Market Overview

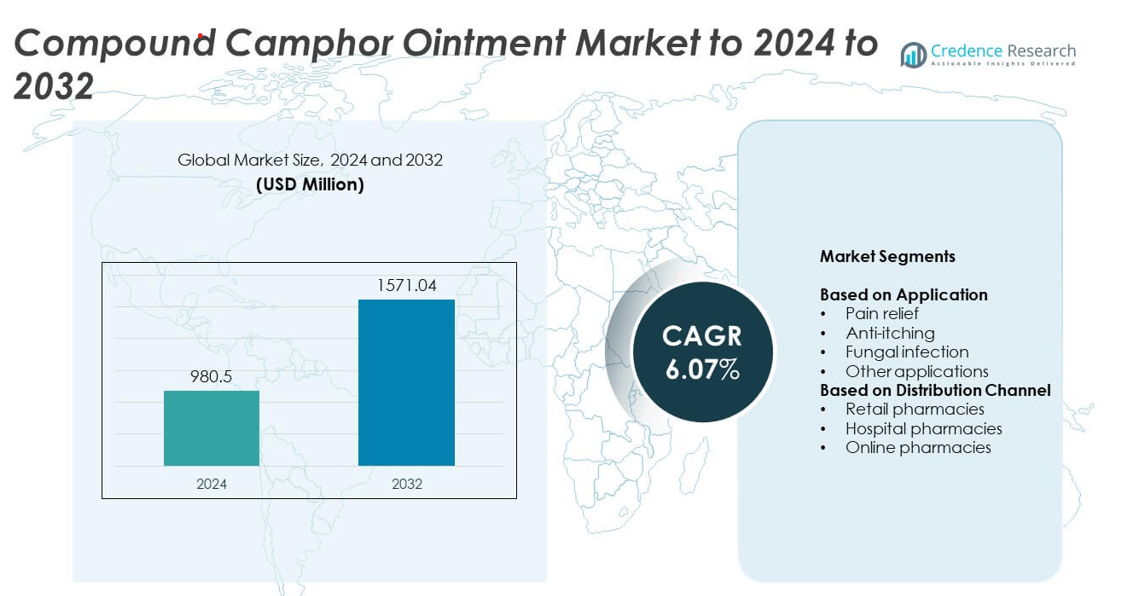

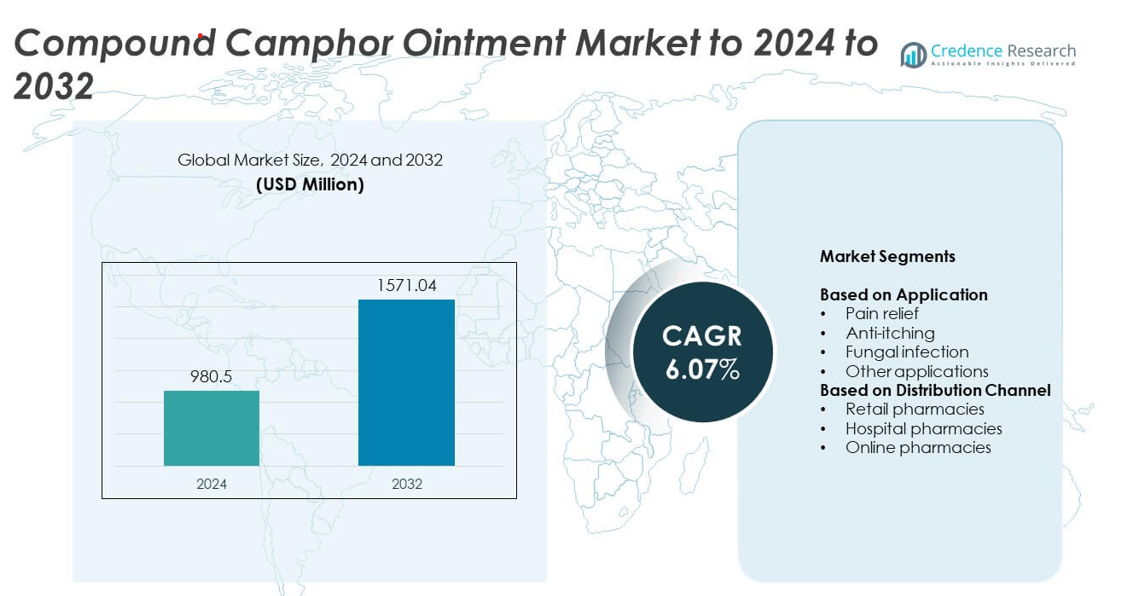

The Compound Camphor Ointment market size was valued at USD 980.5 million in 2024 and is projected to reach USD 1,571.04 million by 2032, growing at a CAGR of 6.07% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Compound Camphor Ointment Market Size 2024 |

