Market Overview

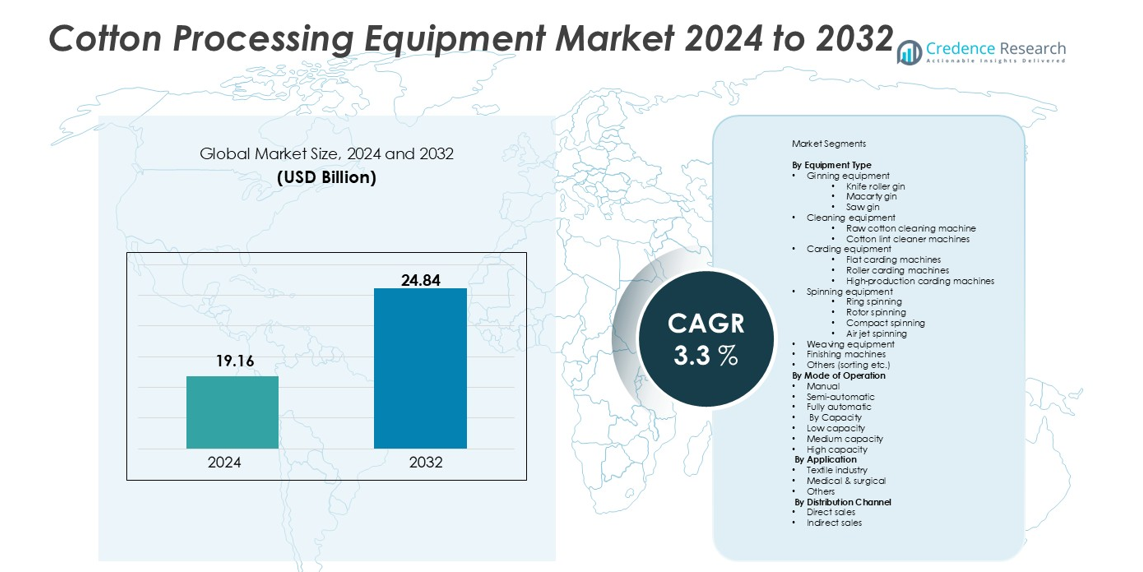

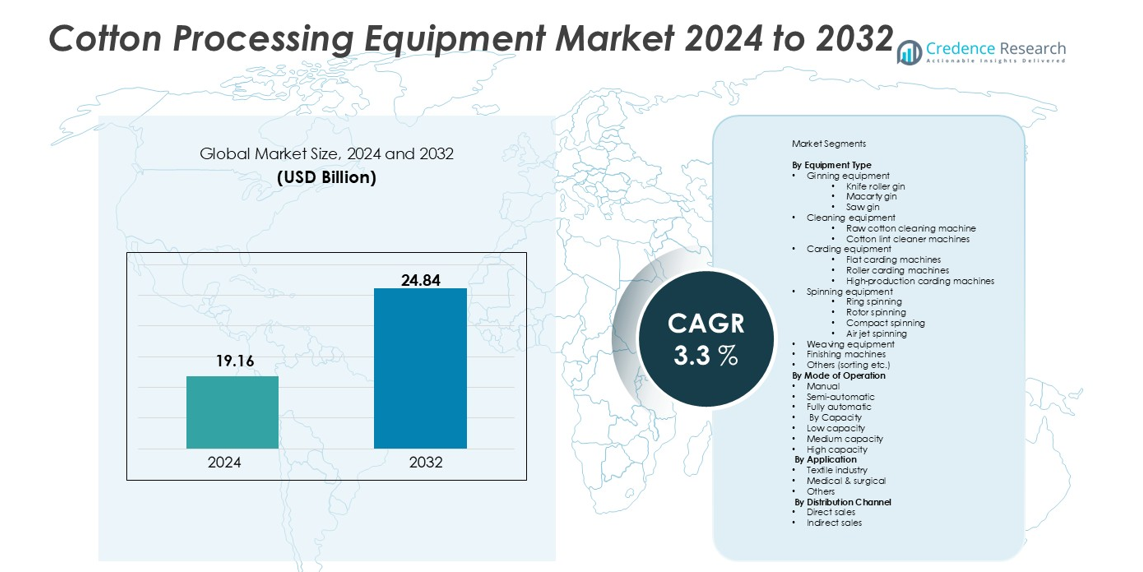

The Cotton Processing Equipment Market was valued at USD 19.16 billion in 2024 and is anticipated to reach USD 24.84 billion by 2032, at a CAGR of 3.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cotton Processing Equipment Market Size 2024 |

