Market Overview

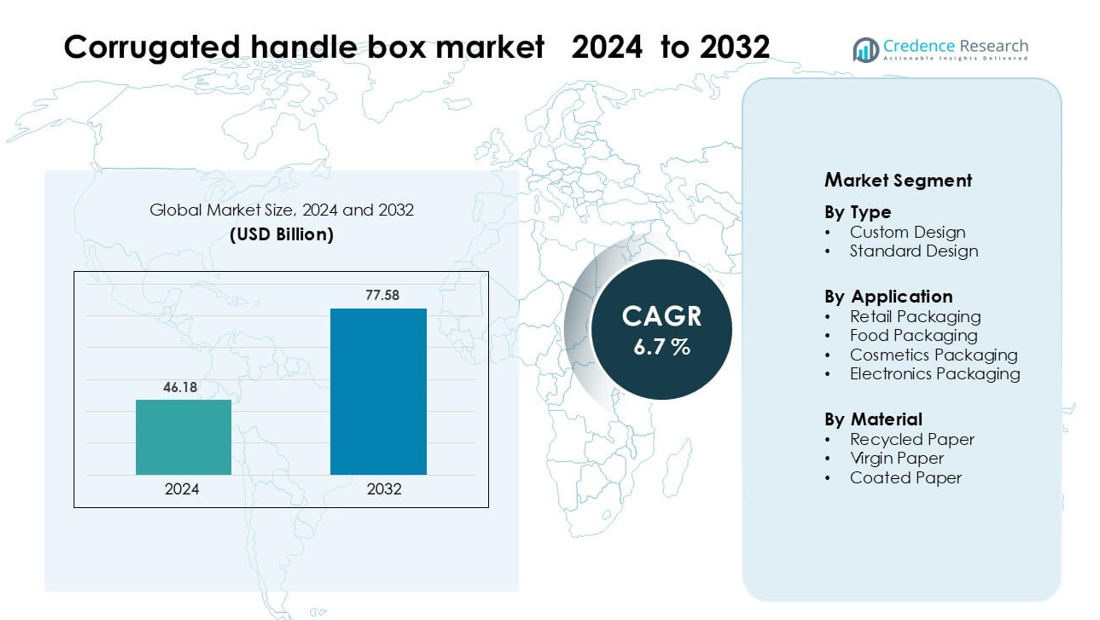

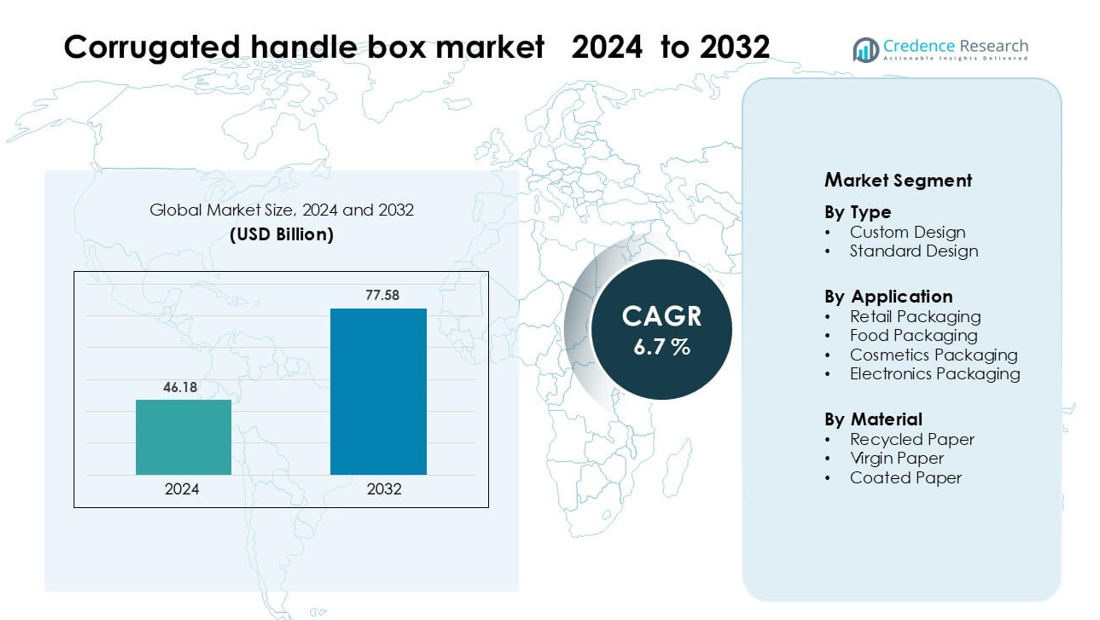

Corrugated handle box market was valued at USD 46.18 billion in 2024 and is anticipated to reach USD 77.58 billion by 2032, growing at a CAGR of 6.7 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Corrugated Handle Box Market Size 2024 |

USD 46.18 billion |

| Corrugated Handle Box Market, CAGR |

6.7% |

| Corrugated Handle Box Market Size 2032 |

USD 77.58 billion |

The corrugated handle box market is shaped by key players such as GWP Group, CBS Packaging, Unicraft, FOREST PACKING GROUP CO., LTD., Riverside Paper Co. Inc., REID Packaging, Guangzhou Bosing Paper Printing and Packaging Co., Ltd., Allen Field Company Inc., WH Skinner, and BR Engineering Plastics Private Limited. These companies compete through custom design capabilities, strong printing quality, and sustainable material use. Asia-Pacific remained the leading region in 2024 with about 41% share, supported by high retail activity, expanding e-commerce, and strong manufacturing capacity. Growing sustainability adoption and rising branding needs continue to strengthen competition across global markets.

Market Insights

- The Corrugated Handle Box Market was valued at USD 46.18 billion in 2024 and is projected to reach USD 77.58 billion by 2032, growing at a CAGR of 6.7 %.

- Strong demand for sustainable packaging drives growth as recycled paper boxes gain wider adoption, supporting the leading recycled material segment holding about 52% share in 2024.

- Custom-designed handle boxes remain the dominant type with nearly 58% share, supported by rising demand for branded, visually appealing, and durable formats across retail and food sectors.

- Competition intensifies among players such as GWP Group and CBS Packaging as companies invest in lightweight designs, improved printing tech, and reinforced handle structures while managing raw material fluctuations.

