Market Overview

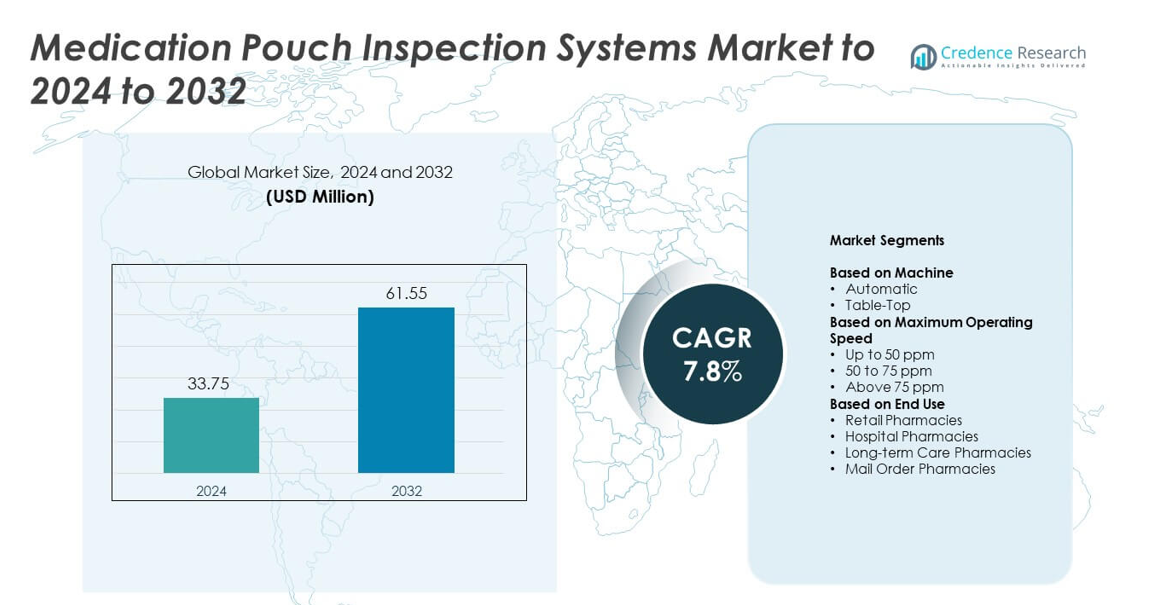

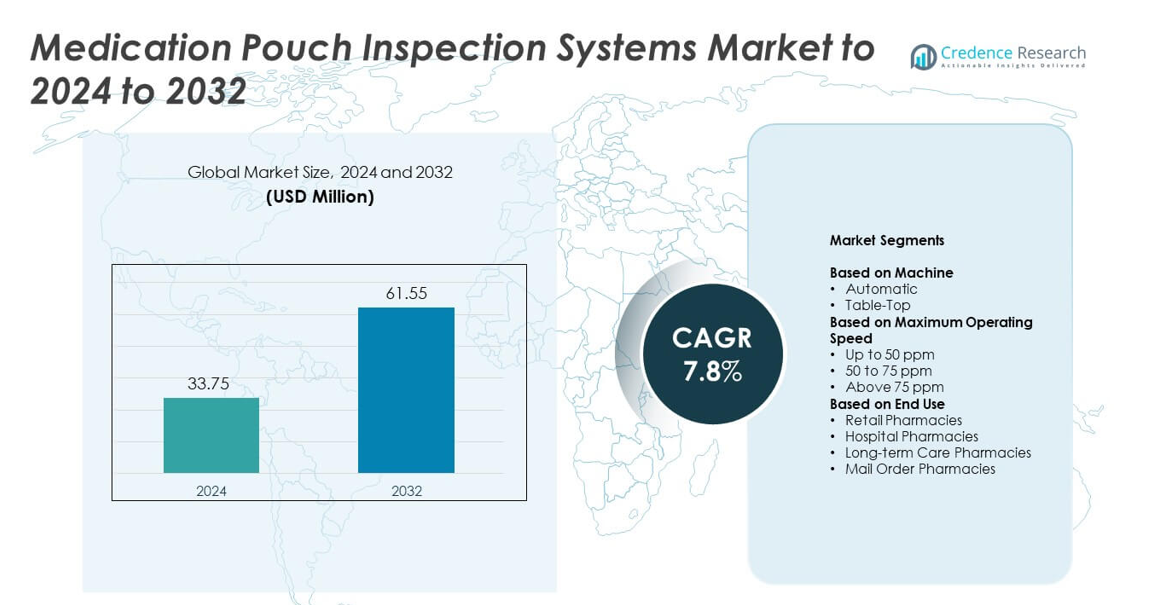

Medication Pouch Inspection Systems Market size was valued at USD 33.75 Million in 2024 and is anticipated to reach USD 61.55 Million by 2032, at a CAGR of 7.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Medication Pouch Inspection Systems Market Size 2024 |