USD 19.16 billion |

| Cotton Processing Equipment Market, CAGR |

3.3% |

| Cotton Processing Equipment Market Size 2032 |

USD 24.84 billion |

The cotton processing equipment market is led by several prominent companies, each holding significant shares in their respective segments. Rieter stands out as the market leader, commanding approximately 30% of the global market share. Other key players include Trützschler, Lummus, Saurer, and Savio, collectively accounting for an estimated 5% to 8% of the market share. These companies offer a diverse range of equipment, including ginning, cleaning, carding, spinning, and weaving machinery, catering to the growing demand for efficient and high-quality cotton processing solutions. The Asia-Pacific region dominates the market, driven by massive textile production in countries like China and India, which together contribute to over 42% of the global market share. North America and Europe also hold substantial shares, supported by advanced manufacturing capabilities and a focus on automation and sustainability in cotton processing operations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global cotton processing equipment market was valued at USD 19.16 billion in 2024 and is projected to grow at a CAGR of 3.3% during the forecast period, driven by rising demand for mechanization and high-quality textile production.

- Growth is fueled by increasing adoption of fully automatic ginning, carding, and spinning machines, improving efficiency, reducing labor dependency, and enhancing yarn quality across large-scale textile operations.

- Key trends include the shift towards high-capacity and IoT-enabled equipment, focus on energy-efficient and sustainable machinery, and rising integration of Industry 4.0 technologies for predictive maintenance and process optimization.

- The market is competitive, led by Rieter, Trützschler, Lummus, Saurer, and Savio, with dominant players leveraging technological innovation, strategic partnerships, and regional expansion to maintain leadership and expand market share.

- Asia-Pacific dominates with over 42% market share, followed by North America (~22%) and Europe (~18%), while segment-wise, ginning equipment leads with approximately 35% share, driven by high-volume cotton processing demand.

Market Segmentation Analysis

By Equipment Type:

The Cotton Processing Equipment market by Equipment Type is led by ginning equipment, with the saw gin sub-segment dominating market share due to its efficiency in fiber separation and higher output compared to knife roller and Macarty gins. Cleaning equipment, including raw cotton cleaning machines and cotton lint cleaners, supports consistent fiber quality, while carding equipment such as high-production carding machines ensures uniformity in fiber alignment. Spinning equipment, particularly ring spinning machines, remains critical for high-strength yarn production, whereas weaving and finishing machines contribute to the downstream textile quality. Growth is driven by rising mechanization in cotton processing and demand for superior yarn quality.

- For instance, Bajaj Steel Industries Ltd.’s 201 Saw Gin operates with 201 saw blades rotating at 615 RPM, each blade having 330 teeth and a diameter of 16 inches (406 mm), ensuring efficient separation of lint from cotton seeds.

By Mode of Operation:

The fully automatic segment holds the largest share, benefiting from enhanced productivity, reduced labor costs, and precision in processing operations. Semi-automatic equipment also maintains a notable presence, offering a balance between cost-efficiency and operational control. Manual machines continue to serve small-scale operations but represent a declining share due to limited throughput. Drivers include increasing labor scarcity, rising adoption of Industry 4.0 technologies, and the need for consistent quality and energy-efficient operations across cotton processing plants.

- For instance, Karunanand Press’s fully automatic cotton ginning and pressing plant has a production capacity ranging from 7 to 30 bales per hour, depending on requirements, with a total capacity of 500 tons, demonstrating significant advancements in automation.

By Capacity:

The high-capacity sub-segment leads the market, reflecting large-scale mills’ preference for machines capable of handling bulk volumes efficiently. Medium-capacity equipment captures moderate demand from regional manufacturers seeking scalability, while low-capacity units cater to niche and small-scale operations. Market growth is propelled by the expansion of large textile hubs, increasing demand for yarn in domestic and international markets, and the adoption of advanced machinery that reduces processing time while enhancing output quality and operational reliability.

Key Growth Drivers

Rising Demand for Mechanization in Cotton Processing

The growing adoption of mechanized cotton processing equipment is a primary growth driver, fueled by the need to enhance productivity and reduce labor dependency. Modern ginning, cleaning, and spinning machines enable large-scale mills to process higher volumes of cotton efficiently while maintaining consistent fiber quality. For instance, high-production carding machines and fully automatic ring spinning systems significantly reduce manual intervention, lower processing time, and improve yarn uniformity. Additionally, advancements in energy-efficient equipment and digital monitoring systems contribute to operational optimization, attracting investments from both domestic and international textile manufacturers. The expansion of organized cotton processing clusters and increasing government initiatives supporting mechanization further accelerate the shift from traditional methods to modern equipment, creating sustained demand across emerging and established markets.