- Asia-Pacific led with about 41% share in 2024 due to strong retail, food delivery, and e-commerce expansion, followed by North America at 34%, while retail packaging remained the top application segment with nearly 46% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Custom design held about 58% share in 2024 due to strong demand for brand-specific packaging that helps retailers improve shelf impact and product differentiation. Buyers choose custom formats because these boxes support unique dimensions, reinforced handles, and visual branding that boost consumer appeal. Standard design grew at a steady pace as companies with lower budgets preferred ready-made formats for fast procurement. Growth in custom variants also came from rising e-commerce needs, where brands sought durable and personalized packaging solutions.

- For instance, Mondi deployed its high-performance digital printing to produce corrugated boxes for KOMSA, enabling the company to ship up to 35,000 parcels per day with sequential barcodes printed directly on all four sides eliminating the need for separate labels.

By Application

Retail packaging dominated the segment with nearly 46% share in 2024 as stores used handle boxes for apparel, accessories, gifts, and premium goods. This application expanded because retailers needed sturdy, easy-to-carry packaging to enhance customer experience and branding. Food packaging grew quickly as bakeries and takeaway chains adopted corrugated handle boxes for safety and transport ease. Cosmetics and electronics packaging contributed steady demand as brands relied on compact, protective, and visually appealing formats for sensitive products.

- For instance, DS Smith developed its Easy Bowl® corrugated food-contact tray with a double rim that enabled Panvita to convert over 1.6 million trays annually, replacing rigid plastic containers and reducing plastic use significantly.

By Material

Recycled paper led the material segment with around 52% share in 2024 as brands focused on sustainability and cost-efficient packaging. Companies favored recycled grades because they lowered material waste and met rising environmental compliance needs across major markets. Virgin paper held a smaller but steady share where higher strength and print quality were required, especially for premium goods. Coated paper grew in niche uses due to its smooth surface and moisture resistance, supporting cosmetics and electronics packaging.