USD 33.75 Million |

| Medication Pouch Inspection Systems Market, CAGR |

7.8% |

| Medication Pouch Inspection Systems Market Size 2032 |

USD 61.55 Million |

4The Medication Pouch Inspection Systems Market is shaped by leading companies including Gerresheimer, JVM, Global Factories, ARxIUM, Jones Healthcare Group, PTI, Parata Systems, TCGRx, Nireco, and ZiuZ Holding. These players compete through high-speed inspection technology, AI-based accuracy improvements, and integration with automated dispensing systems. Product upgrades focus on reducing medication errors and supporting large-volume pharmacy operations. North America led the global market in 2024 with about 38% share, driven by strong automation adoption across retail chains, long-term care facilities, and centralized fill centers. Europe followed with nearly 29% share, supported by strict medication safety standards and expanding digital pharmacy infrastructure.

Market Insights

- The Medication Pouch Inspection Systems Market reached USD 33.75 Million in 2024 and is projected to hit USD 61.55 Million by 2032, growing at a CAGR of 7.8%.

- Market growth is driven by rising adoption of multi-dose pouch packaging, expanding pharmacy automation, and increasing focus on medication safety across long-term care and hospital pharmacies, where long-term care held about 41% share in 2024.

- AI-enabled inspection, high-speed verification units, and compact modular systems form key trends as pharmacies modernize workflows to handle higher prescription volumes with improved accuracy.

- The competitive landscape features strong innovation in high-speed and AI-powered systems, along with integration upgrades that support centralized fill operations and advanced dispensing environments.

- North America led the market with about 38% share in 2024, followed by Europe at nearly 29% and Asia Pacific at around 23%, driven by expanding automation and rising chronic disease-related prescription loads.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Machine

Automatic systems dominated the Medication Pouch Inspection Systems Market in 2024 with about 67% share. Automated units gained strong traction because pharmacies sought higher accuracy, faster output, and reduced manual checks. Large chains and hospital networks preferred these systems due to reliable error detection and seamless link with dispensing workflows. Table-top units grew at a steady pace as smaller pharmacies adopted compact systems for basic verification needs, but their market share remained lower because they offer limited throughput and fewer advanced inspection features.

- For instance, BD’s BD Rowa Vmax automated pharmacy robot has a documented stock input capacity of 150–200 packs per hour for rectangular packs, according to its official technical brochure.

By Maximum Operating Speed

The above 75 ppm category led the segment in 2024 with nearly 49% share. High-speed systems supported large-volume prescription handling and ensured faster verification for multi-dose pouch packaging. Pharmacies processing thousands of pouches per hour selected these models to reduce bottlenecks and improve medication safety. The 50 to 75 ppm range showed healthy growth among mid-sized pharmacies, while the up to 50 ppm category remained relevant for smaller facilities with lower daily pouch output and limited automation needs.

- Parata’s pouch inspection solution, the BD Parata InspectRx™2 Pouch Inspector, has a base transport speed of up to 5,000 pouches per hour. An optional add-on, the Collector unit, enables an upgrade to a high-speed capacity of 12,000 pouches per hour to accommodate increased production demand

By End Use

Long-term care pharmacies held the dominant position in 2024 with about 41% share. These facilities rely heavily on multi-dose pouch packaging to support adherence programs for chronic-care patients, driving significant demand for advanced inspection systems. Hospital pharmacies followed due to rising inpatient medication volumes and stricter quality compliance needs. Retail pharmacies and mail-order pharmacies also expanded adoption as they shifted toward automated medication management to enhance accuracy, cut dispensing errors, and streamline high-volume prescription fulfillment.

Key Growth Drivers

Rising Adoption of Multi-Dose Pouch Packaging

Demand increased as pharmacies used multi-dose pouches to improve patient adherence and reduce medication errors. Healthcare facilities relied on these formats for chronic disease management and long-term care settings, which pushed pharmacies to adopt faster and more accurate inspection systems. Growing prescription volumes and higher focus on safety standards supported wider installation of automated pouch verification units across retail, mail-order, and hospital pharmacies.

