Market Overview

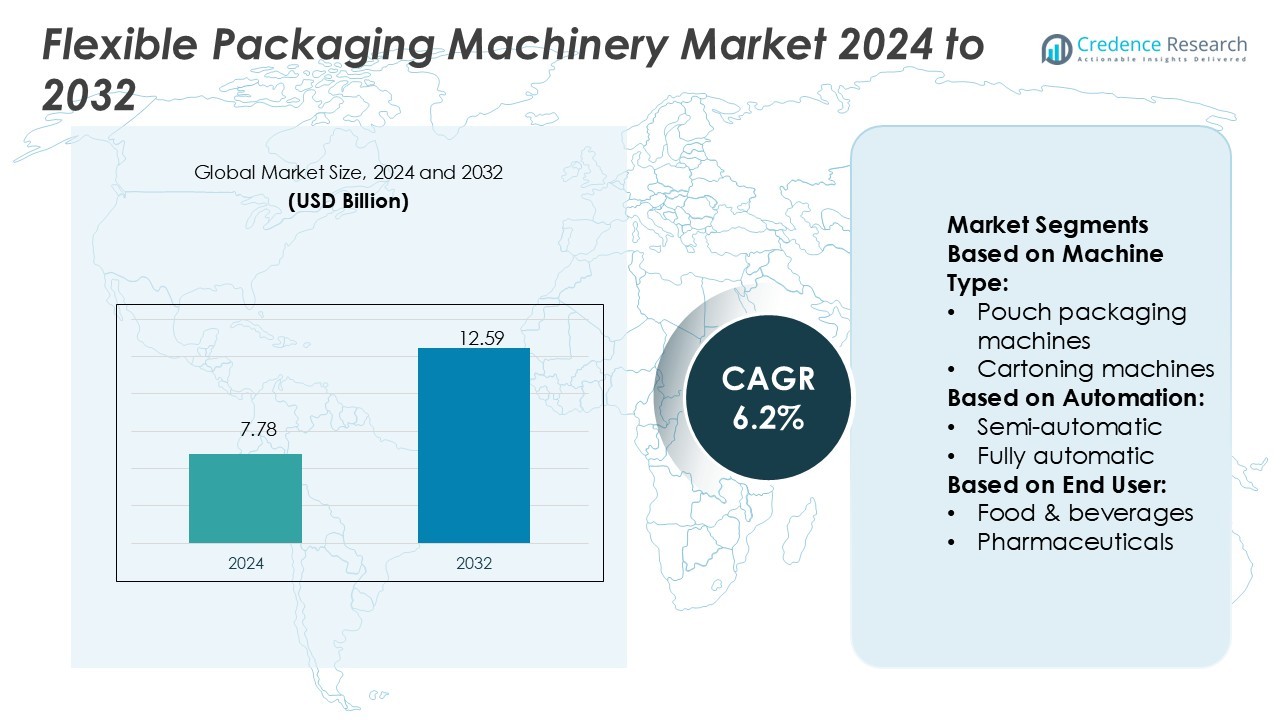

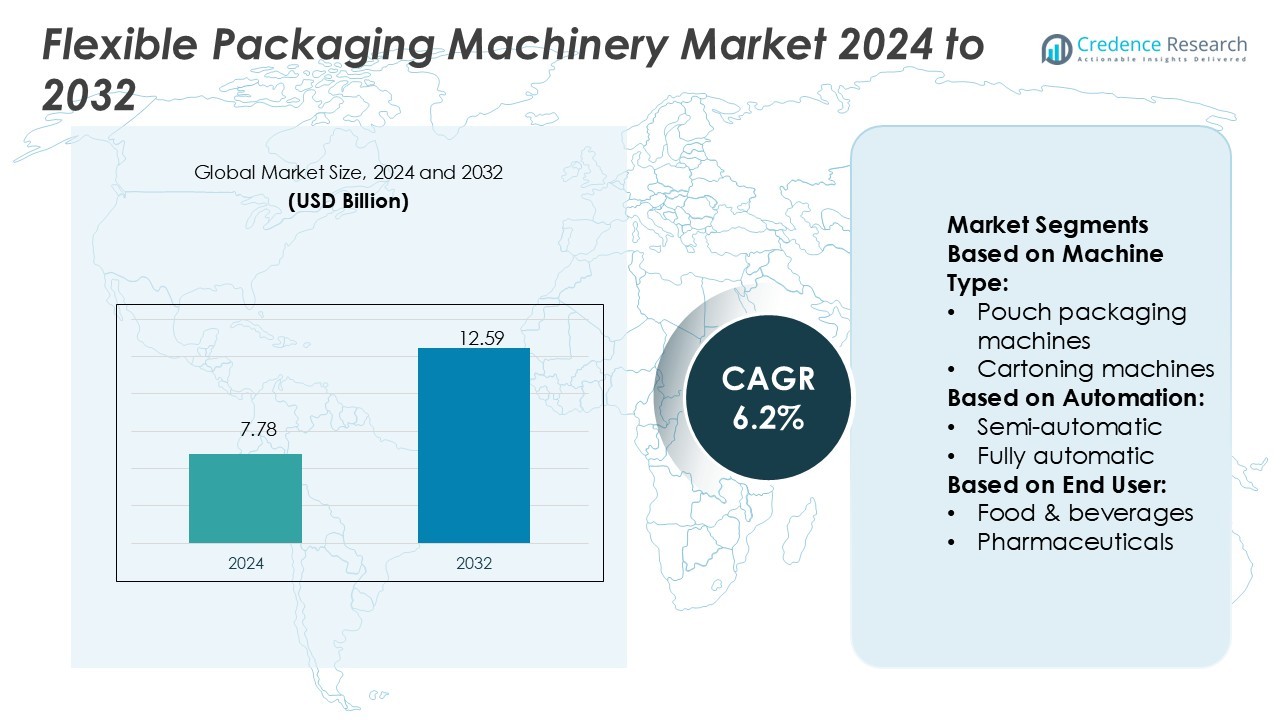

Flexible Packaging Machinery Market size was valued USD 7.78 billion in 2024 and is anticipated to reach USD 12.59 billion by 2032, at a CAGR of 6.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Flexible Packaging Machinery Market Size 2024 |

USD 7.78 Billion |

| Flexible Packaging Machinery Market, CAGR |

6.2% |

| Flexible Packaging Machinery Market Size 2032 |

USD 12.59 Billion |

The flexible packaging machinery market is shaped by leading players including Mespack, Coesia Group, MULTIVAC, Ishida Co., Ltd., PFM Packaging Machinery, Hayssen Flexible Systems, Optima Packaging Group, IMA Group, KHS GmbH, and GEA Group. These companies drive growth through innovation in automation, energy-efficient machinery, and solutions compatible with sustainable packaging materials. Strategic investments in R&D, global partnerships, and expansion into emerging economies strengthen their competitive edge. Regionally, Asia-Pacific leads the market with a 34% share, driven by rapid industrialization, rising packaged food consumption, and increasing adoption of automated systems to meet growing consumer and export demands.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The flexible packaging machinery market was valued at USD 7.78 billion in 2024 and is projected to reach USD 12.59 billion by 2032, growing at a CAGR of 6.2%.

- Rising demand for packaged food and beverages, coupled with the shift toward sustainable packaging, is a major driver of market expansion.

- Key players such as Mespack, Coesia Group, MULTIVAC, Ishida Co., Ltd., and IMA Group focus on automation, energy efficiency, and smart technologies to maintain competitiveness.

- High initial investment costs and compliance with strict environmental regulations remain significant restraints, particularly for small and medium enterprises.

- Asia-Pacific dominates the market with a 34% share, followed by North America at 28% and Europe at 26%, while the food and beverage segment leads end-user adoption with a 41% share, supported by strong demand for flexible and efficient packaging solutions.

Market Segmentation Analysis:

By Machine Type

Form fill seal (FFS) machines hold the dominant share of 32% in the flexible packaging machinery market. Their popularity stems from high efficiency, reduced labor costs, and adaptability across food, beverage, and pharmaceutical applications. These machines integrate filling and sealing in a single process, which improves productivity and consistency in packaging quality. Demand is further supported by the rising need for portion packaging and single-serve products. Growing emphasis on minimizing material waste and achieving higher output rates drives adoption, making FFS machines the preferred choice over pouch packaging and cartoning machines.