Key Growth Drivers

Rising Demand or Sustainable and Eco-Friendly Packaging

Sustainability remains a major growth engine for the corrugated handle box market as brands shift toward recyclable and low-impact packaging solutions. Many companies choose corrugated formats because the material reduces environmental load and aligns with global waste-reduction policies. Retailers and food chains steadily replace plastic carry containers with recycled corrugated boxes to meet evolving customer expectations around responsible packaging. This shift encourages higher adoption across apparel, bakery, cosmetics, and premium gift segments. Government regulations promoting biodegradable packaging further support this growth path. The trend strengthens as manufacturers introduce lightweight, durable, and visually enhanced corrugated designs that keep performance strong while maintaining eco-safe properties, boosting long-term demand.

- For instance, Mondi commissioned a recycled containerboard machine at its Duino mill in Italy that can produce 420,000 tonnes of containerboard annually from 100% recovered fibre, enhancing its capacity to supply eco-friendly corrugated solutions.

Expansion of E-Commerce and Omni-Channel Retail

The rapid rise of e-commerce plays a central role in increasing the need for strong, convenient, and branded packaging such as corrugated handle boxes. Online sellers rely on these boxes to enhance unboxing experience, offer easy handling, and ensure secure product delivery. Handle boxes also support hybrid retail formats where consumers buy online and pick up in-store, increasing the demand for durable, transport-friendly packaging. Growth in express delivery and subscription services adds steady volume to this segment. Brands benefit from the large printing surface of corrugated boxes, which helps strengthen identity and improve customer recognition. As global online retail continues its strong upward curve, demand for handle-equipped corrugated packaging grows across electronics, beauty, fashion, and gourmet food categories.

- For instance, Amazon operates more than 50 dedicated packaging labs worldwide, where its Frustration-Free Packaging program tests corrugated designs capable of withstanding up to 26 drop sequences under ISTA-6 standards, helping reduce damage during e-commerce shipments

Rising Use in Foodservice, Bakery, and Premium Retail

Foodservice chains, bakeries, and specialty retailers drive strong adoption because they require sturdy boxes with easy portability for takeaway items, confectionery, and premium goods. Corrugated handle boxes offer higher load-bearing strength, ventilation options, and personalized branding, making them suitable for delicate food and luxury gift products. Growth accelerates as small restaurants, cloud kitchens, and café chains adopt corrugated packaging to improve presentation and minimize leakage or damage. Premium retail brands also favor these boxes due to their ability to support creative shapes, embossing, and coatings. The combination of convenience, strength, and visual appeal expands the market footprint across diverse use cases, strengthening long-term demand.

Key Trend & Opportunity

Advancements in Box Customization and Print Technology

Digital and flexographic printing technologies create major opportunities by enabling brands to personalize corrugated handle boxes with high-quality visuals, QR codes, and product details. Retailers and consumer brands leverage this capability to create premium unboxing experiences and enhance shelf presence. Custom die-cutting, reinforced handles, and ergonomic box formats also support niche uses across cosmetics, electronics, and gourmet food. As manufacturers offer low-minimum-order customization, small businesses gain access to premium branded packaging that was earlier limited to large retailers. This trend unlocks wider adoption, encouraging new product innovation, high-value packaging formats, and stronger competitive differentiation in the market.

- For instance, HP’s PageWide T1195i Press, used by several major corrugated converters, can print at speeds up to 305 meters per minute and supports 1,200-dpi graphics, enabling large-scale production of highly customized corrugated boxes with variable data and branding.

Growing Shift Toward Lightweight and Cost-Optimized Packaging

Brands increasingly prefer lightweight corrugated handle boxes to reduce logistics costs and improve material efficiency. Manufacturers respond by developing thinner yet strong boards, advanced fluting structures, and hybrid paper combinations that maintain durability while reducing weight. This shift opens opportunities for high-volume sectors such as e-commerce, apparel, and food delivery. Lightweight packaging also supports sustainability goals by lowering fiber use and energy consumption during production. Together, these developments create new growth paths for manufacturers that offer efficient, durable, and cost-optimized handle box solutions tailored to diverse industry needs.