- For instance, TCGRx disclosed that it has installed over 700 automated pouch-packaging systems, and one ATP 2 deployment was described as handling about 260,000 medication doses per month into roughly 50,000 pouches, underlining real-world multi-dose pouch volumes.

Strict Medication Safety and Compliance Requirements

Regulatory focus on error reduction encouraged pharmacies to implement advanced inspection systems. Healthcare providers strengthened quality checks to meet safety guidelines for dispensing accuracy, especially in settings where multi-dose packaging is common. Automated inspection systems helped reduce human error and supported digital traceability, which made them essential for pharmacies aiming to meet rising compliance benchmarks and improve patient outcomes.

- For instance, a study on Swisslog’s PillPick unit-dose robot reported that the system packed 377 unit doses per hour and dispensed 537 unit doses per hour, demonstrating industrial-scale, controlled packaging and dispensing performance for safety-focused hospitals

Expansion of Large-Scale Pharmacy Automation

Major pharmacy chains and long-term care facilities expanded automation to handle high prescription loads. These organizations invested in high-speed inspection units to improve throughput and cut operational delays. Integration with automated dispensing machines improved workflow efficiency and reduced manual handling, encouraging broader adoption. Growth in centralized fill centers further boosted demand for high-capacity inspection solutions across regional pharmacy networks.

Key Trends & Opportunities

Growth of AI-Enabled Inspection Capabilities

AI-based systems gained momentum as pharmacies looked for greater accuracy in detecting packaging defects, missing pills, and labeling issues. Machine learning features improved real-time error identification and reduced false alarms. Vendors leveraged data analytics to enhance decision-making in pharmacy workflows, creating opportunities for more advanced, predictive inspection models. The shift toward intelligent automation supported wider use across large-volume dispensing settings.

- For instance, RxSafe’s RapidPakRx adherence strip packager uses an integrated machine-vision verification workflow and can fill a 30-day supply of multi-med pouches in under 10 minutes, according to RxSafe’s published FAQs and buyer guidance.

Rising Demand for High-Speed and Compact Systems

Pharmacies handling large prescription volumes sought faster inspection units to reduce bottlenecks in pouch verification. High-speed designs helped optimize daily operations in centralized fill models, while compact inspection systems opened growth avenues for smaller pharmacies with limited space. Manufacturers responded by offering modular systems that balanced accuracy, footprint efficiency, and scalability. This created strong opportunities in both urban and rural pharmacy environments.

- For instance, ScriptPro’s SP 200 robotic dispensing system, designed as a compact unit, is specified to fill, label, and deliver up to 150 prescriptions per hour and to hold 200 universal dispensing cells, combining high throughput with a relatively small footprint.

Increasing Adoption in Long-Term and Home-Care Settings

A rise in chronic diseases increased the need for consistent medication adherence support. Long-term care pharmacies expanded multi-dose pouch dispensing, opening opportunities for advanced inspection systems. Growth in home-care programs encouraged adoption of reliable pouch packaging to support elderly patients. Vendors benefited as more healthcare providers integrated automated inspection into broader medication management solutions.

Key Challenges

High Initial Investment and Integration Complexity

Many pharmacies faced financial barriers due to high upfront installation costs for advanced inspection systems. Integration with existing dispensing workflows, software platforms, and automation lines increased project complexity. Smaller pharmacies often delayed adoption due to limited budgets and concerns about operational disruption. These factors slowed penetration in cost-sensitive markets despite long-term efficiency benefits.

Limited Skilled Workforce for Automated Systems

Operating and maintaining advanced inspection units required trained staff, which many pharmacies lacked. Workforce gaps created challenges in achieving smooth system operation and handling technical issues. Training programs remained inconsistent, especially in small and mid-sized pharmacies. This reduced the pace of technology adoption and increased dependence on vendor support, slowing wider deployment across diverse pharmacy environments.

Regional Analysis

North America

North America held the largest share of the Medication Pouch Inspection Systems Market in 2024 with about 38%. Growth remained strong as retail chains, long-term care facilities, and centralized fill centers expanded automation to improve medication accuracy and reduce dispensing errors. Hospitals increased adoption to meet strict compliance standards and support rising inpatient prescription volumes. Strong presence of advanced automation vendors, along with rapid integration of AI-based verification systems, helped reinforce regional leadership. Mail-order pharmacies also invested heavily in high-speed inspection units to support large-scale prescription fulfillment.

