil (25.4 µm) film; however, in thicker films, such as a 10 mil (250 µm) construction liner application, the dart impact resistance exceeds 2,200 grams, surpassing the Class A standard specification.

By Capacity

The 150–500 ML category held the dominant share in 2024 with about 41%. This capacity range fits everyday consumer products such as sauces, honey, condiments, and personal care items, making it the most widely used format. Manufacturers favor this range because it balances portability, portion control, and cost efficiency. Below 150 ML gained traction in travel-size and single-use packs, while 500 ML–1 liter serves family-size needs. Above 1 liter remained limited to industrial and bulk-use segments.

Key Growth Drivers

Rising Use in Food and Beverage Packaging

Food brands adopt inverted pouches to improve dispensing and reduce product waste. These pouches help consumers use thick items like sauces and spreads with ease. Better product flow supports frequent repeat use and improves customer satisfaction. Brands also choose this format to cut material weight and lower transport load. Strong demand for easy-squeeze packs in retail drives wider adoption across global markets.

- For instance, Coca-Cola lightweighted small PET bottles from 21 grams to 18.5 grams across key drink sizes.

Shift Toward Lightweight and Sustainable Formats

Manufacturers reduce rigid plastic use and prefer flexible pouch formats. Inverted pouches use less material while keeping product safety high. The design supports recyclable structures and helps brands meet eco goals. Many companies switch to mono-material builds that fit recycling systems. This shift supports growth as buyers favor low-waste packaging.

- For instance, Nestlé cut plastic packaging from 1.5 million tons in 2019 to 0.872 million tons by 2024.

Expansion in Personal Care and Household Products

Personal care brands use inverted pouches for lotions, gels, and cleaners. The format offers quick dispensing and better hygiene. Strong growth in refill systems boosts adoption. Brands cut packaging costs while offering a premium experience. Household product makers also shift to this design to support easy use and better shelf presence.

Key Trends and Opportunities

Growth of Refill and Reusable Packaging Models

Refill stations and pouch-to-bottle systems grow across retail channels. Inverted pouches offer strong fit because they reduce plastic use and improve storage. Many brands launch refill packs for soaps, creams, and cleaners. This supports lower carbon output and appeals to environment-focused buyers. Retailers highlight refill packs as part of long-term waste-cut programs.

- For instance, Unilever’s refill stations sold 91,000 litres to about 6,000 customers, saving roughly 6 tonnes of plastic in a year.

Advances in High-Barrier Film Technology

New barrier films protect products against oxygen, moisture, and light. These upgrades help extend shelf life for food and personal care lines. Better barrier control supports the shift from rigid bottles to flexible pouches. High-performance films also help brands maintain flavor, texture, and stability. This creates chances for premium launches and extended product ranges.

- For instance, Amcor’s AmLite Ultra Recyclable laminate achieves oxygen barrier under 0.1 cubic centimetres and moisture under 0.1 grams per square metre per day.

Key Challenges

Recycling Limitations and Material Complexity

Many inverted pouches use multilayer films. These layers are hard to recycle in common waste systems. Limited sorting infrastructure slows sustainable adoption in some regions. Brands face pressure to shift toward mono-material builds. Material changeovers raise cost and require redesign.

Competition From Low-Cost Rigid Packaging

Rigid bottles remain cheaper in some markets. They offer simple processing and wide machine availability. Small brands may choose rigid formats to reduce early investment. This slows pouch replacement in cost-sensitive regions. Manufacturers must compete on efficiency and film savings to stay ahead.

Regional Analysis

North America

North America led the inverted pouch market in 2024 with about 34% share. The region benefits from high adoption in sauces, dressings, condiments, and premium personal care products. Brands prioritize convenient dispensing formats and invest in lightweight packaging to reduce transport load. Major retailers support flexible packaging due to shelf efficiency and waste-reduction goals. Strong demand for recyclable mono-material pouches further strengthens regional growth. The United States drives most sales, followed by Canada, supported by rising uptake in refill packs and sustainable packaging programs across organized retail chains.

Europe

Europe held nearly 29% share in 2024, supported by strict sustainability rules and strong preference for low-waste packaging formats. Countries such as Germany, the U.K., France, and the Netherlands adopt inverted pouches in food, cosmetics, and home-care categories. Brands shift to recyclable structures as the region enforces packaging-waste reduction targets. Consumers prefer compact and easy-dispense packs, which boosts adoption across supermarkets. Growth is also supported by the rise of refill models and brand investments in bio-based and mono-material films. Premium product lines continue to expand, reinforcing steady regional demand.

