Market Overview

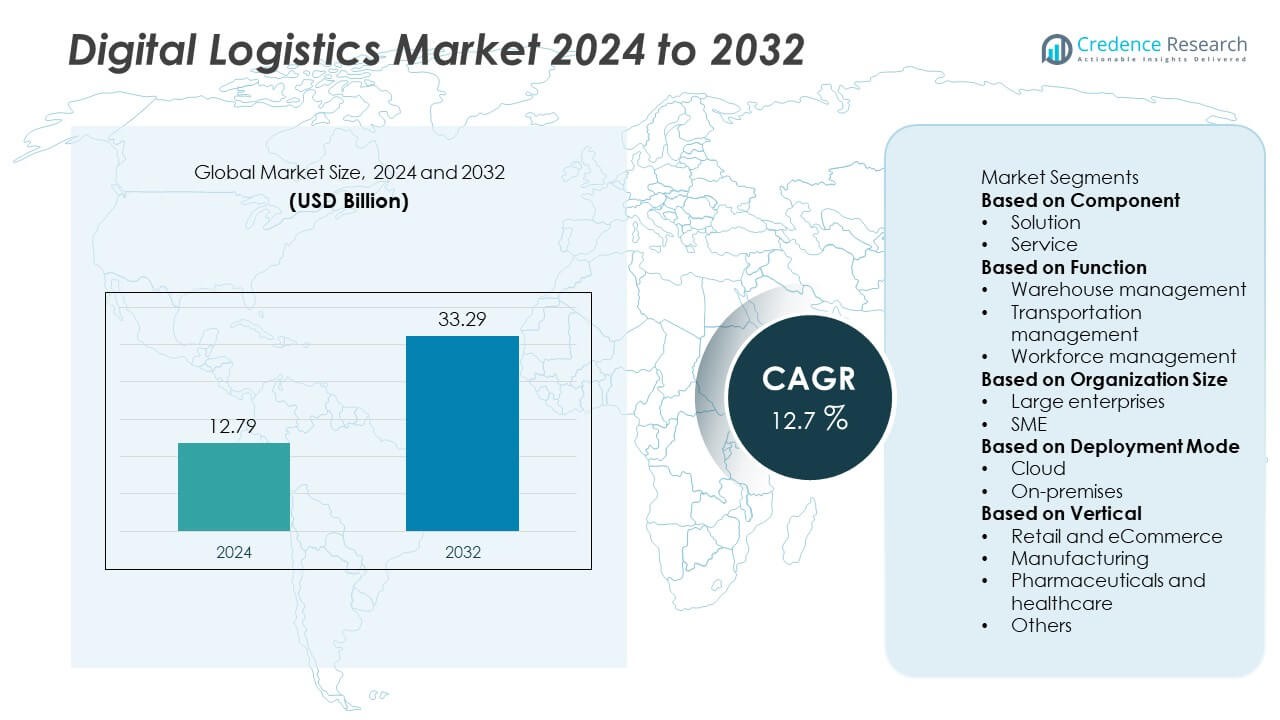

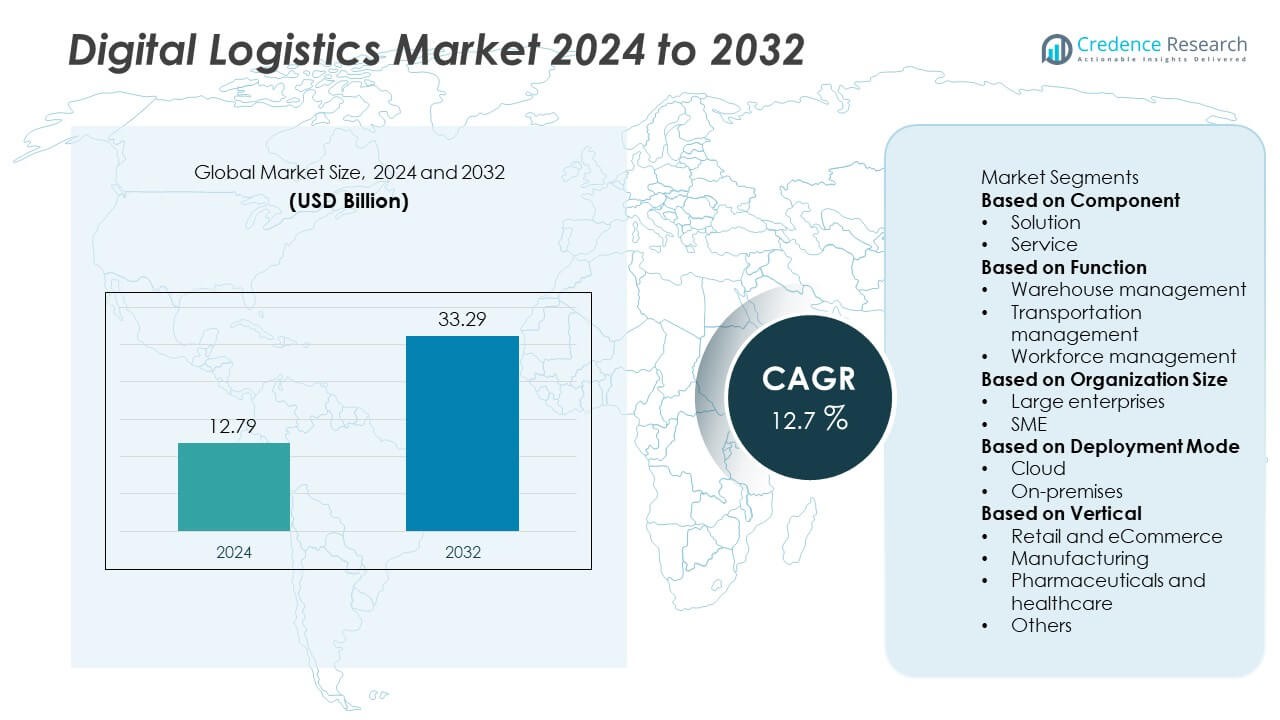

The Digital Logistics Market was valued at USD 12.79 billion in 2024 and is projected to reach USD 33.29 billion by 2032, growing at a CAGR of 12.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Digital Logistics Market Size 2024 |

USD 12.79 Billion |

| Digital Logistics Market, CAGR |

12.7% |

| Digital Logistics Market Size 2032 |

USD 33.29 Billion |

The Digital Logistics Market is led by major players such as Oracle Corporation, Infosys Limited, IBM (International Business Machines Corporation), Honeywell International Inc., SAP SE, AT&T Inc., Blue Yonder, Siemens AG, C.H. Robinson Worldwide, and Manhattan Associates. These companies dominate through strong technological expertise, AI-based logistics software, and cloud-enabled supply chain solutions that enhance visibility and operational efficiency. Asia-Pacific emerged as the leading region in 2024, holding a 37% market share, driven by rapid e-commerce growth, digital transformation initiatives, and expanding manufacturing activities. North America followed with 32%, supported by early adoption of IoT, AI, and advanced logistics analytics across transportation and warehouse management systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Digital Logistics Market was valued at USD 12.79 billion in 2024 and is projected to reach USD 33.29 billion by 2032, growing at a CAGR of 12.7%.

- Rising adoption of IoT, AI, and automation across supply chains is driving the demand for digital logistics solutions to improve visibility and operational efficiency.

- The market is witnessing trends such as the integration of predictive analytics, blockchain, and cloud-based platforms for real-time tracking and data-driven logistics management.

- Key players including Oracle Corporation, SAP SE, IBM, Honeywell International Inc., and Blue Yonder are focusing on software innovation, partnerships, and digital transformation strategies to strengthen competitiveness.

- Asia-Pacific led the market with a 37% share, followed by North America at 32% and Europe at 26%; by function, the transportation management segment dominated with 48% share, driven by growing e-commerce and cross-border logistics operations.