USD 980.5 million |

| Compound Camphor Ointment Market, CAGR |

6.07% |

| Compound Camphor Ointment Market Size 2032 |

USD 1,571.04 million |

The Compound Camphor Ointment market is driven by major players such as Amrutanjan Health Care, Vi-Jon Laboratories, McKesson Canada, Sanjiu Medical & Pharmaceutical, DLC Laboratories, GHC Group, Delon Laboratories, Cigna, and Vicks. These companies compete through product innovation, expanded retail presence, and strong brand positioning across both developed and emerging markets. Their focus on fast-acting, skin-friendly formulations and strategic distribution through pharmacies and online platforms strengthens market reach. North America leads the global market with a 34% share in 2024, supported by high consumer awareness, strong healthcare infrastructure, and broad availability of over-the-counter camphor-based ointments.

Market Insights

- The Compound Camphor Ointment market was valued at USD 980.5 million in 2024 and is projected to reach USD 1,571.04 million by 2032, growing at a CAGR of 6.07%.

- Rising cases of arthritis, muscle strain, and skin infections drive demand for camphor-based topical products, supported by growing consumer preference for non-invasive pain relief solutions.

- Increasing adoption of natural and herbal formulations, coupled with the rise of e-commerce platforms, is shaping new market trends and expanding product accessibility.

- The market is competitive, with key players focusing on innovation, quality enhancement, and strategic partnerships to strengthen distribution and brand presence across global regions.

- North America led with a 34% share in 2024, followed by Europe at 28% and Asia-Pacific at 25%, while the pain relief segment dominated with 48% share, reflecting strong consumer preference for effective muscle and joint pain treatments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Application

Pain relief accounted for the largest share of about 48% in the Compound Camphor Ointment market in 2024. Its dominance is driven by widespread use in treating muscle soreness, joint pain, and arthritis-related discomfort. The ointment’s ability to stimulate nerve endings and improve blood circulation enhances pain relief efficiency. Rising cases of musculoskeletal disorders and sports-related injuries continue to strengthen this segment. Anti-itching and fungal infection applications are growing steadily due to increased skin sensitivity issues and rising demand for multi-purpose dermatological formulations.

- For instance, Amrutanjan Relief Pain Balm’s label lists camphor 10%, menthol 8%, and methyl salicylate 14% per 100 g.

By Distribution Channel

Retail pharmacies held the dominant share of nearly 52% in 2024, driven by strong consumer accessibility and trust in over-the-counter availability. These outlets offer a wide range of topical analgesics and skin care ointments, making them the preferred purchase point for customers seeking immediate relief products. Hospital pharmacies follow as the second-largest channel, supported by physician-prescribed usage for post-treatment care. Online pharmacies are gaining traction as digital health platforms expand and consumers shift toward convenient, home-based product delivery options, particularly in urban regions.

- For instance, as of the fiscal year ending March 31, 2025, Apollo Pharmacy added a net of 596 new stores. This brought its total count to 6,626 outlets across India.

Key Growth Drivers

Rising Incidence of Muscle and Joint Disorders

The growing prevalence of arthritis, back pain, and muscle strain is a major driver for the Compound Camphor Ointment market. Increasing physical strain from sedentary work and sports-related injuries fuels demand for topical analgesics. Camphor-based formulations provide fast relief and improved mobility without oral medication side effects. The aging population, particularly in developed regions, further supports growth as individuals seek non-invasive, easily accessible pain management solutions.

- For instance, Haw Par’s Tiger Balm reports presence in about 100 countries, signaling sustained global pain-relief demand.

Expanding Use in Dermatological Treatments

Camphor ointments are increasingly used for anti-itching and fungal infection relief, expanding their medical relevance. Rising awareness of skin hygiene and the growing number of dermatological conditions drive product adoption. Pharmaceutical advancements have enhanced camphor’s formulation stability and safety profile, boosting its acceptance among healthcare professionals. The preference for natural, multi-purpose ointments also strengthens this segment, especially in markets emphasizing herbal and over-the-counter products.

