Market Overview

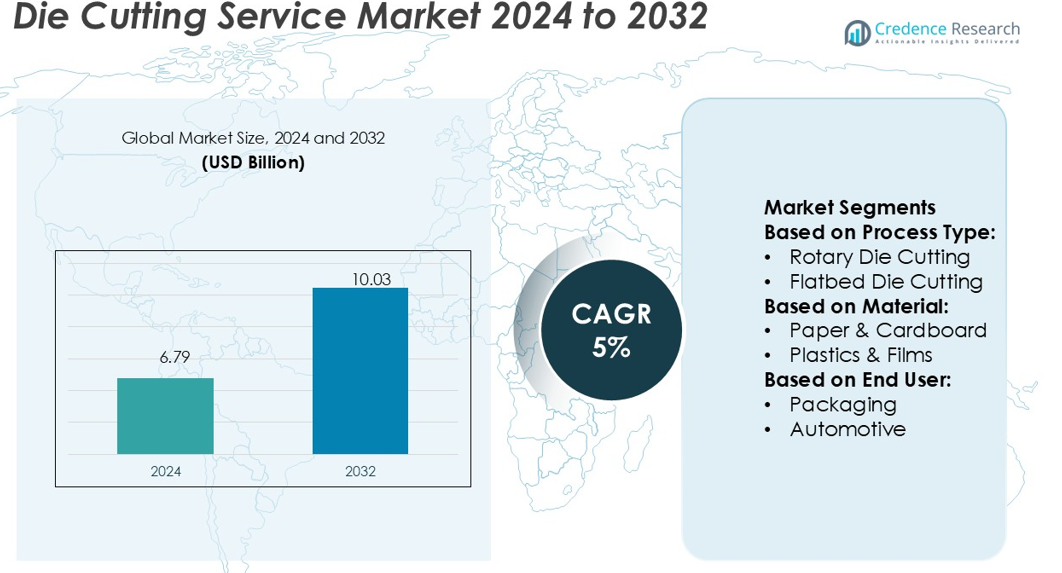

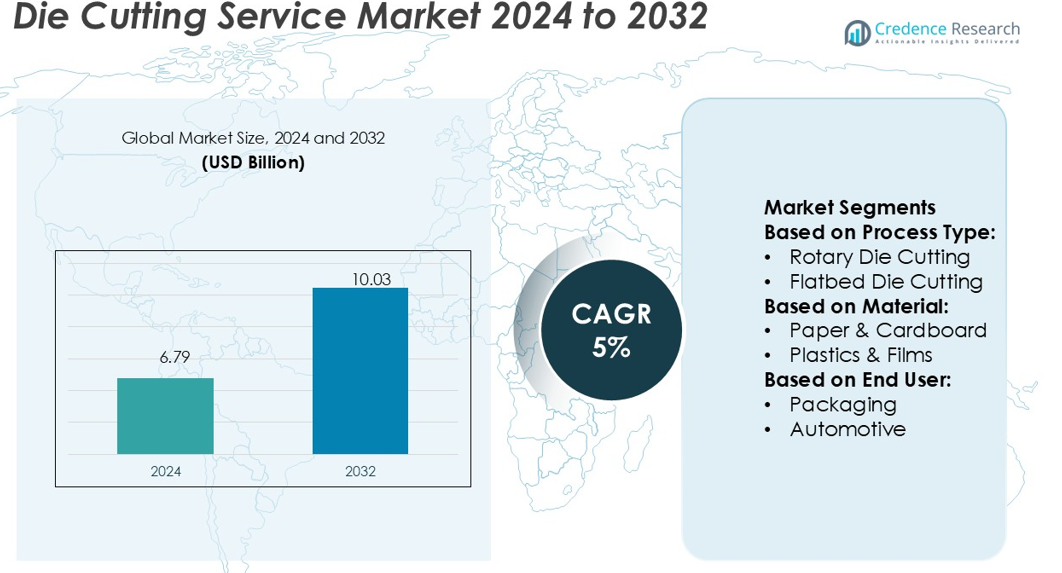

Die Cutting Service Market size was valued USD 6.79 billion in 2024 and is anticipated to reach USD 10.03 billion by 2032, at a CAGR of 5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Die Cutting Service Market Size 2024 |

USD 6.79 billion |

| Die Cutting Service Market, CAGR |

5.3% |

| Die Cutting Service Market Size 2032 |

USD 10.03 billion |

The die cutting service market features prominent players such as Thrust Industries, Eurolaser, Heubach Corporation, Bernard Group, Gardico Inc, Custom Fabricating & Supplies, Inc., Baril Corporation, Colvin-Friedman Company, American Industrial Company, and The Strouse Corporation. These companies compete through innovation, automation, and material versatility to meet diverse industrial needs. Eurolaser leads in laser-based precision cutting, while Thrust Industries and Gardico Inc focus on gasket and insulation applications. The Strouse Corporation excels in adhesive and film conversion for medical and electronic sectors. North America dominates the global market with a 34% share, supported by advanced manufacturing infrastructure, strong packaging demand, and high adoption of digital and automated die cutting technologies across multiple industries.