Europe

Europe accounted for nearly 29% share in 2024, supported by strong use of automated pharmacy technologies across hospital and retail networks. Medication safety regulations and standardized dispensing practices drove higher installation of inspection systems. Long-term care organizations expanded multi-dose pouch adoption to support chronic patient needs, further boosting demand. Countries with advanced healthcare infrastructure invested in high-speed systems to improve accuracy and reduce operational workload. Growth also came from rising digitalization of pharmacy workflows and broader adoption of centralized dispensing models.

Asia Pacific

Asia Pacific held around 23% share in 2024 and recorded the fastest growth due to expanding pharmacy automation across China, Japan, South Korea, and Australia. Rapid rise in chronic disease cases increased reliance on multi-dose pouch packaging, especially in elderly-care settings. Large hospital networks modernized their dispensing systems to reduce manual handling and improve safety. Regional pharmacies adopted compact and mid-capacity inspection units to manage growing prescription volumes. Government support for digital healthcare transformation further strengthened adoption across emerging markets.

Latin America

Latin America captured roughly 6% share in 2024, driven by gradual adoption of automated dispensing technologies across urban hospital networks and select retail pharmacy chains. Countries such as Brazil and Mexico increased investment in medication safety tools to reduce prescription errors. Growth remained moderate due to budget constraints in smaller pharmacies, but centralized dispensing facilities expanded use of inspection systems to handle high drug volumes. Rising focus on digital health and modernization of pharmacy workflows continued to support market expansion.

Middle East and Africa

Middle East and Africa held about 4% share in 2024, supported by growing automation in hospital pharmacies across the Gulf region. Large healthcare facilities adopted high-accuracy inspection systems to strengthen quality assurance and reduce manual verification time. Adoption in Africa remained slower due to limited infrastructure, but private hospitals and specialty pharmacies showed rising interest in automated pouch packaging. Investment in digital health programs and modernization of pharmacy services helped drive gradual market penetration across both public and private sectors.

Market Segmentations:

By Machine

By Maximum Operating Speed

- Up to 50 ppm

- 50 to 75 ppm

- Above 75 ppm

By End Use

- Retail Pharmacies

- Hospital Pharmacies

- Long-term Care Pharmacies

- Mail Order Pharmacies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Medication Pouch Inspection Systems Market features key players such as Gerresheimer, JVM, Global Factories, ARxIUM, Jones Healthcare Group, PTI, Parata Systems, TCGRx, Nireco, and ZiuZ Holding. The competitive landscape continued to advance through strong emphasis on automation, higher detection accuracy, and integration with large-scale dispensing workflows. Vendors focused on enhancing AI-driven inspection capabilities to reduce human error and streamline pouch verification. Product portfolios expanded through the launch of high-speed systems designed for centralized fill centers and long-term care pharmacies. Companies also invested in compact units to support smaller pharmacies seeking low-footprint automation. Strategic moves included software upgrades, workflow optimization tools, and improved connectivity with pharmacy management systems. Growing demand for scalable solutions encouraged manufacturers to offer modular platforms suitable for diverse prescription volumes and operational needs across global markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Gerresheimer

- JVM

- Global Factories

- ARxIUM

- Jones Healthcare Group

- PTI

- Parata Systems

- TCGRx

- Nireco

- ZiuZ Holding

Recent Developments

- In 2025, Parata Systems, a BD company, launched the enhanced InspectRx™2 Pouch Inspector.

- In 2024, Gerresheimer Successfully completed the acquisition of the Bormioli Pharma Group, a move expected to expand their product portfolio for high-value plastic solutions and glass manufacturing capabilities relevant to pharmaceutical packaging.

- In 2024, the Jones Healthcare Group launched a new line of smart adherence packages that utilizes technology to monitor medication usage and enhance patient engagement.

Report Coverage

The research report offers an in-depth analysis based on Machine, Maximum Operating Speed, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as pharmacies increase automation to manage rising prescription loads.

- AI-driven inspection features will improve accuracy and reduce false error alerts.

- High-speed systems will gain wider adoption in centralized fill and mail-order pharmacies.

- Compact and modular inspection units will grow in demand among small and mid-sized pharmacies.

- Long-term care facilities will continue driving strong usage due to chronic patient needs.

- Integration with advanced dispensing robots will streamline full pharmacy workflows.

- Cloud-based analytics will support better tracking of medication accuracy and system performance.

- Global vendors will invest in smarter software to optimize real-time decision-making.

- Adoption will increase in emerging regions as healthcare digitalization progresses.

- Focus on patient safety will continue to push pharmacies toward automated inspection technologies.