Market Segmentation Analysis:

By Component

The solution segment dominated the Digital Logistics Market in 2024, accounting for a 63% market share. Its leadership is driven by the widespread use of digital platforms that integrate transportation, warehouse, and inventory management into unified systems. Businesses are adopting advanced logistics software for automation, real-time tracking, and predictive analytics to streamline operations and improve visibility across global supply chains. The increasing adoption of cloud-based and AI-powered logistics solutions by large enterprises and e-commerce players continues to strengthen the dominance of this segment.

- For instance, SAP SE operates its SAP Transportation Management (SAP TM) platform, which integrates with SAP S/4HANA to optimize freight planning, inventory synchronization, and predictive ETAs using embedded AI algorithms. The platform enables logistics enterprises to achieve CO₂ emissions reductions by streamlining shipment routes and improving load utilization through advanced analytics.

By Function

The transportation management segment held the largest share of 48% in the Digital Logistics Market in 2024. The segment’s growth is fueled by rising demand for real-time shipment visibility, route optimization, and cost control in global logistics operations. Transportation management systems enable efficient fleet operations through predictive analytics, IoT tracking, and automation tools. The expansion of cross-border trade and e-commerce has further increased reliance on digital transportation platforms, allowing logistics providers to enhance delivery accuracy and reduce fuel consumption across long-haul networks.

- For instance, Blue Yonder manages digital logistics operations for over 3,000 enterprise clients using its Luminate Control Tower platform, which processes more than 1.5 trillion supply chain data signals daily. The platform leverages machine learning models to predict transportation delays and optimize multi-modal shipments across 120 global logistics networks, enabling dynamic re-routing and inventory balancing for large distributors and 3PL providers.

By Organization Size

The large enterprises segment led the Digital Logistics Market in 2024, capturing a 58% market share. Large organizations are investing heavily in digital transformation to manage complex global supply chains efficiently. The adoption of AI, blockchain, and big data analytics is helping enterprises improve demand forecasting, warehouse automation, and end-to-end supply visibility. High IT budgets and strategic partnerships with logistics technology providers support faster digital integration. The increasing focus on supply chain resilience and efficiency optimization continues to drive strong adoption among large enterprises globally.

Key Growth Drivers

Rising Adoption of IoT and Automation Technologies

The growing integration of IoT sensors, AI, and automation is transforming logistics operations. These technologies enable real-time asset tracking, predictive maintenance, and route optimization, improving efficiency and reducing delays. Companies are using IoT-based systems to monitor cargo conditions, ensuring transparency and security in transit. Automation in warehousing and fleet management minimizes human error while enhancing accuracy and speed, driving global adoption of digital logistics platforms.

- For instance, Honeywell International Inc. offers its Connected Logistics suite, which uses IoT devices across warehouse and transport networks to track assets and enable data-driven decision-making. This system integrates sensors for conditions such as temperature, vibration, and humidity to provide real-time visibility for high-value and perishable goods in transit.

Expansion of E-Commerce and Global Trade

The rapid rise of e-commerce and cross-border trade is fueling demand for advanced digital logistics systems. Online retailers and logistics providers rely on digital platforms for inventory visibility, demand forecasting, and last-mile delivery optimization. Increasing consumer expectations for faster deliveries and real-time order tracking have encouraged companies to digitize logistics operations. Global trade growth and supply chain diversification further amplify the need for integrated digital logistics solutions.

- For instance, C.H. Robinson Worldwide manages 37 million shipments annually through its Navisphere® platform, connecting over 83,000 customers (shippers) and 450,000 contract carriers globally. The system uses artificial intelligence, machine learning, and API integrations for optimization across modes like air, sea, and road logistics.

Increasing Focus on Supply Chain Visibility and Efficiency

Growing pressure to improve operational transparency and reduce logistics costs is driving digital transformation across supply chains. Businesses are deploying cloud-based platforms and data analytics to monitor shipments, optimize inventory, and manage risks. Enhanced visibility allows proactive decision-making and reduces disruptions caused by unforeseen events. As global supply chains become more complex, digital tools enabling real-time insights and predictive analytics have become critical for maintaining efficiency and resilience.