Market Insights

- The Die Cutting Service Market was valued at USD 6.79 billion in 2024 and is projected to reach USD 10.03 billion by 2032, growing at a CAGR of 5%.

- Market growth is driven by rising demand from the packaging, automotive, and healthcare industries, supported by increasing automation and precision manufacturing.

- Digital and laser die cutting technologies are gaining traction, offering faster turnaround, minimal waste, and high design flexibility across multiple materials.

- North America holds a 34% share, leading global growth, while the packaging segment dominates with over 45% of total market revenue due to e-commerce expansion.

- Key players focus on automation, sustainable materials, and innovation to maintain competitiveness, though high equipment costs and complex material compatibility remain major restraints affecting small and mid-sized service providers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Process Type

Rotary die cutting dominates the market with a 38% share due to its high-speed precision and suitability for large-scale production. It is widely used in packaging and automotive applications for consistent cutting of labels, gaskets, and films. The process supports continuous web operation, reducing material waste and downtime. Flatbed die cutting follows, favored for thicker materials and short runs. Digital die cutting is growing rapidly due to demand for customized designs and zero tooling costs, while laser and waterjet methods serve specialized industrial applications.

- For instance, Eurolaser’s XL-3200 CO₂ laser system handles a working area of 2,270 × 3,200 mm, with beam speeds up to 1,414 mm/s and acceleration up to 9.1 m/s², delivering precise contour cuts in non-metal materials.

By Material

Paper and cardboard account for the largest market share at 42%, driven by the packaging industry’s transition toward eco-friendly materials. High adoption in consumer goods and e-commerce packaging strengthens demand for precise and high-volume cutting. Plastic and film materials hold a notable share due to their use in electronics, automotive interiors, and medical disposables. Foam and rubber follow, driven by sealing and insulation applications. Metal sheets and leather-based materials cater to niche markets like aerospace and luxury goods manufacturing.

- For instance, machine shops use vertical milling machines that can achieve positional tolerances of ±0.002 inches (≈ 0.05 mm) and create custom die tooling for large sheet widths and thick substrates.

By End-User

The packaging sector leads the market with a 46% share, supported by the global surge in sustainable and flexible packaging demand. Companies rely on die cutting for accurate shaping of cartons, labels, and inserts, ensuring branding consistency. The automotive industry follows, using die cutting for gaskets, seals, and interior trims. Electronics and medical sectors adopt digital and laser die cutting for high-precision components. Other end-users, including aerospace and consumer goods, benefit from automation and efficiency gains offered by modern die cutting systems.

Key Growth Drivers

Rising Demand from the Packaging Industry

The packaging industry drives strong growth in the die cutting service market. Manufacturers rely on die cutting for producing precise shapes for boxes, cartons, and labels. The rise in e-commerce and food packaging increases demand for efficient and scalable cutting solutions. Sustainable paper and cardboard packaging also enhance market adoption. Brands seek custom designs and recyclable materials, pushing service providers to invest in high-speed, automated die cutting systems that deliver precision and waste reduction, improving both productivity and environmental performance.

- For instance, Custom die-cutting services typically use presses ranging from smaller clicker presses (e.g., 20-ton) to larger flatbed presses (e.g., 50-ton) to cut materials such as cork, foam, rubber, felt, gasket sheet, and thin plastics.

Technological Advancements and Automation

Automation and digitalization are transforming die cutting services. Modern equipment integrates CNC systems, AI-driven control, and digital die cutting, improving precision and reducing setup times. Companies adopt hybrid systems combining laser and rotary technologies to serve multiple materials efficiently. This trend boosts throughput and customization capabilities for diverse end-users. Automated workflows also lower labor costs and minimize material waste, increasing profitability. The adoption of cloud-based monitoring and predictive maintenance further strengthens operational efficiency and service reliability across manufacturing facilities.