- For instance, Saint-Gobain’s Norseal PS-V0 micro-cellular polyurethane foam achieves UL94 V-0 rating in thicknesses from 3.5 mm up to 12 mm, and when compressed by 30 % it remains airtight up to 10 kPa (1.5 psi).

By Automation

Fully automatic machines account for the largest market share of 57%, driven by efficiency and reliability. They reduce human intervention, lower operating errors, and achieve high-speed production, which appeals to large-scale manufacturers. The growth of smart factories and Industry 4.0 integration also accelerates their adoption. Real-time monitoring, IoT connectivity, and predictive maintenance features in advanced models further enhance productivity. Companies in food and pharmaceuticals particularly prefer fully automated systems to meet strict quality and safety standards, ensuring consistent output. Rising labor costs and demand for cost-effective operations fuel their continued dominance.

- For instance, Armacell’s ArmaComfort NR-P combines polyurethane (PU) foam with mass loading to provide acoustic insulation. The product is rated with a weighted sound absorption coefficient of 0.25 (H) for its 12 mm thick variant, according to ISO 354 and EN ISO 11654.

By End User

The food and beverages segment dominates with a 41% share, supported by high demand for packaged convenience foods and drinks. Flexible packaging machinery enables extended shelf life, lightweight transport, and cost-effective branding solutions. Growth in ready-to-eat meals, frozen foods, and single-portion packs amplifies machine adoption in this sector. Increasing regulations on food safety and labeling also push manufacturers toward advanced machinery with better hygiene standards. The segment benefits further from rising global consumption of packaged snacks and beverages, which require efficient, high-speed machinery capable of handling diverse packaging materials and formats.

Key Growth Drivers

Rising Demand from Food and Beverage Industry

The food and beverage sector remains the largest consumer of flexible packaging machinery, accounting for substantial global revenues. Increasing demand for packaged and ready-to-eat products fuels machinery adoption, as producers seek efficient, high-speed systems to meet volume needs. Flexible packaging supports extended shelf life, improved product safety, and sustainable material use, aligning with consumer expectations. Growth in single-serve portions, frozen meals, and convenience foods further strengthens demand. As global consumption patterns shift toward packaged products, manufacturers prioritize advanced machinery that ensures consistent quality and reduced operational costs.

- For instance, Dow’s STYROFOAM™ Highload XPS insulation delivers compressive strengths of 40, 60, and 100 psi (275, 415, 690 kPa) while maintaining R-value of 5.0 per inch.

Advancements in Automation and Smart Technologies

The integration of automation and smart technologies significantly drives market growth. Fully automated machines with IoT-enabled sensors, predictive maintenance, and AI-driven analytics reduce downtime and optimize throughput. Industry 4.0 adoption empowers manufacturers with real-time monitoring, data-driven decision-making, and reduced dependency on manual labor. These innovations enhance accuracy in labeling, sealing, and portioning, addressing strict compliance requirements. Rising labor costs and the need for cost-efficient operations further promote automation. Companies investing in digitalized packaging machinery benefit from improved productivity and stronger adaptability to varied packaging formats, fueling long-term competitiveness.

- For instance, Huntsman’s ACOUSTIFLEX® VEF BIO system incorporates up to 20 % bio-based content while still achieving the same acoustic attenuation magnitude as their standard VEF foams (< 500 Hz).

Shift Toward Sustainable Packaging Solutions

Growing environmental concerns and stricter global regulations accelerate demand for eco-friendly packaging machinery. Manufacturers increasingly adopt systems designed to handle biodegradable, recyclable, and lightweight materials while minimizing material wastage. The shift toward sustainable packaging also addresses consumer preferences for greener solutions. Packaging companies emphasize machines that support energy-efficient operations and flexible material compatibility. Demand is particularly strong in Europe and North America, where single-use plastic restrictions drive rapid innovation. As industries align with circular economy goals, sustainable machinery investments become essential growth drivers in the flexible packaging machinery market.

Key Trends & Opportunities

Rising Adoption of Pouch Packaging Formats

Pouch packaging has emerged as a fast-growing trend due to its lightweight design, portability, and cost-effectiveness. Flexible packaging machinery tailored for stand-up pouches, spouted pouches, and resealable formats supports expanding use across food, beverage, and personal care industries. The format offers strong branding opportunities with innovative designs and print finishes. Demand for eco-friendly pouch materials further enhances growth potential. Manufacturers investing in advanced pouch packaging machinery can tap into expanding opportunities in convenience-driven markets, especially in emerging economies where lifestyle changes drive packaged product consumption.