Asia Pacific

Asia Pacific captured about 28% share in 2024 and showed the fastest growth. Strong demand from packaged food, beauty, and household goods industries drives adoption. Rapid urbanization, rising income, and high consumption of convenient products support market expansion. Countries such as China, India, Japan, and South Korea increase use of inverted pouches due to efficient storage and lower shipping costs. Regional manufacturers invest in cost-effective flexible materials and higher-barrier films. Growing e-commerce also boosts use of lightweight packaging. Sustainability programs in developed markets further push recyclable pouch formats.

Latin America

Latin America accounted for almost 6% share in 2024, driven by growing demand for condiments, dairy items, and personal care products. Brazil and Mexico lead adoption as brands invest in efficient and affordable packaging solutions. Consumers prefer inverted pouches for ease of use and portion control. Local manufacturers shift toward flexible formats to reduce logistics cost and improve product differentiation on store shelves. Expansion of retail chains and rising preference for single-serve packs also support growth. Economic recovery in key markets helps stabilize demand across food and household categories.

Middle East and Africa

Middle East and Africa represented about 3% share in 2024, with gradual growth driven by rising urban consumption and expanding retail networks. Countries in the Gulf region adopt inverted pouches for sauces, honey, and personal care items due to improved dispensing and reduced product waste. Growth in South Africa and Egypt is supported by expanding FMCG brands and regional sourcing of flexible packaging films. Limited recycling infrastructure slows broader adoption of advanced pouch materials, yet demand increases steadily as brands shift to cost-efficient and lightweight formats to reach more consumers.

Market Segmentations:

By Pouch Type

- Form Fill Seal (FFS)

- Premade

By Material Type

- Polyethylene

- Polypropylene

- Polyolefin

- Metalized Aluminum

- Ethylene Vinyl Alcohol (EVOH)

- Others

By Capacity

- Below 150 ML

- 150–500 ML

- 500 ML–1 Liter

- Above 1 Liter

By End User

- Food

- Personal Care

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Goglio SpA, Mondi, Glenroy Inc., APTAR, Mattpack Inc., Cheer Pack, Constantia, Coveris, and Amcor Plc lead the competitive landscape of the inverted pouch market. These companies focus on high-barrier films, advanced dispensing closures, and lightweight pouch structures to meet rising demand for convenient and low-waste packaging. Manufacturers invest in improved sealing systems, precision filling, and customized nozzle designs to enhance usability across food, personal care, and household categories. Sustainability drives major upgrades as firms shift toward recyclable mono-material builds and chemical-recycling-ready laminates. Partnerships with FMCG brands support large-scale adoption, while regional expansions strengthen supply reliability and reduce logistics costs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Goglio SpA

- Mondi

- Glenroy Inc.

- APTAR

- Mattpack Inc.

- Cheer Pack

- Constantia

- Coveris

- Amcor Plc

Recent Developments

- In 2025, Amcor launched the AmFiber Performance Paper stand-up pouch, a recyclable and paper-based pouch aimed at dry beverage brands to reduce carbon footprint and support sustainability efforts.

- In 2025, Constantia Flexibles expanded its product portfolio with over €100 million invested in global facilities, including advanced pouch solutions.

- In 2025, Goglio continued to innovate in flexible packaging, focusing on sustainable and recycle-ready flexible laminated pouches including multi-layer designs and advanced valve-integrated systems.

Report Coverage

The research report offers an in-depth analysis based on Pouch Type, Material Type, Capacity, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as brands shift from rigid bottles to flexible formats.

- Demand will rise for recyclable mono-material inverted pouches across major industries.

- High-barrier films will gain adoption to improve product protection and shelf life.

- Refill-based packaging models will grow across personal care and home-care categories.

- Automation in pouch filling and sealing will improve output speed and reduce costs.

- E-commerce growth will increase demand for lightweight and durable pouch formats.

- Brands will adopt ergonomic nozzle and cap designs to enhance consumer convenience.

- Regional manufacturers will invest in advanced lamination and coating technologies.

- Sustainability rules will push companies to redesign multilayer structures for recycling.

- Premium food and beauty brands will expand inverted pouch use to improve product appeal.