Key Trends & Opportunities

Integration of AI and Predictive Analytics

Artificial intelligence and predictive analytics are revolutionizing logistics by enabling smarter decision-making and automated planning. These technologies support demand forecasting, route planning, and shipment optimization. Logistics companies are using AI algorithms to analyze vast datasets for improving delivery accuracy and warehouse efficiency. Predictive tools also help identify potential delays and cost inefficiencies, creating opportunities for innovation and enhanced service quality. The shift toward data-driven logistics operations is a major trend shaping the market’s long-term growth.

- For instance, IBM Corporation offers its AI-driven supply chain platforms, which leverage analytics to process logistics and shipment data. These systems integrate with IoT sensors and ERP tools to help predict disruptions across supply chains, providing actionable insights for freight re-routing and inventory balancing.

Emergence of Blockchain and Cloud-Based Platforms

Blockchain and cloud technologies are enhancing transparency, security, and collaboration across logistics networks. Blockchain ensures tamper-proof documentation and traceability of shipments, while cloud systems enable real-time data sharing between stakeholders. These technologies improve communication across supply chains and reduce manual paperwork. Their scalability and flexibility make them particularly valuable for international logistics and third-party providers. Growing adoption of blockchain-enabled logistics platforms presents new opportunities for efficiency and trust in global trade operations.

- For instance, Oracle Corporation launched its Blockchain Cloud Service for integrated supply chain operations, allowing network members to securely share a single, trusted version of transaction data.

Key Challenges

High Implementation Costs and Integration Complexity

The initial cost of deploying digital logistics systems remains a key challenge, especially for small and medium enterprises. Integrating IoT devices, AI platforms, and analytics tools with existing systems requires significant investment and technical expertise. Many organizations struggle to align legacy infrastructure with modern solutions. The complexity of implementation can delay digital transformation, limiting adoption among cost-sensitive players in emerging markets.

Data Security and Privacy Concerns

Rising digitization in logistics increases exposure to cyber threats and data breaches. Sensitive supply chain information, such as shipment data and customer details, is at risk if not properly secured. Companies must invest in robust cybersecurity frameworks and compliance protocols to safeguard digital assets. Managing data privacy across multiple platforms and regions remains challenging, especially with evolving regulatory standards. Ensuring data integrity and secure connectivity is essential for maintaining trust in digital logistics systems.

Regional Analysis

North America

North America held a 32% market share in the Digital Logistics Market in 2024. The region’s dominance is supported by early adoption of IoT, AI, and cloud technologies across logistics and transportation sectors. The United States leads demand due to high e-commerce activity, extensive trade networks, and strong investment in supply chain automation. Companies are focusing on digital warehouse management, real-time shipment tracking, and predictive analytics to improve operational efficiency. Ongoing developments in smart logistics infrastructure and partnerships between logistics providers and technology firms continue to strengthen the regional market.

Europe

Europe accounted for a 26% market share in the Digital Logistics Market in 2024. The region’s growth is driven by increasing cross-border trade, rising sustainability goals, and expansion of e-commerce logistics networks. Countries such as Germany, France, and the United Kingdom are investing in smart logistics platforms, warehouse automation, and blockchain-enabled tracking systems. The European Union’s focus on green supply chains and digital transformation under the Industry 4.0 framework further accelerates adoption. Enhanced collaboration between logistics service providers and technology firms supports efficient, transparent, and sustainable logistics operations across the region.

Asia-Pacific

Asia-Pacific dominated the Digital Logistics Market in 2024, capturing a 37% market share. The region’s leadership is fueled by rapid industrialization, booming e-commerce, and strong government support for digital transformation in logistics. China, India, and Japan are leading adopters of cloud-based logistics systems and AI-driven supply chain analytics. Investments in 5G connectivity and smart logistics infrastructure are enhancing supply chain visibility and efficiency. The growth of major e-commerce players and manufacturing hubs in the region continues to drive demand for digital logistics solutions focused on real-time tracking and intelligent automation.