- For instance, A clean room (ISO Class 7) can house specialized web converting equipment, such as a rotary cutter with an inline inkjet printer. This setup can support a range of web widths, including up to 13 inches, and achieve tight tolerances, such as ±0.002 inches (≈ 50 µm), for precise contour cuts in non-metal materials.

Growing Applications Across End-User Industries

The use of die cutting extends beyond packaging into automotive, electronics, and healthcare industries. Automotive manufacturers use it for gaskets, seals, and insulation parts, ensuring consistent quality at scale. In electronics, precision cutting supports flexible circuits and display components. The medical sector demands sterile, high-accuracy cutting for adhesive dressings and diagnostic devices. This broad industrial adoption diversifies revenue streams and encourages innovation in materials like films, foams, and composites, enhancing the market’s overall growth potential and resilience against sector-specific fluctuations.

Key Trends & Opportunities

Adoption of Sustainable and Eco-Friendly Materials

A major market trend is the shift toward sustainable and recyclable materials. Companies prefer paper-based, biodegradable, and reusable substrates over plastics to meet global environmental regulations. This shift opens opportunities for die cutting service providers to specialize in handling eco-friendly materials while maintaining performance standards. Innovation in blades and non-contact laser systems supports precise cutting without damaging fragile materials, helping packaging brands achieve green labeling certifications and reduce carbon footprints while maintaining strong aesthetic and functional quality.

- For instance, Colvin-Friedman’s rotary die cutting lines support webs up to 16 inches in width and thicknesses to 0.015 inches, with tolerances down to ±0.005 inches.Their flat-bed presses handle sheets up to 40 inches × 96 inches, cutting thicknesses up to 0.50 inches with tolerances near ±0.010 inches.

Expansion of Digital and On-Demand Die Cutting

Digital die cutting is creating new business opportunities, particularly for short runs and custom orders. The technology eliminates the need for physical dies, reducing production costs and lead times. Industries like advertising, personalized packaging, and crafts benefit from rapid prototyping and intricate cutting capabilities. Cloud-connected systems enable remote design uploads and real-time order management, streamlining production. This flexibility supports small and mid-sized enterprises seeking scalable, cost-effective solutions, making digital die cutting one of the fastest-growing market segments globally.

- For instance, American Industrial Company (AIC) uses a VyTek FiberCAB 44 3,000-watt fiber laser for precision cutting of metals. This acquisition in 2015 allowed the company to expand its services to include in-house metal laser cuts and etching, supplementing its metal stamping offerings.

Key Challenges

High Equipment and Maintenance Costs

Advanced die cutting systems involve high initial investment and ongoing maintenance expenses. Rotary and laser systems, in particular, require specialized tooling, regular calibration, and skilled operators. Small and mid-sized firms often face budget constraints, limiting technology adoption. The cost of downtime for equipment servicing also impacts profitability. To stay competitive, service providers must balance operational costs with efficiency gains, pushing manufacturers toward leasing models or partnerships to access high-performance machines without large capital expenditure.

Material Compatibility and Precision Issues

Working with diverse materials such as foams, metals, and films presents precision challenges. Each material reacts differently to pressure, heat, or laser intensity, affecting cut accuracy and edge quality. Inconsistent results can lead to waste, rework, and customer dissatisfaction. Maintaining consistent output across multiple materials requires continuous process optimization and skilled workforce training. Companies that fail to manage these complexities risk falling behind technologically advanced competitors offering precision-engineered, multi-material die cutting solutions that meet evolving industry standards.

Regional Analysis

North America

North America holds the largest share of 34% in the die cutting service market, driven by strong demand from packaging, automotive, and healthcare industries. The U.S. leads regional growth due to advanced automation and the adoption of digital die cutting systems. Expanding e-commerce packaging and medical device manufacturing further boost service utilization. Major players focus on sustainability through recyclable paper and cardboard solutions. The presence of key machine manufacturers and consistent technological innovation supports market expansion, while the region’s robust industrial base ensures steady demand for customized and high-precision cutting services.

Europe

Europe accounts for 28% of the global market share, supported by strong adoption of eco-friendly materials and stringent environmental regulations. Countries such as Germany, Italy, and France drive demand through advanced manufacturing and packaging sectors. The region’s focus on sustainable production enhances the use of recyclable paper and biodegradable plastics in die cutting operations. Automation and Industry 4.0 initiatives foster efficiency, while the growing demand from luxury packaging and automotive interior applications strengthens market growth. European service providers emphasize high precision and innovation in material handling technologies.