- For instance, Bajaj Steel Industries Ltd.’s 201 Saw Gin operates with 201 saw blades rotating at 615 RPM, each blade having 330 teeth and a diameter of 16 inches (406 mm), ensuring efficient separation of lint from cotton seeds.

Growing Domestic and Global Textile Demand

Rising consumption of textiles, both domestically and globally, drives the need for efficient cotton processing equipment. The surge in apparel, home textile, and industrial textile production requires high-quality yarn and fabric, creating pressure on manufacturers to upgrade machinery. Segments like high-capacity spinning and weaving equipment see significant uptake, as they enable faster production and maintain fiber strength and consistency. Moreover, export-oriented textile hubs in Asia and Africa emphasize mechanized operations to meet stringent international quality standards. This increasing demand encourages investment in integrated cotton processing lines, including cleaning, carding, and finishing equipment, ensuring higher throughput, reduced waste, and improved operational efficiency. Consequently, the market experiences continuous growth, fueled by textile consumption trends and the need for reliable, scalable processing solutions.

- For instance, the TONGDA FA1569 ring spinning machine achieves a spindle speed of up to 25,000 RPM, increasing production capacity by 10% and reducing energy consumption by 7%-10%, thereby enhancing yarn quality and operational efficiency.

Technological Advancements and Industry 4.0 Integration

Technological innovations, including automation, IoT-enabled monitoring, and AI-based process optimization, serve as a major growth driver. Fully automatic ginning and spinning machines with real-time sensors enable predictive maintenance, minimize downtime, and improve overall operational efficiency. For instance, smart lint cleaners and high-production carding machines integrated with digital dashboards allow operators to monitor quality parameters and energy consumption effectively. These innovations enhance productivity, reduce human error, and lower operational costs, appealing to both large-scale and mid-sized manufacturers. The adoption of Industry 4.0 solutions in cotton processing not only streamlines production but also facilitates traceability, sustainability, and compliance with environmental standards, positioning manufacturers to meet global market demands efficiently and remain competitive in a rapidly evolving industry.

Key Trends & Opportunities

Shift Towards Fully Automatic and High-Capacity Equipment

The cotton processing industry is witnessing a clear trend toward fully automatic, high-capacity machinery to meet increasing production demands. Manufacturers are investing in advanced ginning, spinning, and weaving equipment that minimizes labor intervention while ensuring precision and consistent quality. This trend opens opportunities for equipment suppliers to introduce energy-efficient solutions and modular machines that can be scaled as per mill capacity. Additionally, integration of automation with IoT and AI analytics allows real-time process optimization, reducing downtime and operational costs. The demand for high-capacity solutions also presents opportunities for strategic partnerships between equipment manufacturers and textile producers, enabling faster adoption of modern technologies, improved throughput, and better alignment with domestic and international market requirements.

- For instance, Rieter’s air-jet spinning machine J 70 features 200 individually automated spinning units, each capable of operating independently to manage quality cuts and natural ends efficiently. This design enhances flexibility and productivity, with delivery speeds reaching up to 600 meters per minute.

Growing Emphasis on Sustainability and Energy Efficiency

Sustainability is emerging as a critical trend and opportunity in the cotton processing equipment market. Textile manufacturers are increasingly adopting energy-efficient gins, lint cleaners, and spinning systems to reduce environmental impact and comply with global sustainability standards. For instance, low-energy carding machines and optimized air jet spinning systems help conserve electricity while minimizing fiber waste. Governments and industry bodies are promoting eco-friendly initiatives and subsidies for sustainable machinery, creating a favorable market environment. Additionally, equipment manufacturers have the opportunity to innovate in recycling cotton waste and integrating clean energy solutions, positioning themselves as leaders in sustainable processing. The growing consumer preference for eco-friendly textiles further incentivizes mills to upgrade machinery, driving long-term demand for sustainable cotton processing equipment.

- For instance, Rieter’s carding machine C 77 offers energy savings of up to 30% through its optimized design, which includes a compact construction, efficient suction system, and energy-efficient drives.