Latin America

Latin America captured a 3% market share in the Digital Logistics Market in 2024. The region is witnessing gradual digital transformation in logistics, driven by e-commerce growth and infrastructure modernization in Brazil, Mexico, and Chile. Companies are adopting digital tools for inventory management, route optimization, and shipment tracking to reduce logistics costs and improve efficiency. Government initiatives supporting trade digitization and cross-border logistics platforms are encouraging adoption. Increasing foreign investment and partnerships with global logistics technology providers are expected to further boost market growth across Latin America.

Middle East & Africa

The Middle East & Africa region held a 2% market share in the Digital Logistics Market in 2024. Market growth is supported by expanding trade corridors, infrastructure projects, and industrial development across the Gulf Cooperation Council (GCC) countries and South Africa. Governments are investing in digital supply chain solutions to improve efficiency and transparency in logistics operations. The rise of free trade zones, smart ports, and e-commerce platforms is creating opportunities for digital logistics adoption. Regional players are focusing on cloud-based platforms and real-time analytics to enhance competitiveness and operational reliability.

Market Segmentations:

By Component

By Function

- Warehouse management

- Transportation management

- Workforce management

By Organization Size

By Deployment Mode

By Vertical

- Retail and eCommerce

- Manufacturing

- Pharmaceuticals and healthcare

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Digital Logistics Market features key players such as Oracle Corporation, Infosys Limited, IBM (International Business Machines Corporation), Honeywell International Inc., SAP SE, AT&T Inc., Blue Yonder, Siemens AG, C.H. Robinson Worldwide, and Manhattan Associates. These companies lead through innovation in AI-driven logistics platforms, cloud-based supply chain solutions, and IoT-enabled tracking systems. Global players are focusing on developing integrated platforms that enhance supply chain visibility, automate workflows, and optimize transportation and warehouse operations. Strategic collaborations and digital transformation partnerships with logistics service providers are strengthening their global presence. Companies are also investing heavily in predictive analytics, blockchain technology, and sustainability-driven digital solutions to address evolving customer demands. Intense competition among established players and emerging tech-driven logistics firms continues to accelerate advancements in automation, connectivity, and data intelligence across the digital logistics ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Oracle Corporation

- Infosys Limited

- IBM (International Business Machines Corporation)

- Honeywell International Inc.

- SAP SE

- AT&T Inc.

- Blue Yonder (formerly JDA Software)

- Siemens AG

- H. Robinson Worldwide

- Manhattan Associates

Recent Developments

- In August 2025, Oracle rolled out new AI forecasting and IoT-enabled logistics features in its Cloud SCM suite to improve shipment visibility, route decisions, and ESG tracking.

- In May 2025, Manhattan Associates introduced Agentic AI—a suite of autonomous digital agents integrated into its Manhattan Active platform to automate supply chain tasks and orchestration.

- In May 2025, Blue Yonder acquired Pledge Earth Technologies to embed accredited logistics CO₂e emissions reporting into its supply chain platform, enhancing sustainability transparency across transport modes.

- In May 2025, Oracle Corporation was named a Leader in the 2025 Gartner Magic Quadrant for Transportation Management Systems, reflecting strong execution and vision in cloud logistics.

Report Coverage

The research report offers an in-depth analysis based on Component, Function, Deployment Mode, Vertical and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand rapidly with increasing adoption of AI and IoT in logistics operations.

- Demand for real-time tracking and predictive analytics will continue to rise across industries.

- Cloud-based logistics platforms will dominate due to scalability and cost efficiency.

- Automation and robotics will transform warehouse and inventory management processes.

- Asia-Pacific will remain the leading region driven by e-commerce growth and manufacturing expansion.

- Companies will focus on integrating blockchain to enhance transparency and security in supply chains.

- Data-driven logistics decisions will become essential for improving efficiency and reducing costs.

- Strategic collaborations between technology providers and logistics firms will intensify.

- Sustainability goals will drive investment in green and energy-efficient digital logistics solutions.

- Continuous innovation in connected logistics ecosystems will redefine competitiveness in the global market.