- For instance, DS Smith introduced its R-Flute®, designed to be thinner than B-flute while offering up to 15% more box strength per millimetre, allowing brands to optimize packaging weight without compromising durability.

Key Challenge

Fluctuating Costs of Paper and Raw Materials

Volatile prices of recycled paper, virgin fiber, adhesives, and coatings remain a major restraint for market growth. Manufacturers struggle to maintain stable pricing because raw material costs shift due to supply shortages, freight issues, and rising global demand for sustainable packaging. Sudden price spikes can reduce profit margins for small and mid-scale converters, limiting their ability to invest in new designs or advanced machinery. These fluctuations also push end-users to seek cheaper alternatives during economic slowdowns, affecting long-term stability. Managing raw material volatility remains a critical operational challenge for the industry.

Competition from Alternative Packaging Formats

Corrugated handle boxes face competitive pressure from reusable bags, rigid plastic containers, molded pulp carriers, and foldable paperboard boxes. These alternatives often offer lighter weight, lower cost, or better moisture resistance depending on the application. Retailers and food brands sometimes switch to alternative formats when seeking ultra-low-cost or waterproof solutions. Strong competition forces corrugated box manufacturers to innovate constantly, improve coating technologies, and strengthen value-added features such as branding and ergonomics. The need to differentiate against multiple packaging materials becomes a persistent challenge that shapes market strategies and investment priorities.

Regional Analysis

North America

North America held about 34% share in 2024, driven by strong use of corrugated handle boxes across retail, foodservice, and e-commerce sectors. Brands in the United States and Canada favored recyclable packaging as sustainability mandates strengthened. Rising adoption in apparel, bakery, and premium gift packaging supported steady market expansion. E-commerce players used durable handle boxes to improve delivery convenience and branding impact. Growth also came from small businesses choosing customizable formats for enhanced shelf presence. The regional focus on eco-friendly materials and high-quality printing kept demand stable across diverse applications.

Europe

Europe accounted for nearly 29% share in 2024 as strict environmental regulations boosted demand for recyclable corrugated handle boxes. Retailers and FMCG brands adopted recycled paper formats to comply with packaging waste directives. The presence of advanced printing and converting technologies encouraged broader use in cosmetics, gourmet food, and electronics packaging. Germany, France, Italy, and the U.K. led consumption due to strong retail and bakery sectors. Premium brands also preferred coated and custom-designed handle boxes for enhanced branding. Sustainability-driven innovation and regulatory alignment continued to shape the regional market landscape.

Asia-Pacific

Asia-Pacific dominated with approximately 41% share in 2024, supported by rapid expansion in retail, e-commerce, and food delivery services. China, India, Japan, and Southeast Asian markets showed strong adoption as businesses sought cost-efficient and durable packaging. Rising urbanization and growing organized retail chains fueled higher use of corrugated handle boxes for fashion, electronics, and takeaway food. Manufacturers benefited from abundant raw material availability and competitive production costs. Digital printing growth enabled small brands to offer attractive customized packaging. The region remained the fastest-growing due to rising consumer demand and expanding supply capabilities.

Latin America

Latin America captured around 12% share in 2024, driven by rising adoption in retail, bakery, and small business packaging. Brazil and Mexico led the region as demand grew for lightweight and cost-effective corrugated handle boxes. Food delivery services continued to expand, supporting higher consumption of durable takeaway packaging. Economic shifts encouraged brands to move toward recyclable materials as sustainability awareness grew. Limited local manufacturing capabilities in some countries slowed high-end customization, but demand remained steady across apparel, cosmetics, and artisanal product packaging. Growth prospects improved with increasing investment in packaging upgrades.