- For instance, Glenmark’s dermatology line lists multiple antifungals and steroid-combos with defined strengths, such as the 2% sertaconazole cream and 1% clotrimazole variants.

Strong Retail and E-Commerce Distribution Network

The expansion of retail and online pharmacy networks significantly supports market growth. Consumers prefer easily available topical products with trusted brand recognition, encouraging frequent purchases. E-commerce platforms provide accessibility and discounted pricing, attracting younger and urban populations. Additionally, the growing presence of pharmaceutical retail chains across emerging economies enhances product reach and awareness, particularly in developing regions with improving healthcare infrastructure.

Key Trends & Opportunities

Shift Toward Natural and Herbal Formulations

Consumers are increasingly favoring camphor ointments formulated with natural and herbal ingredients. This trend aligns with the broader movement toward clean-label, plant-based healthcare products. Manufacturers are developing formulations combining camphor with menthol, eucalyptus, or clove oils to improve efficacy and aroma. The rise of alternative medicine practices such as Ayurveda and aromatherapy further encourages the integration of camphor in natural treatment products, creating strong opportunities for innovation and differentiation.

- For instance, Himalaya’s Rumalaya Pain Balm (also sold as Pain Balm Strong) contains six key botanical oils and nutmeg, including wintergreen oil (Gandhapura), mint oil (Pudina), eucalyptus oil (Tailapatra), and camphor (Karpura), and is sold in 45 g packs. The balm also contains pine oil (Sarala) and nutmeg (Jatiphala).

Rising Online Sales and Telemedicine Integration

The digitalization of healthcare has opened new opportunities for camphor ointment sales. Online pharmacies and teleconsultation services allow consumers to access prescriptions and purchase products conveniently. Companies are enhancing digital marketing efforts and partnering with health e-commerce platforms to expand product visibility. This shift not only reduces distribution costs but also enables personalized recommendations and subscription-based sales models, strengthening long-term consumer engagement.

- For instance, in 2023, Practo reported that 90% of its online consultations were conducted via video. In addition, over 20 million digital appointments were managed on the platform in 2023.

Key Challenges

Regulatory and Safety Compliance Issues

Stringent regulations concerning ingredient concentrations and labeling standards pose challenges for manufacturers. Excessive camphor content may cause toxicity, leading to strict monitoring by health authorities. Complying with varying regional standards for topical analgesics adds complexity to global market operations. Companies must invest in quality assurance, clinical validation, and transparent labeling to ensure product safety and maintain consumer trust.

Rising Competition from Alternative Therapies

The growing popularity of herbal balms, pain relief patches, and non-camphor-based products presents a key challenge. Consumers seeking faster results or milder formulations may shift toward alternatives like menthol or diclofenac-based creams. Price-sensitive markets also experience competition from local and generic brands. To stay competitive, major players must focus on innovation, brand differentiation, and effective marketing strategies that highlight the proven benefits of camphor ointments.

Regional Analysis

North America

North America held the largest share of around 34% in the Compound Camphor Ointment market in 2024. High consumer awareness of topical pain relief products and strong retail pharmacy networks drive regional dominance. The prevalence of arthritis, sports injuries, and dermatological issues supports steady product demand. Major pharmaceutical companies continue investing in advanced formulations and marketing campaigns to increase brand visibility. The U.S. leads regional growth, while Canada shows rising adoption due to increased access to over-the-counter camphor-based ointments through expanding e-commerce and retail distribution channels.

Europe

Europe accounted for about 28% of the Compound Camphor Ointment market in 2024. The region benefits from an aging population and strong healthcare systems promoting topical pain and skin relief solutions. Consumer preference for herbal and natural products supports market expansion in countries such as Germany, France, and the United Kingdom. Stringent quality regulations have led to greater trust in branded formulations, enhancing demand consistency. Increasing cases of muscle and joint pain among elderly populations and professional athletes further strengthen the European market for camphor-based ointments.

Asia-Pacific

Asia-Pacific captured nearly 25% of the Compound Camphor Ointment market share in 2024. Rising population, increasing disposable income, and growing reliance on traditional medicine drive demand across China, India, and Japan. Expanding pharmaceutical manufacturing and the availability of herbal-based camphor ointments support regional dominance. Rapid urbanization and improved healthcare infrastructure also encourage adoption among younger consumers. Local players are leveraging Ayurveda and traditional Chinese medicine concepts to introduce cost-effective, multi-functional ointments, contributing to strong market penetration and sustained growth in both developed and emerging economies.