Expansion of Emerging Textile Hubs

Emerging markets in Asia, Africa, and Latin America are witnessing rapid expansion in textile manufacturing, creating opportunities for cotton processing equipment suppliers. Large-scale investments in new mills and modernization of existing facilities are driving demand for high-capacity, automated machinery. For instance, regional manufacturers are increasingly deploying fully automatic ginning and high-production carding machines to improve productivity and meet international quality standards. This expansion enables equipment suppliers to establish localized support services, training programs, and after-sales solutions, enhancing market penetration. Additionally, favorable trade policies and investment incentives in these regions create a conducive environment for growth. By capitalizing on these emerging hubs, manufacturers can diversify their customer base, increase equipment sales, and strengthen their global presence in the cotton processing equipment market.

Key Challenges

High Capital Investment and Operational Costs

One of the major challenges in the cotton processing equipment market is the significant capital expenditure required to acquire modern, high-capacity machinery. Fully automatic ginning, spinning, and weaving machines demand substantial upfront investment, which can be a barrier for small and mid-sized mills. Moreover, operational costs, including maintenance, skilled labor, and energy consumption, can strain manufacturers’ budgets. For instance, advanced carding and lint cleaning machines require trained operators and periodic servicing to maintain efficiency. These high costs can slow the adoption of modern equipment in regions with limited financial resources. Consequently, suppliers must offer flexible financing options, leasing solutions, or modular machinery designs to mitigate cost barriers and encourage wider market adoption.

Technical Complexity and Skill Shortages

The increasing automation and technological sophistication of cotton processing equipment pose challenges related to technical complexity and skill shortages. Modern machinery, including IoT-enabled spinning and smart ginning systems, requires trained personnel for installation, operation, and maintenance. Lack of skilled operators and technicians can lead to suboptimal performance, increased downtime, and reduced return on investment for manufacturers. Additionally, the need for continuous training and adoption of digital monitoring tools adds operational pressure. To address this challenge, equipment suppliers must provide comprehensive training programs, technical support, and user-friendly interfaces, ensuring manufacturers can fully leverage technological capabilities while minimizing operational disruptions.

Regional Analysis:

North America

North America holds a significant share of the global cotton processing equipment market, with the United States leading in both production and technological advancements. The region’s market is valued at approximately USD 3 billion in 2024, projected to grow at a CAGR of 3.1% between 2025 and 2034 Global Market Insights Inc. This growth is driven by the presence of well-established textile industries, advanced infrastructure, and a strong emphasis on automation and sustainability. The adoption of high-capacity, fully automatic ginning and spinning equipment is prevalent, catering to both domestic consumption and export demands. Additionally, investments in modernizing existing facilities and integrating smart technologies contribute to the region’s robust market position.

Europe

Europe’s cotton processing equipment market is valued at approximately USD 3 billion in 2024, with a projected CAGR of 3.1% between 2025 and 2034 Global Market Insights Inc. The region’s market share is characterized by a strong presence of textile manufacturers in countries like Germany, Italy, and Spain. These nations emphasize high-quality production standards, energy efficiency, and automation in their cotton processing operations. The demand for advanced carding, spinning, and weaving equipment is driven by both domestic consumption and export requirements. Furthermore, Europe’s commitment to sustainability and regulatory compliance fosters the adoption of eco-friendly processing technologies.

Asia-Pacific

Asia-Pacific dominates the global cotton processing equipment market, with a market size of USD 9.5 billion in 2024 and a projected CAGR of 3.9% between 2025 and 2034 Global Market Insights Inc. This region’s leadership is attributed to the presence of major cotton-producing countries like China, India, and Pakistan, coupled with a rapidly growing textile industry. The demand for high-capacity, fully automated machinery is fueled by the need to meet both domestic consumption and export demands. Technological advancements, such as IoT-enabled monitoring systems and energy-efficient equipment, are increasingly adopted to enhance productivity and reduce operational costs. Government initiatives supporting mechanization and infrastructure development further bolster market growth in this region.

Latin America

Latin America’s cotton processing equipment market is valued at approximately USD 1.7 billion in 2024, with a projected CAGR of 2.8% between 2025 and 2034 Global Market Insights Inc. Brazil and Argentina are the primary contributors to this market, driven by their expanding cotton production and textile manufacturing sectors. The adoption of semi-automatic and fully automatic ginning and cleaning machines is on the rise, aiming to improve efficiency and fiber quality. Investment in medium-to-high-capacity machinery supports growing domestic textile manufacturing and export activities. While challenges related to infrastructure and skilled labor availability exist, opportunities for suppliers to introduce energy-efficient, scalable, and cost-effective equipment solutions are evident in the region.