Middle East & Africa

The Middle East & Africa region held nearly 9% share in 2024 as demand increased from retail chains, confectionery brands, and rising e-commerce activity. The UAE, Saudi Arabia, and South Africa led adoption due to expanding modern trade channels and premium gifting culture. Growing interest in sustainable packaging encouraged gradual transition from plastic carriers to corrugated handle boxes. Foodservice and bakery applications supported consistent usage, especially in urban centers. While customization adoption remained slower than other regions, rising import availability and local production improvements strengthened the market outlook.

Market Segmentations:

By Type

- Custom Design

- Standard Design

By Application

- Retail Packaging

- Food Packaging

- Cosmetics Packaging

- Electronics Packaging

By Material

- Recycled Paper

- Virgin Paper

- Coated Paper

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the corrugated handle box market features a mix of global converters, regional packaging specialists, and custom box manufacturers focused on sustainable, durable, and brand-enhancing solutions. Companies such as GWP Group, CBS Packaging, Unicraft, FOREST PACKING GROUP CO., LTD., and Riverside Paper Co. Inc. strengthen competition through advanced corrugation technology, strong print capabilities, and tailored design services. REID Packaging and Guangzhou Bosing Paper Printing and Packaging Co., Ltd. emphasize customized formats and fast-turnaround production for retail, food, and gift packaging. Allen Field Company Inc., WH Skinner, and BR Engineering Plastics Private Limited expand market reach with specialty handles, reinforced structures, and structural engineering expertise. Competitors invest in eco-friendly materials, digital printing upgrades, and lightweight board innovations to meet rising sustainability expectations and brand-driven customization needs. The market remains moderately fragmented, with companies competing on design versatility, quality, pricing, and supply reliability across global and regional segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- GWP Group

- CBS PACKAGING

- Unicraft

- FOREST PACKING GROUP CO., LTD.

- Riverside Paper Co. Inc.

- REID PACKAGING

- Guangzhou Bosing Paper Printing and Packaging Co., Ltd

- Allen Field Company Inc.

- WH Skinner

- BR Engineering Plastics Private Limited

Recent Developments

- In September 2025, DuPont™ Cyrel® Flexographic Solutions unveiled its new branded DEC-185 flexo plates in India at the IndiaCorr Expo, embedding the DuPont™ Cyrel® logo into the plate base to assure authenticity and help customers avoid counterfeit products. The DEC-185 is a low-to-medium durometer digital plate designed for demanding corrugated board applications, offering strong ink transfer, high exposure resolution, and compatibility with water-based inks.

- In July 2025, UniPack Corrugated announced the acquisition of Congzhou Machinery, marking its entry into the Indian packaging machinery market. The deal establishes “UniPack India,” which will localise manufacturing through two plants for corrugated lines, rolls, and re-fluting services, supported by seven spare-parts hubs and regional sales offices. UniPack also introduced its product ranges—UniCorr lines (Smart, Pro, Giant), finishing equipment (UniPrint, UniCut, UniFold)—alongside a strong support infrastructure offering technical assistance in regional languages, aiming to capture the INR 50,000-crore corrugated packaging sector in India.

- In October 2024, Reid Packaging acquired by TransPak.TransPak announced the acquisition of Reid Packaging (Peachtree Corners / Atlanta area) to expand its East Coast packaging, crating, and corrugated capability a move that strengthens regional capacity for custom corrugated and industrial packaging solutions.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Material and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for sustainable corrugated handle boxes will grow as brands move away from plastic.

- Custom-designed boxes will gain traction as companies prioritize stronger branding and customer appeal.

- E-commerce expansion will increase the need for durable, lightweight, and easy-to-carry packaging.

- Food delivery and bakery chains will adopt reinforced handle boxes to improve transport safety.

- Digital printing will advance, allowing faster customization and better visual quality.

- Recycled paper use will rise as firms align with stricter environmental standards.

- Premium products will drive demand for coated and high-strength handle box designs.

- Automation in converting and printing processes will boost efficiency and reduce production time.

- Small businesses will adopt low-volume custom printing as technology becomes more accessible.

- Emerging markets will experience strong growth due to expanding retail and shifting consumer preferences.