Latin America

Latin America represented around 8% of the Compound Camphor Ointment market in 2024. Expanding access to over-the-counter healthcare products and rising awareness of pain relief ointments drive growth. Brazil and Mexico dominate regional sales, supported by increasing healthcare spending and consumer interest in natural and affordable remedies. The growing prevalence of muscle strain and fungal infections among active populations fuels steady demand. However, limited brand presence and uneven distribution networks restrain faster market expansion, prompting key manufacturers to strengthen retail partnerships and promotional strategies.

Middle East & Africa

The Middle East & Africa region held approximately 5% of the Compound Camphor Ointment market share in 2024. Growing healthcare access, urbanization, and consumer awareness are gradually boosting product demand. Gulf Cooperation Council countries, including Saudi Arabia and the UAE, lead regional adoption due to expanding retail pharmacy networks and increasing preference for imported pharmaceutical products. In Africa, rising awareness of self-medication practices supports gradual market growth. However, limited product availability and lower purchasing power in several regions continue to challenge widespread adoption of camphor ointments.

Market Segmentations:

By Application

- Pain relief

- Anti-itching

- Fungal infection

- Other applications

By Distribution Channel

- Retail pharmacies

- Hospital pharmacies

- Online pharmacies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The Compound Camphor Ointment market features strong competition among key players such as Amrutanjan Health Care, Vi-Jon Laboratories, McKesson Canada, Sanjiu Medical & Pharmaceutical, DLC Laboratories, GHC Group, Delon Laboratories, Cigna, World Perfumes, Caribe Natural, Thera Wise, Indiana Botanic Gardens, Emu Joy, Greenbrier International, and Vicks. The market is characterized by continuous product innovation, expanding distribution networks, and increasing investment in research to improve formulation safety and efficacy. Companies are focusing on developing fast-absorbing, non-greasy, and multi-purpose ointments catering to both pain relief and skincare applications. Strategic collaborations with pharmaceutical retailers and e-commerce platforms are enhancing global accessibility, while marketing campaigns emphasize natural and herbal formulations to attract health-conscious consumers. Rising demand in emerging economies is encouraging regional expansion and capacity upgrades. Moreover, growing awareness of over-the-counter pain management solutions continues to intensify competition, pushing firms to maintain product quality and brand differentiation through consistent innovation and consumer engagement.

Key Player Analysis

- Amrutanjan Health Care

- Vi-Jon Laboratories

- McKesson Canada

- Sanjiu Medical & Pharmaceutical

- DLC Laboratories, Inc

- GHC Group

- Delon Laboratories

- Cigna

- World Perfumes

- Caribe Natural

- Thera Wise

- Indiana Botanic Gardens

- Emu Joy

- Greenbrier International

- Vicks

Recent Developments

- In 2025, Amrutanjan Health Care Limited Launched the Amrutanjan Faster Relaxation Roll-on for pain relief.

- In 2024, Vicks launched its “Double Powered Transformation” campaign in India for its new Double Power Cough Drops, an Ayurvedic formulation with camphor and other ingredients.

- In 2024, Amrutanjan Health Care Limited Launched a new pain cream and expanded its “Electro Plus” range with lemon and low-sugar variants made wiingredients

- In 2023, Amrutanjan Health Care Limited Launched the Amrutanjan Stop Pain Dental Gel as a new addition to its healthcare product line.

Report Coverage

The research report offers an in-depth analysis based on Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow due to rising demand for topical pain relief products.

- Increasing cases of arthritis and joint pain will drive consistent ointment usage.

- Expanding e-commerce platforms will enhance product accessibility across global markets.

- Manufacturers will focus on developing safer and more skin-friendly formulations.

- Herbal and natural ingredient-based ointments will gain higher consumer preference.

- Asia-Pacific will emerge as a key growth hub supported by rising healthcare awareness.

- Pharmaceutical companies will strengthen partnerships with retail and online pharmacies.

- Research on multifunctional formulations will increase market competitiveness.

- Growing elderly populations will sustain long-term demand for camphor ointments.

- Product innovation and regional brand expansion will shape future market growth.