Middle East & Africa

The Middle East and Africa region’s cotton processing equipment market was valued at USD 1.7 billion in 2024, projected to grow at a CAGR of 2.8% between 2025 and 2034 Global Market Insights Inc. Countries like Egypt, Turkey, and Ethiopia are emerging as key players, with investments in textile manufacturing hubs and cotton production regions. Demand for modern cotton processing equipment is driven by the need for efficiency, quality enhancement, and integration with export-oriented textile operations. The adoption of semi-automatic and fully automatic machinery, including high-capacity ginning and carding equipment, is increasing to improve throughput and maintain global competitiveness. Government initiatives promoting industrial modernization and infrastructure development further enable market growth in this region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Equipment Type

- Ginning equipment

- Knife roller gin

- Macarty gin

- Saw gin

- Cleaning equipment

- Raw cotton cleaning machine

- Cotton lint cleaner machines

- Carding equipment

- Flat carding machines

- Roller carding machines

- High-production carding machines

- Spinning equipment

- Ring spinning

- Rotor spinning

- Compact spinning

- Air jet spinning

- Weaving equipment

- Finishing machines

- Others (sorting etc.)

By Mode of Operation

- Manual

- Semi-automatic

- Fully automatic

By Capacity

- Low capacity

- Medium capacity

- High capacity

By Application

- Textile industry

- Medical & surgical

- Others

By Distribution Channel

- Direct sales

- Indirect sales

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The global cotton processing equipment market is characterized by a competitive landscape featuring several prominent players, each contributing to the industry’s growth through technological advancements and strategic initiatives. Key companies such as Lummus Corporation, Bajaj Steel Industries, Nipha Exports Private Limited, Shandong Swan Cotton Industrial Machinery Stock Co., Cherokee Fabrication, Rieter, and Toyota Industries Corporation lead the market by offering a diverse range of products, including ginning, carding, spinning, and weaving equipment. These companies focus on expanding their market presence through mergers, acquisitions, and partnerships, enhancing their product portfolios and access to new markets. For instance, Lummus Corporation and Rieter have been instrumental in introducing automated and energy-efficient solutions, catering to the increasing demand for high-capacity and sustainable processing equipment.

Key Player Analysis

- Muratec

- Multipro Machines

- Abel

- Sando Tech

- Saurer

- Savio

- Lummus

- Mitsun

- Rieter

- Kimbell Gin Machinery

- Continental Eagle

- Giannitsa Ginning Mills

Recent Developments

- In May 2025, Truetzschler India a subsidiary of Trützschler Group, marked a major step with the inauguration of its advanced manufacturing facility in Sanand, India. The USD 47.41 million investment reflects the company’s strong commitment to India and its growing role in the global textile machinery industry.

- In April 2025, Tongda Group has forged a strategic partnership with Spain’s Pinter Group. The two powerhouses will engage in profound and far-reaching cooperation in core spun yarn, single spindle detection system, and fancy yarn, pooling their strengths to drive innovation and development in these key areas.

- In May 2024, Saurer introduced energy-saving and flexible solutions for pre-spinning, spinning, and twisting at the ITM in Istanbul. Saurer introduced the new Autoairo 11 to produce commodity yarns at competitive costs, running at 500 m/min at the booth.

Report Coverage

The research report offers an in-depth analysis based on Equipment type, Mode of Operation, Capacity, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to witness steady growth driven by increasing demand for high-quality cotton yarn and fabrics.

- Adoption of fully automatic and high-capacity machinery will continue to rise across large-scale textile mills.

- Technological advancements, including IoT-enabled and AI-integrated equipment, will enhance operational efficiency and predictive maintenance.

- Energy-efficient and sustainable cotton processing machines will gain prominence due to environmental regulations and industry initiatives.

- Expansion of textile manufacturing hubs in Asia-Pacific, Africa, and Latin America will boost equipment demand.

- Small and mid-sized mills will increasingly adopt modular and semi-automatic machines to optimize costs and productivity.

- Integration of digital monitoring systems will become standard to improve quality control and reduce fiber waste.

- Equipment manufacturers will focus on after-sales services, training, and support to strengthen customer relationships.

- Strategic collaborations and partnerships will drive market penetration in emerging regions.

- Continuous innovation and modernization will remain critical to maintaining competitiveness and meeting global market demands.