- For instance, JSP’s ARPRO REvolution grade is made with over 90% recycled content from post-consumer EPP waste, building upon earlier recycled lines that included grades using 25% recycled end-of-life EPP parts.

Integration of Digital Printing and Customization

The adoption of digital printing technologies in flexible packaging creates new opportunities for machinery manufacturers. Digital printing allows shorter production runs, faster turnaround, and greater design flexibility, meeting brand owners’ demand for personalization. Flexible packaging machinery equipped with integrated printing solutions supports cost efficiency while enabling high-quality graphics. Growth in e-commerce further boosts the need for unique, customized packaging that enhances consumer experience. This trend also aligns with sustainability goals, as digital printing reduces material waste. The convergence of printing technology with packaging machinery represents a lucrative growth frontier.

- For instance, Covestro leads chemical innovation with CO₂-based rigid polyurethane foam precursors. In its latest R&D, up to 20 % of petroleum feedstock is replaced by CO₂-derived intermediates, and prototype insulation boards built from CO₂-based polyols matched conventional foam’s thermal and mechanical benchmarks.

Key Challenges

High Initial Capital Investment

The flexible packaging machinery market faces barriers due to significant upfront costs. Advanced systems with automation, IoT integration, and sustainable processing features require large investments, limiting accessibility for small and medium enterprises. High installation, training, and maintenance expenses further add to the financial burden. Many companies in developing economies find it challenging to adopt modern machinery despite growing demand. This cost factor slows adoption rates, particularly in price-sensitive markets, creating a gap between large corporations and smaller manufacturers in terms of technological capabilities.

Regulatory Compliance and Material Handling Issues

Strict regulations on packaging safety, hygiene, and sustainability pose challenges for machinery manufacturers. Equipment must comply with global standards for food safety, pharmaceutical integrity, and environmental guidelines. Handling diverse eco-friendly materials such as biodegradable films or compostable plastics often requires specialized machinery modifications. These adjustments increase operational costs and limit flexibility for manufacturers. Non-compliance risks penalties and brand reputation damage, further pressuring companies to upgrade. Adapting machinery designs while ensuring cost efficiency remains a major challenge in balancing regulatory demands with market competitiveness.

Regional Analysis

North America

North America holds a 28% share of the flexible packaging machinery market, driven by strong demand from the food, beverage, and pharmaceutical industries. The U.S. leads adoption due to high packaged food consumption, advanced manufacturing facilities, and strict regulatory standards on labeling and safety. Canada supports growth with increasing investments in eco-friendly packaging solutions. Rising labor costs and the need for automated machinery further accelerate regional adoption. Continuous innovation, particularly in sustainable packaging and digital integration, positions North America as a mature yet growth-oriented market, with manufacturers emphasizing efficiency and compliance.

Europe

Europe accounts for 26% of the global market, supported by advanced technological adoption and strict environmental regulations. Countries such as Germany, Italy, and France dominate machinery production and consumption. Strong focus on recyclable and biodegradable materials encourages demand for packaging systems that can handle sustainable substrates. The food, beverage, and cosmetics industries are key adopters, with premium packaging needs driving machinery upgrades. EU directives restricting single-use plastics fuel rapid innovation in machinery design. Europe’s emphasis on sustainability and automation strengthens its position as a leading hub for advanced flexible packaging machinery.

Asia-Pacific

Asia-Pacific dominates the market with a 34% share, fueled by rapid industrialization and urbanization. China, India, and Japan are major contributors, driven by expanding food processing, pharmaceuticals, and consumer goods industries. Rising disposable incomes and growing packaged food consumption boost demand for high-speed, cost-efficient machinery. Local manufacturers invest heavily in automation to improve productivity and meet global export standards. The region also benefits from lower production costs and favorable government policies encouraging manufacturing expansion. Asia-Pacific’s scale, cost advantage, and dynamic consumer base position it as the fastest-growing region in the flexible packaging machinery market.