Asia-Pacific

Asia-Pacific captures a 25% market share, emerging as the fastest-growing region due to rapid industrialization and expanding manufacturing sectors. China, Japan, and India dominate the market through strong packaging, electronics, and automotive industries. Increasing consumer goods production and rising e-commerce volumes drive continuous investments in die cutting services. The shift toward sustainable materials and the integration of digital cutting systems enhance regional competitiveness. Low production costs and the presence of global suppliers position Asia-Pacific as a key hub for both mass production and customized die cutting solutions.

Latin America

Latin America holds an 8% share of the global die cutting service market, with Brazil and Mexico leading regional growth. The expanding packaging and automotive industries create steady demand for rotary and flatbed die cutting services. Local manufacturers increasingly adopt automated systems to improve quality and productivity. The growing food and beverage sector also boosts the need for customized labeling and carton production. While economic challenges affect small service providers, government initiatives supporting manufacturing modernization contribute to long-term market opportunities across the region.

Middle East & Africa

The Middle East & Africa region represents 5% of the global market share, supported by growing demand from consumer goods and healthcare sectors. The UAE and South Africa lead in adopting advanced die cutting services, driven by expanding retail and logistics activities. The packaging sector’s focus on sustainability encourages the use of recyclable paper and bio-based materials. Investments in industrial infrastructure and manufacturing diversification support market development. However, limited technology adoption and higher import dependency slightly restrain market growth, creating opportunities for local service expansion and technology partnerships.

Market Segmentations:

By Process Type:

- Rotary Die Cutting

- Flatbed Die Cutting

By Material:

- Paper & Cardboard

- Plastics & Films

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The die cutting service market is highly competitive, with key players including Thrust Industries, Eurolaser, Heubach Corporation, Bernard Group, Gardico Inc, Custom Fabricating & Supplies, Inc., Baril Corporation, Colvin-Friedman Company, American Industrial Company, and The Strouse Corporation. The die cutting service market is characterized by strong competition and continuous technological advancement. Companies focus on automation, precision cutting, and material versatility to meet diverse industry needs. The shift toward digital and laser die cutting enables faster turnaround and higher accuracy, reducing waste and setup time. Service providers emphasize sustainable practices by adopting recyclable and biodegradable materials to align with global environmental goals. Investments in advanced machinery, AI-based quality inspection, and integrated workflow systems enhance productivity and cost efficiency. The market’s competitiveness is driven by innovation, customization, and the growing demand for eco-friendly, high-performance cutting solutions across multiple end-use sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Thrust Industries

- Eurolaser

- Heubach Corporation

- Bernard Group

- Gardico Inc

- Custom Fabricating & Supplies, Inc.

- Baril Corporation

- Colvin-Friedman Company

- American Industrial Company

- The Strouse Corporation

Recent Developments

- In August 2024, American Carton Company (ACC) enhanced its die-cutting productivity by incorporating the BOBST NOVACUT 106 ER into its operations. The new machine has significantly improved the company’s cutting accuracy, setup speed, and overall production speed.

- In June 2024, DS Smith introduced the Highcon Beam 3 system into its French operations, a move aimed at meeting increasing demands for quick, flexible, and sustainable packaging solutions. The system offers precise laser cutting, improving turnaround times for clients.

- In January 2024, Amcor announced the expansion of thermoforming production capacity in North America to support healthcare customer growth. The expansion would permit customers to source thermoforms and companion die-cut lids from a single location, aiding in streamlining product manufacturing and distribution.

- In April 2023, Berhalter Swiss Die-Cutting, a leading manufacturer of high-performance flatbed die-cutting machines located in Widnau, Switzerland, introduced its revolutionary Swiss Die-Cutter B4. This cutting-edge machine marks a pivotal leap in die-cutting technology, aimed at boosting efficiency and precision across diverse applications

Report Coverage

The research report offers an in-depth analysis based on Process Type, Material, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for digital and automated die cutting systems will continue to rise globally.

- Service providers will focus more on eco-friendly materials and sustainable production processes.

- Integration of AI and IoT technologies will enhance precision, speed, and quality control.

- The packaging sector will remain the leading end-user, driven by e-commerce and branding needs.

- Customization and short-run production will gain traction with digital workflow adoption.

- Technological innovations like laser and waterjet die cutting will expand market capabilities.

- Emerging economies in Asia-Pacific and Latin America will experience rapid service adoption.

- Partnerships between equipment manufacturers and service providers will strengthen market efficiency.

- Continuous investment in energy-efficient and waste-reduction systems will shape competitive advantage.

- The market will see increased specialization in multi-material and high-precision industrial applications.