Latin America

Latin America holds a 7% market share, led by Brazil and Mexico as key contributors. Growth is driven by rising packaged food and beverage consumption, supported by expanding urban populations and retail modernization. Investments in pharmaceutical packaging machinery are increasing, particularly with stricter quality standards. However, adoption is challenged by economic volatility and high capital investment costs. Regional players are focusing on affordable automation solutions to cater to mid-sized manufacturers. Sustainability initiatives, especially in Brazil, create new opportunities for machinery capable of processing eco-friendly packaging materials, enhancing long-term market potential.

Middle East & Africa

The Middle East & Africa region represents 5% of the global market, with growth centered in the Gulf states and South Africa. Increasing demand for packaged food, beverages, and pharmaceuticals supports machinery adoption. Infrastructure development and rising consumer purchasing power also contribute to packaging growth. However, limited local manufacturing and reliance on imports raise overall costs, slowing widespread adoption. Governments in the Gulf region promote industrial diversification, spurring investments in advanced machinery. The shift toward sustainable packaging materials creates opportunities for suppliers offering eco-compatible, cost-effective equipment in this developing regional market.

Market Segmentations:

By Machine Type:

- Pouch packaging machines

- Cartoning machines

By Automation:

- Semi-automatic

- Fully automatic

By End User:

- Food & beverages

- Pharmaceuticals

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The flexible packaging machinery market is highly competitive, with leading players such as Mespack, Coesia Group, MULTIVAC, Ishida Co., Ltd., PFM Packaging Machinery, Hayssen Flexible Systems, Optima Packaging Group, IMA Group, KHS GmbH, and GEA Group. The flexible packaging machinery market features intense competition, driven by rapid technological innovation and evolving consumer demands. Companies in the sector prioritize automation, sustainability, and digital integration to differentiate their offerings and meet global standards. Advances such as IoT-enabled monitoring, predictive maintenance, and energy-efficient systems are reshaping machinery design and functionality. Demand for flexible formats like pouches, sachets, and resealable packaging also fuels innovation across product lines. Strategic moves including mergers, acquisitions, and partnerships strengthen market presence, while investments in research and development enhance adaptability to sustainable materials. Overall, the competitive landscape is shaped by a strong focus on efficiency, cost reduction, and compliance with environmental regulations, positioning firms to capture growth in diverse industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Mespack

- Coesia Group

- MULTIVAC

- Ishida Co., Ltd.

- PFM Packaging Machinery

- Hayssen Flexible Systems

- Optima Packaging Group

- IMA Group

- KHS GmbH

- GEA Group

Recent Developments

- In March 2025, ULMA Packaging launched the new series of TFX, transforming machines tailored for food packaging, these machines are designs to overcome the challenges in the food industries which also helps in enhancing production efficiency, helps in digitalization and also promotes sustainability.

- In August 2024, GEA launched a new food packaging machine that enhances efficiency and sustainability. The food industry captures the responsiveness offered by this technology in modular and ecological tuned solutions that minimizes material flow while operating with utmost efficiency.

- In February 2024, IMA Group, a producer of automatic machines for pharmaceutical, food, and battery processing and packaging, unveiled two artificial intelligence (AI) solutions designed to improve the efficiency and effectiveness of its customer services. The IMA Sandbox solution is a collaborative, cloud-based platform that facilitates co-development and partnership in creating advanced algorithms within a secure and shared environment.

- In December 2023, Multivac expanded into Asia-Pacific with its new production and sales plant in Ghiloth, India, MULTIVAC looks to meet the demand for flexible packaging solutions in emerging markets.

Report Coverage

The research report offers an in-depth analysis based on Machine Type, Automation, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness strong growth driven by rising demand for packaged food and beverages.

- Automation and smart technologies will continue to dominate future machinery investments.

- Sustainable packaging solutions will push machinery innovation toward eco-friendly material handling.

- Asia-Pacific will remain the fastest-growing region due to industrial expansion and consumer demand.

- Digital printing integration will create opportunities for customization and shorter production runs.

- Fully automatic machinery will see higher adoption as manufacturers reduce labor dependency.

- Pharmaceuticals and personal care industries will increase reliance on advanced packaging solutions.

- E-commerce growth will fuel demand for versatile and lightweight packaging formats.

- High-speed machines with IoT-enabled monitoring will set new performance benchmarks.

- Regulatory pressure will drive continuous upgrades toward sustainable and compliant machinery.